THE LURE OF THE LUXURY ASSET: HELPING THE HIGH-PROFILE CLIENT BUY LUXURY ASSETS WITH INTELLIGENCE

THURSDAY, DECEMBER 17, 2021 – 10AM PST / 1PM EST

Whether it is buying sports or rock memorabilia, collecting fine wines, investing in collector cars, or acquiring artworks for the home, there are rules for acquiring tangible assets intelligently.

The Fine Art Group is pleased to bring together an expert panel in Part 2 of our latest webinar series. It will provide insight into these markets and collecting categories.

*Calendar invites will be sent to registrants emails.

TOPICS DISCUSSED

- What specific attributes make the piece valuable?

- What is the best venue for acquisition?

- What is the best process for acquisition?

- When is it time to sell, where do you go and what do you do?

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

Further Reading

- High-Profile Client Collections & Sudden Wealth Syndrome

- Helping the High-Profile Client Buy & Sell Smart

- Helping the High-Profile Client Buy Luxury Assets

SUCCESSFUL SALE OF JEWELRY ADVISORY CLIENT COLLECTION

We are pleased to have assisted a client in successfully selling their impressive jewelry collection in the Sotheby’s Magnificent Jewels Sale.

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 29

Fancy Vivid Orange Diamond and Diamond Ring

Estimate: $1,000,000-$1,500,000

Sold: $1,895,500

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 30

Fancy Red Diamond and Diamond Pendant-Necklace

Estimate: $2,500,000-$3,500,000

Sold: $3,166,000

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 191

Padparadscha Sapphire and Diamond Ring

Estimate: $180,000-$220,000

Sold: $226,800

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 192

Suna Sapphire and Diamond Necklace and Pair of Earrings

Estimate: $100,000-$150,000

Sold: $126,000

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 184

Emerald and Diamond Ring

Estimate: $75,000-$100,000

Sold: $163,800

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 185

Oscar Heyman & Brothers

Emerald and Diamond Ring

Estimate: $50,000-$70,000

Sold: $151,200

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 183

Oscar Heyman & Brothers

Emerald, Black Opal and Diamond

Estimate: $50,000-$70,000

Sold: $88,200

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 178

Oscar Heyman & Brothers

Black Opal, Diamond, Ruby and Sapphire ‘Clover’ Necklace

Estimate: $50,000-$70,000

Sold: $100,800

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 176

Oscar Heyman & Brothers

Black Opal, Diamond, Ruby and Sapphire

Estimate: $10,000-$15,000

Sold: $17,640

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 177

Oscar Heyman & Brothers

Black Opal, Diamond, Ruby and Sapphire Bracelet

Estimate: $30,000-$50,000

Sold: $52,920

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 16

Van Cleef & Arpels

Diamond and Pearl Lapel-Watch

Estimate: $25,000-$35,000

Sold: $37,800

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 187

Oscar Heyman & Brothers

Diamond, Colored Diamond and Ruby Brooch

Estimate: $35,000-$45,000

Sold: $88,200

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 186

Oscar Heyman & Brothers

Pair of Sapphire and Diamond Pendant-Earclips

Estimate: $40,000-$60,000

Sold: $69,300

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Helping the High-Profile Client Buy Luxury Assets with Intelligence

THURSDAY, DECEMBER 17, 2021 – 10AM PST / 1PM EST

Whether it is buying sports or rock memorabilia, collecting fine pieces, investing in collector cars, or acquiring artworks for the home, there are rules for acquiring tangible assets intelligently.

The Fine Art Group is pleased to bring together an expert panel in Part 2 of our latest webinar series. It will provide insight into these markets and collecting categories.

TOPICS DISCUSSED

- What specific attributes make the piece valuable?

- What is the best venue for acquisition?

- What is the best process for acquisition?

- When is it time to sell, where do you go and what do you do?

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

Further Reading

- High-Profile Client Collections & Sudden Wealth Syndrome

- Helping the High-Profile Client Buy & Sell Smart

The Fine Art Group’s new Sports & Entertainment Specialty Practice and Director Shane David Hall have been featured in the Atlanta Business Chronicle Sports Biz Notebook.

To read the article and learn more about The Fine Art Group’s Sports & Entertainment Specialty Practice please access the link below.

Read the article.

With fame and fortune, many celebrities, sports figures, and entrepreneurs have experienced an influx of wealth and begin to buy art, jewelry, cars, wine and memorabilia. When the money begins to flow, it is common that a high-profile buyer experiences vulnerability.

It is essential that structures are put into place to protect the high-profile client from being taken advantage of.

In Part 1 of our latest webinar series, we will provide specific tools and case studies to assist in protecting the high-profile client.

Join Us Thursday, December 3rd, 10 am PST / 1 pm EST.

TOPICS TO BE DISCUSSED

- How do you buy luxury assets with intelligence and at the right price and in the right venue?

- How to avoid the lure of the “hot for a hot second” artist?

- How do you sell collections to obtain the highest revenue?

- How do you insure, store and ship collections correctly?

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

Further Reading

- High-Profile Client Collections & Sudden Wealth Syndrome

- Helping the High-Profile Client Buy Luxury Assets

Hello from Charlotte, N.C.!

Instant wealth and fame at a young age offers great opportunity. But adding the expertise of an art advisor gives those with sudden early success the enhanced prospect to pursue a sound and wise investment strategy in tangible assets.

This crucial need for the suddenly wealthy crystalized for us when our senior jewelry appraiser and I met with a newly contracted professional athlete, his business manager and risk manager to discuss and implement a plan of action when acquiring unique and unusual luxury timepieces. Throughout 2019 and 2020 this client made a substantial investment in what can be a robust and volatile collecting market, often working directly with dealers and without sound guidance from experts in terms of investment. In one instance before working with us, this client acquired an 18-karat yellow-gold Rolex Daytona set with diamonds and sapphires for $70,000 – a big purchase for a young man who overnight went from less than $20,000 a year to over $5 million a year!

In the late spring of 2020, a trusted friend and insurance broker called me to ask if we could establish appropriate retail replacement values for this growing collection. Our appraisal process began like any other: confirming available dates, scheduling onsite appointments, completing inspection and beginning valuation research. However, during this process we learned that our client had significantly overpaid for a watch that regularly retails for $25,000. A delicate conversation followed in which our team discussed the details of the luxury timepiece market and how to avoid overpaying in the future.

This made me pause and realize that most appraisers and art advisors are accustomed to opining on a range of tangible assets, such as jewelry, luxury accessories, rare automobiles and similar asset classes for private clients. However, there exists another segment of high net-worth individuals whose youth, wealth and celebrity regularly bring new challenges to their financial advisors and business managers. These individuals are often household names, from actors and celebrities to models or government officials – all people who have attained fame and wealth but have neither the time nor expertise to manage the range of investment-quality tangible assets that exist within their collections.

Although the enormous cash influx realized by many of these high-profile clients is properly protected by a team of business managers, wealth managers, accountants and attorneys, suitable guidance from an experienced art advisor who understands the challenges of the tangible asset market is missing. As a result, seemingly common purchases like a fine Swiss timepiece, a luxury handbag or a work of art from an emerging artist can become unstable investments.

SUDDEN WEALTH SYNDROME

Sudden Wealth Syndrome, a term coined by psychologist Stephen Goldbart to describe the stress, guilt, and social isolation that often accompanies a large windfall, often strikes first-round NFL draft picks, overnight IPO millionaires and actors plucked from obscurity. Sudden wealth can overwhelm those who have made it big and encourage overspending coupled with poor decisions when making a significant purchase. The result can be financial ruin. Goldbart and his associates at the Money, Meaning & Choices Institute say that much like the four stages of grief, there are four stages people go through when coming to terms with their new wealth:

- Honeymoon: Like the beginning of a romantic relationship, people who come into money feel powerful and invulnerable. Many go on spending sprees, buying things and making risky investments which often lead to disastrous results.

- Wealth Acceptance: A realization that there are unknown factors associated with wealth and the need to set limits.

- Identity Consolidation: During this stage, people accept that they are now rich but realize that their money does not define who they are.

- Stewardship: In the final phase, people reach a mature resolution of what their money means to them and have established a plan for what to do with their money in terms of personal, family and philanthropic missions.

These cash windfalls are a nice problem to have; however, there are numerous stories detailing the recently wealthy burning though their money in just a few short years, ending up with a collection of expensive toys and objects that hold little return on investment. There are important pitfalls to avoid particularly when managing investment quality tangible assets – the first step being to assemble the right team of experts.

A QUALIFIED ART ADVISOR OFFERS PROTECTION

All newly minted high-profile clients should be encouraged to hire and consult with an art advisor. In fact, it is paramount that the client hires an art advisory firm with a vast range of specialists, experts and conservators who can consult and bring significant insight to any asset class including expert purchase negotiations on the client’s behalf. This team can provide expert advice and analysis on the acquisition of a new asset whether it is a piece of jewelry, sports memorabilia or something more traditional such as a first-edition manuscript. Additionally, an art advisory firm can provide an unbiased opinion on the quality of the investment as well as the condition of the object, steering the client to more solid footing in terms of the client’s overall investment portfolio and potential long-term gains.

Secondly, avoid the dealer dilemma! While a traditional retail setting such as a gallery, fine art show or fine jewelry salon can be an interesting arena to acquire unique and unusual tangible assets, there is a built-in bias on the dealer’s behalf. The seller’s goal is to garner the highest amount possible for any object marketed or sold. Additionally, while a collector’s discount can often be negotiated, the seller has the upper hand because the seller’s understanding of the market is greater. In many cases, and particularly with our watch-collecting client, we see specific instances where high-profile clients are taken advantage of even with negotiated discounts, simply due to the fact that there is money to spend and impulse to buy without sound financial guidance.

In this circumstance, it is important for high-profile clients to have knowledgeable professionals advocating on their behalf in order to avoid additional pitfalls to acquisition, such as authenticity, fakes and forgeries, clear title and condition issues.

When acquiring high value tangible assets, the most important factor beyond understanding value is due diligence. Before payment is made, the potential owner should have a complete grasp of the item’s condition, including previous conservation or restoration. A solid and transparent provenance should also be available to the buyer and his or her team, thus providing a clear knowledge of authenticity and title which alleviates concern surrounding fakes and forgeries. Without proper due diligence, a $250,000 purchase can depreciate to $1,000 in the blink of an eye!

Finally, when working with an art advisory firm, many of the unseen details of acquisition are instantly handled by an experienced team and vetted third-party sources solving unforeseen concerns such as framing, conservation, repair, shipping, fine art storage and other needs associated with ownership of high value tangible assets. It is important for a high-profile client to “not go it alone” because doing so could have unwanted ramifications. For instance, storing a high value painting or print in an untested storage facility could mean significant financial losses if this facility does not meet appropriate standards. Further, if a work requires conservation or repair, an art advisory firm is able to facilitate the proper way forward. In many cases, if an owner does not hire the appropriate conservator, which is often designated by the artist or maker’s estate, foundations and/or other top experts, then a significant loss in value is imminent.

The art market is often considered by many to be the last great unregulated segment of the financial market and can often make for a treacherous experience for new collectors without the proper guidance.

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

FURTHER READING

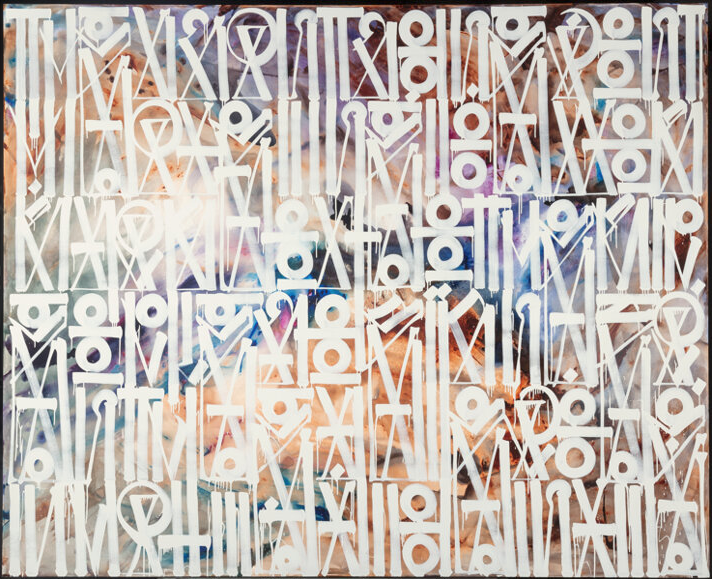

A client has put this impressive work by contemporary street artist Retna for auction. The work They Can’t Come is one of the largest pieces of Retna’s to go to sale.

Heritage Auctions

Urban Art Signature Auction

Lot 66039

RETNA (B. 1979)

They Can’t Come

2015

Acrylic on canvas

96 x 120 inches (243.8 x 304.8 cm)

Signed, dated, and titled in ink to verso

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

The art world is an unregulated and opaque market with significant private and public transactions. Advisors guide collectors and investors, ensuring they do not overpay while offering discipline and market analytics. This model doesn’t necessarily exist when acquiring jewelry. Retail prices are often higher than the intrinsic value of the material and stones, and clients are shocked to discover their fair market value.

Jewelry connoisseurs understand the three c’s (cut, clarity, and carat) but are unaware of additional factors influencing value. Color saturation is important, and its interpretation and identification change as the market evolves. When diamonds are mounted, color can be enhanced by the mount or foil backing. Additionally, the mount or cut of the stone can hide flaws. This isn’t always disclosed when acquired through a dealer or designer, and accompanying certificates give the client a false sense of security.

It is imperative to work with a knowledgeable advisor such as The Fine Art Group’s Advisory Team when acquiring jewelry and loose stones. The following article discusses the myths surrounding red diamonds, highlighting the importance of seeking experienced advisory when navigating the jewelry market, as independent advisors can bring discipline, market analytics and due diligence to collecting.

The Diamond Investment & Intelligence Centre (DICE), Published August 9, 2020

RED DIAMONDS: UNDERSTANDING THEIR RARITY

Red diamonds are not the rarest color in the world! Now we can review the myths…

There are other colors that are rarer such as violet, purple and orange. So why are people under the impression that red diamonds are the rarest? There are so many individuals in the world that claim they know how many red diamonds exist. Some auction houses claim that there are only 29 red diamonds in existence. That is false. Some dealers claim that there are only 30 red diamonds in the world, which is also false. Even some geological websites claim that red diamonds are the rarest colors, which is also false. Do red diamonds even exist? if so, how many do exist? and if they don’t exist, then why does the GIA (Gemological Institute of America) certifies them as such?

What are the various theories? What is the truth about red diamonds? How many exist? These are all very good questions, and it is time to address them all properly.

RED DIAMONDS THEORY #1

The Argyle mine in Australia produces 90% of all pink and red diamonds.

It is believed that the majority (90% as stated) of all pink and red diamonds are mined in the Argyle mine. This theory can be easily verified. There are official documents (mostly Kimberly Process) that can trace back the majority of rough diamonds to mines and therefore we can use this method as a way to verify. Some red diamonds were found in India decades ago from the Golconda region which was also famous for its blue diamonds. This can also be verified as the GIA can easily determine the origin of such diamonds. If we go back less than 40 years, we will find that the Argyle mine has indeed produced the vast majority of pink and red diamonds; just follow the money and sales…

RED DIAMONDS THEORY #2

There are only 29 or 30 red diamonds in existence.

That is completely false. I am personally aware of at least 100 red diamonds in existence, and I am sure that some of the top fancy color diamond dealers that trade in red diamonds are aware of a few more…There is a single collection that has 51 red diamonds in it, from as large as a 4.59 carat red diamond to a 0.24 carat red diamond. With a total weight of just above 50 carats. There is another large collection of 25 red diamonds.

A very well-known dealer, who also produced a rare diamond cross with 11 red diamonds in it, has many other red diamonds in his personal collection. There is an online dealer (which has the largest diamond collection offered on the internet) that has more than 25 red diamonds listed. Let’s not forget that there are many other red diamonds owned by private individuals that have been acquired over the years that we are not aware of.

RED DIAMONDS THEORY #3

Are red diamonds real? The answer is yes, but only relatively recent.

The best-known gemological laboratory is the GIA based in New York and Carlsbad, with many more satellite labs around the world. Before the 1970’s color diamonds were such a rarity that they were discarded by the trade. The GIA started certifying red diamonds only recently (as recent as the 80’s). Prior to that they were all certified as pink diamonds, and in fact, if we look at the pink diamond color chart by the GIA, we will find that at the bottom right corner, there is an area called Fancy Red.

That is the reason that the red color has only 4 categories; Fancy Brownish Red, Fancy Orangy Red, Fancy Red and Fancy Purplish Red. You will not find a single GIA certificate that certifies a red diamond as Intense Red or Vivid Red. The most desired color is Fancy Purplish Red. It has a more lively color than a pure Fancy Red color, and therefore more attractive to the eye. A pure Fancy Red diamond has a more dull color.

RED DIAMONDS THEORY #4

The current largest certified red diamond is the 5.11 carat Moussaieff Red diamond. It has a flawless clarity. There are 2 more known certified red diamonds in the 5 carat size, there is a 4.59 carat red diamond and then the weight scale goes down to the 2.00-3.00 carat area with a 2.71, a 2.29 carat, a 2.26, a 2.11 carat, a 2.09, a 2.06 carat, a 2.03 and a 2.00 (to my knowledge). Then we go down into the 1.00-1.99 weight area with many more.

I heard that there is a 3 carat red diamond that exist, but I have not seen the certificate to confirm it myself. The vast majority of red diamonds are below the 0.50 carat mark. It is extremely rare to find red diamonds with clarities better than SI1. The vast majority are SI1 and below down to an I3 (or half cert). Rarely we see a VS2 or better such as the 2.11 Argyle Everglow. Such a combination makes a Red diamond extremely rare and very much desired by investors and collectors.

RED DIAMONDS THEORY #5

There are not many red diamonds sold in auctions.

It is true that since 1987 when the 0.95 carat round brilliant Hancock Red Diamond was sold for whopping $880k (a newsworthy sum at the time), there have been only 22 red diamonds (or 25 if we count multi red diamond jewelry pieces) that have been offered and sold at auction. The question is why not more red diamonds have been offered (like blue and pink diamonds)? The answer is simple. The vast majority of people, including dealers, do not really understand red diamonds and therefore prefer not to deal with them, unless they have a client that specifically asks for one.

Another famous red diamond that sold at auction, which also holds the current record price per carat for any red diamond sold at auction, is the 2.09 carat, Fancy Red, Heart Shape, with SI2 clarity. It was sold by Moussaieff. It was sold in November 2014 at a Christie’s auction in Hong Kong for over $2.4 million per carat. This 2.09 is the perfect example proving the Red Diamonds Theory #3. This 2.09 carat red diamond was an Argyle tender diamond which was certified as a pink diamond when it was offered.

CONCLUSION

This article summarizes the information and theories about red diamonds and their rarity. Are red diamonds rare? Yes. Are red diamonds the rarest color on earth? No. Violet and purple are; both in terms of quantities as well as in sizes. There are no pure violet and purple diamonds in the 5 carat size like red, not even a single diamond.

When buying a red diamond, one has to work with a trusted advisor that will not have a conflict of interest. The advisor will point out those red diamonds that may have a brown tint or an orange tint to it which should be avoided. The advisor will also help in properly valuing such a diamond and will also help acquire such a rarity.

Read this article at The Diamond Investment & Intelligence Centre (DICE).

Leize Gaillard of William Means Real Estate located in Charleston, SC, recently featured The Fine Art Group Southeastern Regional Representative, Shane David Hall, in her October Newsletter.

Leize is a twelfth generation native to Charleston – this long familiar history has encouraged her passion for Charleston architecture, historic preservation, and the real estate market. Much like The Fine Art Group, Leize appreciates the role of a trusted advisor and encourages a spirit of stewardship and transparency among clients.

Read the full newsletter here.

ART ADVISORS HELP CLIENTS NAVIGATE THE ART MARKET

Art advisors have assisted collectors for centuries, demystifying the seemingly opaque art world and helping passionate individuals assemble legendary collections with meaning and value.

In the early 1900s, the young American-Lithuanian art historian Bernard Berenson, barely in his 30s, traveled across Italy to personally inspect Renaissance masterpieces by Raphael and Titian. His clients across the Atlantic had lots of questions, sending flurries of telegrams back and forth: “Wire whether they are authentic. Are they in good condition? Must have your advice.”

Berenson personally contributed to the stellar Old Master collections of Gilded Age luminaries such as Isabella Stewart Gardner, who purchased her Titian’s Europa and the Bull through Berenson. Today it hangs in her eponymous museum in Boston and remains one of the very best Titians in the United States. As a good art advisor, Berenson was able to provide access to the great treasures of European aristocratic families and held unparalleled expertise in Venetian paintings as the author of the 1894-published book The Venetian Painters of the Renaissance.

In the 18th century ambitious art collectors like the formidable Russian monarch Catharine the Great relied on a network of agents to source important paintings whose owners had a change of fortune. The Russian ambassador to the Netherlands Prince Dimitri Gallitzin was a trusted art agent and advisor to the Empress and was instrumental in securing for her Rembrandt’s The Return of the Prodigal Son among countless other masterpieces to enter her collection. Catharine viewed the process of collecting art as a competitive sport and a point of national pride. In 1772 she wrote to her friend the French philosopher Voltaire: “You have heard correctly, Sir, that this spring I raised the pay of all my military officers . . . by a fifth. At the same time, I’ve bought the collection of paintings of the late M. de Crozat and I am in the process of buying a diamond bigger than an egg.”[i] With her own collecting drive and expert guidance by her art advisors, Catharine amassed a spectacular art collection which in turn formed the basis of the Hermitage Museum in St Petersburgh Russia, one of the most important public art collections in the world.

Art advisors in the early 21st century do not (fortunately) have to fulfill the double function of political envoy/spy and art detective while serving their clients. Much like Catharine the Great, many art collectors are deeply passionate and highly competitive about acquiring great art. As a result, an art advisor’s role is first and foremost to take a dispassionate and critical view of each potential acquisition and find reasons not to buy it. Then and only then, if the work is deemed appropriate, can a good art advisor recommend a purchase.

Art advisors should possess a combination of attributes to best serve their clients: insight into current curatorial trends and changing collecting tastes which steers the market into the future; a deep understanding of artists, their work and their scholarship; and a concrete and up-to-date market knowledge and lines of communication to the key actors in the art market. Most of all they should be independent and invested only in the process of helping their clients acquire the very best art at the best price point.

HERE ARE FIVE QUESTIONS YOU SHOULD ALWAYS ASK YOUR

ART ADVISOR BEFORE ADDING TO YOUR ART COLLECTION

- What trends are you seeing in the market at the moment? How will they move the needle when it comes to my collection’s value in the future?

- Why is this artist so important and what should I know before I buy their work?

- What concerns do you have about this particular work? Are there any condition or provenance questions to be resolved before purchase?

- What is the appropriate market price for this type of work within the artist’s oeuvre?

- Should we buy at auction, galleries, fairs or directly from private collectors?

The answers to these questions are as varied as the types of paintings, sculpture, furniture and jewelry we source for our clients.

FURTHER READING

- The Art Detective: How to Find a Qualified Art Advisory Service

- May 2023 Auction Season: Our Team’s Top Picks & Insights

- The Asking Price: Understanding Value 1

OUR SERVICES

The Fine Art Group’s Art Advisory department’s expertise and deep market knowledge ensure that our clients can focus on passion knowing that the due diligence is taken care of. Best of all, unlike Catharine the Great, you won’t have to balance your war chest to make that perfect acquisition. We hope!

[i] Catherine II to Voltaire, 1 September 1772, Correspondence, 168, as quoted in Documents of Catherine the Great: The Correspondence of Voltaire and the Instruction of 1761, ed. W. F. Reddaway (Cambridge: Cambridge University Press, 1931).