Our team understands the complex and varied needs of institutional and corporate clients. Between our Appraisal and Advisory departments, we can create bespoke plans, working within institutional missions and processes to ensure their collections are properly insured, protected and cultivated.

We are proud to have advised the Carnegie Library of Pittsburgh over the last few years to ensure that their beautiful rare book collection is appropriately insured and worked with law enforcement on the recovery of many volumes for the city of Pittsburgh.

“In the fall of 2016, library officials decided it was time to audit the collection again, and hired the Pall Mall Art Advisors to do the appraisal. Kerry-Lee Jeffrey ….. began their audit on April 3, 2017, a Monday, using the 1991 inventory as a guide. Within an hour, there was trouble. Jeffrey was looking for Thomas McKenney and James Hall’s History of the Indian Tribes of North America. This landmark work included 120 hand-colored lithographs, the result of a project that began in 1821 with McKenney’s attempt to document in full color the dress and spiritual practices of Native Americans who had visited Washington, D.C. to arrange treaties with the government. The three-volume set of folios, produced between 1836 and 1844, is large and gorgeous and would be a highlight in any collection. But the Carnegie Library’s version had been hidden on a top shelf at the end of a row. When Jeffrey discovered why, her stomach dropped. “Once a plump book filled with plates,” she would recall, “the sides had caved in on themselves.” All those stunning illustrations had been cut from the binding.”

Read more at Smithsonian Magazine

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Dear Clients and Friends,

The Fine Art Group is pleased to present Part 4 of our Market Webinar Series.

Bringing together top experts in art and real estate, Anita Heriot, President of The Fine Art Group, Colleen Boyle, Senior Vice President of The Fine Art Group, Chris Ainsworth, Managing Director, Market Manager at Deutsche Bank Trust Company Americas, Brian Mendell, Managing Director, Real Estate Deutsche Bank Trust Company Americas and Bradford S. Cohen, Partner, Jeffer Mangels Butler & Mitchell LLP; the focus will be on the current state of the real estate and art market and how to turn distressed assets into opportunities as well as the tax implications of COVID-19 on planning.

Join us Thursday May 14, 10 am pst / 1 pm est.

*Calendar invites will be sent after Tuesday, May 12.

TOPICS DISCUSSED

- State of the economy update

- Impact on the value of art and real estate due to Covid-19

- Opportunities for art and real estate in a distressed market

- Planning strategies for dealing with distressed real estate and art

This webinar will be interactive. Submit your questions for our experts through our RSVP form.

*Calendar invites will be sent out starting Tuesday, April 28.

TOPICS DISCUSSED

- Sales in the spring, summer & fall

- The impact of Covid-19 on values

- Insurance update on collectibles

- Opportunities for acquisition

Denison Museum in Granville, Ohio is currently hosting Say It Loud, a curated exhibition of the work of contemporary celebrated black artists.

While it’s not possible during this unprecedented time to see the exhibition in person, you can experience Say It Loud through a short video filmed at Denison University Art Museum.

“From the collection of Hedy Fischer and Randy Shull, Say It Loud includes the work of world-renowned contemporary black artists who document and challenge dominant historical perspectives and events. The exhibition illustrates the struggles and achievements of African-Americans, with themes focused on ethnic identity, institutional racism, gender, and beauty. Works come from an array of Guggenheim, Whitney, and MoMA artists, including Kehinde Wiley (Obama’s official portraitist), Kerry James Marshall, Alison Saar, Trenton Doyle Hancock, Mickalene Thomas, Hank Willis Thomas, and Sanford Biggers.”

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Good assets sold through the correct method and in the appropriate sale will hold value and perform well, even in the most uncertain markets.

We are pleased to have assisted a client in selling their Picault bronzes for £100,000, more than doubling their low estimate.

Sotheby’s

The Orientalist Sale

Sale L20100

Lot 44

Émile-Louis Picault

The Priest and The Scribe

Bronze, dark brown patina, with gilt bronze highlights and rouge griotte marble attributes, on gilt bronze, black and rouge griotte marble bases

41 in.

Estimate: £40,000-£60,000

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Dear Clients and Friends,

The financial markets are oscillating from the impact of the coronavirus pandemic. The desire, or need, for liquidity comes as the spread of coronavirus creates significant market instability.

This webinar will address ways in which passion assets are a tool to provide liquidity.

Join us Thursday, April 9, 10 am pst / 1 pm est.

TOPICS DISCUSSED

- The importance of the pre-loan valuation or marketable cash value appraisals

- Targeting the right art and collectables to monetize during a turbulent time

- Leveraging (collateralizing) passion assets as a means of short term liquidity

- Art Bonds as a tool to create recurring revenue

This webinar is interactive.

Please send questions in advance to Jgarlic@pallmallartadvisors.com. Participants will also be able to ask questions using the chat box during the webinar.

*Due to the impact of the corona virus on phone lines, it is recommended that you join via the computer.

DESKTOP APPRAISALS

The “desktop” indicates the appraiser provides a value based on information that is provided at the appraiser’s desk. Clients or their advisors can send electronically, via mail or direct upload, the relevant details which will be placed in our proprietary collection management system and valued by our appraisal team.

In order for our appraisers to conduct a remote appraisal, please provide our administrative team with cataloguing information and photographs.

Click here for a downloadable list of requirements for a desktop appraisal.

Once we have the essential information, our appraisers will provide you with a value and a pdf appraisal document.

The Fine Art Group can provide desktop appraisals for any asset.

REQUIREMENT FOR A DESKTOP APPRAISAL

ART APPRAISALS

- Name of artist

- Measurement inside the frame (sight)

- Photograph of entire painting, signature, back (if possible), all receipts or gallery labels

- Medium (for e.g. oil on canvas, oil on board, print)

- Ownership and purchase history of the artwork

JEWELRY APPRAISALS

- Name of brand/designer

- Description of jewelry

- Photograph of jewelry from various angles (including stamps, engravings, stones)

- GIA report

- Ownership and purchase history of the jewelry piece

OTHER VALUABLE ASSETS

- Photograph of object

- Dimenions of objects

- Ownership and purchase history of object

Virtual Consultations

For prospective clients that have some technological awareness, The Fine Art Group can organize virtual visits to discuss what clients own to determine the appropriate risk management strategy.

The Fine Art Group provides complimentary schedule reviews to make sure that clients are insured appropriately and insight into only the assets that require reappraisal.

Contacts

Western region – Anita Heriot, President

Eastern & Midwest region – Colleen Boyle, SVP & National Sales Director

South East region & Gulf Coast – Shane Hall, Senior Advisor & Appraiser

Appraisal inquiries – Kate Molets, Director of Appraisals

Dear Clients and Friends,

In an effort to provide more context and insight into the current state of the tangible asset market, The Fine Art Group is providing a Market Update Live One Hour Webinar scheduled for Wednesday, March 25 at 10 am pst.

TOPICS DISCUSSED

- The State of the Spring Auction Market

- The Role of Online Sales

- Alternative Assets and the Market

- Private sales

- Art Insurance and the impediments to ecosystem of the art market

This webinar is interactive.

Please send questions in advance to Jgarlic@pallmallartadvisors.com. Participants will also be able to ask questions using the chat box during the webinar.

*Due to the impact of the corona virus on phone lines, it is recommended that you join via the computer.

The Fine Art Group offers bespoke advisory services for all tangible assets.

We have preferred terms for several select categories where we have identified specialty selling venues that consistently have the highest results for the particular object.

Our experienced team of advisors conducts full market analytics on the object to determine the best method of sale.

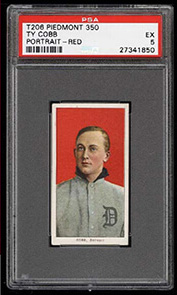

- American Art

- 20th Century Design

- Numismatics

- Fine Jewelry & Watches

- Native American Art

- Fine Books, Maps & Manuscripts

- Entertainment & Sports Memorabilia

- Western Art

- Baseball Cards

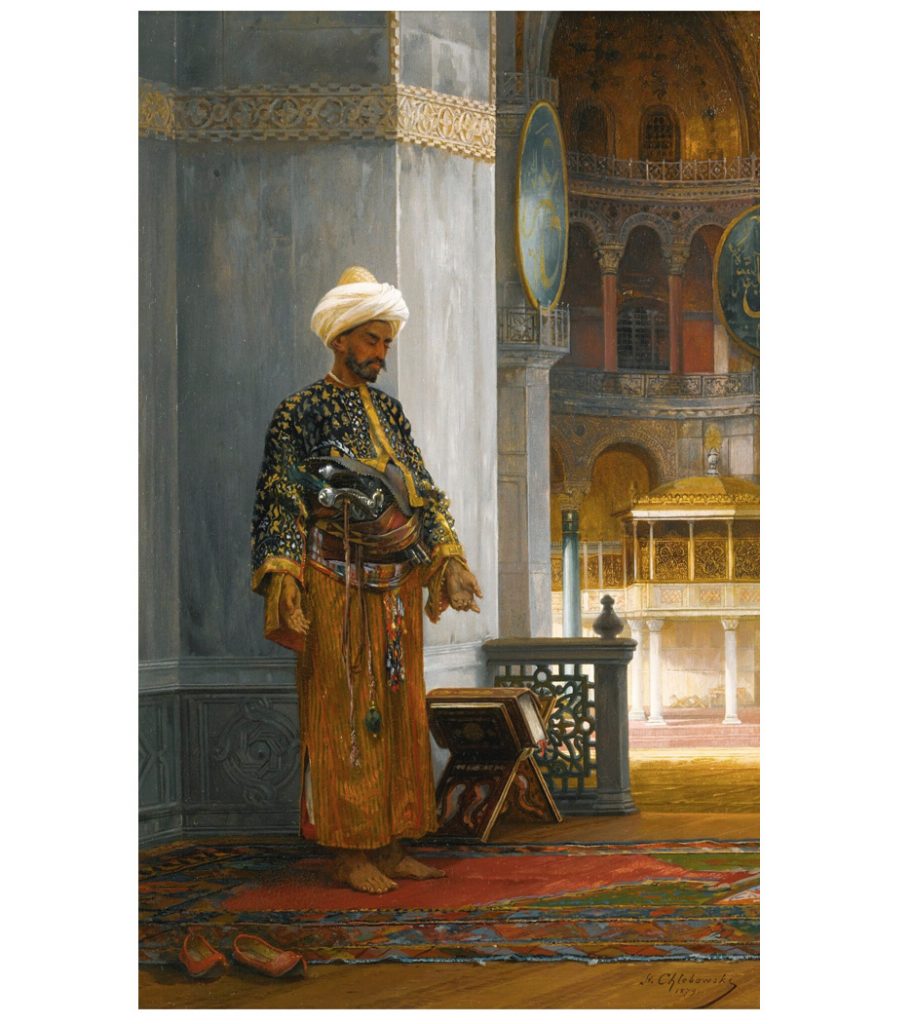

CASE STUDIES

If selling at auction we ensure it is sold in the correct specialty venue to net the highest return. An example of this is highlighted below. This work sold for $50,000 in a general Fine Arts sale. When re-offered a year later in the appropriate annual Orientalist sale in London it sold for $179,000, more than tripling its previous result.

Stanislaus von Chlebowski

At Prayer, Hagia Sophia

Oil on panel

18 x 12 in.

Pall Mall Art Advisors follows the market for all tangible assets including fine jewelry. We alert our clients on when is the best possible time for sale. The market is especially responsive right now for colored diamonds.

Unmounted Fancy Intense Orangey Pink Diamond

Estimate: $100,000-$150,000

Realized Price: $200,000 (with Buyer’s Premium)

Further Readings

- Ten Reasons “Going in Alone” at Auction is a Mistake

- 10 Reasons to Work with an Advisor for a Successful Sales Process

The Fine Art Group is honored to be in contention for the Best Lifestyle Management Award at the prestigious Private Asset Management (PAM) Awards 2020.

The PAM Awards exist to recognize the top investment professionals, wealth advisors, legal firms, consultants and other key service providers in the private asset management space.

The Fine Art Group sends our congratulations to all the winners!

At The Fine Art Group, we advise collectors and their financial and legal advisors on the strategic, long-term management of their collections of art, jewelry and collectibles.

Our team understands the complexity of owning, buying and selling tangible assets like no other, allowing us to function as our clients’ advocate at all times.

Whether providing Appraisal, Advisory (Buying or Selling) or Tangible Asset Management services our clients find our team and our network of more than 50 vetted experts to be a trusted resource.

We are a vetted partner with varied institutions such as High Net Worth Banking, Lifestyle, Accounting, Insurance and Wealth Advisors.