Colleen Boyle, Pall Mall Art Advisors’ Senior Vice President and National Sales Director, makes an appearance in the true crime art documentary Real Fake The Art, Life and Crimes of Elmyr de Hory.

The National Arts Club in New York City will be hosting a special filmmakers’ screening February 5, 2020. Pall Mall Art Advisors would like to encourage you to register for and attend this special event.

Real Fake: The Art, Life and Crimes of Elmyr de Holy

A Film by Jeff Oppenheim

The National Arts Club

15 Gramercy Park S

New York, NY 10003

February 5, 2020 – 8 PM

Elmyr de Hory was one of the most notorious forgers. He is alleged to have painted thousands of “fakes,” many of which still hang in major museums and private collections worldwide. Having eluded prosecution from Interpol, Scotland Yard and other authorities, veteran filmmaker Jeff Oppenheim re-opens the case in this investigative caper that sheds new light on the depth of Elmyr’s crimes.

This event is free and open to the public, however an

RSVP is required at nationalartsclub.eventbrite.com.

The Advisory team at The Fine Art Group is excited to bring you some of the objects of our affection this Valentine’s Day, including jewelry, fine art, handbags, wine, rare books and decorative arts. Hand-picked by our specialists and advisors, from upcoming sale venues, we hope that our selections inspire your gifts for your valentines this year.

Sotheby’s

February 11, 2020 – Contemporary Art Evening Auction

Sale L20020

Lot 3

Banksy

VOTE TO LOVE

Spray paint on UKIP placard mounted on board

46 x 46 x 3 1/4 in.

Estimate: $522,840-$784,260

Heritage Auctions

May 3, 2020 – Luxury Accessories Signature Auction

New York #5505

Chanel

Matte Pink Python Medium Boy Bag

Estimate: $3,000-$4,000

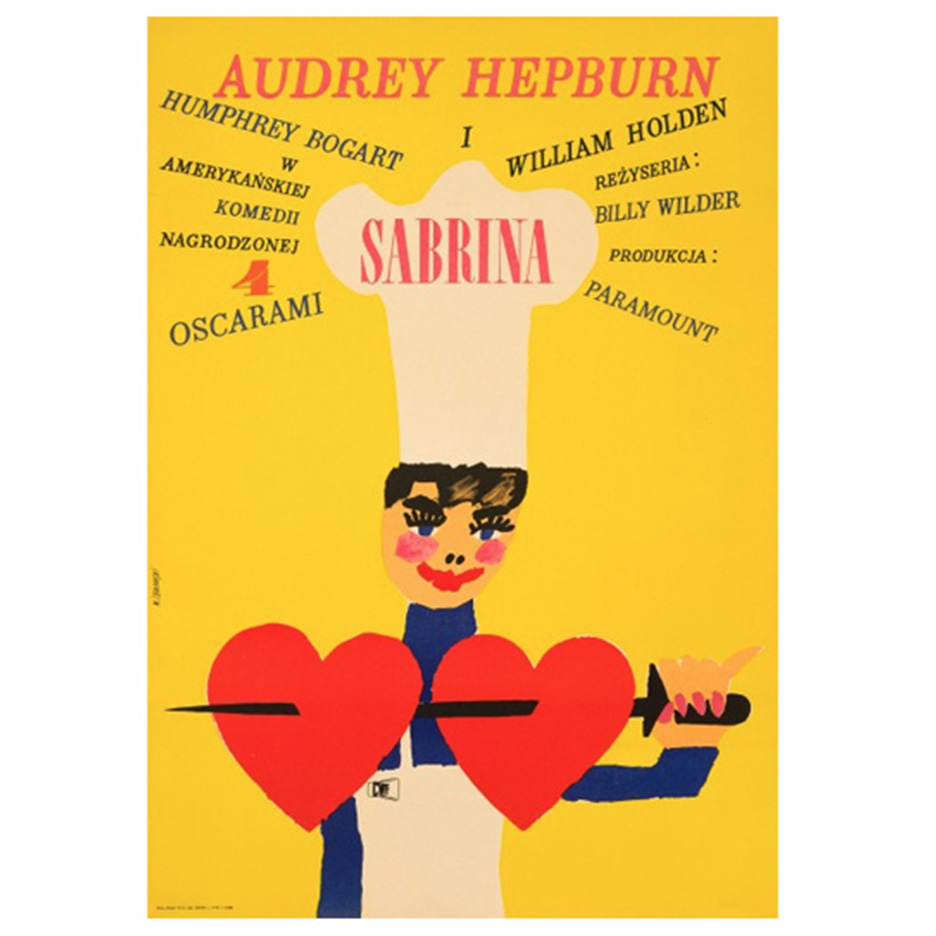

Rock Paper Film

Maciej Zbikowski

Sabrina

33 x 23 in.

1967

Retail Price: $1050

Sotheby’s

January 28, 2020 – Specialist Selects

Sale L20309

Lot 9

Fine Diamond Ring

Set with an oval diamond weighing 10.16 carats, between baguette diamond shoulders, size L.

Estimate: $367,416-$459,270

Sotheby’s

January 25, 2020 – Triumphant Grace: Important Americana from the Collection of Barbara and Arun Singh

Sale N10303

Lot 1072

Rare Stamp and Punch-Decorated Black and Red Leather Key Basket

Circa 1800

Estimate: $5,000-$8,000

Sotheby’s

February 5, 2020 – Impressionist & Modern Art Day Sale

Sale L20004

Lot 125

Marc Chagall

Bouquet d’œillets aux amoureux en vert

Gouache, pastel, oil and brush and ink on paper

31 1/2 x 23 in.

1950

Estimate: $459,270-$721,710

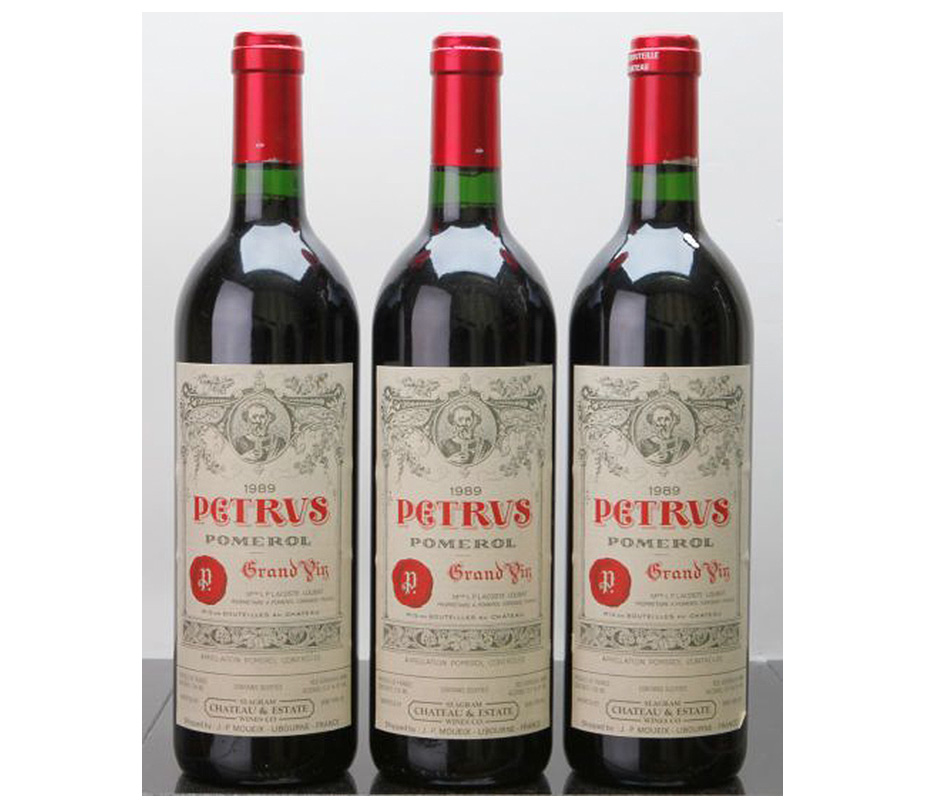

Berry Bros. & Rudd

Petrus, Pomerol

Cab. Sauvignon Blend, Full Bodied, Dry

13.5% alcohol

1989

$38,650

Bonhams

February 5, 2020 – Knightsbridge Jewels

Lot 297

Cartier

A Cultured Pearl and Diamond ‘Panthère’ Necklace

Estimate: $6,600-$9,200

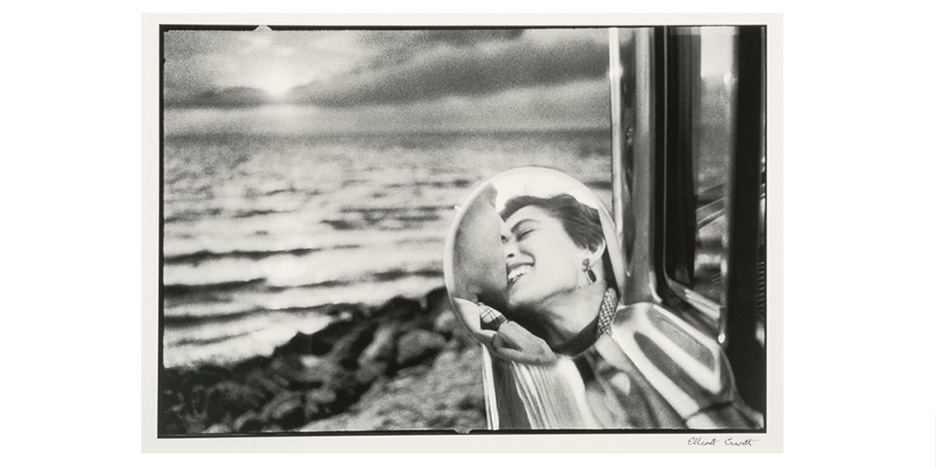

Heritage Auctions

April 4, 2020 – Photographs Signature Auction

New York #8002

Elliott Erwitt

California Kiss, Santa Monica

Gelatin silver print

12 1/4 x 18 in.

1955, printed later

Estimate: $4,000-$6,000

Doyle

January 23, 2020 – Cherished: American Folk Art & Toys from the Estate of a Private Collector

Sale 20FA01

Lot 380

American school

A Courtship Valentine

Watercolor on paper

11 1/4 x 8 in.

19th Century

Estimate: $2,000-$4,000

By Dan Weil, The Wall Street Journal, Published Dec. 15, 2019

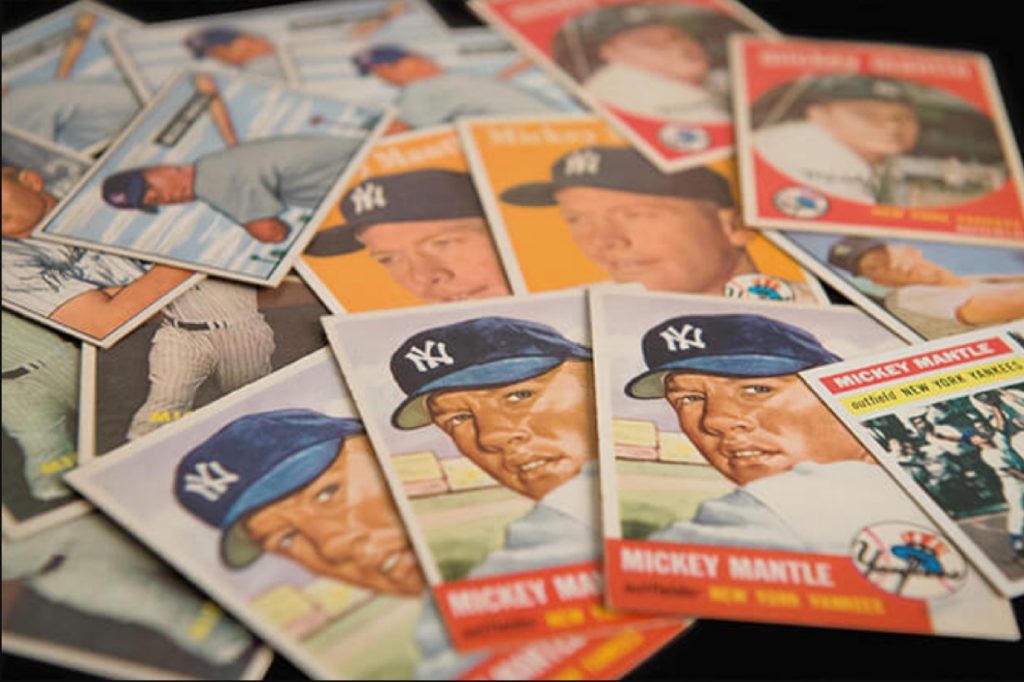

Three years ago, Simon Brown, a 36-year-old public-relations professional in Washington, D.C., purchased a 1938 Joe DiMaggio baseball card for $1,500. Its value now: $2,500, up about two-thirds, based on sales records for comparable cards, he says.

That kind of price appreciation is common in today’s sports-memorabilia market, particularly for items priced at $1,000 or more, market participants say. Just as stocks, bonds and other assets have soared in value since the last recession ended in 2009, so has sports memorabilia.

“It’s the same case for collectibles across the board,” says Chris Ivy, director of sports auctions for Heritage Auctions. “Some collectors even view sports memorabilia as an asset class for investment. A lot of our clients love sports and started collecting as kids for a hobby.”

Numerous factors explain the price run-up for sports memorabilia over the past decade, experts say, including the wealth of baby boomers, the entrance of millennials into the market and growing interest from foreigners. Demand for cards and game-used items, such as balls and jerseys, is particularly intense. Of all the sports, the market is generally strongest for baseball items.

Although experts expect the price inflation to continue as long as the economy stays strong, there is no guarantee, just as there are no guarantees with any investment. Making it even more dicey is that there are plenty of bogus and/or overpriced items out there waiting for careless buyers. That’s why it’s crucial for prospective buyers to do plenty of research before taking the plunge.

MONEY AND PASSION

Baby boomers are the foundation of the market because of the wealth they’ve amassed as a group during their careers. “They have huge buying power and nostalgia for sports memorabilia, such as baseball cards and jerseys of their favorite players,” says Anita Heriot, chief executive of Pall Mall Art Advisors, which assists clients with buying and selling all kinds of memorabilia, including sports items.

Meanwhile, Ms. Heriot says she has found that many millennials and members of Generation Z with the money to start collections, especially men, are turning to sports memorabilia because they’re more familiar with sports than they are with art. “That makes it more digestible as a passion and hobby,” she says.

Foreigners are jumping into the market, too, as more people around the world have more disposable income and more athletes from all over the world are achieving global fame in the most prestigious leagues and competitions. For instance, the wave of foreign players who have entered the National Basketball Association over the past 20 years, such as Yao Ming of China and Luka Doncic of Slovenia, has drawn non-Americans to NBA memorabilia, says collector Jimmy Mahan, 43-year-old director of staffing at a North Carolina summer camp. Collectors in China and even in the Philippines—a country with little basketball tradition and no obvious connection to the NBA—have driven prices up, he says.

USED IS GOOD

Baseball cards, which originated in the 1860s, remain a staple. Cards prior to 1960 have particularly escalated in value. “A handful of old cards have reached iconic status, such as Honus Wagner cards from 1909-11 and Mickey Mantle cards from 1952,” says Mr. Brown, the collector.

In May, one of those Wagner cards sold for $1.2 million, up 54% from its sale price of $776,750 in 2016 and 83% from its sale price of $657,250 in 2014, according to SCP Auctions, a sports-memorabilia specialist based in Laguna Niguel, Calif. Cards from other sports also have done well. A card of basketball icon Michael Jordan recently sold for $350,000 and a card of football legend Tom Brady commanded $400,000, notes Simeon Lipman, a pop-culture appraiser.

The 1997-98 Jordan card, sold on eBay, came from a set of Metal Universe Basketball Precious Metal Gems cards and is considered one of the most valuable Jordan cards, according to Beckett Collectibles. The card’s condition wasn’t rated, but it was listed as “altered.” The Brady card, which also sold on eBay, came from the 2000 Playoff Contenders Championship Ticket collection. Beckett graded it as being in mint condition.

But cards are starting to take a back seat to game-used items, including balls and jerseys, as collectors seek to get closer to the players and game action. “It’s a popular thing to have a jersey propped on a mannequin in someone’s man cave,” says Jasmani Francis, a consultant to the Winston Art Group, which appraises and advises on collectibles.

In June, a Babe Ruth New York Yankees jersey from 1928-1930 was auctioned at Yankee Stadium for $5.64 million, making it the most expensive piece of sports memorabilia ever sold, according to the auctioneer, Hunt Auctions.

Dennis Riehman, 67, a retired banker in Ossining, N.Y., has a 1927 ball purportedly used in batting practice with autographs from Babe Ruth and Lou Gehrig. He bought it from a family friend who was a Yankee Stadium usher for $2,000 about 25 years ago. A sports-memorabilia dealer told him last year that it was now worth five times that. But Mr. Riehman says the ball means too much to him to ever sell. “I’ll give it to my son.”

DON’T TRUST, VERIFY

So how can buyers, especially novices, avoid overpaying in this inflationary environment? Homework is essential. Buyers can do significant price research with an internet search of dealers, auction houses, appraisers and even eBay. Comparison prices exist on the web for many items, says Mr. Francis, the consultant. That includes sale prices for items comparable to the one a buyer is interested in and sometimes for the same item. Recent sale prices allow buyers to judge whether the current price of the item they want is in line with the market.

Buyers also should research the seller. “Know what it is you’re buying and from whom you’re buying it,” says Steve Sloan, president of Professional Sports Authenticator, which grades and authenticates sports memorabilia. “You should only purchase pieces from a reputable dealer that has been in business for at least five years,” he says. Independent, third-party certification of an item’s authenticity is also important, experts say. Authenticators besides PSA include James Spence Authentication and Beckett Authentication Services. A knowledgeable adviser also might help new collectors avoid costly rookie mistakes.

Despite the potential pitfalls, opportunities abound for collectors of sports memorabilia in a way they don’t for traditional art collectors. “Art is an elite passion,” says Pall Mall’s Ms. Heriot, with prices that run into the thousands even toward the lower end of the market. “But with $100, you can buy a decent sports trading card that will hold value. Sports memorabilia is probably the most populist of passion assets.”

Mr. Weil is a writer in West Palm Beach, Fla. He can be reached at reports@wsj.com.

Read the article on The Wall Street Journal

Further Readings

December is the month of presents, holiday travels, and family time. It is also the time of year when most charitable giving happens! Baby boomers are the wealthiest generation in American history and they’re about to pass down their wealth over the next few decades. A portion of this wealth is in the form of tangible assets that reflect the passions, interests and legacies of the individuals and families who owned them. However, what happens when the heirs are not interested in receiving the gift of art, jewelry, wine, furniture, and other objects that their parents and grandparents have collected over the years?

Art and collectibles can have a tremendous amount of value so you may consider using these items to further your philanthropic interests. Historically most people have donated cash to their favorite charities. Instead of writing checks, some individuals may consider converting their tangible assets such as art, jewelry, wine and other valuable collectibles into a philanthropic opportunity. Using tangible assets in a strategic philanthropy initiative presents families with the chance to work collectively to create a unifying legacy.

WHAT IS TANGIBLE PERSONAL PROPERTY?

Tangible gifts of personal property are defined as personal property other than land or buildings. Items that are included in this category are vintage cars, jewelry, artwork, wine, memorabilia, rare books, furniture, stamp and coin collections, and other types of valuable personal objects.[1]

If you are contemplating a gift of tangible personal property to charity, it is important to be aware of the complex tax issues it can present, which will need to be carefully evaluated by a tax professional in order to maximize your client’s gift and the possible tax deduction.

Below are a few issues to consider[2]:

- Have you owned the donated object for at least one year?

- Will the donated object be used by the charity in its tax-exempt function (related use)?

- Has the Charity agreed to keep the object for at least three years?

- Are you a collector or investor? If your are an artist or dealer, consult a tax advisor to understand the different IRS tax allowable deductions.

- Have you obtained a qualified appraisal for the donated object?

WHAT IS RELATED USE?

According to the IRS tax code, in order for a donor of tangible personal property to be able to take full advantage of a tax benefit, the charity must use the object in a manner that is related to its exempt purpose. Examples would be a painting that is added to the collection of an art museum and a tall case clock created by a regional clock maker given to a historical society. [2]

CASE STUDY FOR RELATED USE

A client has owned a painting for the past 12 years that was originally purchased for $50,000. The client has three heirs of whom none are interested in the painting. The client approached a local museum that is very interested in accepting the painting as a donation. In addition, the painting has appreciated over time and has a current fair market value of $225,000. Since the art museum is planning to keep the painting, the donor can deduct the full $225,000 value of the painting.

If the donor wants to give the same painting to an unrelated charitable organization, the client should consult with their tax advisor. The client may only be able to deduct the $50,000 cost basis. It is the donor’s responsibility to establish “related use,” so the donor should secure from the charity a letter stating the charity’s intent to use the property for a purpose related to its mission.

However a gift of artwork doesn’t necessarily have to be given to a museum to be considered for a related use. For example, gifts of artworks to a religious organization would be considered for a related use if the object would have religious and cultural significance. Similarly, gifts of artworks to a hospital may be for a related use if their display in common and patient rooms contributes to a healing environment.[3]

WHAT ARE OTHER PHILANTHROPIC OPTIONS FOR TANGIBLE ASSETS?

Charitable giving has never only been motivated by tax deductions. Even without the full tax advantage, clients still consider donating to passionate causes by converting their valuable objects into liquidity for a cause they really believe in.For example, a collector sold 800 bottles from his wine collection that had been assembled over three decades. The proceeds were donated to a charity that the collector supports which helps to improve the health and education of children and adults living in rural China.[4]In some cases where the need for a charitable deduction outweighs the importance for minimizing capital gains tax, it may make sense to sell the art, jewelry or other tangible assets, recognizing the income and offset it by making a charitable contribution to a donor advised fund. This allows the donor to possibly maximize their tax situation while unlocking art and other tangible assets for charitable dollars.If the donor contributes appreciated art or other appreciating tangible assets to a public charity (including a donor-advised fund), the collector potentially eliminates the capital gains tax that would otherwise be incurred in a sale resulting in more to give to charity.There are many advantages that come with the use of a planned giving vehicle. Nevertheless, should a client decide to donate tangible objects to an institution, donor-advised fund, or foundation, a tax specialist should be consulted to determine the best option.In conclusion, the field of strategic philanthropy is more sophisticated and complex than ever. More individuals are implementing a philanthropic strategy using collections of wine, art, jewelry and other tangible assets to help make a greater impact in the lives of others. Anyone that regularly writes checks to their favorite organizations and causes can develop a more strategic approach to giving by considering using tangible assets. Nonetheless, the philanthropic process involving these objects begins with understanding what your client owns and understanding the value.

OUR SERVICES

Whether you are an individual, family, foundation, or non-profit organization, The Fine Art Group can help make your charitable vision a reality.

[1] 1.14.4.1.5 (04-30-2018) Personal Property Management-Internal Revenue Service Terms/Definitions/Acronyms

[2] IRS Publication 526 (Cat. No. 15050A) Charitable Contributions

[3] IRS Publication 506 Charitable Contributions

[4] Sotheby’s Sale, The Philanthropist’s Cellar: An Extraordinary Collection sold to Benefit Charitable Causes, March 31, 2018.

Art Investment: True Value vs. Emotional Value

Being that the purpose of art is to evoke emotion, it is hard not to let emotions play a big part in its acquisition. Successfully acquiring art requires you to put that emotion aside and make an assessment of the true value of the piece based on an objective set of criteria, especially if you are looking to procure art at least in part for its future investment value.

When you find a painting or another piece of art that interests you and you begin to consider purchasing it, conducting due diligence is a critical step. The piece should be passed through a series of important “quality control” criteria. Then, if you or a trusted expert determines that the quality is excellent, you can begin reviewing the market analytics around the investment opportunity and begin negotiations.

Due Diligence Before Acquiring Artwork

It is important to consider key quality criteria as the foundation of high-quality artwork, regardless of price:

- Artist: Obtaining information about the artist will go a long way in determining the piece’s value. You should ask: How successfully does the artist sell at auction? How many times has the artist sold at auction? If the artist does not sell at auction, which galleries represent the artist? Is the artist represented in museum holdings? Has the artist participated in important exhibitions?

- Medium: Generally, original works such as oil on canvas, watercolor, or ink-on-paper have a better chance of continuing to go up in value. Prints can be an excellent acquisition, but be careful of edition size and quality.

- Size: A small work will never achieve growth in value beyond a certain point, and works between 16 inches and 40 inches are the most logical size. However, some contemporary artists may always work in larger sizes.

- Subject Matter: When you think of Andy Warhol, you may think of a Campbell’s Soup Can. That is because this is the subject matter, which is the essence of the Pop Art movement. The price for one of his works depicting a Soup Can will always surpass the price of a portrait of an unrecognizable figure.

- Rarity: A work that is fresh to the market and has never been seen will generally be more expensive. A rare edition bronze or a low edition print will generally be more expensive than a high edition print.

- Provenance: A painting previously exhibited in important shows and recorded as owned by notable collectors will have a higher price. In addition, provenance helps to establish the authenticity of the painting.

- Sales History: This is a huge red flag. Many dealers will acquire paintings when they go unsold because they can buy them at a better price. It is essential that you confirm the sales price at auction. Understanding the market for the artist is the beginning of your negotiation.

When you have the answers for each of these questions and all of the above criteria, you will have enough information to negotiate. In the art world, knowledge is power, and the information you gather will help you determine the most accurate price and whether the work is a good asset acquisition. While this may seem like an overwhelming amount of information needed to acquire a work, you will find that it will be worth it. At The Fine Art Group these criteria are applied to every acquisition and to every value. As a result, we likely can save a client upwards of 20 percent on a work of art.

Art Purchasing Strategies

There are other factors to consider once you have acquired the work that will have an impact on your bottom line and cost basis. Where the work is stored and strategy for “use” can have a major impact on sales and use tax. For example, if the artwork is stored in Oregon or Delaware, which are states that do not have a sales tax, this can be waived. In addition, creating a “use” strategy for the artwork can also save you from paying a use tax. Californians need to be particularly careful of the use tax.

Remember, don’t purchase a piece based on emotion. Be sure to conduct your due diligence before you acquire any works of art.

Read the Article on the Tiger 21 Website

Further Readings

- Is Art a Good Investment?

- The Asking Price: Understanding Value # 1

- The Asking Price: Understanding Value #2

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

We are delighted to announce that on November 12, 2019, our advisory department assisted one of our clients with acquiring an important Gauguin painting at Christie’s Impressionist & Modern Art Day Sale in New York at $240,000 hammer.

Paul Gauguin (French, 1840-1903)

La ferme de la Groue à Osny

1883

Oil on canvas

15 1/8 x 18 in.

Signed and dated ‘P Gauguin 83′ lower right

Sold: $240,000 (Hammer)

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

We are delighted to announce that Lot 485, Platinum, A Ruby and Diamond Ring and Lot 491, Unmounted Fancy Intense Orangy Pink Diamond both sold for well over the high estimate.

Sale: Important Jewelry, October 16, 2019

Doyle

Lot 485

Platinum, Ruby and Diamond Ring

Centering one cushion-shaped ruby approximately 7.46 cts., flanked by 2 tapered baguette diamonds.

Size 8 1/4.

Estimate: $70,000-$90,000

Sold for $125,000 (with Buyer’s Premium)

Doyle

Lot 491

Unmounted Fancy Intense Orangy Pink Diamond

One cut-cornered rectangular Fancy Intense Orangy Pink diamond.

Approximately 2.

Estimate: $100,000-$150,000

Sold for $200,000 (with Buyer’s Premium)

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

The Fine Art Group is pleased to be a sponsor at the National ACTEC 2019 Fall Meeting.

Experienced attorneys come across clients who own art, jewelry and other valuable collectibles from time to time.

In the process of advising clients you probably have asked yourself one or more of the following questions:

- How do I achieve the best possible return on the sale of an estate’s art, jewelry, wine and collectibles?

- Does my client have a varied and complex portfolio of tangible assets that require an IRS compliant appraisal or a monetization strategy?

- What is the best strategy to include my client’s valuable tangible assets into a philanthropic plan to maximize tax benefits or continue a legacy?

In order to answer these and other questions, we’d like to invite you to stop by The Fine Art Group table at the ACTEC 2019 Fall Meeting.

If you prefer to make an appointment with me or one of my colleagues ahead of time, please don’t hesitate to reach out to me through the below email address or by phone.

I look forward to meeting you in person.

Further Readings

- Protect Your Investments while Divesting Tangible Assets

- Freya Stewart To Speak at the Art Business Conference

WHAT MAKES COLLECTING CARS SIMILAR TO OTHER ASSETS?

Like fine art, many collectibles have seen significant appreciation in value over the past decade. This includes classic cars; which collectors purchase because they are passionate about the cars and can enjoy the asset. Unlike a stock or a painting, part of the fun is that the collector can drive a classic car.

Just as with art, the collector should obtain professional advice to choose a classic car wisely. A collector needs to understand the market and ride out the fads and will usually have to keep a classic car for several years before noticing any potential appreciation.

A collector also needs to be aware of the provenance of a car, understanding its history. Has it been well maintained? How many owners has it had? Has it been shown or won awards? If it has been restored, when was it done and by whom?

WHAT ARE THE BIGGEST CHALLENGES TO COLLECTING CARS?

Because of the illiquid nature of classic cars, there are several issues for collectors to consider. For instance, while a stock can be sold rapidly, finding a buyer willing to pay the asking price for a vintage car may take time, and the interest in different makes and models will differ. These longer cycles may not necessarily correspond with the collectors need to convert a classic car into cash.

While hunting for classic cars is exciting, it is important that collectors plan for their collections. A key issue is capital gains taxes. If the cars are appreciating, collectors should talk with a financial advisor or accountant regarding how to minimize the capital gains. Global trends and tastes change so it is important to follow the market and monetize when demand is strong.

Another concern is that vintage car parts may not be readily available. Since finding replacement parts for a rare car may be difficult or expensive, a newer collector may want to choose something not extremely rare.

It also may be difficult to find a good mechanic. The process of diagnosing automotive problems by sound alone is becoming a lost art. Modern mechanics rely on a host of computerized readers to determine what is wrong with an engine, and that equipment does not work with antique and classic cars.

Storage fees are yet another concern. Depending on how many cars a collector owns, special classic car storage facilities may be required.

CAR COLLECTING TRENDS

Factors such as scarcity, brand, age, condition, provenance and desirability can affect the value of a classic car. A supercar may be a high-risk investment, but it could be very lucrative. The most profitable supercars tend to be models that are in development and up for sale prior to delivery.

According to Steve Linden, classic car expert and CEO of Chrome Strategies, the interest in Preservation Class cars, ‘survivor cars,’ continues to grow. These are cars that are in good condition and have not been restored. Collectors face difficult choices in deciding whether to restore classic cars or leave the vehicle in its original state. The best appreciating classic cars are ones that were produced in limited runs and aspirational vehicles even when they were new.

FURTHER READINGS

- Art, Cars & Collectibles: How to Mitigate Risk Before a Disaster Hits

- Market for Sport Memorabilia Continues to Score Big

Whether you are building a wine, art or trading card collection, or determining the best way to sell your tangible assets, there are fundamental steps to follow.

ACQUISITION STRATEGY

Wine is a traditionally popular place to build assets, but trading cards are growing as viable alternative investments. While each must be approached differently, there are similarities in how best to establish your collection.

Charles Curtis is a Master of Wine and founder of WineAlpha, a fine wine advisory serving private, trade and institutional clients with an interest in the market for fine and rare wine.

He advises following these steps:

- Break it into sub-genres: Since what is true for Bordeaux is not necessarily true of Burgundy, you must understand the multi-year trends for each wine type. Slavishly following trends can result in strategic errors.

- Avoid the bubble: Right now, for example, Burgundy is trading at historic highs so finding value is tricky. To do so, know which producers are popular (Domaine de la Romanée Conti), where prices are rising (La Tâche) and where they are stagnant (the bottling from the Romanée Conti itself).

- Protect value: Pay attention to provenance, condition and rarity, factors essential to driving asset value in any category. For instance, there will be tens of thousands of cases of your typical first-growth Bordeaux produced and hundreds of cases of magnums, but only a few dozen to a few score of larger bottles such as double magnums (3 liters), jeroboams (5 liters) or imperials (6 liters).

- Avoid the “unicorn”: While rarity is important, maintain common sense. Certain wines such as Lafleur ’47 and magnums of Petrus ’29 are so rare that they are almost invariably counterfeit. To steer clear of problems, stick with wines that have a solid provenance and trading history.

- Play the arbitrage: Wine is a global category, so to get in at the right price don’t overlook sourcing in London or Hong Kong. Typically, London sales have the lowest prices, while the best property often comes up in Hong Kong (albeit at a premium).

- Pay attention to expenses, but don’t cut corners either: It is essential to use temperature-controlled shipping and storage and to insure wine end-to-end, but it is important not to overpay for these services, or to pay too much tax. As with everything, the devil is in the details.

While wine has long been popular in collecting for investment purposes, building a trading card portfolio is emerging as a very profitable undertaking. Growing interest was stoked by the sale in February 2018 of a 2000 Tom Brady Rookie Card for nearly $110,000 at auction, reflecting an almost 300% return on investment in just two years

Brent Huigens, CEO of PWCC, the largest trading card venue, lays out six essential rules for investing in trading cards:

- Establish a goal: Determine how long investments will be held and the return desired. Consider whether this will be an actively managed portfolio, which may require more time for tracking demand and pricing trends, or one that can be left alone to appreciate.

- Specialize in a sector: A trading card portfolio should revolve around a type of card – new or old, sports or non‐sports, mainstream or esoteric card productions, or from a specific era within vintage or modern cards. Investors can still diversify within a narrowly defined “sector,” and advanced investors might maintain several portfolios, each with a unique focus.

- Personalize to your interests: Consider gravitating toward a sector that resonates with you because the in-depth research and analysis essential to portfolio construction may be more enjoyable. A passion for the investment could separate the most successful investors from the pack; they are often more willing to dig into the industry’s detail.

- Pick a portfolio size: Whether available funds for this venture are $10,000 or $1 million, it is possible to create a well‐diversified portfolio. Clearly, a smaller budget may mean targeting lower-valued cards, but the ROI is as bright on both low and high value cards. Use historical sales tools to study the market, assess historical sales patterns and build future portfolio goals.

- Understand eye appeal: Evaluate the quality. Card values can be complex, relying on a combination of the card, its professional grade and the quality of a card within that grade, which can significantly impact market value.

- Seek professional guidance: Real‐time analytical tools and investment guidance that help develop an investors strategy and help pinpoint the right cards for a portfolio are available from professionals.

SALES STRATEGY

Selling your tangible assets is a very tricky business, so whether it’s just one item or a collection that you hope to sell, professional guidance is absolutely necessary. It’s a big mistake to do it alone if you want the best results. An advisor will make your endeavor effortless and transparent, and most importantly, ensure you get the highest return.

Anita Heriot, President of Pall Mall Art Advisors, uses the term “tangible asset fiduciary” to describe our work on your behalf in the sale process. A tangible asset fiduciary is a “fire wall” between the client and the auction house, dealer or art advisor. We are your representatives, making certain that the sale process works, that the work of art is placed with the best venue, and that all the steps for a successful sale are met.

We start by determining the most appropriate method and market for sale. While some works can and should be sold privately, others benefit from a more competitive market by being sold at auction in a specialized sale.

Several steps are necessary to ensure a good result at auction, and it starts with finding the right auction house. Although most regional and national auction houses have Fine Art Departments, only a select few have specialized sales that target the right collectors for a particular work. These specialized sales include more thematic categories like the annual “Orientalist Sale” at Sotheby’s in London or Copley Fine Art’s bi‐annual “Sporting Sale,” or regional specializations such as Freeman’s bi‐annual Pennsylvania Impressionists sale or Leslie Hindman’s “Made in Chicago” sale.

Using specialized sales is strategic because the auction venue has dedicated marketing and a focused clientele for the specific work to be sold. Even with the full scope and reach of the internet and international bidding, choosing the right brick-and‐mortar venue still can be the difference between a work selling and a work selling well.

To find the right venue and specialized sale for your artwork, our team looks at how many works of art by the artist in question have been sold by each one of several key auction houses we identify.

We utilize this same thought process when assisting with all tangible assets, including furniture, decorative arts and collectibles.

Equally important is negotiating the terms of the sale. The auction business is expense heavy because auction houses must insure the works while in storage, produce expensive catalogues, pay for expensive real estate and pay their expert staff. As a result, they try to look to sellers to absorb some costs by charging fees for photography, insurance, storage, shipping and marketing, as well as a seller’s commission. However, all of these fees can be waived if the collection has value.

Other essential steps include:

- Marketing: Ensure that your work is featured in any press and placed in a predominant place in the catalogue and in the internal auction marketing campaigns. To get a high price at auction people must be aware of your work of art. High exposure is essential.

- Estimates: These are the “secret sauce” to a successful sale. Auctions need a minimum of two people who want your work. Better yet would be 10 or more people bidding online, in the auction room or on the phone. Therefore, it’s best to place estimates that appear to be below the value of the work, giving you a much better chance at a higher return. It may seem illogical, but auction psychology requires emotion.

- Guarantee: For a very significant work of art, you may benefit from establishing an auction guarantee. While not always in your financial interest, it provides a safety net.

- Reserve: Set a reserve, the lowest number at which you are willing to sell your work. While not known to the public, a reserve should be set as close to the sale date as possible because a lot of information comes into the auction house very close to the sale which will provide insight into buyer interest in the piece. Make sure your reserve is low enough that an auctioneer has the ability to start low to get people excited about bidding on the piece.

- Insurance: The biggest losses tend to occur when the artwork is in transit from your house to the auction house. Have a true insurance value on the piece so that in case of loss you are made whole. Don’t trust the shippers to have appropriate insurance.

- Placement: Make sure that when the exhibition is up for viewers of the sale your work is displayed in a dominant position in the sale room and has good light.

Finally, avoid having your work of art go unsold because that’s not good for its resale value. If you carefully follow the steps above, you should have a successful sale and not get the object back.

As you can see, regardless of the object of value, the selling process can be quite complex, which is why it is a mistake to do it alone. Allow a tangible asset fiduciary to bring expertise to the successful sale of your work of art or collection.