IMPRESSIONIST & MODERN WORKS ON PAPER

Lot 221

Léonard Tsuguharu Foujita (1886-1968)

Les danseuses

signed ‘Foujita’ in Japanese and ‘T. Foujita’ (lower right)

Watercolour and pen and ink on paper

12 7/8 x 18 ¾ in.

1920

Estimate: £50,000-£80,000

Sold: £106,250 (with Buyer’s Premium)

IMPRESSIONIST & MODERN ART DAY SALE

Lot 405

Moïse Kisling (1891-1953)

L’Albergo

signed ‘Kisling’ (lower left)

Oil on canvas

28 7/8 x 21 1/4 in.

1922

Estimate: £50,000– £80,000

Sold: £62,500 (with Buyer’s Premium)

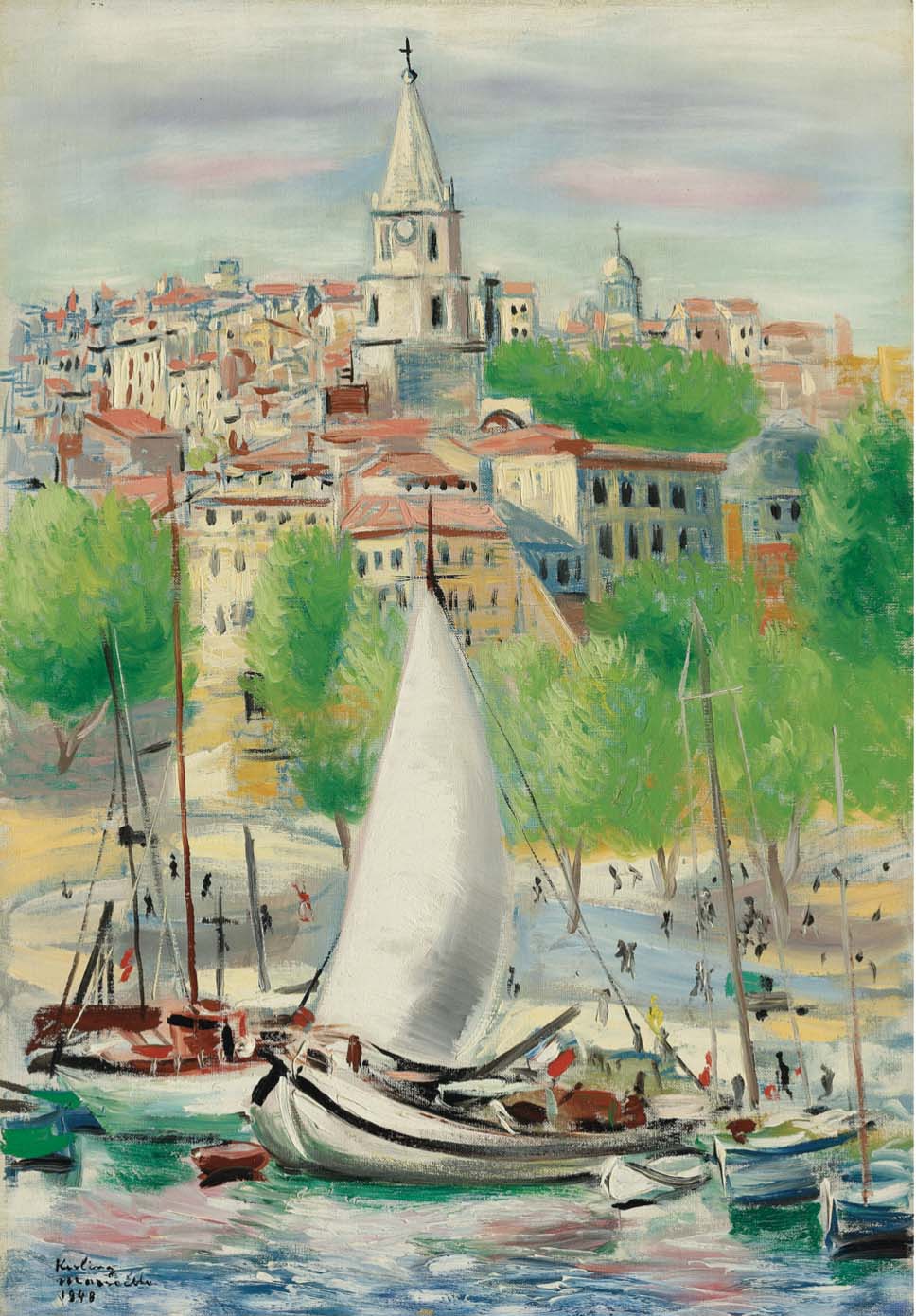

Lot 406

Moïse Kisling (1891-1953)

Marseille

signed, dated and inscribed ‘Kisling Marseille 1948’ (lower left)

Oil on canvas

21 3/4 x 14 7/8 in.

1948

Estimate: £40,000–£60,000

Sold: £75,000 (with Buyer’s Premium)

Lot 412

Marc Chagall (1887-1985)

Enceinte du mur de Jerusalem

stamped with the signature ‘Marc Chagall’ (lower right)

Oil on canvas

15 x 12 1/4 in.

1931

Estimate: £80,000– £100,000

Sold: £162,500 (with Buyer’s Premium)

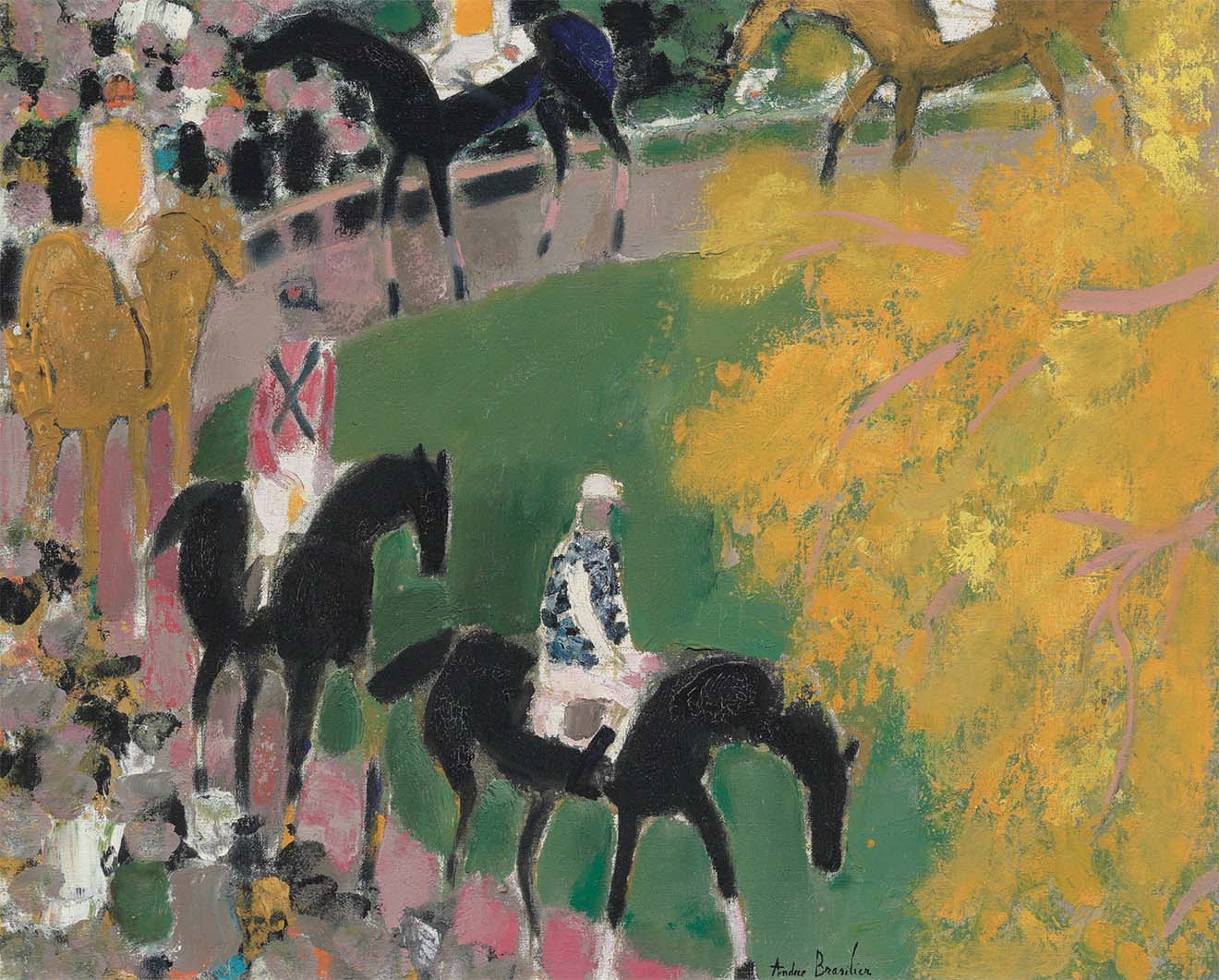

Lot 509

André Brasilier (B. 1929)

Le paddock

signed ‘André Brasilier’ (lower centre)

Oil on canvas

23 3/4 x 28 3/4 in.

1960

Estimate: £35,000–£55,000

Sold: £43,750 (with Buyer’s Premium)

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

UPCOMING EXHIBITION

The UC Berkeley Art Museum and Pacific Film Archive will be exhibiting a recent Hans Hofmann work that The Fine Art Group sold on behalf of a client last year. The work shall be included in the upcoming exhibition Hans Hofmann: The Nature of Abstraction from February 27–July 21, 2019.

Hans Hofmann

Cataclysm (Homage to Howard Putzel)

1945

Oil and casein on board

51 3/4 x 48 in.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

PART IV OF OUR SERIES: ARE YOU A TANGIBLE ASSET FIDUCIARY?

Baby boomers are the wealthiest generation in American history and they’re about to pass down their wealth over the next few decades. A portion of this wealth is in the form of tangible assets that reflect the passions, interests and legacies of the individuals and families who owned them. However, are the heirs interested in acquiring the art, jewelry, wine, furniture and other objects that their parents and grandparents have collected over the years?

Consumer tastes have changed and the younger generation may not be interested in acquiring their parents or grandparents’ treasures. So what can a family do with these objects?

Art and collectibles can have a tremendous amount of value so your client with these types of assets may consider using these items to further their philanthropic interests. Historically most people have donated cash to their favorite charities. Instead of writing checks, some clients may consider converting their tangible assets such as art, jewelry, wine and other valuable collectibles into a philanthropic opportunity. Using tangible assets in a strategic philanthropy initiative presents families with the chance to work collectively to create a unifying legacy.

What is tangible personal property or passion assets?

Tangible gifts of personal property are defined as personal property other than land or buildings. Items that are included in this category are vintage cars, jewelry, artwork, wine, memorabilia, rare books, furniture, stamp and coin collections, and other types of valuable personal objects.

If your client is contemplating a donation of tangible personal property to charity, it is important to be aware of the complex tax issues it can present, which will need to be carefully evaluated by a tax professional in order to maximize your client’s gift and the possible tax deduction.

Below are a few issues to consider:

- Has the client owned the donated object for at least one year?

- Will the donated object be used by the charity in its tax-exempt function (related use)?

- Has the Charity agreed to keep the object for at least three years?

- Is the client a collector or investor? If the client is an artist or dealer, consult a tax advisor to understand the different IRS tax allowable deductions.

- Has the client obtained a qualified appraisal for the donated object?

- What is Related Use?

According to the IRS tax code, in order for a donor of tangible personal property to be able to take full advantage of a tax benefit, the charity must use the object in a manner that is related to its exempt purpose. Examples would be a painting that is added to the collection of an art museum and a tall case clock created by a regional clock maker given to a historical society.

CASE STUDY #1

A client has owned a painting for the past 12 years that was originally purchased for $50,000. The client has three heirs of whom none are interested in the painting. The Fine Art Group recommended that the client approach an art museum that is very interested in accepting the painting as a donation. In addition, the painting has appreciated over time and has a current fair market value of $125,000. Since the art museum is planning to keep the painting, the donor should be able to deduct the full $125,000 value of the painting.

If the donor wants to give the same painting to an unrelated charitable organization, the client should consult with their tax advisor. The client may only be able to deduct the $50,000 cost basis. It is the donor’s responsibility to establish “related use,” so the donor should secure from the charity a letter stating the charity’s intent to use the property for a purpose related to its mission.

However a gift of artwork doesn’t necessarily have to be given to a museum to be considered for a related use. For example, gifts of artworks to a religious organization could be considered for a related use if the object would have religious and cultural significance. Similarly, gifts of artworks to a hospital may be for a related use if their display in common and patient rooms contributes to a healing environment.

When is an appraisal needed?

Contributions of art, jewelry, wine and other tangible assets worth more than $5,000 require the donor to obtain a qualified appraisal from a “qualified” appraiser. The qualified appraiser must be independent of the donor (the appraiser can’t be anyone related to the donor nor have been involved with a former sales transaction with the donor) For instance, if a client purchased a rare historical document from an auction house with the intent to eventually donate the item to a museum, then the donation appraisal can not be completed by the auction house where the object was purchased.

Once the appraisal is completed, the IRS Form 8283 must be completed and filed with the donor’s income tax return. This form includes a summary of the appraisal, signature of the appraiser, a signature of the charity and a statement from the appraiser that he/she is qualified to complete the valuation. Any item valued for fair market in excess of $50,000 is automatically referred to the Art Advisory Panel for review.

What are other philanthropic options for tangible assets?

Charitable giving has never only been motivated by tax deductions. Even without the full tax advantage, clients still consider donating to passionate causes by converting their valuable objects into liquidity for a cause they really believe in.

For example, a wine collector may want to sell 800 bottles of wine from the collection that had been assembled over three decades and allocate the proceeds to a charity that the collector supports.

CASE STUDY #2

Mr. and Mrs. Jones collected contemporary art, Tiffany lamps, rare books and antique coins. Their four children and the seven grandchildren were not interested in inheriting any of these items. However when Mrs. Jones fell ill, the multigenerational family wanted to create a legacy in her honor. The family decided to monetize the collections and create a scholarship fund in Mrs. Jones name at her alma mater. The family worked with a Tangible Asset Fiduciary, such as The Fine Art Group to negotiate the costs associated with monetization process and to determine the best venue for sale for each of the asset class.

There are many advantages that come with the use of a planned giving vehicle. Nevertheless, should a client decide to donate tangible objects to an institution, donor-advised fund, opportunity zone or foundation, a tax specialist should be consulted to determine the best option.

In conclusion, the field of strategic philanthropy is more sophisticated and complex than ever. More individuals are implementing a philanthropic strategy using collections of wine, art, jewelry and other tangible assets to help make a greater impact in the lives of others. Anyone that regularly writes checks to their favorite organizations and causes can develop a more strategic approach to giving by considering using tangible assets. Nonetheless, the philanthropic process involving these objects begins with understanding what your client owns and understanding the value.

OUR SERVICES

Whether you are an individual, family, foundation, or non-profit organization, The Fine Art Group can help make your charitable vision a reality.

MASTER PAINTINGS EVENING SALE

Our Advisory team sells 3 works from one client’s collection. All were a part of the single owner sale, The Gilded Age Revisited: Property from a Distinguished American Collection.

All shining examples of the tangible benefit to working with an advisor who places work appropriately in the marketplace and creates tailored marketing around a collection to ensure the best possible outcome at sale.

Lot 52

Angelika Kauffmann, R.A

Portrait of Three Children, Almost Certainly Lady Georgiana Spencer, Later Dutchess of Devonshire, Lady nenrietta Spencer and George Viscount Althorp

Estimate: $600,000–$800,000

*Sold: $915,000 (world record setting sale)

Lot 69

Claude-Joseph Vernet

A Mediterranean Port at Sunset, with a Fisherman in the Foreground and a Couple at Left Walking Along the Rocky Coast

Estimate: $300,000–$500,000

Sold: $639,000

Lot 68

Jan Brueghel the Elder

A Wooded Landscape with Peasants Crossing the River

Estimate: $500,000–$700,000

Sold: $555,000

RÉGENCE STYLE GILT-BRONZE-MOUNTED EBONIZED CENTER TABLE

Estimate: $4,000-$6,000

Sold: $24,000

Lot 780

Eugen Von Blaas

A Maiden with a Basket of Roses

Oil on panel

Estimate: $200,000-$300,000

Sold: $500,000

Lot 771

William Bouguereau

Pâquerettes

Oil on canvas

Estimate: $$00,000-600,000

Sold: $960,000

Lot 753

Louis XV Ormolu Cartel Clock

Estimate: $10,000-$15,000

Sold: $42,000

19th CENTURY EUROPEAN ART

Lot 411

Virginie Demont-Breton

Femme de Pêcheur Venant de Baigner Ses Enfants

Estimate: $100,000–$150,000

Sold: $543,000 (world record setting sale)

Virginie Demont-Breton Auction History

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

OLD MASTER EVENING SALE

On the evening of January 30th, Sotheby’s New York will be offering a collection of works by female artists from the 16th-19th centuries as part of their old master evening sale.

Among these works is an Angelika Kauffmann, R.A. (COIRA 1741-1807 ROME), Portrait of Three Children, almost certainly Lady Georgiana Spencer, Later Duchess of Devonshire, Lady Henrietta Spencer and George Viscount Althorp.

The Fine Art Group is proud to represent the collection this Kauffmann comes from, which can be viewed as a single owner sale from January 25th to February 1st at Sotheby’s in New York.

Featuring Highlights from The Female Triumphant

Including Masterworks by Rosa Bonheur, Virginie Demont-Breton and Elizabeth Gardner Bouguereau

10 Works by William Bouguereau

Led by Le livre de prix, Unseen on the Market for Over a Century

Exceptional Victorian & British Paintings

Including Works by Sir Lawrence Alma-Tadema and John Atkinson Grimshaw

Elizabeth Jane Gardner Bouguereau

Le captive

Estimate: $250,000-$350,000

William Bouguereau

Le livre de prix

Estimate: $1-$1.5 million

SOTHEBY’S MASTERS WEEK EXHIBITION

OPEN TO THE PUBLIC ON JANUARY 25, 2019

New York, January 18, 2019

Sotheby’s auction of 19th Century European Art on 1 February 2019 will present over 200 works that reflect the rich diversity of artistic production of the period. Paintings by Rosa Bonheur, Virginie Demont-Breton and Elizabeth Gardner Bouguereau are among the highlights from The Female Triumphant – a group of masterworks by trailblazing female artists from the 16th through the 19th centuries, which will be offered across our Masters Week sales this January. The sale is further distinguished by William Bouguereau and Jules Breton’s portraits of rural life, Sir Lawrence Alma-Tadema and John William Godward’s epic visions on the Ancient world, and Pascal Adolphe Jean Dagnan-Bouveret and Jean Béraud’s views of life in the Belle Époque – many of which are from private collections and resurfacing at auction for the first time in over a century.

Open to the public on 25 January, the sale will be presented alongside Sotheby’s Masters Week exhibitions.

THE FEMALE TRIUMPHANT: WOMEN ARTISTS OF THE PREMODERN ERA

Rosa Bonheur

Le Labourage

Estimate: $80,000-$120,000

In the late nineteenth century, Paris invited innovation, experimentation and boundary breaking, yet the advancements made by women artists in the public sphere were met with challenges. Thanks to their irrefutable talent and perseverance, women certainly found success, as illustrated in the vital careers of the artists featured in The Female Triumphant, including Rosa Bonheur, Virginie Demont-Breton and Elizabeth Gardner Bouguereau.

A precocious talent from a young age, Rosa Bonheur first exhibited at the Salon in 1841. Four years later, she presented Le labourage, and earned a third place medal for its characteristically meticulous craftsmanship and photographic realism (above, estimate $80/120,000). Her achievement not only cemented her as a success, but led to further commissions and ultimately the

French Légion d’honneur, which was presented to her in 1865 and marked the first time a woman received the honor.

Elizabeth Gardner Bouguereau was one of the most accomplished Salon artists among expatriates in mid-nineteenth century Paris and in 1887 had the distinction of becoming the only American woman to receive a Salon medal. In addition, Gardner’s personal and professional attachment to her husband William Bouguereau was instrumental in establishing her style and in marketing her work such as La captive, exhibited at the Salon of 1883 (front page, estimate $250/350,000), and Les trois amis (estimate $250/350,000).

Virginie Demont-Breton

Femme de pêcheur venant de baigner ses enfants

Estimate: $100,000-$150,000

Virginie Demont-Breton enjoyed an artistic upbringing and cultivated her talent from an early age, having trained under her father, Jules Breton, who work is also represented in the auction. Winning Demont-Breton’s first medal at the Salon of 1881, Femme de pêcheur venant de baigner ses enfants is the artist’s earliest masterpiece, propelling her distinguished career as a painter and as a pioneering advocate for women artists (estimate $100/150,000). In 1894, Demont-Breton was the second woman in France to be awarded the Légion d’honneur and from 1895-1901 served as the president of the Union des Femmes Peintres et Sculpteurs where she was instrumental in the fight to grant women entrance to Paris’ École des Beaux Arts.

WILLIAM BOUGUEREAU: MASTER OF FRENCH ACADEMIC PAINTING

William Bougereau

Bacchante

Estimate: $600,000-$800,000

A selection of 10 works by William Bouguereau will be highlighted by Le livre de prix, one of the finest canvases of the artist’s mature period to come to auction (front page, estimate $1/1.5 million). The young girl in the present work is Yvonne, one of the artist’s favorite models, who appears in many of Bouguereau’s compositions from 1893. Formerly in the collection of Henry May, Vice President and General Manager of the Pierce-Arrow Motor Company, the work has remained in the same family’s collection for over 100 years. Known only through a black and white photograph from Bouguereau’s studio, its presentation today marks an important and long-awaited rediscovery.

Also featured in the January sale is Bacchante from 1894 (above, estimate $600/800,000). The painting was likely inspired by the mythological subjects favored by many nineteenth century artists, including Bouguereau’s English contemporaries Sir Lawrence Alma-Tadema and John William Godward. The woman in the present work, a Dionysian devotee, belongs to a series the artist referred to as “fantasy paintings,” a theme that the artist established through earlier works that illustrate Classical narratives.

JULES BRETON: THE PAINTER OF PEASANTS

Jules Breton

Le Matin

Estimate: $400,000-$600,000

The January sale features four exceptional works spanning three decades of Jules Breton’s career. La Glaneuse is a recent discovery, compelling a renewed appreciation of the pivotal production of the self-proclaimed “painter of peasants’” early oeuvre (estimate $150/200,000). Known for his Realist, rural landscapes populated by shepherdesses, harvesters and gleaners, the atmospheric tour-de-force of Le Matin (above, estimate $400/600,00) received widespread admiration upon its exhibition at the Salon of 1883, while La Falaise’s enigmatic subject of a peasant girl looking out to sea has captivated audiences since the late 1870s (estimate $200/300,000).

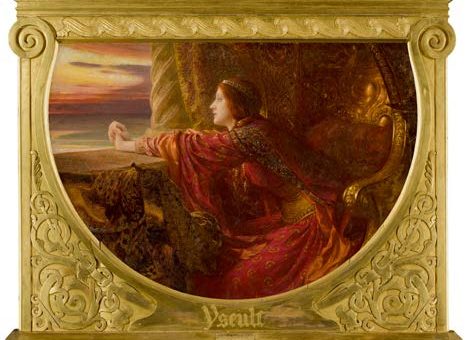

VICTORIAN & BRITISH PAINTINGS

Sir Frank Dicksee P.R.A.

Yseult

Estimate: $1,000,000-$2,000,000

Featured on the sale’s catalogue cover is Sir Frank Dicksee’s Yseult, which the artist presented at the Royal Academy in 1901 (below, estimate $1/2 million). Inspired by Sir Thomas Malory’s Le Morte d’Arthur, the painting depicts Princess Yseult of the White Hands, the wife of Sir Tristram, who gazes out of her window looking for a ship on the horizon.

Female beauty would always be an important element of Dicksee’s paintings and his gorgeously decorative single-figure subjects like the present work are among his most celebrated pictures.

Completed in 1922, A Dilettante by John William Godward marks an important rediscovery for the artist, reappearing for the first time in nearly a century (estimate $400/600,000). Regarded as one of his last great paintings, A Dilettante demonstrates Godward’s painstaking attention to detail and depicts the artist’s vision of idyllic Antiquity.

Painted in 1894, Sir Lawrence Alma-Tadema’s jewel-like Past and Present Generations embodies the artist’s connection to the antique subjects which he cherished (right, estimate $300/500,000). In addition to painting subtle narratives with emotional depth, Alma-Tadema was known for his diligent sourcing of historical references, such as the marble Roman funerary busts of the balustrade, which are based on precise drawings Alma-Tadema made in the Uffizi in Florence and the Capitoline Museum in Rome.

Sir Lawrence Alma-Tadema, O.M., R.A.

Past and Present Generations

Estimate: $300,000-$500,000

The auction also offers an extraordinary oil painting by the great English Victorian-era artist John Atkinson Grimshaw. A prime example of the artist’s trademark street scenes throughout the 1880s, A November Morning, exhibits the hallmarks of Grimshaw’s mature style, and his atmospheric depiction of the evening and the first light of the morning (Estimate: $200,000-$300,000).

Among the selection of outstanding maritime paintings to be offered is Fresh Winds, High Seas by British artist Montague Dawson (Estimate: $200,000-$300,000).

Sailing on the white-capped ocean, with its sails fully unfurled, the sea spray and sunlight tangible, the monumental canvas of the racing clipper is being offered by The Saint Louis Art Museum To Benefit Future Acquisitions.

PART II OF OUR SERIES: ARE YOU A TANGIBLE ASSET FIDUCIARY?

Buying a piece of art may not necessarily be a wise investment – and that’s normally because of a lack of due diligence. It can mean the difference between a favorable return and waving goodbye to every dollar you spent on the piece.

due dil·i·gence

- Reasonable steps taken by a person in order to satisfy a legal requirement, especially in buying or selling something.

- A comprehensive appraisal of a business undertaken by a prospective buyer, especially to establish its assets and liabilities and evaluate its commercial potential.

There are many aspects to consider when you are buying a piece of art that are summarized below:

Provenance and Title are first and foremost when it comes to purchasing a piece. One needs to take every precaution to check that a work was not forged, looted, stolen, promised to an institution or even fake. Opinions of authenticity are crucial to the art market— purchasers want to know they’re buying the genuine article and everyone benefits from weeding out fakes. Reputation is everything in the art world and its very foundations are shaken every time a fake work is presented.

Most works of art preceding the 1900s are recorded on the Art Loss Register, which is an International database that captures information about lost and stolen art and antiques. Most people in the art world refer to this database whenever buying a work of art to ascertain if the piece has previously been looted and offered up for sale without the prior owner’s knowledge. There have been many court cases involving works of art that were looted during World War II – these pieces came up in the art world many years later and the original owner of the work has the right to claim their possessions back in court.

Catalogue Raisonné is a comprehensive, annotated listing of all the known artworks by an artist either in a particular medium or all media. Most of the works would have a reference number by each work and listing of provenance, which helps people track a painting for authentication and ownership. However, sometimes the information is very old where the works have been sold or not recorded so there is a chance there can be gaps in a piece’s timeline due to lack of available research.

Antiquities is one of the trickiest areas to conduct due diligence. Provenance and title for these pieces can be misleading, as the work can be from hundreds of years ago where there were no records of authentication or ownership.

Many artists from the Impressionist and Post War era have foundations that receive hundreds of requests for confirmation of authenticity from galleries, auction houses and collectors. The authentication process can sometimes be a lengthy process, which must be considered.

So, once you have bought a piece of art, what can stop you receiving it?

SHIPPING DELAYS AND SEIZURES

When shipping reproductions of artworks such as antiquities. Customs can halt clearance, should they wish to see further documentation to prove that the work is, in fact, a reproduction and not the real work masquerading as a reproduction. If you cannot provide this, there is a chance that they will never release the piece to you without the relevant documentation.

MATERIALS USED

When buying a piece, the materials used must be considered. For example, there is a Damien Hirst painting consisting of paint and an array of butterflies. It’s important to know that when shipping the work to certain countries you would need to retain a list of the exact species the artist used. This is referred to as CITES, which is the Convention on International Trade in Endangered Species of Wild Fauna and Flora. It’s an international agreement between governments and its aim is to ensure that international trade in specimens of wild animals and plants does not threaten their survival. Customs will not clear the works of art unless they have this list.

BANNED MATERIALS

Materials such as ivory cannot be shipped in and out of specific countries. The US set up the UNESCO Treaty that protects the trafficking of cultural property. Ivory is a protected element, along with tortoiseshell. So, it’s important to check if a piece contains materials of this nature. In certain cases, sales are exempt from this ban, i.e. if the material was imported before the ban in 1989 and authenticated by a government-issued permit, or the material is older than a century.

A known example here is a Parisian client who bought a handbag from the Elizabeth Taylor auction in New York at Christies. The client was unable to have the work sent to her in Paris as it contained pieces of ivory. The client did not consider this before winning the bid and she lost her investment.

CULTURAL HERITAGE

Many countries have their own laws on cultural heritage. For example, a dealer in France was asked to sell an item of jewelry originating from Marie Antoinette. This sale never happened due to the item being part of France’s Cultural Heritage.

Purchasing a piece from Italy that’s more than 50 years old requires its own passport for shipping to another country. This is something to be aware of if one is in a rush to sell or buy a work.

DELIVERY OF INSTALLATION PIECES: PERMITS AND TRANSPORT

When buying a more complex work such as a sculpture or installation, many aspects must be considered regarding the size and fragility of the piece.

In some instances, if living in a property in busy cities such as Manhattan, you may have to apply for a permit to have it delivered, particularly if it needs to be lifted via crane to go in through a window. Traffic may be affected during delivery and this needs to be taken into account.

Transport is also incredibly important especially when shipping long distance. Every measure needs to be taken to ensure safe delivery without loss or damage. Be sure to use a trusted art transport company and installation company whenever possible. Whilst it may be costly, these experts are adept at maneuvering and positioning the piece correctly. This is particularly important when it comes to outdoor sculptures or moving it through narrow hallways and up and down stairs.

TAXES

Protect yourself from the shock of hefty additional charges by researching import and export taxes if shipping out of the US.

Also, be aware of State Taxes that may be applied to your purchase depending on where you live. For example, New York will have % State Sales Tax added to their final purchase price.

PROTECTING YOURSELF AND YOUR MONEY

Buying and selling at an auction house or through a reputable dealer and or advisor can be one of the best ways to protect yourself, as it’s common practice for them to do extensive due diligence on provenance and authenticity. These houses and dealers have tried and tested ways of investigating the history of a piece and maintaining their reputation for handling genuine items is essential for their business. Whilst there is no guarantee, it’s by far the best piece of mind to use these long-established businesses.

So, develop relationships with experts such as galleries, auction houses, and trusted advisors. Buying with confidence can be tricky in the art world but doing as much due diligence as possible should protect you and your investment. The older the work, the more difficult it can be to verify authenticity, so be sure to obtain legitimate paperwork whenever possible. Though it may not always be available to you, it’s the best way to ascertain the authenticity of a piece and will ensure a much easier future sale, should you wish to part with it.

Due diligence forms an essential part of any art purchase. Investigating and obtaining as much information as possible about the sellers and the artwork can protect collectors from making terrible investments.

It is recommended that a third party or independent entity such as The Fine Art Group should review purchases first to make sure all the i’s are dotted and t’s crossed. We wish you only shrewd investments and would be happy to answer any questions you may have regarding this article.

One of the essentials of being a tangible asset fiduciary as it relates to valuation is two part. One, is there a clear understanding of the value of the tangible assets? Two, is the value being applied to objects reflective of the strategies.

What is a Tangible Asset Fiduciary?

The word Fiduciary evolved out of the Latin Fidere, to trust. In order to truly act on behalf of a client’s interest trust needs to be the bedrock of the relationship. A tangible asset fiduciary has no “skin in the game”; the focus of our work is the valuable objects in a client’s collection. Our approach is independency and transparency. This essentially means that every action we take and every strategy we propose is directly in the best interest on the objects and the clients that own them. The client trusts us to represent them.

TOPIC #2: INDEPENDENCE AS THE FOUNDATION OF VALUATION

St. George’s Kermis With the Dance Around the Maypole” (1627), by Pieter Bruegel the Younger. Appraised by Sotheby’s for estate tax purposes in 2005 for $500,000; Sold at Sotheby’s in 2009 for $2.1 million.

When is an appraisal needed?

Whether it is for purchase, sale, estate planning, probate, divorce, rental lease back, fractional interest, insurance or donation, a correct appraisal is needed for any tangible asset. The methodology will directly reflect the overall goal of the valuation. Looking at one object as an example, you can track the different values depending on the purpose.

CASE STUDY

Mr. Smith has decided that he wants to acquire a Milton Avery painting from a gallery in New York City. He contacts The Fine Art Group to obtain a market analysis so that he can negotiate correctly with the gallery. The market analysis reveals that the work sold previously at auction for $200,000 in 2007. As the Milton Avery market has increased in value for the right subject matter and year, his Fine Art Group advisor recommends paying no more than $300,000 for the painting. He purchases the painting at $300,000.

Mr. Smith needs to add the painting to his insurance. As he purchased from a gallery in NYC, his insurance value will be the receipt from the gallery plus tax and shipping. The total cost with expenses was $330,000, which is the retail replacement value.

Mr. Smith decides he would like the portfolio value or estate planning value to begin strategizing with his financial advisor and accountant. The portfolio value is the fair market value. In the current auction market with premium, the Milton Avery would sell for $250,000. This is the value he can use for rental lease back, fractional interest, divorce, estate planning or donation.

Eventually Mr. Smith is interested in using the painting as collateral. The value most appropriate for collateral is marketable cash value which is the auction price minus fees. For the Milton Avery the MCV would be $200,000.

To summarize in this example:

The recommended purchase price was $300,000

The retail replacement value was $330,000

The fair market value price was $250,000

The marketable cash value was $200,000

When the values of the works of art are even more significant, this price differential can be very substantial.

Who does appraisals?

Independence is the key to accuracy.

Appraisals are done by auction houses, dealers, and appraisers. To be a tangible asset fiduciary, it is essential that the valuation should only be conducted by an appraisal firm. While a free-lance appraiser have the knowledge of the piece, frequently individual appraisers do not carry the appropriate liability insurance or insurance to cover damage to an important work of art. There is no licensing for appraisers, the only regulations we have are appraisal associations, including the Appraisers Association of America (AAA), International Society of Appraisers (ISA) and the American Society of Appraisers (ASA) as well as an exam known as Uniform Standards of Professional Appraisal Practice (USPAP). If an appraiser is not a member of at least one of these organizations and is USPAP compliant, he or she should not be conducting appraisals.

There is an inherent conflict when a valuation is conducted by the auction house that wants to sell your work or the dealer that either hopes to sell your work or substantiate a price that they used to sell you the work you purchased from them.

Auction houses often offer appraisals at discounted rates in order to gain access to material and provide additional services for clients. There are several issues with auction houses appraising, including inherent bias and their lack of knowledge on all the markets for objects. While Auction houses have a strong sense of the auction market, they often lack experience with the primary, retail market and with other values such as marketable cash value. If an auction houses wants to sell an object, or recently sold an object, they have a vetted interest in the value benefiting them. A recent court case found that Sotheby’s had valued a painting too low for estate tax in order to entice the estate to sell the painting with Sotheby’s. The painting did sell with Sotheby’s just months later at more than 3 times the estate appraisal value. “Judge Joseph H. Gale ruled instead that the expert had most likely placed a “lowball” estimate on that painting and a second work so as to “curry favor” with the owner, an estate facing a potentially large tax bill, and thus win the business of selling the works at auction.” It should be noted that the IRS art panel strictly follows USPAP and both state that an appraiser is prohibited from appraising an item if they have been involved in the sale of the item.

Similarly, dealers and galleries lack the knowledge and independence that appraisers have, often appraising works of art for substantially higher values than what the client paid. Yearly, complimentary appraisals by the dealers that sold works the works to the owner, often inflate values in order to prove to client’s that their purchase was a good investment. We see this regularly when reviewing insurance schedules that show a yearly increase in the value of the object with appraisals directly from the place of purchase.

Appraisals are a beneficial tool for financial planning, insurance and investment. However, in order to truly be a tangible asset fiduciary, the correct values must be determined by an independent appraisal firm.

FANTASTIC SELL THROUGH RATE OF IMPORTANT JEWELRY COLLECTION

Doyle was honored to auction jewelry from the Estate of Alyce Kalin of Sarasota, Florida, as a highlight of the sale of Important Jewelry on Wednesday, December 12, 2018 at 10am. A private client, we were thrilled with the spectacular sell-through rate of 56 of 60 sold.

Lot 173

Gold, Platinum, Citrine and Diamond Cuff Bangle Bracelet, Trabert & Hoeffer, Mauboussin, Reflection

14 kt., centering one oval citrine approximately 200.00 cts., flanked by 12 fancy-shaped citrines, tipped by rectangular platinum bands of 114 single-cut diamonds approximately 2.70 cts., signed Trabert & Hoeffer, Mauboussin, Reflection, no. 2128, circa 1940, approximately 90 dwts. gross. Inner circle 6 5/16 inches.

Estimate: $5,000 – $7,000

Sold for $43,750 (includes buyer’s premium)

Henry Dunay

Gold, South Sea Semi-Baroque Cultured Pearl and Diamond Necklace

Sold for $22,500 (with Buyer’s Premium)

Lot 252

Buccellati

Gold, Silver and Diamond Pendant-Brooch

18 kt., the delicate filigree oval brooch centering one old European-cut diamond approximately 1.75 cts., within an openwork garland frame of 24 collet-set old-mine cut diamonds approximately 2.80 cts., accented by rose-cut diamonds, signed Buccellati, Italy, 9G, approximately 6.6 dwts. With signed pouch.

Estimate: $4,000-$6,000

Sold: $9,375 (with Buyer’s Premium)

Lot 380

Henry Dunay

Carved Coral, Gold and Diamond Necklace and Bracelet

18 kt., the necklace composed of 31 carved coral beads of floral detail approximately 21.0 to 10.8 mm., bisected by textured gold rings, centering three bombé rings pavé-set with round diamonds approximately 3.00 cts., the bracelet composed of 15 carved coral beads of similar motif approximately 11.8 to 9.3 mm., both signed Dunay, with maker’s mark, necklace no. D2110, bracelet no. C9923. Lengths 20 1/2 and 8 inches.

Estimate: $6,000-$8,000

Sold: $16,250 (with Buyer’s Premium)

Lot 383

Henry Dunay

Gold, Coral and Diamond Bracelet

18 kt., composed of 7 square coral panels approximately 20.0 x 18.5 mm., spaced by brushed stepped bar links, completed by a brushed three bar clasp spaced by a pavé-set diamond bar approximately .55 ct., signed Dunay, no. D3435, approximately 78 dwts. gross. Length 7 inches.

Estimate: $5,000-$7,000

Sold: $12,500 (with Buyer’s Premium)

Lot 267

Wide White Gold, Invisibly-Set Ruby and Diamond Bracelet

18 kt., centering rows of invisibly-set square-cut rubies approximately 78.25 cts., framed by staggered bands of round diamonds approximately 2.40 cts., approximately 59.5 dwts. gross. Length 7 1/16 inches.

Estimate: $8,000-$12,000

Sold: $23,750 (with Buyer’s Premium)

Henry Dunay

Gold, Peridot and Diamond Curb Link Chain Necklace

Sold: $20,000 (with Buyer’s Premium)

RELATED CONTENT

- Selling Jewelry & Watch Collections

- Watch TFG’s New York Luxury Week 2023 Webinar

- Sales Agency Services: Maximizing Value and Efficiency through Comprehensive Sales Strategies

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

SUMMER 2018: AN ART ADVISOR’S ROUND UP OF ART BASEL MIAMI

Roxanne Cohen, Director of Art Advisory, The Fine Art Group, at Art Basel Miami Beach 2018. Leading galleries from North America, Latin America, Europe, Asia and Africa show significant work from the masters of Modern and contemporary art, as well as the new generation of emerging stars.

THE REAL & THE IMAGINED: THE AGE OF IMPRESSIONISM

On loan from a Private Collection at the Columbus Museum of Art through September 2019.

Edgar Degas (French, 1834-1917)

Quesnoy Road, Saint-Valéry-Sur-Somme

1895-1898

Pastel on paper

18 7/8 x 25 1/8 in. (48 x 64 cm)

Henri Eugene Augustin Le Sidaner (French, 1862-1939)

The Quay in Moonlight

1920

Oil on canvas

25 3/4 x 31 7/8 in. (65 x 81 cm)

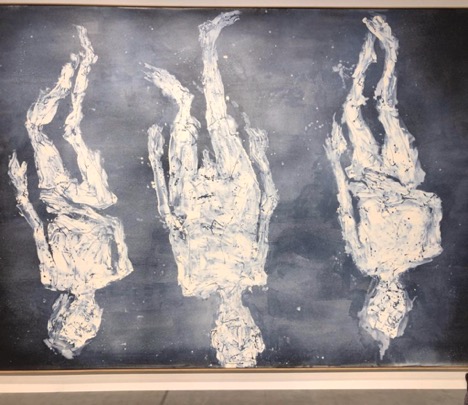

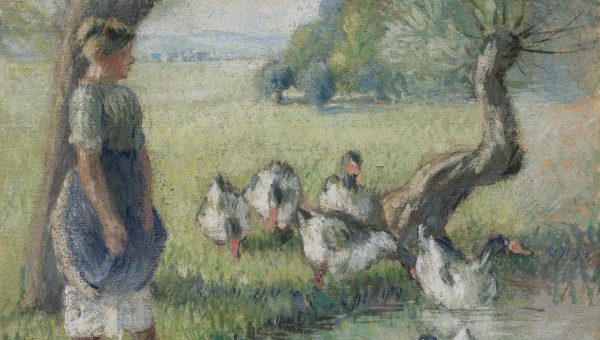

Camille Pissarro (French, 1830-1903)

Goose Girl

c. 1890

Gouache on silk

9 1/4 x 7 1/8 in. (23 x 18 cm)

Auguste Renoir (French, 1841-1919)

View of a Town and Port from a Window

1893

Oil on canvas

9 x 11 3/8 in. (23 x 29 cm)

Henri Rousseau (French, 1844-1910)

View of Billancourt and Bas-Meudon in the Mist

1890

Oil on canvas

8 5/8 x 13 in. (22 x 33 cm)

Maurice de Vlaminck (French, 1876-1958)

Village Square

1918-1919

Oil on canvas

28 3/4 x 36 1/4 in. (73 x 92 cm)

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.