JOHN SINGER SARGENT AT THE AMERICAN ART FAIR

A private client artwork sold at the 11th Annual American Art Fair held November 10-13th, 2018.

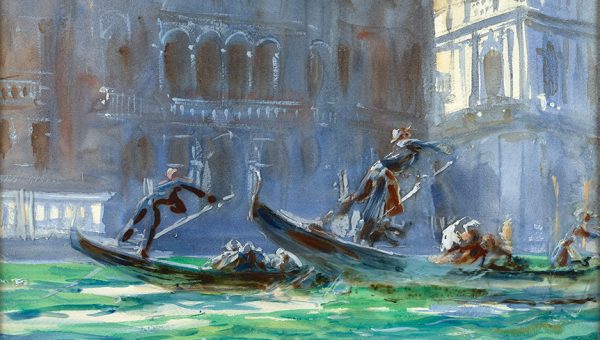

John Singer Sargent (1856-1925)

Festa della Regatta

Oil on glass over watercolor on paper

circa 1903

13 ½ x 19 ½ in.

The gallery’s booth on the 4th floor featured works by George Copeland Ault, George Wesley Bellows, Frank Weston Benson, Albert Bierstadt, William Merritt Chase, Jasper Francis Cropsey, Arthur Garfield Dove, William Michael Harnett, Winslow Homer, Eastman Johnson, Fitz Henry Lane, Robert Laurent, George Benjamin Luks, Thomas Moran, Fairfield Porter, Edward Henry Potthast, and John Singer Sargent, among others.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Selection of works from the Private Collection of a TFG Client coming up in auction at Sotheby’s – 219 lots across five sales between now and February 2019.

Impressionist & Modern Art Evening Sale,

Sotheby’s New York (2 Lots)

November 12, 2018

Lot 57

Henri Fantin-Latour

Reines Marguerites

Estimate: $700,000-$1,000,000

Lot 58

Alfred Sisley

Les Noyers, Effet de Soleil Couchant – Premiers Hours d’Octobre

Estimate: $1,500,000-$2,000,000

Impressionist & Modern Art Day Sale

Sotheby’s New York (4 Lots)

November 13, 2018

Lot 149

Henri Fantin-Latour

Roses

Estimate: $250,000-$350,000

Lot 150

Henri Fantin-Latour

Pommes

Estimate: $400,000-$600,000

Lot 151

Alfred Sisley

La Seine au Point du Jour

Estimate: $700,000-$1,000,000

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Impressionist & Modern Art Day Sale at Sotheby’s

FEATURING THE GILDED AGE REVISITED: PROPERTY OF A DISTINGUISHED AMERICAN COLLECTION

Jean Béraud (French, 1849-1935)LE PARC MONCEAUSigned Jean Bèraud and dated Xbre 1887 (lower right)

Painted in October 1887

Oil on panel

9 1/8 by 12 7/8 in. (23.2 by 32.7 cm)

Estimate: $150,000-$200,000

PROVENANCE

Madame H. Antoine-May (acquired by 1933)

Sale: Hôtel Drouot, Paris, March 18, 1983, lot 21

Richard Green Fine Paintings, Ltd., London

Acquired from the above.

EXHIBITED

Paris, Exposition du Cercle de l’Union artistique, 1888, n.n.

Paris, L’Union interalliée, Exposition des cent portraits, 1922, no. 13 (titled Portrait de M.A.M. et de ses fils)

Paris, Palais du Louvre, Pavillon de Marsan, Le Décor de la vie sous la IIIe République de 1870 à 1900, 1933, no. 23 (titled Monsieur Antoine-May et ses fils)

Paris, Musée Carnavalet, Jean Béraud, Peintre de la vie parisienne, 1936-37, no. 23, illustrated in the catalogue (titled Portrait de M. Antoine-May et de ses fils (Devant la grille du parc Monceau))

London, Richard Green Fine Paintings, Ltd., Exhibition of 19th and 20th Century French Paintings, 1983, no. 2, illustrated in the catalogue

LITERATURE

“Les Expositions des Cercles,” in L’Artiste, 1888, vol. CXXVII, no. 1, p. 190

“Les Oeuvres et les Hommes,” in Le Correspondant, Paris, 1888, vol. 150, p. 728

Auguste Dalligny, “L’Exposition du Cercle de l’Union artistique,” in Le Journal des arts, February 14-17, 1888, p. 1

Ernest Hoschedé, “Exposition de l’Union Artistique,” in L’Événement, February 15, 1888, p. 3

Paul Mantz, “Exposition du Cercle de l’Union artistique,” in Le Temps, February 28, 1888, p. 3

Louis de Fourcaud, “À travers les expositions,” in La Revue illustrée, April 1, 1888, pp. 247-48, illustrated p. 245

Patrick Offenstadt, Jean Béraud 1849-1935, The Belle Époque: A Dream of Times Gone By, Catalogue Raisonné, Cologne, 1999, no. 5, illustrated p. 89

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Over the next five months, each of our executives – Anita Heriot, President, Roxanne Cohen, Director of Art Advisory, Kerry-Lee Jeffery, Director of Consignment, Colleen Boyle, Director of Sales, Kate Molets, Director of Appraisals – will focus on some of the ways we embrace independence, transparency and expertise to bring the best service to our clients. We will be exploring the importance of choosing the right auction house for the sale of our client’s objects, understanding appraisal values, art financing, Philanthropic strategy and acquisition due diligence as key components in working as a fiduciary on behalf of our clients and institutions.

WHAT IS A TANGIBLE ASSET FIDUCIARY?

The word Fiduciary evolved out of the Latin Fidere, to trust. In order to truly act on behalf of a client’s interest trust needs to be the bedrock of the relationship. A tangible asset fiduciary has no “skin in the game”; the focus of our work is the valuable objects in a client’s collection. Our approach is independency and transparency. This essentially means that every action we take and every strategy we propose is directly in the best interest on the objects and the clients that own them. The client trusts us to represent them.

TOPIC #1: CHOOSING THE RIGHT AUCTION HOUSE

When contracted with assisting a client with the sale of a single work of art, an entire collection, or other valuable objects; our responsibilities include making it an effortless and transparent process, negotiating all commissions and fees, facilitating all logistics and most importantly maximizing the return.

The initial step when first approached by a client who is looking to monetize a work is to determine the most appropriate method and market for sale. Certain works can and should be sold privately, while others would benefit from a more competitive market by being sold through specialized sale at auction. While most regional and national auction houses will have Fine Art Departments, only a select few will have specialized sales that target the right collectors for a particular work. These specialized sales include more thematic categories like the annual ‘Orientalist Sale’ at Sotheby’s in London or Copley Fine Art’s bi-annual ‘Sporting Sale’, or regional specializations such as Freeman’s bi-annual Pennsylvania Impressionists sale, or Leslie Hindman’s ‘Made in Chicago’ sale.

A further layer to this specialized approach is when a particular auction venue has cornered the market, so to speak, for a particular artist. A little known artist is Ida Rittenberg Kohlmeyer, a Louisiana based abstract artist who studied and was influenced by Hans Hoffmann. Kohlmeyer is predominately collected in the south, with 288 records at auction, 216 of those are split between two New Orleans based auction houses that also hold the record prices for the artist. Examining the sales records for this particular artist shows that the best results, save for one or two outliers, are when works have sold at one of those two venues. An even more compelling example is that of Boris Vallejo, a Peruvian born illustration artist, with 224 records at auction and a staggering 210 of those at Heritage Auction House! We recently assisted a client in Pennsylvania with an illustration work by Vallejo. The value was fairly modest and most may think special consideration need not apply. However, based on the results for Vallejo at Heritage, where there is a considerable interest for the artist’s work in their illustration sales, the work sold for ten times the estimate – and set a world record for the artist! This is a result that would not have been achieved had the work been sold in a more general paintings sale at a regional house.

We assisted a West Coast based client with the sale of a modern Chinese work by famed artist Xu Beihong. While works by this artist have sold in New York and London, the most successful results have always been achieved in Hong Kong. In this particular case, the work soared past its estimate of $400,000-$600,000. A result that would not necessarily have been achieved had the work been sold in the United States where the work had been consistently estimated for under $100,000.

We utilize this same thought process when assisting with all tangible assets; including furniture and decorative arts, collectibles and other asset areas. For example, there are certain auction houses that specialize in 20th Century design, and in some cases, build the secondary market for a particular craftsman. The curated nature of the sales and specific marketing introduce works that had formerly no secondary market and generate a higher sale price. Other houses have a regional focus, like Leslie Hindman’s ‘Made in Chicago’ or a very focused specialty like Rago’s Modern Ceramics and Glass sales. When looking at larger traditional collections with varied contents and value levels we look to see where the overall collection will be best served as a possible ‘single owner sale’, pulling out specific pieces to be sold in specialized venues. Keeping more of the collection together allows for lesser or more moderately valued property to be marketed and cataloged in a better venue and allows for more competitive terms. Once the right venue placement has been identified we negotiate to ensure all fees are minimized or eliminated altogether. Auction houses can present a laundry list of fees; including seller’s commission, buy-in fees, insurance, catalogue fees, registrar fees, photography fees, storage fees, shipping fees etc. Based on the value of the overall consignment, these fees are always negotiable. In some cases, for highly desirable works, we negotiate to have the auction house *pay* our client a percentage from the buyer’s commission.

Another small, but very important aspect where we advocate on behalf of the client is in regards to marketing and catalogue placement. We need to ensure our client’s work is placed sequentially in the most advantageous place in the catalogue. I.e. if there are several works by the same artist or a very similar work, there is a strategy in place to which work comes first and last in the sequence as this can impact buyers’ spending. We would also work with the specialists to ensure other works are not consigned in for the same sale which would ‘compete’ directly with our clients’ work. We also work directly with the marketing departments to ensure our clients’ work or collection is given the utmost attention from a promotional standpoint, from basic advertisements, catalogue cover placement, signage, panels or lectures, cocktail events, traveling exhibits or luncheons.

The overall success of this bespoke service in placing works of art and other tangible assets in specialized sales is based ultimately on the fact that the auction venue has dedicated marketing and a focused clientele within reach for the specific work or item. Even with the full scope and reach of the internet and international bidding – choosing the right brick and mortar venue can be the difference between a work selling and a work selling well.

By Neil Kaplan, Esq., the Managing Partner of Cork Counsel, and Charles Curtis MW, the Founder of WineAlpha.

COLLECT WHAT YOU LOVE

Or understand what you collect. Collecting is about passion, and the most successful collectors have the understanding of their category that comes only with true love (or hire an expert)

GO DEEP

- Break the category into sub-genres, as what is true of Bordeaux wine is not necessarily true of Burgundy. Understand the multi-year trends for each wine type. Slavishly following trends can result in strategic errors.

- Example: Find the sleeper to maximize alpha (vintage port and sauternes are great categories to nab a bargain)

AVOID THE BUBBLE

Example: Right now Burgundy is trading at historic highs, and finding value is tricky. To do so, know which producers are popular (Domaine de la Romanée Conti), and where prices are rising (La Tâche) and where they are stagnant (the bottling from the Romanée Conti itself).

PROTECT VALUE BY PAYING ATTENTION TO PROVENANCE, CONDITION & RARITY

- As in any category, these three factors are essential to driving asset value.

- Example: there will be tens of thousands of cases of your typical first-growth Bordeaux produced and hundreds of cases of magnums, but only a few dozen to a few score of larger bottles such as double magnums (3 liters), jeroboams (5 liters) or imperials (6 liters)

AVOID THE UNICORN

While rarity is important, don’t overlook common sense. Certain wines such as Lafleur ’47 or magnums of Petrus ’29 are so rare that they are almost invariably counterfeit. To steer clear of problems, stick with wines that have a solid provenance and trading history.

PLAY THE ARBITRAGE

Wine is a global category. In order to get in at the right price, don’t overlook sourcing in London or Hong Kong. Typically London sales have the lowest prices, while the best property often comes up in Hong Kong (albeit at a premium).

PAY ATTENTION TO EXPENSES, BUT DON’T CUT CORNERS

It is essential to use temperature controlled shipping and storage and to insure wine end to end, but it is important not to over-pay for these services, or to pay too much tax. As with everything, the devil is in the details.

In order to combine their respective talents to provide you with the best services possible; Neil & Charles have formed a New York–based strategic alliance for the purpose of performing not only wine appraisals and providing consultancy services for wine collectors, but also inspections, relocations and brokerage of wine collections.

CHARLES CURTIS

Charles Curtis of WineAlpha has unparalleled qualifications. He is:

- A Master of Wine

- An Appraisers Association of America certified wine appraiser

- A published author

- A member of the board of the Institute of Masters of Wine.

With a certified wine and appraisal expert, you are guaranteed a wine appraisal that stands up to scrutiny. Charles has been called to testify in court proceedings regarding his wine appraisals, and none has ever been rejected.

Charles is also fully expert as a wine broker. He was for many years Head of Wine for Christie’s in both Asia and the Americas, during which tenure he acquired intimate knowledge of the collectible wine market. He continues to hone his expertise:

- Monitoring and documenting trade in fine and rare wine

- Remaining up to date on market conditions

- Identifying the most effective wines to sell at a given moment.

NEIL KAPLAN

Neil Kaplan of Cork Counsel will monitor each project to ensure that your particular needs are being fulfilled. Neil’s background makes him uniquely suited for this role. He:

- Practiced for six years as an attorney in New York City

- Has 25 years of sales and support experience in the wine and spirits industry

- Has advanced wine certification.

Moreover, Neil has learned and understands first and foremost that service and communication are the essence of any business. During all phases of each relationship, from the initial consultation through the final report, Neil is listening to your individual needs and objectives. He will:

- Design each deal accordingly

- Maintain effective communication

- Provide appropriate updates.

With Cork Counsel handling your personal, business and administrative needs and WineAlpha directing the wine appraisals and wine brokerage you can be confident of receiving expert and timely work, distinctive service, and an authoritative final product.

COMMISSIONING PET PORTRAITS AS AN ART COLLECTOR

You may not have noticed but there is a new staff member of staff at Pall Mall Art Advisors, Augie, our Springer Spaniel.

I never anticipated writing about a dog in our monthly correspondence, but Augie’s addition to my home and to our office has provided me with insight into how much we all love our pets. Certainly, artists have been portraying pets for kings, pharaohs, emperors and aristocrats throughout the history of painting. This renewed focus on our furry friends motivated me to gain greater knowledge into the techniques necessary when painting our pet.

Having seen the lively portrait of a terrier painted by Philadelphia artist Stephen Megargee, I was inspired to have him share a bit of his insight into the secret of painting a pet portrait.

Stephen Megargee comes from a long line of horse and dog painters. His ancestor S. Edwin Megargee was one of the official artists of The Kennel Club. So, it seems inevitable that Stephen would embrace that path.

Stephen pinpointed the key ingredients to a successful pet portrait:

- The artist needs to have mastered technique by practicing and perfecting. If the artist doesn’t have his 10,000 hours of practice, it will be evident in the work.

- Empathy and passion for the subject matter are essential. Many of the clients who commission a portrait of their pet have a strong emotional connection to the subject matter. It is essential that the artist himself empathizes with that connection and treats the subject matter with that level of respect.

- The painting needs to actually look like the pet. If it doesn’t, then the artist has not done his or her job. As Stephen said, “I don’t want my clients to think they are looking at a drawing of their dog, but the dog himself”.

Every portrait of a dog, cat or horse, loved by an owner, has its own story to tell. Stephen interviews the owner to find out why they are having a portrait painted and some of the key memories of their pet. This helps inspire Stephen. A good example would be the owner whose Dalmatian had passed away. All the owner had were two little snapshots of her beloved pet. Stephen decided to create a portrait that played on the two photos. The finished work became a painting within a painting. A true sign of success is the fact that many of Stephen’s clients cry when they see the final portraits of their pets.

As I welcome Augie, our Springer Spaniel, into our family, I can fully see the impact of these pets on our lives. More information on Stephen’s work can be seen on his website.

THE BACHMAN COLLECTION

LIVE AUCTION – JUNE 4, 2018

What started as an exciting estate appraisal for me has blossomed into one of the most anticipated single owner sales of American abstract expressionism. Eighteen important works of modern art collected by Gilbert and Lee Bachman will be sold at an auction scheduled for noon on Monday, June 4, 2018, at Freeman’s Auction House, 1808 Chestnut St., Philadelphia.

The Bachmans spent many years compiling a collection that includes major works by Hans Hofmann, Louise Nevelson, Willem de Kooning and Fernando Botero. Original purchase receipts demonstrate the stellar provenance of the works. In addition, several were exhibited in important institutions like The Whitney and owned by Clement Greenberg, arguably the most significant art critic of Abstract Expressionism.

Provenance is important because at any point in its history a work of art’s authenticity can be called into question. A detailed provenance record authenticates the artwork and gives an insight into the history of past owners of the work, both of which may impact the value and desirability of the piece. For example, the value of works owned by Elizabeth Taylor, in the Taubman Collection and in the Rockefeller collection skyrocketed because these works are more desirable because the previous owners were famous.

Their exhibition history and record of ownership will make these 18 works highly desired by collectors and institutions. The sale will consist of paintings, sculptures and works on paper.

A member of the Georgia Institute of Technology’s Engineering Hall of Fame, Gilbert was chairman, chief executive officer and majority stockholder of printing powerhouse Dittler Brothers in Atlanta. He and his wife, Lee, were active in several community organizations, including the Atlanta Humane Society, the Atlanta Chapter of the Anti-Defamation League and the Atlanta Jewish Federation.

Auction highlights include:

- “Cinquecento” (estimated value $300,000-500,000), a large canvas by American abstract expressionist Helen Frankenthaler.

- Three works by Hans Hofman: “Phantasie in Red” (estimate: $20,000-30,000), “Cataclysm (Homage to Howard Putzel)” (estimate: $150,000-250,000) and “Composition #43” (estimate: $150,000-250,000), which was previously in the collection of art critic Clement Greenberg, who championed abstract expressionism from its earliest days.

- Two black painted wood sculptures by Louise Nevelson, a student of Hofmann and one of the leading figures in American sculpture of the 20th century: “Dream House Wall II” (estimate: $250,000-400,000), comprised of eight separate painted wood components; and “Cascades – Perpendiculars XII” (estimate: $50,000-80,000).

- “Head #3” (estimate: $250,000-400,000), a bronze by abstract expressionist Willem de Kooning.

- “Dog,” (estimate: $120,000-180,000), a sculpture by Colombian artist Fernando Botero, who was executed in 1981. Botero, who received several international awards, portrays his subjects in exaggerated, rotund form.

- “Woman in White Wicker Rocker” (estimate: $100,000-150,000) and “Nude Torso” (estimate: $2,000-3,000), sculptures by George Segal who is best known for his life-size plaster figures.

- Two fantastic wall sculptures by Lynda Benglis who invented a new format with her celebrated “pours,” which resembled paintings but came off the wall to occupy the space of sculpture.

These works will be on view from May 30 until the auction on June 4.

Christie’s

Sale 16721

Lot 565

Edward Henry Potthast

Low Tide

Oil on board

12 x 16 in.

Hammer: $125,000

Heritage Auctions

Lot 68102

Theodore Earl Butler

Bethesda Fountain, Central Park, New York, 1915

Oil on canvas

24 x 28 in.

Hammer: $14,000

Christie’s

Sale 15973

Lot 439

Jean Dufy

Environs de Boussay

Oil on canvas

15 x 21 ¾ in.

Hammer: $25,000

Sotheby’s

The Ruth and Jack Bloom Collection

Thomas Molesworth

Floor Lamp

61 1/4 in.

Hammer: $20,000

Sotheby’s

The Ruth and Jack Bloom Collection

Thomas Molesworth

Two-Tier Side Table

22 1/4 x 16 1/4 x 27 1/2 in.

Hammer: $38,000

Sotheby’s

The Ruth and Jack Bloom Collection

Thomas Molesworth

Door

80 x 40 in.

Hammer: $110,000

Sotheby’s

The Ruth and Jack Bloom Collection

Thomas Molesworth

Club Chair

31 1/2 x 28 x 31 1/2 in.

Hammer: $24,000

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

THESE DAMAGE STORIES WILL MAKE YOUR ART-LOVING HEART BREAK

Perhaps the most publicized story, in 2006 business magnate Steve Wynn infamously elbowed his most beloved and iconic painting, Picasso’s Le Rêve. The unfortunate mishaps took place while showing the painting to reporters. It cost $90,000 to repair the damage. So much for “off the records”!

To share a story from our own experience, one of our appraisers once witnessed a $15,000 chair get irreparably crushed between the doors of a freight elevator.

In 2015, King Tut’s chair was damaged in a move between museums as a result of pure carelessness. This unfortunate event followed news of botched restoration to the king’s mask. Let’s hope no one is haunted for the sub-par handling and treatment!

In 2004, Artnews shared the story of an employee at a SoHo gallery who enthusiastically unwrapped a poorly packaged work of art that had been shipped to them. To their utter dismay, he accidentally ripped up the drawing in his fervor.

While traveling from Paris to The Armory Show last year, a Lucio Fontana sculpture was found damaged in its crate. Still pending is the legal retribution for damage that Lloyd’s of London is seeking from the responsible art handling companies and airliner.

It is not uncommon for pets to damage a collector’s favorite work of art. In one instance, a painting resting against a wall fell onto a dog. The spooked dog leaped and pranced about on the painting, resulting in several punctures through the canvas.

WHEN FINE ART MEETS BUBBLE WRAP

by Simon Hornby, President of Crozier Fine Arts

With an increasing number of collectors shipping art from art fairs to their private homes, plenty can go wrong during transit. According to Simon Horby, President of Crozier Fine Arts, the majority of damage to art occurs when a piece is moved. Whether lending art to institutions for exhibit or shipping art from auction houses to tax advantaged locations such as Delaware or Switzerland, the movement of art can be a complex process.

For example, the client who chooses a ‘common carrier’ – a general commodity packer, shipper or storage business who will transport and store anything from art to furniture to bicycles – to transport their million dollar painting may find its canvas punctured upon arrival due to improper packing and handling. For this reason, the importance of selecting appropriate transportation and storage for valuable objects cannot be understated. Hornby emphasizes that works should only be transported using shippers experienced in handling art. To ensure safe transport, it is highly recommended that art is stabilized and transported in air-ride, climate-controlled, GPS- tracked and alarmed trucks. It is also recommended that clients get a condition report prior to having anything transported just to verify that no damage occurred during transit.

Choosing a company that has a TSA-approved Certified Cargo Screening Facility (CCSF) may also prevent damage during transit. Under TSA rules, all cargo, including packed crates, loaded onto domestic and international passenger flights must be individually screened. Screening may involve inspection, unpacking and handling of the artwork, which if performed by trained art specialists at a CCSF, ensures safe handling.

Lastly, find out whether third party shippers or other subcontractors will be involved, especially when hauling valuable objects long distances or internationally. If this occurs, make sure that the contracted party has experience transporting and handling fine art and also has adequate security measures in place (e.g., tracked trucks and background checks on its employees).

Although most damage to fine art and collectibles occurs during transport, the storage environment of these objects is equally critical. Best practices dictate that fine art be housed in a climate-controlled environment and in fire resistant, sole-use warehouses. Additionally, fine art storage facilities should be alarmed and equipped with 24-hour system monitoring and be properly insured.

Simon Hornby is the President of Crozier Fine Arts, the leading provider of global art logistic solutions.

FINALLY, A NEW KIND OF ART FAIR

As art advisors we need to make the rounds. Art Basel, Art Frieze, Tefaf, the Armory Show. Each art fair follows the basic formula, a large space with dealers displaying their works in their booths. Little red dots under works sold in advance to top collectors… champagne flowing at the VIP opening.

I live in Silicon Valley. As wealth and innovation are the bed rock of Silicon Valley, art has taken a back seat. It’s not surprising. It’s hard to believe that a traditional art fair model would be appealing to young, innovative and wealthy entrepreneurs and royalty of the tech world.

There is no doubt that is exactly what Linda Helen Gieseke and Sho-Joung Kim-Wechsler must have been thinking when they realized that there was an artistic vacuum in Silicon Valley. Kim-Weschler knows the tech world after stints at Artsy and 1st dibs. Hence this fair needed be more than champagne and art, it needed to be a full artistic experience integrating visual art, performance, technology and innovation.

What is even more important is that If So What is positioning itself as a thought leader, bringing tech founders and CEO’s with art professionals in a series of panels.

The Fine Art Group is proud to be part of the forefront of a new generation of art fairs that are uniquely positioned to appeal to the young, the innovative and those seeking knowledge.

All The Fine Art Group’s Clients receive 10% Discount to this Inaugural Event – see details below. A portion of the proceeds support Art in Action – Empowering children through affordable art education – artinaction.org.

WHERE ART AND DESIGN MEET SILICON VALLEY

Join us to experience art, design, music, and innovation in a unique, immersive environment, to connect to the transformative power of art and design. Discover new galleries and compelling works from international artists, experience immersive multimedia installations, and join in a dialogue with our visionary panelists who will speak about the interconnection between art and society. Enjoy live music performances and relax on our piazza, connecting with friends both old and new.

BE PART OF THE MOVEMENT

April 26-29, 2018

Palace of Fine Arts

3301 Lyon Street

San Francisco, CA 94123

Sign up for a 10% discount here

ENTER CODE: PALLMALL.ISW

Get your Ticket now!

EXCLUSIVE VIP PREVIEW

April 26, 2018

3-9pm

Palace of Fine Arts

3301 Lyon Street

San Francisco, CA 94123

VIP BENEFICIARY – ART IN ACTION

Empowering children through affordable art education

artinaction.org

DISCOVER

Discover traditional and cutting-edge art and design galleries and artworks from all over the world. Leading galleries and curators from Europe, Asia, and the US will present works ranging from the most innovative global design to the latest trends in contemporary art.

LEARN AND ENGAGE

Learn about the latest advances in AI, what the future of cryptocurrency looks like and how art and technology are interfacing in unprecedented ways. Listen and discuss with current and former Executives from Apple, Google, Facebook, Artnet, GoDaddy, as well as leaders from Academia such as Stanford or Institutions as BAMPFA and Nevada Museum of Art. This program will be round-up by forward-looking crypto discussions of pioneering crypto artists and art blockchain technologies.

LISTEN

Enjoy music performances and relax on our Piazza while connecting with friends, both old and new. If So, What? will present contemporary music performances produced by San Jose Jazz, a Silicon Valley-based non-profit organization celebrating jazz as a dynamic, evolving art form.

More surprise music bands announced shortly, but here a flavor:

.jpg)

.jpg)