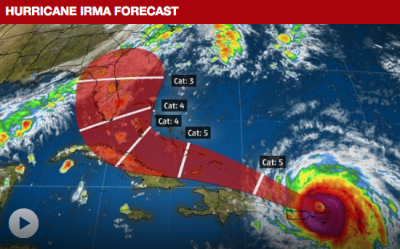

As Hurricane Irma sets its sights on Florida, Georgia and the Carolinas, The Fine Art Group has prepared a list of what to do before, during and after the storm to minimize the loss of tangible assets. Along the Gulf Coast in the wake of Hurricane Harvey, many residents are facing the consequences of inadequate insurance coverage and lack of planning for their tangibles. There has been a large increase in thefts, as well as flood and water-related damage to home contents including art, furniture, decorative arts and jewelry.

Image provided by Weather.com.

While protecting your tangible assets it is important to prioritize your safety, and the safety of family, friends, neighbors and pets. The National Hurricane Center and FEMA have provided additional guidelines and resources for hurricane preparedness.

Here is a list of suggested actions you should take now:

PREPARATION BEFORE THE STORM

- Discuss insurance coverage with your broker. Review your policy for costly gaps in coverage. If moving any fine art, verify that your collection is insured during transit. Some insurance companies have a waiting period before activation of policy changes, so plan ahead.

- Determine the type of damage your building and area is likely to suffer. Are trees likely to fall from strong winds? Have them trimmed regularly to remove weaker branches. Do you have lots of windows? Prepare to board them up. Are you located in a flood zone? Know where you can find sandbags in the event of an emergency and avoid storing valuables in the basement.

- Update your inventory with photographs and copies of your receipts. For maintaining records of your tangible assets, The Fine Art Group offers video inventories that can be shared with your insurance broker and used to reconstruct the contents of your home in the event of a loss. Think about items you have acquired recently or didn’t have included in a recent appraisal.

- Maintain a list of fine art shippers, art storage facilities, conservationists and your insurance broker. Turn your smartphone camera into a scanner with apps like CamScanner and Scannable to capture records and receipts digitally to store on the cloud and store important paper records in a waterproof safe.

- Establish a plan to relocate valuables. Select a reputable fine art shipper to move valuables to a predetermined secondary location out of the storms path.

- Collect all of the recommended items, below, for your Tangible Asset Emergency Kit.

- If you are likely to be away in the event of an emergency, communicate emergency plans with your property manager. Ensure they are aware of your valuables and know how to handle them during an emergency.

DURING STORM WARNINGS AND ACTIVE STORMS

- Board windows and establish a perimeter of sandbags around flood-prone zones.

- Remove art from damage-prone areas. This includes art facing windows and art hanging on walls made of plaster. Plaster becomes damp and may not have the structural integrity to support works of art.Learn from the mistakes of Hurricane Sandy and avoid storing valuables in the basement.

- Move works of art to a safe room, preferably a room without windows located at the center of the structure. Pack valuables in waterproof crates and plastic bins. Use acid free cardboard to prevent frames and works on paper from touching. You may also carefully wrap valuables in plastic poly to prevent water damage, possibly using acid free cardboard (and extra caution) to protect the surface. If possible, keep the works of art elevated from the floor should flooding occur.

- Monitor the storms progress and be prepared to evacuate.

HURRICANE EMERGENCY KIT FOR FINE ART PROTECTION

DEALING WITH THE AFTERMATH

- If the structure is secure, begin assessing the damage. Photograph overall damage to the site with subsequent photographs of specific damage.

- Do not throw away any damaged items! Even if the item is a total loss, consult with your insurance broker first and photograph the item for later claims.

- Move items out of harms way and to a safe, dry location.

- If necessary, put the dehumidifier and wet vac to use! Create an air-flow with fans and the AC. Clearing the air of moisture is key to preventing further damage from mold.

- Inspect the property for any new leaks and board up any damaged areas.

- Inform your insurance broker and begin the process of filing a claim. If faced with sizeable damage to your collectibles and art, establish a plan of action with your insurance broker in collaboration with art handlers, conservationists and appraisers.

MORE TIPS

Like an Emergency Kit, we recommend keeping these items on hand to manage your art collection in the event of a natural disaster. These items can be used to thoroughly document any damage, protect your collection as best as possible during an emergency, and prevent further damage from occurring.

- To document: Digital camera with extra memory card, batteries and charger, pencils, notepad, flashlights with additional batteries.

- To pack and transport: Latex gloves, rolls of plastic poly, packing tape, string tags, labels, scissors, box cutters, markers, acid free cardboard sheets and tissue paper.

- To protect during and after: Sand bags, plastic bins, waterproof crates, buckets, portable generator, dehumidifier, wet/dry vacuum, fans and extension cords.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

THE SCENARIO IS A SIMPLE ONE

Husband and Wife built an art collection over the course of the marriage. Wife, who had majored in art history during college, was responsible for selecting the pieces and attending the auctions; Husband paid the invoices. The art was on display in the parties’ residences.

The parties eventually decide to separate and divorce. During the intervening years, the collection appreciated in value. Husband claims that since he paid the invoices, the artwork belongs to him; Wife claims that Husband had no real interest in the artwork and it was effectively a “gift” to her during the marriage. There are no documents assigning title to either of the parties. Who is entitled to the art?

In New York, in the recent case of Anonymous v. Anonymous, 150 A.D.3d 91 (1st Dept. 2017), the Court was called upon to determine the ownership of valuable works of art in the parties’ collection. There, the Husband claimed that a collection worth tens of millions of dollars was his separate property, based upon the language in the parties’ prenuptial agreement which provided that any property “acquired” by a party would remain that party’s separate property. In support of his position, the Husband referred to the invoices which identified the Husband – and not the Wife – as the purchaser of the art.

However, the prenuptial agreement also provided that property which was “jointly held” by the parties would be considered “marital” property and would be equally divided between the parties. It was the Wife’s contention that the parties had agreed to acquire the art as a “joint collection” and therefore it was marital property.

The court found that although the invoices were in the Husband’s name, such invoices were not dispositive on the issue of ownership of the pieces, and remanded the matter for a hearing to determine all of the facts and circumstances surrounding the acquisition of the collection. What did this result mean to the parties in Anonymous? More time. More money. Risk.

What steps can you take to avoid this type of uncertainty and litigation?

- Make sure that each purchase is accompanied by a certificate of title or other document evidencing ownership.

- Make sure that your prenuptial (or post-nuptial) agreement provides that the party who pays for the piece is the owner, and that an invoice or bill of sale would be sufficient proof to establish title.

In the absence of a prenuptial (or postnuptial) agreement providing that title ownership controls the disposition of a particular asset, it remains critically important to maintain proper paperwork regarding the scope of your fine art and collectibles in the event of divorce. Why? Too often marriages dissolve and, because of one party’s “divorce planning,” pieces of art or other valuable items begin to disappear from a home, a second home or storage. The change may not even be initially decipherable. In the context of a divorce litigation, one party may claim he or she believes a watch is missing, or a piece of art was removed from a vacation home, without any way to prove this occurred beyond that person’s memory, leading to an inevitable “he said/she said” scenario.

How do you prevent this from happening to you?

- Check your insurance riders regularly. Make sure that they are up to date and modified as necessary to reflect sales and purchases.

- If you have fine art, jewelry and/or collectibles that are not insured, at a minimum, maintain an inventory (including photos), regularly update and, if possible, include the purchase price for each item.

The critical take-away in either scenario is the importance of maintaining and regularly updating the documentation reflecting the acquisition, ownership and sale of your fine art, jewelry and/or collectibles. The more objective proof there is, the less that will be left to chance.

Michael A. Mosberg, Esq.

Michael, a partner with the firm Aronson, Mayefsky, and Sloan, represents clients in all aspects of family law.

Heidi Harris, Esq.

Heidi, a partner of the firm Aronson, Mayefsky, and Sloan, handles all aspects of matrimonial and family law cases, including negotiating settlement and prenuptial agreements, trying cases and arguing appeals.

FAMILY DIVISION & DIVORCE VALUATIONS

An equitable division of marital assets demands an accurate and properly documented valuation. Pall Mall Art Advisors is regularly asked to consider the value of property acquired by an individual prior to the partnership, or through inheritance and the rise in value of jointly owned items due to market activity.

A pre-nuptial agreement which includes valuations of high value chattels, is increasingly seen as sensible. Again accurate valuations, subject to periodic review, are required.

When faced with the challenges of a divorce, the Visual Inventory provides an accurate account of marital property and is a necessary, date-stamped tool that facilitates the division of assets.

Have a professionally edited Visual Inventory conducted by a seasoned appraisal professional.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

Navigating the Art Market: The Pitfalls of Buying, Selling, and Valuing Your Fine Art

Originally Published Jet Set Magazine November 2014

Welcome to the most unregulated market in the world, the art market. As an art advisor and appraiser, I have seen the dark side of the industry: art appraisers that charge clients exorbitant fees, art advisors that broker fine art to clients at prices far above the painting’s real value, auction houses that lure clients to sell and their work goes unsold, dealers that place a huge price tag on a painting which has little or no value, and charlatans that hand out “certificates of authenticity” for fake works.

Don’t get me wrong; there are professional appraisers and auction houses that look after the client’s best interests. There is a cadre of art advisors that negotiate strategically on behalf of buyers and sellers of art, and dealers of the highest quality and the best taste. In this article, I will provide you with some guidance and help the art buyer and seller make smarter decisions. Navigating the art market correctly will make all the difference with your next fine art venture.

RULE #1

Just because an artwork is expensive, doesn’t mean that it has value.

The story usually goes like this. Mr. and Mrs. Smith go to Nantucket for vacation. A painting is purchased, a colorful seascape or a Nantucket scene, a memento of their trip. More than likely, the price tag for the painting is high. Jump ahead some years later. Mr. Smith and Mrs. Smith divorce. My firm, The Fine Art Group, is retained by Mr. Smith to conduct a valuation of their tangible assets. Mrs. Smith remembers spending $50,000 on the Nantucket painting and assumes it will be valued at a higher price.

As appraisers, we do our due diligence. We investigate the artist’s sales in the auction marketplace. In the case of the painting bought in a gallery while on vacation, it is likely that the artist’s paintings have never sold at auction. It is probable that the piece cannot be valued above $1,000. The price paid to a dealer is not its fair market value nor the price it will sell for in the open market. Fair market value is used for estate planning and estate taxes, equitable division, charitable donation, estimates for sale and when appraising a work used as collateral for a loan. It is not necessarily the price you paid for it. When buying at a gallery, have an independent appraiser provide an opinion of value before you write a check.

RULE #2

The auction house is not your friend.

Sure, it seems like they are your friends. They offered to do your appraisals for free, invited you to glamorous parties and private exhibitions. They arranged internships for your children and generously sent you their beautiful auction sales catalogues.

An auction house is trying to build up your loyalty so that when it comes time to sell, you call them first. Their actions are completely appropriate. The job of an auction house’s contemporary art department is to consign the best pieces at a commission rate that is profitable for the auction house. What you need to know is that the auction market is VERY competitive. At the highest level, there are two major auction houses, Sotheby’s and Christie’s, whose profit margins are quite small and who offer generally the same product. All of the auction houses below the two dominant players are even more competitive.

Some houses specialize in specific areas of the market such as Asian or American art, and some are general auction houses. The important point to remember is that like any competitive market, you need to let capitalism do its job. When selling a significant work of art, you want the auction houses to compete for the sale of your art.

An auction house makes its money from the buyer and the seller. From the buyer it charges a “buyer’s premium” which can range from 10 to 25 percent. For the seller, the auction house can charge fees for the following: shipping, insurance, photography, marketing, authentication, restoration, research and a “seller’s commission.” The good news is that depending on the work, all or some of these fees can be waived. At The Fine Art Group, we have negotiated on behalf of clients for the sale of their collections. When auction houses know that they are in a bidding war, commissions suddenly disappear, along with all of the other fees. If a seller is charged five percent to consign a $5,000,000 painting, the auction house will collect an additional $250,000 from the seller.

Our job is to ensure that the client is paying the least in commission and achieving the highest revenue. At times, the auction houses have been so keen to consign the collection that they have given the clients part of the buyer’s premium, as well.

RULE #3

Never hire an appraiser that charges a fee based on the value of the collection.

Traditionally, this fee structure was a common practice for an appraiser. The client would hire the appraiser to value a one million dollar painting and the appraiser would charge percentage of the value of the painting as his or her fee. If the appraiser charged 2.5 percent of the value of a one million dollar painting, the fee would be $25,000. If the painting was worth $10,000, the appraiser would charge $250. The incentive to overvalue the client’s work is obvious.

Recently, a very unhappy client called us with a story of a prominent appraiser still engaging in this practice. The appraiser charged $100,000 for the valuation of six paintings and stated that her fee was based on a percentage of the value of the painting. According to the standard practice of our profession, an appraiser’s fee for service must be hourly or based on a predetermined amount agreed upon by the appraiser and the client. Appraisers that charge these ridiculous fees give the profession a bad name.

RULE #4

A certificate of authenticity does not mean the item is authentic.

In 2014, a client called us seeking to sell her collection of 100 paintings. After looking at her list of artists, I was encouraged. She owned a Chagall, Dali, Miro, and Picasso, to name a few. I dug deeper into the collection, asking her where she bought the paintings and what she paid. My excitement for the collection dropped immediately when she told me that “they all had certificates of authenticity” and she had purchased them all while traveling on her yearly cruise. Certificates of authenticity can be downloaded off the Internet. Even worse, she had paid high retail for each of the works and I knew that the majority were fakes.

I showed her list to seven or eight auction houses and each told me the same thing. They would get pennies on the dollar for each work. One of the hardest messages to deliver to a collector is that their treasures have little to no value. Just because the work is signed by Chagall doesn’t mean that it is an original Chagall. In fact, if one looks closely at many of the certificates of authenticity, the small print clearly delineates that the work is a replica or print of an original.

The goal of this article is not to dissuade you from buying or selling art or having your art appraised. When buying a painting from a dealer, ask for an independent opinion. So many of our clients seek counsel from our firm before they make a purchase of thousands of dollars. When selling anything at auction, go to more than one auction house. If you are not comfortable doing that yourself, have an independent advisor negotiate on your behalf.

When hiring an appraiser, ask a few simple questions:

- What is the fee structure? You want to ensure they base their fee for service on an hourly rate.

- What is their experience valuing your material? You never want an American furniture specialist valuing your Asian works.

If you are provided a “certificate of authenticity,” read the small print and seek the guidance of an independent appraiser to advise you on the correct value of the piece. If you follow these basic rules, you will successfully be able to buy smart, sell smart and ensure your collections are valued correctly, thus effectively navigating the art market.

Anita Heriot: Before becoming President of The Fine Art Group, a U.S. and U.K. appraisal and art advisory firm, Anita Heriot served as Vice President, Head of Appraisals, and ran the British & Continental Furniture and Decorative Arts department for Samuel T. Freeman & Company. She also worked for Masterson Gurr Johns International, a London-based firm, as an appraiser. Ms. Heriot is a member of the Appraisers Association of America, is USPAP certified and has testified as an expert witness in major court cases involving art valuations. She is a graduate of Bowdoin University with advanced degrees from University of London and New York University.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

BURGUNDY, SUPER TUSCANS AND CULT CALIFORNIAN WINES ARE CATCHING TOP DOLLAR

DIVERSIFYING YOUR CELLAR WITH INVESTMENT-QUALITY WINES

With an uncertain market climate, savvy investors are turning to unconventional investments in efforts to diversify their portfolio, minimize losses, and maximize gains. While some markets have cooled in the uncertain market climate, others have soared: the ultimate example being the Wine Market, which has demonstrated sizable gains and resilience. According to Cult Wines, data compiled over the last thirty years shows that a £5,000 investment in the FTSE 100 in 1984 would now be worth £34,473; The same investment in 18 cases of Lafite Rothschild 1982 would be worth £698,832. Even on a broad scale, the Liv-ex 1000 closed in 2016 at a record high with gains of 22.3% over the course of the year.

While Bordeaux continues to perform strongly, other wine regions of the world are producing investment quality fine wines that have increased significantly in market prominence. In fact, the best performing sub-index of the Liv-ex 1000 is ‘Rest of the World 50’ (the ten most recently physical vintages for five wines from Spain, Portugal, the USA, and Australia) which increased over the last five years by a staggering 47.48%.

As a growing component of the tangible asset portfolio, wine cellars void of Bordeaux should not be overlooked. Due to market misconceptions, these areas represent the greatest potential for amplified risk exposure and oversight in effective portfolio management. High performing regions include Burgundy, Italy and California, as well as exploratory investment potential in South Africa and Australia, among others.

Here are some top market performers to be aware of when assessing a cellar:

FRANCE

Bordeaux producers carry with them the prestige of an ironclad reputation established by consistent quality and cellaring potential–which interprets to strong long-term investment potential. Leading châteaux include familiar names such as Mouton-Rothschild, Margaux, Lafite-Rothschild, Haut Brion and Latour. These ‘First Growths’ routinely captivate international buyers at leading auction houses; In October 2016, Christie’s London auctioned eleven bottles of Latour 1945 for $43,217 and, more recently, a case of twelve bottles of Château Palmer 1961 sold for $33,476.

Burgundy, a region known for its superb red and white wines with a market driven by scarce quantity, producing only 25% the quantity of Bordeaux (excluding Beaujolais). Yet this small production has outperformed Bordeaux with the Liv-ex Burgundy 150 indicating a 44.3% increase over the last five years. Among the most renowned producers is Romanée-Conti. In 2014, Sotheby’s made headlines with the sale of a superlot comprised of 114 bottles of Romanée-Conti spanning from 1992 to 2010. The lot achieved a record-setting $1.6 million, calculating to $14,121 per bottle.

ITALY

According to Wine Investments, select Italian wines are becoming increasingly prized as part of a well-rounded investment portfolio. In the last year alone, the Liv-ex Italy 100 has increased 18.26%, which coincides with increased interest as well as concerted efforts to increase Italian wine exports, up 17% in 2016. Fine wines with investment potential include producers in Piedmont and Tuscany, most notably the Super Tuscans, including vintages from the producers’ Sassicaia, Ornellaia, Masseto, Tignanello and Solaia. In today’s market, the legendary 1985 Sassicaia, often described as perfezionare, retails as high as $6,000 per bottle.

CALIFORNIA

With the growing interest in fine wines from the New World, California is one of the largest producers with investment quality dominated by the ‘Cult Californian’ Wines. These wines are produced in extremely small volumes, have notable cellar-potential and routinely obtain high scores, thus driving the market to some of the highest values paid for wine. Leading California fine wines include Scarecrow, Harlan Estates and Screaming Eagle. In 2000, a single bottle of Screaming Eagle Cabernet 1992 raised a staggering $500,000 for charity, the sale of which still has yet to be beat.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

SUMMER FEVER: BUYING SMART WHEN THE HEAT WAVES HIT

HOW TO AVOID VACATION IMPULSE ACQUISITIONS AND BUYER’S REMORSE

Have you ever bought a work of art that seemed like a great idea at the time, but now you can’t stand to look at it? We all have those precious paintings hiding in our closet, out of sight, and we remain puzzled why we were ever drawn to the piece in the first place.

Some blame those long summer nights, others succumb to impaired judgment on hot afternoons after that complimentary glass of wine at the gallery opening. Whatever the reason, vacation art always looks better on the beach and buyer’s remorse is in full vengeance post summer vacation.

Images courtesy Christie’s

So, how can you avoid the mistake of acquiring a painting you won’t like come Thanksgiving?

EXAMPLE #1

- Problem: You let your emotions do the buying and have acquired a gauche work of art. We always advise our clients to buy what they love, but this notion can run away with you when under the sun of your favorite summer hot spot. After all, the gallery opening was happening, you met the artist, and you were swept away by the idea of your vacation colliding with a paint bucket. But after your tan has faded, will the painting really bring back the memories? Is this the best you can find at that price? Does the work of art sync with the other pieces in your collection? Do you really love it? And we mean, really?

- Solution: Sit back and assess. You are on vacation, so what’s the rush? Ask the gallery if you can have a period of time, say three days to a week, to consider the painting before they sell it to someone else. If they are a good gallery, they will give you the courtesy of a phone call should another buyer show interest. If you still love it within that grace period, then get it home! But you may be relieved you did not rush.

Image courtesy Christie’s

EXAMPLE #2

- Problem: You are uncertain which artists have long-term market potential. It is all everyone seems to be talking about! And all the information can be challenging to apply when it comes to actually purchasing a work of art. But it starts with identifying quality.

- Solution: Learn to distinguish between Decorative Quality and Investment Quality. We always encourage clients to buy what they love, and sometimes it will be a decorative piece. But it is possible to buy what you love and acquire smart. The best place to start is discussing your collecting interests with your art advisor. Or even frequenting museums a bit more often. Which brings us to…

Image courtesy Pierre Bergé & Associés

EXAMPLE #3

- Problem: You haven’t been to a museum in months, maybe years. You need to look at the best to understand quality. Regularly visiting the permanent collections and curated exhibitions of museums is the greatest way to do that.

- Solution: Check out these great summer exhibitions! This is the final month to see The New Museums’ exhibition of new works by Lynette Yiadom-Boakye, which concludes September 3rd. The Hunter Museum of American Art in Tennessee just opened Thrill After Thrill: Thirty Years of Wayne White on June 30th. Meanwhile, the Seattle Art Museum is exhibiting Spencer Finch: The Western Mystery. If you are in Raleigh, The North Carolina Museum of Art is exhibiting a curated photography exhibition titled You + Me now through September 3rd.You can always request your art advisor arrange specific visits to museums, galleries and art fairs. Having a knowledgeable advisor by your side can prevent some of common pitfalls and buyer’s remorse.

SPRING JEWELRY AUCTIONS REVEAL CURRENT TRENDS

This year was particularly intriguing as we saw many collections from prominent individuals go up for sale, including the Dodo Hamilton Collection at Freeman’s, which included a 16.56 carat emerald-cut diamond, which sold for $802,000. Another lot of note is the Farnese blue diamond, which was given to Elizabeth Farnese (daughter of the Duke of Parma) as a wedding gift in 1715. This diamond was passed down through royal families all throughout Europe. Sotheby’s sold the diamond in their Geneva Magnificent Jewels auction for $6.7 million, which exceeded the pre-sale estimate of $3.6 million – $5.2 million. Christie’s New York had an auction on June 12th where many pieces from the Rockefeller collection were sold, including 2 bracelets by Jean Schlumberger that both more than tripled their estimates.

In addition to the blue diamonds outlined above, it is also a good time to sell:

- Art Deco Cartier – Christie’s sold an Art Deco diamond bracelet (lot 94) by Cartier for $118,750 (estimate: $60,000-80,000) in their Magnificent Jewels sale on June 12th.

- Quintessential Van Cleef & Arpels brooches – Christie’s sold a gold, diamond and ruby ‘Love Birds’ brooch by VCA (lot 76) for $47,500 (estimate: $12,000-$18,000) in their Magnificent Jewels sale on June 12th.

- High Quality White Diamonds – In the Sotheby’s and Christie’s Magnificent Jewels sales, we saw many D color, Flawless or Internally Flawless diamonds sell for within or above estimates. For example, Sotheby’s Geneva sold a 51.71 carat (lot 373) round brilliant-cut diamond that is D color and Flawless for CHF 9,260,000 (estimate: CHF 7,870,000-9,100,000). In the exact same sale, an oval diamond that weighs 50.39 carats (lot 350) that is D color and Flawless sold for CHF 8,131,000 (estimate: CHF 6,960,000-7,680,000).

In the same sale (lot 163), a ‘mystery-set’ (method of setting stones for which the house is known) sold for $162,500 (estimate: $70,000-100,000).

Doyle in New York, also sold a VCA gold, black enamel and sapphire ‘dog’ brooch (lot 286) for $16,250 (estimate: $2,000-3,000).

The Spring jewelry sales are showing that it is still a great time to sell your signed pieces and standout stones.

– Lauren Peck, National Tangible Asset Manager, GG

RELATED CONTENT

- Kate Waterhouse Joins The Fine Art Group as Director & Senior Jewelry Specialist

- White Glove Jewelry Sale at Sotheby’s for The Fine Art Group Client

- Watch TFG’s New York Luxury Week 2023 Webinar

AS A NON-TRADITIONAL COUPLE, WHAT CAN WE DO TO BETTER PREPARE FOR THE FUTURE?

Just this last fall, I opened the Sunday edition of The New York Times to find an article detailing an all-too-familiar story. Mr. Bill Cornwell and Mr. Tom Doyle lived together in their West Village brownstone loyally for over fifty years, creating a home together which nourished their deep and loving relationship. Sadly, Mr. Cornwell died in 2014; and now his will – which bequeathed the brownstone to his longtime partner – is in dispute. At the age 85, Mr. Doyle was turned out from the home he had known for the past five decades, and now is entrenched in a legal battle with Mr. Cornwell’s closest relatives. Mr. Cromwell created his last will and testament roughly a decade ago, naming his longtime partner as the recipient of all of his assets, including the three-story brownstone. Regrettably, the execution of the will was witnessed by one person and not two as required in the state of New York, making it “legally invalid.” Without a valid will, Mr. Cromwell’s assets go to his next of kin, two nieces and two nephews, who have since sold the brownstone for over $7 million dollars, leaving Mr. Doyle to live the remainder of his days in unfamiliar surroundings. I found myself asking the question, “Are we protected and, if not, what can we do to better protect ourselves?”.

For me, this story resonated deeply. After a recent move from St. Louis to Philadelphia, my partner and I were talking about our future. As we were settling into a new home where we could focus on our new life, including our passion for collecting, I began thinking about our own situation. Although I assist others with the management of their tangible assets on a daily basis, I still contend with the long-term care and management of mine. With over ten years in the fine art auction industry, I have witnessed the above situation countless times – in the arms of grief, friends and families alike are often not so concerned about the multi million-dollar family business or the generational summer home; these assets have usually been appropriately planned for years ago. But on many occasions, what they are quarreling over are high-value tangible assets with significant sentimental value. With the United States Supreme Court’s 2015 ruling in favor of same-sex marriage, these very problems now plague high net worth same-sex couples and can easily be resolved with appropriate planning and care.

Sexual orientation is a growing standard demographic variable in market research, along with traditional factors such as age, income, net worth, occupation, and education. A recent study conducted by Walter H. Zultowski, PH.D. shows that between 4% and 7% of high net worth households identify as gay, lesbian, bisexual or transgender. Although this may seem like a small number, of those polled 4% translates to approximately 300,000 same-sex households. This survey also shows that the high net worth LGBT market tends to be younger and slightly more educated than the high net worth heterosexual population. These individuals are also more likely to be found in professional occupations and business-owning categories where they can continue to grow their wealth and diversify investment though various asset classes. For many attorneys, wealth advisors, and risk management firms, this change opens a new segment of potential clients and raises the question: How do we solve problems for this new, and largely overlooked, demographic?

For advisors who are not LGBT themselves, it is important to identify and understand the very specific issues this group may face when managing risk and planning for the future. Tangible assets are now often considered a significant percentage of an individual’s portfolio, and these assets need both care and management, with strategic oversight for long term planning.

BELOW ARE THREE KEY FACTORS I LEARNED ALONG THE WAY

ASSEMBLE A TEAM OF EXPERTS

Clients and wealth managers who wish to appropriately manage tangible assets should first develop a team of trusted experts including accountants, attorneys, an independent appraiser, and an independent insurance advisor who specializes in high net-worth clients. Experts in their respective fields can easily guide clients through the unfamiliar waters of fine art and tangible assets.

SECURE AN ACCURATE APPRAISAL

The appraisal itself is the foundation for every decision made with tangible assets. In order to appropriately manage what can be a varied portfolio, it is important to conduct an insurance valuation for retail replacement purposes. This valuation reflects the cost of replacement after loss or damage. Oftentimes, responsibility for up-to-date values lies with the client. Being under-insured can result in loss, or worse, a voided policy. Having more insurance than necessary can lead to unnecessarily high premiums or disputes, in the case of a loss or damaged asset. An accurate appraisal will safeguard the owner from undue stress related to the loss and result in a quick settlement for replacement.

For those fiduciaries seeking to preserve wealth and manage tangible assets for same-sex couples, it is essential to remember that without a recognized legal relationship, there is no automatic safety net. According to the law, the estate (including high value tangible assets such as fine art, antiques, jewelry, investment wine and spirits, classic cars, etc.) will be inherited by the closest living family members, without proper estate planning in place. Like with heterosexual couples, a will can protect the assets and wishes of same-sex couples, properly dividing assets per an individual’s or couple’s wishes and avoiding costly inheritance tax issues. It is recommended that a fair market valuation is conducted for estate planning purposes. This valuation not only provides a clear understanding of the value of assets in the current market, but also provides a clear baseline value in terms of investment, return, and strategic estate planning.

TRACK NEW ACQUISITIONS AND MONITOR APPROPRIATE MARKETS

Collectors should consider cloud-based software to appropriately manage their assets. These convenient, access-anywhere systems can store important details about each asset along with value, provenance, exhibition history, and oftentimes, documentation. Further, collectors should continue to request and receive insurance schedule reviews by an independent appraiser in order to account for changing trends within the market. In addition, appraisers can continue to conduct annual and semi-annual revaluations for those assets that have experiences market shifts.

In the event that the Supreme Court decision is ever overturned, fiduciaries and non-traditional couples alike prepare for the unexpected. It is important that the estate planning strategy covers as many unknowns as possible. Encouraging non-traditional couples to create a domestic partnership agreement, living wills, and living trusts in order to properly manage their tangible assets will allow greater control of how these assets are distributed or monetized in times of disruption.

– Shane David Hall, National Tangible Assets Manager

FINDING THE RIGHT ‘FIT’: THE IMPORTANCE OF CONNECTING WITH YOUR TANGIBLE ASSETS TEAM

By Nick J Alexander, Private Risk Management, Wells Fargo Insurance Services USA, Inc.

Imagine your favorite pair of blue jeans. The ones that fit perfectly. You can wear them all day or curl up on the couch and nap in them. Think about your first cup of coffee in the morning. The aroma alone puts a smile on your face and gives you hope for a prosperous day. Now think of your best friend, the one you trust no matter the topic. These simple, everyday items give us comfort, put us at ease and allow us to trust.

Now imagine sitting across the table from your insurance broker or your family advisor. The person with whom you share your personal financial information and the value of your tangible assets. Imagine not feeling comfortable with this person. Imagine having to “come out” to this person when you don’t feel comfortable, at ease or have trust.

FROM POWERLESS TO POWERFUL

A new client recently sent me insurance information to review for her existing personal insurance program. Included was a separate policy for a person who lived at the same address but was insured by a different company. When I asked who this person was and if I needed to include her and her vehicle on the proposal, the client replied that she had “sent this document in error”. I told the client I noticed the document had the same address and that I would need to know about each individual living in the household. With hesitation, she said it was “her partner.”

“Great!” I replied, “We should look at placing you on the same policy for multi-car discounts, one billing, and now you will have one broker to discuss your personal insurance program with.” I then added, “My partner and I saved several hundred dollars and simplified our household bills.”

She replied, “You have no idea what a relief it is to work with someone who understands us. We were fearful of telling our current broker about us, so we insured everything separately.”

Great progress has been made for the LBGT community across this country in recent years. However, some still live in fear or are hesitant to “come out” to people they work with, including their insurance broker. Wouldn’t it be great if we could all approach our conversations with our trusted advisors the same way we approach our first cup of coffee in the morning?

When choosing a team to help manage your personal assets, whether it’s your art collection, finances or personal insurance program, look for the right fit—just like your favorite pair of blue jeans.

With over 20 years of experience in the field of personal insurance and risk management, Nick J. Alexander is a highly trusted expert who regularly advises regarding private risk management for traditional and non-traditional couples alike.

APPRAISALS & VALUATION SERVICES

Valuation of our clients’ assets forms the foundation of our business, enabling us to develop strategies to maximize a collection’s value.

The Fine Art Group was launched in response to a growing demand for wholly independent valuation services along with a requirement for a more personal service in today’s more complex art market. We provide confidential valuations for the purposes of Insurance, Taxation & Probate, Trusts & Estates, Family Division and Divorce, Sale on the Open Market or Art as Collateral.

Each of our clients are unique and our appraisal approach is tailored to meet their needs. To learn more, contact us at (610) 254 8400 or info@pallmallartadvisors.com.

This material is for informational purposes and is not intended to be exhaustive nor should any discussions or opinions be construed as legal advice. Contact your broker for insurance advice, tax professional for tax advice, or legal counsel for legal advice regarding your particular situation. Products and services are offered through Wells Fargo Insurance Services USA, Inc., a non-bank insurance agency affiliate of Wells Fargo & Company, and are underwritten by unaffiliated insurance companies. Some services require additional fees and may be offered directly through third-party providers. Banking and insurance decisions are made independently and do not influence each other.

© 2016 Wells Fargo Insurance Services USA, Inc. All rights reserved.

FROM CHAOS TO CLARITY

DEVELOPING A PLAN & IMPLEMENTING STRATEGIES FOR LONG-TERM COLLECTION MANAGEMENT

It’s a scenario many of us are all too familiar with. Overtime as large collections grow and management changes hands, collections have a tendency to become unorganized, valuable items are misplaced or missing all together, and no one really has a clear picture of the entire collection or its significance. The frustrating scenario conjures up images of dusty piles of paper, leaning stacks of old frames, dated filing cabinets and storage closets employees would just as soon forget.

Spring is here, and with the brighter days it is time to clear the cobwebs, assess the situation and implement a strategy in alignment with your organization’s goals. The good news is, you don’t have to do it alone. As a range of services and expertise that The Fine Art Group advisors provides, we begin at square one with clients who seek clarity and are in need of an extra hand to provide direction for long-term collection management and development. Here is how we can assist:

COLLECT THE DATA FOR DECISION-MAKING AND STRATEGIC PLANNING

The Fine Art Group can help you understand the scope of the collection by establishing an updated inventory and providing an appraisal that provides comprehensive values derived from the most current market data. These reports are designed to provide you with a basis for strategic development and decision making. Is there a gap in risk management? Are there new exposures to consider? What should you prioritize in the collection? What are the lower-valued items that merit less attention? Should you sell some of the pieces? And to what end?

DEFINE A PURPOSE OF THE COLLECTION

Your collection can and should align with your organization’s mission, vision and brand. The Fine Art Group works alongside corporate and institution leaders to articulate a clearly defined mission for the collection. Are you seeking to engage the community with local artists? Market to next generation collectors with emerging art? Create a collection with investment potential? Defining purpose establishes a direction in order to move forward with editing, refining and curating the collection.

EDIT AND REFINE

Once a purpose is in place and inventory is complete, it is time to edit and refine. The Fine Art Group provides recommendations for monetizing or donating items that are aligned with your organization’s ultimate goal. We have assisted organizations with the delicate process of deaccessioning items that have been donated yet are not accentuated within the collection. There may be duplicates that can be sold or items that dilute the overall quality. Editing the collection can reduce the amount of resources expended on the collection and clear storage space. Monetizing specific works can contribute funds to reinvest in collection management and curated acquisitions.

RECOVER YOUR LOSSES

During this process, it often comes to light that pieces from the collection are missing and others are in disrepair. For missing items, just because the item is no longer there doesn’t mean it should be forgotten. As options to explore, The Fine Art Group may facilitate the claims process, file a report with the Art Loss Registry and secure a replacement. With regards to damage, we will establish whether or not the item was covered on your insurance, evaluate the loss in value and, if suitable, coordinate conservation. After the work has been conserved, The Fine Art Group will recommend an updated retail replacement value of the item for adequate insurance coverage on your current policy.

CONSERVATION

In addition to conversation of damaged items, The Fine Art Group can arrange annual inspections by a professional conservationist. Delicate, rare and/or expensive items should be watched over carefully by trained professionals who can treat or prevent condition issues before they tarnish the value. As required, we will incorporate annual conservation inspections as a component of our recommendations for collection management.

UPDATE YOUR RISK MANAGEMENT STRATEGY

We regularly work alongside insurance brokers to establish thorough insurance coverage as part of the risk management portfolio. The Fine Art Group then takes it a step further: With expertise in the preservation and care of artwork, we provide recommendations on where best and how to display works of art from the collection with consideration to conservation and theft prevention.

LONG-TERM COLLECTION MANAGEMENT

With values determined and purpose defined, it is time to move forward with Collections Management and establish plans to maintain the collection. In order to protect and preserve the sentimental, aesthetic, historic, and financial values of your collection, The Fine Art Group offers routine appraisals, inventory management, database systems, logistical support, storage solutions and additional research for the long-term care of your collection.

GET YOUR TEAM INVOLVED

The Fine Art Group provides educational workshops for employees on best practices for handling, storing, displaying and preserving valuable objects, antiques and works of art. Workshops may be one-on-one or with a group, and are customized to meet the needs of your organization and collection.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth

Hong Kong & China Art Markets Thriving

With all the fluctuations and uncertainties in the world’s markets lately, it is good to know that the art market in Hong Kong and China is still very much alive.

Hong Kong has been an international environment for decades, and one familiar to many dealers and collectors. With its very attractive tax laws and ease of communication, it has long been an ideal place for the world to buy and sell artwork. Selling in Hong Kong is a great way to take advantage of the economics and still reach collectors from all over the globe. Because of this, most of the top-tier auction houses have branches on the island, often providing them with their most profitable sales. This small, welcoming island also hosts the premier art fair – Art Basel Hong Kong – and a limited, but healthy gallery and dealer scene.

While the Hong Kong market has been popular for some time, the market in Mainland China has been growing significantly. Despite some recent economic downturns, Mainland China has still one of the fastest growing economies with rapidly increasing numbers of “High Net Worth Individuals”. With the lack of investment opportunities that may be available in other countries, these newly wealthy Mainland Chinese have been looking toward the arts as an investment vehicle. This is evidenced by the number of Art Funds still active in China and the growing Private Museum trend all over the mainland. Traditional arts and cultural antiquities has always been an area of interest for the connoisseur collector in Mainland China and now, with the younger generations coming of age, we see a growing market interest in both modern and contemporary Asian and Western art.

Mainland China has never had a very strong gallery or dealer scene. Because of this, auction houses are still the primary place for collectors to seek out and purchase works of art and objects of significance. With this established demand… the only issue has been the supply. Collectors, auction houses, and private museum directors have been looking hungrily toward European and American collections. They are seeking out ceramics, paintings, bronzes and jades that have found their way into Western collections decades, and sometimes centuries, ago and they have been willing to part with headline-grabbing sums to acquire these works.

So, for owners of fine works of art and notable objects, one option that should not be overlooked is selling in Asia. However, these East Asian waters are foreign to many, and knowing how to navigate them can still be tricky. Where are the best and most reputable dealers, galleries and auction houses? How do the standard contracts and tax laws differ? What micro-market has the greatest demand for your particular category of art? These are the questions that a good advisor with contacts and experience in Asia can answer. For centuries, explorers have found good fortune in distant lands – but they all needed a navigator!

– Patrick Regan, Appraiser & Advisor