Originally published on Tiger21.com, September 2, 2022

Market Insights for Fine Art Investment

Spring Art Market Recap: Top Sellers, Auction Records and Trends for the Future

While you might expect that Covid’s impact and an increase in inflation would deter art buyers at auction, Spring 2022 auctions in New York City demonstrated just the opposite.

With around $2.5 billion worth of art sold in the span of two weeks, the widely anticipated New York May Marquee Sales wrapped up the spring season, achieving new auction records and concluding the first half of 2022 at their highest level ever. Of the total sales, Post-War and Contemporary art accounted for 48.8%, while Impressionist and Modern art comprised 51.2%.

The Boost of the Season: Single-Owner Collections

The sales included major single-owner collections, which accounted for 38.5% of the total evening Marquee Sales, and raised a total of $795.3 million. Included were The Ammann Collection with landmark Post-War and Contemporary pieces; the Bass Collection of leading 19th– and 20th-century artworks by Claude Monet, Edgar Degas, and Mark Rothko, among others; and the Macklowe Collection, which became the most valuable single-owner collection ever sold at auction. The collection of Rosalind Gersten Jacobs and Melvin Jacobs showcased works from Dada and Surrealist movements.

New York Art Auction Records

Despite a backdrop of economic and political uncertainties, the evening sales set new auction records and strong sell-through rates. The headlining work from the Ammann Collection, Andy Warhol’s Shot Sage Blue Marilyn (1964), sold for $195 million with buyer’s premium[1], becoming the most expensive 20th-century artwork ever sold at auction, while Man Ray’s Le Violon d’Ingres (1924) achieved $12.4 million with premium, setting a record for the most expensive photograph sold.

Phillips had the most successful sale in its history. The sale was mainly driven by the 1982 Untitled by Jean-Michel Basquiat, which reached $85 million with premium, becoming the most expensive artwork ever sold at Phillips. The Marquee Sales set numerous artist records and saw a continuous rise in prices for artworks by young contemporary artists. Separate evening sales were dedicated to 21st-century art with works by female artists making up more than half of the lots.

Fine Art Investment: Looking Ahead

With a strong start in the first half of 2022, the auction market is preparing for the upcoming fall months. There will be a number of important single-owner collections available, including the Paul G. Allen Collection and the Ann & Gordon Getty Collection at Christie’s. Together with Frieze London in October and Art Basel Miami in December, the art market is expected to see a busy fall season.

As advisors to many collectors who are looking to invest in fine arts and acquire art as an asset, we feel that continuing to collect during periods of uncertainty may present advantages. With a potential recession in the coming months and various economic and political factors currently strengthening the U.S. dollar across Europe and the UK, an increased focus on asset acquisition might be expected, particularly in the art world.

FURTHER READING

- Don’t Go It Alone: Let Us Be Your Auction Sale Advocate

- Salma Shaheem Discusses the Growth of Fractional Art Investment with Spear’s

- Protect Your Investments While Divesting Tangible Assets

[1]In addition to the winning bid for a lot at auction, known as the hammer price, auction houses charge buyers an additional fee known as a buyer’s premium, which is calculated as a percentage of the hammer price. Source

Morgan Long, Managing Director of The Fine Art Group, spoke with Barron’s about Christie’s sale of the Paul Allen Collection, what masterpieces she hopes to see for sale in November, and what this might mean about the health of the upcoming auction season.

Click here to find out more and read the article in full.

The approaching end of summer heralds not only the arrival of chillier weather, but a new wave of international art fairs. As the first fall since 2019 without lockdowns and covid restrictions, one can be sure the art world will be gearing up for another busy run of fairs in the next few months.

We have selected some of our top picks from around the globe. Be sure to look out for some familiar faces from The Fine Art Group’s Advisory Team if you drop by.

SOUTH KOREA

Seoul

KIAF Seoul

VIP – September 1-2, 2022

September 3-6, 2022

Frieze Seoul

VIP – September 2, 2022

September 2-5, 2022

Possibly the most anticipated art fair of the year, Frieze announced in May 2021 that they would open their fifth edition in Seoul, which is rapidly becoming the new hotbed of the global art market. Featuring over 100 galleries, it will take place alongside KIAF Seoul, South Korea’s first international art fair which will celebrate its twentieth anniversary this year. Like Frieze London, Frieze Seoul will also have a Frieze Masters section, as well as Focus Asia, a new feature showcasing young emerging Asian artists and galleries.

UNITED STATES

New York City

The Armory Show

VIP – September 8, 2022

September 9-11, 2022

Founded in 1994, the fair is located near the Chelsea gallery district in the Javits center. The first go-to event of New York’s fall art season, it will feature over 240 international galleries from over 30 countries. Its 2022 Platform section will also showcase a series of large-scale installations entitled Monumental Change. Co-ordinated by Tobias Ostrander, curator of Latin American Art at the Tate London, it will examine the current and controversial debate around public monuments.

Miami

Art Basel Miami Beach

VIP – November 29-30, 2022

December 1-3, 2022

While December may seem very far away, Art Basel Miami is the important bookend of what will surely be an exciting fall art season. Running off the back of the November New York sales, Art Basel Miami 2021 drew much attention for its inclusion of NFT galleries as exhibitors, as well as a partnership with blockchain Tezos, where visitors were encouraged to mint their own NFT. In the aftermath of the cryptocurrency market crash and fall in the NFT market, it will be interesting to see how techno-friendly the fair is this year.

UNITED KINGDOM

London

Frieze London & Frieze Masters

VIP – October 12, 2022

October 12-16, 2022

Frieze’s inaugural London fair returns for its 19th edition, its first event’s since the UK government officially lifted all Covid restrictions. Set in Regent’s Park, it will also mark the first Frieze London since Victoria Siddal stepped down as global director. The 2022 Frieze Artist Award, which received submissions focused around sustainability, was recently awarded to emerging British Artist Abbas Zahedi. Having graduated from his MFA just three years ago, Zahedi will create an installation by the entrance of the fair, which will host a series of live activations within its structure.

FRANCE

Paris

Paris+, par Art Basel

VIP – October 19, 2022

October 20-23, 2022

One of the biggest stories to hit the art world this year was the announcement of Art Basel’s new edition in Paris. Ousting prestigious French fair, FIAC, from its October slot at the Grand Palais, Paris +, signifies a major turn of events in the fair landscape. Including a Sites sector dedicated solely to artistic projects happening within the city, this newest Basel takeover is seen by many to signify the rise of Paris as a prominent market center in the wake of Brexit.

FURTHER READING

THE SCOOP #7 – August 15th, 2022

In our 7th edition of The Scoop, we cover the stabilizing markets, Blackrock partnering with Coinbase, airdrops, and the conclusion to Damien Hirst’s The Currency experiment.

CRYPTO MARKETS

CRYPTO COMMENTARY

With the bounceback in traditional equity markets over the last couple of weeks, Bitcoin and the broader crypto markets have seen some stability while the crowd seems split as to whether the worst is behind us. The flow of bad news and lender defaults has slowed to a trickle, but many seem to have a bad taste in their mouth from the recent market washout.

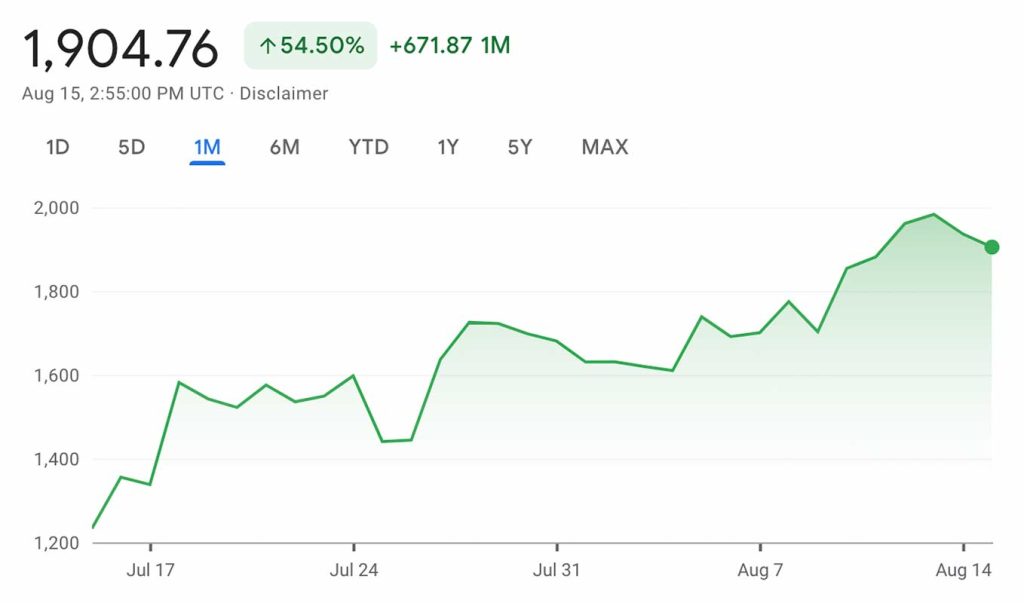

There is some good news though, as Blackrock and Coinbase have agreed to a partnership that would allow crossover for Blackrock clients to trade and manage crypto in-house. The agreement combines Blackrock’s Aladdin service with Coinbase Prime so institutions will have full control of their holdings in one place. The scale that Blackrock brings to this partnership sent Coinbase shares up 44% intraday but closing the day only 10% up.

Amid rising interest rates, geopolitical tension, recession fears and a broader market selloff, this news is a breath of fresh air for a market that was slipping underwater. What this does on a larger scale is show that Wall Street’s appetite for crypto adoption is growing. More institutional adoption may be just what crypto needs to grow in price, maturity, and stability. Now that the biggest fund manager in the world is on board, who will be next?

WHAT’S THE BUZZ?

Imagine looking in your wallet one day and finding a new piece of art from one of your favorite creators. How did it get there? An airdrop.

AIRDROP

- Airdrops are distributions of NFTs, tokens or cryptocurrency to a Web3 wallet address

- Use cases include marketing, additional perks for collectors, or showing proof of attendance

- They are often viewed as “dividends” for owning certain NFTs

- In many scenarios, creators use this tool to connect with their collectors. For example, devoted collectors of Daniel Arsham’s Eroding and Reforming collection on Nifty Gateway will be airdropped an exclusive 11th NFT if they collect all 10 that were released

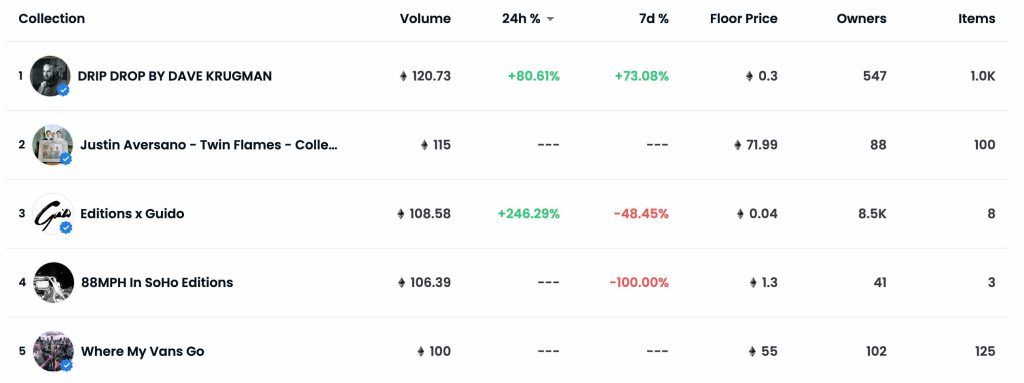

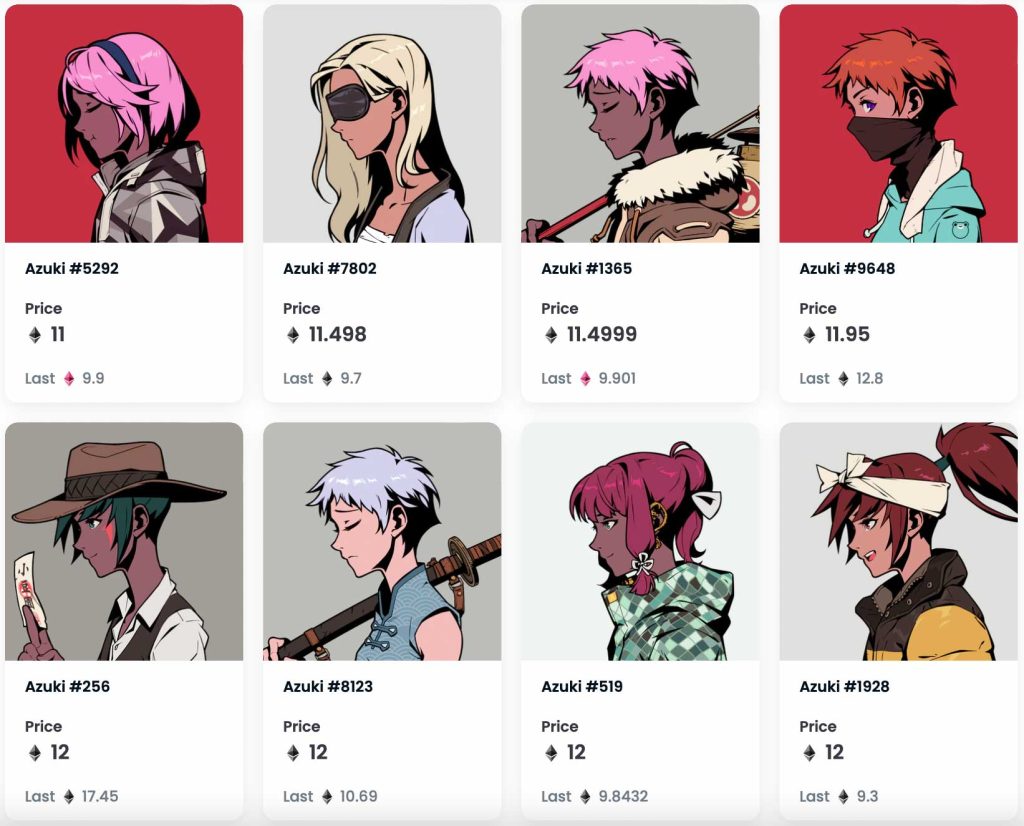

NFT BLUE-CHIP COLLECTIONS

NFT COMMENTARY

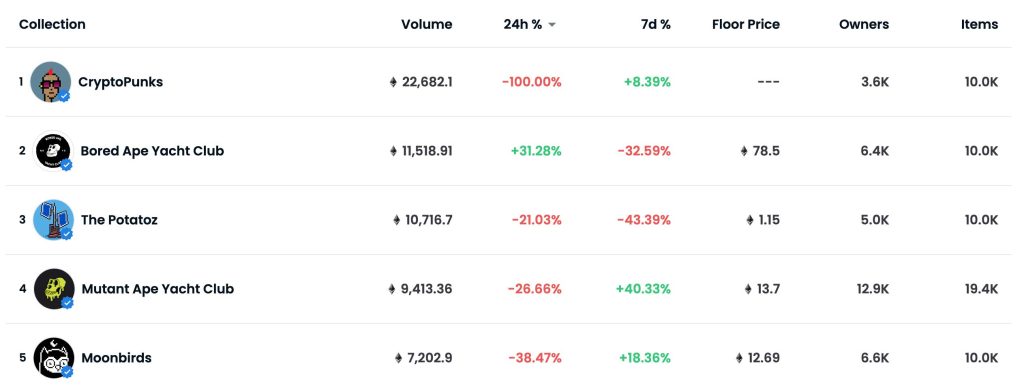

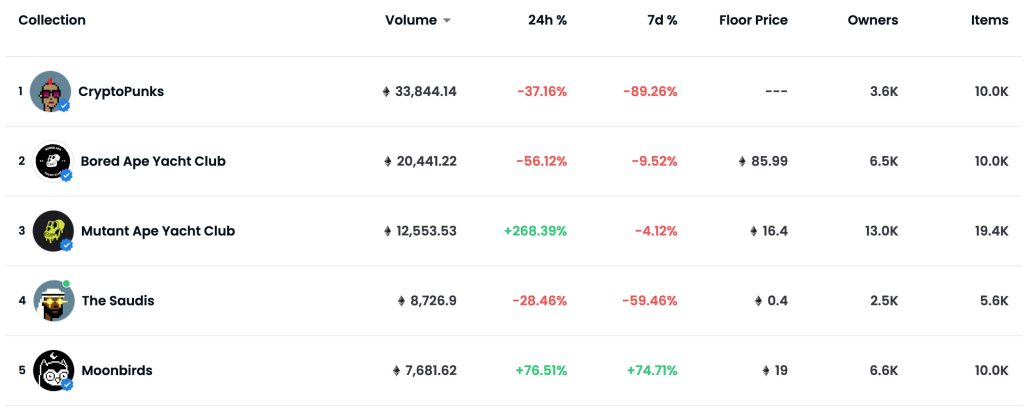

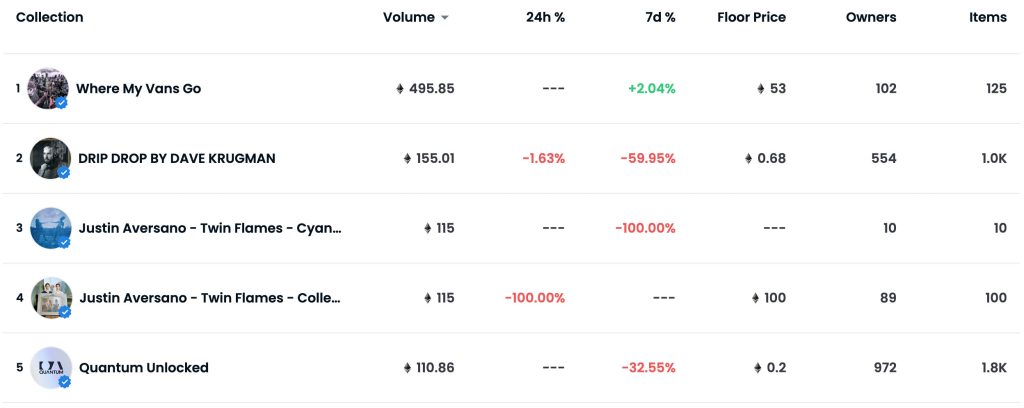

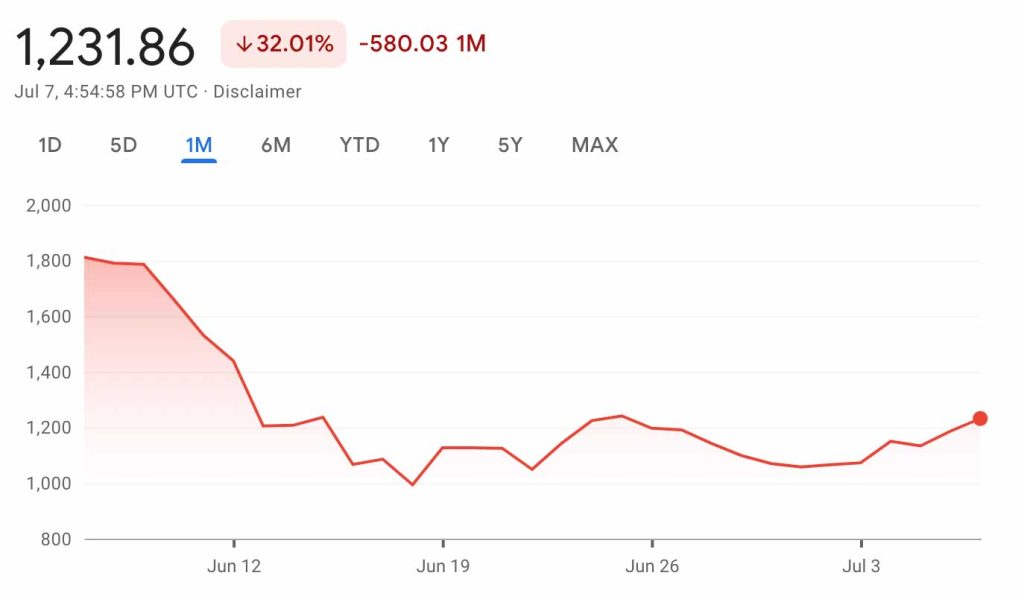

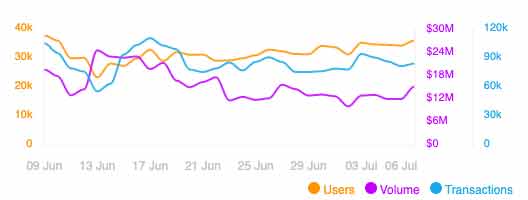

The recent rise in the value of Ethereum has led to a stabilization in floor prices, but we’re still seeing slower volume on OpenSea and other major marketplaces. In the next month or so we’ll be able to see if this was just everyone on summer break or if this is the new normal.

While volumes and values have been treading water not all the metrics have done the same and we are still seeing growth in adoption. The total number of active users was up 2.2% over the last 90 days in a promising sign that this platform is still onboarding new collectors.

In the bigger picture, there have been some conspicuous entries to the NFT market. In the social media world, Meta is working its way towards integrating NFTs into its popular Instagram platform so collectors can show off their pieces and creators can market their work. Major League Baseball is now giving away digital collectibles at their games; ticketholders can claim their NFTs with creative group Candy, introducing a vast audience to Web3. And last but not least, high fashion has jumped into NFT trends with Tiffany’s releasing NFTiffs, which are NFTs valued at $50,000 but paired with custom CryptoPunk avatar pendants. There are some differing opinions which Tiffany’s will have to contend with, but it doesn’t seem like they’re planning on backpedaling. Brands will have to watch how they manage their image in a whole new way moving forward.

NFT ARTIST SPOTLIGHT

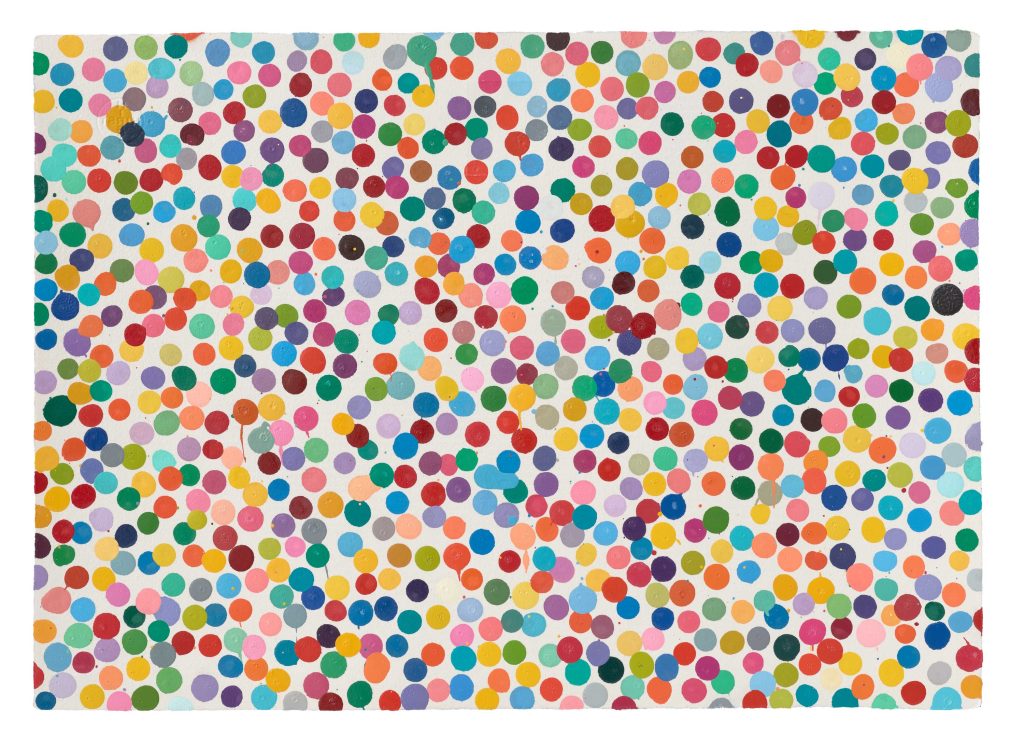

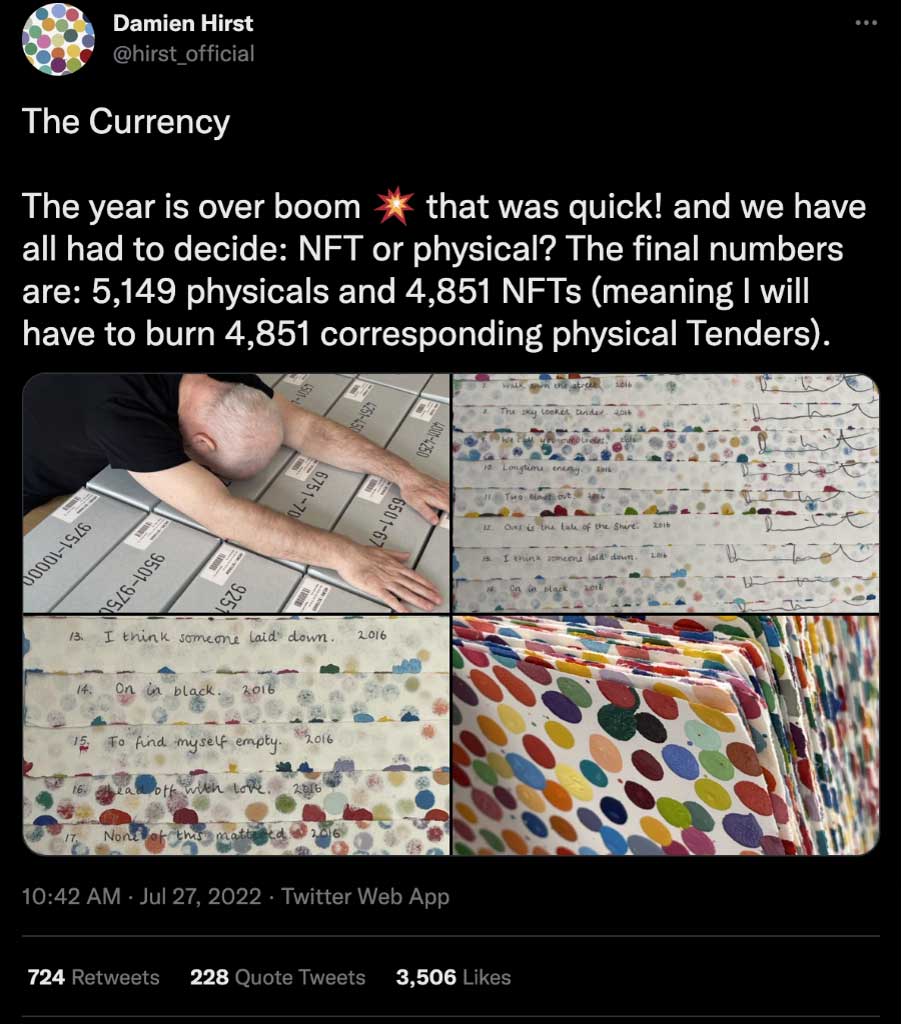

Damien Hirst

He is no stranger to the art world, but he was an early adopter in the NFT world. Damien’s experiment has literally caught fire. About a year ago when he released his collection, The Currency, he gave collectors an ultimatum about how they would ultimately get to keep their art. Each NFT was matched to a physical piece and at the end of the first year they had to decide which they would keep: the physical piece or the NFT. The one not chosen would be burned.

It was not a surprise to the art world that the physical pieces were preferred, but what did raise an eyebrow was how slim the margin was. It wasn’t as lopsided as many expected — 51% chose the physical pieces and 49% picked the NFTs. Perhaps the most difficult decision was for the artist himself. He had to make a choice on his 1,000 pieces and opted for the NFTs on all of them. He churned on the decision for quite some time but laid it all out in a Twitter thread on how keeping them as NFTs would be the next logical step, saying he has “no idea what the future holds, whether the NFTs or physicals are going to be more valuable or less. But that is art! the fun, part of the journey and maybe the point of the whole project. Even after one year, I feel the journey is just beginning.” We’re with you Damien.

NFT & CRYPTO NEWS

- Pearson considers move to NFTs for future book sales

- “CryptoDickbutts” sales surge “for the culture”

- SOL NFTs hit new $1 Billion high

- Metawashing: Are we seeing Greenwashing 2.0?

- OpenSea tweaking it’s stolen item policy

- Prada’s Virtual Fashion Show turns heads in China

- The 20 Top-Selling NFT Artists

- Tiffany & Co. “NFTiffs” sell out in 20 minutes

- NFTs will be regulated like cryptocurrencies in EU

- Polygon Team reports apps on the network surge by 400%

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

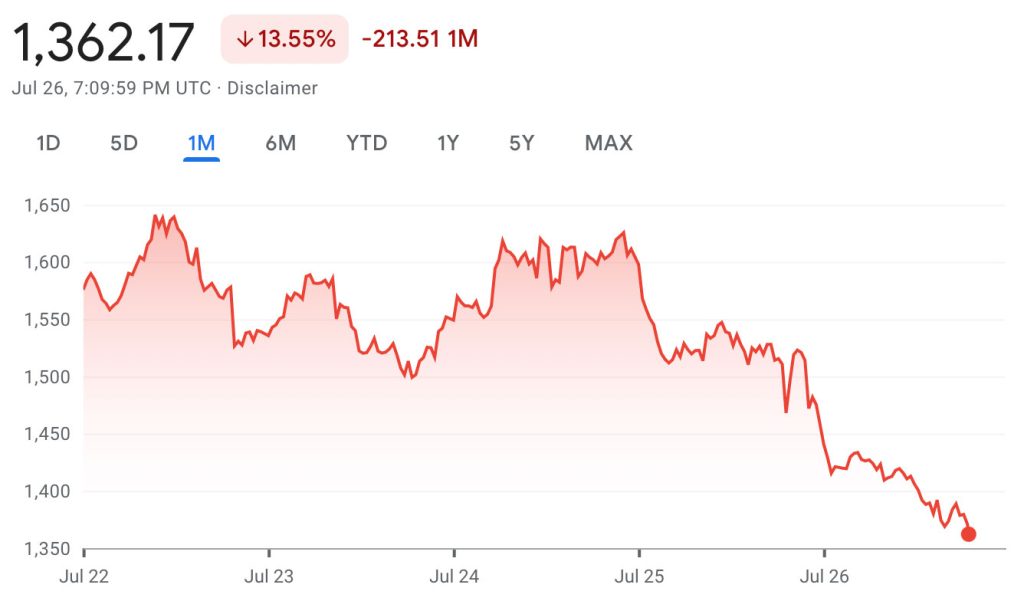

THE SCOOP #6 – July 27th, 2022

In this edition of The Scoop, we cover the latest 3AC default news, consolidation in the NFT market, and dive into DAOs.

CRYPTO MARKETS

CRYPTO COMMENTARY

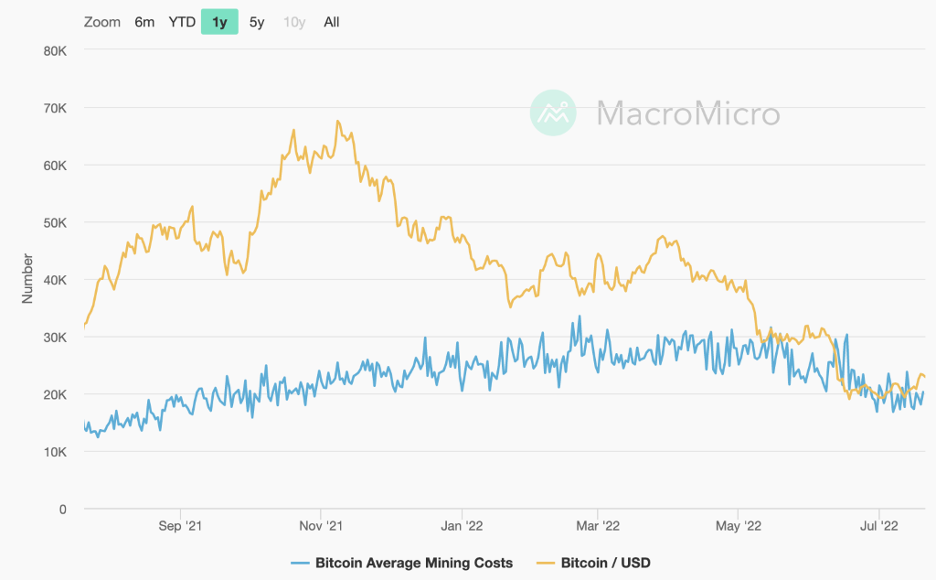

After bank earnings have been reported there is a cautious sense of optimism in the markets with some green in the charts for a change. Many investors are waiting for the next CPI (consumer price index) numbers to come out before making any moves. The restless indecision has created some expected choppiness while JP Morgan warns we may not have seen the bottom yet. The cost to mine a single Bitcoin has dropped dramatically from $24,000 to $13,000 and it could lead to a further decline in the crypto’s value. The price to mine Bitcoin has fluctuated over time since it is so energy-dependent. At the peak in February 2022 it cost $33,500 to mine a single Bitcoin while the cost is now $18,900, a 43% decrease.

The drama continued in the lending space as bankruptcy filings for 3AC, the crypto hedge fund, revealed that the founders made a down payment on a yacht while ignoring their debts. They owe $3.5 billion to insolvent crypto lenders like Celsius and Voyager. The courts fear that 3ACs assets already may have been liquidated and transferred out of the fund with founders Su Zhu and Kyle Davies off the grid and not responsive.

Many believe this event will lead to more cautious investors, slower adoption and more stringent rules from the government. The coming regulation could create more accountability for the malicious actors and build protections for retail investors similar to the traditional securities markets. It feels like we’re moving away from decentralization and more Wall Street, which is a bit of a paradox since that’s what crypto was built to avoid, the traditional banking system.

WHAT’S THE BUZZ?

With so many new communities popping up in Web3, we’re seeing a new form of management in those communities in the form of DAOs. It’s like a corporate structure for decentralized entities.

DAO

- DAO stands for Decentralized Autonomous Organization.

- It is a structure where token holders take part in the decision making and management of the group.

- With no central authority, the power is distributed across the token holders who cast votes on initiatives proposed by the community.

- Many organizations place their votes on blockchain where the results can be publicly viewed

- Security is crucial for DAOs as any exploit could drain them of their holdings, the most notable being The DAO Hack of 2016 resulting in a $50 million loss.

- A great application of this concept is LinksDAO, a group of golf enthusiasts who are building a community around the game with the goal of owning a golf course. Their token release will be helping fund the purchase and members will be voting on where the course will be along with other initiatives to grow their footprint.

NFT BLUE-CHIP COLLECTIONS

NFT COMMENTARY

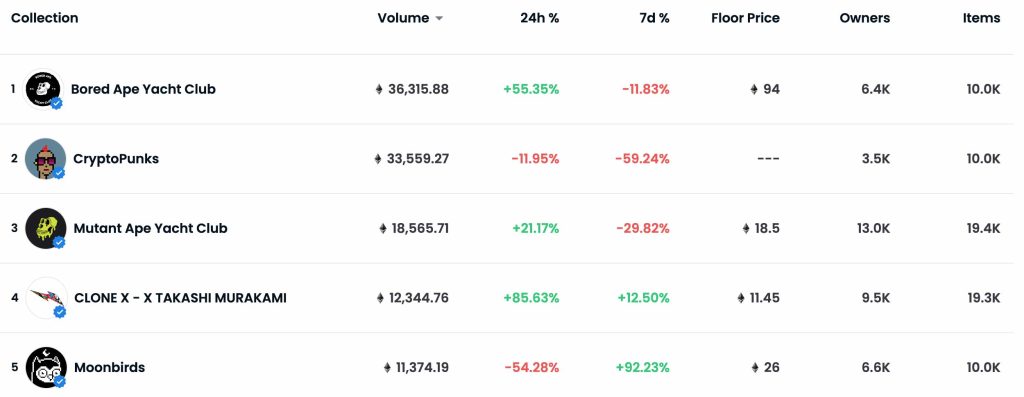

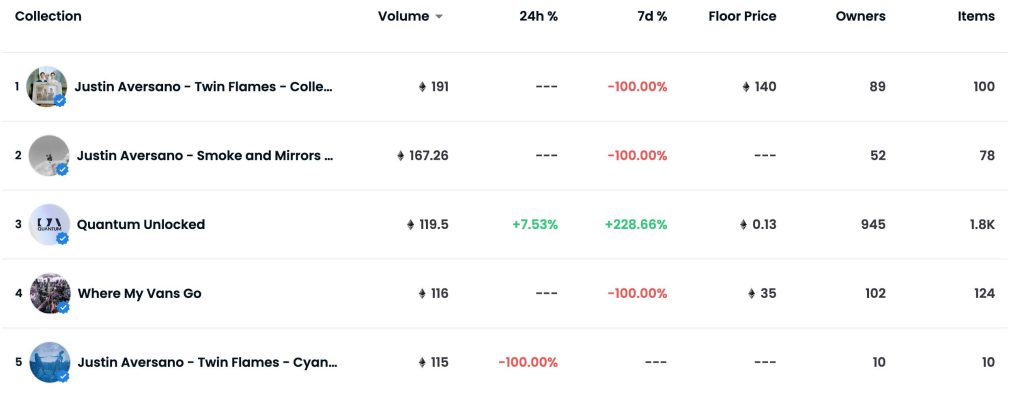

With green in the crypto markets comes an uptick in the NFT markets. The speed of the consolidation into blue chip projects has increased with Bored Apes, CryptoPunks, and Art Blocks increasing in both value and volume. Many other projects have been stuck in neutral, with either modest gains or slight declines despite a lift in the cryptocurrency value.

The recent dip has given everyone a renewed perspective on what value is. Some projects didn’t survive, and maybe that’s a good thing. Collectors are getting pickier with NFTs they’re putting money into, and the two biggest drivers are history and utility. If a project doesn’t have any cultural significance or doesn’t grant access to any meaningful perks, collectors are passing on it.

In a meeting recently, we were asked what we thought about the recent market pullback. We think it was bound to happen after an explosive first year and necessary to bring sky-rocketing expectations back to earth. The amount of building in this space by both artists and other industries is increasing during this market lull, and the technology cannot be ignored at this point. Christie’s has launched a new enterprise named Christie’s Ventures to engage with early-stage companies in Web3.0 innovation, art-related financial products, and solutions and technologies that enable seamless consumption of art. This is a positive sign and possibly an indicator of more players entering the space.

NFT ARTIST SPOTLIGHT

Tyler Hobbs

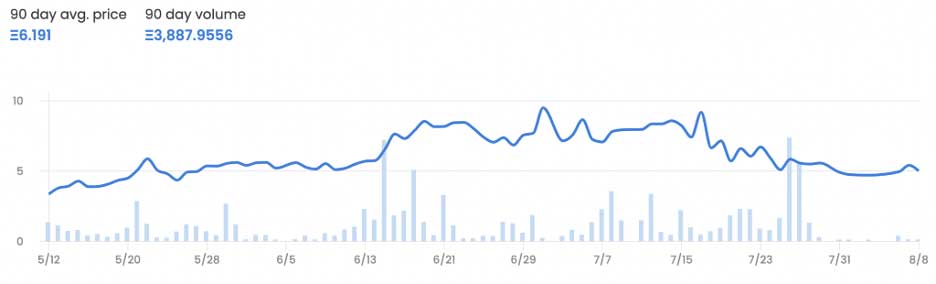

The Austin, Texas-based artist behind the iconic Art Blocks Fidenza collection has had creating in his blood from a very young age. He took up painting when he was little with inspiration from Van Gogh and other landscape artists he had seen with the goal of becoming an artist. For pragmatic reasons, Hobbs was persuaded by his dad to study computer programming and got a programming job in his 20s while still creating on the side.

One day he had an idea: “What if I wrote a program that created a painting?” Hobbs went to work on combining his two passions and developed algorithms that would do just that. Tyler was sharing his work on social media and eventually he was getting messages on Twitter about NFTs. The rest is history.

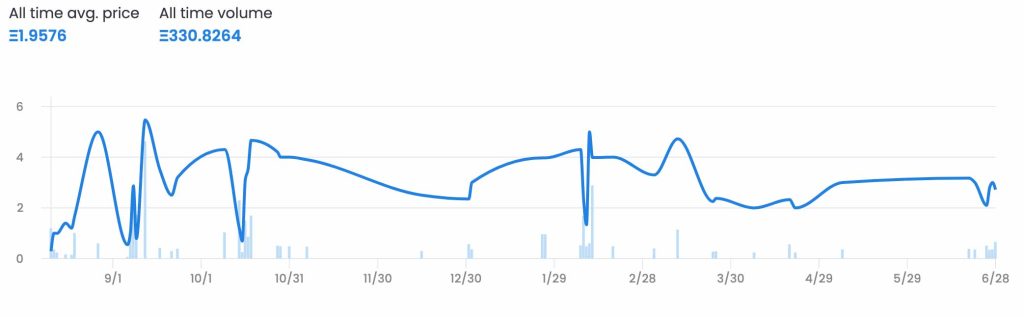

The above chart shows all the volume (vertical bars) this collection has seen in July with the price (blue line) gradually going up. They have seen a recent resurgence in secondary sales as the rest of the Art Blocks collection continues to grow. Fidenzas have become a grail item for many in the collecting space with only 999 of them in existence. Many have placed historical value in this collection since it was one of the first formal Art Blocks releases.

NFT & CRYPTO NEWS

- Tesla unloads some of it’s Bitcoin in Q2

- Damien Hirst’s NFT experiment is on fire (literally)

- A joke gone wrong and the fumble of the century? Eth Whale loses big after misstep

- Italy halts museum NFT contracts

- Coinbase is in hot water with the SEC

- Pressure is building for regulation

- The creator of Art Blocks on the rapid growth

- Phillips’s Generative Art Sale negatively impacted by crypto volatility

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

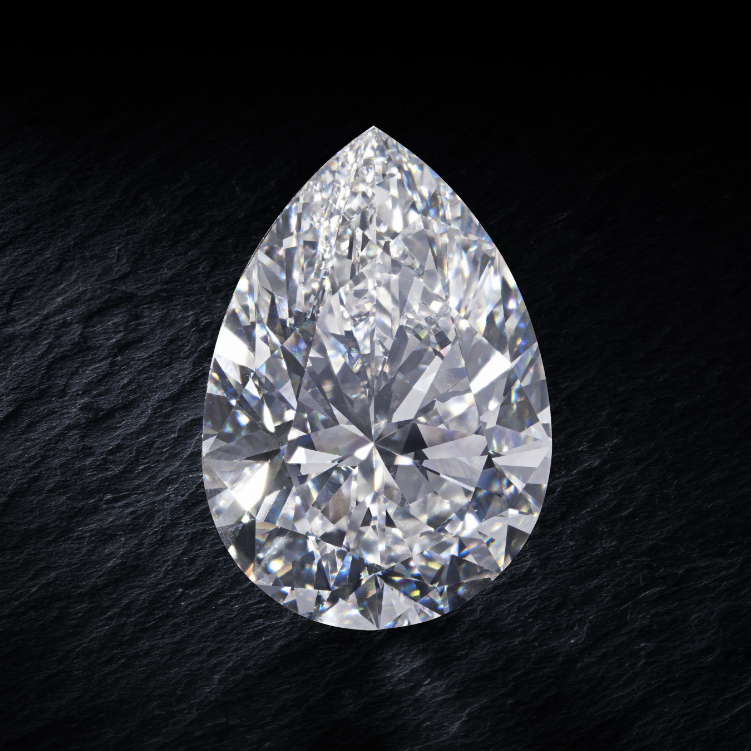

2022 Jewelry Market Report to Date

The two sale seasons at auction for significant jewels occur in the May/June time frame and in December, selling across sale rooms in Geneva, Hong Kong, and New York. Several important stones sold at auction in the first half of 2022, the most valuable of which was the “De Beers Blue” which sold for $57.4 million at Sotheby’s, Hong Kong. It was the largest vivid blue diamond to sell at auction and one of the highest prices ever paid for a diamond at auction.

An analysis of the significant jewelry sales at auction so far this year show three areas of strength: colored diamonds, pieces by established luxury makers such as Harry Winston and Cartier, and strong value appreciation of specimen stones such as the paraiba tourmaline and spinel.

SOME KEY TAKEAWAYS

- The global jewelry market has an upwards trend, with an anticipated CAGR of 15.39% by 2026, with 29% of growth within North America..

- Unusual specimen stones such as paraiba tourmalines and spinels have seen increased interest and appreciation on the market due to demand from Asia.

TOP FIVE SOLD JEWELRY PIECES IN 2022 TO DATE

The step-cut fancy vivid blue diamond weighing 15.10 carats

The De Beers Blues

Sotheby’s, Hong Kong

April 27, 2022

Lot 1800

SOLD: $57,466,161

228.31 carats, G color, VS1 clarity, excellent polish and symmetry

Magnificent Jewels Sale

Christie’s, Geneva

May 10, 2022

Lot 26

SOLD: $22,371,214

103.49 carats, D color, Flawless, excellent polish and symmetry, Type IIa

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $11,000,000 – 18,000,000

SOLD: $20,084,000

Fancy intense yellow cushion modified brilliant-cut diamond of 205.07 carats

Magnificent Jewels Sale

Christie’s, Geneva

May 10, 2022

Lot 61

SOLD: $14,626,895

Pear-shaped diamond weighing 101.41 carats.

Magnificent Jewels Sale

Sotheby’s, Hong Kong

June 16, 2022

Lot 487

SOLD: $12,963,500

COLORED DIAMONDS

According to the Fancy Color Diamond Index (FCDI), which tracks and analyzes wholesale prices of colored diamonds, the market value of fancy-colored diamonds has typically increased 9-12% annually in recent years. Though not all colored diamonds are created and valued equally, even lower quality colors have appreciated in value. For example, fancy pink diamonds, a lower grade, gained 325.6% in price from the start of 2005 through the first quarter of this year, while fancy vivid pink diamonds, a high grade, achieved 427.8% growth. In comparison, the price of gold gained 300% over that period, and the S&P was up 384%.

MAGNIFICENT JEWELS SALES

The success of colored diamonds is made evident by their performance at the 10 Magnificent Jewels sales held by Christie’s and Sotheby’s in the first half of this year. Two of the top five pieces sold in 2022 were colored diamonds, with the overall highest-grossing piece being the Fancy Vivid Blue Diamond from Sotheby’s De Beers Blue sale. Further, the other top-grossing colored diamond, the Red Cross Diamond from Christie’s Magnificent Jewels sale in Geneva, exemplifies the popularity and desire for yellow diamonds, which accounted for most colored diamonds in the Magnificent Jewels sales. Of the top 12 colored diamonds sold in Magnificent Jewels auctions in the first two quarters of 2022, all but one performed above estimate range.

Old-mine cut Fancy Intense Pink diamond weighing 4.08 carats

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $1,200,000 – 1,800,000

SOLD: $3,801,000

Old mine-cut Fancy Gray-Violet diamond weighing 3.46 carats

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $1,200,000 – 1,800,000

SOLD: $3,801,000

WHAT IS IN A JEWELRY BRAND NAME?

JEWELRY BY IMPORTANT MAKERS

- HARRY WINSTON

- CARTIER

- VAN CLEEF & ARPELS

- JAR

- BULGARI

Highly esteemed and established makers including Harry Winston, Cartier, Van Cleef & Arpels, JAR and Bulgari, were present across Magnificent Jewels auctions in New York, Hong Kong, and Geneva. Sales highlighted the continued confidence and trust in these major names, as exhibited by the sale of a Harry Winston Diamond Necklace from Christie’s New York, which performed 323.4% above its conservative estimate of $300,000-500,000, grossing $970,200. Similarly, a Harry Winston Diamond Ring at Christie’s Geneva scored 129.66% over its low estimate, further illustrating the brand’s prestige and reputation. Other makers such as JAR continue to have soaring prices on the secondary market due to a strong demand and limited supply.

Agate, Diamond And Sapphire Zebra Brooch

Carved banded agate, round diamonds, marquise-shaped cabochon sapphire, black enamel, silver and 18k yellow gold

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $50,000 – 70,000

SOLD: $554,400

A Highly Important ‘Mystery-Set’ Ruby and Diamond Clip-Brooch, France

Designed as a leaf with numerous undulating calibré-cut rubies en serti mystérieux, accented with baguette and tapered baguette diamonds

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $50,000 – 70,000

SOLD: $982,800

Diamond Necklace

Round, baguette and pear-shaped diamonds, platinum

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $300,000 – 500,000

SOLD: $970,200

Diamond Ring

Centering a pear-shaped diamond weighing 22.80 carats, flanked by tapered baguette diamonds, size 4¾, with sizing spheres

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $400,000 – 600,000

SOLD: $882,000

Emerald and Diamond Pendant Necklace

The pendant set with a step-cut emerald weighing 83.21 carats, surrounded by pear- and marquise-shaped diamonds weighing a total of 17.66 carats, suspended from a brilliant-cut diamond necklace, mounted in platinum, 18 karat white and yellow gold

Magnificent Jewels I Sale

Sotheby’s, Hong Kong

April 29, 2022

Lot 1837

ESTIMATE: $866,244 – 1,146,500

SOLD: $1,091,468

An Impressive Boreal Necklace

Centering a pear-shaped diamond weighing 22.80 carats, flanked by tapered baguette diamonds, size 4¾, with sizing spheres

Magnificent Jewels Sale

Sotheby’s, New York

June 16, 2022

Lot

ESTIMATE: $1,00,000 – 1,500,000

SOLD: $1,197,000

An extraordinary gem set and diamond bracelet, ‘Birds in Flight’

Articulated bracelet of exotic inspiration, decorated with tropical birds in flight amidst floral sprigs, pierced and millegrain-set with buff top rubies, emeralds, sapphires, and onyx as well as circular-cut diamonds, length approximately 185mm, unsigned, numbered

Magnificent Jewels and Nobel Jewels Sale

Sotheby’s, Gevena

May 10, 2022

Lot 400

ESTIMATE: $472,454 – 748,890

SOLD: $1,449,027

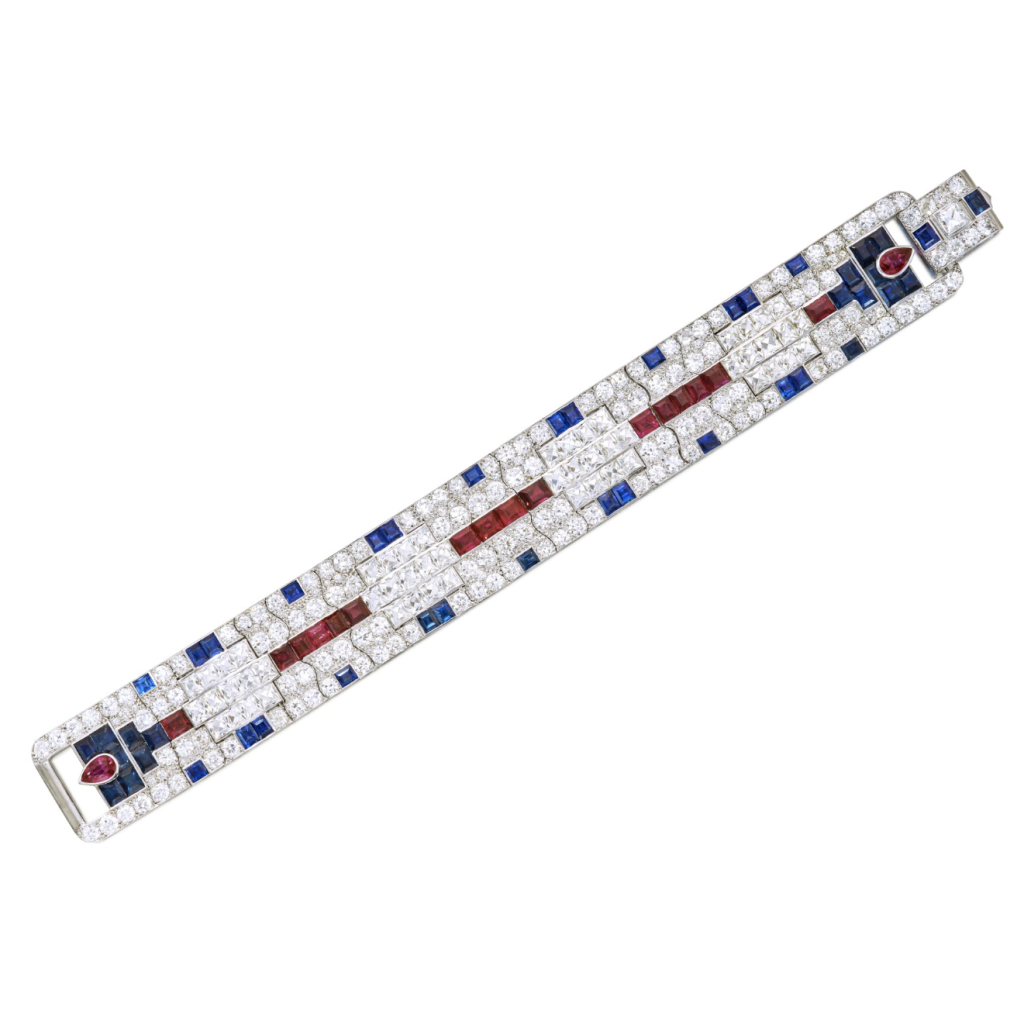

An Exceptional Ruby, Sapphire and Diamond Bracelet, Paris

Designed as a wide band, decorated with old European-, single- and French-cut diamonds, accented by calibré-cut rubies and sapphires and pear-shaped rubies, length 7⅜ inches, signed Cartier Paris Londres New York, with French assay and partial workshop marks; circa 1930

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $150,000 – 250,000

SOLD: $466,200

RARE AND UNUSUAL STONES

2022 has seen increased interest and appreciation in value for unusual specimen stones such as paraiba tourmalines and spinels.

PARAIBA TOURMALINES

The Fine Art Group was pleased to assist a client in selling its exceptional Paraiba Tourmaline and Diamond Pendant-Necklace. The result was the second highest amount secured for a Paraiba at auction and shows the strength of the market for outstanding specimen stones of rarity. Other paraiba tourmaline pieces also saw prices soar above estimate. One pair of Boodles paraiba tourmaline and diamond earrings from Sotheby’s Magnificent Jewels & Nobel Jewels sale in Geneva performed 705.6% above the conservative estimate of $50,000-70,000, selling for just over $360,180. In parallel, a superb paraiba tourmaline and diamond ring from the same maker also sold for $540,270, 264.5% higher than the conservative estimate of $200,000-300,000. Stewart Young, Head of Jewelry for Asia at Bonhams, notes that the market price of Paraiba has soared in recent years as it has become a desired stone by many Asian collectors.

SPINELS

Another area of strong results are spinels. These rare stones were often mistaken for rubies. In 2022, exceptional examples have seen results soar past auction estimates. A significant 54 carat specimen example sold at Christies, Geneva for $504,000 against an estimate of $200,000-300,000.

For both paraiba tourmalines and spinels, color saturation and size play an important role in determining the examples of significant value.

Suspending a modified triangular brilliant-cut Paraiba tourmaline weighing 10.31 carats, capped and accented by round diamonds, length adjustable from 14 to 18 inches

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $500,000 – 700,000

SOLD: $1,197,000

Set with a cushion-shaped sapphire weighing 5.95 carats, between pear-shaped diamond shoulders, size 56, Italian assay marks for gold and platinum and maker’s mark

Magnificent Jewels and Nobel Jewels Sale

Sotheby’s, Gevena

May 10, 2022

Lot 399

ESTIMATE: $281,462 – 467,428

SOLD: $823,376

Pear-shaped spinel of 54.03 carats, 18k rose gold

Magnificent Jewels Sale

Christie’s, Geneva

May 11, 2022

Lot 38

ESTIMATE: $204,875 – 307,313

SOLD: $516,286

RELATED CONTENT

- Selling Jewelry & Watch Collections

- Watch TFG’s New York Luxury Week 2023 Webinar

- Sales Agency Services: Maximizing Value and Efficiency through Comprehensive Sales Strategies

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Jewelry Advisory Team combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Images: All images courtesy of associated auction houses

Listen to Our Latest 20-Minute Webinar

We invite you to listen to the below webinar where Philip Hoffman, CEO, and Anita Heriot, President of the Americas, further discuss the economic advantages of diversifying into art or collectibles and where to take caution when considering an investment.

Our CEO & Founder Philip Hoffman speaks with President Anita Heriot in a 20-minute virtual forum. Watch to learn about the latest on inflation and how to leverage collections to maneuver through the current economic climate.

ART & INFLATION IN 2022

In recent months, as inflation rates have surged and stock markets have slumped on both sides of the Atlantic, collecting art has increasingly become recognized as a solid investment strategy. Whilst not all artworks and collectibles are created equally, and therefore do not offer the same possible financial protection, the art market has historically shown resilience during market downturns and is largely uncorrelated to other major asset classes. The right art investment has proven to be an excellent store of wealth over all time periods, exceeding inflation.

CASE STUDY

The best – and only – case study of art investment as a hedge against inflation is that of the British Railway Pension Fund, which specifically and successfully bought art in the 1970s against a backdrop of inflation rates as high as 17%. The fund invested 3% of its holdings at the time (£40m) into 2,400 objects across a vast range of categories and achieved an annual compound interest of 13.1%, while the average stock market investment returned 10%.

ART IN THE POST-PANDEMIC MARKET

Apart from hedging against inflation, we see the benefit of art being uncorrelated to other asset classes in the speedy recovery of the market during moments of economic decline. In 2021 – as the world entered a post pandemic recession – auction sales totaled around $12.6B at the three major auction houses (Sotheby’s, Christie’s and Phillips) up 2.3% from 2018. Furthermore, collectors returned to the market with a renewed appetite for buying and 167 artworks achieved $10m+ each, twice as many as the previous year. The market so far in 2022 continues to go from strength to strength with the ArtPrice Contemporary Art Index reporting a 16.2% year to date increase compared to the S&P, which is down 14% over the same period.

TOP 5 TAKEAWAYS

AUDIT YOUR COLLECTION

It is crucial to understand the current fair market value of your collection before making any financial moves. Once you have this information, you can then develop a strategy.

BE PREPARED TO HOLD ART FOR 3 TO 5 YEARS

Art acquisitions typically should not be liquidated for several years. With annual revaluation, one can develop an intelligent sales strategy that corresponds to the market.

STICK WITH BLUE-CHIP ARTISTS

Now is not the time to risk investing in Young Contemporary artists with little track record. Stick to blue-chip artists with an established secondary market that has steadily increased in value. There may be some fantastic buying opportunities in the near future, with masterworks coming to market to bring their owners liquidity, with less competition from other buyers.

DIVERSIFY YOUR ART & COLLECTIBLES

Look to other opportunities in the collectibles market such as jewelry and watches of the highest quality possible.

DO YOUR HOMEWORK

Be sure to turn to a trusted advisor and research your options before committing to any important financial decisions.

FURTHER READING

- Market Update Live Webinar: The State of the Art, Collectibles & Jewelry Market

- Watch Art & Collectibles: The Rise of Alternative Investments

- Good News for Sellers: Highest Inflation in the U.S. in Four Decades

Looking for a bit of creative inspiration while vacationing this summer? We have rounded up some of the key art attractions both inside and outside the UK that would be well worth a road trip.

United Kingdom

Wakefield, York

Yorkshire Sculpture Park – Robert Indiana: Sculpture, 1958-2018

March 12, 2022–January 8, 2023

Included in price of entry to park (£6 full price)

Open daily, 10AM–6PM

Spanning six decades of the American artist’s career, YSP has unveiled the first major European exhibition of sculpture, painting and prints by Indiana.

Bruton, Somerset

Hauser & Wirth – Henry Moore

May 28, 2022–September 4, 2022

Free entrance

Open daily, 10AM–5PM

Occupying all five gallery spaces with an additional open-air presentation, this large-scale exhibition has been curated by the Henry Moore Foundation in partnership with Mary Moore, the artist’s daughter.

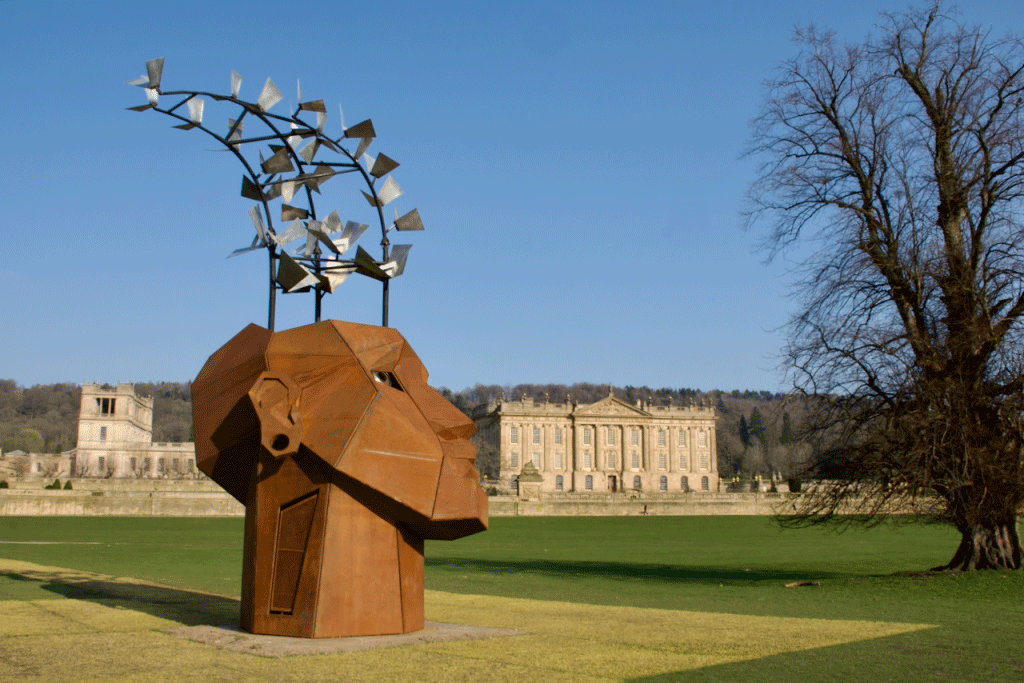

Peak District, Derbyshire

Chatsworth House – Radical Horizons: The Art of Burning Man at Chatsworth

April 9, 2022– October 1, 2022

Free entrance

Garden open daily, 10AM–5:30PM

The team behind the Burning Man arts festival, which usually takes place in the Black Rock Desert in Nevada, has brought a major display of twelve sculptures to the parkland of Chatsworth house.

Edinburgh, Scotland

Jupiter Artland – Tracey Emin

May 28, 2022–October 2, 2022

£10 entry (full price). Tickets must be booked online

Open daily, 10AM–5PM

Presenting Emin’s first Scottish show in 14 years, this sculptural exhibition takes place amidst the architecture and woodland of the Jupiter Artland sculpture park and gallery.

France

Île de Porquerolles, South of France

Carmignac Foundation – Ulysses’ Dream

April 30, 2022–October 16, 2022

15 entry (full price), includes exhibition and sculpture park

Open Tuesday to Sunday, 10AM–6PM (last ticket at 4PM)

Inspired by the tale of The Odyssey, guest curator Francesco Stocchi (curator at the Boijmans van Beuningen Museum and of the Swiss Pavilion at the 2022 Venice Biennale) has put together an exhibition of modern and contemporary artists, inspired by the ancient Greek quest.

Provence, South of France

Château La Coste – Idris Khan, Annie Morris, Mary McCartney, Zhou Li, Bob Dylan

May 2022-September 2022 (see website for respective dates)

€15 entry (full price)

Open daily, exhibitions 12PM–5PM, art centre 10AM–5PM

The 600-acre sculpture park, art centre and winery hosts several exhibitions in their gallery spaces. These five separate shows of contemporary artists are open throughout the summer, ranging from works on paper to photography to installation.

Monaco

Larvotto, Monaco

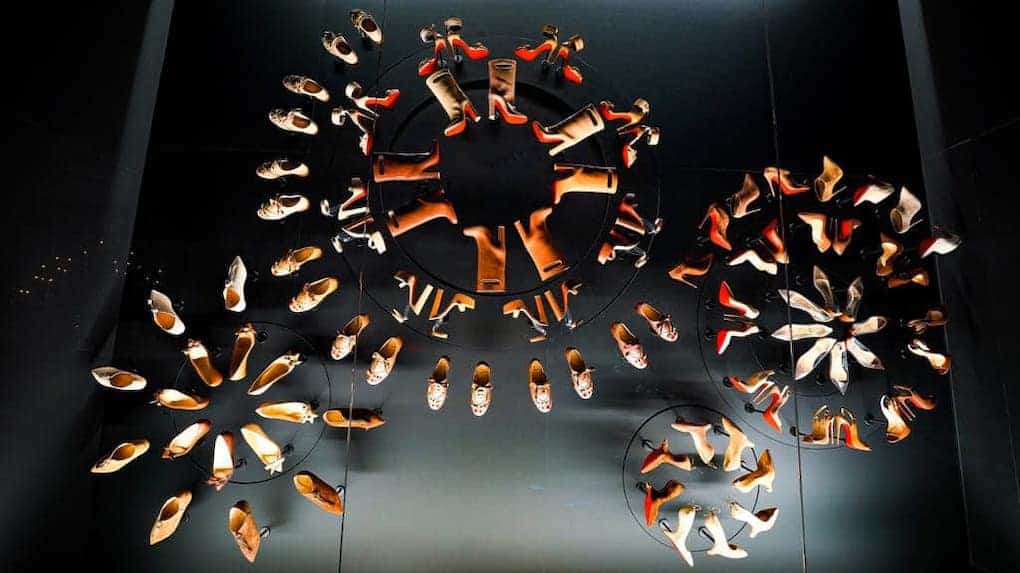

Forum Grimaldi – Christian Louboutin

July 9, 2022–August 28, 2022

€11 entry (full price)

Open daily 10AM–8PM, Thursdays until 10PM

First shown at the Palais de la Porte Dorée in Paris, this exhibition explores 30 years of design and examines Louboutin’s numerous influences, including Pop Art, Russian ballet, and oceanography.

Menorca

Illa del Rei, Balearic Islands

Hauser & Wirth – Rashid Johnson: ‘Sodade’

June 19, 2022–November 13, 2022

Free entrance (a ferry ticket can be purchased via the website)

Open daily until October, 10AM–10PM

Johnson’s first solo show in Spain, this exhibition takes its inspiration from the term ‘Sodade,’ which signifies a state of emotional longing. The artist uses this term to continue to explore narratives around migration and journeys.

Greece

Slaughterhouse, Hydra Island

Deste Foundation for Contemporary Art – Jeff Koons: Apollo

Free entrance

Open Monday–Sunday (closed Tuesdays), 11AM– 1PM & 7PM–10PM

June 21, 2022–October 31, 2022

In addition to their exhibition programme in Athens, the Deste Foundation presents summer shows in the Island of Hydra’s renovated slaughterhouse. Koons’s first solo show in Greece for over 20 years, this installation displays a series of new sculptures and readymade objects which encourage a dialogue between the contemporary and the ancient.

United States

East Hampton, New York

Pace Gallery – Joel Shapiro & Kiki Smith

July 21 through 31, 2022 (Shapiro)–August 14, 2022 (Smith)

Free entrance

Open Wednesday–Saturday 11AM-5PM, Sundays 12PM–4PM

Situated in the heart of New York’s holiday district, Pace’s East Hampton Gallery presents two summer shows: Shapiro’s experimentation with wood in the form of wall-mounted, suspended, and free-standing sculptures; and a display of Smith’s new metal sculptures, prints and drawings which draw on themes from the natural world.

Aspen

Sotheby’s – In Focus: Warhol on Paper

June 17, 2022–July 31, 2022

Free entrance

Open Tuesday–Sunday, 11AM–7PM

This summer Sotheby’s has opened a pop-up show of Andy Warhol works on paper. Addressing the artist’s love-affair with the popular Rocky Mountains town, this selling exhibition also includes work by a range of contemporary artists including David Hockney, Damien Hirst, Rashid Johnson, and Lynda Benglis.

FURTHER READING

June of this year finally saw the return of Art Basel to its familiar slot, swiftly followed by TEFAF in Maastricht and Masterpiece in London. With the June auctions concluding a busy month of fairs, there was some anticipation as to their performance against a backdrop of potential buyer fatigue and economic uncertainty.

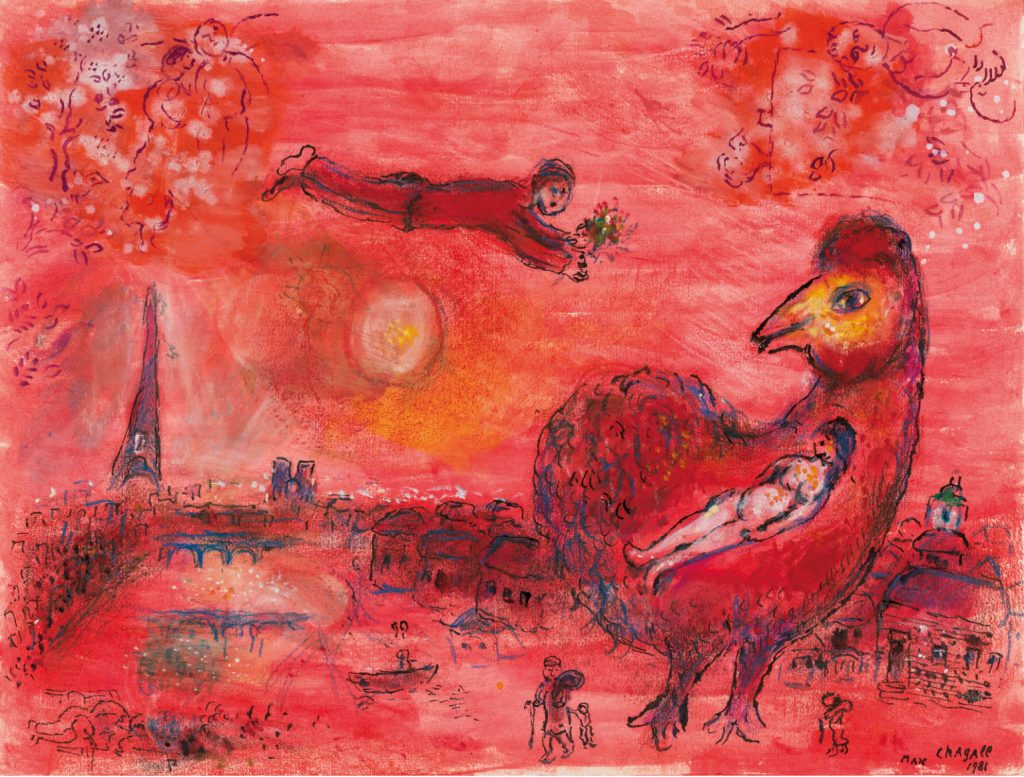

Christie’s, Sotheby’s and Phillips all distinctively strategized to compete with those challenges facing the June auctions. Christie’s began their five hour marathon of sales with a group of Chagall works sold directly from the estate, where a number of buyers fiercely competed for fresh to market pieces (90% of lots sold above the high estimate); this was followed by a relay sale from London to Paris, enhancing their European outreach. Sotheby’s contrastingly opted to begin their auction with a mixed category ‘Jubilee Sale’ which included British artists spanning Gainsborough and Millais through to Hirst and Hockney. Targeting the growing cross-collecting market, this tactic felt very much in the spirit of Masterpiece fair concurrently running that week. Phillips’ sale was strategically weighted towards the Ultra-Contemporary category, which has been the strongest market segment over the last two years, and seemingly a sure-fire way to ensure a strong sell through rate and robust sales total against pre-sale estimates.

These strategies largely paid off with all the houses successfully reaching sales totals within expectations and realizing healthy sell-through rates. Phillips’ raked in £17.5 million (premium), close to the high end of its presale estimate range of £13.6-18.4 million, with a 94% sell-through rate. Sotheby’s totaled £149.2 million (premium) across both sales, against the pre-sale estimate of £143-201 million, with a 79% sell-through rate. Christie’s had the highest total of the week, bringing in £203.8 million (premium), within the presale estimate of £145-220 million, up from last year’s £153.6 million (premium) total. It had an average sell-through rate of 93% across its three sales, largely due to the white glove Chagall sale.

Despite the healthy results, there was a sense of a cooling market compared to the strength of the New York May sales, and a marked difference to the frenzy witnessed in New York in November 2021. Stock market volatility, rising interest rates, rampant inflation and crypto-currency crashes have no doubt had an impact on the confidence and buying power of collectors.

This growing conservatism felt most apparent in the Ultra-Contemporary category which has previously seen lengthy bidding wars and works consistently hammering in excess of £1 million against very low estimates. Flora Yukhnovich was one artist who continued to receive frantic bids. Both paintings that sold during the week hammered far in excess of £1 million, with globally competitive bidding. However, several other works by recent auction stars such as Shara Hughes, Anna Weyant, Cristina Quarles and Amoako Boafo attracted muted bidding selling within estimates rather than far exceeding them. While wider economic concerns are having an impact, these results should also be seen as a wider price correction for these artists and the category overall. The previous heat and competition at those price levels was unsustainable, and a much needed selectivity among collectors is becoming apparent.

Generally, at the top of the market, bidding felt thin. The much lauded fresh-to-market portrait of Lucian Freud by Francis Bacon sold for one bid above the guarantee at £35.5 million hammer against a reported £35 million guarantee. Several works were withdrawn by each house, including works by Cy Twombly, Sigmar Polke, Georg Baselitz and Dana Schutz, presumably due to lack of interest.

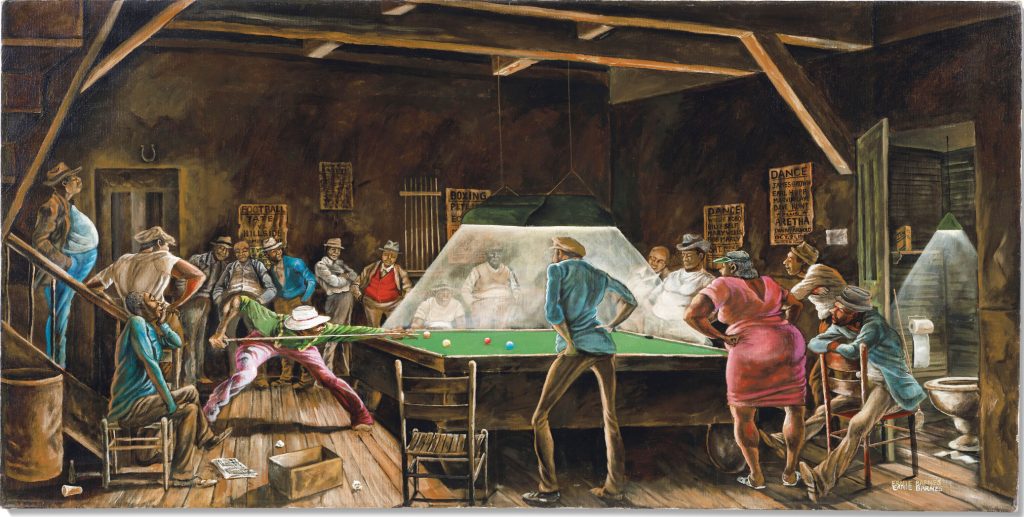

However, there were several strong results for blue-chip category works which served to reinforce that the art market is still very much afloat. Christie’s, despite a glut of top tier Monet paintings coming to market recently, achieved very solid results for both of their Monet paintings, which sold to the same buyer. Waterloo Bridge, effet de brume (1899–1904) sold for £30 million (premium), just reaching its presale high estimate. Nymphéas, temps gris (1907) achieved £30.1 million (premium), just under its £32 million high estimate. Following a huge new auction record in May, a battle also broke out for Ernie Barnes’s 1978 painting Main Street Pool Hall, from the collection of the late film producer Danny Arnold. The painting sold for £1.5 million (premium), more than ten times expectations, to an in-room bidder. There was also an exceptional result for a small-scale René Magritte apple painting, selling for £16.1 million (premium) against an estimate of £5-7 million, which is now the third highest price for a work by the artist at auction.

Sotheby’s reached a top price for an unusual work by August Strindberg, selling for £6.8 million (premium) against a £3 million high estimate, it was a new record for any Swedish work of art. Gerhard Richter’s Study for Clouds (1970) also received healthy room bidding by Francis Outred and Gabriela Palmieri before it eventually sold to Lisa Dennison’s phone client for £11.2 million (premium) against an estimate of £6-8 million.

Several new auction records occurred over the week. Christie’s reached a record with Barbara Hepworth, the sculpture Hollow Form with White Interior (1963) sold for £5.8 million (premium). Frank Auerbach’s Portrait of Gerda Boehm, previously acquired at the David Bowie sale, also made a new record at Sotheby’s at £4.1 million (premium), as well as rare-to-market work by the British Pop artist Pauline Boty at £1.16 million (premium).

These results prove there is still resilience in the market. Numerous repeat bidders, including the Monet buyer at Christie’s and a persistent online bidder from Lebanon at Phillips, significantly helped further push results. However, buyers are approaching the sales with more caution and this sense of sobriety will likely continue in the next round of October sales in London. A total of 74% of one Christie’s sale was guaranteed by value; likewise, half of Sotheby’s sales were also guaranteed. This will continue to be a crucial tool to help ensure stability in the coming months. With such strong results for young artists over the past two years, the economic uncertainties might encourage a return in interest to previous art market stalwarts whose works have received less attention in previous sale cycles.

FURTHER READING

- New York Spring 2022 Auction Round Up

- London March 2022 Auctions Round Up

- Spring Art Market Recap 2022

THE SCOOP #5 – JULY 8, 2022

In the 5th edition of The Scoop, we share the latest on the crypto market meltdown, a recap of NFT NYC, and share an eye for architecture in our latest Artist Spotlight.

CRYPTO MARKETS

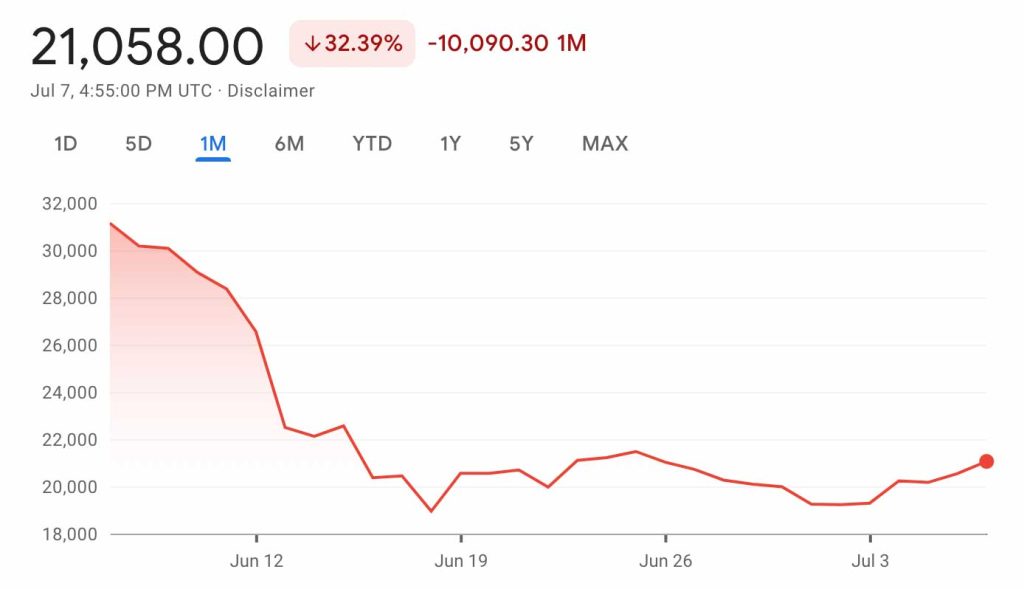

CRYPTO COMMENTARY

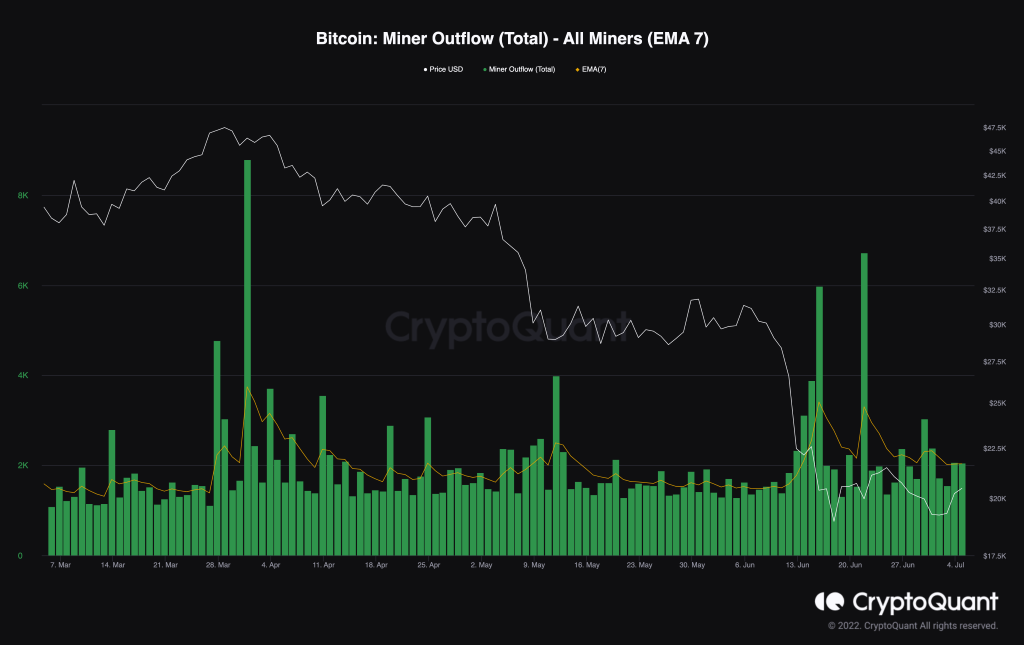

After the recent drop across the broader markets, we have seen the most significant cryptocurrencies level out, with Bitcoin still hanging around its $20,000 support line. The buy-and-sell pressure is in equilibrium, and it appears the market is waiting for a new catalyst before making any moves. What is interesting is looking at miner outflows; a sudden spike in sales from Bitcoin miners to exchanges and OTC markets indicates that miners are bearish. In the last four months, we saw value fall shortly after each time we saw a spike in sales volume. With two recent spikes this month, many technical onlookers are waiting for another drop.

The fallout from the Terra Luna implosion is still lingering. It has been three weeks since Celsius halted withdrawals on its platform, and investors are still stuck. It was in acquisition talks with FTX; however, FTX passed on the deal due to a “$2 billion hole” in the Celsius balance sheet. Celsius has managed to repay some of its debts, while others are still outstanding. More recently, a sign that the contagion may still be spreading, another crypto lender, Vauld, announced it had also halted withdrawals. Rival Nexo had approached Vauld about a possible acquisition, but nothing has materialized yet.

While this isn’t as big as the Terra Luna hole, many insiders expect there to be ripples from this event. Last Friday, crypto hedge fund 3AC (Three Arrows Capital) formally filed for bankruptcy in New York after being forced to liquidate by a court in the British Virgin Islands. By filing for Chapter 15, they can shield their assets from repossession in the U.S.

The Biden administration is working on a stablecoin regulatory package that could be law as soon as Q4. Stablecoins (USDC, Terra) are coins pegged to currencies like the US dollar. The US regulatory package will define how the burgeoning $70 billion markets will operate and how they will be used. In the EU, regulators are looking to make reserves mandatory for these stablecoins, similar to the banking system. The pressure is on regulators to create guardrails for this new industry after the Terra Luna bust harmed many.

WHAT’S THE BUZZ?

Say you love an artist, and you’re not picky. You just want a piece from their newest drop. How much is it going to cost?

FLOOR PRICE

- The Floor Price is the cost of the lowest-priced piece you can purchase in any given collection.

- In PFP projects, the floor usually consists of NFTs with shared traits. NFTs with rare characteristics fetch a higher price.

- For utility collections, where the tokens are generally identical, there are usually more pieces at the same price point, creating a “thick floor.”

- Opportunities arise when high-volume collections have a “thin floor”, meaning there are few pieces at the bottom with a swift rise in price once the lowest have been purchased.

NFT BLUE-CHIP COLLECTIONS

NFT COMMENTARY

The NFT market has been moving sideways for the most part to match the lull in crypto markets. The volume and the overall number of transactions have fallen since NFT NYC. Prices haven’t dipped further, but with such light trading the values don’t have as much support as they usually do. It’s like everyone went to the conference and followed it up with summer vacation, which very well could be the case.

While we aren’t in a crypto winter (yet), it could be said that many in the NFT space are frozen. Similar to the crypto markets, it feels like NFT holders and creators are in a holding pattern. Sometimes no action is the best, but we are still seeing consolidation from riskier projects to safer bets. It also underscores a more significant shift in strategy. Yes, flips are still possible, but they are more dangerous and scarce. People are starting to research before investing in projects because there isn’t as much easy money floating around, and everyone has been ‘rugged’ at least once by this point. The collector space is getting smarter and piling into either historically significant collections like CryptoPunks or seeking utility with VeeFriends or LinksDAO. Art and community still sell projects, but this could be the beginning of a long-term trend where collectors expect more from their NFTs than just .jpegs.

NFT NYC

With 15,000 registered attendees, this year’s conference was the largest yet. Even in a bear market, there was a quiet optimism throughout the week, with many in the space saying it was the perfect time to build. Around 1,500 speakers from the fashion, art, sports, and finance worlds were eager to share their insights. There was something to learn from everyone. The event planners blended these topics efficiently, making jumping from one speaker to another easy. The conference went off without a hitch, other than mile-long registration lines, but the most exciting get-togethers were happening after hours.

In the PFP world, several large exclusive parties with Doodles, Azuki, and Nifty Portal offered IRL (In Real Life) experiences to their NFT holders. Fewocious offered a paint party for his followers that did not disappoint, but the headliner outside the conference was ApeFest. Several nights at Pier 17 ended with rappers Eminem and Snoop Dogg introducing a new song incorporating their Bored Ape avatars. Yuga Labs (creators of BAYC) showed again that they are cultivating the best community with premier experiences in the PFP spectrum.

There were plenty of galleries to cruise through showcasing fine art. Comp Stomp Studios, led by a group of photographers, set up shop to provide a relaxed gallery experience for the photography community. SuperRare had its pop-up gallery up and running with some of its platform’s best work on display. Time magazine and its Time Pieces NFT collection took over a movie theatre and showcased both creators and their art through interactive artist panels and big-screen showings of curated works. It was the most creative event of the week. Christie’s hosted a reception for its Cartography of the Mind charitable collection benefiting MAPS. It was one of the first high-profile philanthropic auctions with several pieces far outperforming expectations, mixed in with underperformers.

What was clear is that presentation is everything for NFTs. The more innovative, the better. Time Pieces set a new precedent we believe will be duplicated by others. Christie’s put its professional touch on NFTs with its signature clean and contemporary gallery feel. Pace Verso took it a step further and kept its showing to a smaller area in its gallery, giving Jeff Koons’ moon NFT project plenty of room in a high-end display. When Refik Anadol made his big-ticket Casa Batlló sale, the exhibit for that was a master class for the rest. Details like the Anadol piece reacting to where a viewer was standing made a difference. In contrast, many of the pop-up galleries felt rushed; the art was displayed but it seemed the details could have been executed with more care.

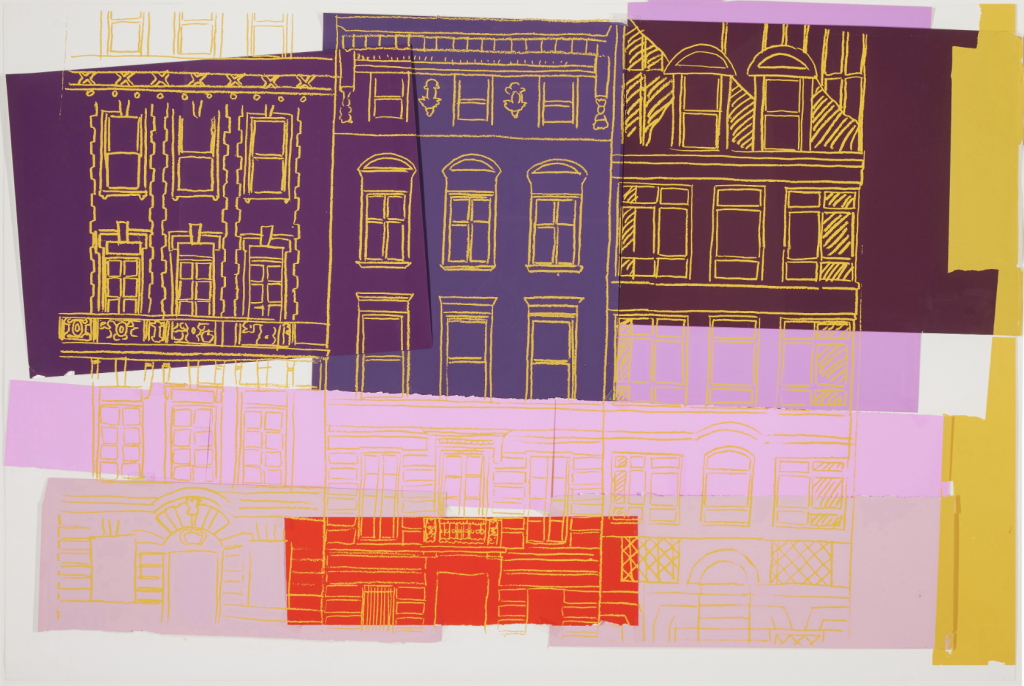

NFT ARTIST SPOTLIGHT

Chris Hytha

Hailing from Philadelphia and the Drexel School of Architecture, Chris Hytha has evolved over his career, experimenting with surreal concepts through Photoshop and documenting the architecture around him with his camera. A master in his craft, he is an expert in taking ordinary subjects and making them extraordinary. After selling photo prints for many years, he set out into the NFT world with a small run of 1/1 art. Encouraged by his initial release selling so well, he created his first collection, Rowhomes, which put him on the map on NFT marketplace platform OpenSea.

For Rowhomes, Hytha photographed dilapidated houses in Philadelphia and applied his eye for architecture to meticulously add details and eerie backdrops to produce his highly sought 100-piece collection. Each drop sold out within minutes, and we’ve seen strong secondary sales from its inception as well.

His newest collection, Highrises, is currently being released in phases, with the second leg dropping just recently. A key piece of his strategy for Highrises was utilizing the Rowhomes collection sales as a whitelist to give his early collectors first dibs on his latest work. The success of that plan showed in the spat of secondary sales of Rowhomes before the Highrises drop. It will be interesting to see where his experiments take him next.

NFT & CRYPTO NEWS

- Big Players soothe crypto doubts at NFT NYC

- NFT Corvette doesn’t sell… twice

- Christie’s brings in $1.6 million with Cartography of the Mind auction

- The biggest Rug Pulls in history

- An AI take on NFT Valuation

- UPenn Auctions their first NFT with Christie’s

- Why Solana is going mobile

- Yuga Labs Otherside Testing

- Global Recession and Crypto Winter?

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.