STATE OF THE ART MARKET: INSIGHTS INTO THE SPRING 2022 AUCTION SEASON

Our Art Advisory Team gives an overview on the current state of the art market and comment on the Spring 2022 auctions.

FURTHER READING

- Looking Forward: Ten Art Market Predictions for 2023

- Market Update: How the Art Market Joined the Digital Age

- Navigating the Art Market

Our CEO & Founder spoke with The New York Times journalist Robin Pogrebin after the land mark auction, where rare Andy Warhol silk-screen Shot Sage Blue Marilyn was sold for a record breaking $195 million. Although Marilyn fetched an outstanding price, is it against the trend of a disappointing sale?

Click here to find out more and read the article in full.

The Scoop: A Bi-Weekly NFT & Digital Art Newsletter by The Fine Art Group

INTRODUCTION FROM PHILIP HOFFMAN, CEO + FOUNDER

The Fine Art Group’s team has always had a finger on the pulse of the global art market in order to give our clients the highest quality guidance in this dynamic marketplace. Over the last year, we have watched as a new generation of art exploded in front of our eyes in the form of digital art and NFTs. We expect this new medium to alter the landscape of the art world while being an important source of growth and opportunity for many of the market players. To continue to provide best-in-class service, our clients expect us to provide coverage of this growing industry. After much due diligence, The Fine Art Group may gradually incorporate NFTs into all of the services we currently offer.

Just like many of you, I have become overwhelmed at times with the explosion of information coming from this new market segment. With new collections, artists, and platforms popping up every day, the goal of Greg’s newsletter is to cut through the background noise, complexity, and focus on the most critical information and commentary on this space. We plan to provide updates on the most relevant market trends, highlights on projects that deserve our clients’ attention, and briefs on the significant developments in the related worlds of technology, risk management and financial innovation.

Furthermore, we will launch a dedicated section on our website designed to provide education and serve as a resource library for our clients and partners. As this market is evolving rapidly, so will this newsletter, and we appreciate any feedback that will help us serve you better. I look forward to seeing where our new line of business takes us and helping our clients achieve their goals in this rapidly expanding market.

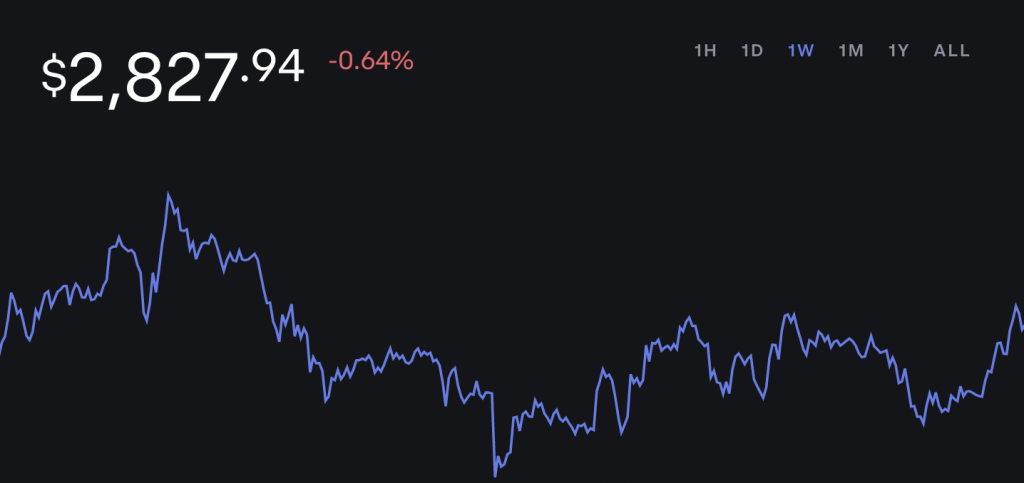

CRYPTO MARKETS

The three blockchains we will be tracking are Bitcoin, Ethereum, and Solana. Bitcoin has been around the longest as a standalone asset and serves as a bellwether for the crypto markets, due to many of the smaller networks following its price movement. Ethereum and Solana are more transaction-based and serve as the backbone of the NFT ecosystem. Ethereum is the gold standard, with Solana being a close second. The majority of NFTs are hosted on these two networks.

Bitcoin to USD

Ethereum to USD

Solana to USD

CRYPTO COMMENTARY

The crypto markets have experienced some volatility over the past week, with many still in the red. We are beginning to see some price movement correlation with traditional equity indexes in the US. In the past they’ve been significantly more independent of one another. Institutional adoption is rising with Fidelity’s recent announcement that they’ll be allowing 401k plan participants to hold Bitcoin in their accounts. However, there is still a question on how the government will regulate cryptocurrencies. There is an expectation that once a decision is made it will be a catalyst for change in valuation, either positive or negative, dependent on the outcome.

WHAT’S THE BUZZ?

This is a new frontier for everyone and we’ll be providing explanations for commonly used terms in the space. We decided to start with cross-chain since there is certainly a lot of chatter around the concept.

CROSS-CHAIN

- NFTs once minted are generally siloed to a single network.

- Cross-chain is when a token can exist on more than one blockchain, for example an NFT that can be transferred from Solana to Ethereum and vice versa.

- The Metaverse will need to be able to interact with many different networks, making this a crucial task for this technology to address.

- Many projects and protocols are working on solutions, the only current fix is using a “wrapped asset”, which essentially puts, for example, a Solana NFT in an Ethereum “envelope”.

- This capability will rely on building bridges between the networks and the existence of a universal key to metaverse (K2M) being built into every token.

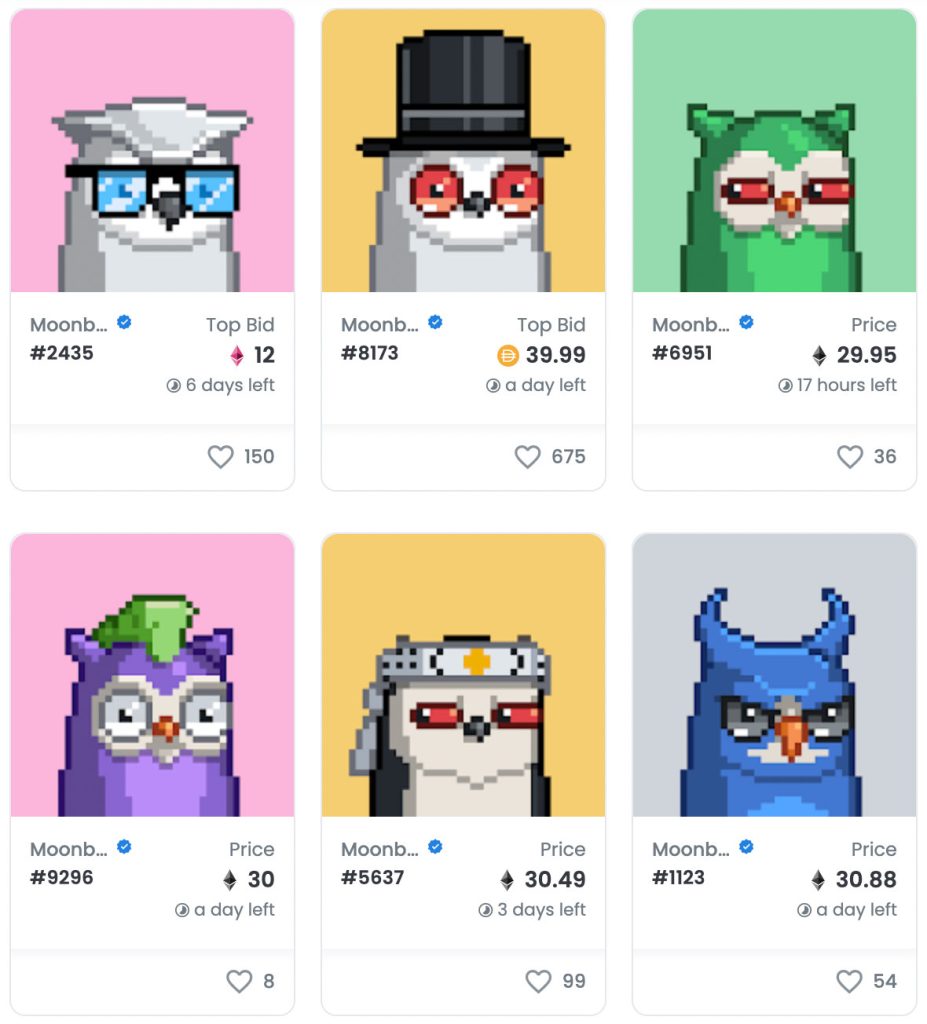

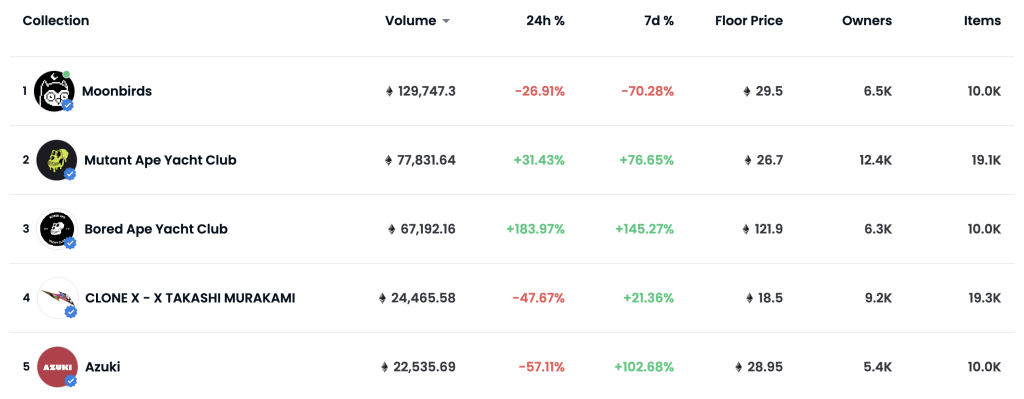

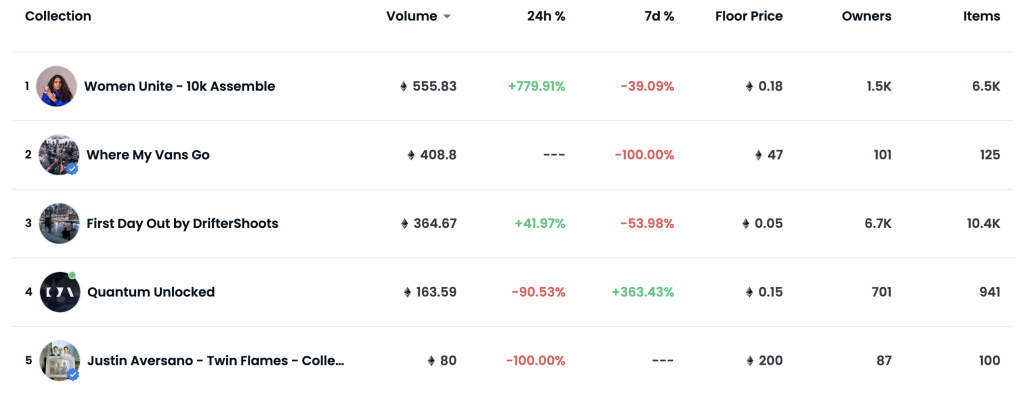

NFT BLUE CHIP COLLECTIONS

The below are considered collections to watch based on overall volume and liquidity over the last thirty days. Click the links to see full lists on OpenSea.

Top 5 Collectible Collections

Top 5 Photography Collections

NFT COMMENTARY

The Moonbirds collection has absolutely flown during their debut; after minting for 2.5 Eth, their floor now sits at 26 Eth. The main driver is Kevin Rose, following the success of his first project, Proof Collective, many from the tech world were itching for a new opportunity to bet on the savvy entrepreneur.

The Bored Ape Yacht Club Otherside land sale over the weekend became problematic, with gas fees amounting to $150 million. The Ethereum network struggled to keep up with the massive number of transactions and resulted in Yuga Labs netting over $300 million.

There has also been a lot of movement in the Solana NFT space. We will see more of this moving forward, especially since OpenSea, the largest NFT marketplace, has started supporting Solana NFTs. Solana’s gas (transaction fees) and energy consumption are generally much lower, making it attractive for creatives and collectors alike.

NFTs had their largest quarter yet in Q1 of 2022. Over $12 billion in sales were recorded, with more active wallets joining the networks in the last three months than the entire second half of 2021. Many long-term critics have changed their stance to embracing these new markets. Others are proceeding cautiously and with good reason, since a little over a billion dollars in assets have been displaced in hacks and security issues. Security will be paramount moving forward as the space continues to grow. We believe we’ll be seeing new firms specializing in both securing and insuring digital assets.

FRESH & UPCOMING DROPS

- Edward Barber and Jay Osgerby x Galerie Kreo are releasing their first NFT collection together: Signal C4V, which will be available for purchase on OpenSea in early May.

- Daniel Arsham released his new NFT collection on Niftygateway on 4/30.

- With a successful launch of Rowhomes, the architecture focused Chris Hytha is releasing his new collection Highrises.

- Yuga Labs Land Sale went live on 4/30, after a KYC only ApeCoin will be accepted for payment.

NFT ARTIST SPOTLIGHT

Isaac ‘Drift’ Wright

I’ve been following Drift’s story since 2020, and it is easily one of the most moving plot lines in the NFT space yet. After serving in the U.S. Army Special Forces for several years, he came back with ghosts in the form of PTSD. He learned to cope with his condition through urban adventuring and photography. While changing his narrative, he produced some of the most incredible images from the top of skyscrapers around the U.S.. Consequentially, Drift was arrested for trespassing and incarcerated for four months without bond.

He felt the government he served turned on him and used his race and military background against him. Drift was pushed through a system that was biased against him, with many officials saying he’d never make it out of jail. He launched an NFT collection, Where My Vans Go, and used the proceeds to pay his lawyer fees. As his story spread, his collection began to take flight as people were sympathetic to his plight and wanted to help any way they could. To this day, it is one of the bestselling collections on OpenSea, with a floor price of 50 Eth. The icing on the cake was when he auctioned his NFT Whatever it Takes through Sotheby’s for £185,000 over the estimated value. Against all odds, he made it out and continues his journey with photography.

NFT & CRYPTO NEWS

- Two Famed Art World Stars Think Artists Need to ‘Pay Attention to NFTs’

- Gas war burns the Otherside Launch, $157 million in Ethereum burned

- The NFT market by the numbers

- SuperRare opening a gallery in NYC

- $26 Million gas bill for $8.6 million sales – Vayner Sports Pass Mint is a disaster

- Everything you need to know about the Otherside

- Sotheby’s latest Metaverse Auction fetches $1.5 Million in partnership with Liverpool FC

- Jeff Koons’ new collection will literally be out of this world

- Solana NFTs are getting more exposure from OpenSea

- Bored Ape Yacht Club gets hacked, owners phished, some lose their Apes

- How Crypto is shaping Ukraine, it’s more than just currency

- The impact of the Crypto Executive Order, explained

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third party advertising or website does not mean that we endorse that third party’s website, products or services. Your use of a third party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Fine Art Group is pleased to announce Digital Asset Specialist and Advisor Greg Adams is now overseeing our expansion into the Web3 and NFT art market space.

Over the last year, we have watched as a new generation of art exploded in front of our eyes in the form of digital art and NFTs. We expect this new medium to alter the landscape of the art world while being an important source of growth and opportunity for many of the market players. To continue to provide best-in-class service, our clients expect us to provide coverage of this growing industry. After much due diligence, The Fine Art Group may gradually incorporate NFTs into all of the services we currently offer:

Advisory, Art Finance, Sales Agency, Investment & Appraisals

Founded over 20 years ago, The Fine Art Group has established an unrivaled track record across the art ecosystem. From first acquisitions and building collections, through to appraisals and art financing, we offer clients an experienced and skillful hand – helping to navigate the opacities of the market.

Greg Adams is a Digital Asset Specialist and Advisor for The Fine Art Group. Prior to working in the art industry, he worked as a leader in the fintech sector for over a decade while building his portfolio of cryptocurrencies. Greg holds a B.S. in Business marketing and management from The Pennsylvania State University. He is an active member of the NFT community and will be taking The Fine Art Group into the Web3 world.

FURTHER READING

- The Scoop: The Next Generation Collector #14

- Reintroducing The Scoop: The Next Generation Collector #13

- The Scoop: A Bi-Weekly NFT & Digital Art Newsletter #12

ART FAIRS

INDEPENDENT

May 5th – May 8th | Spring Studios

Independent is pleased to announce plans for its 13th year. The fair will return to its former location with new spring dates May 5 – 8, 2022 at Spring Studios in Tribeca. Independent in May will be an opportunity for the fair to expand to its full roster of 65 international leading galleries.

TEFAF

May 6th – May 10th | Park Avenue Armory

TEFAF New York is one singular, annual fair that encapsulates modern and Contemporary Art, Jewelry, Antiques, and Design, featuring around 90 leading exhibitors from around the globe.

FRIEZE

May 18th – May 22nd | The Shed

Following the successful return of Frieze New York in 2021, this year’s fair brings together leading international galleries with some of the most exciting young spaces. More than 65 galleries will participate in this year’s fair, which returns to The Shed.

20th & 21st Century Auctions

CHRISTIE’S

Viewing: May 1st – May 12th | Mon – Sat: 10am – 5pm, Sun: 1pm – 5pm

Auctions: May 9th – May 12th | 20 Rockefeller Plaza

Auction Highlights

The Collection of Thomas and Doris Ammann (20th Century Art, including works by Andy Warhol, Robert Ryman, and Cy Twombly)

The Anne H. Bass Collection (19th and 20th Century Art, including works by Edgar Degas, Claude Monet, and Mark Rothko)

SOTHEBY’S

Viewing: May 6th – May 19th | Mon – Sat: 10am – 5pm, Sun: 1pm – 5pm

Auctions: May 16th – May 20th | 1334 York Avenue

Auction Highlights

The Macklowe Collection (Works by Mark Rothko, Gerhard Richter, Agnes Martin, Jeff Koons, Andy Warhol, Jean Dubuffet, Roy Lichtenstein, and Donald Judd, among others)

PHILLIPS

Viewing: April 30th – May 18th | Mon – Sat: 10am – 6pm, Sun: 12pm – 6pm

Auctions: May 18th – May 19th | 432 Park Avenue

Auction Highlights

20th century and contemporary works by Mark Rothko, Yves Klein, Jean-Michel Basquiat, Carmon Herrera, Jonas Wood, among others

FURTHER READING

- Commentary: Will Online Platforms Kill Art Fairs?

- What to Hang on Your Walls: The 5 Golden Rules

- Avoid these Vacation Blunders While Acquiring Art

Originally published in RedBook, March 22, 2022

When looking to acquire art works for your new home, there is often one big question: where exactly do I start?

Leading authorities in the field, Guy Jennings and Henry Little, share all you need to know.

1. Are you a decorator, collector or investor?

A key question to consider when acquiring art works for a new home. Most people are a mixture of all three, but it’s important to understand the nuances of each. Decorators might be content with works which lack art historical importance and whose financial value will deteriorate in the long term. Collectors will take a more research driven approach, looking to acquire works which embody an aesthetic position and demonstrate a degree of knowledge about art and the market. While investors might seek medium to long term returns at the expense of art historical merit or developing a personal aesthetic. There’s no reason these priorities should be mutually exclusive, however. With a sufficient degree of knowledge and the right advice, from an art advisor such as The Fine Art Group, it’s entirely plausible to source a group of works which accords beautifully with the architecture, is artistically consequential and will appreciate in value. Prepare to invest time if you want to do more than simply fill walls.

2. Look, listen, read.

There really is no shortcut for learning, whether guided or independent. Visiting major museums will set a yardstick for determining quality in a marketplace which is notoriously cacophonous. Attend the major art fairs. Frieze and Frieze Masters in London or Art Basel can be dizzying at first, but offer an unparalleled view of the market in a compact viewing experience. If time permits, there are long lists of books intended to cater for the time poor and information hungry. Phaidon or Thames and Hudson are great places to start, for example. And there are excellent short reads about the market which elucidate the mechanics at play. We’d recommend Big Bucks: The Explosion of the Art Market in the 21st Century and Dark Side of the Boom: The Excesses of the Art Market in the 21st Century by art market doyenne Georgina Adam. Above all, become visually literate before committing substantial sums of money to an important acquisition. A small amount of effort to understand the market and what’s available will be richly rewarded.

3. Buy what you like, but pay attention.

Within reason, buy what you like and develop your own taste, but take your time to do so. Everyone’s taste evolves. As advisors we’re always thinking about what it would be like to resell an object we buy on behalf of a client if, for whatever reason, they no longer want to live with it. By following a few simple rules, and focusing on those artists who are well known with relatively liquid markets, you can hone and prune a collection as circumstances dictate. Collecting is most gratifying when personal preferences come to the fore, but these impulses should be considered and kept in check by an objective view of the acquisition: could it be immediately resold at cost if I needed to? This becomes especially pertinent when looking at younger artists. The most noise tends to be around those markets in a state of rapid ascension. While involvement might entice potential buyers with large returns, markets in such a rapid state of flux – where works go from selling for tens of thousands to multiple millions in a few short months – are to be avoided, or treated with the utmost caution. When spending significant sums to buy blue chip artists you’re buying into a collective consensus which has staying power for the future. While you may hear anecdotal evidence that casual purchasing can lead to high returns, this is the exception rather than rule, unless working with a specialist advisor like The Fine Art Group. It’s often better to buy a top tier print by an established artist than a unique work by an unknown, for example. Above all, be aware of fads and trends. Many artists might be flavour of the month now, but their market will evaporate in the medium term. Whenever someone recommends an artist or art work, stop and ask: who do they work for? Whose interests are they serving? If you instruct an art advisor you can be sure they are acting in your interests and no-one else’s.

4. Always negotiate.

Art dealers are a charming bunch who will talk you out of negotiating if they can. There are some conventions which dictate discussions about money, but really there are no rules and everything is up for negotiation. When buying work on the primary market – where the work is being sold for the first time by an artist’s representing gallery – the accepted norm is a 10% discount. You might be able to get shipping thrown in if you’re lucky. Pressing for more than this can lead to offence and you might do yourself a disservice, especially if the artist is highly sought after. When working with a living artist the dealer has a duty of care first and foremost to the artist and, in a sense, they are the gallery’s client, not you. When buying on the secondary market – when an object is traded for the second of subsequent time – the dealer typically has no motive other than profit. And they will price aggressively. With the right knowledge and expertise, you might be able to secure discounts up to 40% on the list price of an artwork. The art market thrives on knowledge asymmetry: our job is to make sure our clients know as much as the dealers. The same applies at auction. When preparing bid levels, be disciplined, set clear parameters and avoid losing control in the heat of the moment. No matter how much you love a work, you’ll find something else you love just as much if you look hard and long enough. In our experience there are few works you should overpay for.

5. Don’t ignore the boring stuff.

It can be tempting to brush aside considerations of tax and shipping when chasing a dream work, but these are ignored at your peril. If buying at auction, for instance, you need to consider a raft of additional costs which can quickly rack up including, but not limited to, buyer’s premium, VAT on the buyer’s premium, import VAT, artist’s resale rights, shipping and framing. Do your sums in advance and get an exhaustive picture of what a purchase will cost. Condition is also key. Unless a work is brand new, always ask for detailed condition reports and inspect a work in person. Always ask to see it off the wall or out of the frame. Frames are known to hide all manner of sins which should be avoided. Research, as far as possible, an object’s recent market history: how long has a dealer had the work? How many times has it been exhibited? Has it failed to sell at auction? As a (very) rough rule of thumb, good work shouldn’t hang around for too long. If a dealer’s had a piece for several years, ask yourself: why is that? And be aware that some media will be more vulnerable than others so you’ll need to think very carefully about where they’re hung. Photographs and works on paper, for example, should be kept out of direct sunlight at all costs. And please, whatever you do, pay to have works properly framed by a reputable framer! While this might feel expensive in the short term, the proper use of conservation grade materials is vital. And the right frame will make a work truly sing.

FURTHER READING

- The Intersection of Art & Design

- Why Do You Need to Create a Plan for Art & Collectibles?

- Avoid these Vacation Blunders While Acquiring Art

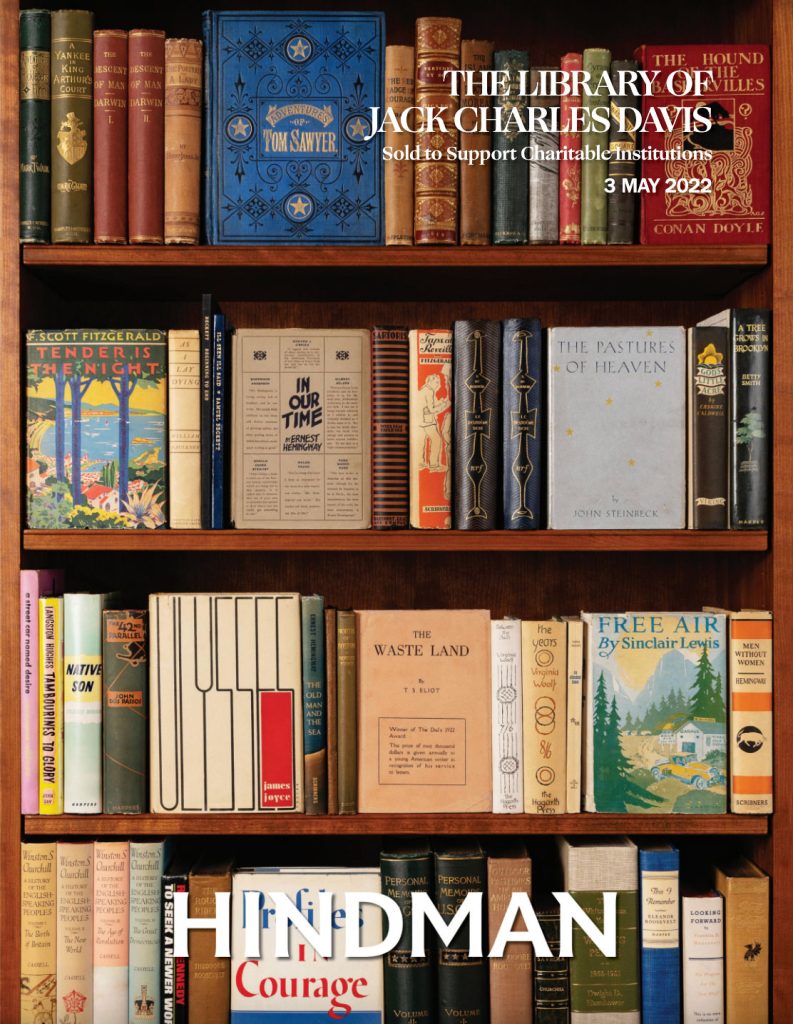

In partnership with MS Gifts, The Fine Art Group’s Philanthropic Strategy Team assists families with creating legacy by collaborating with philanthropic planning advisors and executing effective sales strategy.

Jack Charles Davis was a prominent attorney and philanthropist dedicated to promoting the economic and community development of his hometown, Lansing, Michigan. He was also a passionate book collector and voracious reader.

After Davis passed in 2020, his family sought to honor his history of charitable work by leveraging his extensive collection of iconic and valuable books and manuscripts.

The Jack Charles Davis collection sale with Hindman auctions includes an extensive library of literature acquired over a lifetime. The proceeds of the sale will benefit several regional charities important to Davis and his family.

Click here to view the collection and to register for bidding.

RELATED CONTENT

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory, Sales Agency, and Philanthropic Strategy teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

MASTERWORKS FROM THE ALANA COLLECTION

The Fine Art Group is delighted to announce Old Masters | New Perspectives: Masterworks from the Alana Collection, to be sold with Christie’s New York on June 9, 2022. This selection is one of the most important collections of Italian Old Master Paintings, Sculptures, and Antiquities to ever be offered at auction.

The Fine Art Group is honored to advise our client, a world-renowned collector and his family, in the sale of this extraordinary group of masterworks, refining the public offering to maximize return through selective curation, sales management and marketing optimization. Assembled with great expertise and passion over decades, the Alana Collection’s Gothic, Italian Renaissance, and Baroque paintings comprehensively tell the history of Italian art and have gained international renown following the acclaimed 2019-2020 exhibition at the Musée Jacquemart-André, Paris. Masterpieces by Fra Angelico, El Greco, Orazio Gentileschi and Lorenzo Monaco will be offered alongside important antiquities, rare sculpture, and spectacular jewelry.

The auction comprises over 50 outstanding works that will be sold in a single owner live auction taking place at Rockefeller Center on June 9, 2022, after completing a global tour alongside Impressionist, Modern, and Post-War highlights to London, Hong Kong, New York, and Los Angeles. Proceeds from the sale will benefit a charitable organization that focuses on arts and education. In total, the sale of these works is expected to fetch $30 million – 50 million.

Please contact our team for opportunities to preview the collection.

GLOBAL TOUR

- London: April 5-8

- Hong Kong: April 20-21

- New York: April 29-May 11

- Los Angeles: May 24-26

PRE-SALE EXHIBITION

- New York: June 3-8

AUCTION DATE

- New York: June 9

Chief Executive Philip Hoffman comments, “In recent years, The Fine Art Group has ably assisted families shape their collections for the next generation, such as the ‘white glove’ sale for prominent Saudi collector Walid Juffali at Bonhams in 2018, as well as assisting distinguished collectors to refine their extensive holdings for their next phase of collecting, such as the extraordinary Maharajas & Mughal Magnificence auction – a collection of $110 million of jewelry sold at Christie’s in 2019. Masterworks from the Alana Collection is a fantastic example of these two streams coming together and my global team and I are delighted to be working on behalf of the family, and alongside the team at Christie’s again, to bring a carefully curated selection of works from the wider collection to market.”

Bonnie Brennan, Christie’s President of Americas, comments, “It is an honor to partner with The Fine Art Group to present this once in a generation collection with some of the finest works of their kind to ever come on the public market. The profound quality and breadth of these works stand as a testament of the supreme care and vision that guided the formation of the Alana Collection. We are especially excited to debut these works alongside 20th and 21st century masterpieces, creating a dialogue across the entirety of history.”

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Image 1: Orazio Gentileschi, The Madonna and Child, courtesy of Christie’s

PRESENT FOCUS: ART FINANCE DEBUNKED

Talking Galleries New York in partnership with Schwartzman& Artand_Media Podcast with Loring Randolph

MONDAY, April 4th, 2022 – 2:30 to 3:45PM EST

Gilder Lehrman Hall at The Morgan Library & Museum, New York

The panel “Focus: Art Finance Debunked” will bring together art experts Jan Prasens, Deputy Chairman of The Fine Art Group, Noah Horowitz, Worldwide Head of Gallery & Private Dealer Services of Sotheby’s, and Suzanne Gyorgy, Managing Director and Head of Citibank Private Art Advisory & Finance, in conversation with Melanie Gerlis of the Financial Times to debate art lending and the use of art as collateral.

Are there opportunities for lending against the inventory of mid-level galleries? How do we expand innovative applications of art lending?

Tickets may be purchased by following this link.

FURTHER READING

- The Asking Price: Understanding Value 1

- Are You a Tangible Asset Fiduciary? Topic #1

- Philip Hoffman and Freya Stewart Named Top Professionals in Art Advisory and Art Finance

Bringing Together the Complementary Skills and Resources of The Fine Art Group and Schwartzman&

New York & London – March 31, 2022:

Allan Schwartzman and Philip Hoffman, principals of Schwartzman& and The Fine Art Group, respectively, today announced plans to collaborate on key business initiatives to provide enhanced advisory services to existing and future clients. By leveraging the complementary skills and resources of their two firms, Allan and Philip will be uniquely positioned to address the needs of an ever changing market for both multigenerational and emerging collectors, in addition to artists and institutions. Specific areas of collaboration will include services ranging from valuations and collection development to investment opportunities and philanthropic giving, among others.

Allan Schwartzman commented, “What may appear as an unlikely alliance is born from mutual respect and shared values. Rather than exist as competitors, Philip and I recognize the unique opportunity that we can create for our clients and the broader market. Philip has spent decades building a specific set of skills and experience that I don’t currently offer in-house. Additionally, given the size and scope of his firm, he engages with a pool of clients that I may not necessarily encounter. Together, we can be a more meaningful resource for our respective clients.”

“As a curator and thought leader, Allan has built a unique space and reputation in the art world,” said Philip Hoffman. “His strategic vision is sought after by some of the most esteemed collectors, artists and institutions in the world. Adding his expertise and experience to even a handful of opportunities, while we each maintain our independence and separate businesses, allows us to do something truly unique in the marketplace. And as our firm has recently expanded our presence in the United States, this alliance with Allan and his team is perfectly timed. We both believe deeply in the future of collecting, and together we have the collective knowledge and resources to address not only today’s market but to help shape the future.”

Over three decades, Allan and Philip have distinguished themselves and built successful businesses serving clients across all aspects of the art world. Beginning his career as a curator and a founding staff member of the New Museum of Contemporary Art in New York, Allan has guided the formation of private and public collections, executed legacy and market development strategies for artists (including estates and foundations), and formulated cultural development plans for civic projects – services now part of his firm, Schwartzman&. Philip began his career in the financial services industry before joining Christie’s and rising to the level of the Deputy CEO of Europe. He then spent 20 years, building his firm, The Fine Art Group, into an international market leader in art investment, art finance and art advisory that operates in six countries.

The idea of a potential collaboration between the two firms gathered steam when Jan Prasens was appointed Deputy Chairman of The Fine Art Group in September 2021. During his more than two decades at Sotheby’s, Jan worked closely with Allan Schwartzman and was eager to explore ways to work together. While the collaboration does not include any financial investment or ownership stake in each other’s firms, The Fine Art Group’s New York-based team will share space with Schwartzman& in their West 22nd Street offices in Chelsea.

ABOUT SCHWARTZMAN&

Headquartered in the Dia Art Foundation building in New York, Schwartzman& offers comprehensive advisory services to the full spectrum of individuals and organizations, private and public, involved in forming, assessing, or rethinking the possibilities of art collections. The team of sixteen brings expertise from all aspects of the art world including galleries, museums, auction houses, artist studios and foundations. As part of an ongoing commitment to foster a dialogue around developments in the rapidly changing world of art, Schwartzman& is pleased to help bring the art world symposium Talking Galleries to New York on April 4 & 5, 2022. The event will bring together museum directors, gallerists, curators, artists, scholars, journalists, non-profit leaders, auction houses and art fair executives to tackle the significant issues facing the art world today. Schwartzman& also recently debuted the podcast Hope & Dread in collaboration with Charlotte Burns. The documentary series examines recent clashes of power in culture with interviews by more than 30 guests, from artists to museum directors, philanthropists to politicians.

ABOUT THE FINE ART GROUP

Recently marking its 20th anniversary, The Fine Art Group is an independent global team of nearly 60 advisors and art finance experts committed to supporting clients across all collector markets through its five core service offerings: Advisory, Art Finance, Sales Agency, Investment, and Appraisals. From asset-secured loans and consignment management to their position as the world’s leading art investment house, The Fine Art Group offers a unique set of services and expertise in today’s art world with locations in London, New York, Los Angeles, Philadelphia, and Dubai. The acquisition of Pall Mall Art Advisors in 2021 brought even greater depth and wider global reach, with in-house expertise now spanning Western Art from 1500 to the present day, as well as fine jewelry, watches and valuable collectibles, and a trusted network of vetted consultants for bespoke category insight.

MEDIA CONTACTS

Schwartzman&: Tommy Napier, tommy.napier@finnpartners.com

The Fine Art Group: Daryl Boling, darylboling@fineartgroup.com