In 2020 we celebrate the 20th anniversary of The Fine Art Group. Twenty years ago, I left Christie’s to launch the first institutional art fund. Today I’m proud to say that the Group has grown into a global market leader in the art world with a global team of over 30 professional staff acting for 140 clients in over 20 countries. We have advised and traded over $1.3 billion in value of artworks, with an additional $3 billion of private collections valued in just 3 years. While much has changed in the last twenty years, we’ve always remained true to our company values: offering preeminent art expertise, real transparency, independent, unconflicted, discreet, and innovative services to both the world’s leading art collectors and art novices and focused art investors alike.

LAST YEAR

January marked our much publicised acquisition of London based Falcon Group’s art-secured loan book, strengthening our long-term commitment to being the leading art finance provider to collectors and owners of high-value art globally. The acquisition marked a significant consolidation in the art finance market.

In June, via our Agency business we brought the landmark Maharajas & Mughal Magnificence to auction at Christie’s, New York. After a global tour of six cities and a marathon 12.5 hours of bidding, the collection realised a record-breaking $109,271,875 and was 93% sold.

Throughout the year, we have continually grown our business globally. Now, with representatives in China and Hong Kong, the United States, Switzerland, Germany and the United Arab Emirates, our network of collectors and art professionals is more far-reaching than ever before.

LOOKING AHEAD

As we look to the next decade, I am excited about developing our international art advisory, art agency, art investment and art finance houses. This year will mark the launch of our blue-chip art valuations service.

The Fine Art Group looks very different from the company I founded two decades ago. I am grateful to our exceedingly loyal clients, colleagues, and friends who have supported us from the start.

Yours,

Philip

Not so long-ago January was a dead month in the art world calendar – a collective trade hangover from the autumn season and the slew of dinners in the build up to Christmas. In 2020 it’s an increasingly full month, especially in London. To combat collector malaise associated with a ‘dry’ month – new year resolutions are not conducive to collecting – Condo is now in its fifth London year. Christie’s newly scheduled Modern British sales (on the thin side this season) and the London Art Fair (a localised,entry level event for modern and contemporary art), round off a relatively full few weeks in the city.

Condo has since spawned in New York (2017), Mexico City, Sao Paulo and Shanghai (2019). Condo London reaches across the gallery spectrum, with Sadie Coles, Pilar Corrias and Modern Art among the more established participating galleries. ‘Guests’ for 2020 hail from an incredibly dispersed gallery diaspora: LA, Istanbul, New York, Brussels, Hong Kong / Shanghai, Berlin, Toronto, Chicago, Tokyo, Jakarta, Glasgow, San Francisco, Warsaw, Athens, Mexico City and Vienna. A true microcosm of the so-called global contemporary.

Participation is intentionally cheap (guest galleries pay their hosts a very agreeable £700) and increased footfall the primary objective. The first few days are as close as London gets to a fully-fledged gallery weekend and it’s a remarkably successful way of encouraging gallery goers to traipse across London in the cold and wet. At best, it offers London collectors a chance to discover and acquire works by rapidly rising artists from distant gallery scenes. At worst, presentations are ham strung somewhere between an art fair booth and a true gallery show. Yet Condo is now an essential part of this drab month which is all the better for it.

Looking to the global art fair circuit, the first few months of the year have continued to fill. It’s logical that Taipei Dangdei and Frieze Los Angeles – both enjoying their second iterations – are scheduled for the middle of January and the middle of February respectively. There are few actually quiet moments left and some fairs already encroach on the sacrosanct July-August lull – it’s no surprise that the beginning of the year’s been successfully colonised. Both fairs enjoyed successful first outings in 2019, with Taipei 2020 reporting strong sales and growing, blue-chip roster. While in Barcelona, the art market’s answer to the World Economic Forum in Davos – the Talking Galleries symposium – is now in its eighth year.

It’s hard to imagine what else might fill the slow January weeks in years to come, but for now there’s more to see in London during the first few weeks of the year than ever before.

Images: Installation view, Sofia Mitsola, Darladiladada, Pilar Corrias, London. Courtesy of the artist and Pilar Corrias, London. Photo: Damian Griffiths.

Installation view, Condo London, Southard Reid hosting Öktem Aykut. Courtesy of Ahmet Civelek, Mert Öztekin.

Further Readings

- Spring Art Market Recap 2022

- The Asking Price: Understanding Value #1

- The Asking Price: Understanding Value #2

- Looking Forward: Ten Art Market Predictions for 2023

“Whether you need guidance through the art market or wish to develop your taste and artistic knowledge, it is worth seeing the advice and support of experts. Philip Hoffman is one of the most experiences of these experts.” In the entrepreneurs issue of Credit Suisse’s magazine, Scope, our Founder and CEO Philip Hoffman points out that “collectors are no longer thinking of their art as a separate, purely passion-driven entity – they want it to be financially sustainable, secure, and efficient – from buying to storing to selling. I think both collectors and private bankers now appreciate how valuable proper advice is in this area.”

Follow this link to the full article to read about shifts in collecting trends, the importance of independent art advice, and how to borrow against your art.

In the Deloitte Art & Finance Report 2019, Freya Stewart contributed an article on the current state of the asset-based art-secured lending market, and the challenges and opportunities the next five years will bring.

“Awareness and understanding of art-only asset-based financing among the top-end collecting community and, importantly, their financial advisors and family offices, has without doubt risen in recent years…. In particular, significant younger collectors, and collectors who are entrepreneurs in other markets, are coming to recognize the diverse utility of art-secured credit facilities…

… The growing demand for art-backed loans is a natural reflection and extension of the increasingly sophisticated nature of the world’s most active and prominent art buyers.”

Read Freya’s full article on pages 120 – 121 of the Art & Finance report here.

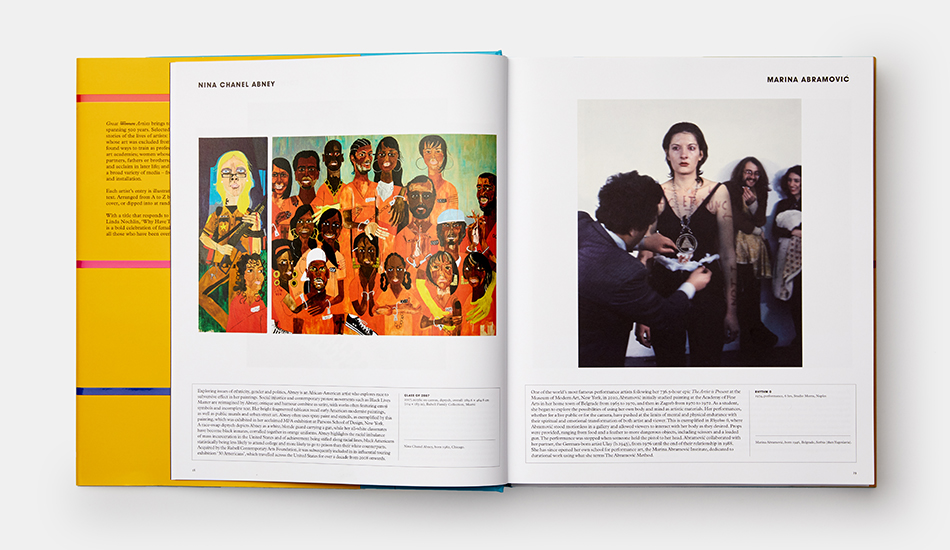

Henry Little, Associate Director of our art team, is a frequent contributor to Phaidon publications such as Vitamin T: Threads and Textiles in Contemporary Art and most recently, Great Women Artists. Past and present female artists are gaining greater recognition throughout the art world, a shift this comprehensive volume reflects. Featuring more than 400 artists from 50 countries, this fascinating presentation of 500 years of female creativity ‘reveals a parallel yet equally engaging history of art for an age that champions a greater diversity of voices’.

The publication Great Women Artists will be available from 25th September 2019, visit the Phaidon website for more information.

FURTHER READINGS

THE FINE ART GROUP AT LONDON ART BUSINESS CONFERENCE

On September 4th, Freya Stewart will be speaking at The Art Business Conference.

Now in its 6th edition, The Art Business Conference is an annual one-day conference, held in the heart of London. Through paneled discussions and speeches by leading experts in art, business, and technology, the conference provides an informed global perspective on key issues of the art market, and looks ahead to potential future developments.

Freya Stewart will be speaking on the subject of Demystifying Art Finance in conversation with Financial Times reporter Melanie Gerlis. Their session includes,

“Whether you own your own art collection, are an advisor seeking more insight for clients, or if you just want to know more about this rapidly developing market, this ‘need to know’ expert session will cover the ins and outs of art lending from loan costs and terms to financing for art business.”

Read more about The Art Business Conference here.

NEW PUBLIC SCULPTURE UNVEILED OF CHARLES DARWIN

ON THE WEST SQUARE OF THE TAIKOO HUI DEVELOPMENT, PART OF SWIRE PROPERTIES

On Thursday 27th June, Phillip King unveiled a new sculpture, named after the celebrated biologist Charles Darwin, at its permanent home in China.

The Fine Art Group advisory team worked closely with the commissioner Swire Properties, the artist, and Thomas Dane Gallery on this exceptional commission. We are delighted to be involved in such an important piece of public sculpture, the second work by the artist in China.

Phillip King said at the unveiling, “My feeling on coming here to witness the unveiling of my work, Darwin, 2019, is mostly one of humility at the honour of being perhaps one of the few British artists who will have a public work in this great historic city.”

King, who like Darwin graduated from Christ’s College Cambridge, based the sculpture on Darwin’s impact, through science and history, on the world today and how he helped us see the world in a new way.

THE SCULPTURE’S MEANING

The composition consists of four interrelated elements. The man himself is found in the dynamically raised triangle, positioned on a tilting slope to represent the unknown world. The circle is placed on the corner of the slope symbolising the known world. These elements are separate from a fourth, a square gate through which both living and non-living entities are able to reach the “Great Unknown”. King explains that he included an angled panel in the doorway as a reminder that the entrance is only partially open.

King goes on to explain that he was not consciously of this symbolism when he worked on the Darwin project. The elements “reflect how the eye connects to the brain through a king of developing filter of past memories and acquired conceptions, for example, the use of the triangle, the circle, and the square which go back to the beginning of my sculptural concerns in the early sixties.”

ABOUT THE ARTIST

Phillip King is a British sculptor, born in Tunis in 1934. He studied Modern Languages at Christ’s College, Cambridge from 1954–57, and sculpture at Central Saint Martins College of Art and Design, London, from 1957–58; where he was a favourite pupil of Anthony Caro. Following his studies, King spent a year working as an assistant to Henry Moore and teaching at Central Saint Martins College of Art and Design, London. King lives and works in London.

SELECTED PUBLIC COLLECTIONS

Arts Council of Great Britain

British Council, London, UK

Calouste Gulbenkian Foundation, Lisbon, Portugal

City of Rotterdam, Netherlands

Contemporary Arts Society, London, UK

Cultural Centre, Adelaide, Australia

Government Art Collection, London, UK

Hakone Open Air Museum, Japan

Hiroshima Museum of Contemporary Art, Japan

Musée National d’Art Moderne, Centre Georges Pompidou, Paris, France

National Gallery of Victoria, Melbourne, Australia

National Museum of Art, Osaka, Japan

New Museum of Contemporary Art, Hiroshima, Japan

Prefectural Museum of Contemporary Art, Toyama, Japan

Rijksmuseum, Netherlands

Scottish National Gallery of Modern Art, Edinburgh, UK

Stuyvesant Foundation, New York, USA

Tate Gallery, London, UK

Tel Aviv Museum, Israel

Yale Centre for British Art, USA

RECENT SELECTED SOLO SHOWS

2018 Luhring Augustine Gallery, New York NY

2017 Thomas Dane Gallery, London, England and Galerie Lelong, Paris, France

2015 Kistefos Museet, Norway

2014 Thomas Dane Gallery, Ranelagh Gardens, and Duveen Galleries, Tate Britain, all London, England

2013 Consortium in Dijon, France

2012 Speerstra Foundation, Apples

2011 Flowers Cork Street, London

2008 Bernard Jacobson Gallery, London

2007 Bernard Jacobson Gallery, London

2006 Bernard Jacobson Gallery, London

2003 Jesus College, Cambridge

2002 Place Gallery, Cavagnole, Italy

2001 Bernard Jacobson Gallery, London and Garth Clark Gallery, New York

PROFESSORSHIP

St Martin’s School of Art, London, England 1959-1980

Hochschule der Künste, Berlin, Germany 1979–1980

Professor Emeritus, Royal College of Art, London, England 1980-1990

Professor of Sculpture, Royal Academy Schools, London, England, 1990-1999

President of the Royal Academy, London, England 1999-2004

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

ART & INNOVATION AT CHELSEA & WESTMINSTER HOSPITAL

We are delighted to have sponsored The Healing Arts, a collection of essays delving into the story of the arts and Chelsea and Westminster Hospital, from the pioneering arts and design programme to the hospital’s impressive art collection.

Spearheaded by the team at the hospital’s charity CW+ the innovative art and design programme combines live performance, workshops and technology to transform the hospital environment for the patients, their families and staff.

Trystan Hawkins, CW+ Arts Director, commented: “The Healing Arts celebrates the legacy of the arts programme founders at Chelsea and Westminster Hospital, demonstrating how their vision allows us to continue to innovate by commissioning ambitious, bold and daring contemporary art and design that has profoundly positive impacts on patients, staff and visitors. We are incredibly grateful to our community of supporters, who make our work possible.”

The hospital’s art collection is funded, curated and managed by CW+ and has over 2,000 artworks, including a Veronese in the hospital chapel and monumental Allen Jones in the atrium. The fact that many of the donations come from local artists, such as Patrick Heron, Mary Fedden and Eduardo Palozzi, cements the collections position in the community.

Philip Hoffman, our CEO and a member of the CW+ Development Board says “Art serves many purposes, often to communicate, to emote, to create a sense of beauty or to motivate; but within the walls of Chelsea and Westminster Hospital it plays another vital role. Art goes above and beyond, and instead becomes a tool for healing.”

Read more about CW+’s incredible work and The Healing Arts here.

The Maharajas & Mughal Magnificence sale

Brought to auction in partnership between Christie’s and The Fine Art Group, the Maharajas & Mughal Magnificence sale achieved the highest total ever for a single owner auction of Indian art and jewelled objects setting three records for Indian works of art. With almost four hundred lots spanning over five hundred years, Maharajas & Mughal Magnificence presented an unprecedented group of jewels, gemstones, and decorative objects that explored the creative dialogue between the Indian subcontinent and Europe.

PIECES FOR SALE

The sale, held on June 14th, 2019 at Christie’s New York achieved:

- $109,271,875

- 92% sold by value

- 93% sold by lot

One of two diamonds presented to Queen Charlotte, wife of King George III by Muhammad Ali Wallajah, Nawab of Arcot. © The Al Thani Collection 2013. All rights reserved. Photographs taken by Prudence Cuming

From the collection of Maharaja Bhupinder Singh of Patiala. © The Al Thani Collection 2013. All rights reserved. Photographs taken by Prudence Cuming

The response to this extraordinary sale was unprecedented. Over 50,000 people attended the global exhibition tour to Shanghai, Geneva, Hong Kong, and London, finally culminating in New York for a marathon 12.5-hour auction. The auction attracted international collectors and institutions from 45 countries across five continents.

OUR TEAMWORK

As part of our Advisory service, The Fine Art Group managed the sales strategy on behalf of the seller; from negotiating terms with the auction house and driving the marketing strategy to publicizing the collection to our own private network of collectors. Philip Hoffman, Founder and CEO, The Fine Art Group, remarks: “I am honoured that The Fine Art Group were able to play a part in this record-breaking sale of Indian and Mughal Jewellery, art and objects. The success of Maharajas and Mughal Magnificence is testament to the hard work of the Christie’s team, led by François Curiel, Rahul Kadakia and William Robinson.”

Highlights included a number of pieces by Cartier such as a Belle Époque Devant-de-corsage, by Cartier, Paris, 1912, which sold for $10,603,500 to an in-room bidder; a pair of emerald, natural pearl, ruby and diamond clips by Cartier achieved $1,695,000; and the ‘Taj Mahal Emerald’ brooch by Cartier which sold for $1,815,000.

In addition, the exceptional Golconda Diamond Rivière Necklace, from the collection of the Nizams of Hyderabad, sold for $2,415,000; the Shah Jahan Dagger achieved $3,375,000; and the Mirror of Paradise realised $6,517,500.

These objects were offered from The Al Thani Collection. From 2021, works of art from this encyclopaedic collection will be shown at a new museum space in Paris. In addition to new acquisitions, sale proceeds will support ongoing initiatives of The Al Thani Collection Foundation which extend from exhibitions, publications and lectures to sponsorship of projects at museums around the world.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

We asked our Jewelry Advisor Raymond Sancroft-Baker to give us his top tips on buying and collecting jewelry.

FIRST QUESTION

When you are thinking of buying a piece of jewelry or a gemstone you must ask yourself two questions, ‘Do I like it’ and ‘Can I afford it’, if the answer is yes to both, go ahead and make the purchase.

BUY QUALITY

I would then look for the best quality jewel I could afford. So often people have bought lots of minor pieces ‘because they were cheap’. There will always be inferior items for sale but jewelry of real quality is rare and always will be. Remember the best gets better. Of course, price is always a consideration but it is preferable to purchase four or five good jewels rather than ten ordinary pieces.

WHERE TO BUY: RETAIL

Walking down Bond Street there are numerous retail jewellery shops to visit. Graff will show you the finest diamonds and gemstones available. Cartier, Van Cleef & Arpels, Boucheron and Tiffany will be able to offer you a broad range of contemporary jewellery as well as a small selection of their vintage pieces. You will see a very wide range of jewels from the low thousands to the high millions. There will be an extensive choice and the benefit of immediate purchase, but you will be paying retail prices as having a shop on Bond Street is very expensive.

WHERE TO BUY: AUCTION

Alternatively, if you go to an auction house to buy your jewellery you will have limited choice. Sometimes there is a good selection from a deceased estate (the family will retain the most wearable!), or someone is elderly and has no occasion to wear their jewellery. Christie’s, Sotheby’s and Bonhams all have auctions and offer a wide selection of gems and jewellery from different periods to choose from. The prices will be lower than retail but make sure you understand exactly what you are buying and look at the condition report as well as asking the specialist their opinion.

INVESTMENT

There is always an implication in the word ‘investment’ that values will rise, I prefer to call jewelry a ’store of value’ and over time good pieces bought at the right price will keep pace with inflation. If you buy retail you will have to wait many years to get your money back and at auction there are fees when buying and selling so it is important to like and hopefully wear, the jewelry you purchase.

VINTAGE JEWELRY

If you like a particular style, be it Belle Epoque or Art Deco make sure that the piece in question is actually from the period. There are a number of clever imitations on the market that can easily fool the layman. So make sure the vendor states in writing that the piece they are selling is Belle Epoque circa 1905 or Art Deco circa 1930. Jewelry from these eras will always display some natural wear and have a soft feeling as opposed to new pieces that will be rather sharp in the hand.

CONDITION REPORT

It is always advisable to request a condition report whether you are buying from a dealer or an auction house. This should give you a complete picture of the gemstone or jewel as it is important to know exactly what has happened to the item. Small changes like ring sizing or minor repairs are normal but major alterations could make re-selling difficult.

CERTIFICATES

Nowadays, more than ever, it is essential to obtain a gemmological report if you are buying an expensive gemstone or piece of jewelry. Pearls are notoriously difficult to judge if they are natural or cultured so it is imperative to have proof that they are natural from a recognized laboratory. Rubies, sapphires, emeralds and pearls should have a report, ideally from the SSEF (Swiss Gemmological Institute) in Basel or Gubelin in Lucerne. The same principle applies to diamonds and the foremost laboratory is the GIA (Gemological Institute of America).

SIGNED JEWELRY

It is certainly preferable to buy a signed piece of jewelry as it inspires confidence that it has been made to a certain standard and that the stones used in its manufacture are superior to a similar but unsigned piece. Some will be numbered as well as signed which means that it could be traced back to it’s place and year of manufacture. A jewel by Cartier from the 1930s is certainly worth double an unsigned piece and this can be justified by knowing one is buying good design, excellent color combination and of quality manufacture.

COMPARISONS

Finally shop around, there will be many people wanting to sell to you and there are lots of places to visit. Grays Market at 58 Davies Street has numerous jewelers as does Burlington Arcade apart from the well-known brands along Bond Street. And one final piece of advice, don’t be tempted to buy treated stones or synthetic diamonds – however cheap they might seem.