Patti Wong, Founder of Patti Wong & Associates, and her successful acquisition of Gustav Klimt’s Dame mit Fächer (Lady With a Fan) on behalf of an anonymous Hong Kong client for a record-breaking $108.4 million was the main topic of Artnet News’ article, “Who Bought the Mysterious Klimt at Sotheby’s? An Equally Enigmatic Hong Kong Power Broker, Some Believe.”

Philip Hoffman, Founder and CEO of The Fine Art Group, spoke with Katya Kazakina of The Art Detective about clients’ interests in the most recent May auctions for the article.

Click here to read the full article on Artnet News.

Newsfeed image credit: Gustav Klimt, Dame mit Fächer (Lady with a Fan) (1917-18).

Anita Heriot, The Fine Art Group’s President of the Americas, speaks with Bowdoin Magazine, a publication for Bowdoin alumni, about her experience in the ever-changing art world and her role at The Fine Art Group.

Click here to read the full article in Bowdoin Magazine.

Newsfeed image credit: Cover of Bowdoin Magazine’s Spring/Summer 2023 issue.

Written by Zhanna Ter-Zakaryan, Associate, Art Advisory; Luke Jacobs, Collections & Inventory Services Associate; Charles Curtis, Wine Specialist & Advisor; Greg Adams, Digital Assets Consultant

THE SCOOP: #14 – June 29th, 2023

Our experts delve into the allure of the collectible whiskey market and its appeal to the next generation of collectors. We then focus on highlighting rising LGBTQIA+ artists and exploring their contributions to the art world. Finally, we provide an update on the exciting NBA NFT collectibles market, where traditional sports card collectors are venturing into the digital asset marketplace.

Whether working with a first-time buyer or an experienced collector, we support our clients across all aspects of the acquisition process. If you are seeking assistance with your collections, please contact our Advisory team.

COLLECTIBLE WHISK(E)Y

BY CHARLES CURTIS

Distilled spirits are among the hottest categories of collectibles, and whisky (or whiskey) leads the pack. To clear up the matter of spelling, it is generally the case that Scottish producers will spell their spirit ‘whisky,’ and American and Irish distillers will usually spell it ‘whiskey.’ However, this is not universally the case. With the proliferation of high-end labels, collectors interested in exposure to this market are spoiled for choice. However, a bit of background is in order since not all whiskey is created equal.

WHAT MAKES A WHISKEY WORTH COLLECTING?

Whisky is commonly purchased for consumption. To be considered collectible, a whiskey must have a viable secondary market. This presents a difficulty for U.S.-based collectors since alcohol is tightly regulated in the United States, distilled spirits even more so than wine. Despite this inconvenience, the collectible market continues to boom. On May 11th, Sotheby’s New York presented ‘The Legacy Collection’, a single-owner sale of 142 lots that is expected to garner between $1.4 and $1.9 million. The results suggest that collectors will pay up for the bottles they need, while there will be room for new collectors to get in at a reasonable price point. While the 53-year-old Macallan distilled in 1948 and a 40-year-old distilled in 1939 made $40,000 per bottle with premium or more, other similar whiskies did not sell. Sotheby’s regularly auctions spirits, as does independent wine and spirits specialist Acker, whose recent ‘Distilled’ sale was on May 31st. Most U.S.-based collectors still try to assemble a collection by buying bottles on release. To succeed at this strategy, knowing which bottles are most sought-after is necessary.

The largest share of the collectible market goes to Scotch whisky. Although there are today 143 distilleries operating in Scotland, not all of these produce collectible spirits. The Scotch whisky with the most brand visibility is certainly Macallan. The world record for the most expensive bottle ever sold is for the 1926 Macallan, sold at auction by Sotheby’s London in October of 2019 for £1.5 million. Other collectible Scotch whisky brands include Port Ellen, Brora, Ardbeg, Bowmore, and Springbank. Quality is a factor, but in the world of whisky, scarcity drives prices even greater than in other categories. The 1926 Macallan was one of 40 bottles produced, while Port Ellen and Brora are examples of distilleries that have closed, known as ‘silent stills.’

October 24, 12:00 PM EDT

ESTIMATE: 350,000 – 450,000 GBP

LOT SOLD: 1,452,000 GBP

Courtesy of Sotheby’s.

According to the Scotch Whisky Association, exports totaled £6.2bn in 2022 and reached 180 countries worldwide. However, the combined impact of Brexit and global economic and political instability have disrupted the secondary market for rare whisky, occasioning a correction of nearly 20% across all types in the past twelve months, according to Whiskystats.com. This website was established by Johannes Moosbrugger in the Netherlands, whose index demonstrated an increase of +191.27% since inception (January 2013) after considering the recent market correction.

The Scots sell more whisky than the American and Japanese distillers combined, but these categories are also very collectible. Worldwide, Japanese whisky is also a dominant force. Brands like Karuizawa, Yamakazi, and Hanyu are the stuff of dreams for initiates of collectible whisky. The most expensive bottle of Japanese whisky is the Yamakazi 55-year-old, which sold for HK$ 6.2 million ($795,000) in August 2020.

SOLD FOR: HK$6.2 million (US$795,000).

Courtesy of Thespiritbusiness.com.

AMERICAN WHISKEY & YOUNG COLLECTORS

American whiskey also has its admirers. Perhaps the most sought-after brand is Pappy Van Winkle. Sotheby’s New York sold a bottle in December 2022 for $52,000, an astonishing 17 times more than its presale estimate. In March of 2022, the house conducted a sale exclusively dedicated to American whiskey, which sold for a combined $1.6 million. Sotheby’s noted that the category appeals to a youthful demographic, with more than 40% of the buyers under 40 years of age. Other brands of collectible American whiskey include Colonel E.H. Taylor, Michters, Eagle Rare, A.H. Hirsch, and Willett Family. Of particular note is the annually-released Buffalo Trace Antique Collection, which includes George T. Stagg, Sazerac 18 Rye, William Larue Weller, Eagle Rare 17, and Thomas H. Handy.

The database Whiskystats.com was established by Johannes Moosbrugger in the Netherlands. This index demonstrated an increase of +191.27% since inception (January 2013) after taking into account the market correction of -18.03% in the past twelve months.

CELEBRATING PRIDE: 5 YOUNG CONTEMPORARY LGBTQIA+ ARTISTS

BY ZHANNA TER-ZAKARYAN AND LUKE JACOBS

As our world and culture continue to evolve, artists in the LGBTQIA+ community are finding more acceptance than ever within the art world when it comes to expressing their identities and cultures. In celebration of Pride Month, below we spotlight five young LGBTQIA+ artists pushing the contemporary art world forward. By exploring their practices, this edition of The Scoop aims to highlight these artists’ professional achievements and their art historical contributions, both in the LGBTQIA+ community and the art world as a whole.

DORON LANGBERG

Radiant in color and quite often monumental in scale, Doron Langberg’s (b. 1985) paintings explore serenity, intimacy, and closeness. The portraits of his friends and lovers, their bodies often intertwined amongst themselves and with the surrounding landscapes, are conceived directly from life and are often painted en plein air. For the artist, the sense of a ‘living person’ and a lived experience in his paintings is essential. In a way, Langberg consistently blurs the line between abstraction and figuration, as his portraits are dissolved within their surroundings, evoking a sense of closeness and queer sensuality. As the artist puts it, “Queerness for me is not just a sexual experience, but a way of being in the world which affects every aspect of my life. Using intense colors and different paint textures and marks to create these everyday scenes, I want to connect with a viewer by speaking to our most basic commonalities – our bodies, our relationships, our interiority – rather than the social categories that may separate us.“

Courtesy of the artist and the Victoria Miro Gallery, London.

Courtesy of the artist.

Doron Langberg currently works and lives in Brooklyn and was born in Yokneam Moshava, Israel, in 1985. The artist received his MFA from the Yale University School of Art and his BFA from the University of Pennsylvania. His works are currently on view at Rubell Museum in Miami (through November 2023), and previous group exhibitions included the Institute of Contemporary Art in Boston, the Institute of Contemporary Art, Miami, and RISD Museum, Rhode Island, among others. Langberg held his first solo exhibition at Victoria Miro in London in 2021 and is represented by the gallery.

SALMAN TOOR

Langberg’s contemporary and friend Salman Toor (b. 1983) focuses on the representation of day-to-day moments of queer men within cosmopolitan and domestic settings. The artist’s subjects, often engaged in routine activities, are fictional in nature but are meant to be versions of himself, his friends, and loved ones. As Toor places them in these mundane environments, he deals with the complex, multi-layered idea of what it means to be queer in society while also playing on how relatable these depictions might seem to the viewer. The rich brushstrokes pay homage to the Dutch masters, and the vibrant color palettes evoke a sense of ambiguity, vulnerability, and even anxiety, as the environments depicted by Toor may or may not be welcoming.

Courtesy of the artist and Luhring Augustine.

Courtesy of the artist and Luhring Augustine.

Born in Lahore, Pakistan, in 1983, Toor lives and works in Brooklyn. He studied painting and drawing at Ohio Wesleyan University and received his MFA from Pratt Institute in New York. Toor’s solo exhibition, originally on view at the Baltimore Museum of Art in 2022, is currently at the Tampa Museum of Art in Florida (through June 2023). Other solo exhibitions include the Whitney Museum of American Art, New York (2020-1), and at Luhring Augustine Gallery, New York (2021), which also represents the artist. Toor’s works have appeared in various public collections, including the Frick Madison, New York, and the Hayward Gallery, London.

RF. ALVAREZ

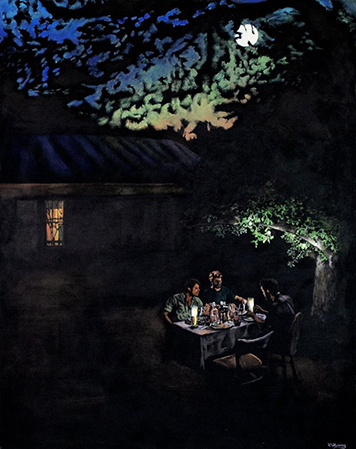

The notion of home is ever-changing, and for RF. Alvarez (b. 1988), this includes the physical environments, people, memories, and experiences through which this concept of belonging is perceived. Alvarez’s paintings depict safe and intimate spaces the artist has created with his husband and loved ones — environments that allow one’s identity and sexuality to be celebrated and fluid. Often placed in nocturnal and enigmatic settings, the figures are captured in fleeting moments, be it an intimate embrace at a large dinner party or a glimpse of the artist’s husband waking in the morning. The concept of home and belonging not being tied to a physical place goes beyond these shared moments as the artist explores his experience as a queer man of Mexican and Texan heritage. As Alvarez puts it, “A lot of my work is about the fallacy of the cowboy figure and its paper-thin vulnerability.”

Courtesy of the artist and Alanna Miller Gallery.

Courtesy of the artist and Alanna Miller Gallery.

RF. Alvarez was born in San Antonio, Texas, and currently lives and works in Austin, Texas. He received his BA from Wesleyan University in Connecticut and has held exhibitions at Alanna Miller Gallery, New York, Taymour Grahne Projects, London, and Ruiz Healy Gallery, San Antonio. Alvarez is represented by Alanna Miller Gallery in New York.

MICHAELA YEARWOOD-DAN

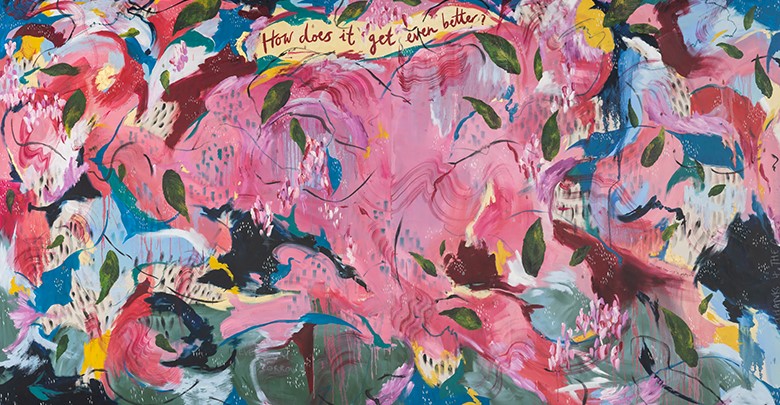

The work of Michaela Yearwood-Dan (b. 1994) aims to build spaces for the queer community, creating a sense of bliss and abundance. Community building and access are crucial components in her work: last year, she made a public mural installation for Queercircle, London, an LGBTQIA+-led charity, working at the intersection of arts, culture, and social action. Her lush paintings, works on paper, and ceramics build on her own personal narrative and reflect on the multitude of her influences, including Blackness, queerness, femininity, poetry, and Carnival culture in the context of her West-Indian heritage. Yearwood-Dan’s monumental paintings with abstract forms, heavy brushstrokes, and lyrical texts that blend with the thick paint go beyond clichés of representation, often giving an inviting feeling of home. The artist’s rich color palette has both personal and symbolic associations, as the bright hues echo the lesbian and bisexual pride flags, while her lyrical inscriptions on the thick brushes of paint create a sense of meditation, familiarity, and closeness with the viewer.

Courtesy the artist and Marianne Boesky Gallery, New York.

Courtesy the artist and Marianne Boesky Gallery, New York.

Yearwood-Dan attended the University of Brighton, where she received a BFA in painting in 2016. She recently closed a show at the Green Family Art Foundation in Dallas called Considering Female Abstractions, now on view at the Contemporary Arts Center in Cincinnati (through August 6th, 2023). Her work is in the permanent collections of the Hirshhorn Museum and Sculpture Garden, Washington, D.C., Institute of Contemporary Art Miami, and the Jorge M. Perez Collection, Miami, among others. She recently held a solo exhibition at Marianne Boesky Gallery in New York and is represented by the gallery.

KYLE DUNN

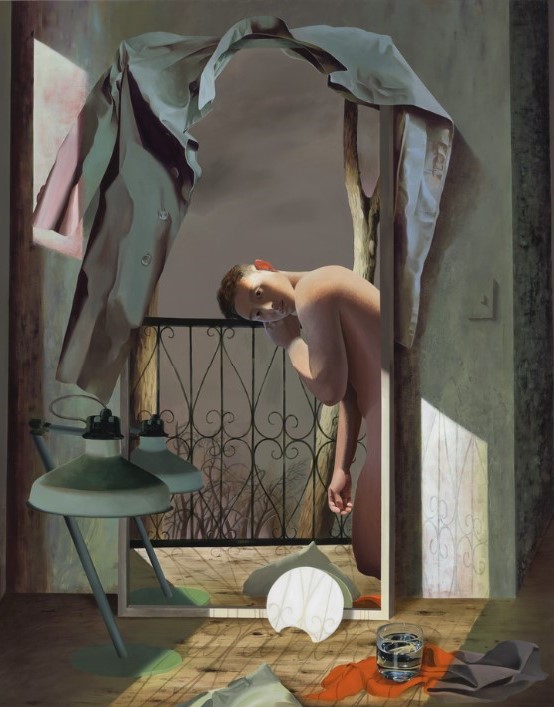

In his sensuous, intimate, and psychologically dense paintings, Kyle Dunn (b. 1990) reflects on queerness from an inward perspective as well as on its outward projection. Drawing inspiration from his own life and sources such as vintage gay photography, Greek antiquity, and film stills, the artist explores the dynamics of gay relationships not often represented in visual culture, along with gender roles and social expectations. Dunn’s figures include sculpted elements: made with plaster and foam, these relief paintings carry autobiographical and, at the same time, fictional accounts as they respond to social and even private expectations of masculinity. These sculptural elements, as well as Dunn’s intentional placement of his subjects often facing away from the viewer, create a sense of ambiguity: these intimate environments may evoke both peace and claustrophobia.

Courtesy of the artist and P·P·O·W, New York.

Courtesy of the artist and P·P·O·W, New York.

The sculptural elements of Dunn’s paintings reflect the artist’s study of Interdisciplinary Sculpture during his 2012 BFA at the Maryland Institute College of Art, Baltimore. He recently had a solo exhibition at P·P·O·W, New York, and is represented by the gallery. His work is in the collections of the Institute of Contemporary Art, Miami, the Sunpride Foundation, Hong Kong, and X Museum, Beijing.

NFT MARKET UPDATE

BY GREG ADAMS

NBA COLLECTIBLES MEETS NFTS

The world of NBA collectibles has expanded into the digital realm with the emergence of Non-Fungible Tokens (NFTs). These unique digital assets have revolutionized the way fans engage with and collect basketball memorabilia. After the recent 2023 NBA playoffs, we want to take a look at the new wave of NBA collectors. NBA Top Shot is an NFT platform that allows users to collect, trade, and showcase digital NBA collectibles as NFTs. NBA Top Shot NFTs are unique digital assets representing a specific moment in time during an NBA game, such as a game-winning shot or a memorable dunk. Each NFT is licensed by the NBA and the NBA Player’s Association and verified on the FLOW blockchain, ensuring its authenticity and scarcity.

Dunk · Oct 11 2020

2020 NBA Finals (Series 1)

Legendary #23/79

9 Moments burned

Owned by @easyaces

TOP SALE:

$230,023.00

Courtesy of Nbatopshot.com.

The popularity of NBA Top Shot has multiplied since its launch in October 2020, with some NFTs selling for hundreds of thousands of dollars. The platform has attracted a wide range of collectors, including NBA fans, crypto enthusiasts, and investors. Many are former basketball card collectors and have transitioned to the new technology. NBA players have also shown interest in the platform, with some creating their own NFTs and partnering with NBA Top Shot to release exclusive collections.

NBA Top Shot has created a new type of collecting culture, where ownership and scarcity of digital assets have become highly valuable. The platform has also sparked discussions about the future of NFTs and their potential to disrupt traditional forms of art and collectibles. While the market for NBA Top Shot NFTs remains volatile, it has become a significant player in the growing NFT ecosystem.

NFT NYC 2023

The event this year was seemingly subdued as crypto winter kept a cold grip on the market. No Radio City Music Hall, no long lines, no huge sales, and far fewer community get togethers that seemed to be the highlight of 2022. It was a different mood for many that were in attendance, less celebratory but far more resilient.

Nonetheless, the culture was still very much alive. LTD.INC showcased a new way to use NFT technology as Wrangler teamed up with artist Jeremy Booth to create a custom “Western Art Dept” black denim jacket. The jacket had Jeremy’s art and an NFC (near field communication) chip that let anyone the artist met during the week scan his sleeve to receive a “proof of friendship” POAP with his art on it. The jacket was also paired with a token that verified ownership and authenticity. This particular practice may become more commonplace with luxury brands in the future as well for ease of tracking

Another highlight was a scavenger hunt around the city hosted by collector and influencer G Money and his Web3 company, 9dcc. Over three days, participants had to hit places around New York City to collect POAPs (Proof of attendance protocols) to complete the challenge. At the first stop, they were treated to baseball caps, which became ubiquitous with the event, and for those that finished, there was a chance at winning a Chromie Squiggle as a prize. Overall a unique way to provide a social and marketable event using the core NFT technology.

Christie’s hosted the Next Wave: New York Edit auction on their Christie’s 3.0 platform, ending with selling 16 lots. It was a mixed batch as far as meeting price expectations, with a total of 135.5311 Eth (~$253,000) spent on the sale.

While it was hard to compare to last year, this year’s conference was nothing to scoff at. Enthusiasts, collectors, and builders are pushing this technology further, and the applications continue growing.

*All images courtesy the artists and the respective galleries.

READ PAST ISSUES OF THE SCOOP

- Reintroducing The Scoop: The Next Generation Collector – March 9th, 2023

- The Scoop #12 – December 21st, 2022

- The Scoop #11 – November 22nd, 2022

OUR SERVICES

From our advisors’ strategic insight and clear guidance to our market-leading art finance and sales agency services, we help our clients build their collection, secure their investments and appraise their assets to realize their true value.

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

Whether you are a collector who wants to sell a few pieces, an executor faced with the fiduciary duty of monetizing an estate, an heir who has inherited pieces they don’t want or need, or an institution deaccessioning pieces that no longer fit the mission – the process can be daunting, complex, and even emotional. Having an independent advisor by your side to guide you through the often-complex sales process can ensure successful results.

Kerry-Lee Jeffery, Senior Director of Sales Agency & Advisory at The Fine Art Group, offers 10 reasons to work with an advisor for a successful sales process.

10 REASONS YOU NEED AN ADVISOR WHEN SELLING ART, JEWELRY & OTHER VALUABLE COLLECTIBLES

TANGIBLE ASSETS & SELLING SMART

- What do you have?

Begin by identifying what you have and understanding the market value of the items.

- When is the best time to sell?

Learn as much as you can about the art, jewelry, and collectibles markets. Your chance of selling successfully largely depends on the market’s current demand as well as other contributing factors such as an increased focus on an artist’s work due to a retrospective exhibit, a world record etc.

- How do you determine the best venue for sale?

Is it better to sell at a specialized sale at a large international auction house or will a regional auction house have better results? Even selecting between the different departments of an auction house is crucial; one house may have a stronger American Art department but a weaker jewelry department. In addition to venue and department, it is also important to choose the best geographic location. Should a luxury watch collection sell in New York, Hong Kong or London?

- Are estimates accurate?

It is important to have an understanding of the true market value of the asset and allow the auction estimate to serve as a tool to generate competitive bidding.

- Are fees negotiable?

Everything is negotiable when selling tangible assets. Be open to negotiations on pricing, fees, logistic costs and terms.

- How can an auction house promote your work?

Discuss with the auction house the catalogue description and positioning of your lot in the context of the sale. Will it have a prominent place during the exhibition?

- Have you considered transport restrictions?

Depending on the work and its location, its transport may be subject to cross-border trade restrictions (for instance, works made of ivory or exotic skins on handbags require special export licenses). It is also important to use established movers who specialize in art, jewelry and valuable collectibles.

- Do you have insurance?

You can keep your valuable objects insured on your home owners insurance policy until the sale occurs. If you do not have the items insured on your homeowners policy then the auction house can also provide insurance.

- It is important to read and scrutinize the terms and conditions on the sales contract.

Seller’s beware – there can be a range of terms contained in a contract and you want to make sure that you understand all the conditions prior to entering a legally binding agreement with an auction house.

- It is important to work with an advisor on the sales process.

By seeking the guidance of an independent advisor, you’ll be well-prepared to embark on a successful selling experience.

OUR SALES AGENCY SERVICES

The Fine Art Group’s dedicated Agency team can add significant value through seamless sales management, financial reporting and marketing optimization.

We take care of every detail of the sale process, from initial valuation all the way through to post-sale reporting and analysis, ensuring that the client communication and involvement is tailored throughout.

See our Sales Agency Case Studies to learn more about our services.

KATE WATERHOUSE EXPLAINS THE LAB GROWN DIAMOND MARKET

There has been a deluge of advertising and conversation lately around the phenomenon of the “lab grown diamond (LGD),” also known as “lab created diamonds,” “engineered diamonds,” “cultured diamonds,” and even “eco diamonds.” But what are we purchasing precisely, and in practical terms, what should we consider before buying? Most importantly, should jewelry collectors be buying lab grown diamonds at all?

What EXACTLY IS A LAB GROWN DIAMOND?

The advertising is correct: A lab grown diamond is chemically a diamond and not a synthetic such as cubic zirconia or moissanite (both of which can yellow over time or become cloudy with age). Using a small sample of a natural diamond and adding a process such as High Pressure High Temperature (HPHT, which has been on the market for decades for other diamond purposes and treatments) or Chemical Vapor Deposition (CVD), it was discovered that a diamond could be “grown” within the lab.

It is worth confirming that lab grown diamonds have similar characteristics to natural diamonds. However, a buyer would still want and must be mindful of color, clarity, cut, and potential fluorescence. Like with a natural diamond, these characteristics will also affect the value (i.e., a lower color and clarity grading).

The difference is that LGB diamonds are not created by nature’s magic process occurring over millions of years but could be a “quick fix” for those looking for an affordable diamond option.

HOW ARE THEY VALUED: LAB GROWN DIAMONDS VS NATURAL DIAMONDS

When we are exploring beyond natural diamonds, consideration should be given to the LGD market; however, only if we appreciate and realize that the LGD is not a natural diamond.

Understanding the differences between these categories is essential because natural diamonds are valued based on their rarity and the current market trading price. The lab grown market does not yet have the historical trading charts to watch the long-term growth and contraction and thus should be approached and considered for purchase with caution, knowing that the future is entirely unknown and currently unregulated.

COMPARABLE MARKETS: NATURAL VS CULTURED PEARLS

We could discuss a different example where the product looks, smells, and acts like a genuine product. One immediate example is the natural saltwater pearl vs. the cultured pearl.

Authentic saltwater pearls develop within a mollusk (oyster) through a natural process. In contrast, a cultured pearl develops when a shell bead or natural irritant is introduced to the mollusk. The culturing process creates layers of luster (known as nacre) over years of care to produce the beautiful, cultured pearls we adore. By default, the origin story of those pearls has taken a different path to create a gem with which we are so familiar, and the buying public is comfortable with this category.

The issue with a lab grown diamond is similar. However, the difference is that instead of a cultured pearl being crafted on a farm, the LBD is created by technicians in a lab. The origin story differs from a diamond created by nature’s forces and thus is likely to effect the long-term potential value.

WHEN YOU SHOULD CONSIDER A LBD OVER A NATURAL DIAMOND

Many retailers will suggest that deciding what kind of diamond to acquire depends on what one can afford. A 2-carat lab grown diamond will cost approximately $2,000, while a natural diamond will cost upwards of $20,000 for the same weight, color, and clarity. In addition, some will try to encourage you to think “carbon neutral” or conflict-free. The answer to this lies entirely in the intended use.

VINTAGE & SECONDARY DIAMOND MARKET: SUSTAINABLE CHOICE WITH LONG-TERM VALUE

For those interested in sustainability, I offer the example of the secondary market to solve the problems of carbon neutrality, conflict-free, and affordability. I have had the pleasure of putting many brides into beautiful, vintage diamonds purchased privately or at auction.

The result is a purchase with an intrinsic value that has stood the test of time for generations, an addition to one’s portable wealth portfolio with historical data and fewer unknown factors in the general jewelry and gem marketplace.

Bulgari

Fancy Vivid Yellow diamond weighing 1.02 carats

Colorless diamond weighing 1.02 carats

Sotheby’s, New York

June 14, 2023

Lot 478

SOLD: $25,400

Tiffany & Co.

Sapphire weighing 8.49 carats

Diamonds weighing a total of approximately 5.25 carats

Sotheby’s, New York

June 14, 2023

Lot 235

SOLD: $50,800

However, if your goal is to purchase a large, attractive, and chemically identical diamond without concern for long-term financial viability, then the LGD market could be a good option for you.

Technology will evolve, and LGDs will continue to exist, as has the NFT, cultured pearls, and synthetic sapphires or rubies. But as with all of the above, jewelry advisors will continue to monitor the markets appropriately, recognizing that many lab grown diamond retailers have already begun to discount these goods. The market continues to stabilize, and new retailers will enter lab grown gem space.

I will end with a reminder to consumers to consult a jewelry advisor before any large diamond purchase. A jewelry advisor will clarify any confusion between the markets and assist you in better understanding your long-term financial goals related to your jewelry collection.

RELATED CONTENT

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Jewelry Advisory Team combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

SUCCESS FOR TFG CLIENT AT MAGNIFICENT JEWELS SALE

The Fine Art Group was thrilled to be able to share this important jewelry collection with Sotheby’s bidders. The jewelry collection was created in love and partnership between the consignor and his wife over many years. The couple collected a stunning array of unusual jewels by Cartier during one of the luxury brand’s most prolific periods of the 1980s/1990s, as well as high jewels by famed fashion house Dior, designed by Victoire de Castellane. The original estimation range was from $854,000 to $1,076,000, and the final sale total with an aggregate of $1,465,696.

We are so pleased that these pieces have found new and happy homes in the next chapter of their history.

THE JEWELRY COLLECTION

Total: $1,154,000

Original Estimate Range Total: $854,000-$1,076,000

SOLD JEWELRY LOT TOTALS (inclusive of aggregate):

- Eighteen karat yellow gold and diamond bracelet, Cartier: $69,850

- Eighteen karat yellow gold and diamond earrings, Cartier: $53,340

- Colored diamond and diamond earrings: $152,400

- Colored diamond and diamond ring: $190,500

- Eighteen karat yellow gold Bamboo bracelet and ring, Cartier: $44,450

- Pair of eighteen karat yellow gold and diamond Bamboo bracelets and earrings, Cartier: $60,960

- Colored diamond and diamond ‘Rose’ necklace and bracelet, Dior: $48,260

- Diamond ear clips, Dior: $69,960

- Ruby and diamond ring: $127,000

- Diamond riviere necklace: $177,800

- Eighteen karat yellow gold and diamond Babylon necklace, Cartier: $190,500

- Eighteen karat yellow gold and diamond Panther ring, Cartier: $33,026

- Eighteen karat yellow gold and diamond bracelet and ear clips, Cartier: $69,850

- Eighteen karat yellow gold jewelry suite, Cartier: $38,100

- Eighteen karat yellow gold and diamond Panther suite, Cartier: $139,700

Highlights From the CLIENTS’ SOLD COLLECTION

Click here to view the rest of the sold collection, lots 1 to 16.

Suspending two cushion-modified brilliant-cut Fancy Vivid Yellow diamonds weighing 3.03 and 3.02 carats, framed and accented by round near-colorless diamonds and diamonds of yellow hue

Magnificent Jewels

Sotheby’s, New York

June 13, 20223

Lot 3

ESTIMATE: $100,000 – $150,000

SOLD: $152,400

Centering a square modified brilliant-cut Fancy Intense Yellow diamond weighing 10.27 carats, flanked by two triangle-shaped diamonds.

Magnificent Jewels

Sotheby’s, New York

June 13, 20223

Lot 4

ESTIMATE: $100,000 – $150,000

SOLD: $190,500

Two sprung cuffs are accented by round diamonds, accompanied by a similarly designed pair of earclips, total gross weight of approximately 89 dwts,

Magnificent Jewels

Sotheby’s, New York

June 13, 20223

Lot 6

ESTIMATE: $22,000 – $28,000

SOLD: $60,960

The pendants, topped by floral and bow motifs, set throughout with variously cut diamonds, signed Dior, numbered 074388, with French assay and workshop marks.

Magnificent Jewels

Sotheby’s, New York

June 13, 20223

Lot 8

ESTIMATE: $12,000 – $18,000

SOLD: $69,960

Centering a cushion-cut ruby weighing 8.22 carats, framed by pear-shaped diamonds

Magnificent Jewels

Sotheby’s, New York

June 13, 20223

Lot 10

ESTIMATE: $60,000 – $80,000

SOLD: $127,000

RELATED CONTENT

OUR SERVICES

Offering expert Advisory and Sales Agency services across sectors, our dedicated Jewelry Advisory Team combines strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Images: All images courtesy of Sotheby’s.

Patti Wong, founder of Patti Wong & Associates, is profiled by Penta Magazine, an imprint of Barron’s. She discusses her incredible over 30-year-long career, her impact on Asia’s rising art market, and the opening of her new Hong Kong-based advisory business Patti Wong & Associates.

Click here to read the full article on PENTA on Barron’s.

Full article

Philip Hoffman and Freya Stewart recognized by Spear’s Magazine

The Fine Art Group is honored to have Philip Hoffman and Freya Stewart recognized by Spear’s Magazine as top recommended professionals in their fields, Art Advisory and Art Finance. They have been ranked as experts in the art market and art finance industry for high-net-worth individuals in the UK.

VIEW EACH LIST AT SPEAR’S MAGAZINE

Spear’s 500 Best Art Advisors List

Spear’s 500 Best Art Finance Advisor List

Originally published on Tiger21.com, May 31, 2023

ANITA HERIOT DISCUSSES ART INVESTMENT & THE STRUCTURES AVAILABLE TO COLLECTORS

Investing in art has become an increasingly popular way to diversify investment portfolios. Over the last 10 years – apart from the disruption during the Covid pandemic – the art market has consistently outperformed the S&P 500.

However, post-Covid, the art market declined less than the anticipated 22% in 2022. In the second half of the year, it bounced back to stronger than pre-pandemic levels. This proves that the value of art is not necessarily subject to the same fluctuations as the global economy. Hence, it can be used as a sound hedge against inflation and recession.

Further to the potentially high returns (the average annual return across all The Fine Art Group’s investments is 14%, versus the average annual return of 8.9% on the S&P 500), investing in art can be a means to support local and global cultural institutions, to pursue the passion of collecting, and to establish a legacy. For more on creating a legacy through art collecting, read our blog.

What type of art should I invest in?

For investors, the right piece of art is critical to a positive return. In recent years, the market has seen a shift towards contemporary art. Works by emerging and mid-career artists are gaining popularity and driving up sales. In 2020, contemporary art accounted for 55% of total sales, up from 49% in 2019.

Returns rely heavily on purchasing the right artwork – the right artist, subject matter, condition, size, and countless other criteria. Advisors can help investors navigate the market to source the right artwork, negotiate optimal prices, arrange tax-efficient storage as required, and eventually purchase the piece. For key criteria to consider when investing in art, click here.

Different Investment Structures for Investing in Art

In recent years there has been a surge in the number and types of structures available through which to invest in art. An art advisor, especially with experience in the art investment space, can be very well placed to guide investors. They not only provide due diligence on the investment structure, but offer a more granular level of advising on the artwork and the price level at which it is purchased.

Art Funds

Art funds are investment vehicles that allow investors to pool their money together to buy art. These funds are managed by professional investment managers who have expertise in the art market. Art funds can provide investors with access to a diverse range of artworks, as well as provide professional management and expertise. However, they often require high minimum investments and charge high fees due to the requirements to have audits and general partners overseeing the fund.

Private/Direct Investment

Private accounts are managed by individual investors (or their advisors) who buy and sell art on their own. This art investment method requires a significant amount of expertise and knowledge of the art market, as well as access to private auctions and galleries. Private accounts can provide investors with greater control over their art investments. However, they also require a substantial amount of time and effort. An advisor can alleviate the requirement for the investor themselves to source, negotiate, and carry out due diligence on every artwork.

Fractionalization

Fractionalization allows investors to own a portion of a larger artwork. This can provide investors with access to valuable works that they may not be able to afford on their own. Fractionalization can also allow investors to diversify their art portfolios, as they can invest in multiple artworks with smaller amounts of capital. However, fractionalization can be complicated, and fees can be high.

Co-Investment

Co-investment allows investors to pool their money together to buy a single artwork. This can provide investors with access to larger, masterpiece artworks that they may not be able to afford on their own. Co-investment can also allow investors to share the risks and rewards of an investment with others. However, like fractionalization, co-investment can be complicated and does require legal expertise to set up.

How To Invest Sensibly in Art

With the influx of players into the art investment market and greater choice for the investor also comes an increasing number of pitfalls for investors to navigate. Read our tips on how to buy art like an expert, and mistakes to avoid, here.

For investors wishing to pursue investment themselves — via a private/direct investment — it may be prudent to find an advisor who can provide thought-leadership, education, and access in the art market, a notoriously opaque market to penetrate.

RELATED CONTENT

- The Fine Art of Determining Value

- Bank of America: Investors Should Buy Real Assets

- The Fine Art Group’s Art-Secured Financing Solutions Continue to Meet Increasing Client Demand

Learn, Access, Connect: TIGER 21 Members gain access to expert insights from global thought leaders at the top of their field. For more on the TIGER 21 Member Experience, click here.

Nothing contained in this article shall constitute, or should be construed as, constituting investment advice or a recommendation by any of the authors, “Anita Heriot” her company, “The Fine Art Group,” or TIGER 21.

THE FINE ART GROUP EXPANDS REACH TO AUSTRALIA AND NEW ZEALAND

The Fine Art Group is the largest art advisory company in the world. Its new alliance with Australian-based Roger McIlroy takes its reach into the Pacific region as McIlroy accepts position as Chairman, TFG, Australia and New Zealand.

TFG Founder and CEO, Philip Hoffman says, ‘Roger has achieved an international reputation for excellence in the art world and is one of the most trusted individuals in the field. His experience, knowledge and extensive global networks make him the ideal new TFG senior resource in the region and we are delighted to have him join the team’.

Roger’s successful 30-year association with Christie’s led to the establishment in Australia of his leading independent art advisory business. Equally recognized for his expertise in the fine art auction room, Roger will continue his prominent role as head auctioneer of Deutscher+Hackett, Australia’s top auction house.

ART CONTINUES GLOBAL GROWTH AS ALTERNATIVE ASSET

This exciting new collaboration between TFG and Roger McIlroy reflects the global growth of art as a recognized alternative asset. TFG is the first international art group to respond to this shift and to move into Australia and New Zealand, providing unrivalled service and access to all aspects of the international art market. This development follows TFG’s expansion into Asia through a joint venture with former Sotheby’s executives Patti Wong and Daryl Wickstrom, and their collaboration with preeminent New York art advisor Allan Schwartzman and his team at Schwartzman&.

In Australia and New Zealand, Roger McIlroy will work in association with TFG Vice President, Leticia Hoffman, a member of TFG since 2014. With over a decade of experience in the art world, Leticia has handled some of the world’s finest artworks, gemstones, and jewels. Notably, Leticia aided with the sale of the Cartier ‘Sky Blue Diamond’ for $18 million.

With their combined skills and expertise, Roger and Leticia will continue to deliver private and corporate clients informed advice for the management, building, care and development of their art and tangible asset collections. Roger’s and TFG’s international alliances provide unrivalled leverage, offering Australian clients premium opportunities to sell, buy and secure finance across diverse categories within the art market.

Roger and Leticia will be supported by a team of 80 specialists and advisors from around the world, covering virtually every type of collecting category and available to provide ready assistance.

GLOBAL ART SERVICES POWERHOUSE

For over two decades, TFG has maintained an unrivalled track record across the art world. TFG helps clients navigate all aspects of the art market, from providing assistance with collection strategies, acquisitions, appraisals and the selling of works of art, through to art financing. This new collaboration with Roger McIlroy adds to the definition of TFG as an art industry innovator now available to meet new market demands in the Pacific region.