THE SCOOP #6 – July 27th, 2022

In this edition of The Scoop, we cover the latest 3AC default news, consolidation in the NFT market, and dive into DAOs.

CRYPTO MARKETS

CRYPTO COMMENTARY

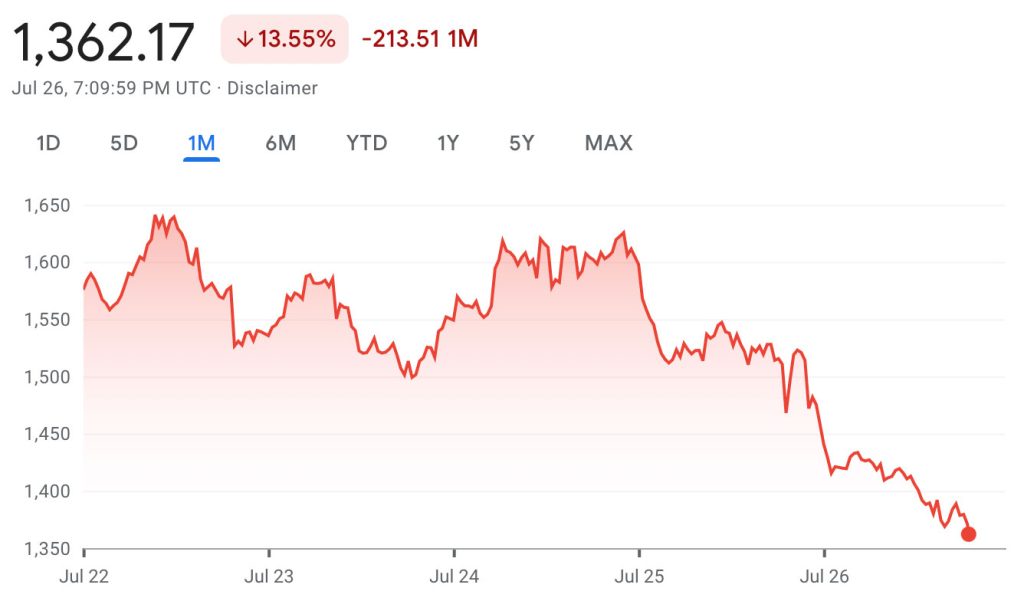

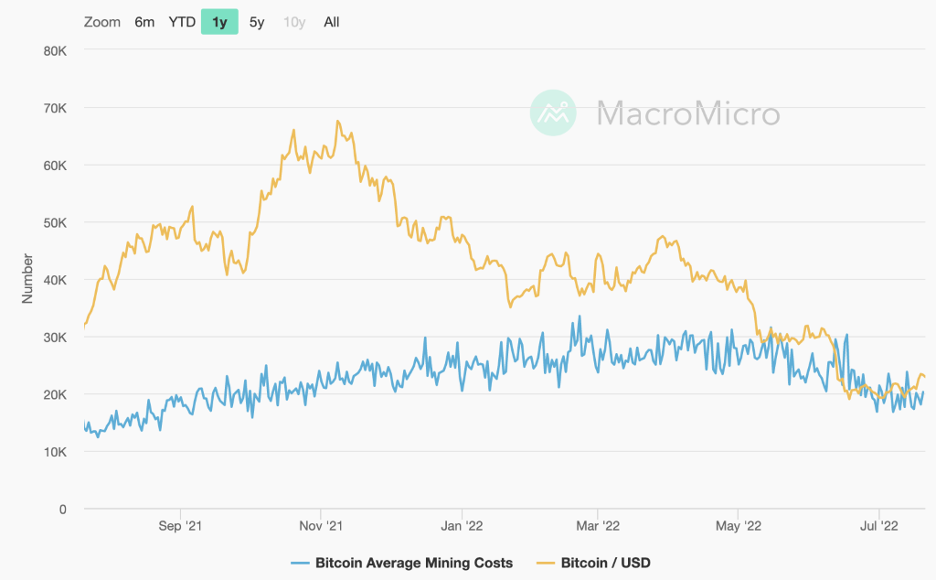

After bank earnings have been reported there is a cautious sense of optimism in the markets with some green in the charts for a change. Many investors are waiting for the next CPI (consumer price index) numbers to come out before making any moves. The restless indecision has created some expected choppiness while JP Morgan warns we may not have seen the bottom yet. The cost to mine a single Bitcoin has dropped dramatically from $24,000 to $13,000 and it could lead to a further decline in the crypto’s value. The price to mine Bitcoin has fluctuated over time since it is so energy-dependent. At the peak in February 2022 it cost $33,500 to mine a single Bitcoin while the cost is now $18,900, a 43% decrease.

The drama continued in the lending space as bankruptcy filings for 3AC, the crypto hedge fund, revealed that the founders made a down payment on a yacht while ignoring their debts. They owe $3.5 billion to insolvent crypto lenders like Celsius and Voyager. The courts fear that 3ACs assets already may have been liquidated and transferred out of the fund with founders Su Zhu and Kyle Davies off the grid and not responsive.

Many believe this event will lead to more cautious investors, slower adoption and more stringent rules from the government. The coming regulation could create more accountability for the malicious actors and build protections for retail investors similar to the traditional securities markets. It feels like we’re moving away from decentralization and more Wall Street, which is a bit of a paradox since that’s what crypto was built to avoid, the traditional banking system.

WHAT’S THE BUZZ?

With so many new communities popping up in Web3, we’re seeing a new form of management in those communities in the form of DAOs. It’s like a corporate structure for decentralized entities.

DAO

- DAO stands for Decentralized Autonomous Organization.

- It is a structure where token holders take part in the decision making and management of the group.

- With no central authority, the power is distributed across the token holders who cast votes on initiatives proposed by the community.

- Many organizations place their votes on blockchain where the results can be publicly viewed

- Security is crucial for DAOs as any exploit could drain them of their holdings, the most notable being The DAO Hack of 2016 resulting in a $50 million loss.

- A great application of this concept is LinksDAO, a group of golf enthusiasts who are building a community around the game with the goal of owning a golf course. Their token release will be helping fund the purchase and members will be voting on where the course will be along with other initiatives to grow their footprint.

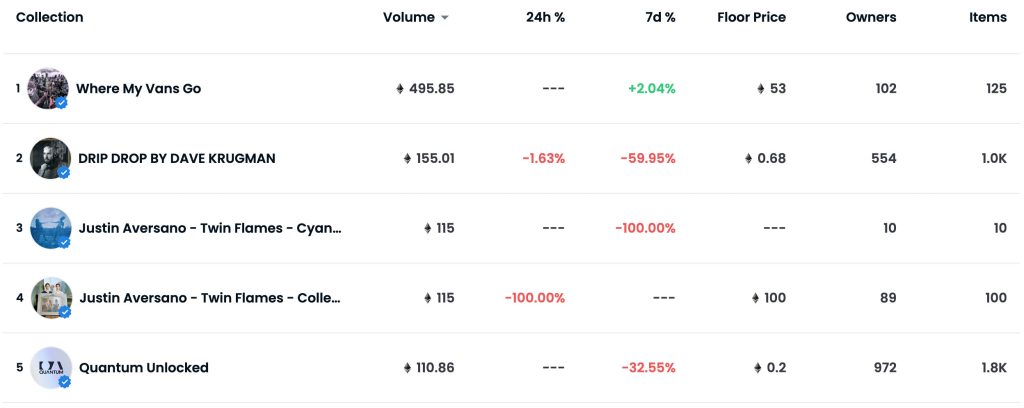

NFT BLUE-CHIP COLLECTIONS

NFT COMMENTARY

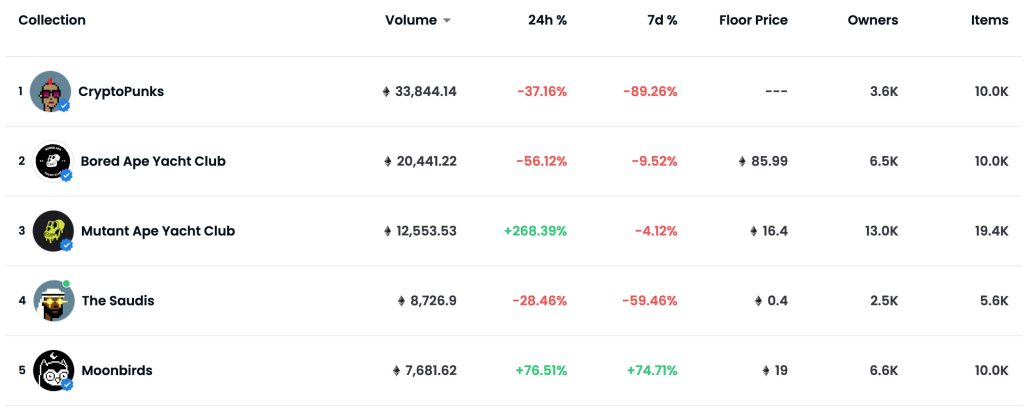

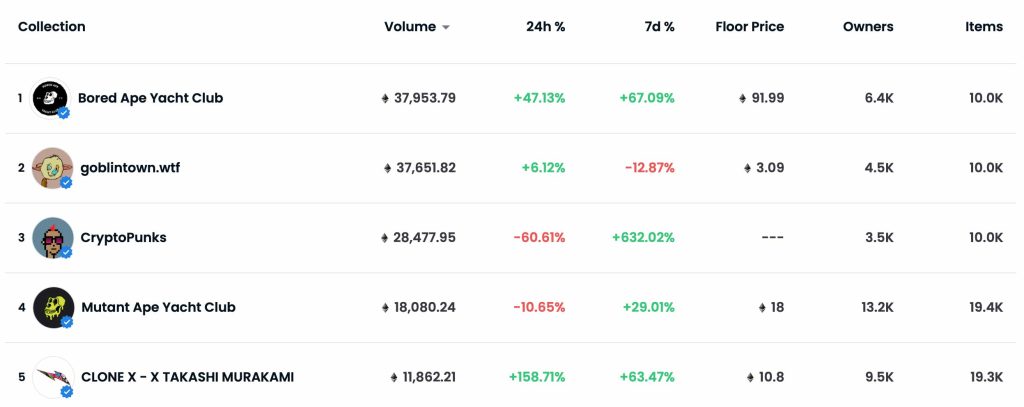

With green in the crypto markets comes an uptick in the NFT markets. The speed of the consolidation into blue chip projects has increased with Bored Apes, CryptoPunks, and Art Blocks increasing in both value and volume. Many other projects have been stuck in neutral, with either modest gains or slight declines despite a lift in the cryptocurrency value.

The recent dip has given everyone a renewed perspective on what value is. Some projects didn’t survive, and maybe that’s a good thing. Collectors are getting pickier with NFTs they’re putting money into, and the two biggest drivers are history and utility. If a project doesn’t have any cultural significance or doesn’t grant access to any meaningful perks, collectors are passing on it.

In a meeting recently, we were asked what we thought about the recent market pullback. We think it was bound to happen after an explosive first year and necessary to bring sky-rocketing expectations back to earth. The amount of building in this space by both artists and other industries is increasing during this market lull, and the technology cannot be ignored at this point. Christie’s has launched a new enterprise named Christie’s Ventures to engage with early-stage companies in Web3.0 innovation, art-related financial products, and solutions and technologies that enable seamless consumption of art. This is a positive sign and possibly an indicator of more players entering the space.

NFT ARTIST SPOTLIGHT

Tyler Hobbs

The Austin, Texas-based artist behind the iconic Art Blocks Fidenza collection has had creating in his blood from a very young age. He took up painting when he was little with inspiration from Van Gogh and other landscape artists he had seen with the goal of becoming an artist. For pragmatic reasons, Hobbs was persuaded by his dad to study computer programming and got a programming job in his 20s while still creating on the side.

One day he had an idea: “What if I wrote a program that created a painting?” Hobbs went to work on combining his two passions and developed algorithms that would do just that. Tyler was sharing his work on social media and eventually he was getting messages on Twitter about NFTs. The rest is history.

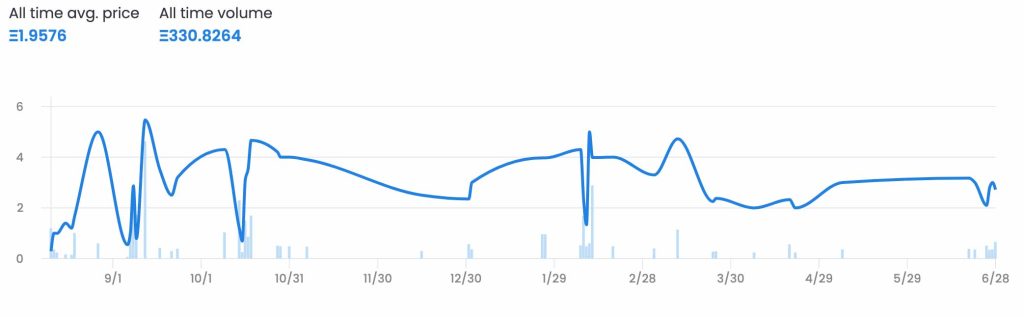

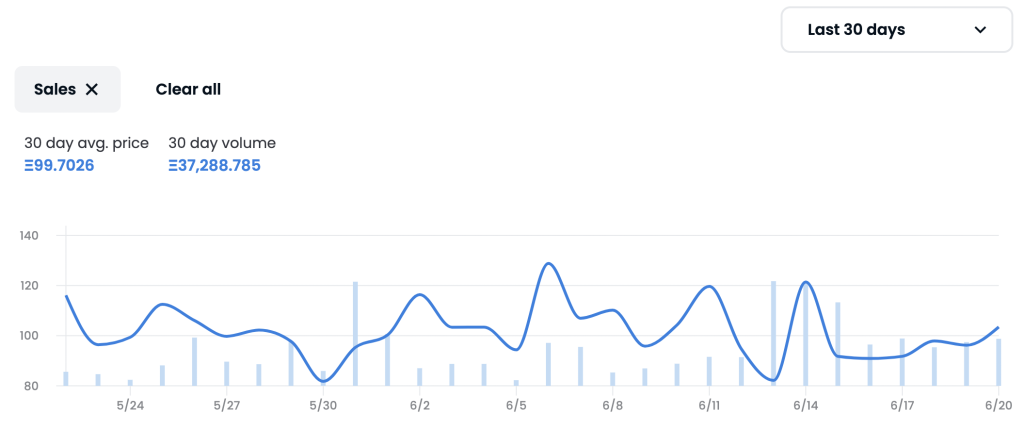

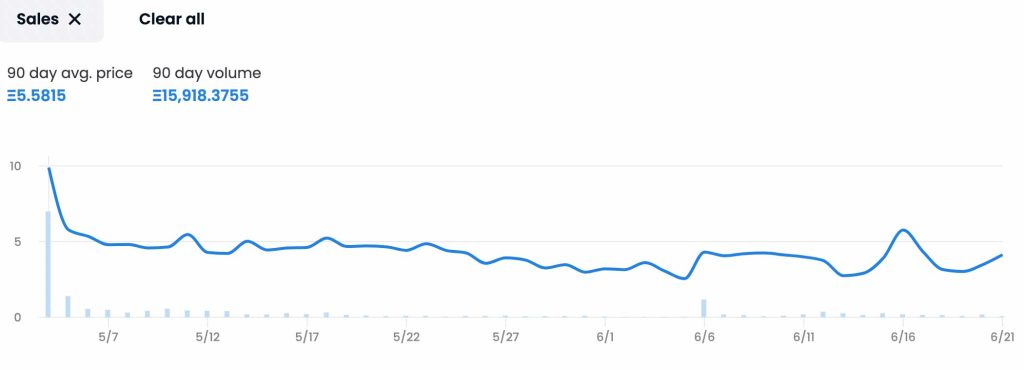

The above chart shows all the volume (vertical bars) this collection has seen in July with the price (blue line) gradually going up. They have seen a recent resurgence in secondary sales as the rest of the Art Blocks collection continues to grow. Fidenzas have become a grail item for many in the collecting space with only 999 of them in existence. Many have placed historical value in this collection since it was one of the first formal Art Blocks releases.

NFT & CRYPTO NEWS

- Tesla unloads some of it’s Bitcoin in Q2

- Damien Hirst’s NFT experiment is on fire (literally)

- A joke gone wrong and the fumble of the century? Eth Whale loses big after misstep

- Italy halts museum NFT contracts

- Coinbase is in hot water with the SEC

- Pressure is building for regulation

- The creator of Art Blocks on the rapid growth

- Phillips’s Generative Art Sale negatively impacted by crypto volatility

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

2022 Jewelry Market Report to Date

The two sale seasons at auction for significant jewels occur in the May/June time frame and in December, selling across sale rooms in Geneva, Hong Kong, and New York. Several important stones sold at auction in the first half of 2022, the most valuable of which was the “De Beers Blue” which sold for $57.4 million at Sotheby’s, Hong Kong. It was the largest vivid blue diamond to sell at auction and one of the highest prices ever paid for a diamond at auction.

An analysis of the significant jewelry sales at auction so far this year show three areas of strength: colored diamonds, pieces by established luxury makers such as Harry Winston and Cartier, and strong value appreciation of specimen stones such as the paraiba tourmaline and spinel.

SOME KEY TAKEAWAYS

- The global jewelry market has an upwards trend, with an anticipated CAGR of 15.39% by 2026, with 29% of growth within North America..

- Unusual specimen stones such as paraiba tourmalines and spinels have seen increased interest and appreciation on the market due to demand from Asia.

TOP FIVE SOLD JEWELRY PIECES IN 2022 TO DATE

The step-cut fancy vivid blue diamond weighing 15.10 carats

The De Beers Blues

Sotheby’s, Hong Kong

April 27, 2022

Lot 1800

SOLD: $57,466,161

228.31 carats, G color, VS1 clarity, excellent polish and symmetry

Magnificent Jewels Sale

Christie’s, Geneva

May 10, 2022

Lot 26

SOLD: $22,371,214

103.49 carats, D color, Flawless, excellent polish and symmetry, Type IIa

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $11,000,000 – 18,000,000

SOLD: $20,084,000

Fancy intense yellow cushion modified brilliant-cut diamond of 205.07 carats

Magnificent Jewels Sale

Christie’s, Geneva

May 10, 2022

Lot 61

SOLD: $14,626,895

Pear-shaped diamond weighing 101.41 carats.

Magnificent Jewels Sale

Sotheby’s, Hong Kong

June 16, 2022

Lot 487

SOLD: $12,963,500

COLORED DIAMONDS

According to the Fancy Color Diamond Index (FCDI), which tracks and analyzes wholesale prices of colored diamonds, the market value of fancy-colored diamonds has typically increased 9-12% annually in recent years. Though not all colored diamonds are created and valued equally, even lower quality colors have appreciated in value. For example, fancy pink diamonds, a lower grade, gained 325.6% in price from the start of 2005 through the first quarter of this year, while fancy vivid pink diamonds, a high grade, achieved 427.8% growth. In comparison, the price of gold gained 300% over that period, and the S&P was up 384%.

MAGNIFICENT JEWELS SALES

The success of colored diamonds is made evident by their performance at the 10 Magnificent Jewels sales held by Christie’s and Sotheby’s in the first half of this year. Two of the top five pieces sold in 2022 were colored diamonds, with the overall highest-grossing piece being the Fancy Vivid Blue Diamond from Sotheby’s De Beers Blue sale. Further, the other top-grossing colored diamond, the Red Cross Diamond from Christie’s Magnificent Jewels sale in Geneva, exemplifies the popularity and desire for yellow diamonds, which accounted for most colored diamonds in the Magnificent Jewels sales. Of the top 12 colored diamonds sold in Magnificent Jewels auctions in the first two quarters of 2022, all but one performed above estimate range.

Old-mine cut Fancy Intense Pink diamond weighing 4.08 carats

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $1,200,000 – 1,800,000

SOLD: $3,801,000

Old mine-cut Fancy Gray-Violet diamond weighing 3.46 carats

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $1,200,000 – 1,800,000

SOLD: $3,801,000

WHAT IS IN A JEWELRY BRAND NAME?

JEWELRY BY IMPORTANT MAKERS

- HARRY WINSTON

- CARTIER

- VAN CLEEF & ARPELS

- JAR

- BULGARI

Highly esteemed and established makers including Harry Winston, Cartier, Van Cleef & Arpels, JAR and Bulgari, were present across Magnificent Jewels auctions in New York, Hong Kong, and Geneva. Sales highlighted the continued confidence and trust in these major names, as exhibited by the sale of a Harry Winston Diamond Necklace from Christie’s New York, which performed 323.4% above its conservative estimate of $300,000-500,000, grossing $970,200. Similarly, a Harry Winston Diamond Ring at Christie’s Geneva scored 129.66% over its low estimate, further illustrating the brand’s prestige and reputation. Other makers such as JAR continue to have soaring prices on the secondary market due to a strong demand and limited supply.

Agate, Diamond And Sapphire Zebra Brooch

Carved banded agate, round diamonds, marquise-shaped cabochon sapphire, black enamel, silver and 18k yellow gold

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $50,000 – 70,000

SOLD: $554,400

A Highly Important ‘Mystery-Set’ Ruby and Diamond Clip-Brooch, France

Designed as a leaf with numerous undulating calibré-cut rubies en serti mystérieux, accented with baguette and tapered baguette diamonds

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $50,000 – 70,000

SOLD: $982,800

Diamond Necklace

Round, baguette and pear-shaped diamonds, platinum

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $300,000 – 500,000

SOLD: $970,200

Diamond Ring

Centering a pear-shaped diamond weighing 22.80 carats, flanked by tapered baguette diamonds, size 4¾, with sizing spheres

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $400,000 – 600,000

SOLD: $882,000

Emerald and Diamond Pendant Necklace

The pendant set with a step-cut emerald weighing 83.21 carats, surrounded by pear- and marquise-shaped diamonds weighing a total of 17.66 carats, suspended from a brilliant-cut diamond necklace, mounted in platinum, 18 karat white and yellow gold

Magnificent Jewels I Sale

Sotheby’s, Hong Kong

April 29, 2022

Lot 1837

ESTIMATE: $866,244 – 1,146,500

SOLD: $1,091,468

An Impressive Boreal Necklace

Centering a pear-shaped diamond weighing 22.80 carats, flanked by tapered baguette diamonds, size 4¾, with sizing spheres

Magnificent Jewels Sale

Sotheby’s, New York

June 16, 2022

Lot

ESTIMATE: $1,00,000 – 1,500,000

SOLD: $1,197,000

An extraordinary gem set and diamond bracelet, ‘Birds in Flight’

Articulated bracelet of exotic inspiration, decorated with tropical birds in flight amidst floral sprigs, pierced and millegrain-set with buff top rubies, emeralds, sapphires, and onyx as well as circular-cut diamonds, length approximately 185mm, unsigned, numbered

Magnificent Jewels and Nobel Jewels Sale

Sotheby’s, Gevena

May 10, 2022

Lot 400

ESTIMATE: $472,454 – 748,890

SOLD: $1,449,027

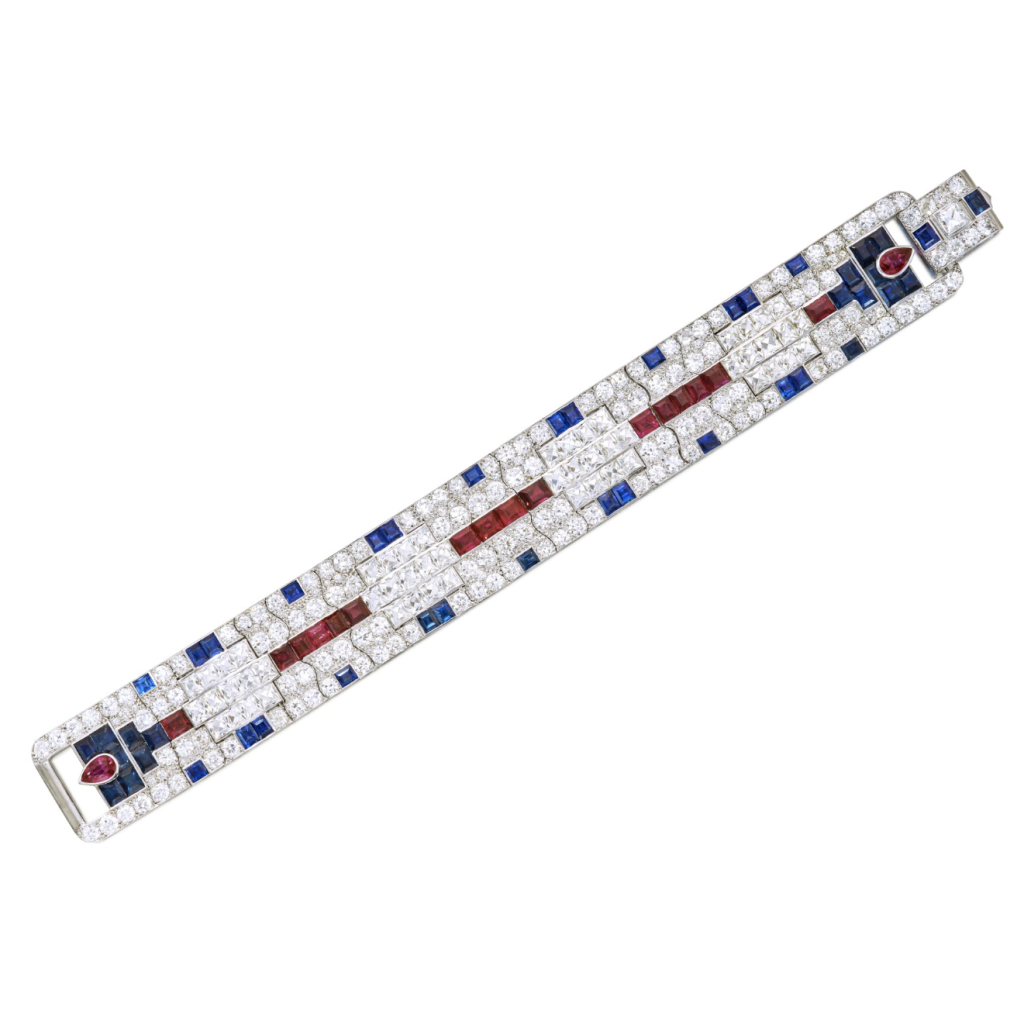

An Exceptional Ruby, Sapphire and Diamond Bracelet, Paris

Designed as a wide band, decorated with old European-, single- and French-cut diamonds, accented by calibré-cut rubies and sapphires and pear-shaped rubies, length 7⅜ inches, signed Cartier Paris Londres New York, with French assay and partial workshop marks; circa 1930

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $150,000 – 250,000

SOLD: $466,200

RARE AND UNUSUAL STONES

2022 has seen increased interest and appreciation in value for unusual specimen stones such as paraiba tourmalines and spinels.

PARAIBA TOURMALINES

The Fine Art Group was pleased to assist a client in selling its exceptional Paraiba Tourmaline and Diamond Pendant-Necklace. The result was the second highest amount secured for a Paraiba at auction and shows the strength of the market for outstanding specimen stones of rarity. Other paraiba tourmaline pieces also saw prices soar above estimate. One pair of Boodles paraiba tourmaline and diamond earrings from Sotheby’s Magnificent Jewels & Nobel Jewels sale in Geneva performed 705.6% above the conservative estimate of $50,000-70,000, selling for just over $360,180. In parallel, a superb paraiba tourmaline and diamond ring from the same maker also sold for $540,270, 264.5% higher than the conservative estimate of $200,000-300,000. Stewart Young, Head of Jewelry for Asia at Bonhams, notes that the market price of Paraiba has soared in recent years as it has become a desired stone by many Asian collectors.

SPINELS

Another area of strong results are spinels. These rare stones were often mistaken for rubies. In 2022, exceptional examples have seen results soar past auction estimates. A significant 54 carat specimen example sold at Christies, Geneva for $504,000 against an estimate of $200,000-300,000.

For both paraiba tourmalines and spinels, color saturation and size play an important role in determining the examples of significant value.

Suspending a modified triangular brilliant-cut Paraiba tourmaline weighing 10.31 carats, capped and accented by round diamonds, length adjustable from 14 to 18 inches

Magnificent Jewels Sale

Christie’s, New York

June 1, 2022

Lot 3

ESTIMATE: $500,000 – 700,000

SOLD: $1,197,000

Set with a cushion-shaped sapphire weighing 5.95 carats, between pear-shaped diamond shoulders, size 56, Italian assay marks for gold and platinum and maker’s mark

Magnificent Jewels and Nobel Jewels Sale

Sotheby’s, Gevena

May 10, 2022

Lot 399

ESTIMATE: $281,462 – 467,428

SOLD: $823,376

Pear-shaped spinel of 54.03 carats, 18k rose gold

Magnificent Jewels Sale

Christie’s, Geneva

May 11, 2022

Lot 38

ESTIMATE: $204,875 – 307,313

SOLD: $516,286

RELATED CONTENT

- Selling Jewelry & Watch Collections

- Watch TFG’s New York Luxury Week 2023 Webinar

- Sales Agency Services: Maximizing Value and Efficiency through Comprehensive Sales Strategies

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Jewelry Advisory Team combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Images: All images courtesy of associated auction houses

Listen to Our Latest 20-Minute Webinar

We invite you to listen to the below webinar where Philip Hoffman, CEO, and Anita Heriot, President of the Americas, further discuss the economic advantages of diversifying into art or collectibles and where to take caution when considering an investment.

Our CEO & Founder Philip Hoffman speaks with President Anita Heriot in a 20-minute virtual forum. Watch to learn about the latest on inflation and how to leverage collections to maneuver through the current economic climate.

ART & INFLATION IN 2022

In recent months, as inflation rates have surged and stock markets have slumped on both sides of the Atlantic, collecting art has increasingly become recognized as a solid investment strategy. Whilst not all artworks and collectibles are created equally, and therefore do not offer the same possible financial protection, the art market has historically shown resilience during market downturns and is largely uncorrelated to other major asset classes. The right art investment has proven to be an excellent store of wealth over all time periods, exceeding inflation.

CASE STUDY

The best – and only – case study of art investment as a hedge against inflation is that of the British Railway Pension Fund, which specifically and successfully bought art in the 1970s against a backdrop of inflation rates as high as 17%. The fund invested 3% of its holdings at the time (£40m) into 2,400 objects across a vast range of categories and achieved an annual compound interest of 13.1%, while the average stock market investment returned 10%.

ART IN THE POST-PANDEMIC MARKET

Apart from hedging against inflation, we see the benefit of art being uncorrelated to other asset classes in the speedy recovery of the market during moments of economic decline. In 2021 – as the world entered a post pandemic recession – auction sales totaled around $12.6B at the three major auction houses (Sotheby’s, Christie’s and Phillips) up 2.3% from 2018. Furthermore, collectors returned to the market with a renewed appetite for buying and 167 artworks achieved $10m+ each, twice as many as the previous year. The market so far in 2022 continues to go from strength to strength with the ArtPrice Contemporary Art Index reporting a 16.2% year to date increase compared to the S&P, which is down 14% over the same period.

TOP 5 TAKEAWAYS

AUDIT YOUR COLLECTION

It is crucial to understand the current fair market value of your collection before making any financial moves. Once you have this information, you can then develop a strategy.

BE PREPARED TO HOLD ART FOR 3 TO 5 YEARS

Art acquisitions typically should not be liquidated for several years. With annual revaluation, one can develop an intelligent sales strategy that corresponds to the market.

STICK WITH BLUE-CHIP ARTISTS

Now is not the time to risk investing in Young Contemporary artists with little track record. Stick to blue-chip artists with an established secondary market that has steadily increased in value. There may be some fantastic buying opportunities in the near future, with masterworks coming to market to bring their owners liquidity, with less competition from other buyers.

DIVERSIFY YOUR ART & COLLECTIBLES

Look to other opportunities in the collectibles market such as jewelry and watches of the highest quality possible.

DO YOUR HOMEWORK

Be sure to turn to a trusted advisor and research your options before committing to any important financial decisions.

FURTHER READING

- Market Update Live Webinar: The State of the Art, Collectibles & Jewelry Market

- Watch Art & Collectibles: The Rise of Alternative Investments

- Good News for Sellers: Highest Inflation in the U.S. in Four Decades

Looking for a bit of creative inspiration while vacationing this summer? We have rounded up some of the key art attractions both inside and outside the UK that would be well worth a road trip.

United Kingdom

Wakefield, York

Yorkshire Sculpture Park – Robert Indiana: Sculpture, 1958-2018

March 12, 2022–January 8, 2023

Included in price of entry to park (£6 full price)

Open daily, 10AM–6PM

Spanning six decades of the American artist’s career, YSP has unveiled the first major European exhibition of sculpture, painting and prints by Indiana.

Bruton, Somerset

Hauser & Wirth – Henry Moore

May 28, 2022–September 4, 2022

Free entrance

Open daily, 10AM–5PM

Occupying all five gallery spaces with an additional open-air presentation, this large-scale exhibition has been curated by the Henry Moore Foundation in partnership with Mary Moore, the artist’s daughter.

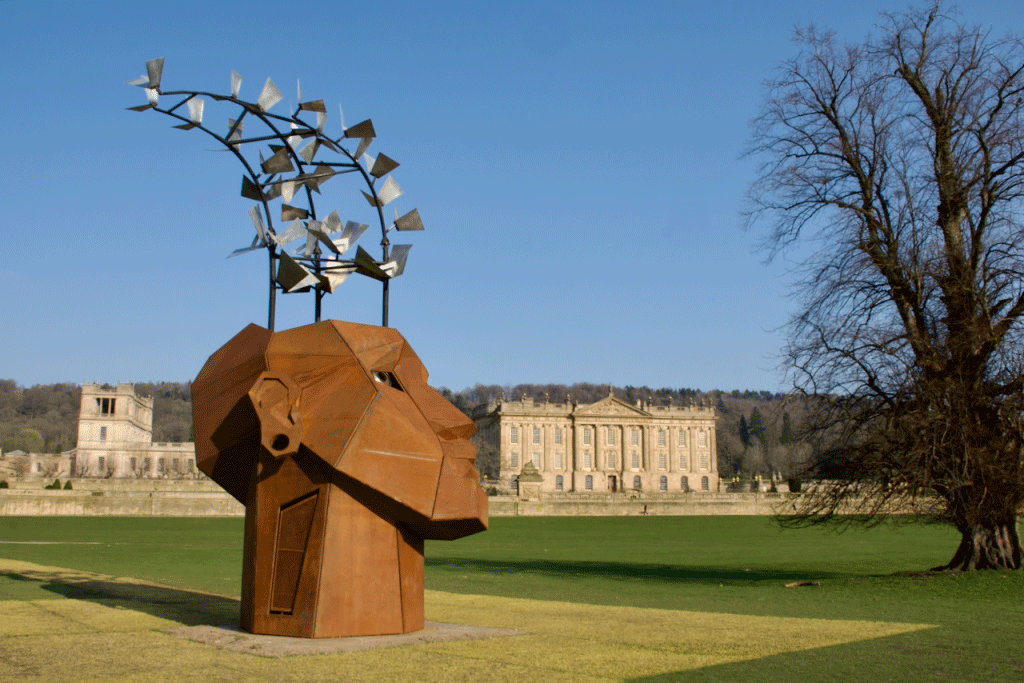

Peak District, Derbyshire

Chatsworth House – Radical Horizons: The Art of Burning Man at Chatsworth

April 9, 2022– October 1, 2022

Free entrance

Garden open daily, 10AM–5:30PM

The team behind the Burning Man arts festival, which usually takes place in the Black Rock Desert in Nevada, has brought a major display of twelve sculptures to the parkland of Chatsworth house.

Edinburgh, Scotland

Jupiter Artland – Tracey Emin

May 28, 2022–October 2, 2022

£10 entry (full price). Tickets must be booked online

Open daily, 10AM–5PM

Presenting Emin’s first Scottish show in 14 years, this sculptural exhibition takes place amidst the architecture and woodland of the Jupiter Artland sculpture park and gallery.

France

Île de Porquerolles, South of France

Carmignac Foundation – Ulysses’ Dream

April 30, 2022–October 16, 2022

15 entry (full price), includes exhibition and sculpture park

Open Tuesday to Sunday, 10AM–6PM (last ticket at 4PM)

Inspired by the tale of The Odyssey, guest curator Francesco Stocchi (curator at the Boijmans van Beuningen Museum and of the Swiss Pavilion at the 2022 Venice Biennale) has put together an exhibition of modern and contemporary artists, inspired by the ancient Greek quest.

Provence, South of France

Château La Coste – Idris Khan, Annie Morris, Mary McCartney, Zhou Li, Bob Dylan

May 2022-September 2022 (see website for respective dates)

€15 entry (full price)

Open daily, exhibitions 12PM–5PM, art centre 10AM–5PM

The 600-acre sculpture park, art centre and winery hosts several exhibitions in their gallery spaces. These five separate shows of contemporary artists are open throughout the summer, ranging from works on paper to photography to installation.

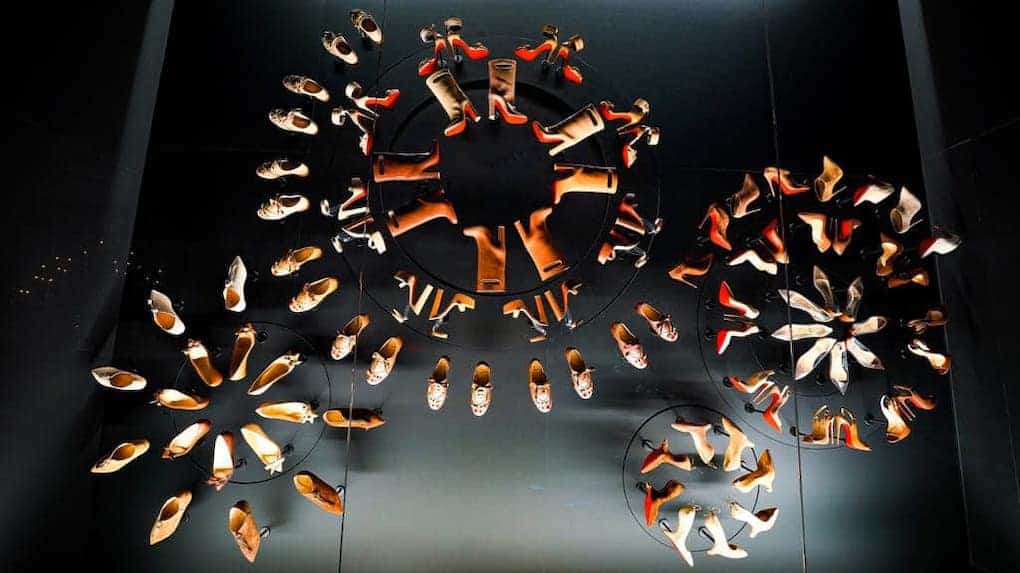

Monaco

Larvotto, Monaco

Forum Grimaldi – Christian Louboutin

July 9, 2022–August 28, 2022

€11 entry (full price)

Open daily 10AM–8PM, Thursdays until 10PM

First shown at the Palais de la Porte Dorée in Paris, this exhibition explores 30 years of design and examines Louboutin’s numerous influences, including Pop Art, Russian ballet, and oceanography.

Menorca

Illa del Rei, Balearic Islands

Hauser & Wirth – Rashid Johnson: ‘Sodade’

June 19, 2022–November 13, 2022

Free entrance (a ferry ticket can be purchased via the website)

Open daily until October, 10AM–10PM

Johnson’s first solo show in Spain, this exhibition takes its inspiration from the term ‘Sodade,’ which signifies a state of emotional longing. The artist uses this term to continue to explore narratives around migration and journeys.

Greece

Slaughterhouse, Hydra Island

Deste Foundation for Contemporary Art – Jeff Koons: Apollo

Free entrance

Open Monday–Sunday (closed Tuesdays), 11AM– 1PM & 7PM–10PM

June 21, 2022–October 31, 2022

In addition to their exhibition programme in Athens, the Deste Foundation presents summer shows in the Island of Hydra’s renovated slaughterhouse. Koons’s first solo show in Greece for over 20 years, this installation displays a series of new sculptures and readymade objects which encourage a dialogue between the contemporary and the ancient.

United States

East Hampton, New York

Pace Gallery – Joel Shapiro & Kiki Smith

July 21 through 31, 2022 (Shapiro)–August 14, 2022 (Smith)

Free entrance

Open Wednesday–Saturday 11AM-5PM, Sundays 12PM–4PM

Situated in the heart of New York’s holiday district, Pace’s East Hampton Gallery presents two summer shows: Shapiro’s experimentation with wood in the form of wall-mounted, suspended, and free-standing sculptures; and a display of Smith’s new metal sculptures, prints and drawings which draw on themes from the natural world.

Aspen

Sotheby’s – In Focus: Warhol on Paper

June 17, 2022–July 31, 2022

Free entrance

Open Tuesday–Sunday, 11AM–7PM

This summer Sotheby’s has opened a pop-up show of Andy Warhol works on paper. Addressing the artist’s love-affair with the popular Rocky Mountains town, this selling exhibition also includes work by a range of contemporary artists including David Hockney, Damien Hirst, Rashid Johnson, and Lynda Benglis.

FURTHER READING

June of this year finally saw the return of Art Basel to its familiar slot, swiftly followed by TEFAF in Maastricht and Masterpiece in London. With the June auctions concluding a busy month of fairs, there was some anticipation as to their performance against a backdrop of potential buyer fatigue and economic uncertainty.

Christie’s, Sotheby’s and Phillips all distinctively strategized to compete with those challenges facing the June auctions. Christie’s began their five hour marathon of sales with a group of Chagall works sold directly from the estate, where a number of buyers fiercely competed for fresh to market pieces (90% of lots sold above the high estimate); this was followed by a relay sale from London to Paris, enhancing their European outreach. Sotheby’s contrastingly opted to begin their auction with a mixed category ‘Jubilee Sale’ which included British artists spanning Gainsborough and Millais through to Hirst and Hockney. Targeting the growing cross-collecting market, this tactic felt very much in the spirit of Masterpiece fair concurrently running that week. Phillips’ sale was strategically weighted towards the Ultra-Contemporary category, which has been the strongest market segment over the last two years, and seemingly a sure-fire way to ensure a strong sell through rate and robust sales total against pre-sale estimates.

These strategies largely paid off with all the houses successfully reaching sales totals within expectations and realizing healthy sell-through rates. Phillips’ raked in £17.5 million (premium), close to the high end of its presale estimate range of £13.6-18.4 million, with a 94% sell-through rate. Sotheby’s totaled £149.2 million (premium) across both sales, against the pre-sale estimate of £143-201 million, with a 79% sell-through rate. Christie’s had the highest total of the week, bringing in £203.8 million (premium), within the presale estimate of £145-220 million, up from last year’s £153.6 million (premium) total. It had an average sell-through rate of 93% across its three sales, largely due to the white glove Chagall sale.

Despite the healthy results, there was a sense of a cooling market compared to the strength of the New York May sales, and a marked difference to the frenzy witnessed in New York in November 2021. Stock market volatility, rising interest rates, rampant inflation and crypto-currency crashes have no doubt had an impact on the confidence and buying power of collectors.

This growing conservatism felt most apparent in the Ultra-Contemporary category which has previously seen lengthy bidding wars and works consistently hammering in excess of £1 million against very low estimates. Flora Yukhnovich was one artist who continued to receive frantic bids. Both paintings that sold during the week hammered far in excess of £1 million, with globally competitive bidding. However, several other works by recent auction stars such as Shara Hughes, Anna Weyant, Cristina Quarles and Amoako Boafo attracted muted bidding selling within estimates rather than far exceeding them. While wider economic concerns are having an impact, these results should also be seen as a wider price correction for these artists and the category overall. The previous heat and competition at those price levels was unsustainable, and a much needed selectivity among collectors is becoming apparent.

Generally, at the top of the market, bidding felt thin. The much lauded fresh-to-market portrait of Lucian Freud by Francis Bacon sold for one bid above the guarantee at £35.5 million hammer against a reported £35 million guarantee. Several works were withdrawn by each house, including works by Cy Twombly, Sigmar Polke, Georg Baselitz and Dana Schutz, presumably due to lack of interest.

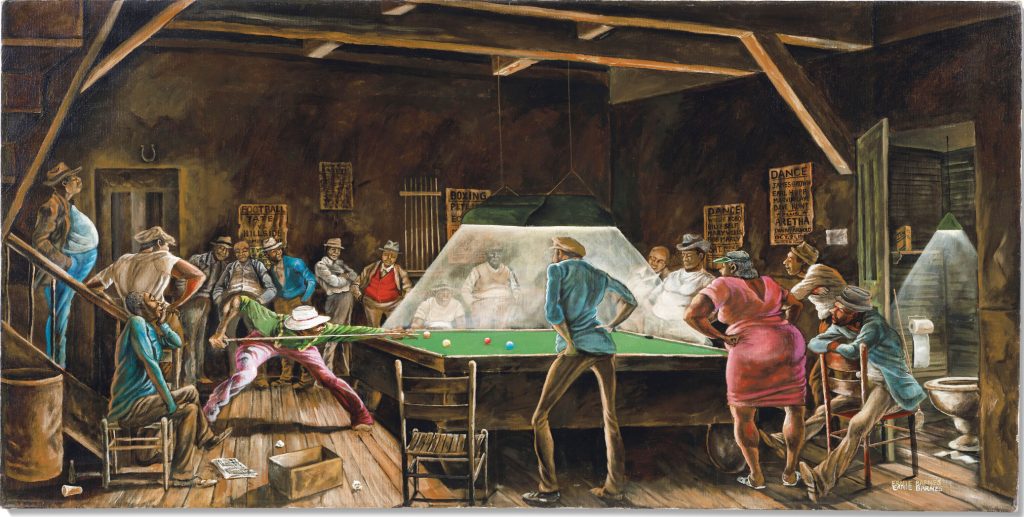

However, there were several strong results for blue-chip category works which served to reinforce that the art market is still very much afloat. Christie’s, despite a glut of top tier Monet paintings coming to market recently, achieved very solid results for both of their Monet paintings, which sold to the same buyer. Waterloo Bridge, effet de brume (1899–1904) sold for £30 million (premium), just reaching its presale high estimate. Nymphéas, temps gris (1907) achieved £30.1 million (premium), just under its £32 million high estimate. Following a huge new auction record in May, a battle also broke out for Ernie Barnes’s 1978 painting Main Street Pool Hall, from the collection of the late film producer Danny Arnold. The painting sold for £1.5 million (premium), more than ten times expectations, to an in-room bidder. There was also an exceptional result for a small-scale René Magritte apple painting, selling for £16.1 million (premium) against an estimate of £5-7 million, which is now the third highest price for a work by the artist at auction.

Sotheby’s reached a top price for an unusual work by August Strindberg, selling for £6.8 million (premium) against a £3 million high estimate, it was a new record for any Swedish work of art. Gerhard Richter’s Study for Clouds (1970) also received healthy room bidding by Francis Outred and Gabriela Palmieri before it eventually sold to Lisa Dennison’s phone client for £11.2 million (premium) against an estimate of £6-8 million.

Several new auction records occurred over the week. Christie’s reached a record with Barbara Hepworth, the sculpture Hollow Form with White Interior (1963) sold for £5.8 million (premium). Frank Auerbach’s Portrait of Gerda Boehm, previously acquired at the David Bowie sale, also made a new record at Sotheby’s at £4.1 million (premium), as well as rare-to-market work by the British Pop artist Pauline Boty at £1.16 million (premium).

These results prove there is still resilience in the market. Numerous repeat bidders, including the Monet buyer at Christie’s and a persistent online bidder from Lebanon at Phillips, significantly helped further push results. However, buyers are approaching the sales with more caution and this sense of sobriety will likely continue in the next round of October sales in London. A total of 74% of one Christie’s sale was guaranteed by value; likewise, half of Sotheby’s sales were also guaranteed. This will continue to be a crucial tool to help ensure stability in the coming months. With such strong results for young artists over the past two years, the economic uncertainties might encourage a return in interest to previous art market stalwarts whose works have received less attention in previous sale cycles.

FURTHER READING

- New York Spring 2022 Auction Round Up

- London March 2022 Auctions Round Up

- Spring Art Market Recap 2022

THE SCOOP #5 – JULY 8, 2022

In the 5th edition of The Scoop, we share the latest on the crypto market meltdown, a recap of NFT NYC, and share an eye for architecture in our latest Artist Spotlight.

CRYPTO MARKETS

CRYPTO COMMENTARY

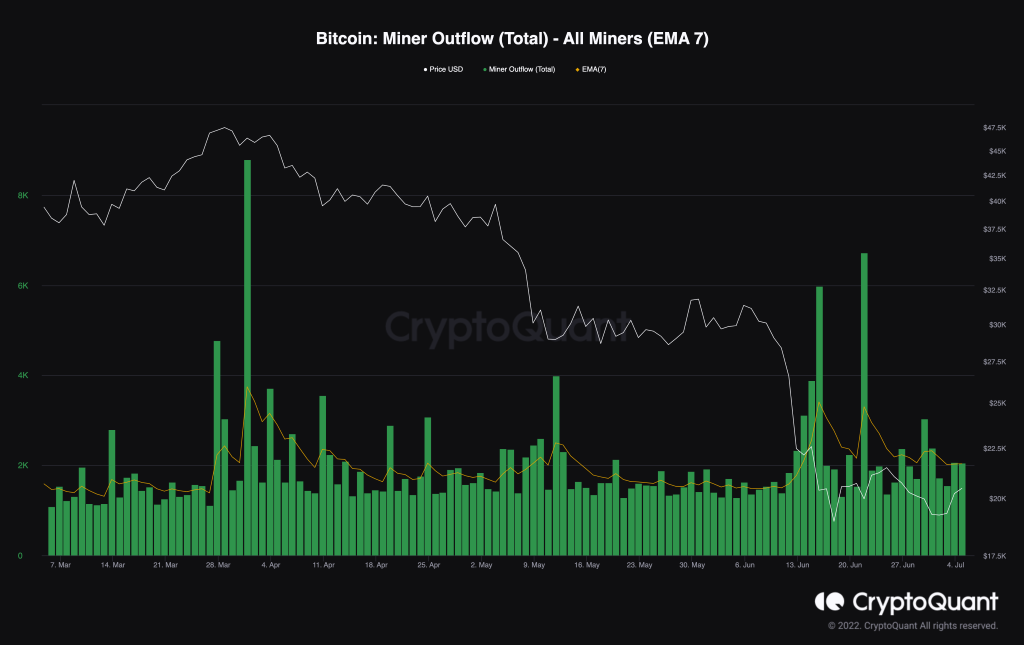

After the recent drop across the broader markets, we have seen the most significant cryptocurrencies level out, with Bitcoin still hanging around its $20,000 support line. The buy-and-sell pressure is in equilibrium, and it appears the market is waiting for a new catalyst before making any moves. What is interesting is looking at miner outflows; a sudden spike in sales from Bitcoin miners to exchanges and OTC markets indicates that miners are bearish. In the last four months, we saw value fall shortly after each time we saw a spike in sales volume. With two recent spikes this month, many technical onlookers are waiting for another drop.

The fallout from the Terra Luna implosion is still lingering. It has been three weeks since Celsius halted withdrawals on its platform, and investors are still stuck. It was in acquisition talks with FTX; however, FTX passed on the deal due to a “$2 billion hole” in the Celsius balance sheet. Celsius has managed to repay some of its debts, while others are still outstanding. More recently, a sign that the contagion may still be spreading, another crypto lender, Vauld, announced it had also halted withdrawals. Rival Nexo had approached Vauld about a possible acquisition, but nothing has materialized yet.

While this isn’t as big as the Terra Luna hole, many insiders expect there to be ripples from this event. Last Friday, crypto hedge fund 3AC (Three Arrows Capital) formally filed for bankruptcy in New York after being forced to liquidate by a court in the British Virgin Islands. By filing for Chapter 15, they can shield their assets from repossession in the U.S.

The Biden administration is working on a stablecoin regulatory package that could be law as soon as Q4. Stablecoins (USDC, Terra) are coins pegged to currencies like the US dollar. The US regulatory package will define how the burgeoning $70 billion markets will operate and how they will be used. In the EU, regulators are looking to make reserves mandatory for these stablecoins, similar to the banking system. The pressure is on regulators to create guardrails for this new industry after the Terra Luna bust harmed many.

WHAT’S THE BUZZ?

Say you love an artist, and you’re not picky. You just want a piece from their newest drop. How much is it going to cost?

FLOOR PRICE

- The Floor Price is the cost of the lowest-priced piece you can purchase in any given collection.

- In PFP projects, the floor usually consists of NFTs with shared traits. NFTs with rare characteristics fetch a higher price.

- For utility collections, where the tokens are generally identical, there are usually more pieces at the same price point, creating a “thick floor.”

- Opportunities arise when high-volume collections have a “thin floor”, meaning there are few pieces at the bottom with a swift rise in price once the lowest have been purchased.

NFT BLUE-CHIP COLLECTIONS

NFT COMMENTARY

The NFT market has been moving sideways for the most part to match the lull in crypto markets. The volume and the overall number of transactions have fallen since NFT NYC. Prices haven’t dipped further, but with such light trading the values don’t have as much support as they usually do. It’s like everyone went to the conference and followed it up with summer vacation, which very well could be the case.

While we aren’t in a crypto winter (yet), it could be said that many in the NFT space are frozen. Similar to the crypto markets, it feels like NFT holders and creators are in a holding pattern. Sometimes no action is the best, but we are still seeing consolidation from riskier projects to safer bets. It also underscores a more significant shift in strategy. Yes, flips are still possible, but they are more dangerous and scarce. People are starting to research before investing in projects because there isn’t as much easy money floating around, and everyone has been ‘rugged’ at least once by this point. The collector space is getting smarter and piling into either historically significant collections like CryptoPunks or seeking utility with VeeFriends or LinksDAO. Art and community still sell projects, but this could be the beginning of a long-term trend where collectors expect more from their NFTs than just .jpegs.

NFT NYC

With 15,000 registered attendees, this year’s conference was the largest yet. Even in a bear market, there was a quiet optimism throughout the week, with many in the space saying it was the perfect time to build. Around 1,500 speakers from the fashion, art, sports, and finance worlds were eager to share their insights. There was something to learn from everyone. The event planners blended these topics efficiently, making jumping from one speaker to another easy. The conference went off without a hitch, other than mile-long registration lines, but the most exciting get-togethers were happening after hours.

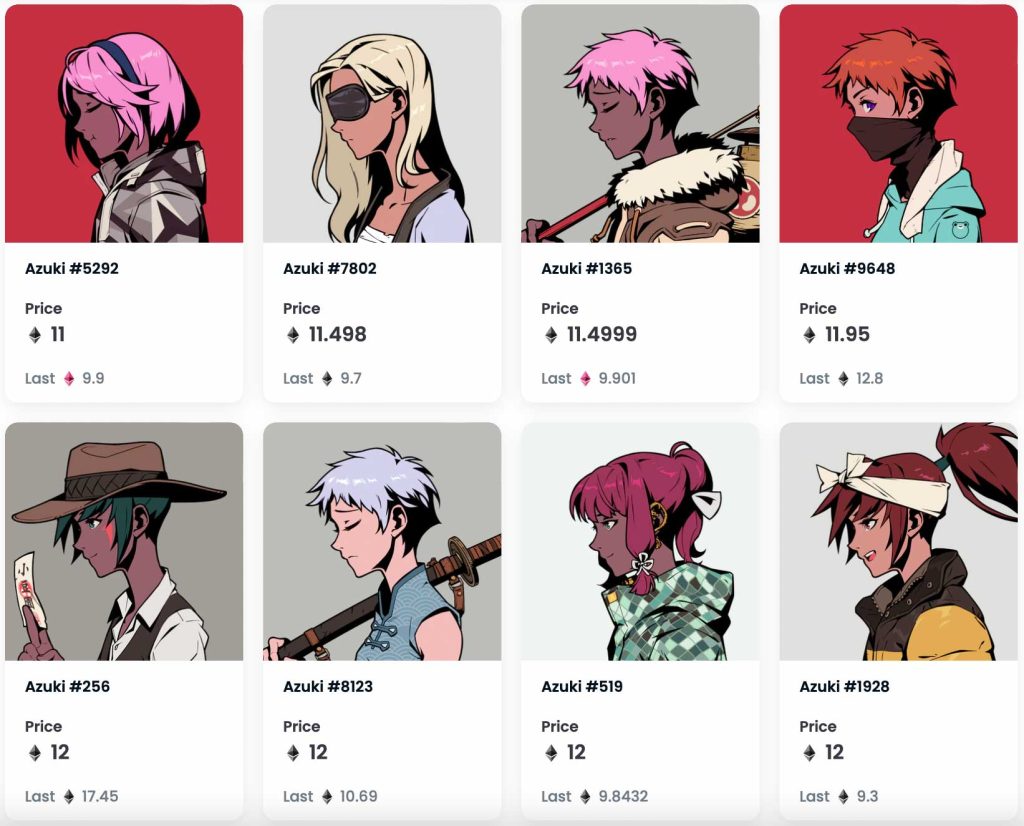

In the PFP world, several large exclusive parties with Doodles, Azuki, and Nifty Portal offered IRL (In Real Life) experiences to their NFT holders. Fewocious offered a paint party for his followers that did not disappoint, but the headliner outside the conference was ApeFest. Several nights at Pier 17 ended with rappers Eminem and Snoop Dogg introducing a new song incorporating their Bored Ape avatars. Yuga Labs (creators of BAYC) showed again that they are cultivating the best community with premier experiences in the PFP spectrum.

There were plenty of galleries to cruise through showcasing fine art. Comp Stomp Studios, led by a group of photographers, set up shop to provide a relaxed gallery experience for the photography community. SuperRare had its pop-up gallery up and running with some of its platform’s best work on display. Time magazine and its Time Pieces NFT collection took over a movie theatre and showcased both creators and their art through interactive artist panels and big-screen showings of curated works. It was the most creative event of the week. Christie’s hosted a reception for its Cartography of the Mind charitable collection benefiting MAPS. It was one of the first high-profile philanthropic auctions with several pieces far outperforming expectations, mixed in with underperformers.

What was clear is that presentation is everything for NFTs. The more innovative, the better. Time Pieces set a new precedent we believe will be duplicated by others. Christie’s put its professional touch on NFTs with its signature clean and contemporary gallery feel. Pace Verso took it a step further and kept its showing to a smaller area in its gallery, giving Jeff Koons’ moon NFT project plenty of room in a high-end display. When Refik Anadol made his big-ticket Casa Batlló sale, the exhibit for that was a master class for the rest. Details like the Anadol piece reacting to where a viewer was standing made a difference. In contrast, many of the pop-up galleries felt rushed; the art was displayed but it seemed the details could have been executed with more care.

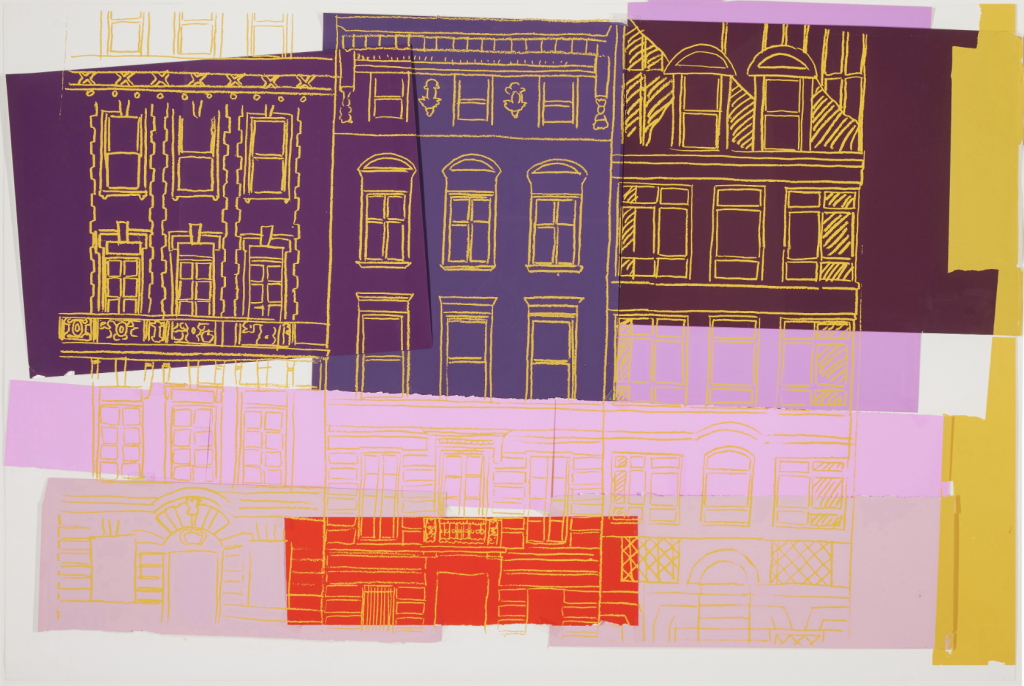

NFT ARTIST SPOTLIGHT

Chris Hytha

Hailing from Philadelphia and the Drexel School of Architecture, Chris Hytha has evolved over his career, experimenting with surreal concepts through Photoshop and documenting the architecture around him with his camera. A master in his craft, he is an expert in taking ordinary subjects and making them extraordinary. After selling photo prints for many years, he set out into the NFT world with a small run of 1/1 art. Encouraged by his initial release selling so well, he created his first collection, Rowhomes, which put him on the map on NFT marketplace platform OpenSea.

For Rowhomes, Hytha photographed dilapidated houses in Philadelphia and applied his eye for architecture to meticulously add details and eerie backdrops to produce his highly sought 100-piece collection. Each drop sold out within minutes, and we’ve seen strong secondary sales from its inception as well.

His newest collection, Highrises, is currently being released in phases, with the second leg dropping just recently. A key piece of his strategy for Highrises was utilizing the Rowhomes collection sales as a whitelist to give his early collectors first dibs on his latest work. The success of that plan showed in the spat of secondary sales of Rowhomes before the Highrises drop. It will be interesting to see where his experiments take him next.

NFT & CRYPTO NEWS

- Big Players soothe crypto doubts at NFT NYC

- NFT Corvette doesn’t sell… twice

- Christie’s brings in $1.6 million with Cartography of the Mind auction

- The biggest Rug Pulls in history

- An AI take on NFT Valuation

- UPenn Auctions their first NFT with Christie’s

- Why Solana is going mobile

- Yuga Labs Otherside Testing

- Global Recession and Crypto Winter?

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

second highest amount secured for a Paraiba at auction

The Fine Art Group was pleased to assist a client in selling their exceptional Paraiba Tourmaline and Diamond Pendant-Necklace. The result was the second highest amount secured for a Paraiba at auction and shows the strength of the market for outstanding specimen stones of rarity.

An Exceptional Paraiba Tourmaline and Diamond Pendant

Estimate: $500,000-$700,000

Realized: $1,197,000

CATALOGUE NOTE

Tourmaline, the most diverse of all gems, has an astonishing range of colors, but none more celebrated than the “electric” Paraiba variety. This type of elbaite is colored by a complex chemical interplay notably involving traces of copper. In rare cases, typically through gentle heating, vivid “neon” green-blues and blues are produced. Many who experience these exotic hues for the first time find it difficult to believe such shocking, vibrant colors are possible in a natural stone.

Discovered in the late 1980s in São José da Batalha in the Brazilian state of Paraíba, this novelty gem was introduced at the 1990 Tucson gem and mineral show. The initial surprise over the unprecedented colors quickly turned into soaring demand and historic values for tourmaline over a short four-day period, cementing a trend that has kept a furious pace ever since. Subsequent exploration yielded small additional Brazilian deposits in the Rio Grande do Norte as well as two African finds, in Nigeria (2001) and later in Mozambique (2005). These mines produced prized Paraiba examples, but it is undeniable that the scarce few exceptional gems mined from the now exhausted original Brazilian sources remain most coveted by connoisseurs.

The present lot is an example of exceptional size and color sourced from the Brazilian finds. Weighing over 10 carats, its vivid saturation and open tone combines a pleasing hint of green to the dominant blue hue. Unlike the vast majority of Brazilian Paraiba which have transparency issues, this stone adds to its distinction with an extraordinary clarity. It is a true gem worthy of the finest collections.

RELATED CONTENT

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

THE SCOOP #4 – JUNE 21ST, 2022

In our 4th edition of The Scoop, we go over the latest crypto and NFT market news and must-attend NFT events this week in New York City.

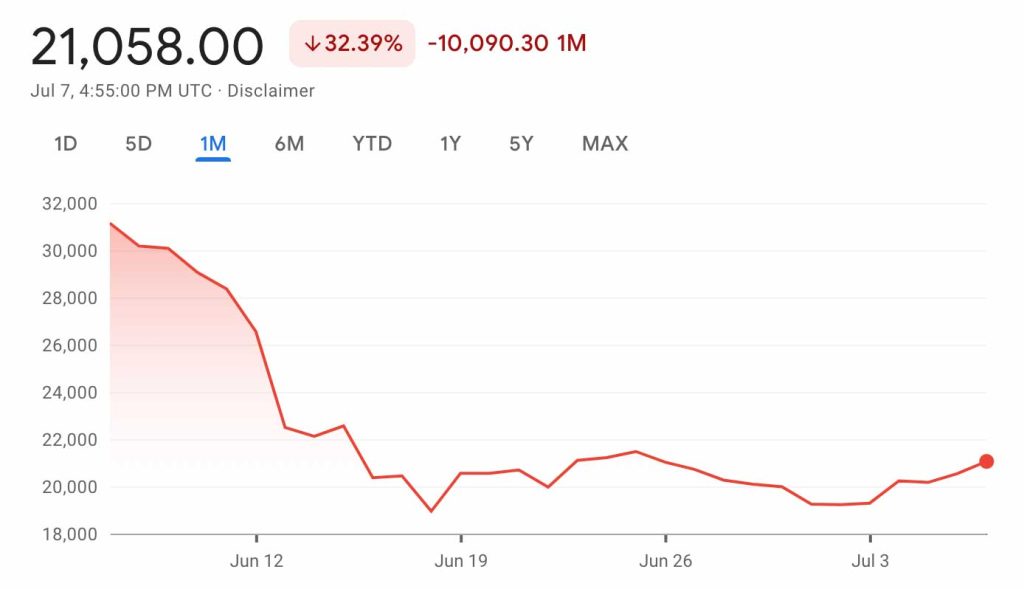

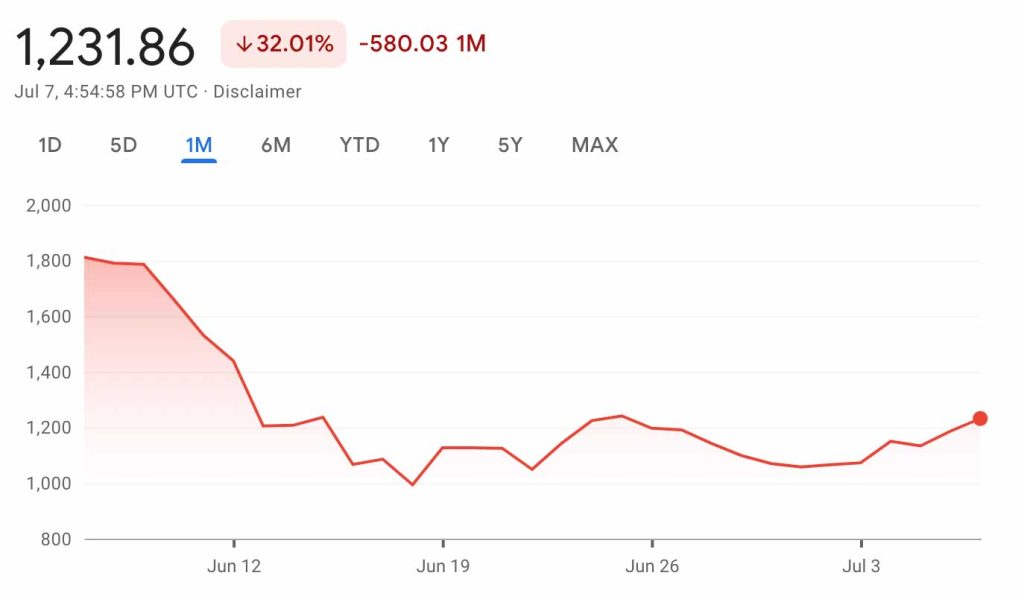

CRYPTO MARKETS

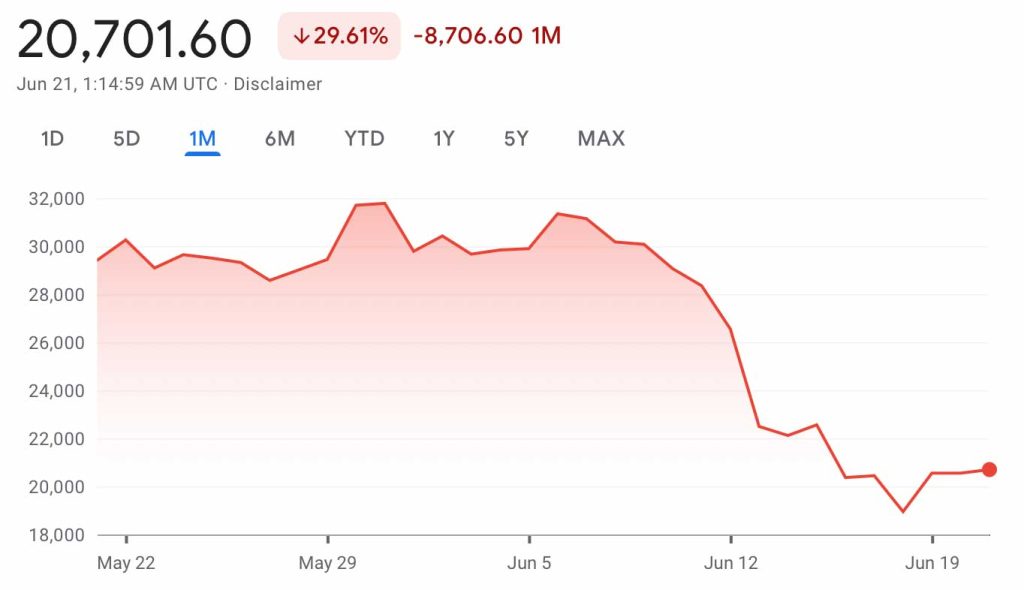

Bitcoin to USD

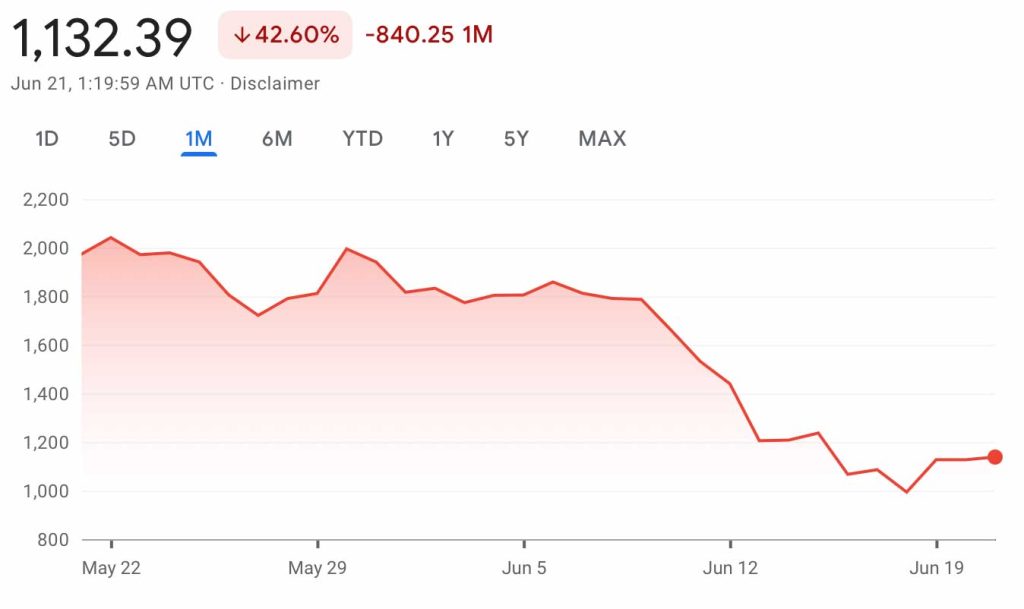

Ethereum to USD

CRYPTO COMMENTARY

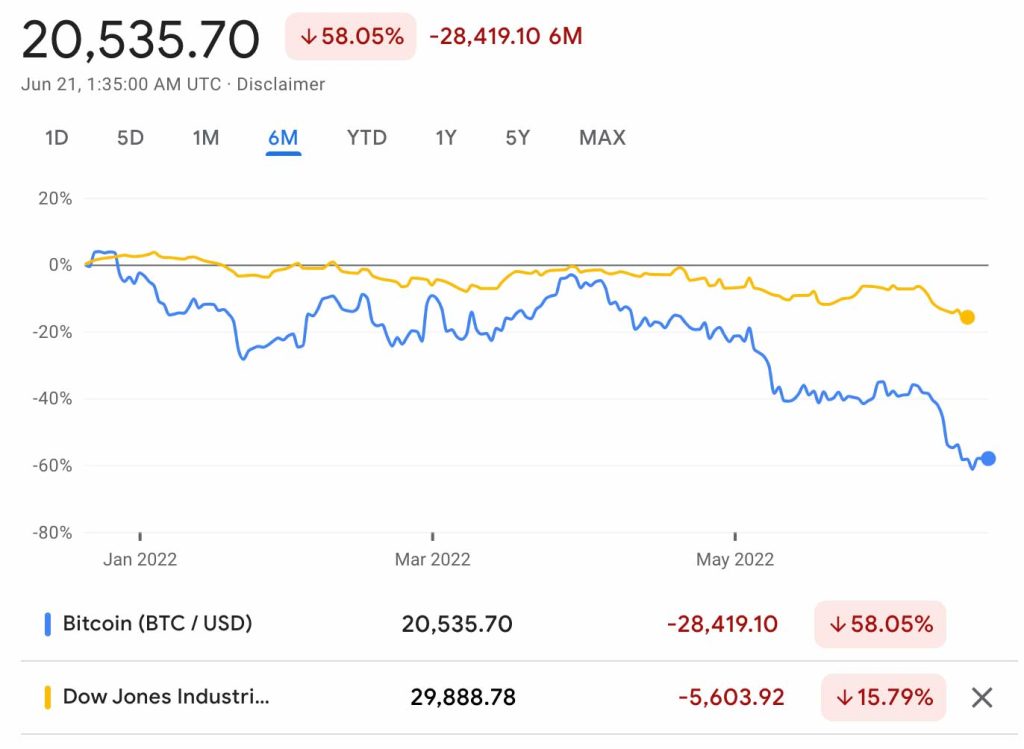

There is red in the charts once again, and it’s hard to tell if the pain is over. Investors continue to be worried about the Fed’s ability to tame inflation without slipping into recession or to achieve a so-called soft landing. While markets initially reacted positively following the Fed’s 75 bp rate increase, the upward movement was quickly reversed, and all major indices fell further. Volatility, as measured by the VIX index, has been persistently above 30, which is more than double the level a year ago, with investors indicating the volatility is here to stay. What is evident is Bitcoin and major stock indices have decoupled after several months of moving in step with each other. With Bitcoin breaking below the key support level of $20,000 on Friday, which was widely speculated to be a bottom, the door is open for an even larger drop. As of the end of last week, the total crypto market cap stood at around $910 billion, down from its high of $3 trillion in November last year.

There has been further carnage in the crypto exchange and lending industries: Celsius, one of the largest lenders in the crypto space, has frozen transactions amid the tumble. It remains to be seen how they are going to navigate this situation. There are rumors Celsius may be insolvent and unable to repay their users, with liquidity issues stemming from staked Ethereum, a derivative of Ethereum that is significantly more sensitive to large selloffs than its base blockchain. 3AC, short for Three Arrows Capital, has also become entangled in this downward spiral. The Dubai based crypto fund has seen liquidations by its lenders of about $400 million after sustaining large losses from the Terra Luna crash. Both firms are hanging in the balance with their moves being closely watched. Their failure could create another ripple in the crypto markets very quickly. Coinbase also announced it was laying off 18% of their workforce, with the CEO stating it was in preparation for a recession and “crypto winter.”

Bitcoin woes have hit outside the crypto world, causing losses for companies in unrelated industries that had invested excess cash in crypto. While Tesla may have reportedly lost about $500 million in its Bitcoin holdings, the loss is manageable for company of its size. The story is more complicated for MicroStrategy, a tech company providing business intelligence, mobile software, and cloud-based services to its clients. Microstrategy has Bitcoin holdings double that of Tesla and purchased much of its holdings on a leveraged basis. Its unrealized losses are more than $1 billion. While facing a potential margin call, Microstrategy’s CEO Michael Saylor is holding strong while predicting a bumpy road ahead. Taylor is tagging his tweets with the infamous #HODL. In the crypto space, this is a typo of the word “hold” that years ago had been adapted as an acronym for “Hold On for Dear Life.” For the current landscape, there is nothing more fitting.

WHAT’S THE BUZZ?

Staking, and everything you need to know about it.

STAKING

- Staking is the way many cryptocurrencies verify their transactions.

- For an investor, staking is a way to use crypto holdings to earn additional rewards, akin to passive income on other financial assets such as interest or dividends.

- Dependent on the cryptocurrency, the validation processes are called proof-of-work or proof-of-stake.

- Each of these validation processes help the network achieve consensus, so that all transactions align.

- Tokens that are staked are locked and cannot be traded.

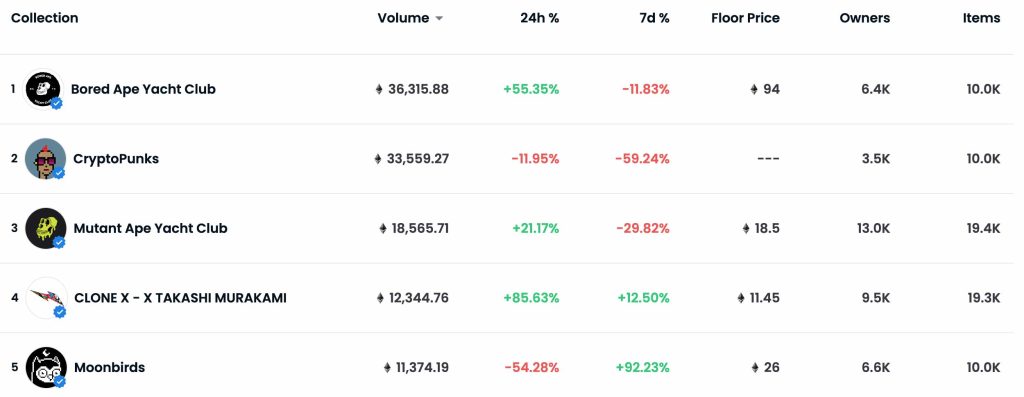

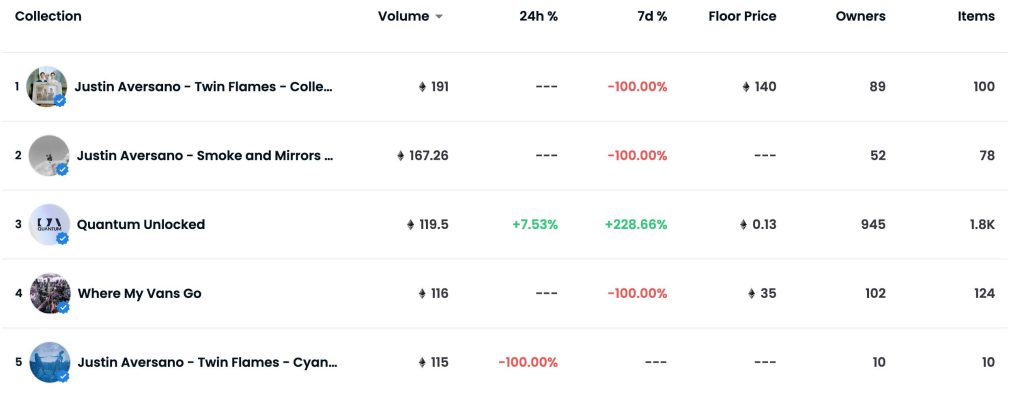

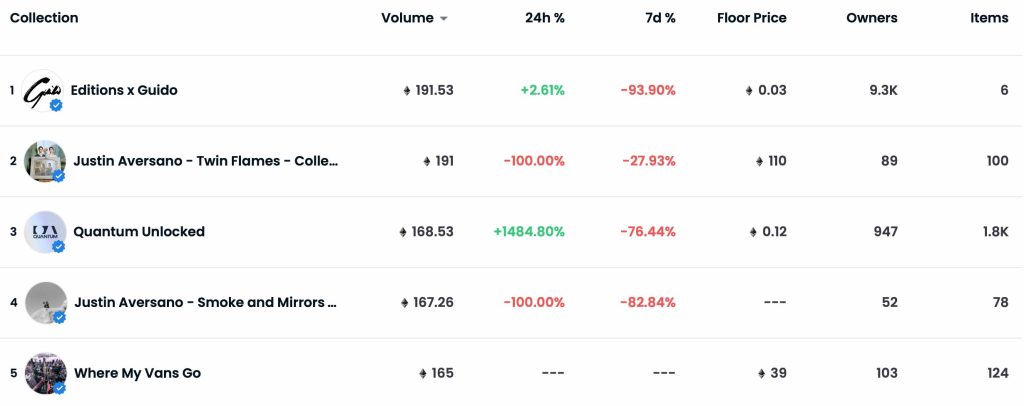

NFT BLUE-CHIP COLLECTIONS

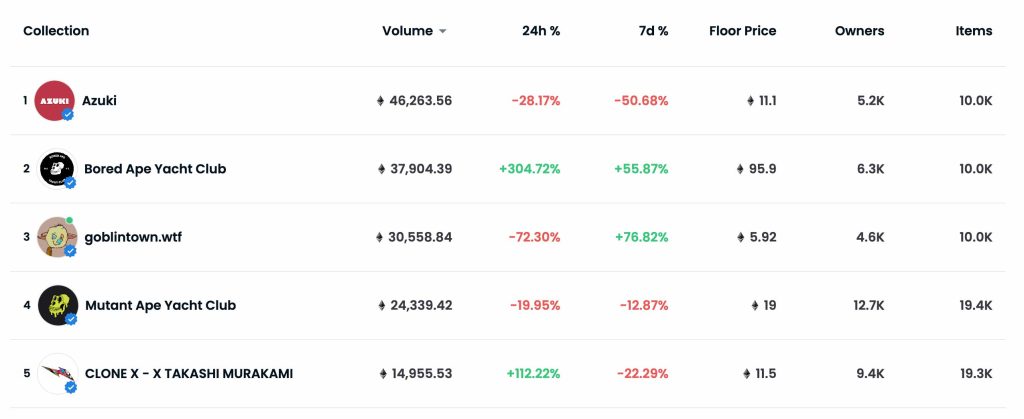

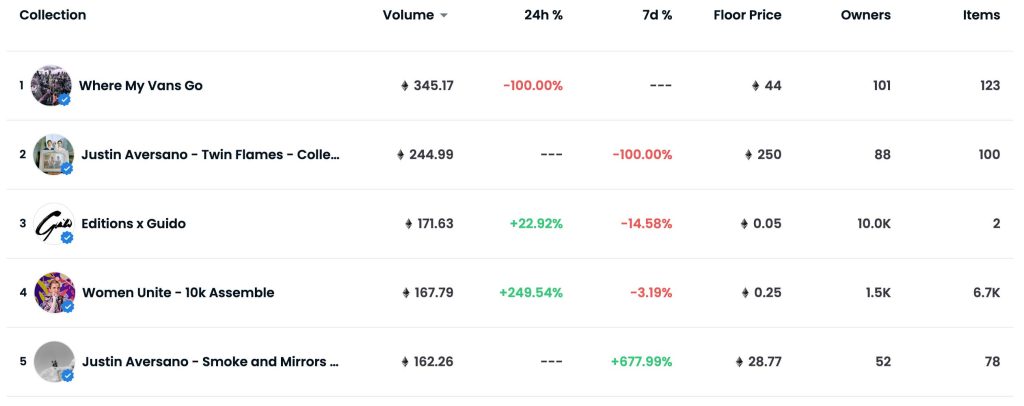

Top 5 Collectible Collections

Top 5 Photography Collections

NFT COMMENTARY

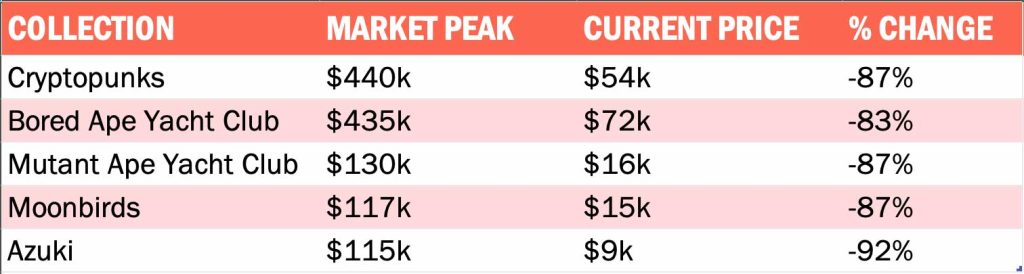

The NFT markets have not been immune to economic turmoil. Many collections have seen their values tumble over the past months. Performance for some of the top collections is summarized below. Obviously, some of these losses are steep, especially with the downturn in Ethereum factored in (down 67% since April 3, 2022).

NFTs seem to thrive on stable blockchain prices, which is not the current landscape. Instead, they are behaving similarly to leveraged assets which are more volatile in nature. This means that when Ethereum goes down the dip is greatly magnified in NFT prices. We’ve seen volume rise in the blue-chip collections like Bored Ape (shown below), which is evidence of the market consolidating behind the safest bets.

Perhaps one of the biggest recent surprises is the rise of free mint NFTs. Free mint NFTs are when there is no cost for the creation of the NFT, but the NFT purchaser must pay gas fees for the blockchain network. Goblintown, a free mint NFT collection, sits at the top of the chart currently and nobody can seem to pinpoint how they’ve gone from zero cost to a 3 Eth floor price, with a peak of over 7 Eth in a bear market with little more than cultural zeitgeist. The pullback in all other assets seems to have pushed the free mint and the community rallied behind it. The art is nothing to show off and there isn’t any utility. While it has created value for many of those that got in for the cost of gas at the beginning, it is hard to have confidence in a project that doesn’t seem to offer much. We’re either seeing a paradigm shift or a flash in the pan. It will be interesting to watch this project unfold.

NFT NYC

There is a plethora of events next week from the NFT NYC conference to Apefest and Christie’s Cartography of the Mind. We’re excited to take part in the largest NFT gathering yet! With pop-ups happening around the city, trying to hit every event seems impossible, but here are a few of the speakers and must attend events we’re excited about.

June 20th

Time Pieces NFT – An NFT collection by Time Magazine is hosting multiple events

- NFTSea: A gallery of curated works from the Time Magazine collection on display and open to the public from 1 – 10PM at iPic Fulton, 11 Fulton Street – One day showing

- Rug Radio/FOTO Gallery Event: A photography focused gallery curated by the Rug Radio Team open to the public from 10AM – 7PM at Superchief Gallery – One day showing

June 21st

NFT NYC Conference – Radio City Music Hall – Hosted by Coinbase (registration required)

- How Best to take NFTs to the Public: Ivan Soto-Wright, MoonPay

- Next-Gen NFTs: Jehan Chu, Kenetic Capital

- NFT Ticketing: Brendan Lynch, Ticketmaster

- The State of NFTs: David Pakman, Coinfund

- The Future of Gaming with NFTs: Ryan Watt, Polygon Studios

- NFT Art for Good: Artist Spotlight with MAPS and Christie’s – Refik Anadol, Sarah Meyohas, Noah Davis, Michah Howard-Dowbak, Ryan Zurrer, and Maciej Kuciara

Christie’s New York

- Cartography of the Mind: The reception for a curated NFT sale to benefit MAPS – Open to the public with an RSVP, 4-7PM at Christie’s – Auction from the the 21st – 28th

June 22nd

Comp Stomp Studios

- Feeling Blue Gallery: Curated by the renowned NFT artist Cath Simard – Open to the public from 8AM – 3PM at 70 Hester Street

NYC Photo Walk

- Hosted by Photer: A walk hosted by some of the best photographers in the business to network over a casual photo stroll – Open to the public starting at 1PM at New York City Hall

June 23rd

NFT NYC Conference – Edison Ballroom (registration required)

- NFT Education for the Mainstream – Sheena Brooks, Kim Merke, Theo Sastre-Garau, David Allan, and Jeremy Fall

- The Technology of Emotion: NFT Experiences are the Future – Arthur Carmazzi

- Hospitality and NFTs – FlyFish Club with Conor Hanlon, Josh Capon, Andrew Wang, and David Rodolitz

- Securing Your Digital Self – Sebastien Badault

NFT ARTIST SPOTLIGHT

Takashi Murakami

As a storied artist with a signature style that has spanned the fine and commercial art space and blurred the lines between low and high art, Murakami hardly needs an introduction. He has been on the traditional art scene since the early 90’s and taken part in many high-profile collaborations. As one of the few established fine artists playing in the NFT space, Murakami appears comfortable moving between the physical and digital art worlds, but this evolution hasn’t come without some painful lessons. After releasing his first collection Murakami.Flowers in April 2021, Murakami almost immediately suspended the sale, citing his lack of understanding the NFT market. There were whispers that his NFT sale was a result of his studios near bankruptcy at the onset of the pandemic.

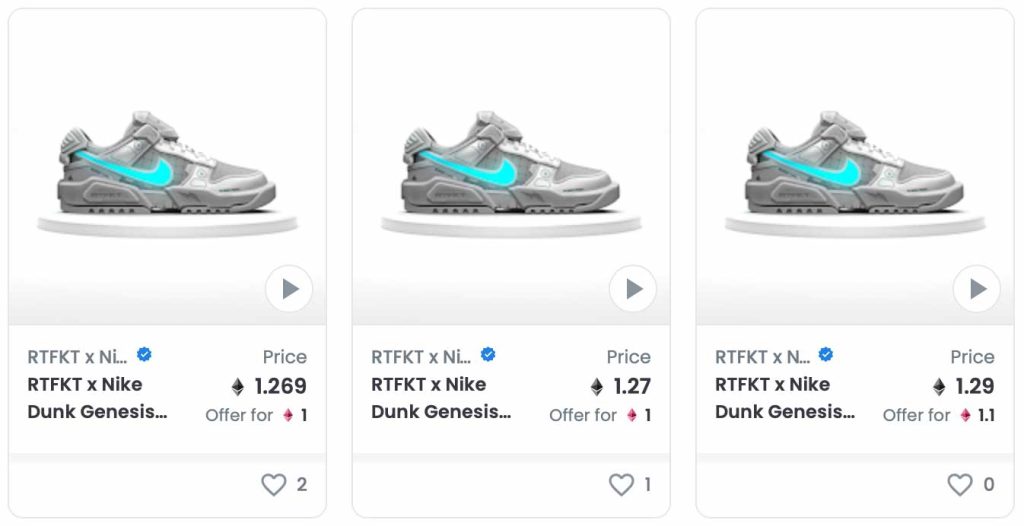

After his initial rough start in the NFT space, in November of 2021 Murakami announced he was partnering with Nike’s RTFKT Studios to create their CloneX Avatars. These avatars are widely seen as a key part of the Metaverse that Nike is building.

Since entering the NFT space, Murakami has stated, “I was reborn.” He is at the center of the Nike ecosystem, and his financial woes should be in the past. In early May, Murakami relaunched Murakami.Flowers as a part of a new exhibition at Gagosian titled An Arrow through History. This new body of work translates the computer generated NFT art for both Murakami.Flowers and CloneX Avatars into handpainted paintings and sculptures. Talk about coming full circle! The show runs through June 25th at both Gagosian Madison Ave spaces.

NFT & CRYPTO NEWS

- Chevy Corvette NFT comes with the car

- Who owns the rights to Old Masters?

- Real estate NFTs are here

- Psyched, Christie’s offers NFT sale with philanthropy in mind

- The Celsius Scenario

- Bill Gates’ take on NFTs

- Mastercard to allow direct NFT Purchases

- Can the art world and NFT world become one?

- LaCoste digs deeper into fashion NFTs

- Marina Abramovic on the Eve of Her First NFT: Web3 Is ‘Undoubtedly the Future’

- Crypto Heavyweights Made Appearances at Art Basel, But NFTs Were Scarce

as Bitcoin Continues Its Plunge - Bipartisan crypto regulatory overhaul would treat most digital assets as commodities under CFTC oversight

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

This year’s Art Basel has been fantastic as ever! The week started off with a bang at our annual dinner at Restaurant Kunsthalle. Our team was thrilled to meet so many new people and connect with old friends once again.

The company was good, but the art was better. This fair was not to be missed!

THE SCOOP #3 – JUNE 6TH, 2022

Welcome to the third edition of The Scoop! Read more for the latest news in crypto regulation, notable art sales, and NFTs and taxes.

CRYPTO MARKETS

Bitcoin to USD

Ethereum to USD

CRYPTO COMMENTARY

Traditional equity markets and crypto have been largely in sync during the recent weeks reacting to a mixed bag of economy statistics and Fed notes indicating consensus for 50 bp rate hikes in June and July. While day-to-day volatility continues, Bitcoin has stabilized around the $30,000 mark in recent days.

Crypto and fintech companies remain under pressure with the Gemini exchange announcing a 10% staff cut, citing a contraction phase in the industry, or “crypto winter,” further compounded by macroeconomic and geopolitical turmoil. This announcement follows upon an earlier earnings miss by competitor Coinbase whose revenues fell by 27% year-on-year. The collapse of terraUSD “stablecoin” (valued at some point at $60 billion) last month is still reverberating through the market. At the same time, Binance, yet another crypto exchange, announced its venture arm raised $500 million for a fund dedicated to investing in Web3 start-ups. This is on top of the new $4.5 billion fund launched by company Andreessen Horowitz for investments in crypto and blockchain companies. The venture capital firm is hoping to capitalize on opportunities during the bear market.

REGULATORY UPDATE

Regulation is clearly a hot topic in the crypto space and we’ve been keeping our eye on several lawsuits filed in the US which may result in a precedent on how cryptocurrencies are classified. Crypto issuers and trading platforms claim tokens are in essence commodities, such as gold, which have no federal regulator. While the SEC has been slow to provide any specific guidance, its enforcement actions have made it clear that many crypto tokens should be listed as securities and exchanges should be registered. To determine whether an asset is a security, regulators and courts apply a four-part test developed in a 1946 Supreme Court ruling over orange groves. Known as The Howey Test, it entails an investment of money in a common enterprise with an expectation of profits derived from the efforts of others. The Howey Test standard will no doubt be challenged in the class action suit filed against Coinbase claiming that 79 of the tokens listed on the platform are unregistered securities. While Coinbase filed a motion to dismiss the case, the recent rout in the cryptocurrency markets will likely not be helpful in their efforts, and we expect the litigation in this space to intensify.

As a further sign that government is stepping up its enforcement efforts in the crypto arena, the Department of Justice has charged a former manager at OpenSea with NFT insider trading. More on this here.

WHAT’S THE BUZZ?

Vitalik Buterin, the creator of the Ethereum network, recently coauthored a white paper that laid out the ground work for possibly the next big thing in Web3: soul bound tokens (SBTs).

SOUL BOUND TOKENS (SBTs)

- As opposed to NFTs which can be bought, sold, and transferred, SBTs are with you forever and cannot be transacted upon.

- They will not replace NFTs, but they will add another use case to the technology already in place.

- A practical example of this concept would be a university granting a diploma to an individual in the form of SBT, residing within a digital incorruptible “resumé wallet” (an on-chain resume is proof of a person’s participation and experience in the crypto community).

- For artists, it’s another lever to pull in the world of customization. SBTs open the door for artists to control who owns their art (e.g. a client or an institution commissioning a piece would not be able to deaccession the work without the artist’s express approval).

NFT BLUE-CHIP COLLECTIONS

The below are considered collections to watch based on overall volume and liquidity over the last 30 days. Click the links to see full lists on OpenSea.

Top 5 Collectible Collections

Top 5 Photography Collections

NFT COMMENTARY

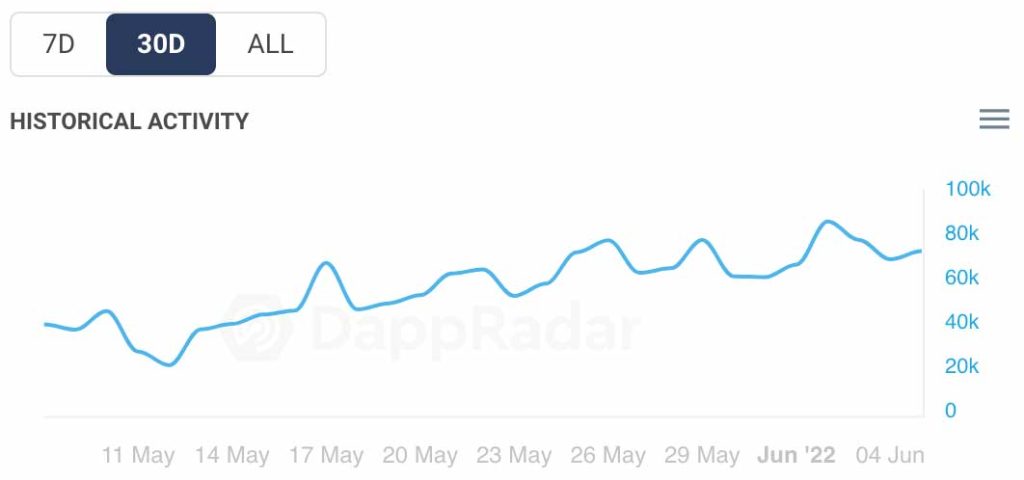

Looking at the top collections we can see the floor prices have dipped for many of the high performers as the crypto and traditional market pullback has finally leaked into the NFT space. These collections initially had some staying power but ultimately could not avoid the gravity of events going on around them. While prices have dipped, the number of daily transactions on OpenSea over the last 30 days has slowly risen showing there is still an appetite from buyers which is positive.

Most recently, a CLONE X – X TAKASHI MURAKAMI by RTFKT NFT was set to be auctioned by Christie’s Hong Kong but with a lack of interested bidders, it went unsold. Seeing a piece get such a cold reception on this big of a stage is uncomfortable, especially when it was the only NFT in the sale. This avatar type PFP (picture for profile) is a rare piece in a collection of 9300 unique characters. While PFP collections have been some of the highest performers in the NFT space, only time will tell how they age compared to 1/1 art.

A high profile purchase by Jim Carrey has many talking. Carrey recently purchased his first NFT and took to Twitter to show it off. The piece Devotion by Ryan Koopmans is a video clip showcasing a Soviet era building being reclaimed by nature, with Carrey noting “this one stops me” in his tweet. The purchase price was 20.0 Eth. ($40,000).

Tax Talk

In our recent meetings with clients, we’ve been getting many questions on how NFT transactions are taxed. Obviously, tax treatment may vary from one jurisdiction to another. Moreover, there is not absolute clarity in this area and every investor should seek professional advice when reporting on related transactions. In the US, the IRS issued guidance on treatment of cryptocurrencies early on and confirmed they should be treated as property. As such, for most investors, any gain or loss on a sale involving cryptocurrency would be treated similarly to other capital assets such as stocks or bonds. However, no formal guidance was provided specifically for NFTs.

If the IRS determines that a particular NFT is “a work of art” and such “a collectible”, any related gain or loss from a sale, among other things, would be subject to a higher maximum capital tax rate than the one set for cryptocurrencies or other financial investments. Since many of the investors use their crypto holdings to purchase NFTs, the tax analysis becomes even more complicated as a purchase of an NFT for cryptocurrency triggers capital gain or loss on the underlying crypto holding. As NFTs come in all shapes and sizes, the debate as to what taxation applies to what kind of NFT will continue until the IRS issues specific guidelines for NFT transactions. We believe clarity on the tax front is critical in attracting new investors to this space and we will certainly be watching any developments very closely and reporting on them when appropriate.

More on this topic from these sources:

NFT ARTIST SPOTLIGHT

Chris Le

Chris Le is the lead designer behind Nike’s NFT Collection and co-founder of RTFKT, a digital assets creative firm. He has been designing digital assets in the gaming spectrum for quite some time through several different ecosystems, building and selling businesses along the way. More recently, his company RTFKT is behind Nike’s launch of CryptoKicks and a collection with Takashi Murakami called Clone X which is currently in the top 5 collections on OpenSea (despite the Christie’s auction not going well).

We recently had the pleasure of interviewing Chris for the Morgan Stanley Esports Conference about what he sees in the future for this space. His grand vision is that 10-15 years from now augmented reality will be a regular part of life, allowing us to interact with both the real and digital worlds seamlessly. There will be more than one metaverse, different ecosystems in the digital cloud, some working with others and some remaining standalone. These virtual worlds will open a new opportunity for businesses and creators alike to build whatever they can dream up within a new digital economy.

Le’s collaboration with Nike started with shoes, but he mentioned that was just the start, and that Le and Nike are developing a metaverse world for people to wear their digital shoes in on their avatars. According to Chris, the Web3 infrastructure for the future is being built now, and we can’t wait to see how his predictions play out.

NFT & CRYPTO NEWS

- Gagosian to accept crypto payments

- Nike sells digital kicks for six figures

- Solana can’t keep up

- Is Free Mint the new norm? Goblintown takes off

- What are institutions buying?

- How the Terra Luna crash happened

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.