Clients of The Fine Art Group and Christie’s came together in Los Angeles to celebrate the spectacular sale Old Masters, New Perspectives: Masterworks from the Alana Collection. Anita Heriot, President of The Fine Art Group, was in attendance. Over cocktails and dinner, guests enjoyed a preview of the collection and had the pleasure of learning more about key works by Fra Angelico, El Greco, and Orazio Gentileschi directly from Christie’s specialists.

The auction will be held Thursday, June 9th. Follow the link to view the collection and register to bid.

Old Masters, New Perspectives: Masterworks from the Alana Collection

The New York May Marquee sales concluded with around $2.5 billion worth of art sold across two weeks. With streams of new auction records and robust sell through rates, the market remains healthy against the backdrop of growing global economic and political uncertainties. There was, however, a sense of restraint compared to the frenzied bidding witnessed in the New York November 2021 sales. Moreover, four major single owner sales accounted for more than a third of these auction totals, proving they remain crucial to boosting volume.

The first of these came at Christie’s with the Ammann Collection, the star lot of which was the Warhol Shot Sage Blue Marilyn (1964). Hammering at $170 million to Larry Gagosian, the work fell short of its unpublished $200 million estimate. With fees, however, it is now the second most expensive artwork sold at auction behind the Salvator Mundi attributed to Leonardo da Vinci. Gagosian further went on to buy two paintings by Cy Twombly for $16.9 million (premium) and $21 million (premium), and a pink Franz West sculpture for $592,200 (premium). Trade bidding was heavy throughout the sale with Iwan Wirth also competing on several lots, as expected for a dealer’s collection. Regardless, the sell through rate of 94% felt particularly strong with no works in the sale guaranteed. It became the second highest single owner sale for Christie’s at $317.8 million.

The second part of the Macklowe Collection at Sotheby’s was also a major contributor for the May sales totals, at $246.1 million (premium). Combined with the results from part one in November 2021, the $922 million (premium) total has become the most expensive single owner sale in auction history, surpassing the Christie’s 2018 Rockefeller sale. Whilst bidding and results were less strong than the first part, this is largely reflective of the content rather than signalling a dramatic market shift, although there was a sense of waning demand compared to the heat of November.

Two more single owner sales at Christie’s from the Impressionist & Modern genres punctuated the fortnight of auctions, including the collection of Fashion retailers Rosalind Gersten Jacobs and Melvin Jacobs. As a primary theme of this year’s Venice Biennale, the sale of this group of remarkable Surrealist works was exceptionally well timed, totalling $42 million (premium) against a pre-sale estimate of $19 – 30 million. The standout result was Man Ray’s Le Violon d’Ingres (1924) which sold for $12.4 million (premium) against an estimate of $5 – 7 million, making a new record for the most expensive photograph sold.

A group works from the Impressionist & Modern Collection of Anne H. Bass, also at Christie’s, saw healthy bidding for major paintings by Monet and Degas, whilst the two Rothko paintings both sold to the guarantor. The mood felt calmer compared to the hyperactivity during the recent Cox Collection auction, however, this is more reflective of the high price point of the lots, totalling $363 million (premium) across just twelve pieces.

The other sales of the week were broadly broken down into what has recently become the three main categories of the market, Impressionist & Modern, 20th Century and then 21st Century or ‘Ultra-Contemporary’. With intensity of bidding scaling up towards the latter genre, which has seen the largest market growth over the last two years. More than half of the lots in these sales were made up of female artists and several records were achieved across all three houses for artists including newly signed Gagosian artist Anna Weyant, Avery Singer, Yayoi Kusama, Simone Leigh, Christina Quarles, Howardina Pindell, Robin F. Williams and Lynne Drexler amongst others.

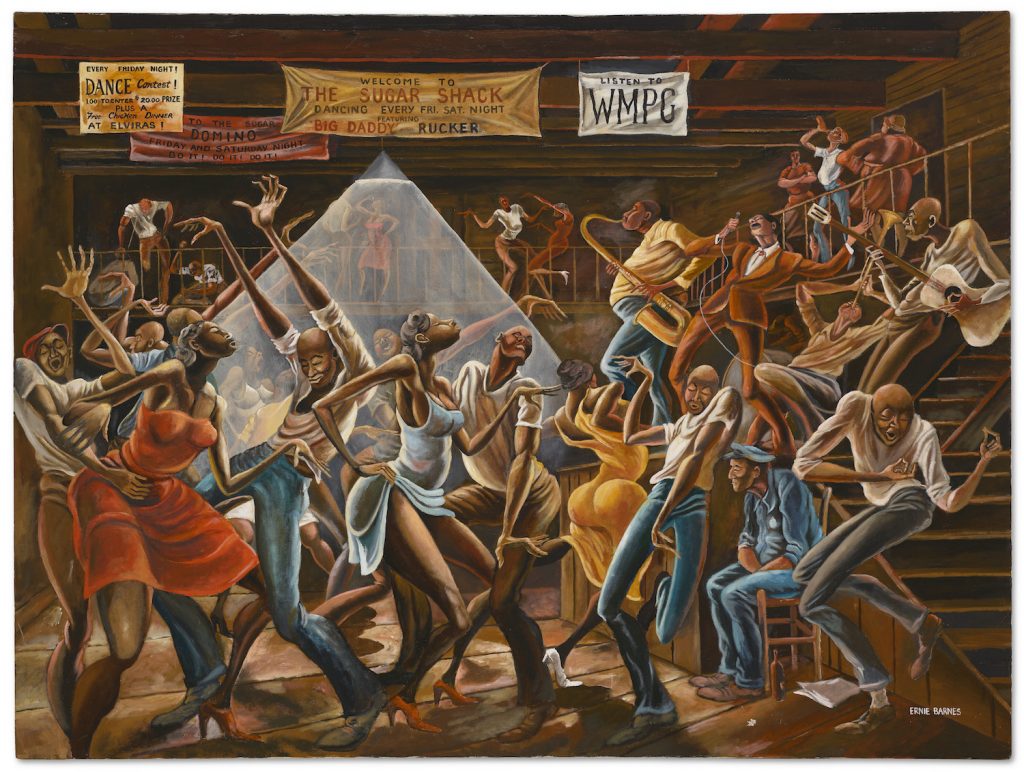

Encouragingly there were also strong results for historically underrepresented artists including a major auction record for Ernie Barnes’s 1976 painting The Sugar Shack. The work performed well over its $150,000 low estimate at Christie’s in New York, selling for $15.3 million (premium) to Bill Perkins. A well-timed statement shortly followed this result, announcing that the estate of Barnes is now represented by two major New York galleries, Andrew Kreps and Ortuzar Projects.

Asian bidding continues to be a key factor which is helping to propel strong sale results, but the latest round of auctions demonstrated that this activity remains most zealous in the 21st Century category, with less attention on more traditional lots.

Phillips, who have pioneered sales in this genre, reached a landmark moment with their highest sale total to date at $225 million (premium). This number was primarily driven by the sale of Yusaku Maezawa’s 1982 Basquiat. Acquired just six years ago from Christie’s for $57.3 million (premium), it sold for $85 million (premium), and is the most expensive work that Phillips has ever sold. The work likely sold to the guarantor as did a number of the top lots this season which were accompanied by bold estimates. This is a distinguishing trait which became apparent throughout the sales; bidding activity is thinning at the trophy level of the market in the current climate.

Regardless, with two fairs, TEFAF and Frieze, also opening during the same fortnight, the robust sell through rates and totals speak to a healthy market able to absorb the significant volume on offer. These were of course hugely supported by the substantial number of single owner sales, which will be vital in achieving similar levels of sales totals during future auction cycles.

The Fine Art Group is honored to bring to market a curated selection from the extraordinary Alana Collection, to be sold at Christie’s New York on June 9th.

Please join us for a panel discussion led by Christie’s specialists Jonquil O’Reilly and Ana Maria Celis and moderated by The Fine Art Group President Anita Heriot. We will take you through the most important lots in the sale and how Old Master Paintings form the bedrock of working practices of every contemporary artist today.

Being one of the most important collections of Italian Old Master Paintings, Sculptures, and Antiquities, The Alana Collection sale will be a once in a lifetime opportunity to acquire museum-quality masterpieces from the Early Modern era. Highlights include extraordinary pieces by some of the most renowned artists of Art History such as Fra Angelico, Orazio Gentileschi, El Greco, Lorenzo Veneziano amongst others.

DATE

- Wednesday, June 1st – 12PM EST

FORMAT

- Live webinar

LENGTH

- 1 hour

*Guests will receive a Webex calendar invite through their registered email

OTHER WAYS TO JOIN

https://fineartgroup.webex.com/fineartgroup/j.php?MTID=me55429aee33be65f0a70ff9e225af44f

Wednesday, June 1, 2022 12:00 pm | 1 hour | Eastern Time (US & Canada)

Meeting number: 2631 718 2962

Password: AzG3FiA5ix4

Join by video system

Dial 26317182962@fineartgroup.webex.com

You can also dial 173.243.2.68 and enter your meeting number.

Join by phone

+1-415-655-0001 US Toll

Access code: 2631 718 2962

FURTHER READING

- The Fine Art Group & Christie’s Bring Old Master Sale to New York

- The Fine Art of Determining Value

- Dinner in Los Angeles with Christie’s

THE SCOOP #2 – May 20th, 2022

Welcome to the second edition of The Scoop! Read more for our take on the latest market fluctuations, recent NFT drops and auction results, and upcoming Web3 industry events in NYC.

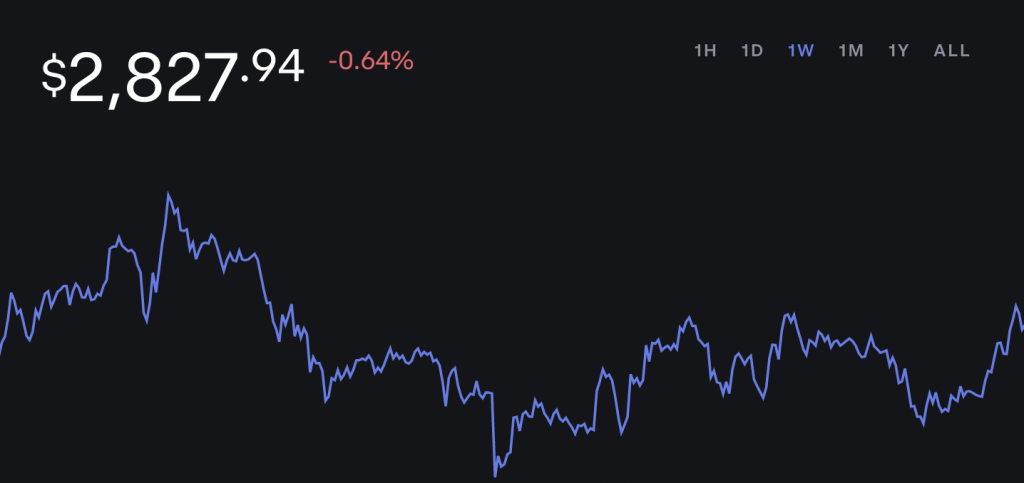

CRYPTO MARKET

Bitcoin to USD

Ethereum to USD

CRYPTO COMMENTARY

We have seen a large flight from risk over the past week with markets down across the board from US equities to crypto and NFTs. The rise in interest rates is one of the core causes, with the Federal Reserve walking a fine line between getting inflation under control and tipping the economy into a recession. Continued volatility can be expected as markets digest the changes in the economic landscape, and it may not snap back quickly.

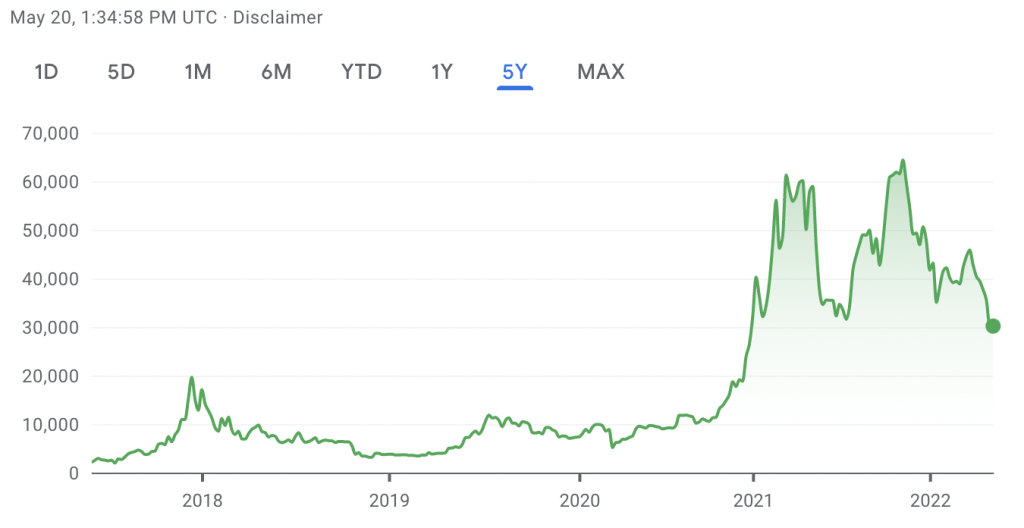

For those that are new to the crypto markets, wild swings in value are par for the course. Investors in this market should get comfortable with this level of volatility. Case in point – Bitcoin:

Looking at the Bitcoin’s roller coaster ride since its inception, one can see the magnitude of the swings has only grown. While its performance exhibits some correlation to traditional financial markets, Bitcoin’s price is primarily linked to its mining algorithm and so called “halving events”. (A Bitcoin halving event occurs when the reward for mining bitcoins is cut in half. This reduces the amount of Bitcoin in circulation, leads to an increase in demand and thus higher pricing.) The halving in July 2016 has produced Bitcoin’s first notable spike which combined with increased awareness in the financial sector propelled Bitcoin from pre-halving price of $647 to just below $20,000 in less than 6 months. And while the pricing has gradually come down over the next year Bitcoin settled at over 5x the pre-halving pricing. We saw a similar pattern during the most recent halving in May 2020 when on the day of the halving Bitcoin closed 634% higher and reached $60,000 for the first time. The next halving is expected sometime in the early 2024. In the meantime, we will be watching how crypto prices evolve with major catalysts being crypto regulation in the US and the geopolitical uncertainty surrounding Ukraine.

WHAT’S THE BUZZ?

We’ve seen a lot of big drops pushing blockchains to their limits recently. High demand in a small amount of time often results in what is called a gas war, our buzz word for this issue.

GAS WAR

- Every time you make a transaction on a blockchain network, there will be a network fee which is commonly referred to as ‘gas’.

- Under normal circumstances gas fees can range from $10-$200 on the Ethereum network.

- In instances of extreme demand where transaction speeds matter, fees can amount to thousands of dollars.

- The gas war comes when many users increase their gas fee to pay for priority in the transactions queue and beat others to the sale.

- Ultimately, those who do not increase their gas will end up paying a gas fee and while receiving the token they were attempting to purchase.

- Planning purchases for when network activity is low can save a significant amount of money in fees.

UPCOMING EVENTS

The Fine Art Group will have team members head to New York city this June from the 20th to the 25th. They will be attending events NFT NYC, an annual industry event, and ETH NY, a hackathon featuring highly talented developers, and speaking to some of the best in the business. If you would like to connect, please reach out to our Digital Assets Specialist, Greg Adams.

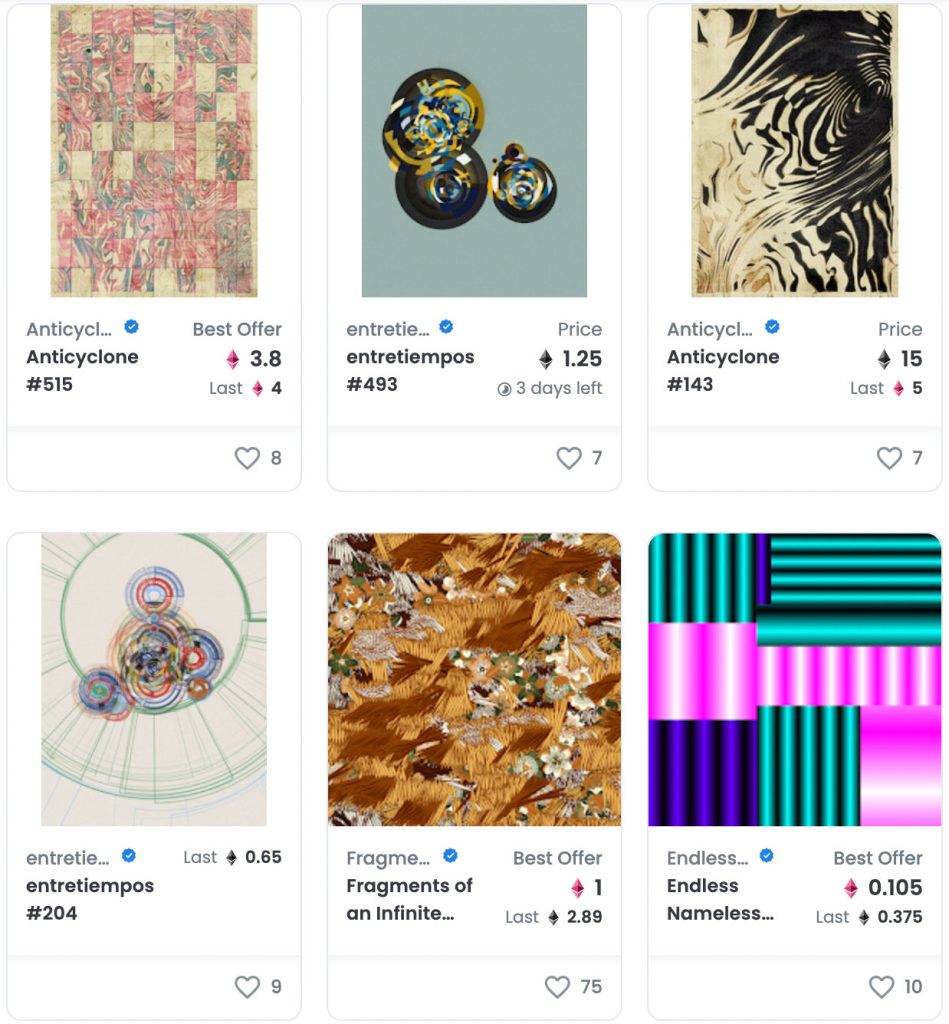

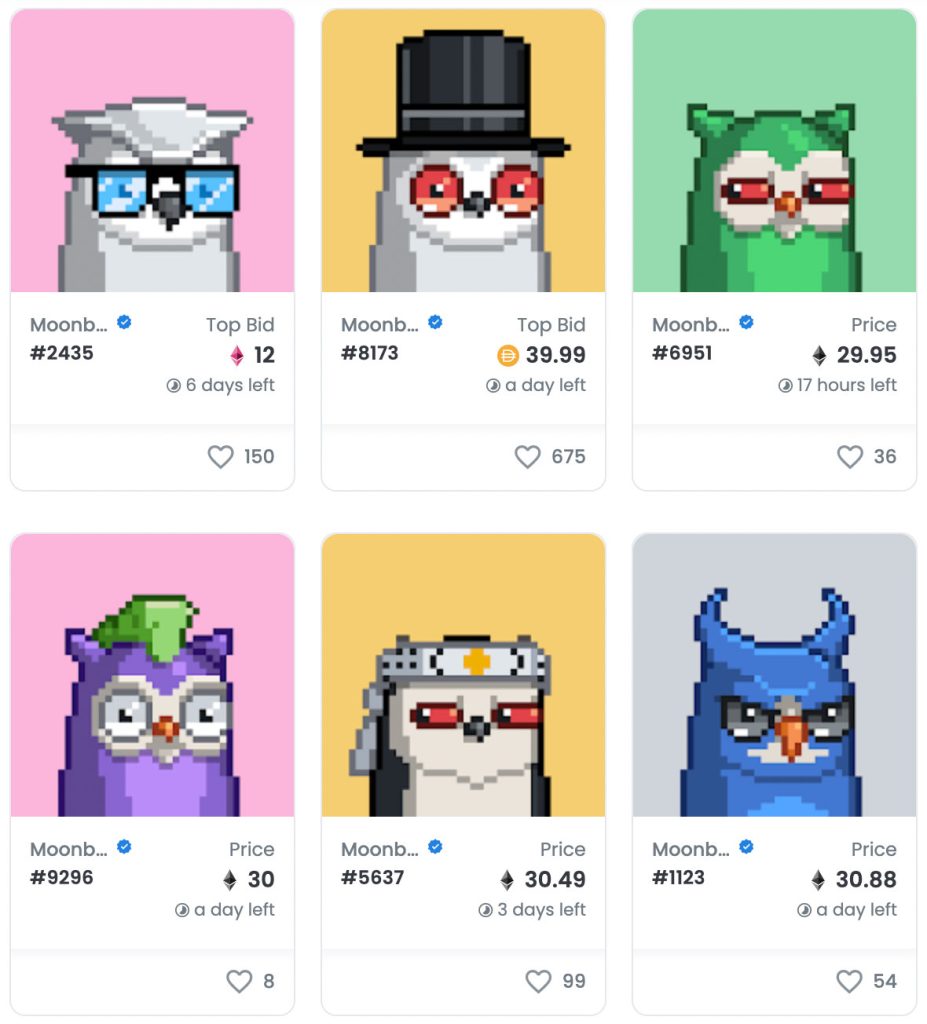

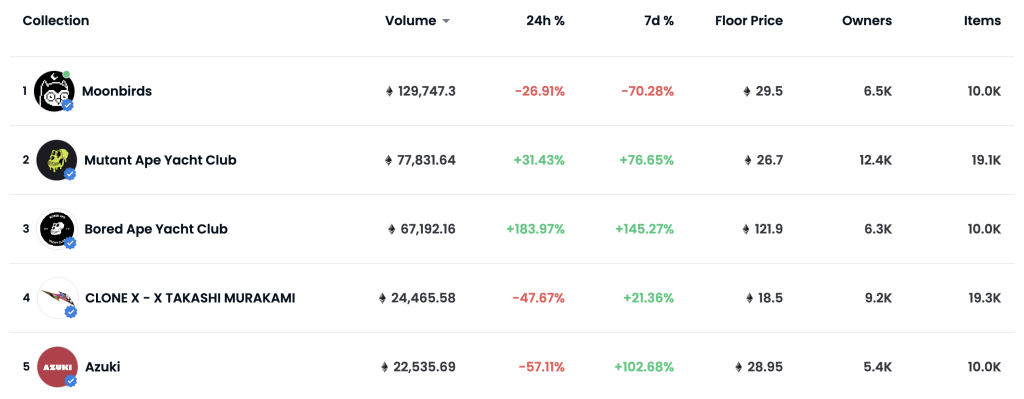

NFT BLUE-CHIP COLLECTIONS

NFT COMMENTARY

From a large sale at Christie’s to Madonna and Beeple’s collaboration, it has been an exciting couple weeks for digital assets. Refik Anadol’s Living Architecture: Casa Batlló sold for $1.38 million in Christie’s 21 Century Evening Sale. It was the only digital offering in the sale alongside pieces from Monet, Picasso, Warhol, and Basquiat. This hallmark sale among elite names brings this new medium further into the spotlight. However, demand was limited, and there had been hope for a larger sale price.

We are still absorbing the complex new work from Madonna and Beeple, Mother of Creation. Their launch on SuperRare was well received with all pieces receiving sizeable bids. Ever since Beeple changed the art world with his $69 million sale of Everydays: The First 5000 Days, collectors have been looking for his next big thing. With the proceeds going to charity, this certainly had a lot of eyes on it, even if it was somewhat uncomfortable to view.

With the recent broader market pullback there are two layers of movement: the underlying Ethereum is lower presently and on top of that we’re seeing a lull in floor prices across many PFP (profile pic) markets. What is interesting is we’re seeing some resilience and even upward movement in the Art Blocks Curated collection and photography space. Editions of 1/1 art is showing itself as possibly a resilient investment during downturns.

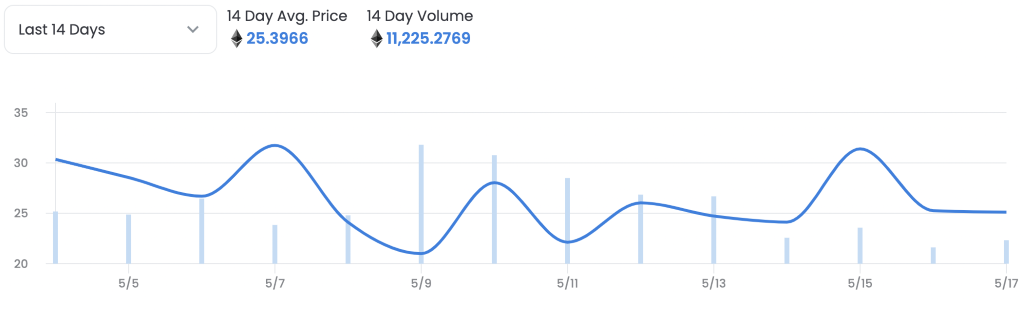

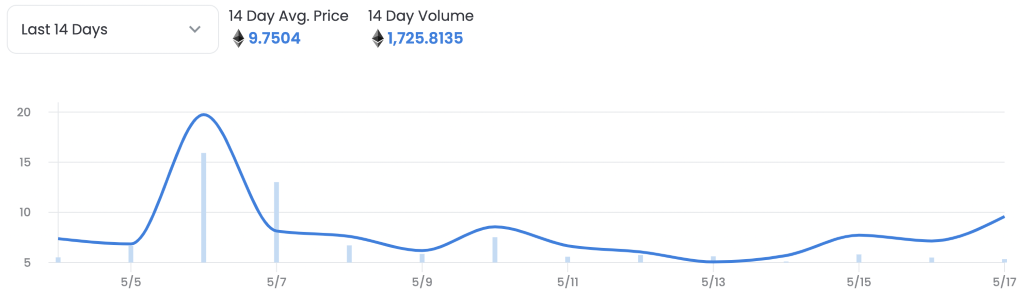

For example, in the Moonbirds NFT collection, the average price was down around 20% over the past two weeks with many transactions and volatility.

In comparison we have Chromie Squiggles, a collection curated by Art Blocks. We saw an initial spike in transactions and value from those exiting riskier positions, but after that there was very little movement. Holders seemed unwilling to sell and ultimately were rewarded for their patience, with a 32% increase in average price.

FRESH & UPCOMING DROPS

While there isn’t much to note with many projects on hold, one that stands out: Following up on its successful Damien Hirst NFT projects, Heni are launching a new edition series by graffiti artist MadC entitled Color Rhythms. The series will feature 1,000 unique NFTs which were created by generative algorithm, but were hand selected by the artist. Another innovative element is the use of machine learning in naming of the individual NFTs – the name of each work is linked by AI to a movie character or another pop culture reference. Moreover, each image is stored on a decentralized storage system, IPFS. This project uses Palm blockchain instead of Ethereum, the main cause being less energy consumption. The application for the series closes on May 24 and each NFT is priced at $1,000.

NFT ARTIST SPOTLIGHT

Cath Simard

If you want adventure, look no further than Cath Simard. From Patagonia to Iceland, she has traveled the globe capturing enthralling landscapes. Simard made her biggest splash in September of 2021 with her #FreeHawaii photo project. She took a picture on the island of Oahu that went viral when she originally shared it online. While the recognition of her photography was valuable, the work also became the most stolen photograph she had ever taken. Instead of chasing down thieves for copyright infringement, Simaud chose to hold a unique and disruptive sale in the NFT space. She sold the photo as an edition of 1/1 NFT for around $300,000 and also notably released the rights to the image and a high-resolution file of it to the public, making it so anyone could use the photograph without paying a licensing fee.

Most recently, Simaud sold her piece Continuum through Sotheby’s in April 2022 for approximately $60,000. She continues her travels in Peru while creating new photographic works.

NFT & CRYPTO NEWS

- Uncomfortable with Beeple & Madonna

- Instagram is incorporating NFTs!

- Solana NFTs come full circle with Okay Bears

- The collapse of TerraLuna

- Crypto Lobbyists are starting to influence Washington

- NFTs changed Takashi Murakami’s life

- Deviantart expands it’s stolen NFT Tracking Service

- Will Spotify be next to market?

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

To celebrate our alliance with Schwartzman& and the opening of our new offices in New York City as well as a kick off of the Spring 2022 auction season, our Executive and Advisory Teams hosted a special cocktail evening.

NYC OFFICE

535 West 22nd Street

4th Floor

New York, NY 10011

STATE OF THE ART MARKET: INSIGHTS INTO THE SPRING 2022 AUCTION SEASON

Our Art Advisory Team gives an overview on the current state of the art market and comment on the Spring 2022 auctions.

FURTHER READING

- Looking Forward: Ten Art Market Predictions for 2023

- Market Update: How the Art Market Joined the Digital Age

- Navigating the Art Market

Our CEO & Founder spoke with The New York Times journalist Robin Pogrebin after the land mark auction, where rare Andy Warhol silk-screen Shot Sage Blue Marilyn was sold for a record breaking $195 million. Although Marilyn fetched an outstanding price, is it against the trend of a disappointing sale?

Click here to find out more and read the article in full.

The Scoop: A Bi-Weekly NFT & Digital Art Newsletter by The Fine Art Group

INTRODUCTION FROM PHILIP HOFFMAN, CEO + FOUNDER

The Fine Art Group’s team has always had a finger on the pulse of the global art market in order to give our clients the highest quality guidance in this dynamic marketplace. Over the last year, we have watched as a new generation of art exploded in front of our eyes in the form of digital art and NFTs. We expect this new medium to alter the landscape of the art world while being an important source of growth and opportunity for many of the market players. To continue to provide best-in-class service, our clients expect us to provide coverage of this growing industry. After much due diligence, The Fine Art Group may gradually incorporate NFTs into all of the services we currently offer.

Just like many of you, I have become overwhelmed at times with the explosion of information coming from this new market segment. With new collections, artists, and platforms popping up every day, the goal of Greg’s newsletter is to cut through the background noise, complexity, and focus on the most critical information and commentary on this space. We plan to provide updates on the most relevant market trends, highlights on projects that deserve our clients’ attention, and briefs on the significant developments in the related worlds of technology, risk management and financial innovation.

Furthermore, we will launch a dedicated section on our website designed to provide education and serve as a resource library for our clients and partners. As this market is evolving rapidly, so will this newsletter, and we appreciate any feedback that will help us serve you better. I look forward to seeing where our new line of business takes us and helping our clients achieve their goals in this rapidly expanding market.

CRYPTO MARKETS

The three blockchains we will be tracking are Bitcoin, Ethereum, and Solana. Bitcoin has been around the longest as a standalone asset and serves as a bellwether for the crypto markets, due to many of the smaller networks following its price movement. Ethereum and Solana are more transaction-based and serve as the backbone of the NFT ecosystem. Ethereum is the gold standard, with Solana being a close second. The majority of NFTs are hosted on these two networks.

Bitcoin to USD

Ethereum to USD

Solana to USD

CRYPTO COMMENTARY

The crypto markets have experienced some volatility over the past week, with many still in the red. We are beginning to see some price movement correlation with traditional equity indexes in the US. In the past they’ve been significantly more independent of one another. Institutional adoption is rising with Fidelity’s recent announcement that they’ll be allowing 401k plan participants to hold Bitcoin in their accounts. However, there is still a question on how the government will regulate cryptocurrencies. There is an expectation that once a decision is made it will be a catalyst for change in valuation, either positive or negative, dependent on the outcome.

WHAT’S THE BUZZ?

This is a new frontier for everyone and we’ll be providing explanations for commonly used terms in the space. We decided to start with cross-chain since there is certainly a lot of chatter around the concept.

CROSS-CHAIN

- NFTs once minted are generally siloed to a single network.

- Cross-chain is when a token can exist on more than one blockchain, for example an NFT that can be transferred from Solana to Ethereum and vice versa.

- The Metaverse will need to be able to interact with many different networks, making this a crucial task for this technology to address.

- Many projects and protocols are working on solutions, the only current fix is using a “wrapped asset”, which essentially puts, for example, a Solana NFT in an Ethereum “envelope”.

- This capability will rely on building bridges between the networks and the existence of a universal key to metaverse (K2M) being built into every token.

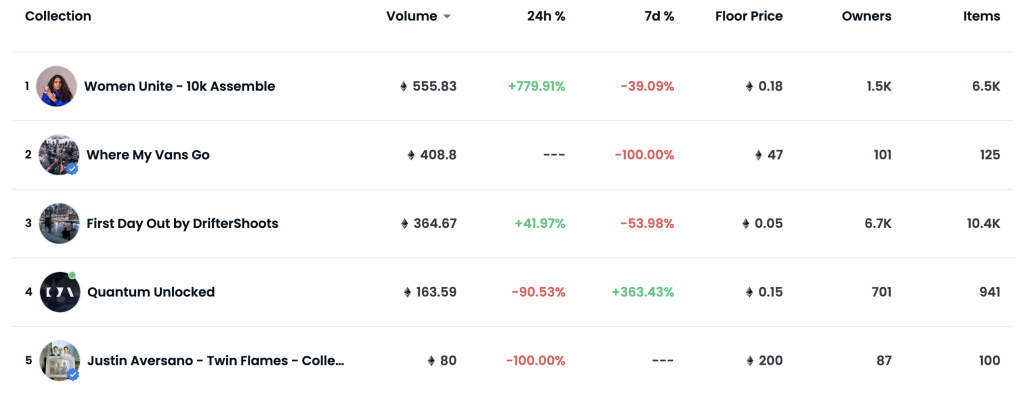

NFT BLUE CHIP COLLECTIONS

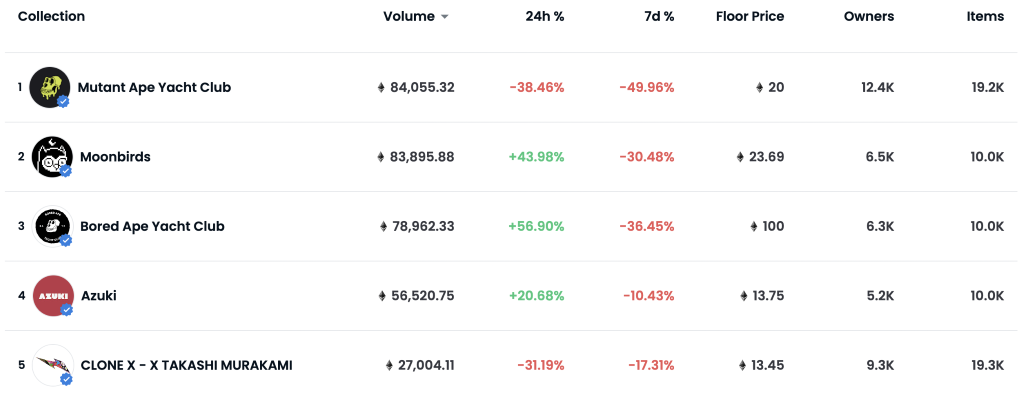

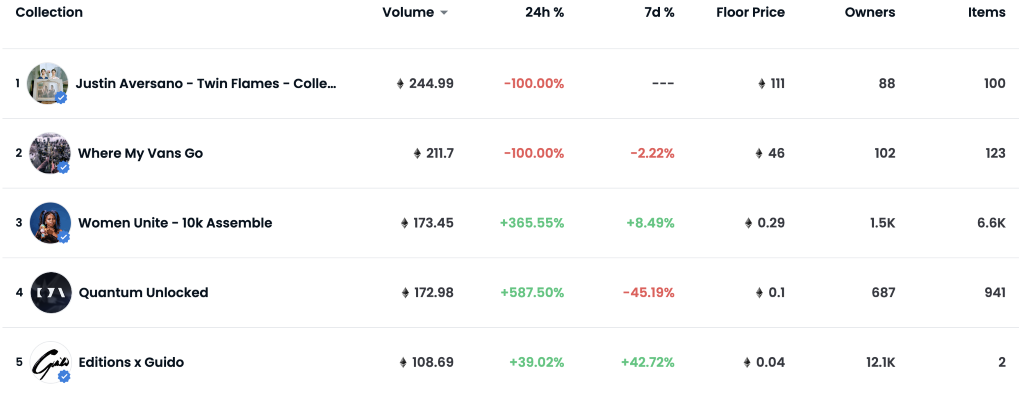

The below are considered collections to watch based on overall volume and liquidity over the last thirty days. Click the links to see full lists on OpenSea.

Top 5 Collectible Collections

Top 5 Photography Collections

NFT COMMENTARY

The Moonbirds collection has absolutely flown during their debut; after minting for 2.5 Eth, their floor now sits at 26 Eth. The main driver is Kevin Rose, following the success of his first project, Proof Collective, many from the tech world were itching for a new opportunity to bet on the savvy entrepreneur.

The Bored Ape Yacht Club Otherside land sale over the weekend became problematic, with gas fees amounting to $150 million. The Ethereum network struggled to keep up with the massive number of transactions and resulted in Yuga Labs netting over $300 million.

There has also been a lot of movement in the Solana NFT space. We will see more of this moving forward, especially since OpenSea, the largest NFT marketplace, has started supporting Solana NFTs. Solana’s gas (transaction fees) and energy consumption are generally much lower, making it attractive for creatives and collectors alike.

NFTs had their largest quarter yet in Q1 of 2022. Over $12 billion in sales were recorded, with more active wallets joining the networks in the last three months than the entire second half of 2021. Many long-term critics have changed their stance to embracing these new markets. Others are proceeding cautiously and with good reason, since a little over a billion dollars in assets have been displaced in hacks and security issues. Security will be paramount moving forward as the space continues to grow. We believe we’ll be seeing new firms specializing in both securing and insuring digital assets.

FRESH & UPCOMING DROPS

- Edward Barber and Jay Osgerby x Galerie Kreo are releasing their first NFT collection together: Signal C4V, which will be available for purchase on OpenSea in early May.

- Daniel Arsham released his new NFT collection on Niftygateway on 4/30.

- With a successful launch of Rowhomes, the architecture focused Chris Hytha is releasing his new collection Highrises.

- Yuga Labs Land Sale went live on 4/30, after a KYC only ApeCoin will be accepted for payment.

NFT ARTIST SPOTLIGHT

Isaac ‘Drift’ Wright

I’ve been following Drift’s story since 2020, and it is easily one of the most moving plot lines in the NFT space yet. After serving in the U.S. Army Special Forces for several years, he came back with ghosts in the form of PTSD. He learned to cope with his condition through urban adventuring and photography. While changing his narrative, he produced some of the most incredible images from the top of skyscrapers around the U.S.. Consequentially, Drift was arrested for trespassing and incarcerated for four months without bond.

He felt the government he served turned on him and used his race and military background against him. Drift was pushed through a system that was biased against him, with many officials saying he’d never make it out of jail. He launched an NFT collection, Where My Vans Go, and used the proceeds to pay his lawyer fees. As his story spread, his collection began to take flight as people were sympathetic to his plight and wanted to help any way they could. To this day, it is one of the bestselling collections on OpenSea, with a floor price of 50 Eth. The icing on the cake was when he auctioned his NFT Whatever it Takes through Sotheby’s for £185,000 over the estimated value. Against all odds, he made it out and continues his journey with photography.

NFT & CRYPTO NEWS

- Two Famed Art World Stars Think Artists Need to ‘Pay Attention to NFTs’

- Gas war burns the Otherside Launch, $157 million in Ethereum burned

- The NFT market by the numbers

- SuperRare opening a gallery in NYC

- $26 Million gas bill for $8.6 million sales – Vayner Sports Pass Mint is a disaster

- Everything you need to know about the Otherside

- Sotheby’s latest Metaverse Auction fetches $1.5 Million in partnership with Liverpool FC

- Jeff Koons’ new collection will literally be out of this world

- Solana NFTs are getting more exposure from OpenSea

- Bored Ape Yacht Club gets hacked, owners phished, some lose their Apes

- How Crypto is shaping Ukraine, it’s more than just currency

- The impact of the Crypto Executive Order, explained

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third party advertising or website does not mean that we endorse that third party’s website, products or services. Your use of a third party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Fine Art Group is pleased to announce Digital Asset Specialist and Advisor Greg Adams is now overseeing our expansion into the Web3 and NFT art market space.

Over the last year, we have watched as a new generation of art exploded in front of our eyes in the form of digital art and NFTs. We expect this new medium to alter the landscape of the art world while being an important source of growth and opportunity for many of the market players. To continue to provide best-in-class service, our clients expect us to provide coverage of this growing industry. After much due diligence, The Fine Art Group may gradually incorporate NFTs into all of the services we currently offer:

Advisory, Art Finance, Sales Agency, Investment & Appraisals

Founded over 20 years ago, The Fine Art Group has established an unrivaled track record across the art ecosystem. From first acquisitions and building collections, through to appraisals and art financing, we offer clients an experienced and skillful hand – helping to navigate the opacities of the market.

Greg Adams is a Digital Asset Specialist and Advisor for The Fine Art Group. Prior to working in the art industry, he worked as a leader in the fintech sector for over a decade while building his portfolio of cryptocurrencies. Greg holds a B.S. in Business marketing and management from The Pennsylvania State University. He is an active member of the NFT community and will be taking The Fine Art Group into the Web3 world.

FURTHER READING

- The Scoop: The Next Generation Collector #14

- Reintroducing The Scoop: The Next Generation Collector #13

- The Scoop: A Bi-Weekly NFT & Digital Art Newsletter #12

ART FAIRS

INDEPENDENT

May 5th – May 8th | Spring Studios

Independent is pleased to announce plans for its 13th year. The fair will return to its former location with new spring dates May 5 – 8, 2022 at Spring Studios in Tribeca. Independent in May will be an opportunity for the fair to expand to its full roster of 65 international leading galleries.

TEFAF

May 6th – May 10th | Park Avenue Armory

TEFAF New York is one singular, annual fair that encapsulates modern and Contemporary Art, Jewelry, Antiques, and Design, featuring around 90 leading exhibitors from around the globe.

FRIEZE

May 18th – May 22nd | The Shed

Following the successful return of Frieze New York in 2021, this year’s fair brings together leading international galleries with some of the most exciting young spaces. More than 65 galleries will participate in this year’s fair, which returns to The Shed.

20th & 21st Century Auctions

CHRISTIE’S

Viewing: May 1st – May 12th | Mon – Sat: 10am – 5pm, Sun: 1pm – 5pm

Auctions: May 9th – May 12th | 20 Rockefeller Plaza

Auction Highlights

The Collection of Thomas and Doris Ammann (20th Century Art, including works by Andy Warhol, Robert Ryman, and Cy Twombly)

The Anne H. Bass Collection (19th and 20th Century Art, including works by Edgar Degas, Claude Monet, and Mark Rothko)

SOTHEBY’S

Viewing: May 6th – May 19th | Mon – Sat: 10am – 5pm, Sun: 1pm – 5pm

Auctions: May 16th – May 20th | 1334 York Avenue

Auction Highlights

The Macklowe Collection (Works by Mark Rothko, Gerhard Richter, Agnes Martin, Jeff Koons, Andy Warhol, Jean Dubuffet, Roy Lichtenstein, and Donald Judd, among others)

PHILLIPS

Viewing: April 30th – May 18th | Mon – Sat: 10am – 6pm, Sun: 12pm – 6pm

Auctions: May 18th – May 19th | 432 Park Avenue

Auction Highlights

20th century and contemporary works by Mark Rothko, Yves Klein, Jean-Michel Basquiat, Carmon Herrera, Jonas Wood, among others