Originally published in RedBook, March 22, 2022

When looking to acquire art works for your new home, there is often one big question: where exactly do I start?

Leading authorities in the field, Guy Jennings and Henry Little, share all you need to know.

1. Are you a decorator, collector or investor?

A key question to consider when acquiring art works for a new home. Most people are a mixture of all three, but it’s important to understand the nuances of each. Decorators might be content with works which lack art historical importance and whose financial value will deteriorate in the long term. Collectors will take a more research driven approach, looking to acquire works which embody an aesthetic position and demonstrate a degree of knowledge about art and the market. While investors might seek medium to long term returns at the expense of art historical merit or developing a personal aesthetic. There’s no reason these priorities should be mutually exclusive, however. With a sufficient degree of knowledge and the right advice, from an art advisor such as The Fine Art Group, it’s entirely plausible to source a group of works which accords beautifully with the architecture, is artistically consequential and will appreciate in value. Prepare to invest time if you want to do more than simply fill walls.

2. Look, listen, read.

There really is no shortcut for learning, whether guided or independent. Visiting major museums will set a yardstick for determining quality in a marketplace which is notoriously cacophonous. Attend the major art fairs. Frieze and Frieze Masters in London or Art Basel can be dizzying at first, but offer an unparalleled view of the market in a compact viewing experience. If time permits, there are long lists of books intended to cater for the time poor and information hungry. Phaidon or Thames and Hudson are great places to start, for example. And there are excellent short reads about the market which elucidate the mechanics at play. We’d recommend Big Bucks: The Explosion of the Art Market in the 21st Century and Dark Side of the Boom: The Excesses of the Art Market in the 21st Century by art market doyenne Georgina Adam. Above all, become visually literate before committing substantial sums of money to an important acquisition. A small amount of effort to understand the market and what’s available will be richly rewarded.

3. Buy what you like, but pay attention.

Within reason, buy what you like and develop your own taste, but take your time to do so. Everyone’s taste evolves. As advisors we’re always thinking about what it would be like to resell an object we buy on behalf of a client if, for whatever reason, they no longer want to live with it. By following a few simple rules, and focusing on those artists who are well known with relatively liquid markets, you can hone and prune a collection as circumstances dictate. Collecting is most gratifying when personal preferences come to the fore, but these impulses should be considered and kept in check by an objective view of the acquisition: could it be immediately resold at cost if I needed to? This becomes especially pertinent when looking at younger artists. The most noise tends to be around those markets in a state of rapid ascension. While involvement might entice potential buyers with large returns, markets in such a rapid state of flux – where works go from selling for tens of thousands to multiple millions in a few short months – are to be avoided, or treated with the utmost caution. When spending significant sums to buy blue chip artists you’re buying into a collective consensus which has staying power for the future. While you may hear anecdotal evidence that casual purchasing can lead to high returns, this is the exception rather than rule, unless working with a specialist advisor like The Fine Art Group. It’s often better to buy a top tier print by an established artist than a unique work by an unknown, for example. Above all, be aware of fads and trends. Many artists might be flavour of the month now, but their market will evaporate in the medium term. Whenever someone recommends an artist or art work, stop and ask: who do they work for? Whose interests are they serving? If you instruct an art advisor you can be sure they are acting in your interests and no-one else’s.

4. Always negotiate.

Art dealers are a charming bunch who will talk you out of negotiating if they can. There are some conventions which dictate discussions about money, but really there are no rules and everything is up for negotiation. When buying work on the primary market – where the work is being sold for the first time by an artist’s representing gallery – the accepted norm is a 10% discount. You might be able to get shipping thrown in if you’re lucky. Pressing for more than this can lead to offence and you might do yourself a disservice, especially if the artist is highly sought after. When working with a living artist the dealer has a duty of care first and foremost to the artist and, in a sense, they are the gallery’s client, not you. When buying on the secondary market – when an object is traded for the second of subsequent time – the dealer typically has no motive other than profit. And they will price aggressively. With the right knowledge and expertise, you might be able to secure discounts up to 40% on the list price of an artwork. The art market thrives on knowledge asymmetry: our job is to make sure our clients know as much as the dealers. The same applies at auction. When preparing bid levels, be disciplined, set clear parameters and avoid losing control in the heat of the moment. No matter how much you love a work, you’ll find something else you love just as much if you look hard and long enough. In our experience there are few works you should overpay for.

5. Don’t ignore the boring stuff.

It can be tempting to brush aside considerations of tax and shipping when chasing a dream work, but these are ignored at your peril. If buying at auction, for instance, you need to consider a raft of additional costs which can quickly rack up including, but not limited to, buyer’s premium, VAT on the buyer’s premium, import VAT, artist’s resale rights, shipping and framing. Do your sums in advance and get an exhaustive picture of what a purchase will cost. Condition is also key. Unless a work is brand new, always ask for detailed condition reports and inspect a work in person. Always ask to see it off the wall or out of the frame. Frames are known to hide all manner of sins which should be avoided. Research, as far as possible, an object’s recent market history: how long has a dealer had the work? How many times has it been exhibited? Has it failed to sell at auction? As a (very) rough rule of thumb, good work shouldn’t hang around for too long. If a dealer’s had a piece for several years, ask yourself: why is that? And be aware that some media will be more vulnerable than others so you’ll need to think very carefully about where they’re hung. Photographs and works on paper, for example, should be kept out of direct sunlight at all costs. And please, whatever you do, pay to have works properly framed by a reputable framer! While this might feel expensive in the short term, the proper use of conservation grade materials is vital. And the right frame will make a work truly sing.

FURTHER READING

- The Intersection of Art & Design

- Why Do You Need to Create a Plan for Art & Collectibles?

- Avoid these Vacation Blunders While Acquiring Art

In partnership with MS Gifts, The Fine Art Group’s Philanthropic Strategy Team assists families with creating legacy by collaborating with philanthropic planning advisors and executing effective sales strategy.

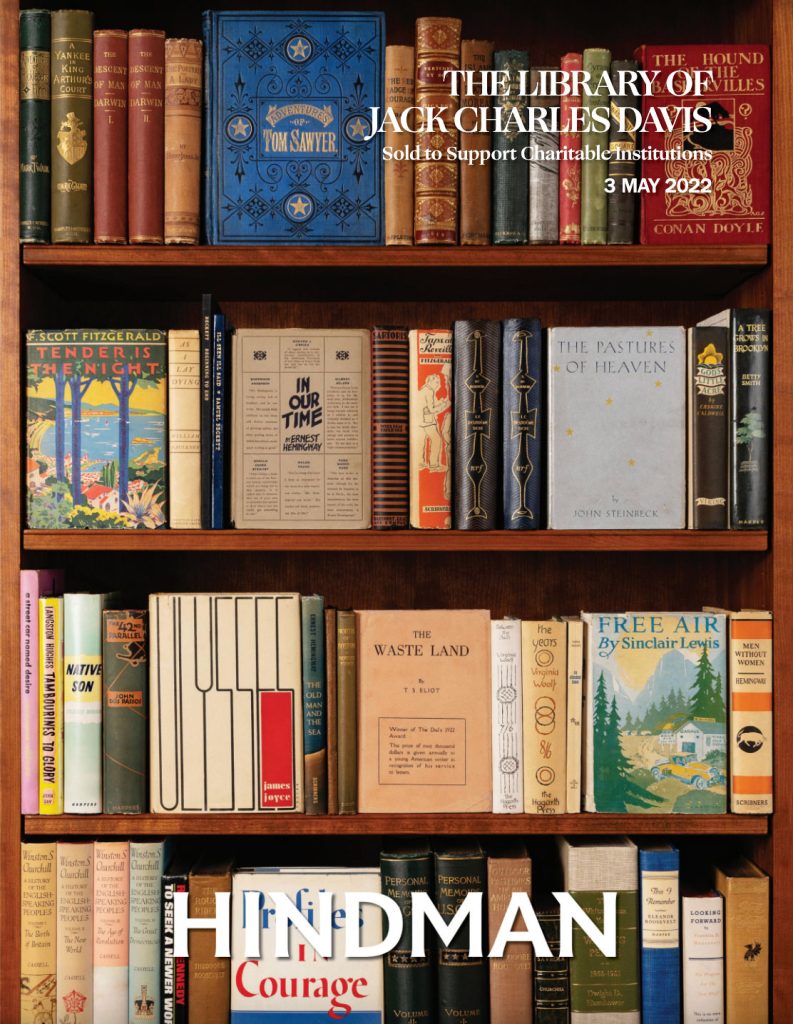

Jack Charles Davis was a prominent attorney and philanthropist dedicated to promoting the economic and community development of his hometown, Lansing, Michigan. He was also a passionate book collector and voracious reader.

After Davis passed in 2020, his family sought to honor his history of charitable work by leveraging his extensive collection of iconic and valuable books and manuscripts.

The Jack Charles Davis collection sale with Hindman auctions includes an extensive library of literature acquired over a lifetime. The proceeds of the sale will benefit several regional charities important to Davis and his family.

Click here to view the collection and to register for bidding.

RELATED CONTENT

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory, Sales Agency, and Philanthropic Strategy teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

MASTERWORKS FROM THE ALANA COLLECTION

The Fine Art Group is delighted to announce Old Masters | New Perspectives: Masterworks from the Alana Collection, to be sold with Christie’s New York on June 9, 2022. This selection is one of the most important collections of Italian Old Master Paintings, Sculptures, and Antiquities to ever be offered at auction.

The Fine Art Group is honored to advise our client, a world-renowned collector and his family, in the sale of this extraordinary group of masterworks, refining the public offering to maximize return through selective curation, sales management and marketing optimization. Assembled with great expertise and passion over decades, the Alana Collection’s Gothic, Italian Renaissance, and Baroque paintings comprehensively tell the history of Italian art and have gained international renown following the acclaimed 2019-2020 exhibition at the Musée Jacquemart-André, Paris. Masterpieces by Fra Angelico, El Greco, Orazio Gentileschi and Lorenzo Monaco will be offered alongside important antiquities, rare sculpture, and spectacular jewelry.

The auction comprises over 50 outstanding works that will be sold in a single owner live auction taking place at Rockefeller Center on June 9, 2022, after completing a global tour alongside Impressionist, Modern, and Post-War highlights to London, Hong Kong, New York, and Los Angeles. Proceeds from the sale will benefit a charitable organization that focuses on arts and education. In total, the sale of these works is expected to fetch $30 million – 50 million.

Please contact our team for opportunities to preview the collection.

GLOBAL TOUR

- London: April 5-8

- Hong Kong: April 20-21

- New York: April 29-May 11

- Los Angeles: May 24-26

PRE-SALE EXHIBITION

- New York: June 3-8

AUCTION DATE

- New York: June 9

Chief Executive Philip Hoffman comments, “In recent years, The Fine Art Group has ably assisted families shape their collections for the next generation, such as the ‘white glove’ sale for prominent Saudi collector Walid Juffali at Bonhams in 2018, as well as assisting distinguished collectors to refine their extensive holdings for their next phase of collecting, such as the extraordinary Maharajas & Mughal Magnificence auction – a collection of $110 million of jewelry sold at Christie’s in 2019. Masterworks from the Alana Collection is a fantastic example of these two streams coming together and my global team and I are delighted to be working on behalf of the family, and alongside the team at Christie’s again, to bring a carefully curated selection of works from the wider collection to market.”

Bonnie Brennan, Christie’s President of Americas, comments, “It is an honor to partner with The Fine Art Group to present this once in a generation collection with some of the finest works of their kind to ever come on the public market. The profound quality and breadth of these works stand as a testament of the supreme care and vision that guided the formation of the Alana Collection. We are especially excited to debut these works alongside 20th and 21st century masterpieces, creating a dialogue across the entirety of history.”

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Image 1: Orazio Gentileschi, The Madonna and Child, courtesy of Christie’s

PRESENT FOCUS: ART FINANCE DEBUNKED

Talking Galleries New York in partnership with Schwartzman& Artand_Media Podcast with Loring Randolph

MONDAY, April 4th, 2022 – 2:30 to 3:45PM EST

Gilder Lehrman Hall at The Morgan Library & Museum, New York

The panel “Focus: Art Finance Debunked” will bring together art experts Jan Prasens, Deputy Chairman of The Fine Art Group, Noah Horowitz, Worldwide Head of Gallery & Private Dealer Services of Sotheby’s, and Suzanne Gyorgy, Managing Director and Head of Citibank Private Art Advisory & Finance, in conversation with Melanie Gerlis of the Financial Times to debate art lending and the use of art as collateral.

Are there opportunities for lending against the inventory of mid-level galleries? How do we expand innovative applications of art lending?

Tickets may be purchased by following this link.

FURTHER READING

- The Asking Price: Understanding Value 1

- Are You a Tangible Asset Fiduciary? Topic #1

- Philip Hoffman and Freya Stewart Named Top Professionals in Art Advisory and Art Finance

Bringing Together the Complementary Skills and Resources of The Fine Art Group and Schwartzman&

New York & London – March 31, 2022:

Allan Schwartzman and Philip Hoffman, principals of Schwartzman& and The Fine Art Group, respectively, today announced plans to collaborate on key business initiatives to provide enhanced advisory services to existing and future clients. By leveraging the complementary skills and resources of their two firms, Allan and Philip will be uniquely positioned to address the needs of an ever changing market for both multigenerational and emerging collectors, in addition to artists and institutions. Specific areas of collaboration will include services ranging from valuations and collection development to investment opportunities and philanthropic giving, among others.

Allan Schwartzman commented, “What may appear as an unlikely alliance is born from mutual respect and shared values. Rather than exist as competitors, Philip and I recognize the unique opportunity that we can create for our clients and the broader market. Philip has spent decades building a specific set of skills and experience that I don’t currently offer in-house. Additionally, given the size and scope of his firm, he engages with a pool of clients that I may not necessarily encounter. Together, we can be a more meaningful resource for our respective clients.”

“As a curator and thought leader, Allan has built a unique space and reputation in the art world,” said Philip Hoffman. “His strategic vision is sought after by some of the most esteemed collectors, artists and institutions in the world. Adding his expertise and experience to even a handful of opportunities, while we each maintain our independence and separate businesses, allows us to do something truly unique in the marketplace. And as our firm has recently expanded our presence in the United States, this alliance with Allan and his team is perfectly timed. We both believe deeply in the future of collecting, and together we have the collective knowledge and resources to address not only today’s market but to help shape the future.”

Over three decades, Allan and Philip have distinguished themselves and built successful businesses serving clients across all aspects of the art world. Beginning his career as a curator and a founding staff member of the New Museum of Contemporary Art in New York, Allan has guided the formation of private and public collections, executed legacy and market development strategies for artists (including estates and foundations), and formulated cultural development plans for civic projects – services now part of his firm, Schwartzman&. Philip began his career in the financial services industry before joining Christie’s and rising to the level of the Deputy CEO of Europe. He then spent 20 years, building his firm, The Fine Art Group, into an international market leader in art investment, art finance and art advisory that operates in six countries.

The idea of a potential collaboration between the two firms gathered steam when Jan Prasens was appointed Deputy Chairman of The Fine Art Group in September 2021. During his more than two decades at Sotheby’s, Jan worked closely with Allan Schwartzman and was eager to explore ways to work together. While the collaboration does not include any financial investment or ownership stake in each other’s firms, The Fine Art Group’s New York-based team will share space with Schwartzman& in their West 22nd Street offices in Chelsea.

ABOUT SCHWARTZMAN&

Headquartered in the Dia Art Foundation building in New York, Schwartzman& offers comprehensive advisory services to the full spectrum of individuals and organizations, private and public, involved in forming, assessing, or rethinking the possibilities of art collections. The team of sixteen brings expertise from all aspects of the art world including galleries, museums, auction houses, artist studios and foundations. As part of an ongoing commitment to foster a dialogue around developments in the rapidly changing world of art, Schwartzman& is pleased to help bring the art world symposium Talking Galleries to New York on April 4 & 5, 2022. The event will bring together museum directors, gallerists, curators, artists, scholars, journalists, non-profit leaders, auction houses and art fair executives to tackle the significant issues facing the art world today. Schwartzman& also recently debuted the podcast Hope & Dread in collaboration with Charlotte Burns. The documentary series examines recent clashes of power in culture with interviews by more than 30 guests, from artists to museum directors, philanthropists to politicians.

ABOUT THE FINE ART GROUP

Recently marking its 20th anniversary, The Fine Art Group is an independent global team of nearly 60 advisors and art finance experts committed to supporting clients across all collector markets through its five core service offerings: Advisory, Art Finance, Sales Agency, Investment, and Appraisals. From asset-secured loans and consignment management to their position as the world’s leading art investment house, The Fine Art Group offers a unique set of services and expertise in today’s art world with locations in London, New York, Los Angeles, Philadelphia, and Dubai. The acquisition of Pall Mall Art Advisors in 2021 brought even greater depth and wider global reach, with in-house expertise now spanning Western Art from 1500 to the present day, as well as fine jewelry, watches and valuable collectibles, and a trusted network of vetted consultants for bespoke category insight.

MEDIA CONTACTS

Schwartzman&: Tommy Napier, tommy.napier@finnpartners.com

The Fine Art Group: Daryl Boling, darylboling@fineartgroup.com

Click here to download the full press release.

Henry Little, Director of Art Advisory, has contributed to Phaidon’s latest book, PRIME: Art’s Next Generation. With ultra-contemporary artists breaking onto the scene with unprecedented force, PRIME is a timely survey of over 100 innovative artists working across the globe.

Henry had the honor of nominating several of these artists as well as providing texts for Harold Ancat, Rachel Maclean, and Loie Hollowell.

Congratulations to Henry for being part of an amazing and insightful book!

Available now from Phaidon and other good book stores.

FURTHER READING

- The Asking Price: Understanding Value 1

- Henry Little: The State of the Art Market at Themerode

- Great Women Artists

Art and collectibles are an alternative asset class that has garnered a lot of interest in recent years. Uncorrelated to the stock market, these investments are attractive to those looking to hedge against crashes and volatility. They’re also more personal than stocks and easier to get passionate about—especially when they’re posting record-breaking returns.

If you were unable to attend our latest roundtable event you may now watch the recording below.

TOPICS DISCUSSED

- Using collections as a diversification tool

- Providing liquidity & cash flow by leveraging collections

- Identifying emerging artists and underrepresented artists

FURTHER READING

- Watch TFG’s New York Luxury Week 2023 Webinar

- Watch How to Utilize Your Collections as a Hedge Against Inflation

- Watch The Educated Eye: How to Navigate a Multi-Category Collection at Auction

Header image credit: Kehinde Wiley, Prince Albert, Prince Consort of Queen Victoria, 2013, courtesy of the Hedy Fischer and Randy Shull art collection

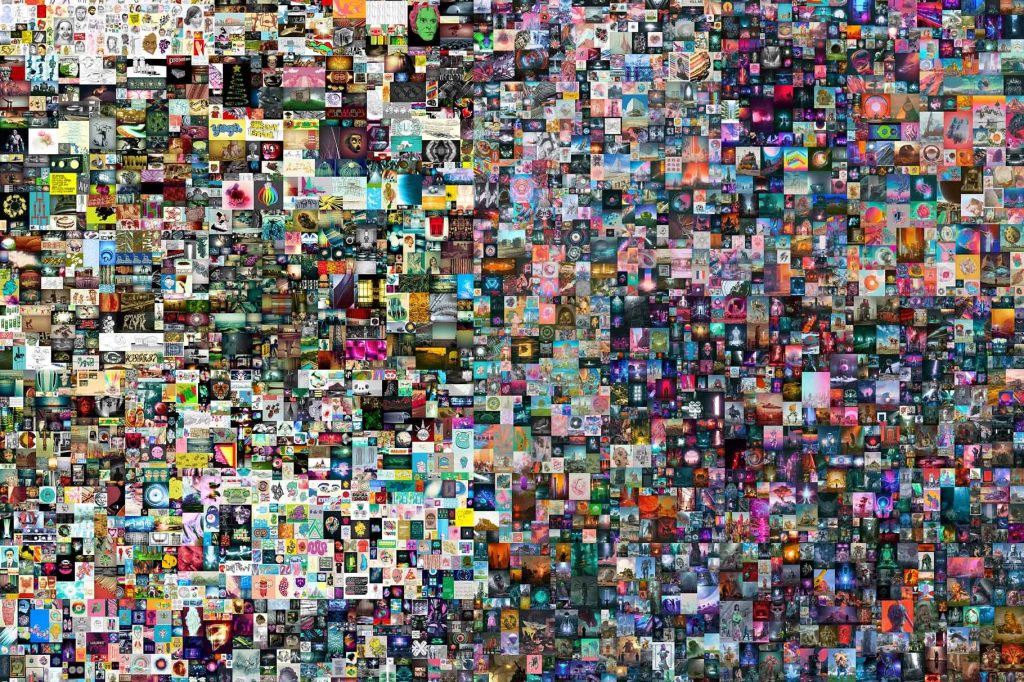

Reflecting on current circumstances, the underlying resilience and adaptability of the occasionally archaic art market has surprised even the most ebullient optimists. Twelve months ago, stringent and interminable lockdowns were in force across the majority of art market centers. Mass vaccine rollouts still lay in the future, museum collections were gathering dust, and most of us had not yet heard of an NFT.

What a difference a year makes. At times the rate of change has felt dizzying. In the same way many of us participated in the pandemic as armchair epidemiologists, the art world at large has become au fait with non-fungible-tokens in their plurality at pace, with widespread adoption across the auction, commercial gallery and museum sectors. Likewise, it seems as though every commercial player in the market ‘big and small’ has embraced digital channels as the primary means of reaching new and existing buyers. Entire swathes of the gallery sector have been busy replacing outdated retrograde websites with flashy new platforms offering e-commerce, video content, online viewing rooms and virtual exhibition tours.

While the digital realm inevitably came to define our collective experience of the market in 2021, art fairs, auctions and exhibitions have increasingly been held ‘IRL’ (in real life), with some semblance of pre-pandemic life emerging in a new guise from the nebulous ruins of the 2019 art market calendar. More than ever, the art market has found itself to be remarkably adaptable.

TEN ART MARKET PREDICTIONS FOR 2022

1. Global auction sales will fall below 2021 results by value.

2. Private sales at the major auction houses will surpass 2021 results.

3. A price correction will manifest in the ultra-contemporary auction category (artists born after 1974).

4. Los Angeles, Seoul and New York will see the largest number of new gallery spaces opening in 2022 (whether for new or existing businesses).

5. Significant disruption will continue in the art fair sector throughout 2022; we may hope and expect that 2023 will be the first full year of uninterrupted scheduling since the onset of the pandemic.

6. NFTs will remain prominent in top tier auction house sales, with major investment in standalone departments destined to take their place alongside the more established departments in terms of revenue, visibility and prestige.

7. NFTs will achieve comparable global auction sales at Christie’s, Sotheby’s and Phillips, without a single auction lot surpassing the result of Beeple’s EVERYDAYS: THE FIRST 5,000 DAYS (2021).

8. Professionals from the traditional fine art market, especially auction houses, will migrate to dedicated NFT businesses.

9. Several high profile NFT start-ups in the fine art market will close as quickly as they opened.

10. One digitally native NFT company will open a permanent physical presence in a major art market hub before the end of the year, aiming to provide some of the experiential, real world trappings of the traditional fine art business.

Image 2: Courtesy of KÖNIG SEOUL; Image 3: Courtesy of Christie’s

“The proportion of Russian (art) buying has diminished since most so-called oligarchs made their collections between 2000 and 2015.”

Senior Director Guy Jennings speaks to Melanie Gerlis at The Financial Times to discuss the impact of the UK government’s decision to ban art exports to Russia on the current art market.

To read the article in full please click here or read on The Financial Times.

The Fine Art Group is pleased to announce Senior Appraiser and Advisor Kimberly Hong is now overseeing their expansion into Denver, Colorado, and the mountain region.

Denver is one of the fastest growing cities in America, increasing its population by over 20% in the last decade. Its beauty is attracting high-net-worth families seeking exceptional quality of life for both primary and secondary residences. As an independent, global team of art advisors and art finance experts, this expansion allows The Fine Art Group’s experienced team to continue guiding clients through all collector markets and our five core services:

Advisory, Art Finance, Sales Agency, Investment & Appraisals

Kimberly Hong will serve as Regional Representative providing access to our experienced team of appraisers and advisors who maintain the highest levels of accessibility, transparency and trust for clients located in Colorado, Idaho, Montana, New Mexico, Utah, and Wyoming.

Founded over 20 years ago, The Fine Art Group has established an unrivaled track record across the art ecosystem. From first acquisitions and building collections, through to appraisals and art financing, we offer clients an experienced and skillful hand – helping to navigate the opacities of the market.

Kimberly Hong is a Senior Appraiser and Advisor for The Fine Art Group. Prior to working in the field of appraisals, she worked in the auction industry as Director of Consignments at Ahlers & Ogletree Auction Gallery in Atlanta, Georgia and as a cataloguer at Jackson’s International Auctioneers and Appraisers in Cedar Falls, Iowa. Kim holds a B.A. in Art History and Communication from Saint Louis University. Hong earned her M.A. in Art History from the University of Oregon. Kimberly is a member of the International Society of Appraisers and serves on their Antiques, Furnishings, and Decorative Arts Committee. She recently earned an Applied Jewelry Professional diploma from the Gemological Institute of America.