The first round of 2022’s marquee evening sales took place in London last week with significant results. Sales totals from all three houses reached just over £400 million ($525 million), above 2019 pre-pandemic levels for the same period.

The ongoing crisis in Ukraine created an understandably strained atmosphere for all houses but the auctions continued with consummate professionalism. Phillips, owned by the Russian company The Mercury Group, especially came under fire, despite having no financial links to any of the sanctions imposed on Russian businesses. In response, Phillips donated all vendor’s commissions and buyer’s premium from their evening sale, totalling £5.8 million ($7.7 million), to the Ukrainian Red Cross Society. Christie’s made an announcement later in the week that they too would make a significant donation to the Red Cross efforts in Ukraine.

The top prices of the week were for Franz Marc’s recently restituted painting The Foxes (Die Füchse) (1913) which sold for a record £42.6 million ($56.8 million) premium. There was also a new record for René Magritte at Sotheby’s; L’empire des lumières (1961) sold for £59.4 million ($79.4 million) premium, almost tripling the artist’s previous record. Both works carried a guarantee, as did most top priced lots in the sales, including Francis Bacon’s Triptych (1986-87), which sold at Christie’s to the guarantor for £38.5 million ($51.2 million) premium. Guarantees accounted for about 64% of the overall sales total across the houses, with the total low estimates of guaranteed lots around £257 million ($337 million). This resulted in £249 million ($327 million) in guaranteed actual sales, signalling how crucial guarantees are in the current business, in terms of winning consignments as well as ensuring a high sell through rates for the overall sales figures.

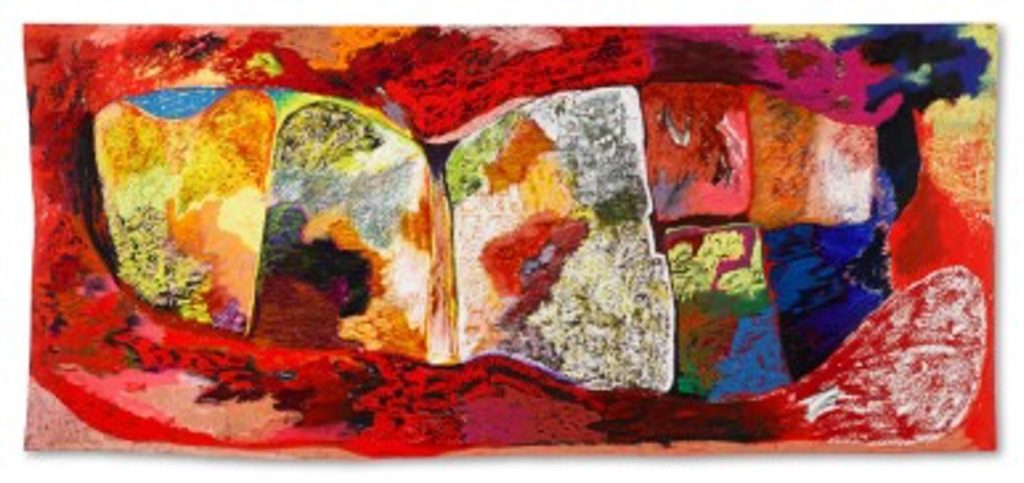

A slew of auction records were achieved for works from the newly coined ‘ultra-contemporary’ category, with new record prices set for Issy Wood, Shara Hughes, Flora Yukhnovich and Hilary Pecis, among others. This became the fastest growing auction category of 2021 and looks set to continue a strong trajectory for 2022. Two sales predominantly offered works from this category: Christie’s Shanghai Evening sale and Sotheby’s New Now Evening sale. 70% and 55% of their lots respectively sold above estimate, compared to around 25-30% in the Modern and Contemporary sales. The result for Rachel Jones who had her debut at Sotheby’s, selling for £617,400 ($828,600) premium against an estimate of just £50,000 – 70,000, felt particularly illustrative of the momentum in this area of the market.

Despite some very strong performances, a few disappointing results indicated that with secondary market supply increasing for some of these ‘hot’ artists, buyers are becoming somewhat selective about the lots they chase, as well as perhaps a waning appetite for the new price levels of these popular names. Amoako Boafo had four works at auction during the week, two of which sold on or below their low estimate. A work by one of the breakout stars of 2021, Salman Toor, was withdrawn from the Christie’s day sale, another in the Phillips day sale sold for one bid above the low estimate. While in no way does this indicate a slowing down of these artist’s markets (the works by Boafo that did sell well are now the second and third highest prices at auction) it suggests increasing selectivity as well as a possible plateau in terms of price points for these names that have on many occasions in the past twelve months far exceeded their estimates.

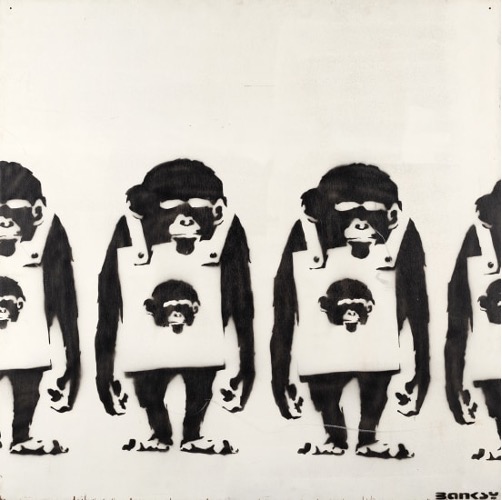

Another noticeable shift was a softening in demand for works by Banksy. With a total of ten works on offer across Phillips, Sotheby’s and Christie’s, at various price points, buyers could be discerning with the works they bid on. Together the works had a presale estimate of £14 – 21 million ($18 – 26 million) and the hammer total was just £7.5 million ($9.8 million). Four top priced pieces either went unsold or were withdrawn, significantly affecting the artist’s sales total for the week.

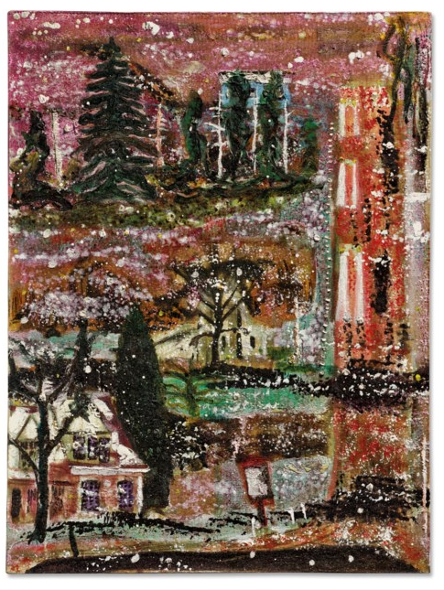

Despite the noticeable contrast in bidding between the ultra-contemporary and post-war and modern categories, this is not reflective of the latter’s slowing market. Their estimates represent very different price points, and, in some instances, several the highly priced lots were accompanied by estimates at the mid to top end of the artist’s market, which accordingly limits the amount of action and live bidding in the room. A number of these lots sold on one or two bids. Works that the market felt were under-priced, for example Peter Doig’s Some Houses on Iron Hill (1992), estimated at £600,000 – 800,000, were chased by buyers, with the work selling for £2.4 million ($3.3 million) premium.

Ultimately, despite the various categories performing at different levels, major auction records were achieved in both the modern and next generation contemporary segments. The exceptional sell through rates of all the auctions, ranging from 88% to 95%, is further testament to the overall strength of the market which proved resilient during a difficult week.

FURTHER READING

- 10 Reasons “Going in Alone” at Auction is a Mistake

- Watch The Educated Eye: How to Navigate a Multi-Category Collection at Auction

- London June 2022 Auction Round Up

The year is off to a busy start as clients seek to release liquidity from their collectible assets with loans from The Fine Art Group. Our flexible and bespoke financing structures, as well as our unrivalled speed of execution, has drawn an increasing number of clients to utilize our financing products, particularly as confidence continues to return to the art market in 2022.

Following is a snapshot of three loans recently funded by The Fine Art Group. Each client came to us with specific financing requirements and we were able to execute each loan efficiently and to the client’s satisfaction:

PURCHASE FINANCING TO AN ESTABLISHED US COLLECTOR

Loan amount: $3 million against 2 Contemporary artworks

- The collector was the winning bidder on 2 artworks at a recent NY evening auction

- The Fine Art Group provided a loan of 50% of the purchase price of the pieces, funding the loan directly to the auction house

- The loan was funded in 3 weeks from the initial enquiry

FINANCING TO A RENOWNED BLUE-CHIP GALLERY

Loan amount: $6 million against 3 Post-War paintings

- The gallery requested a loan to provide additional working capital, supplementing their traditional bank credit lines

- A bespoke loan provided the gallery with the ability to change or add collateral in the future, allowing crucial flexibility, with the collateral held in London and New York.

IMMEDIATE LIQUIDITY USING JEWELRY AS COLLATERAL

Loan amount: $4.5 million against an important jewelry collection

- Th Fine Art Group provided a loan against 9 pieces of jewelry, including a significant diamond, vintage Cartier pieces and a magnificent sapphire and diamond necklace, held in Geneva

- The loan funds were needed for an investment opportunity that required swift action. The Fine Art Group was able to act quickly, providing financing in 2 weeks from the initial enquiry

FURTHER READING

- Freya Stewart Speaks with Artnet News about Art-Backed Loans

- Freya Stewart Quoted in The Art Newspaper about the Rise of Art-Backed Loans

- Artnet Art-Secured Lending Brokerage Program

“That insane market we started to see already in November, a lot of it was a preparation for an increase in inflation, knowing it was coming, preparing for it,” said Anita Heriot, the Fine Art Group’s president of the Americas, referring to the bellwether New York auctions. “People have a lot of liquidity and they need to put it into hard assets.”

Artnet’s Katya Kazakina speaks with Anita Heriot about inflation’s impact on the current art market.

Read the full article here.

“The focus is very much on the best of the best. Clients want the best blue diamond, the best wristwatch, the best impressionist picture, but the second rate is of no interest.” It isn’t, Hoffman says, “a case of digging deep into a particular artist. It’s more about having a well-known and ostentatious collection.”

Bloomberg’s James Tarmy gained valued insight from The Fine Art Group’s Philip Hoffman about the appetite for collecting in Asia.

To read the full article please click here.

Josh Baer of the Baer Faxt + sat down with Philip Hoffman, Founder and CEO of The Fine Art Group, and Anita Heriot, President of The Fine Art Group Americas, to discuss what makes the company unique.

Philip and Anita explain that what initially started, over 20 years ago, as a fund has grown to include five different verticals, allowing The Fine Art Group to provide unmatched services in the art industry.

Hoffman and Heriot speak broadly about the different aspects of the company and highlight specific projects they are currently working on.

See the below video to watch the interview.

Josh Baer sits down with Philip Hoffman, Founder and CEO of the Fine Art Group, and Anita Heriot, President of The Fine Art Group Americas, to discuss what makes their company unique. What initially started as a fund over twenty years ago has grown to include five different verticals allowing The Group to provide unmatched services in the art industry. From speaking broadly about the different aspects of the company to highlighting specific projects they are currently working on, check out the video to learn about working with The Fine Art Group.

FURTHER READING

- The Financial Times Recognizes Philip Hoffman & The Fine Art Group

- Philip Hoffman Quoted in Artnet News About the Sotheby’s Mo Ostin Collection and Modern Evening Auction Results

- Anita Heriot & Tiger21: Collecting Art as a Family

The New York November 2021 auctions saw a staggering $2.3 billion in sales, across two weeks of seven Evening sales and five Day sales, in a triumphant return to market heights not seen since before the pandemic.

Both Christie’s and Sotheby’s offerings were boosted by major single owner sales, The Cox Collection and The Macklowe Collection. Both sales were entirely guaranteed, and indeed irrevocable bids were omnipresent throughout all auctions, accounting for eighty-three percent of the total value of the evening sales, with reportedly stiff competition by third parties to buy out the house guarantees ahead of the sales. Taiwanese collector Pierre Chen, the seller of Peter Doig’s Swamped which set a new record for the artist at Christie’s, was supposedly a major backer of several of the top Macklowe lots, including the Rothko, De Kooning and Richter.

Christie’s, perhaps anticipating potential fatigue from the magnitude of the Macklowe Collection, opted to hold their sales a week earlier. Following their extraordinary results, it appears the strategy paid off. The Cox Collection, a group of twenty-five Impressionist and Post-Impressionist pictures from Texan collector Edwin Lochridge Cox, was a hundred percent sold with their sale total more than doubling the high end of the pre-sale estimate. Bidding was extraordinarily competitive on nearly every work, spanning customers in the room, online, and via specialists in Hong Kong and London. The sale ultimately proved incredibly important in restoring some much-needed confidence to the Impressionist and Modern market. Moreover, the success of low value lots that would traditionally be placed in a day sale, such as those by Gustave Loiseau, spoke to the benefits of marketing objects as part of a single owner sale.

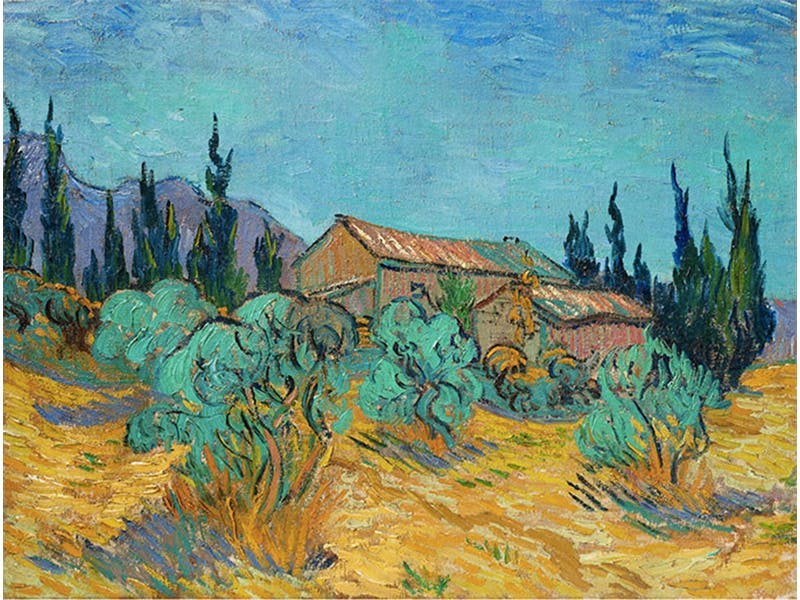

The Macklowe Collection, by contrast, consisted of thirty-five major Post-War and Contemporary works brought about by court order, as part of a bitter divorce between real-estate developer Harry Macklowe and his museum trustee ex-wife Linda. The remainder of the collection will be offered in May but the results of the first half were incredibly strong. The white glove sale, far exceeding the presale low estimate, totalled $676 million (premium) and was the highest total for a single collection in Sotheby’s history. The auction saw new records for Jackson Pollock and Agnes Martin, as well as the result for the highest priced artwork of the November sales. Rothko’s No. 7 (1951), sold for $82.5 million (premium) to an Asian client, the second highest price for the artist at auction. Vincent van Gogh’s, Cabanes de bois parmi les oliviers et cyprès (1889), from the Cox collection, was the second highest price paid over the two weeks, at $71.4 million (premium).

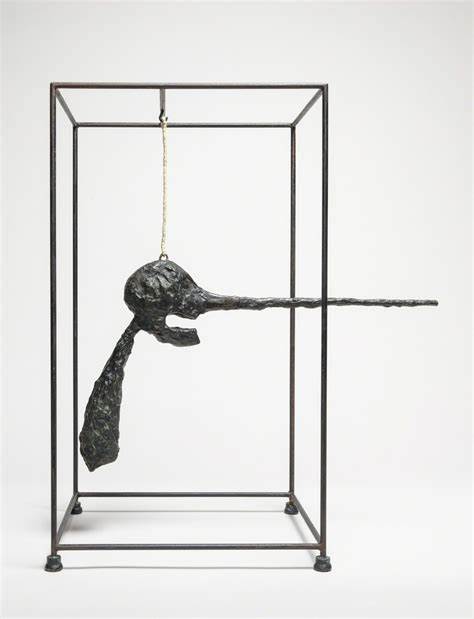

Another key headline from the Macklowe sale was the unexpected buyer of Giacometti’s Le Nez, unveiled as Justin Sun, the Chinese-born, thirty-one-year-old tech billionaire behind Web3 infrastructure company TRON. He plans to donate the sculpture (and two other recent auction acquisitions) to his APENFT Foundation, where it will be tokenized on the blockchain.

Cryptocurrencies and NFTs continued to be a major presence in this round of sales. The NFT recording setting artist Beeple (in a move not seen since Damien Hirst’s primary market sale with Sotheby’s in 2008), created HUMAN ONE specifically for Christie’s, the artist’s first physical artwork (accompanied by a NFT). Christie’s paid the artist a house guarantee for the right to consign the work. Nearly doubling its $15 million estimate, the work sold for $29 million (premium) to crypto Swiss financier Ryan Zurrer.

As part of the ever-shifting sales categories, Sotheby’s offered an additional evening sale entitled ‘The Now’ which focussed on art executed in the last twenty years. This sale marked the first time the auction house accepted bids in cryptocurrency for a live auction, with auctioneer Oliver Barker, navigating between bids in the millions of U.S. dollars (USD) and in thousands of Ether (ETH). That sale saw eleven records for primarily ‘wet paintings’ by artists including Lisa Brice, Maria Nerrio, Toyin Ojih Odutola, Hernan Bas, Stanley Whitney, Christina Quarles, Jordan Casteel, and Lukas Duwenhögger. The feel of ‘The Now’ sale was very much in brand alignment with Phillips who have traditionally shown strength in this area, with Sotheby’s clearly looking to compete for further market share in a category proving increasingly lucrative.

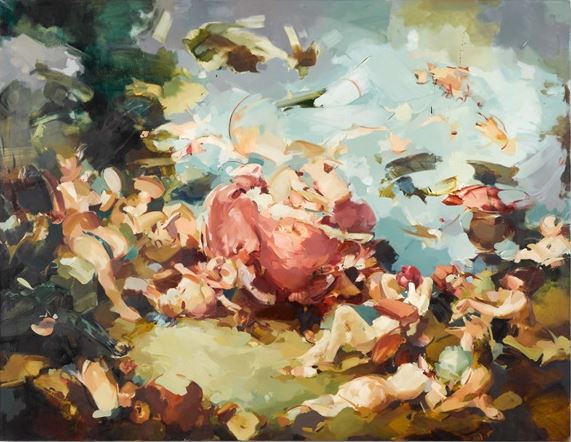

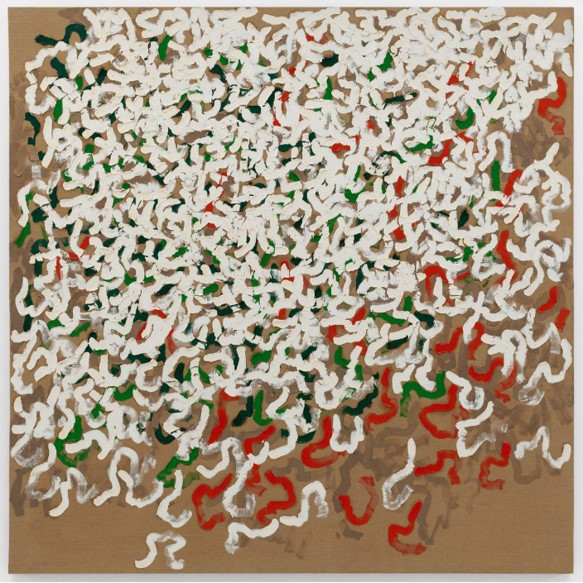

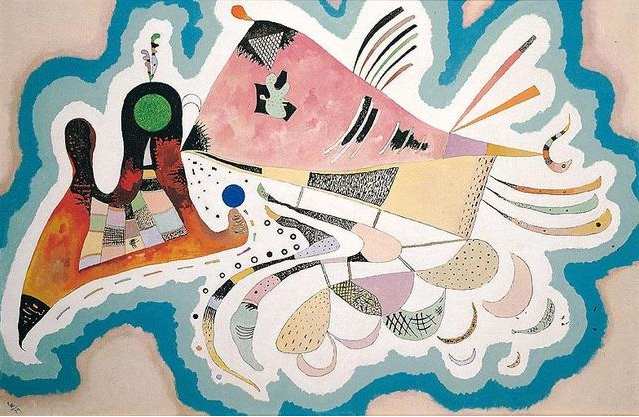

The Phillips evening sale, with similarly hot ultra-contemporary works which have come to define their auctions, saw consistent bidding wars, affording the house their highest evening sale total ever at $139 million (premium). It was perhaps this sale which most accurately encapsulated the character of the art market over the last six months: frothy bidding for young figurative painters and more muted demand for the traditional auction stalwarts. Shara Hughes broke her previous auction record of $1.2 million, made just last month in London, with the sale of Inside Outside (2018) for $1.5 million (premium). Other records were made for Jadé Fadojutimi and Ewa Juszkiewicz. With the only two unsold lots by Willem de Kooning and Wassily Kandinsky. The underwhelming result for their top lot, a Francis Bacon which hammered at $33 million on a single bid, below its $35 million low estimate, appeared to further illustrate the divide.

Other disappointments during the sales included Basquiat’s Made in Japan II which went unsold at Sotheby’s against an estimate of $12 – 18 million. Christie’s also offered a major Basquiat in their 21st Century evening sale: The Guilt of Gold Teeth sold on just one bid to the guarantor for $37 million hammer, below the low estimate of $40 million. Both signs that the Basquiat market is perhaps top heavy following several high-profile results. However, the successful results of the Macklowe and Cox sales served to highlight that the global market is not currently making a choice about genres, it’s simply becoming more selective about traditional artists and the price levels they typically command. When the best examples hit the auction block appetite remains strong, as illustrated by artist records outside the major single owner sales, with new top prices for Pierre Soulages and Frida Kahlo, both from Sotheby’s Modern Evening sale. In conclusion, the November sales marked a very strong end to a year that started off shaky, but these results were deservedly achieved for exceptionally strong material. Had it not been bolstered by two historic single owner collections the week would have likely felt calmer.

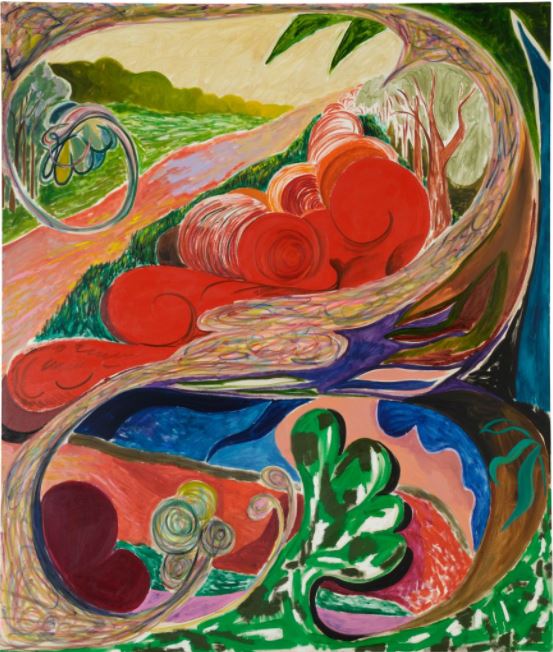

Image 1: Courtesy of Christie’s; Image 2: Courtesy of Sotheby’s; Image 3: Courtesy of Sotheby’s; Image 4: Courtesy of Phillips

FURTHER READING

- New York Spring 2022 Auction Round Up

- Don’t Go It Alone: Let Us Be Your Auction Sale Advocate

- Ten Reasons “Going in Alone” at Auction is a Mistake

This October, Frieze week in London marked the city’s first in person art fair and auctions since 2019, returning some sense of normality to the long-disrupted art world calendar. The week was bolstered by a flurry of exhibition openings, both institutional and commercial, including Frieze’s new exhibition space on Cork Street, the widely lauded flora Anderson show at Thomas Dane and Tate Modern’s turbine hall commission by Anicka-Yi, which further energised the week.

Frieze fair itself, providing the back drop to the week, had a notably more global feel compared to the recent instalment of Basel. A number of high-profile Indian, Bangladeshi and Latin clients were spotted as well as some high-level American collectors, including Jimmy Iovine and Rosa and Carlos de la Cruz. Sales reports were positive and several prominent seven figure sales were reported by dealers and galleries for works by Günther Förg, Kerry James Marshall and Alex Katz, among others.

Punctuating Frieze week were the evening sales, kickstarted by Sotheby’s totalling £55.3 million (hammer) against a presale estimate of £39.1 – 54.2 million, followed by consecutive sales with Christie’s and Phillips held in the afternoon to capture Asian and American bids. Christie’s totalled £54 million (hammer) against a presale estimate of £44.8 – 64.2 million and Phillips totalled £20.5 million (hammer) against the £16.2 – 23.3 million estimate.

The main auction headline of the week was the Banksy record for the previously shredded painting, newly titled Love is in the Bin, for which Sotheby’s were accepting cryptocurrency. Hammering at £16 million (£18.6m premium) to an Asian buyer, it surprisingly did little to help the robustly estimated Balloon Girl diptych at Christie’s the next day which sold on one bid to the guarantor at £2.5 million (hammer).

Also of note was a new auction record for Hurvin Anderson whose works rarely come to market. The work sold at Christie’s for £6.2 million (hammer) to New York based specialist Jennifer Wright after more than ten minutes of bidding. Christie’s also offered their first NFT in a European sale: a collection of three works, one Bored Ape Yacht Club edition and two Mutant Ape Yacht Clubs, which carried an estimate of £800,000 – 1.2 million. The lot hammered on its low estimate selling to Kosta Kantchev, a cofounder of the cryptobank Nexo Finance which has an NFT fund.

Aside from Anderson, the other auction records achieved during the week were primarily reserved for young rising artists whose primary markets remain inaccessible, forcing collectors to the secondary market to compete for access, in turn driving these higher prices. Works by Cinga Samson, Shara Hughes, Serge Attukwei Clottey, Hilary Pecis, Jadé Fadojutimi, Issy Wood, Tunji Adeniyi-Jones, were among those selling significantly in excess of their estimates. Yet with only a handful of works by these artists previously sold at auction, it is easy for new price levels to be achieved. The most talked about in this category was young artist Flora Yukhnovich, graduating from her MA just four years ago, she achieved a new artist record of £1.84 million hammer (£2.3 million with premium), which put her on a similar price level to stalwart artists such as Cy Twombly also in the same sale. Christie’s and Phillips also had works by Yukhnovich which sold for exceptionally high prices, both in excess of £500,000.

Phillips’ evening sale was particularly populated by said artists which no doubt contributed to the success of their sale total against the pre-sale estimate, with works by Polke, Warhol and Milton Avery receiving more measured bidding compared to the frenzy for other artists. In support of this activity throughout the evening sales, another key conclusion from the week was the remarkable success of the day sales, all totalling in excess of their pre-sale estimates, across all auction houses. It continues to indicate the price points at which collectors have the deepest appetite currently, possibly a characteristic of an increasingly younger collector base entering the market, with Sotheby’s noting over a quarter of their evening sale bidders being under forty. Despite bidders predominantly chasing younger artists across the auctions, the main value of the sales remained with artists like Gerhard Richter, Jean-Michel Basquiat, David Hockney, Lucio Fontana and Alexander Calder, whose works have significantly higher price points, just with fewer bidders competing for the lots.

Image 1: Photo by Jack Taylor/Getty Images Image 2: Courtesy of Artnet Image 3: Courtesy of Artnet

FURTHER READING

- The Fine Art Group Art Advisory Team at Frieze LA

- The Asking Price: Understanding Value 1

- What to Hang on Your New Walls: The 5 Golden Rules

Dislocated from the more familiar June spot, Art Basel opened the autumn season in September 2021. After a long period of forced abstinence from art fairs, commercial galleries, collectors and advisers alike are buoyed by the return of such significant large-scale events in person. While the pandemic has hastened a rationalization of the annual fair calendar, with numerous casualties, the Basel Fair brand is set to retain its position at the apex of the art market.

Within the wider context of the past eighteen months, that Art Basel successfully opened at all in September 2021 is a cause to celebrate and a clear milestone along the progression to a post-pandemic art world. As much as attendees might rush to embrace normality and each other once again, there were clear signs we’re not quite back to business as usual. Fair attendance was strong, given the circumstances, with 60,000 attendees, compared to 93,000 in 2019.

Most notable of the absences were American and Asian buyers, a trend likely to continue for some time, with collectors and the associated trade less enthusiastic about crossing continents for fairs, but very happy to travel regionally. Indeed, European and American collectors could only look on jealously in May 2021 when Art Basel, Hong Kong opened, the brand’s first since 2019. In mainland China, fairs had opened as early as November 2020 with Art021 and West Bund in Shanghai, albeit with strict quarantine measures in place. Americans may similarly look forward to Art Basel, Miami Beach, slated to take place in December 2021. This is likely to retain the usual Latin American inflection, but likewise to be thinner on European and Asian collectors.

Despite a decrease in footfall, and a raft of enhanced safety protocols in place, galleries appeared to chalk up a steady stream of transactions. While the more expensive works at the fair – a 40 million USD Basquiat with Van de Weghe and a 26 million USD Robert Ryman with David Zwirner – appeared to go unsold, numerous seven figure works found new homes but the vast majority of sales were under 1 million USD. The highest reported sale being a 1939 Kandinsky, Voisinage, sold by Helly Nahmad for 7 million USD.

Pre-selling, already commonplace before the pandemic, is now vital to a successful fair for galleries. Online Viewing Rooms (OVRs) seem destined to accompany real world events for some time to come (if not indefinitely), as they significantly expand the fair’s reach beyond those known clients who get privileged early access to booth previews or those who can attend in person. Competition remains fiercest for a relatively small number of artists whose markets currently burn white hot. For galleries this can create the decidedly high-quality (but nonetheless highly fraught) problem of deciding which longstanding client or esteemed museum trustee will be allowed to buy new work by such fought over artists as Michael Armitage, Lisa Brice, Lynette Yiadom-Boakye, Cecily Brown, Kerry James-Marshall, Laura Owens or Nicolas Party.

Around town the usual cluster of satellite events took place, with Liste – the fair for bleeding edge contemporary art – among the most important. The scrappy but revered Liste acts as a crucial feeder come proving ground for galleries aspiring to participate in Art Basel’s Statements section which spotlights emerging artists. Since inception twenty-five years ago, Liste has historically taken place at Werkraum Warteck pp, a former brewery roughly fifteen minutes’ walk from the main fair. A labyrinthine post-industrial location, with booths spread across intersecting floors, long, narrow corridors and tight spaces, the pandemic forced a historic and first-time relocation to the Messe Basel Hall 1.1, the same complex as Art Basel. While lacking the innate hipster chic of the fair’s usual location, this relocation into a more typical art fair context – wide open space, high ceilings, white cube booths in a regular layout – was hugely beneficial for visitors. The intentionally ‘rough’ finish of the Werkraum Warteck pp can be unkind to newer art, which is often willfully anti-commercial or ‘provisional’ (unfinished looking). The uniformity of white booths, while perhaps seen by some exhibitors as limited, had the contrary effect (in our view) of formalizing and professionalizing the presentations. Although this move may be temporary, we can’t help but hope it outlasts the pandemic.

Image 1: Courtesy of Jacques Demarthon/AFP via Getty Images; Image 2: Courtesy of David Zwirner; Image 3: Courtesy of Art Basel Karma International 2021; Image 4: Courtesy of Artnet

FURTHER READING

- Henry Little the State of the Art Market at TheMerode

- The Asking Price: Understanding Value 1

- The Asking Price: Understanding Value 2

Part 1 of The Educated Eye: How to Buy & Sell Smart

WEDNESDAY, SEPTEMBER 15, 2021 – 2PM PST / 3PM EST

There are many factors that can influence the value of a Picasso print. So what makes one Picasso print more expensive than another? Whether you are buying new Picasso prints or consigning prints that you own, this presentation will help you better understand the value of these works.

TOPICS DISCUSSED

- What impacts the value of Picasso prints?

- How do you identify an authentic vs. fake Picasso print?

- How should a new collector of Picasso prints begin their collection?

- What are conservation concerns for Picasso prints?

- Is it a good time to sell Picasso prints?

- What other artist prints are a good investment?

EVENT DATE

- Wednesday, September 15th – 12 pm PST / 3 pm EST

EVENT LENGTH

- 30 minutes

FORMAT

- Live interactive webinar

*Image courtesy of Phillips, Pablo Picasso, Minotaure aveugle guidé par Marie-Thérèse au pigeon dans une nuit étoilée (Blind Minotaur Guided Through a Starry Night by Marie-Thérèse with a Dove), plate 97, from La Suite Vollard

About The Fine Art Group

Launched in 2000, The Fine Art Group is a global leader in art and finance with deep market connectivity and a unique position within the art ecosystem. With a proven track record, private collectors and member of the art trade can benefit from in-house legal and finance teams, backed up by a highly experienced group of art and logistics experts, ensuring every art finance transaction is completed efficiently and within deadline. Our wider understanding of the art market and experience of working with many of the world’s most important collectors, advisors, dealers, and gallerists means we are in a position to deliver client service and a capital solution which sets us apart.

Why Work With Us

- 20-year track record in the art market

- Non-circumvent agreements provided to Art Advisors

- Unrivalled speed of execution – loans typically funded within 3 – 4 weeks

- In-house collateral appraisals in consultation with the Art Advisor ensure absolute confidentiality, far removed from auction houses and the wider market

- Transparent client interactions – always working alongside the Art Advisor

- Front to back execution process managed in-house with white-glove client service

- Highly competitive interest rates

- No borrower financial disclosure or credit underwriting

- Up to 50% Loan to Value

THE FINE ART GROUP ACQUIRES PALL MALL ART ADVISORS

“The industry proved popular during the depths of the pandemic as ultra-wealthy individuals tapped art collections as a source of cash when other assets were frozen or plunging in value.”

Our CEO of Art Finance, Freya Stewart, and Bloomberg journalist Harriet Habergham discuss the increasing use of art finance, and the current appetite amongst investors for debt products backed by art.