Dislocated from the more familiar June spot, Art Basel opened the autumn season in September 2021. After a long period of forced abstinence from art fairs, commercial galleries, collectors and advisers alike are buoyed by the return of such significant large-scale events in person. While the pandemic has hastened a rationalization of the annual fair calendar, with numerous casualties, the Basel Fair brand is set to retain its position at the apex of the art market.

Within the wider context of the past eighteen months, that Art Basel successfully opened at all in September 2021 is a cause to celebrate and a clear milestone along the progression to a post-pandemic art world. As much as attendees might rush to embrace normality and each other once again, there were clear signs we’re not quite back to business as usual. Fair attendance was strong, given the circumstances, with 60,000 attendees, compared to 93,000 in 2019.

Most notable of the absences were American and Asian buyers, a trend likely to continue for some time, with collectors and the associated trade less enthusiastic about crossing continents for fairs, but very happy to travel regionally. Indeed, European and American collectors could only look on jealously in May 2021 when Art Basel, Hong Kong opened, the brand’s first since 2019. In mainland China, fairs had opened as early as November 2020 with Art021 and West Bund in Shanghai, albeit with strict quarantine measures in place. Americans may similarly look forward to Art Basel, Miami Beach, slated to take place in December 2021. This is likely to retain the usual Latin American inflection, but likewise to be thinner on European and Asian collectors.

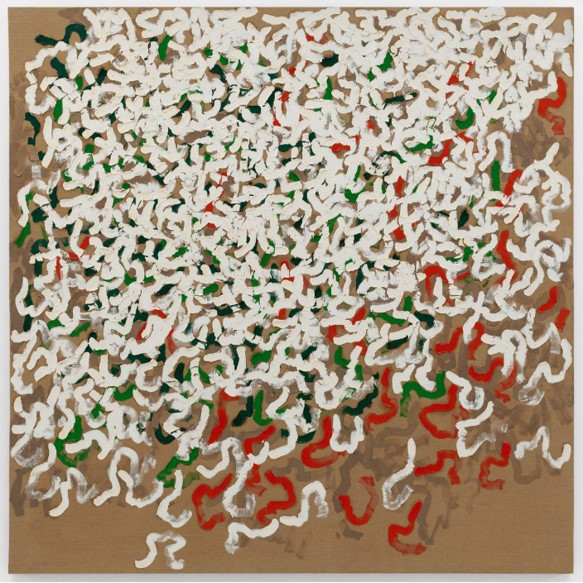

Despite a decrease in footfall, and a raft of enhanced safety protocols in place, galleries appeared to chalk up a steady stream of transactions. While the more expensive works at the fair – a 40 million USD Basquiat with Van de Weghe and a 26 million USD Robert Ryman with David Zwirner – appeared to go unsold, numerous seven figure works found new homes but the vast majority of sales were under 1 million USD. The highest reported sale being a 1939 Kandinsky, Voisinage, sold by Helly Nahmad for 7 million USD.

Pre-selling, already commonplace before the pandemic, is now vital to a successful fair for galleries. Online Viewing Rooms (OVRs) seem destined to accompany real world events for some time to come (if not indefinitely), as they significantly expand the fair’s reach beyond those known clients who get privileged early access to booth previews or those who can attend in person. Competition remains fiercest for a relatively small number of artists whose markets currently burn white hot. For galleries this can create the decidedly high-quality (but nonetheless highly fraught) problem of deciding which longstanding client or esteemed museum trustee will be allowed to buy new work by such fought over artists as Michael Armitage, Lisa Brice, Lynette Yiadom-Boakye, Cecily Brown, Kerry James-Marshall, Laura Owens or Nicolas Party.

Around town the usual cluster of satellite events took place, with Liste – the fair for bleeding edge contemporary art – among the most important. The scrappy but revered Liste acts as a crucial feeder come proving ground for galleries aspiring to participate in Art Basel’s Statements section which spotlights emerging artists. Since inception twenty-five years ago, Liste has historically taken place at Werkraum Warteck pp, a former brewery roughly fifteen minutes’ walk from the main fair. A labyrinthine post-industrial location, with booths spread across intersecting floors, long, narrow corridors and tight spaces, the pandemic forced a historic and first-time relocation to the Messe Basel Hall 1.1, the same complex as Art Basel. While lacking the innate hipster chic of the fair’s usual location, this relocation into a more typical art fair context – wide open space, high ceilings, white cube booths in a regular layout – was hugely beneficial for visitors. The intentionally ‘rough’ finish of the Werkraum Warteck pp can be unkind to newer art, which is often willfully anti-commercial or ‘provisional’ (unfinished looking). The uniformity of white booths, while perhaps seen by some exhibitors as limited, had the contrary effect (in our view) of formalizing and professionalizing the presentations. Although this move may be temporary, we can’t help but hope it outlasts the pandemic.

Image 1: Courtesy of Jacques Demarthon/AFP via Getty Images; Image 2: Courtesy of David Zwirner; Image 3: Courtesy of Art Basel Karma International 2021; Image 4: Courtesy of Artnet

FURTHER READING

- Henry Little the State of the Art Market at TheMerode

- The Asking Price: Understanding Value 1

- The Asking Price: Understanding Value 2

Part 1 of The Educated Eye: How to Buy & Sell Smart

WEDNESDAY, SEPTEMBER 15, 2021 – 2PM PST / 3PM EST

There are many factors that can influence the value of a Picasso print. So what makes one Picasso print more expensive than another? Whether you are buying new Picasso prints or consigning prints that you own, this presentation will help you better understand the value of these works.

TOPICS DISCUSSED

- What impacts the value of Picasso prints?

- How do you identify an authentic vs. fake Picasso print?

- How should a new collector of Picasso prints begin their collection?

- What are conservation concerns for Picasso prints?

- Is it a good time to sell Picasso prints?

- What other artist prints are a good investment?

EVENT DATE

- Wednesday, September 15th – 12 pm PST / 3 pm EST

EVENT LENGTH

- 30 minutes

FORMAT

- Live interactive webinar

*Image courtesy of Phillips, Pablo Picasso, Minotaure aveugle guidé par Marie-Thérèse au pigeon dans une nuit étoilée (Blind Minotaur Guided Through a Starry Night by Marie-Thérèse with a Dove), plate 97, from La Suite Vollard

About The Fine Art Group

Launched in 2000, The Fine Art Group is a global leader in art and finance with deep market connectivity and a unique position within the art ecosystem. With a proven track record, private collectors and member of the art trade can benefit from in-house legal and finance teams, backed up by a highly experienced group of art and logistics experts, ensuring every art finance transaction is completed efficiently and within deadline. Our wider understanding of the art market and experience of working with many of the world’s most important collectors, advisors, dealers, and gallerists means we are in a position to deliver client service and a capital solution which sets us apart.

Why Work With Us

- 20-year track record in the art market

- Non-circumvent agreements provided to Art Advisors

- Unrivalled speed of execution – loans typically funded within 3 – 4 weeks

- In-house collateral appraisals in consultation with the Art Advisor ensure absolute confidentiality, far removed from auction houses and the wider market

- Transparent client interactions – always working alongside the Art Advisor

- Front to back execution process managed in-house with white-glove client service

- Highly competitive interest rates

- No borrower financial disclosure or credit underwriting

- Up to 50% Loan to Value

THE FINE ART GROUP ACQUIRES PALL MALL ART ADVISORS

“The industry proved popular during the depths of the pandemic as ultra-wealthy individuals tapped art collections as a source of cash when other assets were frozen or plunging in value.”

Our CEO of Art Finance, Freya Stewart, and Bloomberg journalist Harriet Habergham discuss the increasing use of art finance, and the current appetite amongst investors for debt products backed by art.

Please read the full article here.

“Our in-house art experts have years of experience in fine art valuation, which means we are able to assess the suitability of potential collateral accurately and quickly. The more difficult artworks for lending purposes are particularly atypical examples by an artist, or those which are outsized.”

Founder and CEO Philip Hoffman spoke to Andrew Shirley and The Wealth report, Knight Frank’s global thought-leadership publication for its UHNWI clients and their advisors.

Together, they discussed art as an investment, and how it is used as an asset to borrow against by clients across the globe looking to release meaningful capital from their own collections of art and jewellery.

To learn more about borrowing against art and the loan process here at The Fine Art Group, please click on the link below.

https://www.knightfrank.com/research/article/2021-08-02-fine-art-as-an-investment

Anita Heriot, President of the Americas for The Fine Art Group, was interviewed by journalist Katya Kazakina for Artnet News’ latest article, “Why the Biggest Blue-Chip Art Collectors in the World Are Suddenly Pumping Hundreds of Millions of Dollars Into Baseball Cards.”

Read More on Artnet.com

Read the Full Artnet Article

Art can be the glue that binds a family and can create a lasting financial legacy. Anita Heriot, President of the America’s, shares her art collection journey with one Tiger21 family.

At the most recent installment of summer sales, traditionally held in London in June, Phillips instead started the cycle in New York, as part of the now common shifting of auction locations and dates.

Held at their newly opened headquarters, the Phillips sale generated an above estimate $98 million hammer, more than double their 2020 total and up nearly 20% from its May 2019 sale. That being said, it’s important to note Phillips opted not to hold a London sale, pushing their ‘May sale’ to June which no doubt assisted volume. Strong evidence of this was the unusual inclusion of a Winston Churchill painting, which surely was destined for a London summer sale but was moved into their hybrid New York lot list, likely impacting the result, selling on just one bid.

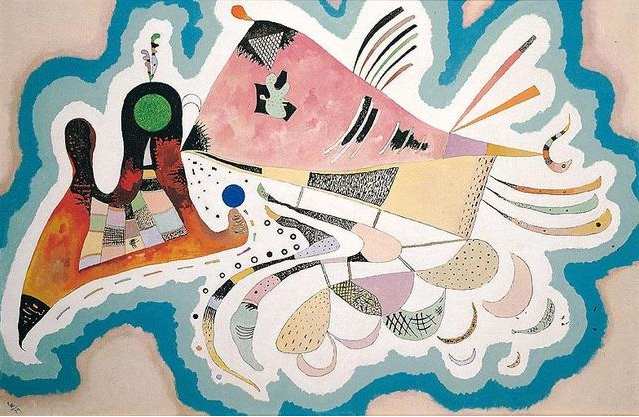

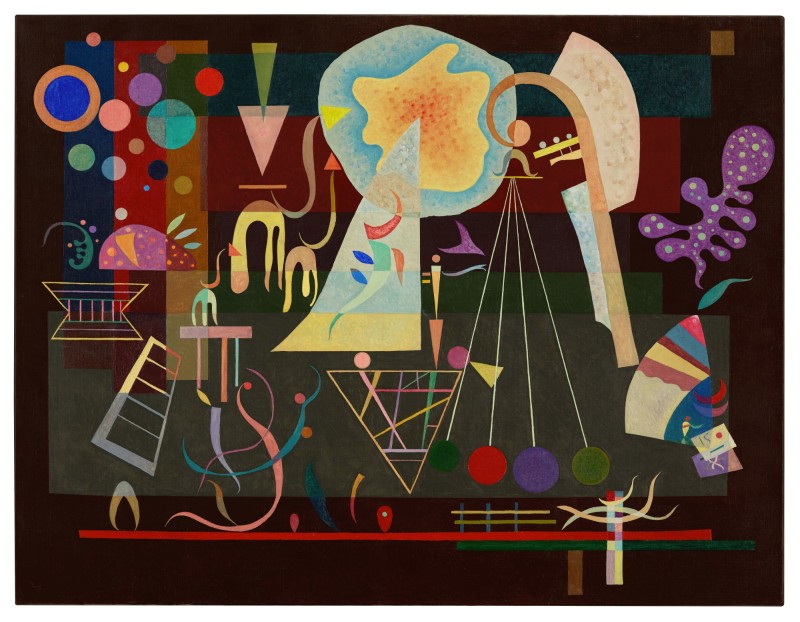

The following week Sotheby’s and Christie’s presented their multitude of cross category evening sales, although in fact held in the afternoon so as to allow for global bids from New York and Hong Kong. Sotheby’s staged a British Art Evening sale, then followed by a Modern & Contemporary Art Evening sale which traversed art history with works by Degas and Monet to Mark Bradford and Julie Curtiss. The top lot of the evening being the 1937 Kandinsky estimated at £18 – 25 million, it sold for £18.3 million hammer (£21.2 million premium). Their eighty-three lot sale totalled a hammer of £130.3 million against a presale estimate of £119.7 – 170.3 million. Twelves lots, however, were withdrawn, some well before the sale and whose presence is now unknown to all but Sotheby’s as the auction house rapidly removed them from their online catalogue where possible. These works totaled well over £10 million in low estimates, which technically results in a below target sale total.

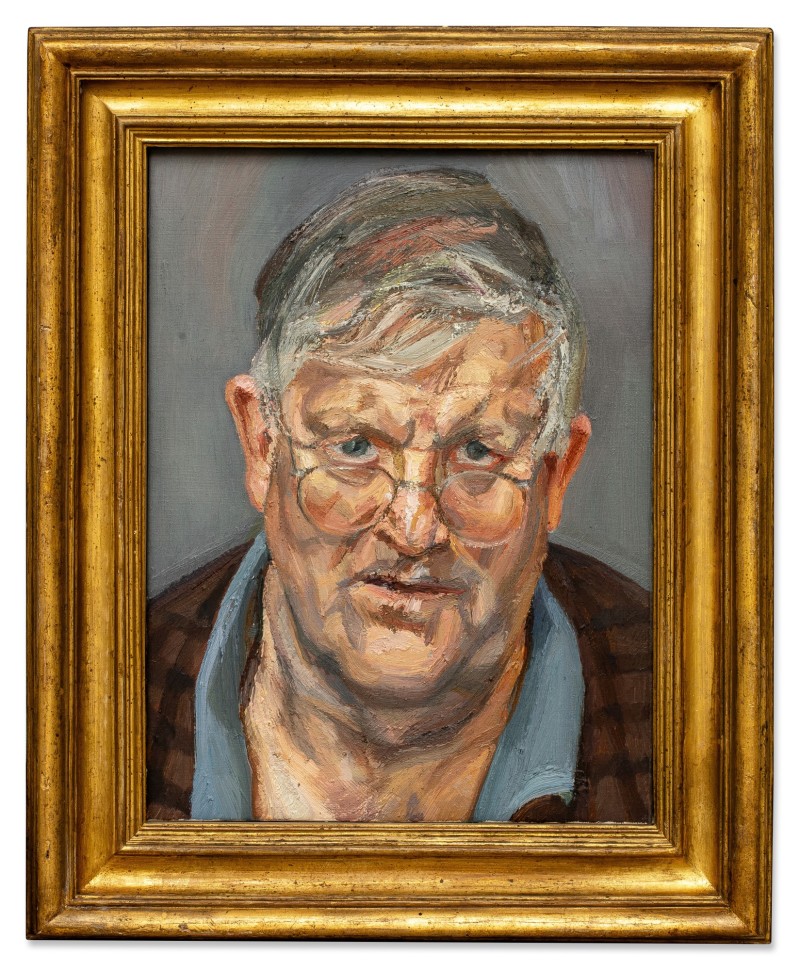

There was strength in the early part of both Sothebys’ evening sales, with deserving lots including Hockney’s Gladioli painting and Freud’s Portrait of David Hockney performing well. The latter for a hammer price of £12.8 million (£14.9 million premium) selling to James Sevier’s client after being chased by more than six bidders through to the top end of the bidding. Towards the second half of both sales, however, bidding began to feel thin with many lots selling on a single bid around or often below the low estimate. Over half of their sale was guaranteed and the lack of deep bidding proved this was required to help ensure their 93% sell through rate.

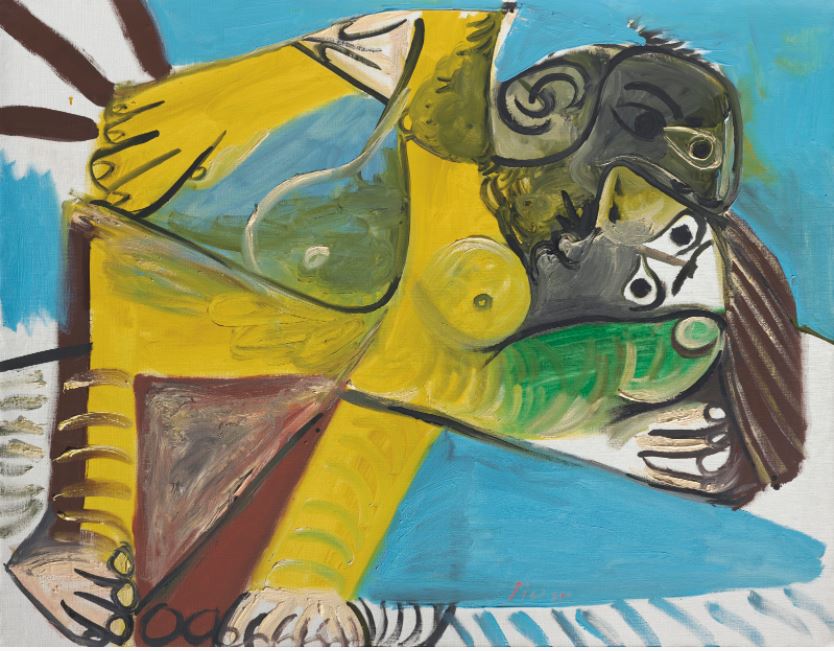

Christie’s opted to combine the 20th and 21st centuries into one sale with the collection of Francis Gross and a Paris evening sale following on, in the now normal relay fashion. With a total of ninety-four lots across the three sales, and a presale estimate around £114 – 167 million, (not including the four lots that were withdrawn, comprising just over £5 million in low estimate) the sales brought in a total of £119 million hammer. Considering the withdrawn lots, the three sales achieved within the low end of their presale expectations and similarly to Sotheby’s, apart from some key works by Picasso, James Ensor and Bridget Riley, several works sold on just one or two bids. Interestingly none of the Paris lots were guaranteed, compared to over half of the London auction, which resulted in an 87% sell through rate across all three sales. Top lots by value included Picasso’s L’Étreinte (1969) selling for £14.7 million (premium) and a René Magritte, La Vengeance (1936) which sold well above its €6 – 10 million estimate for €14.6 million (premium).

The strength of the Asian market continued to help propel these auctions. Phillips saw strong Hong Kong bidding on several lots, primarily for younger artists. Lot one at Sotheby’s, Jadé Fadojutimi, was chased by almost exclusively Hong Kong bidders and several clients of Patti Wong bid significantly on the higher end lots, notably Degas and Picasso. And similarly at Christie’s, artworks by Condo, Degas, Kusama, Chagall, Miro, Leger, Klee and Stanley Whitney all went to Hong Kong phones, with Asian bidding on over a third of lots in the London segment.

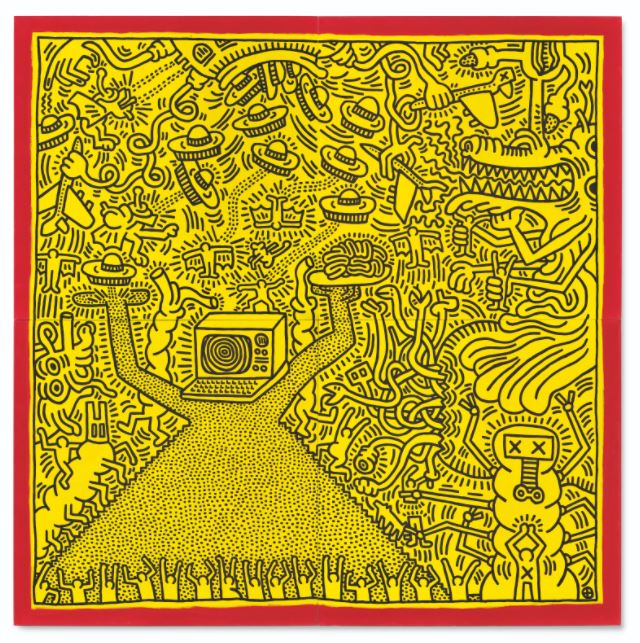

Also of note is the increasing number of lots for which the auction houses are accepting cryptocurrencies. Sotheby’s notionally accepted Ether or Bitcoin for their Banksy Laugh Now painting estimated at £2.5 – 3.5 million, it sold for a single bid at £2 million hammer. Christies also offered this for their 1984 Keith Haring painting estimated at £3.9 – 4.5 million, again selling on just one bid for £3.9 million to the third-party guarantor. Whilst the houses are clearly trying to tailor the works they select for this to a specific clientele, it certainly didn’t have the effect the consignors and houses alike were hoping for and will be interesting to see how this develops in future sales.

As has been the case over the last several sale cycles, emerging and historically under-represented artists continue to see the bulk of interest. Phillips set a new record for Avery Singer at $4.1 million (premium); Singer’s previous auction high, $3.1 million, was set just a month ago at Christie’s Hong Kong. Records were also set for Julie Curtiss, whose painting Three Widows (2016) sold for $466,200, more than double the $150,000 high estimate, and Titus Kaphar, whose portrait sold for just over $1 million, well above its $400,000 high estimate.

The reduced estimate for Phillips’ top lot, further demonstrated where heat in the market still lies. David Hockney’s A Neat Lawn (1967), was reduced from a low estimate of $12 to $9.5 million, accompanying a last minute third party guarantee, to whom it sold. Also of note in the Phillips sale was Jeff Koons’ Gazing Ball sculpture, surprisingly offered with no reserve, selling for $800,000 hammer ($998,000 premium).

In the current auction climate prices for young, figurative painters are exceeding that of some of the most historically expensive artists at auction, including Koons and Picasso. The auction debut for Flora Yukhnovich, estimated at $60,000 – 80,000 in the Phillips day sale, being a prime example, selling for an astonishing $950,000 hammer ($1.2 million premium). With only five solo shows to date and the artist having never received an institutional exhibition, the level of speculative buying has reached new heights.

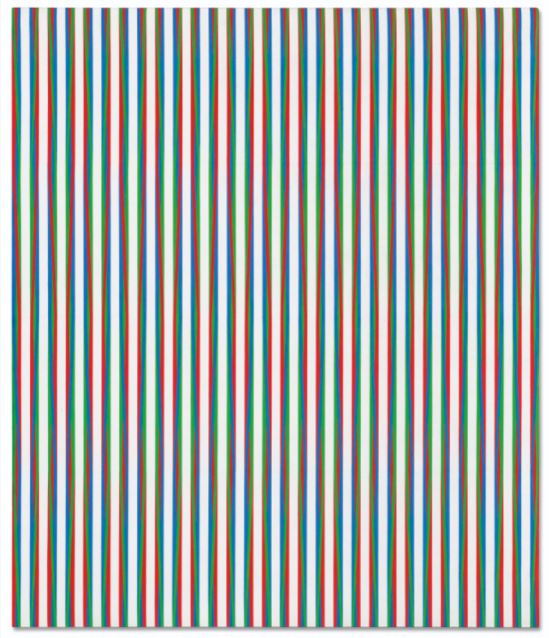

During the London sales the situation was similar but less aggrandized due to the material, instead emphasizing the limited demand for the more traditional areas of the Impressionist & Modern market. At Christie’s, an exceptional work by Kirchner, Pantomime Reimann: Die Rache der Tänzerin (1912) sold on just one bid for £6 million hammer, whereas works by George Condo, Elizabeth Peyton and Bridget Riley experienced much more global and spirited bidding. Riley’s Zing 2 (1971) successfully sold for £3.3 million (premium), clearing the high estimate of £2.2 million and marking the second-highest auction price for Riley to date.

The next marquee sale cycles in October are again traditionally held in London and then Paris, adding to the pressure for the houses to swiftly gather more material. Brexit and Covid restrictions seem to have weakened Europe’s auction positioning but perhaps some of the stronger consignments have been pushed towards the ‘Frieze slot’, typically the most major calendar moment for the London art scene. The results of October will help inform how some of the trends seen during these sales will develop. What is in no doubt, however, is the strength of the Asian auction market. Compared to a 43% drop in New York and 38% decline in London, Asia’s sales fell just 3% in 2020. With almost $900 million worth of art sold to date, 2021 is poised to be another record for the region.

Image 1: Image courtesy Sotheby’s; Image 2: Image courtesy Sotheby’s; Image 3: Image courtesy Christie’s; Image 4: Image courtesy Sotheby’s; Image 5: Image courtesy Christie’s; Image 6: Image courtesy Phillips; Image 7: Image courtesy Phillips; Image 8: Image courtesy Phillips; Image 9: Image courtesy Christie’s

FURTHER READING

- What Will Collectors Buy in 2022?

- Ten Reasons “Going in Alone” at Auction is a Mistake

- Protect Your Investments While Divesting Tangible Assets

The Art of Leverage: Art & Jewelry as Powerful Financial Tools

TUESDAY, JUNE 29, 2021 – 10AM PST / 1PM EST

Have you considered art-secured lending for your High-Net-Worth individual and Ultra High-Net-Worth clients?

Art and jewelry loans allow collectors to realize liquidity without having to make unfavorable sales to satisfy short-term cash-flow requirements, or simply extract valuable investment capital. Through this form of financing, collections can be expanded, and investment returns can be optimized.

Please join the Fine Art Group for an informative discussion on current lending opportunities with art and jewelry.

TOPICS DISCUSSED

- What is Art Finance & what are the different types of Art Finance products?

- What makes suitable collateral?

- Key commercial terms & the execution process

- Borrowing rationales & borrower characteristics

- Key trends & predictions

About The Fine Art Group

Launched in 2000, The Fine Art Group is a global leader in art and finance with deep market connectivity and a unique position within the art ecosystem. With a proven track record, private collectors and member of the art trade can benefit from in-house legal and finance teams, backed up by a highly experienced group of art and logistics experts, ensuring every art finance transaction is completed efficiently and within deadline. Our wider understanding of the art market and experience of working with many of the world’s most important collectors, advisors, dealers, and gallerists means we are in a position to deliver client service and a capital solution which sets us apart.

Why Work With Us

- 20-year track record in the art market

- Non-circumvent agreements provided to Art Advisors

- Unrivalled speed of execution – loans typically funded within 3 – 4 weeks

- In-house collateral appraisals in consultation with the Art Advisor ensure absolute confidentiality, far removed from auction houses and the wider market

- Transparent client interactions – always working alongside the Art Advisor

- Front to back execution process managed in-house with white-glove client service

- Highly competitive interest rates

- No borrower financial disclosure or credit underwriting

- Up to 50% Loan to Value

THE FINE ART GROUP ACQUIRES PALL MALL ART ADVISORS

FURTHER READING

- High-Profile Client Collections & Sudden Wealth Syndrome

- Helping the High-Profile Client Buy & Sell Smart

- Helping the High-Profile Client Buy Luxury Assets

“Since the pandemic, we have seen increased demand as people want to retain more personal liquidity. It makes sense to offer the service to buyers at auction as well as on the private market.” -Freya Stewart

Our CEO of Art Finance Freya Stewart speaks to Melanie Gerlis at the Financial Times to discuss purchase financing and its role in the art market. Freya highlights the benefits of purchase financing, particularly in regards to the upcoming London auctions.

To read the article in full and learn more about the qualifying works for financing from The Fine Art Group please click here.

Our CEO and Founder Philip Hoffman appeared on this week’s episode of the ArtTactic Podcast. Philip discusses his decision to acquire Pall Mall Art Advisors during a trend of consolidation within the broader art market and uncertainty of the pandemic. He also shares his views on the current landscape of the art market, from what collectors are looking for and the importance of appraisals to a discussion on the impact of Covid-19.

To listen to the podcast in full and learn more about where valuable opportunities in the art market lie, please click here.