Leize Gaillard of William Means Real Estate located in Charleston, SC, recently featured The Fine Art Group Southeastern Regional Representative, Shane David Hall, in her October Newsletter.

Leize is a twelfth generation native to Charleston – this long familiar history has encouraged her passion for Charleston architecture, historic preservation, and the real estate market. Much like The Fine Art Group, Leize appreciates the role of a trusted advisor and encourages a spirit of stewardship and transparency among clients.

Read the full newsletter here.

“This is serious business and should not be trivialized.”

Managing Director Guy Jennings comments on the recent 20th Century Evening Sale at Christie’s, arguing that its distracting entertainment should not be taken lightly, nor detract from the sales results.

To read more of Guy’s insight into the content of the sales and the overall sales statistics, please click here.

“Collectors have already adjusted to considerable uncertainty [in 2020] in every aspect of their lives, and the industry as a whole has adapted at a remarkable pace to the radically transformed trading conditions.”

Senior Director Morgan Long comments on the latest Christie’s 20th-Century Evening Sale, and how it reflects that collectors have already fully adjusted to these times of uncertainty.

To read more about the auction results and the high-tech, live-streamed event, click here to read the article in full.

By Jonathan Levy, Head of DACH Region

The German-speaking Art world emerged from this year’s seemingly endless summer, with a hat trick of overlapping gallery weekends. Zurich, Munich and Berlin all opened their respective versions of the Corona-friendly format on the second weekend of September, to regional visitors anxious to experience Art IRL.

My forays took me to most galleries, museums and artist-run spaces in and around Zurich, followed by a day trip to Munich, where I was able to visit two extraordinary exhibitions at the Museum Brandhorst and immerse myself in the Bavarian capital’s gallery scene.

ZURICH ART WEEKEND

My Zurich Art Weekend started on Thursday evening, with a visit to Acrush, a production company on the industrial outskirts of Zurich. Acrush works with international galleries, museums and artists to realize ambitious large-scale commissions and exhibition projects. The impressive roster of artists includes names like Urs Fischer, Rob Pruitt, Paul McCarthy and the American artist, Darren Bader, with whom Acrush produced a special AI-experience to mark the occasion.

Bader’s work falls into a variety of categories, including “trash”- and “impossible” sculptures, “pairings” and “collaborative installations”. Using a range of experimental media, Bader explores inter-connections between seemingly disparate narratives and objects and presents the viewer with surprising and often humorous juxtapositions. In the current exhibition, entitled “Character Study”, Bader expands and confuses the object nature of art. He presents an experience in augmented reality that merges guided city walks in New York and Zurich, simultaneously. These walks are accompanied by an AR-character that can be produced and purchased in any desired scale. One version of the 3D character – part turtle, part cartoon – is placed at the centre of the exhibition space. The walls show posters of “Scott Mendes”, Bader’s fictitious travel agent, whom the artist developed as a mobile application for the 2019 Venice Biennale, to add an extra layer of content to the already crowded Arsenale and Central Pavillion exhibitions.

Over at Karma International, visitors are invited to explore the gallery’s massive 2-floor extension in an empty furniture showroom. The group exhibition in the new space combines exceptional works on paper by Meret Oppenheim and Bauhaus stage proposals by Xanti Schawinsky from the 1930s, with large paintings by Ida Ekblad and installation pieces by Sylvie Fleury, Pamela Rosenkranz, Ser Serpas and Vivian Suter.

Across the street, the gallery presents an exhibition curated by former artistic director of Documenta, Adam Szymczyk. The show is dedicated to Elisabeth Wild, whose colourful geometric collages, made from found magazine clippings, contrast against works by Raúl Itamar Lima and Sophie Thun.

The Swiss response to London’s Mayfair gallery scene, is the area between the infamous Kronenhalle restaurant and the soon-to-be opened, David Chipperfield-designed Kunsthaus.

Opening on Friday afternoon, ZAW-visitors were invited to discover shows by Georg Baselitz (Levy Gorvy with Rumbler), Mira Schor (Fabian Lang Gallery), Jannis Kounellis (Larkin Erdmann), Matt Mullican (Galerie Mai 36) and Sarah Slappey (Gallery Maria Bernheim). Galerie Eva Presenhuber opened a new gallery on Waldmannstrasse, with a solo exhibition of large, colourful works by the American painter, Joe Bradley.

Next door, at Tobias Mueller Modern Art, visitors are greeted by wall-mounted installations and large paintings by American artists, including Julian Schnabel, Terry Winters, Virginia Overton, Philip Taafe and Tim Rollins & K.O.S (Kids of Survival). Climbing up the stairs to Galerie Bernhard on the second floor, we find an intimate display of new works by the Swiss-born, Berlin-based artist, Tobias Spichtig, whose paintings of sunglasses and resin sculptures of languid figures radiate the sense of primitive coolness inherent to underground youth culture, which creates the perfect transition from the elegant showrooms of uptown Rämistrasse to the local scene of artist- and curator run off-spaces that would round off my Zurich Art Weekend after a good night’s rest.

VARIOUS OTHERS, MUNICH

On Monday I left for Munich to catch the end of “Various Others”, a slightly different response to the Zurich and Berlin gallery weekends. The event is organized and hosted by VFAMK E.V., the Society for the Promotion of Munich’s External Perception as a Cultural Location. In this year’s edition the organizers asked local gallerists to host cooperative art projects together with other foreign gallery friends.

Galerie Nagel Draxler invited Lars Friedrich (Berlin) to its recently opened Munich dependence, for a sensual exhibition of paintings by the German abstract painter, Stefan Müller and a group of large scale leather leaves by the South Korean artist Min Yoon.

Other visiting galleries include Thomas Dane (at Jahn und Jahn), Sultana and Peres Projects (at Nir Altman), Emanuel Layr (at SPERLING) and Esther Schipper (at Walter Storms Gallery).

The highlight of my trip to Munich, however, was the impressive collection display at the Museum Brandhorst, and the fantastic mini-retrospective by Glaswegian artist, Lucy McKenzie (1977).

Walking into the museum, I stared down the barrel of Patty Hearst’s machine gun, in one of my favourite works by the American artist, Cady Noland. The menacing sculpture is placed against a huge backdrop by Louise Lawler and is flanked by two St. Petersburg-style displays of works by Andy Warhol. The Brandhorst collection spans the period from 1950 to the present day and boasts not only the largest collection of works by Warhol, but also substantial holdings of works by Cy Twombly that fill the entire upstairs galleries.

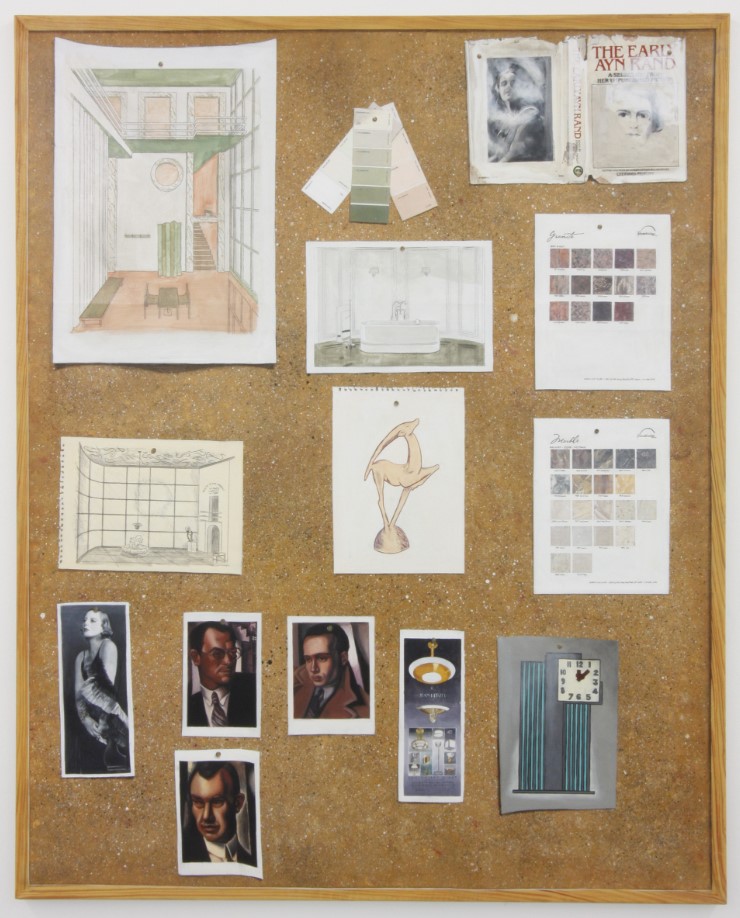

Walking down the large staircase into the museum’s belly, the first thing I notice is a long painting by Lucy McKenzie, entitled “Mooncup”, originally designed to mimic a multi-storey advertising banner. It leads into the artist’s first retrospective exhibition, which curator Jacob Proctor structures along the artist’s successive artistic phases. The show begins with a salon display of paintings, reminiscent of McKenzie’s Dundee diploma show in the late 1990s and moves through different iconic bodies of her work. The interest in painting and its conceptual potential was strongly influenced by German painters like Kai Althoff and Martin Kippenberger, whom McKenzie discovered during an Erasmus exchange in Karlsruhe. Her blown-up architectural maquettes reference the work of early modern architects like Charles Rennie Mackintosh and Adolf Loos. McKenzie creates fantastically immersive spaces that shrink the viewer and invite reflections on the power shared by architecture, design and authoritarian regimes. McKenzie’s further studies at the Van Der Kelen School for decorative painting in Belgium resulted in a series of “Quadlibet-”paintings. McKenzie uses these arranged inorganic still lives as powerful moodboards on which to experiment, juxtapose and confront themes of social and political tension. In one such moodboard McKenzie imagines the task of an interior designer, balancing colours, materials nd surfaces for a Fascist bathroom, with a glass door aptly labelled “Avanti”.

Delighted by the humorous, thought-provoking and enormously skillful display of Lucy MkKenzie’s work, I leave the museum in search of a typical Munich “Wirtshaus” and the hope that I will continue to be able to travel and experience more great exhibitions as the months get colder.

FURTHER READING

- Market Update: How the Art Market Joined the Digital Age

- Commentary: Will Online Platforms Kill Art Fairs?

- See You at the Fair?

The market has changed faster than ever before and two recent art market reports have added considerable detail to this picture. According to Artnet’s autumn 2020 Intelligence Report, fine art auction sales fell 60% from 1 January to 10 July 2020. The Art Basel & UBS Report – The Impact of COVID-19 on the Gallery Sector – records a comparable slimming of sales for surveyed galleries, with sales declining an average of 36% when compared year on year. How, then, has the market innovated in response?

Covid has clearly accelerated digitisation of the art market. Christie’s, Sotheby’s and Phillips held 131 online sales in the year to 10 July 2020, more than twice as many for the equivalent period in 2019. The move to seemingly continuous online sales has further driven down the average price for a work of art sold at auction by 41.3% (to 25,926 USD) compared with the same time last year, according to Artnet’s report.

Within the gallery sector, the ongoing digital migration has increased online purchases from 10% in 2019 to 37% in the first half of 2020. The Art Basel & UBS Report highlights further changes. Sales at art fairs have dropped from 46% in 2019 to 16% for the first half of 2020 as entire swathes of the calendar have been postponed or cancelled. Notably, commercial strategies have also shifted. Last year galleries listed their top priorities as art fair exhibitions and widening the geographical reach of their client base. Naturally the outlook for dealers is far more defensive in 2020, with cost cutting, development of online channels and maintaining existing client relationships now the order of the day.

Works on Paper from a Distinguished Private Collection. Pace, East Hampton.

Over the past decade the distinctions between dealers, auction houses, museums and art fairs have become increasingly blurred. Top tier galleries have long mimicked the reverential aura of museums; museums frequently use auctions to raise funds; auction houses now ‘curate’ sales and selling exhibitions; while numerous fairs contain thematic sections, some with entirely non-commercial ‘public’ presentations.

Recent developments continue this trend. Even before covid, Acquavella, Gagosian and Pace collaborated to win the revered Marron estate, intentionally challenging the received wisdom that such a significant assortment of high value works was automatically the preserve of the auction houses. In a recent profile of Pace Gallery for the Wall Street Journal (Michael Shnayerson, 9 September 2020), it was revealed that this initial collaboration has given rise to a longer term partnership – called AGP – that will compete for similarly important collections and estates in the future. Such collusion among fierce rivals is one of the more notable evolutions in response to the auction houses’ perceived encroachment on gallery turf.

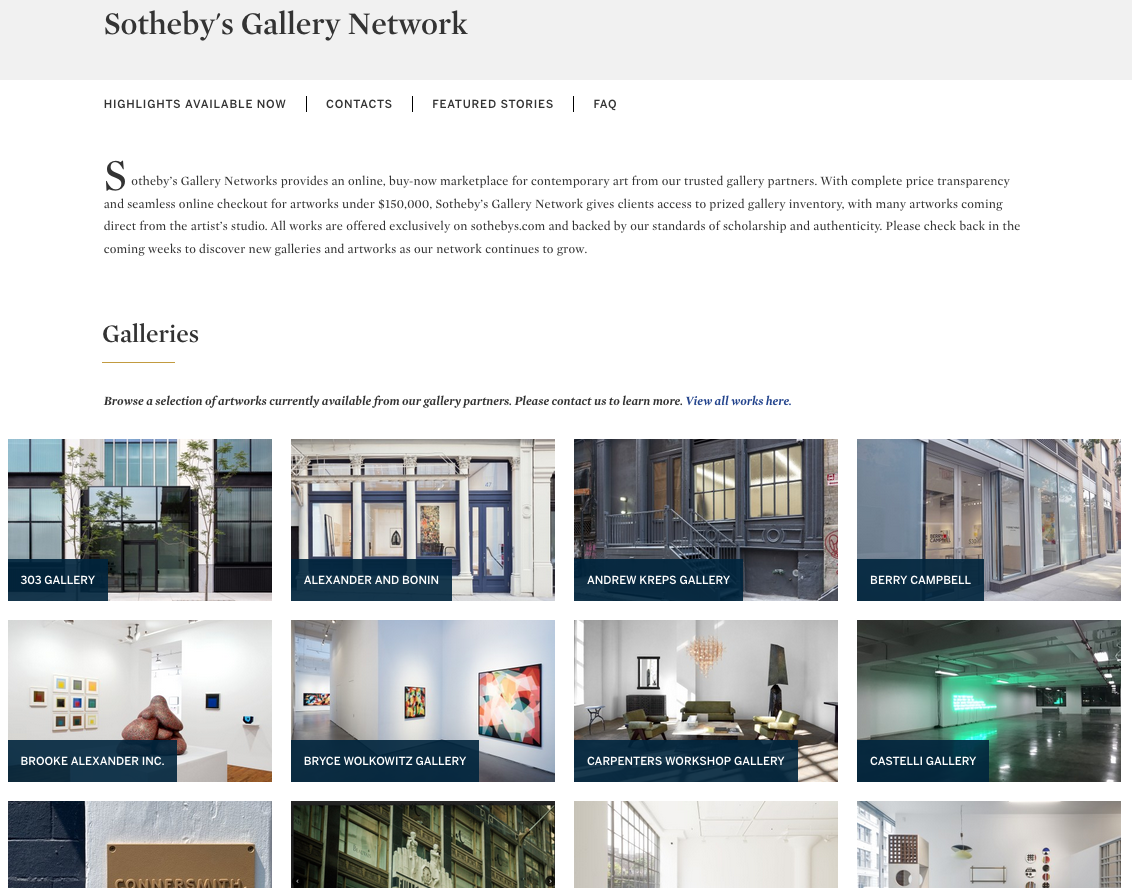

Despite competition for consignments, galleries and auction houses are also collaborating in new ways. Sotheby’s Gallery Network – an online, buy-now market place for works under 150,000 USD – hosts virtual storefronts for 34 dealers including 303 Gallery, Andrew Kreps, Fergus McCaffrey, Lévy Gorvy and Peres Projects, among others. Such partnerships would have been unimaginable not long ago. While quality of works is mixed – most dealers don’t want prime stock available to anybody at the click of the button – it demonstrates the softening of traditional enmities in a moment of crisis. For the time being, at least.

Messe in St. Agnes. König Galerie.

In Berlin, König Galerie is hosting Messe in St. Agnes #2 from 12 to 20 September. A ticketed selling exhibition – hung salon style – with primary and secondary market consignments, the enterprise was an unusual but apparently effective way of generating revenue in the ultra-contemporary Berlin gallery scene which has historically demurred from such outright mercantile endeavours. Lingering somewhere in the murky interstitial space between art fair, auction hang and selling exhibition, the project seems an intelligent way of maintaining close contact with gallery clients looking to offload works or trimming collections as a consequence of long periods of confinement at home.

One of the most successful new ventures to join the fray is a new concept remarkable for its simplicity. Former Christie’s ‘rainmaker’ Loic Gouzer has developed an invitation only auction app, Fair Warning, which offers a single work at auction on an almost weekly basis. Auction participants are closely vetted and results have so far been impressive. Pieces by Steven Shearer, David Hammons, Steven Parrino, George Condo and others have all been offered, with the highest price to date achieved for an Untitled 1982 Basquiat work on paper, which sold for 10,810,000 USD premium. Not bad for a sale orchestrated from a garage on Long Island, albeit the Hamptons end.

While historically resistant to the technological ‘disruption’ so common in other industries, the art market has found the inclination this year to be a little more experimental. Most market commentators are united in welcoming the silver lining of greater price transparency from the migration online. In this alone, 2020 may have delivered a meaningful transformation for the industry.

Image 1: Image courtsey Gagosian; Image 2: Image courtesy Sotheby’s Gallery Network; Image 3: Image courtesy König Galerie; Image 4: Image courtesy @loicgouzer

Further Reading

ART ADVISORS HELP CLIENTS NAVIGATE THE ART MARKET

Art advisors have assisted collectors for centuries, demystifying the seemingly opaque art world and helping passionate individuals assemble legendary collections with meaning and value.

In the early 1900s, the young American-Lithuanian art historian Bernard Berenson, barely in his 30s, traveled across Italy to personally inspect Renaissance masterpieces by Raphael and Titian. His clients across the Atlantic had lots of questions, sending flurries of telegrams back and forth: “Wire whether they are authentic. Are they in good condition? Must have your advice.”

Berenson personally contributed to the stellar Old Master collections of Gilded Age luminaries such as Isabella Stewart Gardner, who purchased her Titian’s Europa and the Bull through Berenson. Today it hangs in her eponymous museum in Boston and remains one of the very best Titians in the United States. As a good art advisor, Berenson was able to provide access to the great treasures of European aristocratic families and held unparalleled expertise in Venetian paintings as the author of the 1894-published book The Venetian Painters of the Renaissance.

In the 18th century ambitious art collectors like the formidable Russian monarch Catharine the Great relied on a network of agents to source important paintings whose owners had a change of fortune. The Russian ambassador to the Netherlands Prince Dimitri Gallitzin was a trusted art agent and advisor to the Empress and was instrumental in securing for her Rembrandt’s The Return of the Prodigal Son among countless other masterpieces to enter her collection. Catharine viewed the process of collecting art as a competitive sport and a point of national pride. In 1772 she wrote to her friend the French philosopher Voltaire: “You have heard correctly, Sir, that this spring I raised the pay of all my military officers . . . by a fifth. At the same time, I’ve bought the collection of paintings of the late M. de Crozat and I am in the process of buying a diamond bigger than an egg.”[i] With her own collecting drive and expert guidance by her art advisors, Catharine amassed a spectacular art collection which in turn formed the basis of the Hermitage Museum in St Petersburgh Russia, one of the most important public art collections in the world.

Art advisors in the early 21st century do not (fortunately) have to fulfill the double function of political envoy/spy and art detective while serving their clients. Much like Catharine the Great, many art collectors are deeply passionate and highly competitive about acquiring great art. As a result, an art advisor’s role is first and foremost to take a dispassionate and critical view of each potential acquisition and find reasons not to buy it. Then and only then, if the work is deemed appropriate, can a good art advisor recommend a purchase.

Art advisors should possess a combination of attributes to best serve their clients: insight into current curatorial trends and changing collecting tastes which steers the market into the future; a deep understanding of artists, their work and their scholarship; and a concrete and up-to-date market knowledge and lines of communication to the key actors in the art market. Most of all they should be independent and invested only in the process of helping their clients acquire the very best art at the best price point.

HERE ARE FIVE QUESTIONS YOU SHOULD ALWAYS ASK YOUR

ART ADVISOR BEFORE ADDING TO YOUR ART COLLECTION

- What trends are you seeing in the market at the moment? How will they move the needle when it comes to my collection’s value in the future?

- Why is this artist so important and what should I know before I buy their work?

- What concerns do you have about this particular work? Are there any condition or provenance questions to be resolved before purchase?

- What is the appropriate market price for this type of work within the artist’s oeuvre?

- Should we buy at auction, galleries, fairs or directly from private collectors?

The answers to these questions are as varied as the types of paintings, sculpture, furniture and jewelry we source for our clients.

FURTHER READING

- The Art Detective: How to Find a Qualified Art Advisory Service

- May 2023 Auction Season: Our Team’s Top Picks & Insights

- The Asking Price: Understanding Value 1

OUR SERVICES

The Fine Art Group’s Art Advisory department’s expertise and deep market knowledge ensure that our clients can focus on passion knowing that the due diligence is taken care of. Best of all, unlike Catharine the Great, you won’t have to balance your war chest to make that perfect acquisition. We hope!

[i] Catherine II to Voltaire, 1 September 1772, Correspondence, 168, as quoted in Documents of Catherine the Great: The Correspondence of Voltaire and the Instruction of 1761, ed. W. F. Reddaway (Cambridge: Cambridge University Press, 1931).

Our team understands the complex and varied needs of institutional and corporate clients. Between our Appraisal and Advisory departments, we can create bespoke plans, working within institutional missions and processes to ensure their collections are properly insured, protected and cultivated.

We are proud to have advised the Carnegie Library of Pittsburgh over the last few years to ensure that their beautiful rare book collection is appropriately insured and worked with law enforcement on the recovery of many volumes for the city of Pittsburgh.

“In the fall of 2016, library officials decided it was time to audit the collection again, and hired the Pall Mall Art Advisors to do the appraisal. Kerry-Lee Jeffrey ….. began their audit on April 3, 2017, a Monday, using the 1991 inventory as a guide. Within an hour, there was trouble. Jeffrey was looking for Thomas McKenney and James Hall’s History of the Indian Tribes of North America. This landmark work included 120 hand-colored lithographs, the result of a project that began in 1821 with McKenney’s attempt to document in full color the dress and spiritual practices of Native Americans who had visited Washington, D.C. to arrange treaties with the government. The three-volume set of folios, produced between 1836 and 1844, is large and gorgeous and would be a highlight in any collection. But the Carnegie Library’s version had been hidden on a top shelf at the end of a row. When Jeffrey discovered why, her stomach dropped. “Once a plump book filled with plates,” she would recall, “the sides had caved in on themselves.” All those stunning illustrations had been cut from the binding.”

Read more at Smithsonian Magazine

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

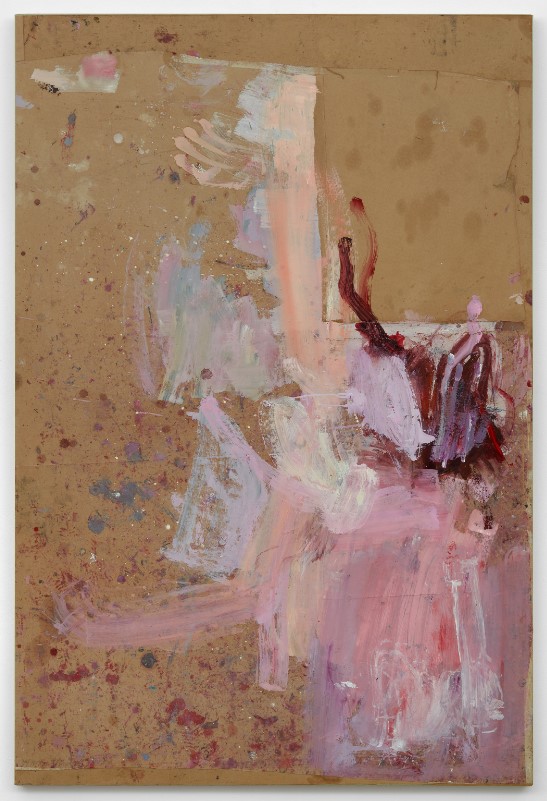

Inaugurating Modern Art’s new space on Bury Street is a group of recent paintings by Austrian artist Martha Jungwirth. Born 1940 in Vienna, much of her reputation, influence and exhibition history has been confined to central Europe. Although recognised during the 1960s – 1970s (she participated in Documenta 6, 1977) she had since faded from international view until 2010, all the while remaining an important figure in the Vienna art scene. This turning point is often linked to the inclusion of her work in a group show curated by German painter Albert Oehlen at the Essl Museum in Austria that year. While many of the subsequent commercial exhibitions over the past decade have presented historical bodies of work, Modern Art’s new exhibition presents paintings and works on paper from the past few years.

Jungwirth’s work elides numerous art historical genealogies while somehow standing apart from them. Studying in the 1950s and early 60s, the prevailing artistic winds of the time are evident in her handling of mark and gesture. Cy Twombly and Joan Mitchell are often mentioned, and there’s certainly a lyrical nature to her late career abstraction which might be traced to the tail end of Abstract Expressionism. Like numerous artists of her generation, the lingering presence of Surrealist interests – especially automatism and the role of chance – greatly inform her practice.

One of the most notable aspects of her work is the prominence of touch, centre stage. Her surfaces are splattered, stroked, stained, dragged and brushed into existence, while large expanses of empty sheet are left lightly touched, leaving the buff brown of the card she often uses to become a primary component of the overall personality of each work. As such, her gestures have been likened to ‘actors on a stage’: individual marks dancing with each other across the sheet.

Numerous works in oil are marked by purposefully visible, paint-y finger prints from where the artist has handled the sheet in the studio. Understood art historically, these could be seen as a sort of joke on the dogmatic clash between AbEx with Pop and Minimalism in the 1960s. Where AbEx asserted the singular authorship of the artist as a uniquely endowed creator of meaningful works, Pop and Minimalism – in line with left-leaning literary theory of the time – denied the ‘hand of the artist’ almost entirely. Perhaps given a further twist, the predominant shades in recent works are bright pinks, rich maroons, vivid reds and deep purples – a decidedly fleshy, even bruised, palette. Whether understood as a record of a performative act, or a physical encounter with the artist’s touch, the body is consistently evoked in her work as painterly presence.

The title of a solo show in 2013 at Galerie Cinzia Friedlaender, Berlin provides further insight on her views to the artistic milieu of her early career. Pädagogisch wertlos – translated as Devoid of Pedagogical Value – may refer to her ten years as an art school professor in Vienna, but could well be a rejoinder to see the value of her work in tactile, visual pleasure. Where so much of AbEx was high-minded (even quasi-spiritual in the case of Rothko) – the show title suggests that retinal pleasure is as important, if not more so, than lecturing the viewer with a diffuse, overbearing rhetoric beloved of many mid-century abstractionists. Perhaps a plea to see colour as colour, and to enjoy it as such, rather than as an existential cry into the abyss.

Guilty, like many, of coming to her work in the past decade we’ve followed this later career reappraisal with considerable attention. Market interest has become fierce in recent years, with an auction record of 80,000 EUR (with fees) set in March 2020. While her work rarely left central Europe for many decades, those further afield – such as the Rubell Family Collection in Miami – have now acquired her work in depth. Likewise a show at Fergus McCaffrey, New York in 2019 was the artist’s first commercial exhibition outside Europe. As such the current presentation at Modern Art, closing 26 September 2020, presents a cherished opportunity to see a new body of recent works in the round. Not to be missed!

Banner Image: Copyright Martha Jungwirth. Courtesy the artist and Modern Art, London.

FURTHER READING

- May 2023 Auction Season: Our Team’s Top Picks & Insights

- The Educated Eye: Understanding the Hermès Luxury Handbag Market

THE ART MARKET & COLLECTORS IN 2022

Reinvigorating the ‘heat’ and associated public relations noise around the global calendar of auctions and commercial exhibitions is one key challenge facing the art market in the medium to long term. Another is the covid associated disruption to a huge variety of ostensibly non-commercial activities which are often the art historical engines propelling value growth for young, old and dead artists alike.

The Venice Biennial, for example, has been moved to 2022. While the 2020 Turner Prize will now comprise a proportionate cash prize to ten shortlisted artists rather than announce a single winner. Museum exhibitions around the world have also been put on hold (although some are now beginning to reopen) which further softens the positive impacts that might have been elicited by institutional solo exhibitions, major monographic surveys or permanent collection acquisitions. Many institutions are also now fighting for survival. With drastic cuts to exhibition budgets or outright closures, the art historical and intellectual capacity of the visual arts ecology may well contract markedly in the next twenty-four months.

Understanding the impacts this may have on market trends and values remains to be seen. Several trends at lower price points were especially evident pre-covid – figurative painting by mainly female artists addressing identity politics, for example – while artists at the other end of the spectrum, such as Alex Katz, were enjoying major late career market jumps.

Recent auction results have shown collectors’ predisposition to proven names at sensible prices. But the new stars of tomorrow, the long forgotten late career artists ripe for ‘rediscovery’ and the next hot artist estates will not be anointed in 2020, or perhaps even 2021. Collector tastes may also change as they invariably do following seismic global changes. Look, for example, at the market of Anselm Reyle. Eight of his top ten auction records were achieved in 2007 – 08 in the heady, frothy days before the economic crash of 2008 – 09. His market has since dived in value and is only just beginning to recover. Given the current situation might take twelve, eighteen or twenty-four months to solve itself globally, tastes may shift significantly before they begin to make themselves apparent in the galleries and salerooms.

With the art world – to an extent – preserved in aspic at a moment from February 2020, it may not be until the summer of 2022 that we see a global visual arts ecology establishing and validating financial and art historical value in a fully functioning manner at all levels as it was before.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Image 1: Image courtesy La Biennale di Venezia; Image 2: Image courtesy BBC News; Image 3: Image courtesy Phillips

FURTHER READING

- Why Serious Collectors Need Professional Collection Management Services

- El Niño 2023: Are Your Art & Collectibles Protected?

- Market Update: How the Art Market Joined the Digital Age

PART IV: ART BASEL DURING THE COVID-19 PANDEMIC

Art Market Pulse is a timely 4-part video series presented by The Fine Art Group. Each episode, we will offer an informative view on the current state of the art market, taking the pulse of real-time developments. Providing access and insight, viewers will hear intriguing conversation from top executives within the art industry.

In the final episode of Art Market Pulse, The Fine Art Group’s Founder and CEO Philip Hoffman sits in conversation with Art Basel’s Global Director, Marc Spiegler.

Find out how Art Basel, the world’s most prestigious art fair, is adapting and innovating to meet the needs of its participating galleries and collectors.

Watch the full video here:

https://www.ubs.com/global/en/our-firm/art/2020/pulse-video-series.html?campID=CAAS-ActivityStream