As New Yorkers took shelter amid the March Covid-19 lock-down, many collectors fled to the Hamptons, the eastern tip of Long Island better known as a playground for the wealthy rather than a place to buy art.

Well, times have changed. Beginning in June 2020, the openings of East End outposts from established New York based galleries started attracting attention in the press. Skarstedt, Van de Weghe, Michael Werner, Pace and Sotheby’s Private Sales are among some of the newest spaces in the beachside community. These businesses join the long-established East Hampton galleries Ross + Kramer, Rental Gallery, Harper’s Books, Eric Firestone and Halsey-McKay.

Within two blocks visitors can now hit numerous galleries and see some very good art from established names. The offering is a mix of curated exhibitions – such as Yoshitomo Nara’s After all I’m cosmic dust at Pace – and Sigmar Polke, Francis Picabia and Friends at Michael Werner, while Skarsdedt feature various works by assorted blue artists from their roster including Eric Fischl (a Hamptons resident), Sue Williams, George Condo and David Salle. The Sotheby’s space offers a wide presentation of property across sale categories: post-War and contemporary art, design, jewelry and watches. In an effort to create comradery and patronage amongst neighbors, many of the East Hampton spaces stay open late on Thursday evenings to host pandemic-style receptions with masks and hand sanitizer at the ready.

Changes are certainly underway in the artworld and the length of the gallery leases could be an indication of how long these dealers expect to make use of their new East End spaces. Although Pace has taken the lease until October 2020, others like Van de Weghe have signed for three years while Hauser & Wirth have a one year lease in Southampton, only a few miles down the highly trafficked highway 27. Also in Southampton is Emmanuel Di Donna’s new space Sélavy, showcasing fine art and design.

Following are a selection of my photos from my July gallery visits in East Hampton:

Francis Picabia

Portrait de Suzanne, 1941

Oil on paper mounted on canvas

31 ¾ x 17 ¾ inches

55 x 45 cm

Eric Fischl

The Disconnect, 2015

Oil on linen

56 x 75 inches

142.2 x 190.5 cm

Tom Wesselmann

Study for Still Life #40, 1964

Liquitex and graphite on paper

22 ¾ x 31 5/8 inches

57.7 x 80.3 cm

Yoshitomo Nara installation view

Genieve Figgis

The Circus Has Been Canceled, 2020

Acrylic on canvas

60 x 60 inches

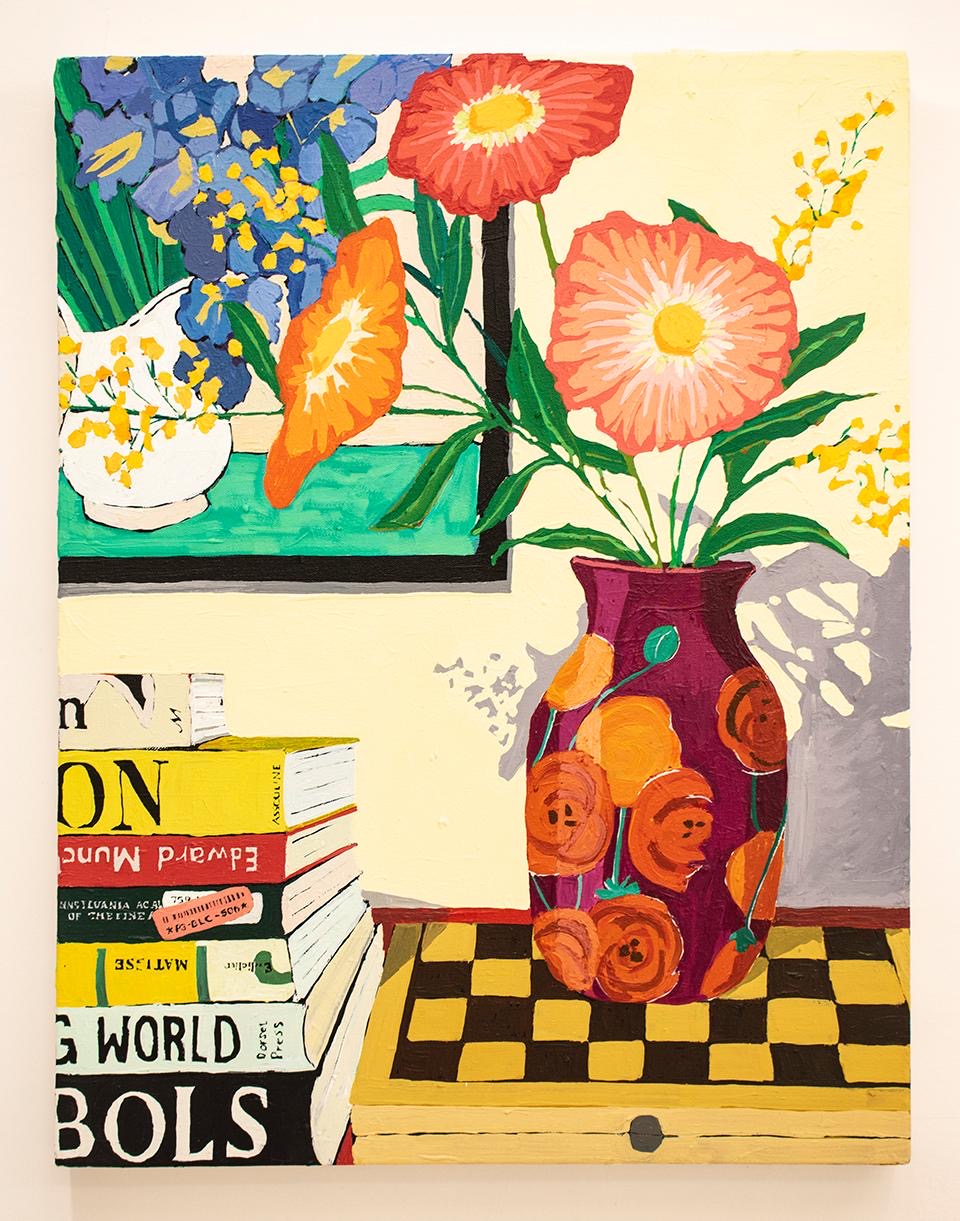

Hilary Pecis

Poppies In A Purple Vase, 2020

Acrylic on canvas

28 x 22 inches

71.1 x 55.9 cm

FURTHER READING

Normally held at Christie’s, Sotheby’s, or Phillips around the world, this season’s Breakfast Briefing took place virtually instead. Senior Director Morgan Long and Managing Director Guy Jennings sat in virtual conversation with Founder & CEO Philip Hoffman; they analyze the auction sale results, discuss the state of the current market and predict what to expect in the future.

PART III: Inside Christie’s during the Covid-19 Pandemic

Art Market Pulse is a timely 4-part video series presented by The Fine Art Group. In each episode, we will offer an informative view of the current state of the art market, taking the pulse of real-time developments. Providing access and insight, viewers will hear intriguing conversations from top executives within the art industry.

In the third episode, Philip Hoffman, Founder & CEO of The Fine Art Group, sits in a virtual conversation with Christie’s Global President Jussi Pylkkänen and Rahul Kadakia, International Head of Jewelry.

Learn about Christie’s efforts in the fine art and jewelry sectors amidst market conditions caused by the COVID-19 Pandemic.

Watch the full video here:

https://www.ubs.com/global/en/our-firm/art/2020/pulse-video-series.html

Founder & CEO Philip Hoffman discusses the jewelry market, from positive sales to future predictions, with François Curiel (Chairman, Christie’s Europe and Asia), Olivier Wagner (Senior Director, Sotheby’s), and Raymond Sancroft-Baker (Jewelry Consultant, The Fine Art Group).

Christie’s freshly minted relay sale, ONE, was hosted by live auctioneers simultaneously in Hong Kong, Paris, London and New York on Friday 10th July 2020. Consolidating the entirety of Christie’s top tier summer auctions into a single event, the sale demonstrated the potential of a defensive commercial strategy prioritising quality over volume. While a handful of lots were withdrawn (presumably due to lack of interest), the house achieved remarkably solid sell-through rates of 94% by lot and 97% by volume.

Touted as a ‘global’ relay, more than half the lots were sold from America – still the world’s most important market – with relatively tokenistic clusters held in Hong Kong, Paris and London. That said, each location conformed in a fashion to historical type. Hefty works with hefty guarantees were reserved for New York, while estimates in Paris were more reasonable. Some limited local inflection was further evidenced, for example, by the Ben Nicholson sold in London, and the more expensive Zao Wou-Ki offered in Hong Kong.

More than a third of the sale was guaranteed, many of which were subsequently passed on to third parties. This enabled Christie’s to consign A / A+ grade works, with few of inferior quality. The sale also sensibly favoured works which reproduce well online, engendering a sense of confidence in buyers unable to view in person.

Consolidating an entire auction season into a single sale allowed for a handful of more unusual contrasts. Jean Prouvé’s ensemble (1946 – circa 1955) (Design) and Théo van Rysselberghe’s Barques de pêche–Méditerranée (1892) (Impressionist and Modern), comprised a sale with notable gravitas which nonetheless concluded with Maurizio Cattelan’s drowned, polyurethane figure Daddy Daddy (2008). Eliding three distinct auction categories worked solely on the basis of the strength of the works offered. Lesser material would not bear such a disregard for art historical lineage or classification, although it demonstrates how far ‘cross-collecting’ has progressed as a commercial strategy for the auction houses.

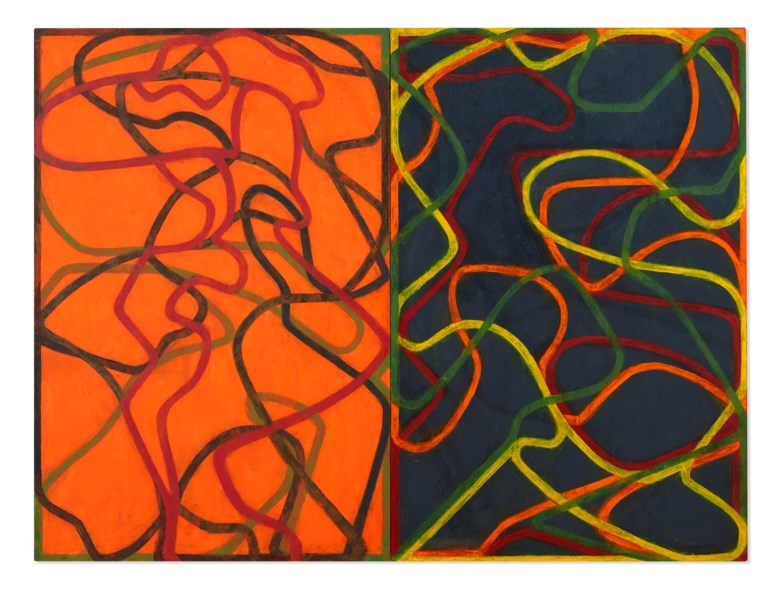

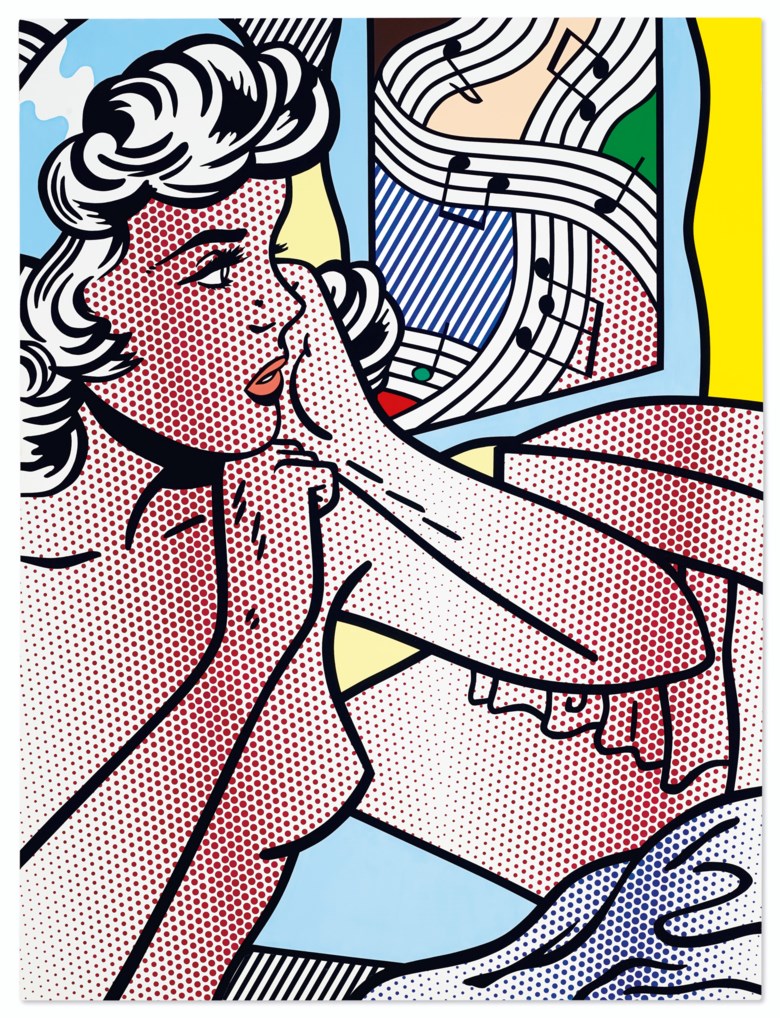

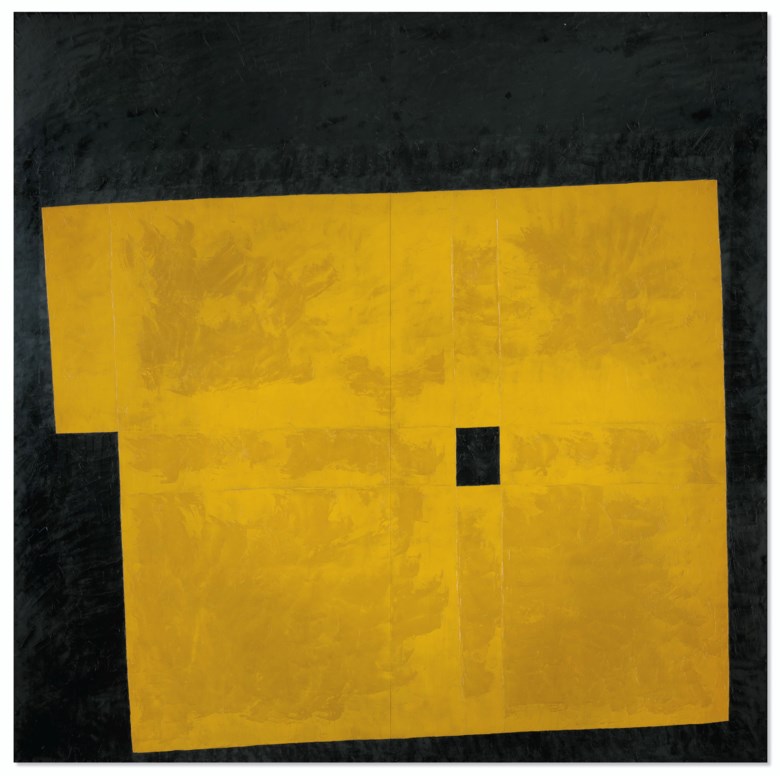

Making USD 420 million in total, the sale’s top lot was Lichtenstein’s late Nude with Joyous Painting (1994) which made USD 46,242,500 with fees and, impressively, auction records were set for seven artists. In Hong Kong, Yellow Quadrangle (1959) by Takeo Yamaguchi made HKD 15,125,000 against an estimate of HKD 2,000,000 – 3,000,000, while George Condo’s Force Field (2010), made HKD 53,150,000 against an estimate of HKD 18,000,000 – 28,000,000 (final prices include fees, estimates do not).

New York’s saleroom saw new auction records for Complements (2004 – 7) by Brice Marden, making USD 30,920,000 against an estimate of USD 28,000,000 – 35,000,000 and Wayne Thiebaud’s Four Pinball Machines (1962) sold for USD 19,135,000 against an estimate of USD 18,000,000 – 25,000,000. Lots by Manolo Millares, Ruth Asawa and Richard Avedon completed the complement of new records.

Wayne Thiebaud (b. 1920), Four Pinball Machines, 1962. Oil on canvas. 68 x 72 in (172.7 x 182.8 cm). Sold for $20,137,500 in ONE: A Global Sale of the 20th Century on 10 July 2020 at Christie’s in New York. © 2020 Wayne Thiebaud / Licensed by VAGA at Artists Rights Society (ARS), NY

Understood on its own terms and against developments of the past few months, this auction – and those accompanying headline sales at Sotheby’s and Phillips in recent weeks – should be seen as an unqualified success. The relay format was unusual, more specifically as a successful experiment which should not be repeated. Auctioneers are hubristic, demanding creatures and four competing for attention was a distraction. A starting delay of nearly 50 minutes, while clearly unintentional, was likewise an unforced error. Similarly, fielding bids from the book, online, the phones and (very) limited saleroom attendance, simultaneously, from four locations, works – but not well.

Online selling has clearly come of age, both in terms of the prices paid and the audiences reached (a reported 80,000 globally, with some 60,000 from Asia via social media platforms according to Christie’s). But while virtue has been decisively fashioned from necessity, bigger volumes and lower price points must return. Crunching so much of the auction season into one ultra-conservative, super blue-chip, defensively hedged sale will not sustain the fine art departments at Christie’s, or indeed any of the major auction houses, for long. We eagerly await the notoriously tricky second album in the autumn season.

Image Credits: Christie’s

FURTHER READING

- Philip Hoffman Talks with Bloomberg About Asian Art Market

- Asia’s Collectors Are Still Eager to Buy, But Only If It’s the Best

- The Financial Times Speaks with Patti Wong about Asian Art Market

“The whole market is going to change in how it’s transacted.”

The Fine Art Group Founder and CEO, Philip Hoffman, spoke to CoBo Social Managing Editor, Denise Tsui, about what the art market might look like in the wake of COVID-19.

To read more of his perspectives on the future of the art market, please click here.

“There are likely lots of collectors out there looking for liquidity who are just not aware that art-based financing can be a fast route to capital.”

Speaking to Bloomberg, CEO of Art Finance Freya Stewart discusses the two-fold increase in art-based financing enquiries during the spread of COVID-19.

To learn more about how clients are increasingly turning to their art collections for the security of readily available capital, click here to read the full article.

Monday 29th June saw a landmark moment in which Sotheby’s consolidated their delayed New York May auctions into one 74-lot, 5-hour mega auction. Consisting of three consecutive sales, the Ginny Williams Collection, Post-War & Contemporary Art, and then Impressionist and Modern sales, eventually ending in the early hours of the morning for Europe.

Overall Sotheby’s response to the pandemic was impressive. Auctioneer Oliver Barker took bids from the rostrum in an empty room in London via screens with socially distanced specialists on the phones in New York, Hong Kong, and London alongside online bids. Their format looked remarkably smart and professional and Barker adeptly navigated this ground-breaking hi-tech format with aplomb. The most effective was a split screen offered when bids were being accepted from multiple locations and bidders.

We also saw online bidding reaching new heights with a record for an online auction purchase for the Basquiat work on paper at $13.1m hammer ($15.2m incl. premium). Although not the winning bid, we noted that the same online bidder (reportedly from China) also bid up to $73.1m for the Bacon triptych, a new level for online bidding, notably his increments were only allowed at $100,000. As our specialist, Guy Jennings commented in the New York Times post-sale: “As a result of this sale we may see much more confident online bidding at a higher level than we’ve seen before. There used to be a ceiling of a few hundred thousand on internet bids.”

The Bacon eventually sold to Sotheby’s New York head Grégoire Billault’s client on the phone for a $74m hammer ($84.6m with fees) after 10 minutes of bidding. A number of lots markedly saw the hammer fall rather slowly, which meant an unusually lengthy sale, no doubt caused by this new multi-screen format.

Overall, unsurprisingly the sale totals were down from last year, consignment must have been extraordinarily difficult during this period. However, the sell-through rates were extremely strong and several artist records showed encouraging prices for deserving works, most notably Helen Frankenthaler’s new auction record of $7.9m (incl. premium) for a vibrant 4-meter 1975 painting, more than doubling her previous record. From our team, Morgan Long, our Managing Director, speaking to Barron’s prior to the auction had noted the “fantastic grouping” of Latin American art, which ultimately saw 5 new artist records, including that for Wifredo Lam at $9.6m (incl. premium) and the female Surrealist Remedios Varo at $6.2m (incl. premium).

This format was an imaginative and professional response to selling art at auction in the current difficult climate and certainly showed that even the most expensive works can be sold in this environment. We do not, however, feel that it is the future. Despite Sotheby’s great efforts the format was very slow and lacked any sense of theatre. Live sales will return but for the time being, we must be grateful to Oliver Barker and the whole Sotheby’s team.

Further Readings

Dear Clients and Friends,

The Fine Art Group is pleased to present Part 4 of our Market Webinar Series.

Bringing together top experts in art and real estate, Anita Heriot, President of The Fine Art Group, Colleen Boyle, Senior Vice President of The Fine Art Group, Chris Ainsworth, Managing Director, Market Manager at Deutsche Bank Trust Company Americas, Brian Mendell, Managing Director, Real Estate Deutsche Bank Trust Company Americas and Bradford S. Cohen, Partner, Jeffer Mangels Butler & Mitchell LLP; the focus will be on the current state of the real estate and art market and how to turn distressed assets into opportunities as well as the tax implications of COVID-19 on planning.

Join us Thursday May 14, 10 am pst / 1 pm est.

*Calendar invites will be sent after Tuesday, May 12.

TOPICS DISCUSSED

- State of the economy update

- Impact on the value of art and real estate due to Covid-19

- Opportunities for art and real estate in a distressed market

- Planning strategies for dealing with distressed real estate and art

With galleries, auction houses and shippers temporarily closed, the art world has adapted fast to bring art onto our screens at home, recreating exhibitions, studio and canvas in the virtual world. Of course, some projects have been in development for some time, but current circumstances have accelerated the delivery of these products, whilst other platforms have long existed but are seeing greater transactional flow. We look at a selection of these developments, how their user experiences compare, and what they could mean for the future of how we transact in the art market.

ART FAIR

The first iterations of our new digital involvement with art began with Art Basel Hong Kong’s online viewing rooms, initially organised due to the political problems faced in the region but by the time it came to its opening date, a necessary installment to initiate the fair. Unsurprisingly the site crashed in its first moments, testament to the popularity of the Basel brand, but was soon up and showcasing viewing rooms of up to ten works per gallery. Specific retail prices or large pricing brackets could be shown, the latter requiring an inquiry to find out more, which hindered what could have been greater price transparency for the fair. Some presentations, including those of Lisson & Pace, offered a zoom walk through explaining their booth which worked with some effect to bring the works to life. Galleries varied in the quality of their viewing rooms with some offering installation and scale images, whilst others had just single images which felt like a jpeg slide show. Overall the fair reported some significant sales, not only offering hope for online transactions but also paving the way for other players, galleries and art fairs alike to take things online, faced with the reality that our sector was globally shutting down for a significant period of time.

Dallas Art Fair ensued, which largely followed that same format but offered galleries the chance to hide prices. There was also no zoom function which made assessing images increasingly difficult without requesting high res images from galleries – perhaps a way for trade to facilitate direct enquiries? Nevertheless, taking Dallas online has given global access to a smaller, less visited fair that we might not otherwise encounter IRL and highlights the increasing global connectivity that online access affords. Frieze New York will be the next major instalment of an online fair at the beginning of May and it will be interesting to note how they might have been able to profit from the do’s and don’ts of these earlier fairs.

AUCTION

Auction houses have long had a digital commercial presence, but unsurprisingly are shifting consignments to additional online sales. 21st April saw Sotheby’s highest ever online sale total with their Contemporary Curated London auction bringing in £5.1 million ($6.4m), sailing past its pre-sale high estimate of £4.7 million ($5.75m). It also included the highest price ever paid for an artwork in an exclusively online auction; George Condo’s 2005 canvas selling for £1 million ($1.3m) against a low estimate of £800,000. A positive signal that whilst these times are financially challenging for art businesses, transacting online is a viable revenue resource, even at higher price levels – a trend The Fine Art Group’s Managing Director, Guy Jennings, suspects will continue, “if this lasts six to nine months, people will become more relaxed about buying online at a higher level,” as quoted in The New York Times last week. Whether online sales continue in strength post-pandemic will remain to be seen.

GALLERY

A couple of weeks prior to the auction, Condo’s online show at Hauser & Wirth, his first with his new gallery, sold out before it even launched onscreen. Bidding for the Sotheby’s work was perhaps prompted by those who missed out on the primary works on paper priced between $100,000 and $125,000, inspired by isolation.

The blue-chip galleries have all differed in their approach to the situation. A number of galleries have opted for online exhibitions of shows that were due to open, if they have been fortunate enough to have been able to photographs works. Stephen Friedman’s latest exhibition of Andreas Eriksson included a virtual gallery space which you could move through to experience the works hung together; whilst a little rudimentary, it certainly offered a sense of scale and context for the pieces that can’t be found in a mere PDF.

Pace and David Zwirner have opted for more curatorial approaches, presenting online exhibitions in a holistic way, creating multimedia environments with artist created content, embedded videos and longer excerpts of art historically relevant material to contextualise their shows. Zwirner is also opting to use its position and power as a platform for younger or smaller galleries perhaps hardest hit by these recent times. Gagosian has avoided taking their scheduled exhibitions online as ‘that’s not how they were conceived’ according to the gallery’s owner Larry. Instead they are opting for their ‘Artist Spotlight’ series which invites a different artist to take over the gallery’s editorial and social media channels and transform them into a new multifaceted online platform for presenting a single artwork each week.

Most excitingly this period has seen an expeditated release of new technologies and apps that were in the pipeline but have now been forced into early fruition. These are notably being generated by the big blue-chip galleries with the ability to put their weight and capital behind these costly projects – which smaller galleries lack the resources to produce. Lisson Gallery has just launched its initiative with the software company Augment. The platform has been in development for the past year and a half and allows user to begin “placing” one of 100 available works into their own personal environments; not only easing the experience for clients but also businesses, enabling them to avoid the cost and travel implications of shipping works for consideration.

Massimo de Carlo has also just launched Virtual Space, or VSpace an immersive walkable experience accessed via their website or a VR headset. The inaugural show features works conceived especially for the virtual platform by artists John Armleder and Rob Pruitt.

Certainly not the only other notable tech release in this sector but Oliver Miro, son of gallerist Victoria Miro, has launched a virtual reality app named Vortic, due to be released with a joint exhibition with Victoria Miro & David Zwirner in the next few weeks. The venture offers galleries a subscription-based service with customizable virtual gallery spaces wherein they can show their art using virtual and augmented reality technology. The product is divided into two apps Vortic Collect and Vortic VR, the latter designed for use with a VR headset if owned, the former offering a virtual space.

With such a slew of new ways to experience art at home it remains to be seen which will stand the test of time. However, it has been a useful exercise to view art in a different environment, without a crowd or unaccompanied by in person salesmanship, with more room for careful consideration and time for contemplation. And despite some of these online initiatives working more effectively than others, it is testament to the art world’s resilience and the ever-creative methods industry traders are employing in an effort to keep their businesses going.

Critics and dealers are citing this as accelerating changes that were already taking shape in the industry, predicting a future where digital, online exhibitions become more frequent and physical art fairs reducing. Will this become the new normal? Digital developments help with accessibility, to widen audiences and connect an increasingly globalised art world; but we ourselves wait with bated breath for the moment we can experience art in the flesh again. These new platforms will provide an excellent accompaniment to transacting in the post COVID environment; however, we feel they will always remain in tangent with physical encounters to art, as opposed to replacing them altogether.