Dear Clients and Friends,

The financial markets are oscillating from the impact of the coronavirus pandemic. The desire, or need, for liquidity comes as the spread of coronavirus creates significant market instability.

This webinar will address ways in which passion assets are a tool to provide liquidity.

Join us Thursday, April 9, 10 am pst / 1 pm est.

TOPICS DISCUSSED

- The importance of the pre-loan valuation or marketable cash value appraisals

- Targeting the right art and collectables to monetize during a turbulent time

- Leveraging (collateralizing) passion assets as a means of short term liquidity

- Art Bonds as a tool to create recurring revenue

This webinar is interactive.

Please send questions in advance to Jgarlic@pallmallartadvisors.com. Participants will also be able to ask questions using the chat box during the webinar.

*Due to the impact of the corona virus on phone lines, it is recommended that you join via the computer.

“A true real asset art loan (meaning a loan secured solely by art, without extensive borrower financial assets/liquidity tests) is very attractive for owners of high value art (and jewelry) because it’s a very straightforward way of releasing capital in short order, at a time where access to fast liquidity is so valuable for many people.”

CEO Art Finance and Group General Counsel of The Fine Art Group, Freya Stewart, speaks to Patricia Lee at Withersworldwide and discusses bank loan liquidity opportunities and current art loan challenges.

Read the article in full here.

DESKTOP APPRAISALS

The “desktop” indicates the appraiser provides a value based on information that is provided at the appraiser’s desk. Clients or their advisors can send electronically, via mail or direct upload, the relevant details which will be placed in our proprietary collection management system and valued by our appraisal team.

In order for our appraisers to conduct a remote appraisal, please provide our administrative team with cataloguing information and photographs.

Click here for a downloadable list of requirements for a desktop appraisal.

Once we have the essential information, our appraisers will provide you with a value and a pdf appraisal document.

The Fine Art Group can provide desktop appraisals for any asset.

REQUIREMENT FOR A DESKTOP APPRAISAL

ART APPRAISALS

- Name of artist

- Measurement inside the frame (sight)

- Photograph of entire painting, signature, back (if possible), all receipts or gallery labels

- Medium (for e.g. oil on canvas, oil on board, print)

- Ownership and purchase history of the artwork

JEWELRY APPRAISALS

- Name of brand/designer

- Description of jewelry

- Photograph of jewelry from various angles (including stamps, engravings, stones)

- GIA report

- Ownership and purchase history of the jewelry piece

OTHER VALUABLE ASSETS

- Photograph of object

- Dimenions of objects

- Ownership and purchase history of object

Virtual Consultations

For prospective clients that have some technological awareness, The Fine Art Group can organize virtual visits to discuss what clients own to determine the appropriate risk management strategy.

The Fine Art Group provides complimentary schedule reviews to make sure that clients are insured appropriately and insight into only the assets that require reappraisal.

Contacts

Western region – Anita Heriot, President

Eastern & Midwest region – Colleen Boyle, SVP & National Sales Director

South East region & Gulf Coast – Shane Hall, Senior Advisor & Appraiser

Appraisal inquiries – Kate Molets, Director of Appraisals

Dear Clients and Friends,

In an effort to provide more context and insight into the current state of the tangible asset market, The Fine Art Group is providing a Market Update Live One Hour Webinar scheduled for Wednesday, March 25 at 10 am pst.

TOPICS DISCUSSED

- The State of the Spring Auction Market

- The Role of Online Sales

- Alternative Assets and the Market

- Private sales

- Art Insurance and the impediments to ecosystem of the art market

This webinar is interactive.

Please send questions in advance to Jgarlic@pallmallartadvisors.com. Participants will also be able to ask questions using the chat box during the webinar.

*Due to the impact of the corona virus on phone lines, it is recommended that you join via the computer.

The Fine Art Group offers bespoke advisory services for all tangible assets.

We have preferred terms for several select categories where we have identified specialty selling venues that consistently have the highest results for the particular object.

Our experienced team of advisors conducts full market analytics on the object to determine the best method of sale.

- American Art

- 20th Century Design

- Numismatics

- Fine Jewelry & Watches

- Native American Art

- Fine Books, Maps & Manuscripts

- Entertainment & Sports Memorabilia

- Western Art

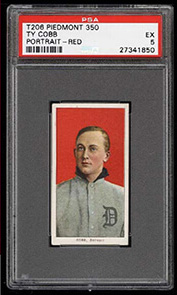

- Baseball Cards

CASE STUDIES

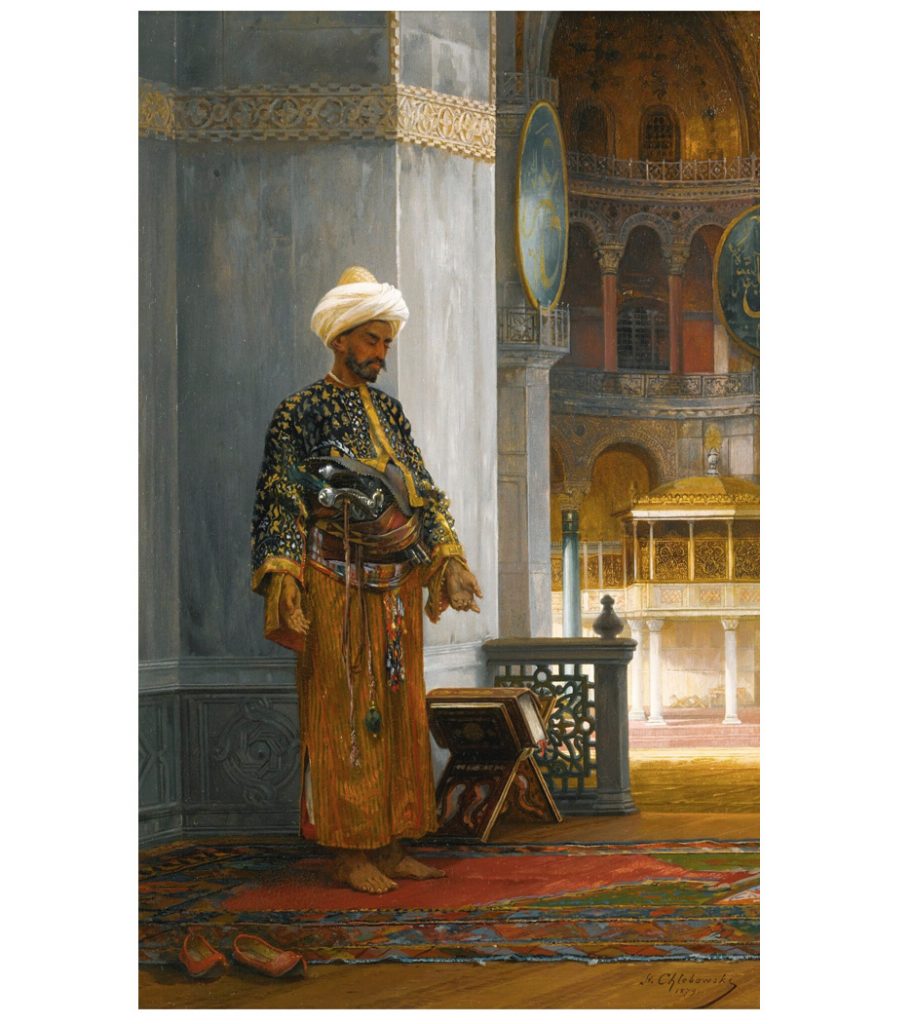

If selling at auction we ensure it is sold in the correct specialty venue to net the highest return. An example of this is highlighted below. This work sold for $50,000 in a general Fine Arts sale. When re-offered a year later in the appropriate annual Orientalist sale in London it sold for $179,000, more than tripling its previous result.

Stanislaus von Chlebowski

At Prayer, Hagia Sophia

Oil on panel

18 x 12 in.

Pall Mall Art Advisors follows the market for all tangible assets including fine jewelry. We alert our clients on when is the best possible time for sale. The market is especially responsive right now for colored diamonds.

Unmounted Fancy Intense Orangey Pink Diamond

Estimate: $100,000-$150,000

Realized Price: $200,000 (with Buyer’s Premium)

Further Readings

- Ten Reasons “Going in Alone” at Auction is a Mistake

- 10 Reasons to Work with an Advisor for a Successful Sales Process

The Fine Art Group is honored to be in contention for the Best Lifestyle Management Award at the prestigious Private Asset Management (PAM) Awards 2020.

The PAM Awards exist to recognize the top investment professionals, wealth advisors, legal firms, consultants and other key service providers in the private asset management space.

The Fine Art Group sends our congratulations to all the winners!

At The Fine Art Group, we advise collectors and their financial and legal advisors on the strategic, long-term management of their collections of art, jewelry and collectibles.

Our team understands the complexity of owning, buying and selling tangible assets like no other, allowing us to function as our clients’ advocate at all times.

Whether providing Appraisal, Advisory (Buying or Selling) or Tangible Asset Management services our clients find our team and our network of more than 50 vetted experts to be a trusted resource.

We are a vetted partner with varied institutions such as High Net Worth Banking, Lifestyle, Accounting, Insurance and Wealth Advisors.

In 2020 we celebrate the 20th anniversary of The Fine Art Group. Twenty years ago, I left Christie’s to launch the first institutional art fund. Today I’m proud to say that the Group has grown into a global market leader in the art world with a global team of over 30 professional staff acting for 140 clients in over 20 countries. We have advised and traded over $1.3 billion in value of artworks, with an additional $3 billion of private collections valued in just 3 years. While much has changed in the last twenty years, we’ve always remained true to our company values: offering preeminent art expertise, real transparency, independent, unconflicted, discreet, and innovative services to both the world’s leading art collectors and art novices and focused art investors alike.

LAST YEAR

January marked our much publicised acquisition of London based Falcon Group’s art-secured loan book, strengthening our long-term commitment to being the leading art finance provider to collectors and owners of high-value art globally. The acquisition marked a significant consolidation in the art finance market.

In June, via our Agency business we brought the landmark Maharajas & Mughal Magnificence to auction at Christie’s, New York. After a global tour of six cities and a marathon 12.5 hours of bidding, the collection realised a record-breaking $109,271,875 and was 93% sold.

Throughout the year, we have continually grown our business globally. Now, with representatives in China and Hong Kong, the United States, Switzerland, Germany and the United Arab Emirates, our network of collectors and art professionals is more far-reaching than ever before.

LOOKING AHEAD

As we look to the next decade, I am excited about developing our international art advisory, art agency, art investment and art finance houses. This year will mark the launch of our blue-chip art valuations service.

The Fine Art Group looks very different from the company I founded two decades ago. I am grateful to our exceedingly loyal clients, colleagues, and friends who have supported us from the start.

Yours,

Philip

Colleen Boyle, Pall Mall Art Advisors’ Senior Vice President and National Sales Director, makes an appearance in the true crime art documentary Real Fake The Art, Life and Crimes of Elmyr de Hory.

The National Arts Club in New York City will be hosting a special filmmakers’ screening February 5, 2020. Pall Mall Art Advisors would like to encourage you to register for and attend this special event.

Real Fake: The Art, Life and Crimes of Elmyr de Holy

A Film by Jeff Oppenheim

The National Arts Club

15 Gramercy Park S

New York, NY 10003

February 5, 2020 – 8 PM

Elmyr de Hory was one of the most notorious forgers. He is alleged to have painted thousands of “fakes,” many of which still hang in major museums and private collections worldwide. Having eluded prosecution from Interpol, Scotland Yard and other authorities, veteran filmmaker Jeff Oppenheim re-opens the case in this investigative caper that sheds new light on the depth of Elmyr’s crimes.

This event is free and open to the public, however an

RSVP is required at nationalartsclub.eventbrite.com.

The Advisory team at The Fine Art Group is excited to bring you some of the objects of our affection this Valentine’s Day, including jewelry, fine art, handbags, wine, rare books and decorative arts. Hand-picked by our specialists and advisors, from upcoming sale venues, we hope that our selections inspire your gifts for your valentines this year.

Sotheby’s

February 11, 2020 – Contemporary Art Evening Auction

Sale L20020

Lot 3

Banksy

VOTE TO LOVE

Spray paint on UKIP placard mounted on board

46 x 46 x 3 1/4 in.

Estimate: $522,840-$784,260

Heritage Auctions

May 3, 2020 – Luxury Accessories Signature Auction

New York #5505

Chanel

Matte Pink Python Medium Boy Bag

Estimate: $3,000-$4,000

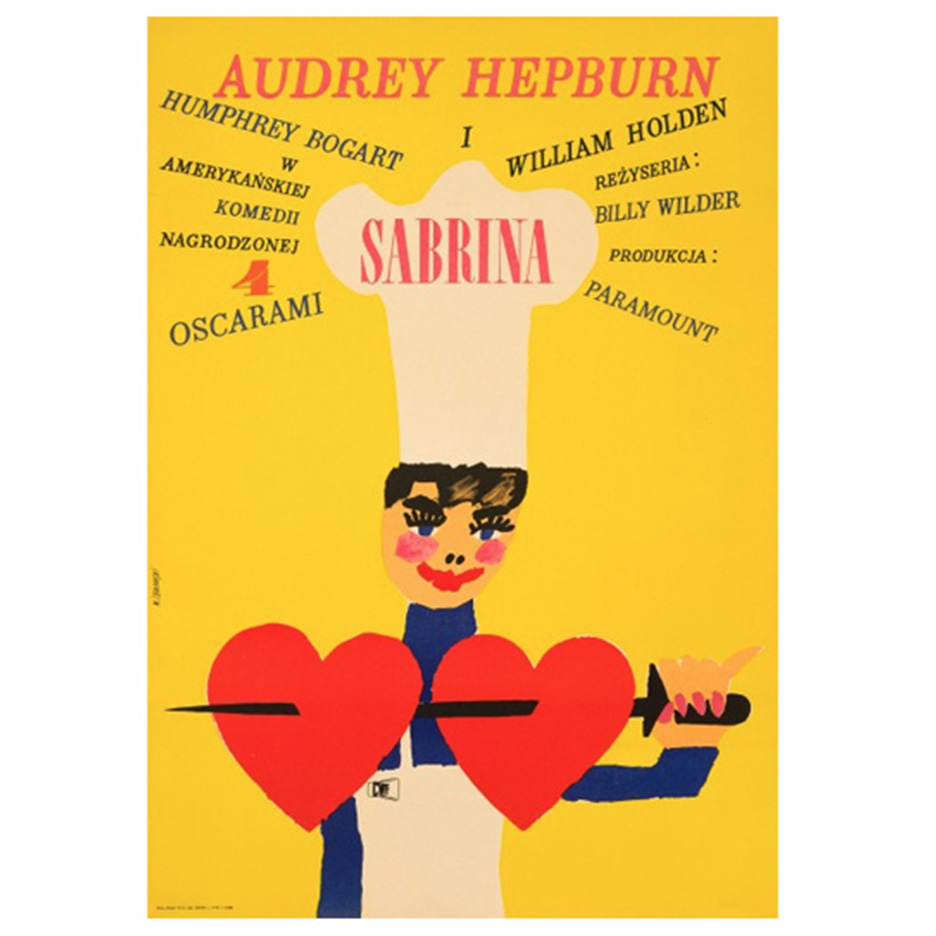

Rock Paper Film

Maciej Zbikowski

Sabrina

33 x 23 in.

1967

Retail Price: $1050

Sotheby’s

January 28, 2020 – Specialist Selects

Sale L20309

Lot 9

Fine Diamond Ring

Set with an oval diamond weighing 10.16 carats, between baguette diamond shoulders, size L.

Estimate: $367,416-$459,270

Sotheby’s

January 25, 2020 – Triumphant Grace: Important Americana from the Collection of Barbara and Arun Singh

Sale N10303

Lot 1072

Rare Stamp and Punch-Decorated Black and Red Leather Key Basket

Circa 1800

Estimate: $5,000-$8,000

Sotheby’s

February 5, 2020 – Impressionist & Modern Art Day Sale

Sale L20004

Lot 125

Marc Chagall

Bouquet d’œillets aux amoureux en vert

Gouache, pastel, oil and brush and ink on paper

31 1/2 x 23 in.

1950

Estimate: $459,270-$721,710

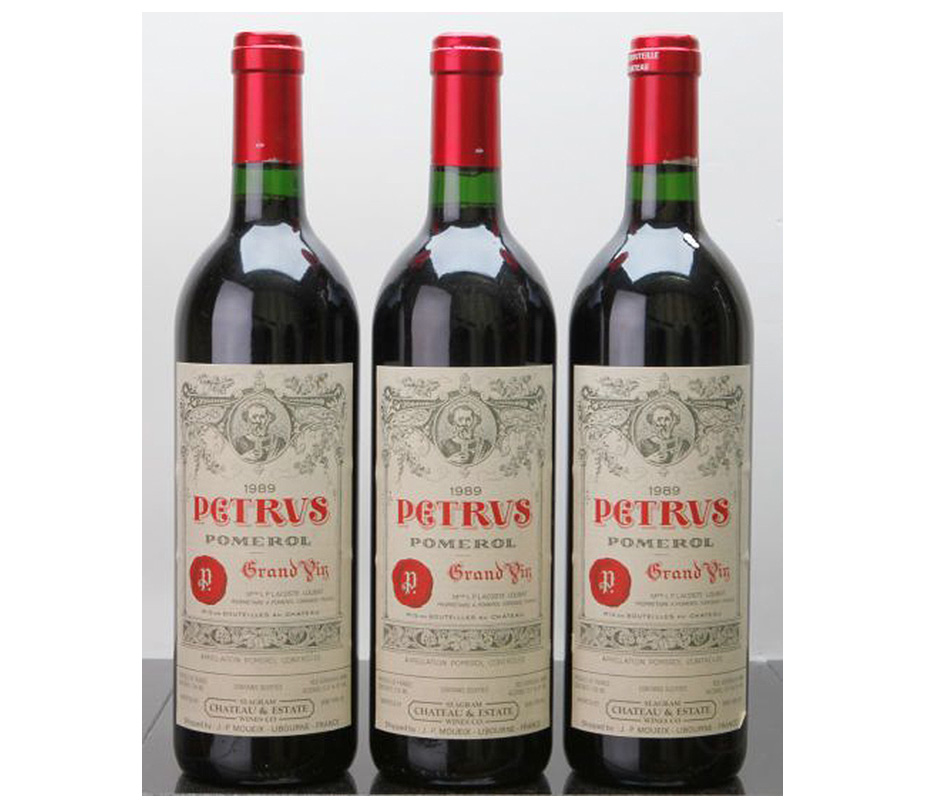

Berry Bros. & Rudd

Petrus, Pomerol

Cab. Sauvignon Blend, Full Bodied, Dry

13.5% alcohol

1989

$38,650

Bonhams

February 5, 2020 – Knightsbridge Jewels

Lot 297

Cartier

A Cultured Pearl and Diamond ‘Panthère’ Necklace

Estimate: $6,600-$9,200

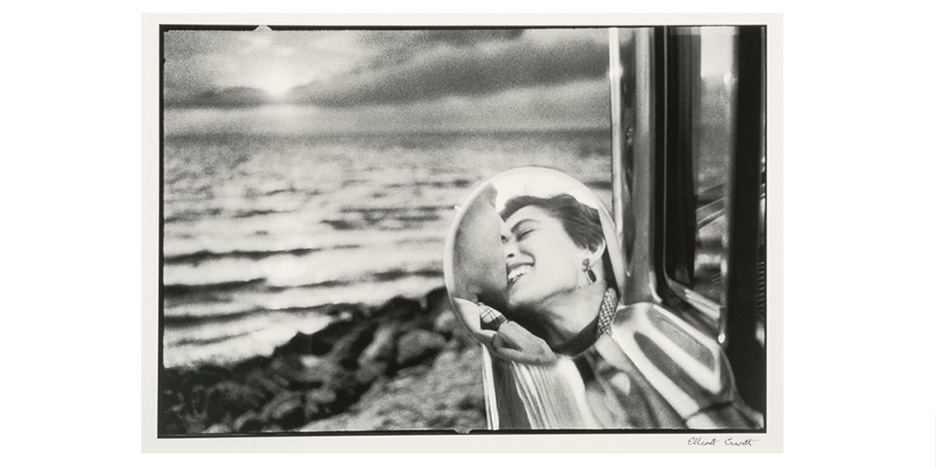

Heritage Auctions

April 4, 2020 – Photographs Signature Auction

New York #8002

Elliott Erwitt

California Kiss, Santa Monica

Gelatin silver print

12 1/4 x 18 in.

1955, printed later

Estimate: $4,000-$6,000

Doyle

January 23, 2020 – Cherished: American Folk Art & Toys from the Estate of a Private Collector

Sale 20FA01

Lot 380

American school

A Courtship Valentine

Watercolor on paper

11 1/4 x 8 in.

19th Century

Estimate: $2,000-$4,000

Not so long-ago January was a dead month in the art world calendar – a collective trade hangover from the autumn season and the slew of dinners in the build up to Christmas. In 2020 it’s an increasingly full month, especially in London. To combat collector malaise associated with a ‘dry’ month – new year resolutions are not conducive to collecting – Condo is now in its fifth London year. Christie’s newly scheduled Modern British sales (on the thin side this season) and the London Art Fair (a localised,entry level event for modern and contemporary art), round off a relatively full few weeks in the city.

Condo has since spawned in New York (2017), Mexico City, Sao Paulo and Shanghai (2019). Condo London reaches across the gallery spectrum, with Sadie Coles, Pilar Corrias and Modern Art among the more established participating galleries. ‘Guests’ for 2020 hail from an incredibly dispersed gallery diaspora: LA, Istanbul, New York, Brussels, Hong Kong / Shanghai, Berlin, Toronto, Chicago, Tokyo, Jakarta, Glasgow, San Francisco, Warsaw, Athens, Mexico City and Vienna. A true microcosm of the so-called global contemporary.

Participation is intentionally cheap (guest galleries pay their hosts a very agreeable £700) and increased footfall the primary objective. The first few days are as close as London gets to a fully-fledged gallery weekend and it’s a remarkably successful way of encouraging gallery goers to traipse across London in the cold and wet. At best, it offers London collectors a chance to discover and acquire works by rapidly rising artists from distant gallery scenes. At worst, presentations are ham strung somewhere between an art fair booth and a true gallery show. Yet Condo is now an essential part of this drab month which is all the better for it.

Looking to the global art fair circuit, the first few months of the year have continued to fill. It’s logical that Taipei Dangdei and Frieze Los Angeles – both enjoying their second iterations – are scheduled for the middle of January and the middle of February respectively. There are few actually quiet moments left and some fairs already encroach on the sacrosanct July-August lull – it’s no surprise that the beginning of the year’s been successfully colonised. Both fairs enjoyed successful first outings in 2019, with Taipei 2020 reporting strong sales and growing, blue-chip roster. While in Barcelona, the art market’s answer to the World Economic Forum in Davos – the Talking Galleries symposium – is now in its eighth year.

It’s hard to imagine what else might fill the slow January weeks in years to come, but for now there’s more to see in London during the first few weeks of the year than ever before.

Images: Installation view, Sofia Mitsola, Darladiladada, Pilar Corrias, London. Courtesy of the artist and Pilar Corrias, London. Photo: Damian Griffiths.

Installation view, Condo London, Southard Reid hosting Öktem Aykut. Courtesy of Ahmet Civelek, Mert Öztekin.