According to the latest news reports on Weather.com, Hurricane Matthew is now strengthening again over warm water north of Cuba, with the Bahamas and parts of Florida’s Atlantic coast, the Georgia coast, and coastal Carolinas potentially in line for a strong hurricane strike. In light of these concerns, The Fine Art Group is releasing a list of what to do before, during and after in order to minimize losses of tangible assets.

With limited time to prepare and people already acting on plans to evacuate, we highly recommend starting with a call to your insurance broker to verify proper insurance coverage for all tangible assets, including flood insurance. If you have not done so already, you may wish to provide them a copy of your video appraisal as well as receipt of any recent acquisitions. If preparing to move some art, verify your policy covers transportation as some do not.

As a reminder, most property damage caused by hurricanes is a result of strong winds, heavy rainfall and storm surges. If pressed for time, using sandbags to build a perimeter around flood-prone ares as well as boarding up windows is the least you should do to prevent significant damage. Next, consider removing art from walls made of plaster and art hanging on walls across from windows. Do not store any valuable art or collectibles below ground level (such as the basement). If unable to relocate the art to a safe location out of the storm’s path, move the art to a safe room at the center of the structure that is free from windows, such as a hall closet or bathroom.

HURRICANE PLAN OF ACTION FOR PROTECTING TANGIBLE ASSETS

PREPARATION BEFORE THE STORM

- Discuss insurance coverage with your broker. Review your policy for costly gaps in coverage. If moving any fine art, verify that your collection is insured during transit. Some insurance companies have a waiting period before activation of policy changes, so plan ahead.

- Determine the type of damage your building and area is likely to suffer. Are trees likely to fall from strong winds? Have them trimmed regularly to remove weaker branches. Do you have lots of windows? Prepare to board them up. Are you located in a flood zone? Know where you can find sandbags in the event of an emergency and avoid storing valuables in the basement.

- Update your inventory with photographs and copies of your receipts. For maintaining records of your tangible assets, The Fine Art Group offers video inventories that can be shared with your insurance broker and used to reconstruct the contents of your home in the event of a loss. Think about items you have acquired recently or didn’t have included in a recent appraisal.

- Maintain a list of fine art shippers, art storage facilities, conservationists and your insurance broker. Turn your smartphone camera into a scanner with apps like CamScanner and Scannable to capture records and receipts digitally to store on the cloud and store important paper records in a waterproof safe.

- Establish a plan to relocate valuables. Select a reputable fine art shipper to move valuables to a predetermined secondary location out of the storms path.

- Collect all of the recommended items, below, for your Tangible Asset Emergency Kit.

- If you are likely to be away in the event of an emergency, communicate emergency plans with your property manager. Ensure they are aware of your valuables and know how to handle them during an emergency.

DURING STORM WARNINGS AND ACTIVE STORMS

- Board windows and establish a perimeter of sandbags around flood-prone zones.

- Remove art from damage-prone areas. This includes art facing windows and art hanging on walls made of plaster. Plaster becomes damp and may not have the structural integrity to support works of art.Learn from the mistakes of Hurricane Sandy and avoid storing valuables in the basement.

- Move works of art to a safe room, preferably a room without windows located at the center of the structure. Pack valuables in waterproof crates and plastic bins. Use acid free cardboard to prevent frames and works on paper from touching. You may also carefully wrap valuables in plastic poly to prevent water damage, possibly using acid free cardboard (and extra caution) to protect the surface. If possible, keep the works of art elevated from the floor should flooding occur.

- Monitor the storms progress and be prepared to evacuate.

DEALING WITH THE AFTERMATH

- If the structure is secure, begin assessing the damage. Photograph overall damage to the site with subsequent photographs of specific damage.

- Do not throw away any damaged items! Even if the item is a total loss, consult with your insurance broker first and photograph the item for later claims.

- Move items out of harms way and to a safe, dry location.

- If necessary, put the dehumidifier and wet vac to use! Create an air-flow with fans and the AC. Clearing the air of moisture is key to preventing further damage from mold.

- Inspect the property for any new leaks and board up any damaged areas.

- Inform your insurance broker and begin the process of filing a claim. If faced with sizeable damage to your collectibles and art, establish a plan of action with your insurance broker in collaboration with art handlers, conservationists and appraisers.

HURRICANE EMERGENCY KIT FOR FINE ART PROTECTIONS

Like an Emergency Kit, we recommend keeping these items on hand to manage your art collection in the event of a natural disaster. These items can be used to thoroughly document any damage, protect your collection as best as possible during an emergency, and prevent further damage from occurring.

- To document: Digital camera with extra memory card, batteries and charger, pencils, notepad, flashlights with additional batteries.

- To pack and transport: Latex gloves, rolls of plastic poly, packing tape, string tags, labels, scissors, box cutters, markers, acid free cardboard sheets and tissue paper.

- To protect during and after: Sand bags, plastic bins, waterproof crates, buckets, portable generator, dehumidifier, wet/dry vacuum, fans and extension cords.

FURTHER INFORMATION

- Watch Art, Cars & Collectibles: How to Mitigate Risk before Disaster Hits

- Read more about how climate change is affecting the art world and how collectors protect their investments.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

Investment guru and Chairman of the Board at Pall Mall Art Advisors, Todd Ruppert, talks to Spear’s Magazine about networking skills and helping businesses succeed.

This is the largest Francis Bacon exhibition ever staged in the north of England displaying more than thirty paintings, alongside a group of rarely seen drawings and documents, the exhibition aims to make visitors think differently about the artist’s “bleak and depressing” output.

Francis Bacon often painted a ghost-like frame or structure around the subjects of his paintings. This powerful device skillfully draws our attention to the figures within his work, intensifying their emotional state to us the viewer. Francis Bacon: Invisible Rooms looks at some of the artist’s most iconic and powerful paintings with a special focus on this recurring motif in his paintings.

An element introduced by the artist in the 1930s, Bacon used a barely visible cubic or elliptic cage around the figures depicted to create his dramatic composition. The exhibition demonstrates the ongoing development of the motif, which Bacon tested in different ways from its inception. A period of experimentation on paper in the late 1950s and early 1960s gave way to a greater spatial complexity in the late 1960s, 70s and 80s, where the cubic cages were transformed into theatrical spaces, demonstrated in 1967’s Triptych Inspired by T.S. Eliot’s ‘Sweeney Agonistes’ (Hirshhorn Museum and Sculpture Garden).

There is a parallel exhibition of works by the Austrian painter Marie Lassnig which provides the first UK retrospective of one of the 20th century’s most original painters.

For a review of the exhibition click here.

For more information click here.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Did the recent discovery of a copy of a Shakespeare First Folio at Mount Stuart, the Isle of Bute home of the Marquess of Bute, send you rushing to your shelves? If not, why not?

Even if you strongly suspected you didn’t own the First Folio, did you not for a moment entertain a pulse-racing, lingering doubt that you might at least have a copy of the Second, which has the additional value of containing the first appearance in print of another giant of English Literature, John Milton?

Even if the discovery didn’t prompt any such ambitious reaction, did it, though, at least suggest a return visit to those well stocked, double banked shelves, in the hope of finding something of value even it was unlikely to bear much comparison with that of a Shakespeare First Folio? (Good copies have fetched over £2m and up to £3.5m at auction). But might there, at least, be a good Dickens First Edition, or a James Bond, or even, a Harry Potter?

The first print run of Harry Potter and The Philosophers Stone consisted of 500 copies which retailed at £10.99 in 1997. A pristine copy can now fetch £15,000 to £20,000 at auction.

Recent years have seen substantial price rises for a number of categories of books such as travel, economics and science. Stanley Gibbons Investments recently published an index of valuable books based on past auction data. The most expensive title on the list was F. Scott Fitzgerald’s The Great Gatsby valued at £246,636 in 2015 with an increase in value of over 13 times since 1996 when it was priced at £18,056. The next most valuable on their list was The Hobbit by J R R Tolkien at £65,420, it having doubled its price of two years ago.

Author – Title

George Orwell – Animal Farm

Ayn Rand – The Fountainhead

Ian Fleming – Live and Let Die

George Orwell – Nineteen Eighty-Four

Ian Fleming – Casino Royale

Robert Graves – Good-Bye to All That

J.M.Keynes – The General Theory of Employment

T.S.Eliot – The Waste Land

Evelyn Waugh – Decline and Fall

John Steinbeck – The Grapes of Wrath

Value in 2015

£5,124

£8,540

£8,060

£8,060

£24,180

£3,750

£6,820

£5,624

£9,364

£6,133

Increase Since 1996

2597%

1729%

1579%

1450%

874%

859%

847%

687%

555%

527%

* Top ten first edition books that have seen the most growth. Source: Stanley Gibbons

These prices will have been achieved for copies in near mint condition. It is important to remember that condition is king and will hugely affect the price, along with other factors such as provenance, association, the presence or not of dust wrappers, etc. By and large, investment is best considered over the longer term. Pall Mall Art Advisors can source items or offer guidance on putting a collection together.

When did you last have your collection valued for insurance or other purposes? If books and manuscripts form part of trust assets, are they listed at current values? Books and manuscripts may provide a useful means of transferring wealth to succeeding generations or, if they meet the correct criteria, an opportunity for tax planning taking advantage of Acceptance in lieu or the Cultural Gifts Scheme.

If you would like to discuss any of these issues further, please get in touch. Our book and manuscript specialists John Sibbald and Dr Murray Simpson combine a wealth of knowledge and experience.

John Sibbald

Book & Manuscript Specialist UK

John Sibbald combines over forty years of library, antiquarian bookselling and auction experience.

Dr Murray Simpson

Book & Manuscript Specialist UK

Dr Murray Simpson was, until his retrial in 2008, Head of the Manuscript Division at the National Library of Scotland. His particular expertise equips Pall Mall Art Advisors to be leading specialists in archive valuations.

Researchers believe that 750 or fewer copies of the First Folio were printed, 234 survive today, of which 82 are in the Folger Library in Washington, DC. If your collection lacks this treasure, you may, at least, console yourself by viewing a digital version here. Alternatively, if the Shakespeare 400th anniversary celebrations are really enthusing you, there is at least one copy of the Second Folio currently on the market (around £275,000) – although the dedicated collector might also want to think about the specialist Christie’s auction (25 May) comprising just four lots – a copy of each of the first four Folios.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

With the price of gold, diamonds and jewelry continually changing, seeking professional advice relating to your specific requirement is extremely important. An item retailing for £100,000 one month could lose significant value six months later, so knowing what to insure it for correctly or, possibly even, when to think about selling it, are becoming increasingly critical issues.

At The Fine Art Group our team of jewelry specialists monitor prices and trends in the international market to make sure that you can be properly informed and looked after.

The jewelry market over the past few years has been unusually volatile for several reasons – some directly due to the general ‘woes of the world’ and some caused by some quite dramatic fluctuations in commodity, material and gem prices.

THE GOLD MARKET

In 2007, the price per ounce of gold was around the $750 mark – it peaked late in 2012 at $1,890 – and fell back to just over $1,000 in recent months although it’s edging up to the $1,200 mark today.

However, in pieces of gem set jewelry the gold value factor is not huge – the gem prices, manufacturing costs and retail profits are larger factors.

THE DIAMOND MARKET

Diamonds, despite what De Beers say in their advertisements, are not rare. Huge deposits of good quality stones are regularly being found in mid-Africa and now Botswana has pretty well become the diamond centre of the world, with De Beers moving their headquarters there from London.

Mining techniques are better and more efficient, so there are more than enough stones to go around. Slackening demand from the Middle and Far East for many of the slightly lower grade stones and sizes have seen noticeable drops in market prices. De Beers and their fellow core suppliers have had to do a lot of juggling and adjustment to try and keep things on an even keel.

However, if the stone is exceptional in all of the three main quality criteria i.e. size, colour and clarity, it will still be very expensive. The trade price of a one carat flawless D colour (the best) stone, is well over twice the price of a one carat H colour and VVS2 clarity (both acceptable commercial qualities) stone.

There have been some exceptional auction prices recently for coloured diamonds, specifically for pink and blue stones with prices approaching $1 million dollars per carat. There is a very rare red diamond coming up for sale in the Spring, which could break records despite being only just over one carat, i.e. 6.5 mm diameter.

There’s a slight, but increasing, threat to the stability of the diamond markets with the arrival of man-made diamonds. They have been around for a few years and are ‘genuine’ stones i.e. made from of carbon, but have up until now been a rather unattractive bright orange/yellow color and they were costing more to make than the price for a natural one.

However, techniques have improved and costs have dropped and they are now producing acceptably ‘white’ stones at commercially viable prices.

RUBIES, SAPPHIRES & EMERALDS

The biggest movement in the gem market has been the huge increase in auction prices of good rubies, sapphires and to a slightly lesser degree emeralds – with the big proviso that they are ‘natural and untreated’ stones and have a laboratory certificate to prove it. Nearly all the colored stone modern jewelry that you see in shops today will have stones treated with heat and highly technical processes to improve their color and clarity and therefore retail value. So it is important to ensure you have certificates and an up to date valuation.

Thailand, Vietnam, Ceylon and India are the centers for this stone enhancement. The market is awash with these stones and trade prices are very low, plus with modest manufacturing costs over there, there is plenty of scope for retailers to put a pretty punchy profit mark up on the pieces. So, it’s the good colored stones from the 1920’s and 1930’s, before this enhancement became so wide spread, that are the ones that hit the headlines. A good color and clarity natural ruby can be worth more than a diamond of comparable size, but a recognized laboratory certificate is a must.

There have been two other ‘spikes’ in the market over recent years, both driven by Middle and Far Eastern buying. First came amber, but it has to be a butter scotch brown/red color and as big as possible and unfacetted. Amber has always been associated with good fortune in the Buddhist world and has medicinal properties also. About a year ago, good amber was selling for more per ounce than gold, but there is recent auction evidence to suggest that the amber boom is over.

THE PEARL MARKET

The other spike has been in the pearl market, specifically the natural saltwater pearl market. Cultured pearls are natural beads ‘farmed’ in seawater by introducing man made beads in to the soft tissue of an oyster. The oyster’s reaction to these ‘irritations’ is to cover them in ‘nacre’, which is the lustrous shell like covering that we see on the pearl necklaces in most shops. The beads can be 4 or 5 mm in diameter so the thickness of the nacre coating can be pretty thin and lacking in lustre depth. In a natural seawater pearl the oyster takes in the occasional tiny grain of sand around which it builds up the layers of nacre, so in an 8 mm diameter natural pearl you may have 7 mm depth of nacre rather than 3 or 4 mm in a cultured pearl. If you put one of each of these pearls together the wonderful depth of lustre of the natural pearl is very apparent.

Again a laboratory certificate and an up to date valuation is a must. But the main problem for the pearl market is the arrival of freshwater pearls from China. These are farmed in rivers and lakes and not in oysters but in mussels. A mussel can produce more pearls, more often, but they can be of poor lustre and are prone to being misshapen. They are however very cheap and can be seen up to 15 mm in diameter.

Whilst auction prices for fairly modern ‘ordinary’ jewelry can very modest indeed – and a small fraction of its retail replacement price – the market for ‘big name’ pieces with good style and quality is as strong as ever. Cartier, early Tiffany, Boucheron, Bulgari, Buccellati, and Lalique all sell strongly. From the previous century there is a strong collectors’ market for work by Castellani and Giuliano and anything with an interesting historical or royal background will generally fare well.

So, with the price of gold, diamonds and jewelry continually changing, seeking professional advice and having your jewelry reviewed annually is extremely important.

At The Fine Art Group our team of jewelry specialists monitor prices and trends in the international market to make sure that you can be properly informed when choosing to sell your piece. We can also provide you with an accurate valuation for insurance purposes, reducing the prospect of any issues arising out of loss. Accurate valuations can also play a vital role in successful estate planning.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

When we think of the term ‘home invasion’ we tend to associate it with red-faced commentators on Fox-News. It is tempting to dismiss the tales of armed assailants waiting to smash into our homes to hold us hostage and to plunder our belongings as something that happens to other people in other countries (perhaps Mexico or Honduras).

Sadly however, this is not the case and the UK saw 1287 ‘home invasions’, or aggravated burglaries as they are known in the UK, occurring between 2014 and 2015. January 18th 2016 saw one such attack occurring in Birmingham where machete armed burglars broke into a house and stole £8000 of jewellery from a terrified family[1]. Another attack on a home in the Surrey area on the 19th January led to a family being attacked with crowbars whilst the burglars made off with a stash of gold[2].

Ten to fifteen years ago crimes such as the above would have more commonly taken place in locations such as Mayfair and Belgravia. These areas were once favoured hunting grounds for professional criminals due to the wealth of the residents, but this is now no longer the case, mostly due to vastly increased security. This does not mean that the rich of London are immune from crime. December 2015 saw an aggravated burglary at the home of Geraldine Winner (the wife of late film director Michael Winner). The widow was beaten, threatened and gagged while the attacker made off with jewellery and fine art[3]. Despite this, aggravated burglaries on the wealthy of London have become more infrequent and as the ultra-rich begin to slip out of criminals’ reach, new targets and locations begin to be selected.

In the present day, the most common targets of aggravated burglary tend to be individuals who live in the Home Counties or just inside the M25 commuter belt living in homes that range between £1million & £6million. They tend to be professionals such as lawyers, doctors or business owners who have two cars, two children and do their shopping at Waitrose. As these individuals have never been under any specific threat, they assume criminals will never target them.

Unfortunately it is this optimistic attitude towards security that unfortunately makes them ideal targets, as they will be unaware of the threats against them and will seldom (if ever) take security precautions.

WHAT DEFINES AGGRAVATED BURGLARY?

What defines an aggravated burglary (as opposed to the regular kind) is that the homeowner is present when the burglary takes place as well as the usage of a “firearm, imitation firearm, weapon of offence, or any explosive” used (or threatened to be used) during the course of a normal burglary.

THE CRIMINAL

Criminals that specialize in committing aggravated burglary tend not to be opportunists. Instead they tend to be professionals who work in groups and for whom crime is a way of life. There are several reasons for this: the first is that the use of violence results in much longer jail sentences, making the business of aggravated burglary a high risk one; the second is that for any group to be successful not just once, but several times without getting caught, requires care, patience and planning. Finally the increased media and police attention that comes from committing aggravated burglaries means that for a criminal group to be successful they need to be surprisingly disciplined to avoid capture.

THE TARGETING PHASE

Due to the greater risks for the criminals involved in committing aggravated burglaries, a significant amount of planning and research has to go in to every single crime as it only takes a single mistake for law enforcement to be given crucial clues that lead to an arrest. As well as this, criminals want to ensure that they select the ‘right’ target, one that has the highest reward for the lowest possible risk. After all, if one is going to face a significant jail sentence it should be for a suitable reward.

For a successful aggravated burglary to be carried out, a group must first pick a selection of targets, assess the risks involved and begin the planning process, all of which initially starts online.

The all-pervasive nature of cyberspace and the Internet has meant that criminals have never had greater access into the lives of their potential targets than they do presently. By using websites like 192.com[4] criminals can, in many instances, check who is living at an address. A small fee to the Land Registry or even a browse through websites such as Zoopla can bring up floor plans and information on the value of the house. Once names have been linked to addresses, a quick search of Companies House can reveal the names of related business directors and the potential value of their companies and assets. Finally, Google Maps and Google Street View can put you at the gates of a target’s house or view it from the air, allowing in some instances for security features to be mapped without having to visit the area in person.

All of the above techniques are (in part) similar to the methods that security and intelligence companies use to help their clients, but it would be naïve to suggest that they are the only ones.

Without leaving their desk, a skilled individual (legitimate or not) can often find the following about an individual all from the comfort of their home or office:

- Their place of address (192.com and the Land Registry)

- The value and floor-plan of their place of residence (Zoopla, Rightmove and the Land Registry)

- Any companies they might have and the estimated value of such companies via accounting information (Companies House)

- Places of work (Google and Companies House)

- Patterns of movement (Instagram, Facebook, online social and conventional media)

It is for reasons like the above that make publications such as Hello Magazine and Okay Magazine two of the most popular subscriptions in the British prison system! This is not due to inmates’ interest in Angelina Jolie’s latest adoption (though I’m sure they find her devotion to the less fortunate touching), but because it gives insight and information into the homes of the wealthy, all of which is very valuable to those criminals beginning the targeting phase of a job.

Once the criminals have a rough idea of the areas that they might be targeting or alternatively have a specific individual (or group of individuals) in mind, criminals can begin to establish what is known as a pattern of life. Our pattern of life is the ‘rhythm’ that governs our daily existence; when we get up, when we go to work and when we go out to socialize. Modern life forces us into easily predictable routines, where criminals rely on a predictable pattern of life to be able to effectively target potential victims. Using the information gathered during the target phase as well as observing their potential targets and their homes, criminals can build up ‘dossiers’ on multiple targets and then pick the ones that indicate the greatest chance for reward with the lowest possible risk.

GAINING ENTRY

Once criminals have established a pattern of life, they can work out the best moment to strike. For aggravated burglars this is not during the night or the early hours, instead mornings and afternoons are much more favoured. This is because at night, the roads are clearer and police more active. But, during rush hour in the morning and evening, response times are longer, police are busier and the shifts between their morning and evening at their station may be changing.

When attacking a property, speed and shock are crucial, criminals will often force entry when the homeowner is opening the door to go inside. Once access has been gained, the criminals will use violence or the threat of violence to gain access to valuables before making a swift exit. Valuables will often be buried and hidden nearby to be recovered weeks (or even months) after a burglary has taken place. This is to ensure the chances of the group being caught with stolen property are lowered and that when the group retrieves the valuables, the heat will have died down.

PREVENTION

It may seem that there is little defence against such groups who are both intelligent and well equipped, but this in truth is not the case. Individuals can take numerous steps to help safeguard themselves online and off and a simple place to start is to remove yourself from 192.com, this can be done by filling out a CO1 form.

Minimizing one’s online exposure is also a simple but effective tactic, though abdicating from social media is a touch extreme. One should be careful to ensure that the only information that exists online is information that is necessary for maintaining one’s social and business life.

It is also possible for vigilant homeowners to disrupt the targeting phase of a criminal group. Although there is little one can do regarding the online stage of the targeting phase (barring the removal of information from the web) there is a great deal that can be done to prevent or disrupt the physical targeting phase. This can include everything from increasing the security of one’s home to make it more of an unappealing target to spotting potential observers and informing the police. Most criminals will break off an attempted burglary or aggravated burglary if they feel that their targets have become aware of them as it increases the risk to unacceptable levels.

Although anonymity is an excellent form of defence, physical deterrent is often just as effective. When planning to commit a crime, criminals (using all the tools described above) will create a risk-profile of their prospective targets.

This means that the best way to keep one’s property safe to raise the risk above what a criminal group would likely deem to be acceptable. Though this will not likely stop a crime from taking place, it displaces the criminal threat to others around you. Though you may not be able to stop an aggravated burglary from taking place, you can take steps to ensure you are not the target. This tactic, though perhaps slightly cold-blooded is one of the most effective ways to keep one’s property safe.

THE IMPORTANCE OF INSURANCE

For many victims, though the police will doubtless try their best and security precautions such as the use of DNA marking on belongings will help recover stolen items, in reality often the only way of recovering the value of the lost assets is insurance. Just as important as the value of anything taken is the psychological trauma that an event such as an aggravated burglary causes. The event is an extremely traumatic experience for the victims and can leave them distressed for months afterwards. In some instances, this can lead to post-traumatic stress disorders as well as the physical effects. Counselling can help provide effective coping strategies. In some cases, even a child who wasn’t present during the attack can be affected afterwards. Failure to seek professional help could lead to longer-term issues.

Numerous specialist insurers have begun to recognize that the effects of crimes like aggravated burglary extend far beyond the financial impact and have taken a more holistic approach. Many brokers now have specific cover for aggravated burglary in their home policies. Expenses for psychiatric counselling, lost salaries, temporary relocations and for additional security to be installed in the affected home can all be provided.

Yet despite the financial and psychological help and security that some insurers can provide, many families do not have insurance that will protect them in the event of aggravated burglary.

The issue of under-insurance is widespread and according to Insurance Group Zurich, 80% of UK commercial properties are under-insured[5]. Though reducing insurance coverage may be seen as a sensible method of cutting costs to a household or business (especially when times are tight) in truth it can lead to catastrophe should the worst occur.

Human beings tend to have a comparatively optimistic outlook on the world in general and will often maintain hope that a situation will improve even when it almost certainly will not. The combination of natural optimism and a tight budget often make it tempting to simply ignore insurance as an unnecessary cost. Our optimism in the world around us is also reflected by the fact that though one in five new homeowners will change their bathroom or kitchen, only one in twelve will invest in additional home security [6].

Aggravated burglary is not an issue that is going to go away and as the UK (and many other nations) becomes more unequal the gulf between those who have and those who have not will only deepen. With combined government cuts steadily eating into police budgets, you are left with a situation ideal for criminal growth. As we stare into a more unequal and unstable future it would seem sensible to build our walls slightly higher and perhaps take another look at our home insurance policy.

[1] http://www.birminghammail.co.uk/news/midlands-news/couple-attacked-machetes-home-jewellery-10619129

[2] http://www.getsurrey.co.uk/news/surrey-news/terrifying-ordeal-sees-masked-men-10755100

[3] http://www.telegraph.co.uk/news/celebritynews/12047381/Michael-Winners-widow-to-make-Crimewatch-appeal-over-traumatic-attack.html

[4] http://www.192.com

[5] http://insider.zurich.co.uk/market-expertise/5-things-you-need-to-know-about-underinsurance/

[6] http://www.aviva.com/media/news/item/uk-homebuyers-spend-10000-doing-up-their-homes-in-the-first-year-17557/

Harry Chenevix-Trench is the Intelligence Manager at Blackstone Consultancy and specializes in open source research and risk analysis.

IS THE UK ART TRADE UNREGULATED?

Last year I was invited to be part of a panel at the Art Business Conference in London to discuss how the art trade can best protect its clients. It turned out that what some of the panel wanted to suggest was that the art trade was largely unregulated and that if the trade did not do more to correct this soon, regulation would be imposed on it from outside. I begged to differ and here is why.

To begin with it is simply not true to say that the trade is unregulated. A recent study by the British Art Market Federation lists 167 laws and regulations currently in force and applicable to the UK art market. Many of these are of wide application such as the Consumer Contracts Regulation, copyright regulations, the export control act or money laundering regulations. But others deal very specifically with the art trade such as the Artist’s Resale Right regulations, the Dealing in Cultural Objects Act, the Auctions Bidding Agreements acts etc. The combination of all these laws and regulations provides a pretty comprehensive framework and the art trade certainly does not feel unregulated from the inside. Rather than calling for still more regulation I think that the critics need to begin by explaining what gap it is we need to fill. We need fewer allegations and more facts.

One fact which seems to me insufficiently recognised is that, taking account of the size of the UK economy, the British art trade is by far the most successful in the world. We have twice as much as trade as the rest of the EU put together, 4 times as much as France, 10 times as much as Germany. We have just under a quarter of world trade, not so far behind the USA which has just over one third and whose GDP is about 8 times the size of ours. This success is something we should celebrate and brings huge benefits to our country. It is good for British artists hoping to sell their work, good for employment – the trade employs about 60,000 directly and a further 60,000 indirectly, good for the exchequer in terms of the tax we pay and good for tourism, encouraging wealthy people to visit this country. It is worth asking ourselves therefore just why our trade has been so successful. I have no doubt that there are a number of contributory factors but I believe that a very important one is that, unlike some others, we are not a country which instinctively feels that more government involvement and more regulation is part of the answer. I am not trying to say that there can never be a place for more regulation. But I would urge caution in rushing to fix something which seems to me very far from broken.

I also feel that too many observers looking at the art trade from the outside allow themselves to get carried away by the enormous prices paid at auction for a small number of exceptional works. Here therefore is another fact. The top 1530 lots sold at auction in 2014 accounted for 48% of the value of sales, but less than 0.5% of the number of transactions. 91% of the lots sold at auction went for less than €50,000. Still a lot of money, but not the sort of figure that the press loves to write about.

Looking from the dealer perspective however, I do worry about the number of dealers in the UK who do not belong to any trade association. About 1,000 dealers belong to the three main trade associations, SLAD, BADA and LAPADA, leaving about 7,000 who do not. Of course some of these 7,000 are excellent dealers. But the point about buying from a dealer who belongs to a trade association is that you have an assurance that that dealer meets certain standards of competence and honesty and also have some means of redress if the purchase goes wrong and the dealer declines to settle the matter satisfactorily. If you buy from a dealer who does not belong and things go wrong you are left with the courts and that can be prohibitively expensive. We in SLAD are fairly strict about whom we accept as members but I would like to see more dealers joining one of the three associations. I would also like to find some way of getting it across to the wider public that they should be careful about buying from a dealer who does not belong to any of them.

I am also concerned about the rise of a new group of self-appointed intermediaries who attempt to sell objects they do not own and have no authority to sell. I know that many of our members are becoming more and more concerned about this phenomenon which seems to be on the increase but we are struggling at the moment to find an effective way of dealing with it. I can only urge members of the buying public to question the credentials of those they are dealing with and to check, if in doubt, whether they have the authority to sell what they are advertising.

And my final thought, just as important as regulation, is reputation. Regulations are essential but they are not always easy to enforce. But good dealers will themselves go to considerable lengths to establish and preserve their reputations, often going far beyond what the actual regulations require. Setting standards and helping to maintain reputations is also what the trade associations are all about, which is why I see them as playing such a crucial role in the art trade and would like to encourage all would be customers to keep them in mind when they are buying or selling art.

Christopher Battiscombe CMG is Director General of the Society of London Art Dealers

FURTHER READING

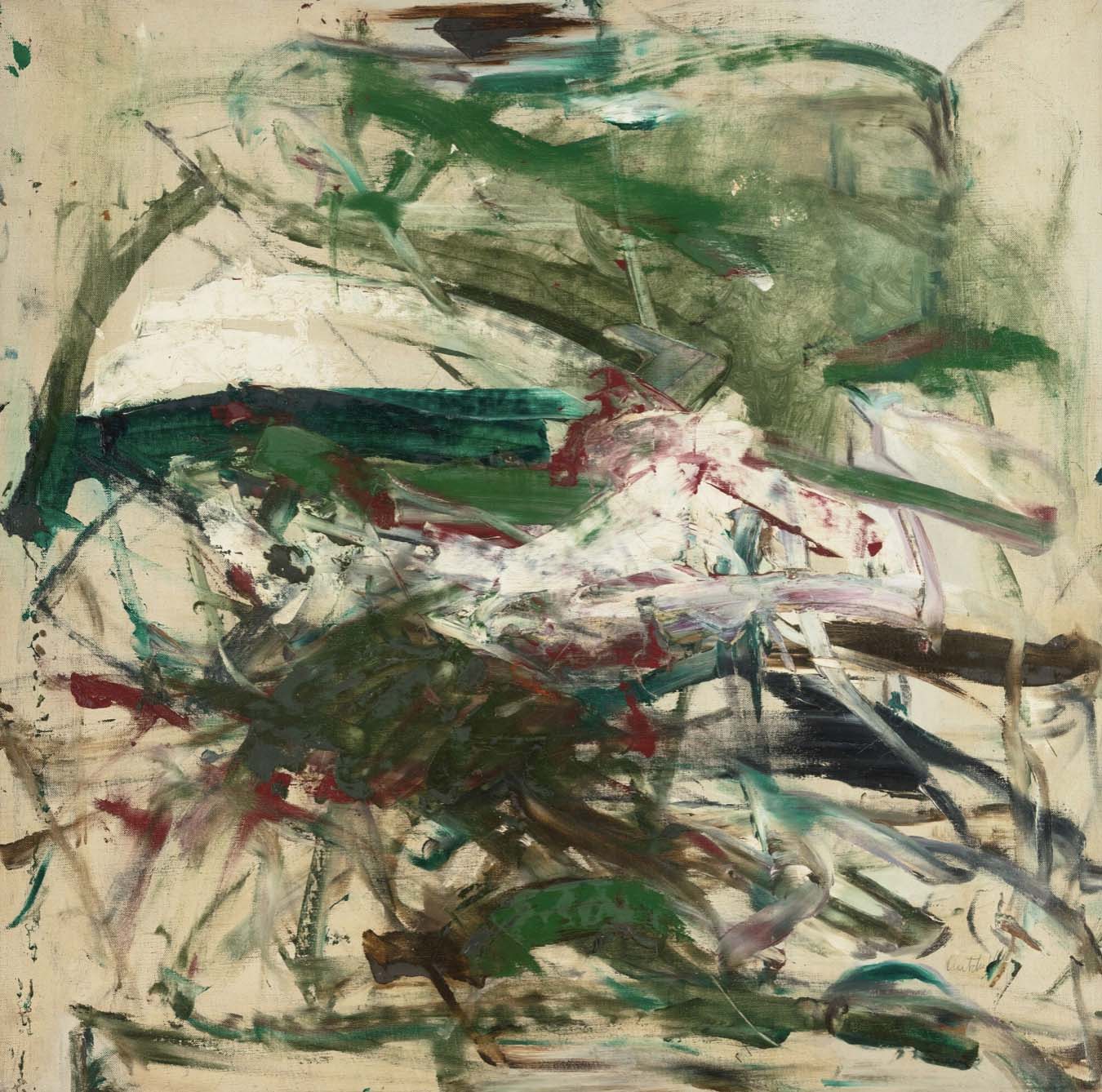

“I paint from remembered landscapes that I carry with me – and remembered feelings of them, which of course become transformed. I could certainly never mirror nature. I would more like to paint what it leaves with me.”

This untitled oil on canvas, executed in 1960 by Joan Mitchell (1925-92), had been acquired by our client at auction in 2006.

Joan Mitchell

Untitled

Oil on canvas

1960

28 1/2 by 28 3/4 in.

Estimate: $400,00-$600,000

Sold: $466,000 (Hammer with Buyer’s Premium)

PROVENANCE

Martha Jackson Gallery, New York

Private Collection, Peru (acquired from the above in April 1967)

Sotheby’s, New York, May 11, 2006, lot 170

Acquired by the present owner from the above sale

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

The Collection of Robert & Barbara Safford

In 2013 our team acted for the Safford family in the dispersal of antiques from Vaux Hill, a 20-room country estate with pre-Revolutionary origins in Phoenixville, Pennsylvania.

Upon the advice of The Fine Art Group, the 274 selected lots were consigned to auction in a single-owner sale that was promoted to the international marketplace with previews in both London and New York.

After an international tour and much media fanfare, the auction of the Selected Contents of Vaux Hill: The Collection of Robert & Barbara Safford achieved $3.9 million in sales—more than tripling the auction’s estimate—and set an auction record. Buyers from around the globe packed Freeman’s third floor gallery for a chance to bid on the 274 works spanning two centuries. Decorative arts from royal and continental craftsmen KPM, the Russian Imperial Porcelain Factory, the House of Hanover, and Louis XV were offered in the sale. Freeman’s attracted nearly 400 potential buyers via the phones, online, and in the room. What would have normally been a two and a half hour auction took place over five hours, as the sale drew fierce bidding.

The top lot was a hand-painted Russian urn produced by Nicholas I’s Imperial Porcelain Factory in St. Petersburg, estimated at $150,000-200,000. After brisk competition from within the room, on the phones, and the internet, it went to the highest bidder in the room for $494,000. Urns of this size are unique and few have survived as they were extremely difficult to cast and very delicate. This was one of several large continental vases sold yesterday (lots 7, 64, 107, 126 152), which attracted heavy bidding and successful results.

An auction record was set for a rare gilt bronze mounted porcelain tall case clock by the Berlin Konigliche Porzellan Manufaktur (KPM), circa 1895, which brought $242,500. It is believed to be one of only six in existence produced after a design by Alexander Kips, estimated at $80,000-120,000. One of these six clocks is proudly displayed at Osborne House on the Isle of Wight; it was a gift given to Queen Victoria by her grandson Kaiser Wilhelm II.

Top Lots from Selected Contents of Vaux Hill: The Collection of Robert & Barbara Safford:

- $494,000

Lot 131: Important ormolu mounted Russian imperial hand-painted gilt-decorated porcelain urn. Russian Imperial Porcelain Factory, St. Petersburg, Period of Nicholas I, circa 1836. - $482,500

Lot 107: Rare pair of Russian hand-painted and gilt decorated blue ground vases, 20thcentury. - $254,500

Lot 1: Very fine gilt metal mounted Meissen porcelain and giltwood secretaire cabinet, circa 1880. - $242,500

Lot 39: Important German gilt bronze mounted gilt decorated and hand-painted KPM porcelain tall clock case clock, circa 1895 - $158,500

Lot 84: Large and impressive Sevres style porcelain white ground vase. - $134,500

Lot 154: Fine Continental Louis XVI style gilt-bronze and rhodonite seven-piece desk.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

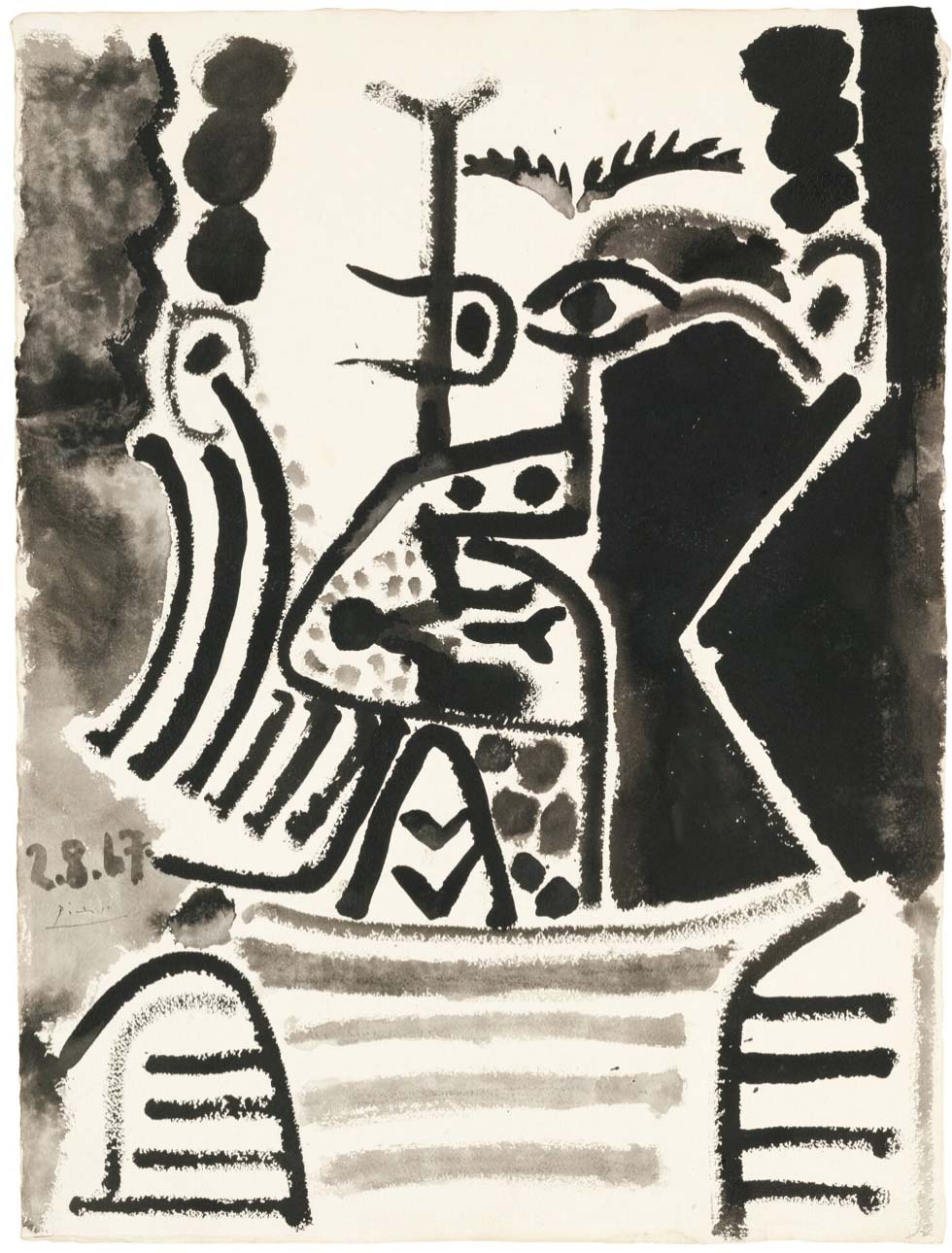

Alfred C. Breuning of Pennsylvania had acquired Pablo Picasso’s Buste d’Homme, a brush and ink sketch dated 2.8.67, from the Galerie Louise Leiris in Paris in 1969.

Acting for Breuning‘s estate it was consigned for sale at Sotheby’s New York in May 2014 where it sold at for $677,000.

The work was completed in the year Picasso began his famous series of cavaliers and musketeers – believed to be the ailing artist’s recreation of himself as a youthful and sexually potent figure.

Pablo Picasso

Buste d’Homme

Brush and ink and ink wash on paper

29 1/2 by 22 1/8 in.

August 2, 1967.

Estimate: $500,000-$700,000

Sold: $677,000

PROVENANCE

Galerie Louise Leiris, Paris

Acquired from the above circa 1969

EXHIBITED

Paris, Galerie Louise Leiris, Dessins 1966-1967, 1968, no. 55

LITERATURE

Christian Zervos, Pablo Picasso, Oeuvres de 1967 et 1968, vol. XXVII, Paris, 1973, no. 95, illustrated pl. 29

The Picasso Project, ed., Picasso’s Paintings, Watercolors, Drawings and Sculpture, The Sixties II, 1964-1967, San Francisco, 2002, no. 67-322, illustrated p. 377

CATALOGUE NOTE

Buste d’homme is an iconic image that exemplifies both the confrontational style of Picasso’s 1960s art and the iconography of the masculine male that the artist championed in his later years. Executed in 1967, the present work was completed during the very year that Picasso began his series of cavaliers and musketeers. Such works, which are laced with references to masculine virility and sexuality, are believed to be the artist’s recreation of himself, then ailing, as a youthful and sexually potent figure. Here, the misplaced facial features suggest an inner torment, yet the firm, deliberate strokes of ink and frankness of the subject indicate a vigor and masculinity that will come to characterize his series of musketeers and swashbucklers. The work thus references both deterioration and resilience, underscoring the psychological complexity of this transitional period.

Picasso’s exploration of self-image in his art is summarized by Simonetta Fraquelli: “In their seventeenth-century garb, Picasso’s musketeers appear in many guises, some holding swords and some wearing wigs or ornate shoes, others smoking. Some are young, others old, some participate while others are voyeurs. They represent many of the possible ages of the artist, ranging from a child genius to an impotent old man. Like Rembrandt, with whom he now became obsessed, Picasso liked to insert himself into his paintings, in one guise or another. The parallels between the two masters, the Dutchman and the Spaniard, are many: both enjoyed a long and fulfilling career; both felt isolated and misunderstood, if not derided, in their old age; and both obsessively recorded their own decline in their numerous self-portraits” (Simonetta Fraquelli, “Looking at the Past to Defy the Present: Picasso’s Painting, 1946-1973,” in Picasso, Challenging the Past, London, 2009, p. 146).

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.