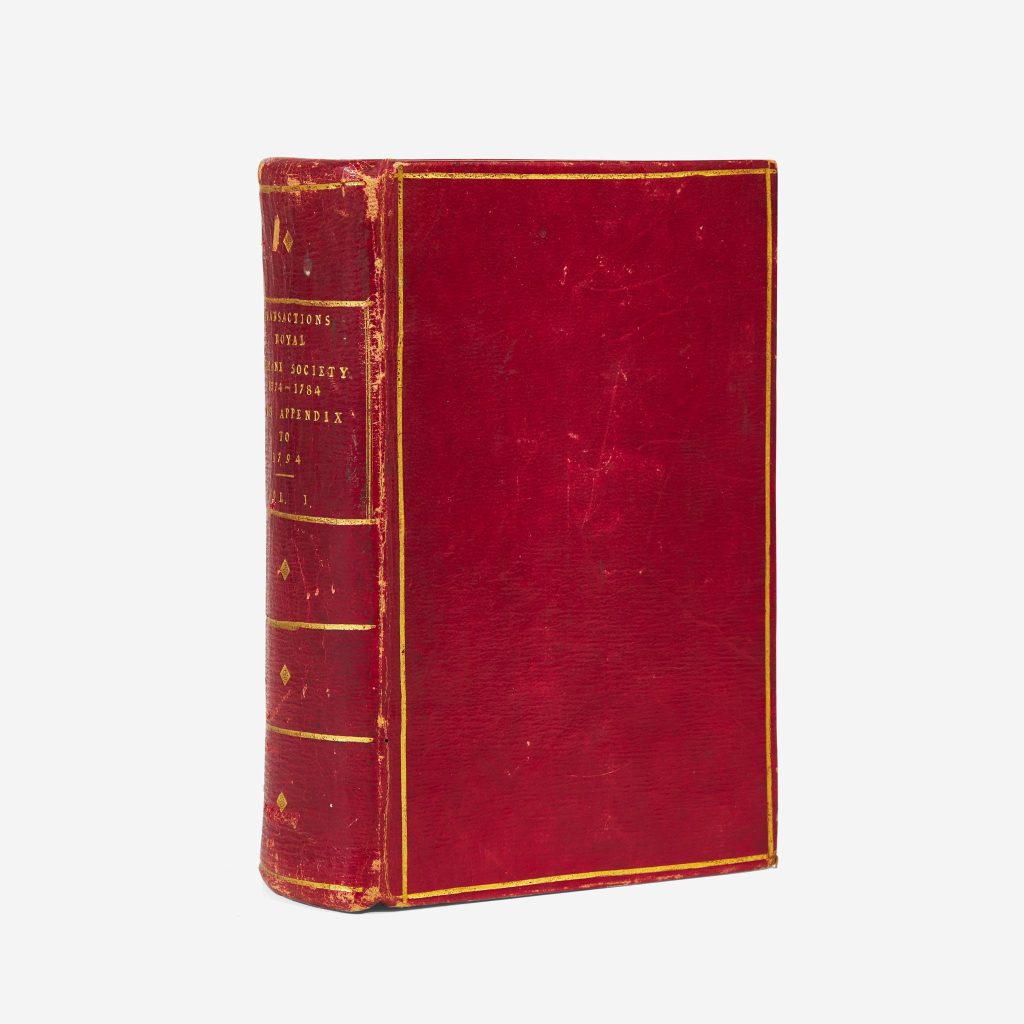

The Fine Art Group is pleased with the impressive sale result for a rare book placed at Freeman’s auction house on behalf of a client. The book, The Transactions of the Royal Humane Society, is a piece from the personal library of the first President of the United States, George Washington.

From the Personal Library of President George Washington

1795

Freeman’s

May 3rd, 2023

Lot 158

ESTIMATE: $12,000 – $18,000

SOLD: $441,000

The book was estimated to sell for $12,000 to $18,000 but achieved a staggering price of $441,000. The Fine Art Group is committed to maximizing returns for its clients. The success of this sale demonstrates the potential for significant returns in the collectibles market, particularly when dealing with rare books and historically significant pieces.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Guy Jennings, Senior Director of The Fine Art Group, spoke with journalist Scott Reyburn of The Art Newspaper about a trend in the art market seen to be growing of art collectors being more interested in spending less on emerging artists than on paying premium prices for blue-chip artwork.

Read the full article at The Art Newspaper by following this link.

Full article here.

The Fine Art Group has made grand strides to grow dramatically over the past year. Following our successful expansion in the United States in 2021, the company has continued to increase international outreach and further consolidated its position as the global leader for collector services including Advisory, Art Finance, Sales Agency, Investment and Appraisals.

Beginning in January 2023, we announced an expansion into Asia through a joint venture with Patti Wong and Daryl Wickstrom. Patti Wong & Associates is a new Hong-Kong based art advisory firm that will focus on the most significant collectors in the region and service their needs across multiple categories. Along with this investment, we expect our partnership to create exciting opportunities in both the art and finance world for our existing and new clients.

Credit: Bonnie H. Morrison

After COVID-19 swept the nation, 2022 found strength again in the global art market as businesses began to once again bloom. Sotheby’s, Christie’s and Phillips repeatedly posted record breaking figures, and the two largest art fair franchises, Art Basel and Frieze, both opened successful new editions in Paris and Seoul, respectively.

TEN ART MARKET PREDICTIONS FOR 2023

1. Amidst macro-economic uncertainty, conservatism will prevail in the auction market with greater sobriety in the ultra- contemporary category.

2. Long overdue appreciation of female artists and artists of color in the market will continue, with galleries striving to represent older or deceased artists who have been historically underrecognized.

3. NFT’s will remain an intriguing value proposition for more adventurous collectors but with far stronger legal regulation and newfound insurance policies. The days of the ‘Wild West’ NFT world will dissipate.

4. Given the crash of cryptocurrency markets in 2022, auction houses and commercial galleries will step away from accepting cryptocurrency as payment and return to traditional purchasing currencies.

5. Confidence in the gallery sector will continue in the mid and upper tiers, with ongoing real estate expansion in Los Angeles, New York and Paris.

6. Another major gallery will ‘corporatize’ like Gagosian by adding creative power players in other industries to their boards.

7. More fairs like Masterpiece without clear value propositions will struggle and we expect further closures.

8. Single owner sales will continue to be the biggest revenue driver for auction houses.

9. Auction house consolidation at the lower levels will continue with Bonhams, Phillips or Rago / Wright announcing further acquisitions.

10. Overall, fine art auction sales volume will be lower than the total for 2022.

FURTHER READING

- Looking Forward: Ten Predictions for 2022

- What Will Collectors Buy in 2022?

- Market Update: How the Art Market Joined the Digital Age

Image 1: Credit: Bonnie H. Morrison; Image 2: Courtesy of Sow & Tailor; Image 3: Courtesy of Masterpiece London

Digue et lumières d’Ostende

1909

Christie’s

April 4th, 2023

Lot 22

ESTIMATE: EUR 300,000 – EUR 500,000

The Fine Art Group is delighted to have assisted a private client in bringing an artwork by Léon Spilliaert to the Impressionism & Modern Art Sale at Christie’s to be held on April 4th, 2023.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Four girls

1907-1990

Sotheby’s

April 6th, 2023

Lot 786

ESTIMATED: 350,000 – 450,000 HKD

For more information on how to register, please visit Sotheby’s by visiting here.

The Fine Art Group is pleased to have assisted a client in bringing a beautiful Affandi painting to Sotheby’s Modern Day Auction. Visit the link above for a rare video of Affandi working on this lively artwork.

“The present lot is a highly rare composition from the artist’s celebrated traveling series. Commissioned by the present owner’s father, who was introduced to Affandi by a mutual friend who was likely an Indonesian diplomat, Four Girls was painted in the summer of 1962 in Annapolis, Maryland.”

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

The Fine Art Group is pleased to announce that we have partnered with Artnet to offer its users immediate access to apply for art-secured loans from The Fine Art Group.

“The Fine Art Group shares Artnet’s vision of improving access to art financing, and we look forward to offering our leading art finance service to Artnet’s clients,” Freya Stewart, Chief Executive Officer of Art Finance at The Fine Art Group.

OUR ART FINANCE SERVICES

The Fine Art Group provides asset-secured loans for collectors, the art trade, and owners of high-quality works of art, jewelry, and watches. The Fine Art Group offers flexible, bespoke financing solutions to meet each client’s requirements. A unique combination of renowned in-house art, finance, legal and logistics experts ensures an unrivaled speed of loan execution, together with exceptional client service.

Visit our Art Finance services page.

FURTHER READING

Freya Stewart speaks to Artnet News about the history of art-backed loans and their growing popularity since the 2008 financial crisis.

Read the rest of the article on Artnet News.

Full article

Philip Hoffman speaks with Bloomberg about Art Basel Hong Kong 2023 and how Hong Kong remains the central hub of the art market in Asia.

Click here to read the full article on Bloomberg.com.

Full article

A LEADER IN BUSINESS DEVELOPMENT & PHILANTHROPIC STRATEGY

The Fine Art Group is pleased to announce our newest Managing Director, Colleen Boyle. Colleen leads Business Development Initiatives and Philanthropic Strategy for The Fine Art Group. While building critical relationships in family office, risk management, legal and wealth sectors, she also regularly assists clients with strategies of non-cash art and collectibles for charitable endeavors as well as identifying institutions for direct donations.

Colleen Boyle brings over 20 years of diverse experience in the art and financial world to The Fine Art Group. She has valued art and collectibles for international corporations, museums, and private collectors across the globe. Colleen has provided legal analysis for court cases involving art valuation and identification.

Colleen earned a diploma in French Fine and Decorative Arts at Christie’s in Paris and a Master of Arts degree in Art History from the University of St. Thomas. She then received a Bachelor of Arts degree in Economics from The College of William & Mary. She is a member of the Appraisal Association of America and is USPAP compliant.

Having earned the Chartered Advisor in Philanthropy designation (CAP®), Colleen regularly assists clients with monetization strategies of tangible assets for charitable endeavors as well as identifying institutions for direct donations. She conducts lectures and Continuing Education classes on diverse topics pertinent to art and collectibles and is featured in a documentary titled “The Real Fake.”

OUR SERVICES

Whether you are an individual, family, foundation, or non-profit organization, The Fine Art Group can help make your charitable vision a reality.

Patti Wong of Patti Wong & Associates speaks with The Financial Times about her role as an art advisor within Asia’s growing art market and her decision to partner with The Fine Art Group to provide her clients with more services, such as art financing.

Click here to read the article at The Financial Times.

Full article