The Fine Art Group is pleased to offer a collection of a variety of Hermès handbags on behalf of a private collector. The sale of the collection is online through Sotheby’s Handbags & Accessories Auction and begins December 5, 2022. For more information on how to register to bid, please visit Sotheby’s by clicking here.

Crocus Clemence Birkin 35 Palladium Hardware

2010

Handbag’s & Accessories Sale

December 5, 2022

Lot 50

ESTIMATE: $8,000-$12,000

Bleu Roi Ostrich Birkin 35 Palladium Hardware

2009

Handbag’s & Accessories Sale

December 5, 2022

Lot 122

ESTIMATE: $15,000-$20,000

Bordeaux Shiny Porosus Crocodile Birkin 35 Palladium Hardware

2010

Handbag’s & Accessories Sale

December 5, 2022

Lot 44

ESTIMATE: $22,000-$32,000

Gris Perle and White Clemence and Mykonos Lizard Club Birkin 35 Palladium Hardware

2012

Handbag’s & Accessories Sale

December 5, 2022

Lot 72

ESTIMATE: $10,000-$15,000

White Clemence Birkin 35 Palladium Hardware

2007

Handbag’s & Accessories Sale

December 5, 2022

Lot 95

ESTIMATE: $8,000-$12,000

Ebene Clemence JPG Birkin 42 Palladium Hardware

2006

Handbag’s & Accessories Sale

December 5, 2022

Lot 127

ESTIMATE: $8,000-$12,000

RELATED CONTENT

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

WATCH OUR LATEST EDITION OF THE EDUCATED EYE: HOW TO BUY & SELL SMART

What makes one bag more expensive than another? How do you protect yourself from the counterfeit market? When is the best time of year to buy or sell luxury handbags? Whether you are starting a collection or selling one, our experts will offer insight into this niche market.

What makes one bag more expensive than another? How do you protect yourself from the counterfeit market? When is the best time of year to buy or sell luxury handbags? Whether you are starting a collection or selling one, our experts will offer insight into this niche market.

*Please note a small time jump in the recording at 36:41 due to a sound distortion we have trimmed from the recording.

UPCOMING SALES OF NOTE

Luxury Week, Handbags & Accessories, Sotheby’s – 5 December 2022•12:00 EST, New York

Luxe Holiday, Sale 1105, Hindman Auctions – Dec 1, 2022 10:00AM CT

TOPICS DISCUSSED

- Hermès history

- The Hermès of today: additional products produced

- What makes Hermès’ luxury handbags high quality and worthy of investment

- Venues for safely buying and selling

- Official handbag materials, colors, and sizes

- Ways advisors and specialists identify counterfeit bags

- Official Hermès handbag design collections

- Handbag investment values over time

- Upcoming collections

FURTHER READING

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Images courtesy of: The Real Real, 1stDibs, Hermès, Sotheby’s, Christie’s, Hindman, Heritage

The Fine Art Group is pleased to offer a collection of luxury handbags on behalf of a private collector. The collection includes top fashion house names such as Christian Dior, Hermès, Prada, and Chanel. It is being offered online through Hindman Auctions Luxe Holiday Sale and begins December 1, 2022. For more information on how to register to bid, please visit Hindman by clicking here.

RELATED CONTENT

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

The Fine Art Group is pleased to announce Kate Waterhouse as their new Senior Specialist, Director of Fine Jewelry. She will oversee Jewelry Appraisals and assist clients in growing and curating their jewelry collections in moments of accession and deaccession.

Kate Waterhouse will represent The Fine Art Group from Palm Beach, Florida, where she has lived and worked since 2015. She is active in Palm Beach’s local fine and performing arts communities, serving on the Norton Museum of Art’s Emerging Collectors Council, the Dreyfoos School of the Arts Foundation Luncheon Committee, as well as being a former chairwoman of the Palm Beach Symphony Young Friends Gala.

Kate is a member of the American Society of Jewelry Historians and has been a featured appraiser in the television program Antiques Roadshow and a jewelry and collectibles expert on NBC’s Today Show.

Kate is a welcome addition to The Fine Art Group’s staff and its mission to guide clients through all collector markets and our five core services:

Advisory, Art Finance, Sales Agency, Investment & Appraisals

Founded over 20 years ago, The Fine Art Group has established an unrivaled track record across the art ecosystem. From first acquisitions and building collections, through to appraisals and art financing, we offer clients an experienced and skillful hand – helping to navigate the opacities of the market.

Kate Waterhouse has continuously worked in the luxury industry for over 18 years, graduating with a BA from Elizabethtown College; she attended the Sotheby’s Institute of Art, London where she worked toward her Master’s in Art Business putting her focus in auction house management, marketing and operation. Kate has been featured as a Specialist team member on the PBS Antiques Roadshow, as well as the NBC Today Show.

In 2006, beginning in Philadelphia at Freeman’s, Mrs. Waterhouse oversaw the Fine Jewelry department as Vice-President, Head of Department before her tenure as Director of Jewelry, New York for Heritage and landing finally at Sotheby’s, as an Assistant Vice-President, Specialist in the Magnificent Jewels department, moving to their Palm Beach office in 2015.

In 2018, Ms. Waterhouse moved to Hindman Auctioneers, to oversee the Southeast region as Vice President of Business Development, including the management of two full time auction rooms, producing as many as twelve auctions per year while also sourcing property for other Hindman sales rooms across the country.

Most recently, Ms. Waterhouse joined The Fine Art Group, and currently serves as their Senior Specialist, Director of Fine Jewelry overseeing both Jewelry appraisals as well as assisting clients to navigate, grow and curate their own collections in moments of accession and deaccession.

FURTHER READING

- Selling Jewelry & Watch Collections: 8 Steps of the Process

- Lab Grown Diamonds: If & When You Should Consider Buying

- Watch TFG’s New York Luxury Week 2023 Webinar

Watch our Founder and CEO Philip Hoffman speak with Finimize about how you can invest in fine art during an era of double-digit inflation.

FURTHER READING

- Good News for Art Sellers: Highest Inflation in the U.S. in Four Decades

- Is Art a Good Investment?

- Watch Art and Collectibles: The Rise of Alternative Investments

The Scoop #11 – November 22nd, 2022

In this edition of The Scoop, we look at the FTX fallout, how other alternative assets are thriving, and feature a master of minimalism in our Artist Spotlight.

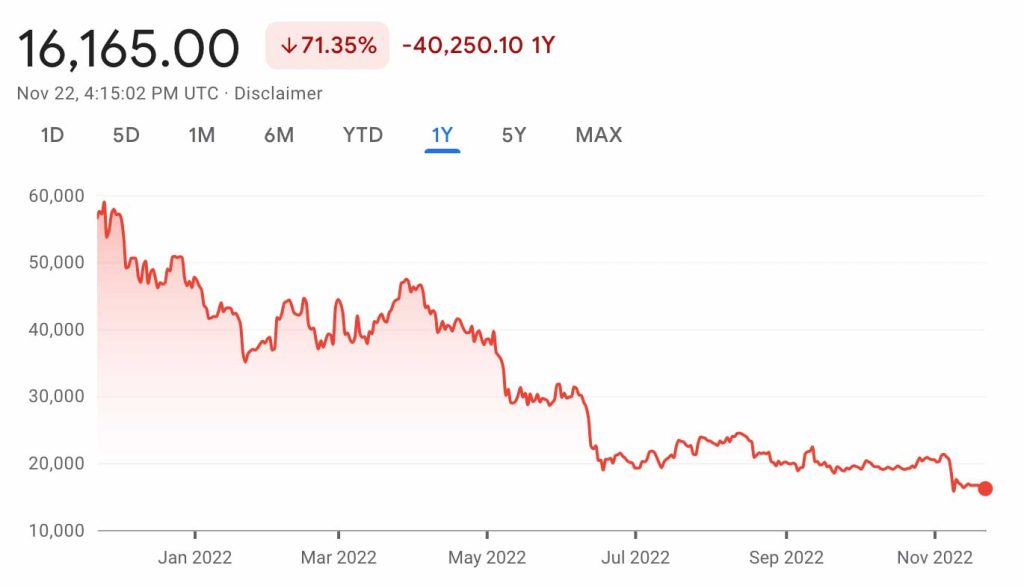

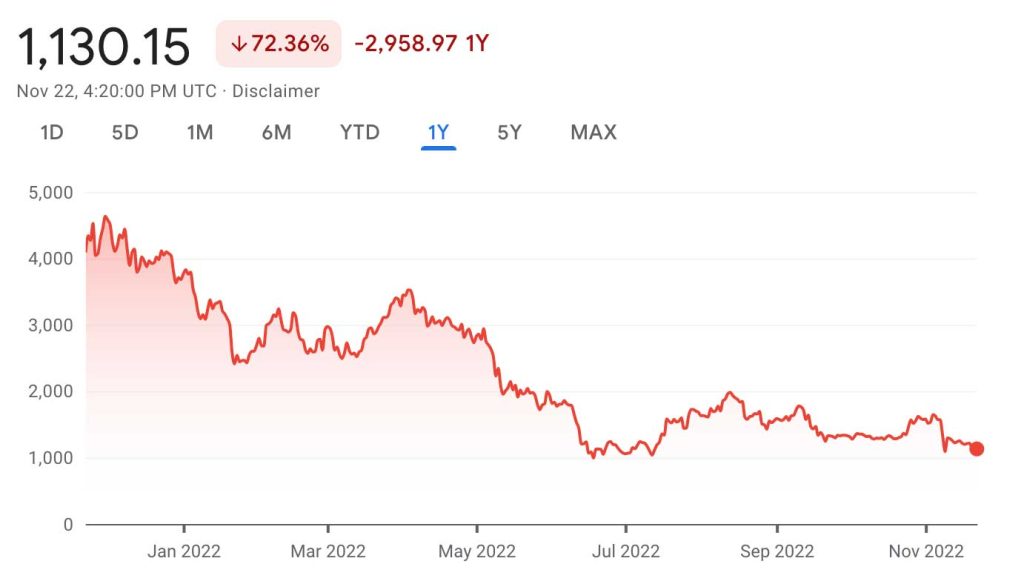

CRYPTO MARKET

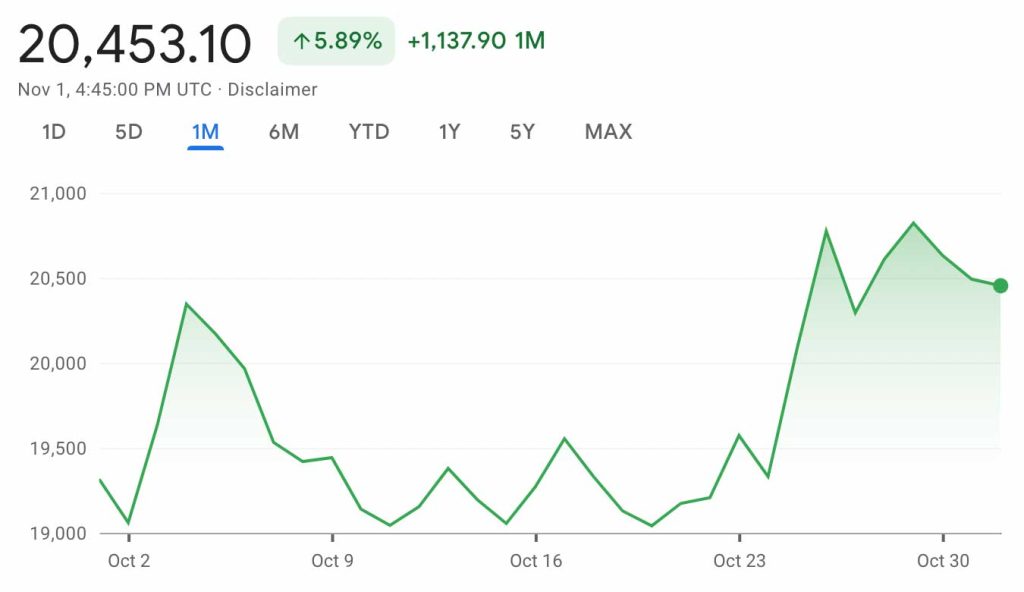

Bitcoin to USD

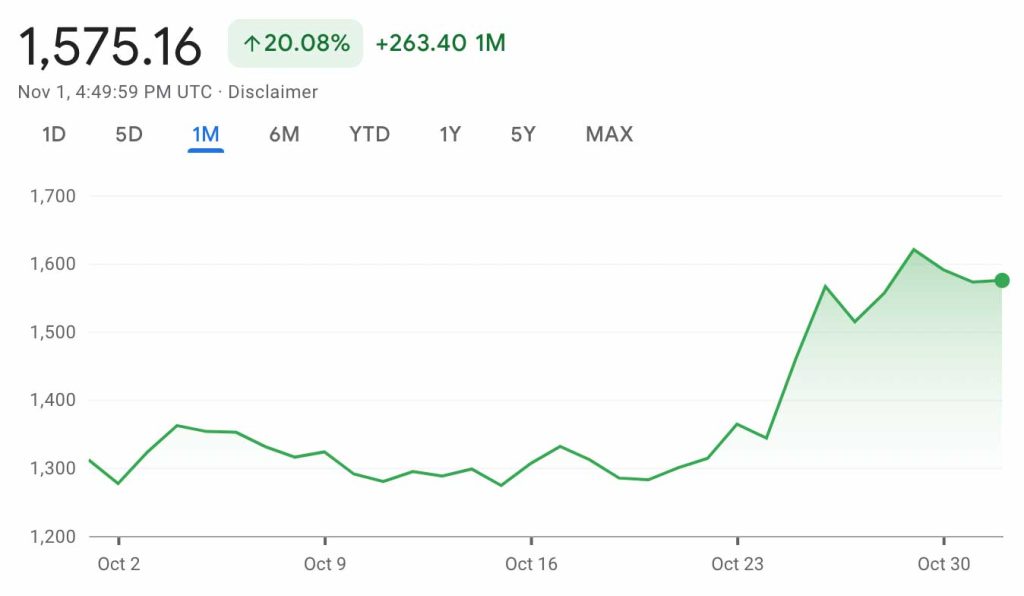

Ethereum to USD

CRYPTO COMMENTARY

In a departure from the correlation we were mentioning in the last edition of The Scoop, the crypto market has taken a further step into crypto winter. Many thought the worst was over after Voyager, Celsius and 3AC collapsed, but it appears that they were just the prelude to something bigger. FTX, the second largest crypto marketplace, was using customer funds to take risky bets on the market, according to the Wall Street Journal. In a since deleted tweet, CEO of FTX Sam Bankman-Fried said “FTX is fine. Assets are fine.”

There was an announcement from the CEO of Binance, Changpeng Zhao, saying that it had signed a letter of intent to acquire FTX after it performs due diligence on the company’s holdings. Shortly after that, Binance said it was walking away from the deal because the financial hole in FTX’s balance sheet is too large. Short of Sam Bankman-Fried pulling a rabbit out of the hat, FTX customers may be stuck holding the bag.

The contagion isn’t over yet, with other platforms that had exposure to FTX experiencing liquidity issues. Gemini, one of the larger US exchanges, had to press pause on its Earn rewards program as it was unable to process withdrawals. In addition to other platforms one of the biggest losers is the Solana (SOL) token. Sam Bankman-Fried has been a large proponent for the network and without FTX’s investment in the token the value has dropped 40%. Solana offers faster transactions and lower gas fees than its larger competitor, Ethereum, but adoption was limited. Traders are trying to catch knives as the value keeps dropping, but what will be interesting is how the thriving NFT ecosystem on Solana reacts.

WHAT’S THE BUZZ

Blockchain networks will be utilized in many ways in the future, but they all rely on nodes to operate effectively.

NODES

- Nodes store and verify new blocks of data as transactions are executed on a blockchain.

- Each node chooses to accept or reject the newest block based on the validity of its signatures and transactions.

- If the block is accepted, then it continues to be shared with other nodes until a consensus is reached.

- Having multiple nodes continuously syncing with one another maintains the integrity of the network.

- Since nodes are distributed in a decentralized manner, there is no single owner of the data.

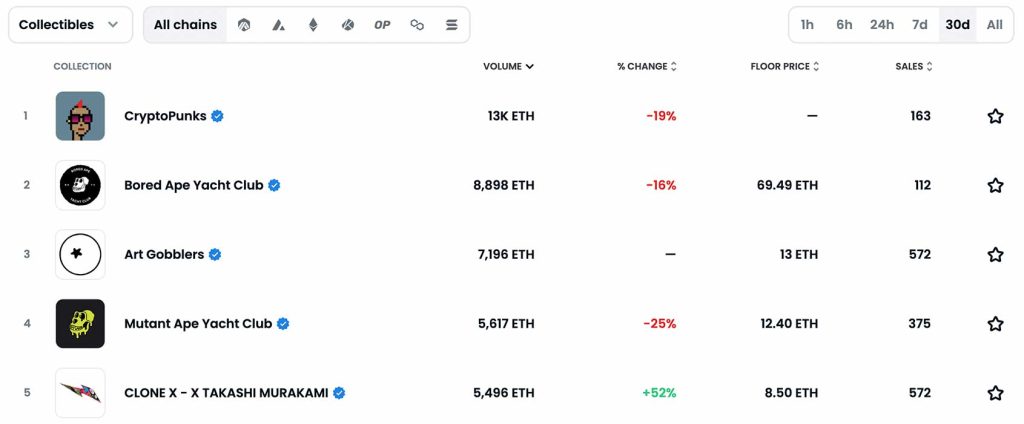

NFT BLUE-CHIP COLLECTIONS

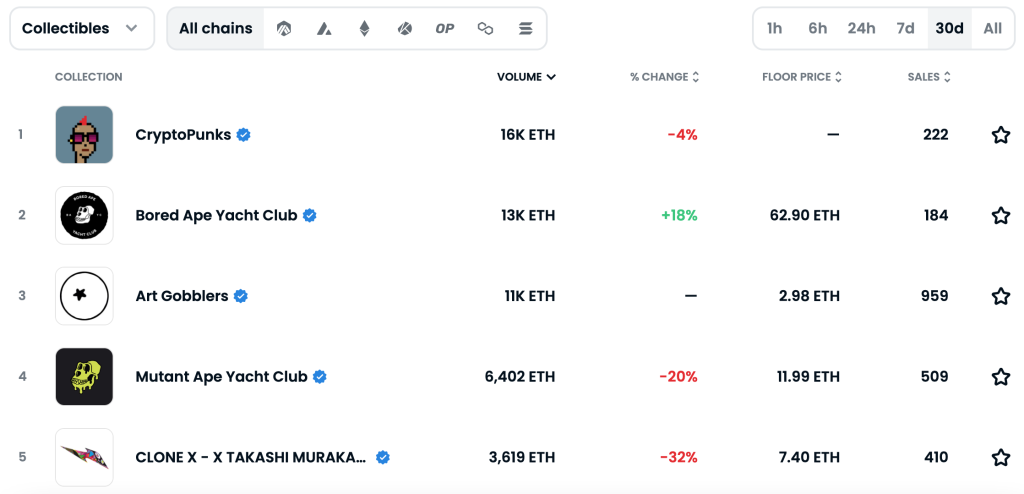

Top 5 NFT Collectibles Collections

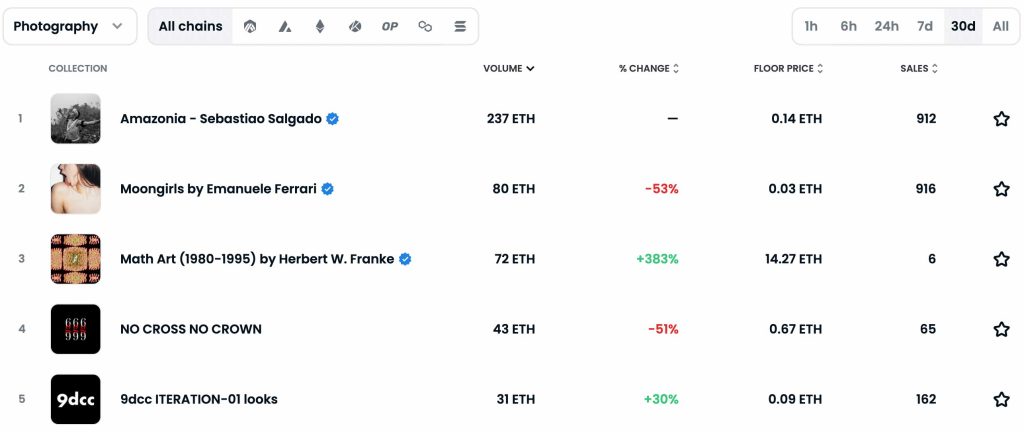

Top 5 NFT Photography Collections

NFT COMMENTARY

The reliance of NFTs on blockchains is something so many people have glazed over. From valuation dependency to functional capability there would be no NFTs without their crypto foundations. With the shakeup at FTX and the ripple going through the crypto markets, Solana has become a victim of questionable financial decisions. In September, Solana NFT sales rose by 77% compared to August, but now they’ve had 40% of their value sapped in a day. This volatility is unprecedented and shows the risk this market presents. What if the same happened to Ethereum?

The rapid fluctuation in value is what has thus far kept NFTs from being more mainstream. The Fine Art Group recently attended the Appraiser Association of America’s Of Value: 2022 National Conference and there were many interesting takeaways on the NFT market. A panel of specialists in the insurance, art and auction businesses gathered to discuss how their industries were approaching the new technology. Each are embracing it and building as they go. The insurance industry has been slow to insure these intangible items since valuation models are still being built. Ultimately, stability (and regulation) would make these tasks much more palatable. Sotheby’s is looking at it as an opportunity to grow; 78% of clients bidding on NFTs were new to Sotheby’s and the majority are under 40. With this fresh crowd, the art industry is starting to embrace the new medium.

ART AS AN ALTERNATIVE ASSET

Those looking for alternative assets that aren’t so tied to crypto valuation and macro-economic factors are looking elsewhere. We’re seeing NFT collectors starting to branch out by adding physical items to their galleries. These next generation collectors are buying everything from contemporary art to high end sneakers and trading cards. NFTs have been the perfect gateway to the art world for many newly affluent collectors.

The Fine Art Group experts are thought leaders in the area of art and investment. With multiple art funds under their belts and with the appraisal division being one of the largest globally, we thought it might be useful to get a bit of insight into the art market today. Both Roxanne Cohen and Elena Ratcheva, Directors in our Art Advisory division, were bidding in the evening sale for Paul Allen at Christie’s so it might be useful to hear their thoughts.

With over 1.5 billion dollars trading in two days, is the art market oblivious to the inflationary economy? Roxanne noted that prices for pieces in the $2 to $8 million range were in many cases double expectations. The price range is very much the sweet spot for investment, and it was clear that wealthy individuals understand this to be the case. There is no doubt that we were seeing investment in this range of value as a “safe” place for them to park their cash. A+ examples of paintings selling in the art market are also achieving above estimate.

The key takeaways from our specialist Elena Ratcheva are:

- “Always collect the very best example you can afford; it should pay dividends in the future.”

- “The very top end of the market is completely separate from the rest: blue-chip, high-quality works are seen as a clear hedge against inflation.”

The Fine Art Group Art Investment Advisors are available to speak in more detail. Their contact info is below.

Elena Ratcheva

Director, Art Advisory

Roxanne Cohen

Director, Art Advisory

NFT ARTIST SPOTLIGHT

GRANT RIVEN YUN

Growing up, he always told his father he wanted to be a photographer and spent his childhood drawing as much as he could. During his freshman year in college, he started using PowerPoint to create images using layers and gradients before transitioning to Adobe Illustrator sometime later, admitting “I felt completely lost when I first came to the digital side.” His artistic influences came from such unique places like Standard Station by Ed Ruscha and The Midnight Ride of Paul Revere by Grant Wood. Another interesting space in which he found inspiration was the early 90s video games. He attributes his clean lines and basic compositions to the combination of all the art that drew him in.

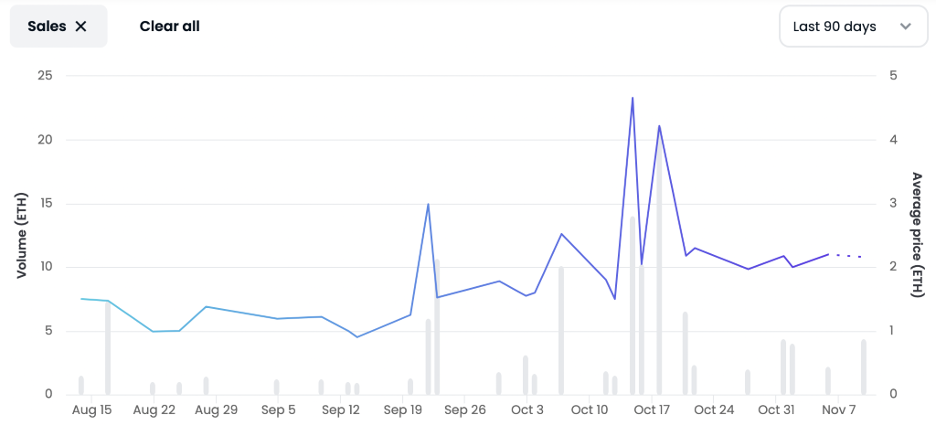

One thing he told himself before even entering Web3 was that he would be featured by an auction house. His success in the NFT space landed him a spot in the Sotheby’s Hong Kong Digital Art Fair with his piece Special Delivery selling for HK $693,000. He has worked across several platforms, with his Nifty Gateway Life in Japan editions on OpenSea being the lowest cost entry point to collect his work.

NFT & CRYPTO NEWS

- 4 Key Takeaways from the FTX Fiasco

- Yuga Labs Donating CryptoPunk to ICA Miami

- Christie’s 3.0 Presents: The Miami Edit

- Solana plummets amid FTX Crash

- Sotheby’s will auction off rare ring with NFT Authentication

- Nike launches .swoosh for larger Web3 ambitions

- Instagram to let creators sell NFTs through platform

- Reddit NFTs Surge

READ PAST ISSUES OF THE SCOOP

- The Scoop #10 – November 2nd, 2022

- The Scoop #9 – October 15th, 2022

- The Scoop #8 – September 20th, 2022

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Fine Art Group is pleased to offer this impressive work by famed American illustration artist N .C. Wyeth on behalf of a private collector. The work, Lot 33, will be offered by Freeman’s Auctioneers in their American Art and Pennsylvania Impressionists auction on December 4, 2022. For more information please visit Freeman’s to learn more about this important painting and bidder registration.

Freeman Auctions

American Art and Pennsylvania Impressionists

Featuring the Collection of Charles and Virginia Bowden

December 4, 2022

Lot 33

N.C. Wyeth (American, 1882-1945)

The Father Kept the Children Near Him, but Always Young Olaf Looked with Tragic Eyes Toward the Slope Where Padfoot Waited

1923

Oil on canvas

24 1/8 x 44 in. (61.3 x 111.8cm)

Signed ‘N.C. Wyeth’ bottom right

ESTIMATE: $120,000 – $180,000

RELATED CONTENT

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Originally published on Tiger21.com, November 3, 2022

Creating a legacy of charitable impact can be challenging when it comes to fine art collections and passion assets. Learn more about charitable options in this guide.

ESTATE PLANNING: CREATING CHARITABLE IMPACT WITH PASSION ASSETS

Baby boomers are one of the wealthiest generations in American history and they will be transferring their wealth over the next several decades. A portion of this wealth is in the form of tangible assets that reflect the passions, interests, and legacies of the individuals and families who own them. This class of tangible personal property, which includes art, jewelry, wine, vintage cars, watches, rare books, coins, and other collectibles, is referred to as “passion assets”. In some cases, family members of heirs will gladly accept these passion assets. However, consumer tastes have changed and some heirs may not be interested in receiving a gift of these types of assets. Or, in some cases, there may not be any heirs.

Creating a Plan for Your Fine Art Collections and other Passion Assets

What options might a collector have in the situation where there is no one to leave these assets? Many donors are beginning to think more holistically about their wealth by leveraging their passion assets for philanthropy. These passion assets can have a tremendous amount of value so collectors may consider using these assets toward a philanthropic goal by creating a life-changing gift. While contribution of passion assets to charitable causes can be more complicated than contribution of cash or stock, it can be an effective philanthropic strategy when executed properly. Using these types of assets in a strategic philanthropy initiative presents families with the chance to work collectively to create a unifying legacy.

What are the Charitable Options for High-Net-Worth Individuals who Own Passion Assets?

If the collector would like to make a charitable contribution during his or her lifetime using passion assets, the collector should consider whether the passion asset earmarked for charity has increased or decreased in value since acquisition.

1) Sell the Passion Asset(s) and donate the proceeds to charity

If the asset has not increased in value since acquisition, the collector does not need to be concerned about capital gains and may consider selling the asset first. Once the asset is sold, the proceeds from the sale can be contributed to a charity or donor-advised fund (DAF), taking advantage of a potentially more favorable deduction for cash and requiring no appraisal.

For cash contributions to public charities or donor-advised funds, donors who itemize their deductions may take an income tax charitable contribution deduction equal to the amount of the gift, limited to 60 percent of their adjusted gross income (AGI). Any deduction in excess of the AGI limitation may be carried forward for five years.

Example: A collector acquired a multi-million dollar rare book collection over the past 30 years. The heirs were not interested in the book collection nor were any libraries interested in receiving the book collection. Since the current value was less than the original purchase price, the client decided to sell the collection and allocate the proceeds to a DAF. The family is very charitable and wanted to support local charities in the community.

The family decided to sell the collection at auction in a single owner book sale with all the proceeds being allocated to a multi-generational DAF to support various charities over time. Establishing a multi-generational DAF to set aside charitable dollars in advance made a family legacy easy to continue for generations.

2) Donate the Passion Asset(s) to a charity for related use

If the asset has increased in value since acquisition, it may be more beneficial for the collector to consider other strategies, thereby taking advantage of an income tax charitable deduction while also removing the appreciated asset from the balance sheet. For those who itemize and want to donate a passion asset to a qualifying charity, a deduction may be available that is equal to the fair market value of the passion asset at the time it is donated, but only if certain requirements are met.

When contributing a passion asset to a charity for a related use-based deduction, it is important to consult with the charity before executing on the contribution. The donor should understand if the object will fit into the charity’s mission or related use. There are many circumstances where the charity may not be interested in or able to accept the object for a related use. If the non-profit does not actually use the contributed piece for a related use, then the donor’s income tax deduction will be limited to the lesser of fair market value or cost basis.

A contribution of a passion asset worth more than $5,000 requires the donor to obtain a qualified appraisal to substantiate the value of the contribution. The qualified appraiser must be independent from the donor, meaning that the appraiser cannot be the donor, related to the donor or a party to the transaction through which the donor acquired the asset. In addition, the appraisal must be prepared no more than 60 days prior to the contribution date.

Example: A collector purchased a painting 15 years ago for $50,000 by a female artist. The collector did not have any heirs and found a regional art museum that was interested in receiving the painting as a donation. The art museum was expanding its permanent collection to include more female artists and planned to keep the artwork to use for permanent exhibition. The painting has appreciated over time and has a current fair market value of $250,000. Because the art museum planned to retain the painting for a use related to its charitable purpose, the collector was eligible for an income tax charitable deduction based on the fair market value of the painting rather than the donor’s $50,000 cost basis. In addition, by contributing to the art museum, the collector was able to avoid capital gains tax on the unrealized appreciation of the painting.

3) Donate the Passion Asset(s) to a donor-advised fund or charity for non-related use

When a passion asset is highly appreciated, more clients are considering contributing these assets to their DAF. By doing so, the donor avoids the capital gains tax on the appreciation and receives an immediate income tax charitable deduction calculated on the lesser of the cost basis of the asset or fair market value. The DAF sponsor can work with an art advisory firm to manage the sale of the asset after contribution. By doing so, the donor is able to make a contribution during his or her lifetime and monetize the passion asset to create liquidity to further philanthropic goals. The same applies if a client donates an appreciated asset directly to a charity for non-related use.

Example 1: A client was in the process of downsizing and has a coin collection with a current fair market value of $750,000, which is higher than the acquisition cost. The heirs had no emotional connection to the coins; however, the family was charitably inclined and interested in supporting multiple non-profit organizations during their lifetime. The family donated the coin collection to a DAF and by doing so, the donor avoided the capital gains tax on the appreciation. The donor-advised fund sponsor worked with The Fine Art Group to manage the sale of the coin collection. The donor was able to monetize the passion asset and create liquidity to use to further philanthropic goals and support local causes. The family decided to sell the coin collection at auction in a single owner coin collection sale with all the proceeds being allocated to a multi-generational DAF to support various charities over time.

Example 2: A collector had a necklace that was acquired more than 20 years ago and none of the collector’s three children were interested in inheriting the jewelry. The family was very philanthropic and interested in supporting a specific non-profit in their community related to children’s education and healthcare. The value of the necklace had increased over time and to avoid paying capital gains tax, the family donated the necklace directly to the charity. The charity sold the necklace at auction, netting $250,000 to support their mission.

CONCLUSION

The process of using passion assets to further your philanthropic legacy begins with identifying which passion assets are earmarked toward charitable causes and understanding the value of those assets. An art advisory firm can provide clients with advice on charitable contributions of passion assets as well as execute the sales strategy and the monetization process.

FURTHER READING

- The Month of Giving: From Passion Assets to Charitable Impact

- When the Kids Don’t Want it: Converting Your Passion Assets into Charitable Impact

OUR SERVICES

Whether you are an individual, family, foundation, or non-profit organization, The Fine Art Group can help make your charitable vision a reality.

Nothing contained in this article shall constitute, or should be construed as, constituting investment advice or a recommendation by any of the author, “Colleen Boyle,” her company, “The Fine Art Group,” or TIGER 21.

Written by Henry Little, Director, Art Advisory; Charlie Wood, Associate Director, Art Advisory; Grace England, Researcher

INTRODUCTION

The Asking Price #1 – November 3rd, 2022

The Fine Art Group is pleased to present The Asking Price, a new monthly newsletter focused on the global art market.

Drawing upon world leading expertise, The Asking Price offers regular insight into the complex world of art dealers, art fairs and auction houses.

For our inaugural edition:

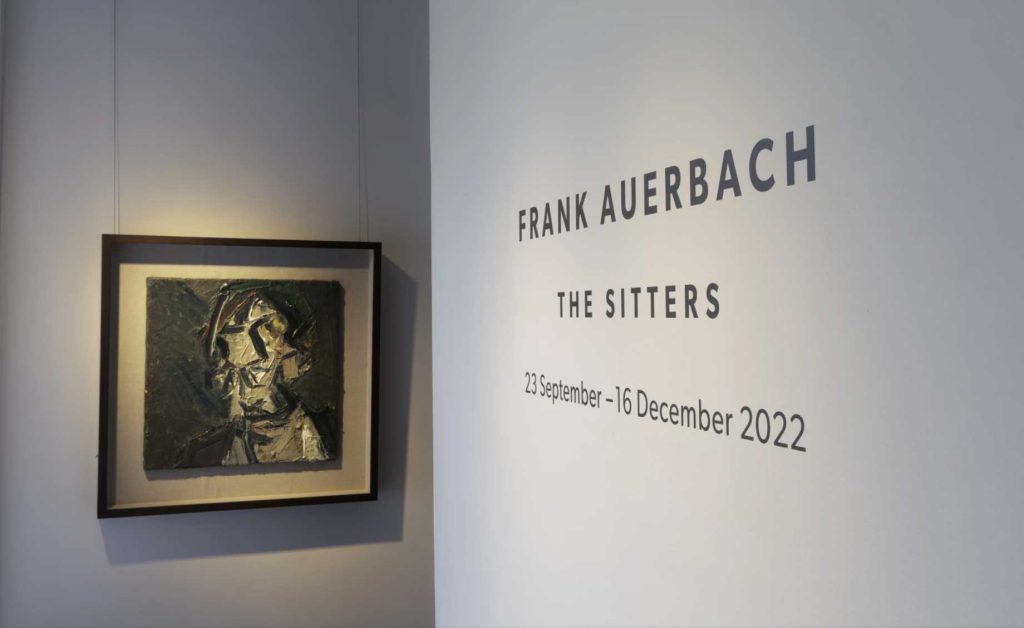

- Henry Little interviews Matthew Travers, Director of Piano Nobile in London, discussing the gallery’s comprehensive survey of Frank Auerbach portraits (7 minute read)

- Grace England covers British painter Glenn Brown’s new private museum, The Brown Collection, exploring the wider trend of self-funded artist museums (6 minute read)

- Charlie Wood provides incisive analysis of the Frieze week auction sales, highlighting some of the most important sales and developments (5 minute read)

INTERVIEW WITH MATTHEW TRAVERS

BY HENRY LITTLE (7 MINUTE READ)

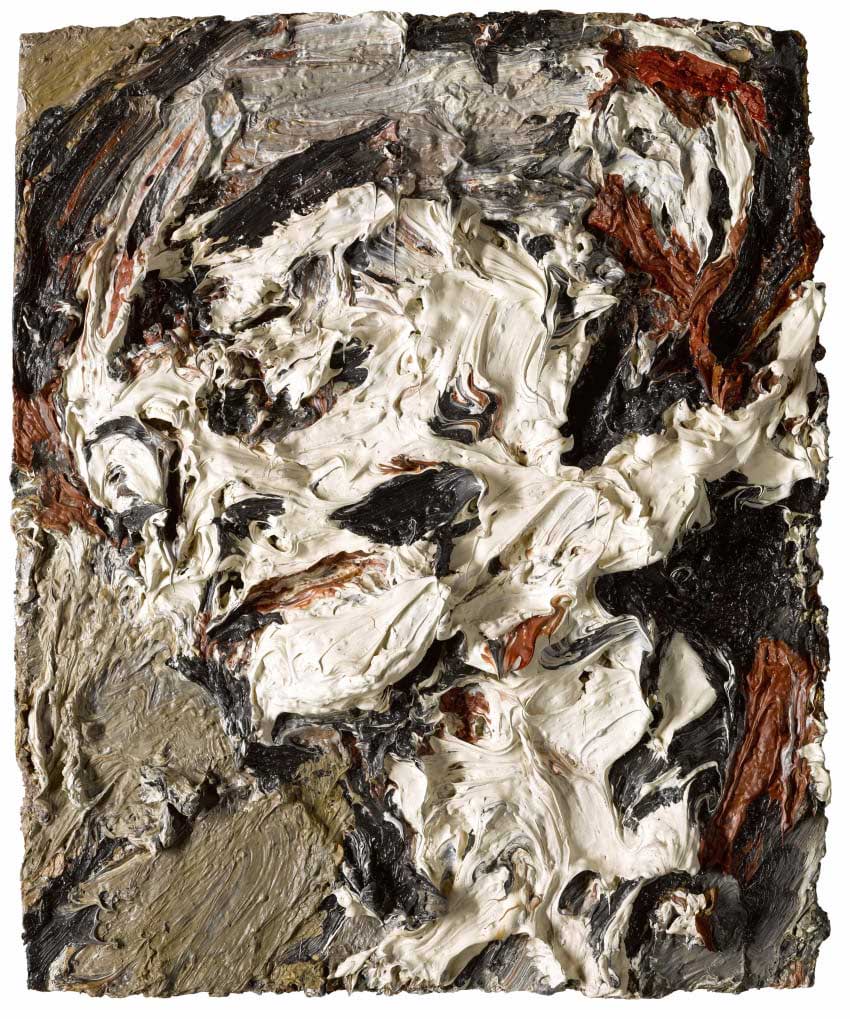

Known for their distinguished taste, Piano Nobile specializes in 20th Century British art. Until Dec. 16, the gallery hosts Frank Auerbach: The Sitters, a wide-ranging survey of the celebrated nonagenarian painter’s portrait heads from 1956 to 2020.

We spoke to Matthew Travers, Director at Piano Nobile, about the process of preparing such an important exhibition, writing catalogues and the nuances of the artist’s market.

Henry Little: You’re currently hosting a major survey of Frank Auerbach’s portrait heads, offering a survey of the artist’s work from 1956 to 2020. Could you describe the process of developing and mounting an exhibition like this? With so many important works there must be a long lead time for such a considered presentation.

Matthew Travers: We love presenting this type of exhibition, particularly for artists whose work we handle regularly. It’s important to find a moment to celebrate the artist because that has two purposes. One, to be able to enjoy them and see them together, and the other, to allow our audience, if they know the work very well, to understand it better. For an audience that doesn’t know it so well, we can introduce them to the work in a deeper way.

Even for someone like Frank Auerbach, to see a concise, consecutive body of work is not necessarily that easy unless there’s a major museum retrospective, so that was the thinking behind it. We’ve been thinking about shows like this for a long time, and we isolated the idea that we wanted to present a show of the portrait heads. For me, they’re some of his greatest works. They’ve got an amazing intensity and power. Of course, the landscapes are incredible, large and beautiful things, and that could be another exhibition entirely. But it was really the heads that we wanted to start with. It’s always about a 12-month lead time from fixing a date to gathering the works and getting the catalogue together. From a press point of view, timing is very important.

Then it’s a case of acquiring works for gallery stock, which we do all the time, and building up a base of works we know we can structure the show around, but then also leaning on the generosity of lenders, and being able to pull a major group of works together. It would be impossible to go into the market and pull together 40 major Frank Auerbachs from across his career that tell a story and are tightly curated. So, it’s very much down to the generosity of owners, whether it be existing clients we sold to or talking to people who have works.

It’s amazing how generous people are prepared to be, and the understanding is that a show like this is only a good thing for everybody. It adds great provenance to a work, it’s wonderful to see it published in a new publication, and it celebrates a painter and develops the world’s understanding of him. These things make people very happy to loan. Often people hear we’re doing a show and voluntarily offer things to us; some great works came to us that way for this exhibition. We often borrow from museums as well; that’s sometimes a longer process. You need a good lead time to achieve that, at least 12 or sometimes 24 months.

One of the great USPs of this show is that all the works come from private collections so they’re works you wouldn’t generally see. I think that’s a wonderful thing to do: to bring a body of work together that not only speaks of the artist and his development throughout his career, but also brings fresh work into the public eye that hasn’t been seen for decades publicly. Visitors can look at them in a relaxed, quiet environment, where they can get up close to works, study them and not be distracted by the larger spaces of a public museum or large gallery space. Smaller works, domestic-size works, life-size works, as in Frank Auerbach heads, can always feel very powerful, but are made to feel rather small in huge spaces.

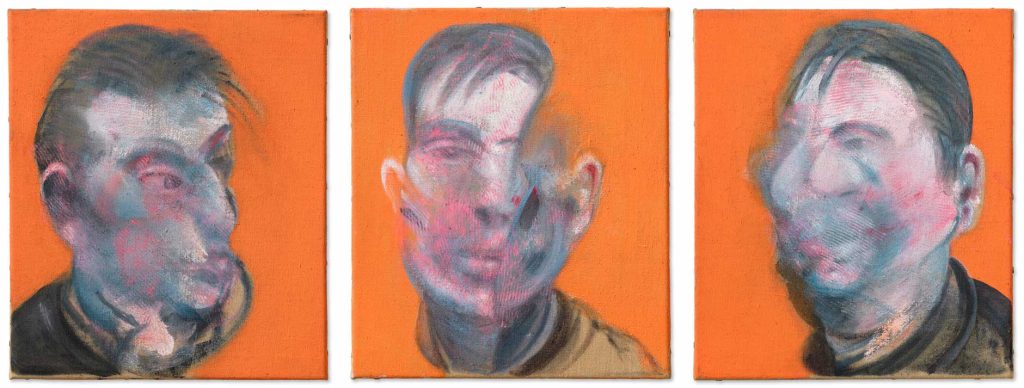

Showing them in smaller rooms speaks very much to the way they were painted, whether it’s particularly for London school, whether it’s Kossoff or Bacon. Bacon’s studio was tiny. Freud worked in domestic spaces. These works were made in London rooms, in London spaces, in the proportions of London houses; therefore, to show them in that type of space only enhances them and the viewing experience.

HL: What purpose do such exhibitions fulfill for the gallery? How do they help build your reputation for specialist expertise?

MT: We have a clear focus on London School painting. Many works come in and out behind the scenes that the world never sees, so to take a moment to celebrate this painter is exciting. From our point of view, it helps a wider public see the breadth and body of work that we’ve handled over the last few years and, of course, works are for sale. It helps a wider public understand what the gallery is up to. Roughly a third of the show is for sale. For an artist such as Auerbach, works appear sporadically in isolation, in the auction sales, at an art fair or in a gallery. But coming to an exhibition with works available from the early 1960s, all the way through to a recent work by Frank from 2020 is special.

To have that choice gives collectors an amazing opportunity to think about buying Auerbach, to compare a body of available work. It’s important to isolate what makes collectors tick and understand which area of the artist’s work appeals to them.

The early work has a hugely important presence within his career, people love it, and traditionally the values have been highest there. But he’s an amazingly consistent painter. I would argue his entire oeuvre is exceptional and within that, it’s natural to have preferences. Some collectors prefer the 1980s, 1990s or the 2000s over the darker, heavier, more angst ridden 1950s and 1960s paintings. That’s personal preference and there’s no right or wrong. To look at all aspects of that and have works within that, that are available, is a big part of the exhibition for us and offering that service to clients and collectors.

HL: Why did you think now was the right time to stage such a meticulously curated show?

MT: When presenting a tightly curated show such as this, timing is important. There have been many shows of Frank’s work in the past, whether large or small, which are more general retrospectives. But he comes out of the wider London School and ultimately the post-war period is about the depiction of the human form, finding new ways of depicting the human form in a post-war world. Surprising as it may sound, we believe this is the first-ever show dedicated to Auerbach’s portrait heads.

That’s why we settled on it and were intent on keeping the curation tight, with a concise body of work from the 1950s through 2020. We have presented paintings and drawings from every decade of the artist’s career that chart changes in sitters from the early works. E.O.W., Gerda Boehm, to Catherine Lampert, the most recent sitter being William Feaver, who has been sitting for over 30 years. Julia Auerbach has been the longest standing sitter, with works from 1960, and his most prominent muse in recent years.

We have, therefore, been quite selective and have not just shown a group of works we can easily secure. Producing something that makes sense, that is not overly weighted in one place and not others, is key to it, and also stands the test of time.

HL: Can you explain how you piece together your exhibition catalogues, the role they play and what you think about when writing texts for such publications?

MT: The catalogues play a huge role in the exhibition. The exhibition is transitory and is here for a couple of months. But then it is gone, and the works go back out into the world. Publishing is a very important aspect of what the gallery does. Every time we produce a catalogue, it is more than just a record of the exhibition. It becomes a reference point for us and collectors.

We wish to produce something that is a meaningful addition to the artist’s literature and ultimately which supports, enriches and promotes the artists in which we’re interested. This catalogue has a previously unpublished interview with the artist and Martin Gayford. We republished an important text by Michael Podro, a great friend of Auerbach. Michael was a wonderful art historian and writer on Auerbach’s work. So many important writings on artists in their lifetime were published in obscure places. Our catalogue is now the most accessible place to find this essay and it still rings true today, even though he wrote it 50 years ago.

Another aspect of the catalogue is to provide a comprehensive record of Frank’s sitters, as this is the focus of the show. We thought it constructive to compile a full list with information on each of them, roughly 40 in total. It also builds a timeline. The earliest sitters were Leon Kossoff and Stella West. In the 1970s and 1980s, there were several short-term sitters. But then, as with the early works, the later works are refined back down to half a dozen regular sitters, who have been sitting for 30 or 40 years.

The sitters would have regular appointments in the studio once a week, often for two-hour sessions, where Frank would paint them. The work would then be pulled out a week later, scraped down and repainted. Sometimes 20 or 30 sittings, which could mean 20 or 30 weeks of sittings, if not longer, for a work to be produced. This is an incredible regimen, enforced by the artist, which is a true partnership with the sitter.

HL: How does Frank’s exhibition fit within the gallery’s wider program?

MT: We specialize in 20th century British art, positioned in the wider context of American and European artists. Britain certainly wasn’t working in isolation. The gallery mounted a show in 2020 titled Drawn to Paper: Degas to Rego, looking at Parisian School painters. We often handle the work of Giacometti or Degas, occasionally Picasso or Léger, because these artists did have an important effect on British painting, like Dalí and British Surrealism. Another aspect of this specialism is British figurative painting from Sickert until today. An important part of that history, that lineage, is post-war London painting, the School of London as Kitaj dubbed it.

It felt like the right moment to mount this exhibition. It could have been something we did in a few years’ time, but it was wonderful to have Frank’s involvement. So it’s part of our wider positioning of celebrating London School painting.

HL: What are the greatest pleasures of bringing together such a historic group of works?

MT: To live with them and study them only adds to one’s expertise on the artist, and one’s assurance when advising and buying in the future. Especially understanding why works are great, what aspects one is looking for in different periods, and what one might look for from a condition point of view. This is incredibly informative and enjoyable, bringing a deep satisfaction in realizing a compelling group of paintings.

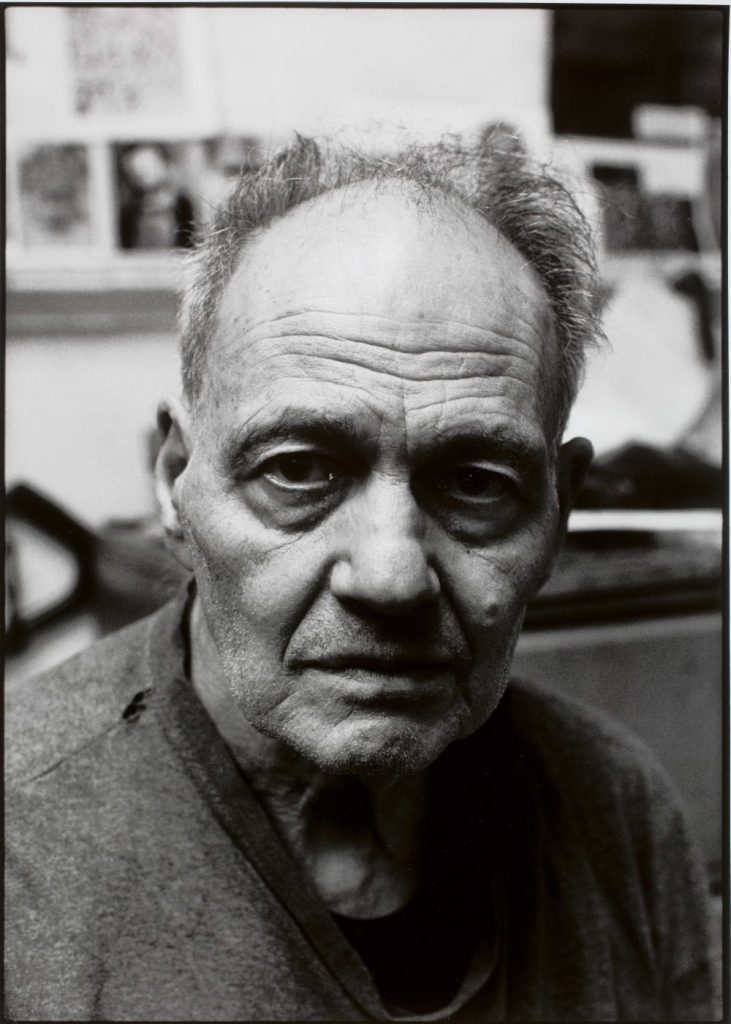

HL: Can you elaborate on the concurrent presentation of Nicola Bensley’s photographs, Frank Auerbach: A Morning in the Studio, and how they complement the wider exhibition?

MT: For any exhibition, it’s always a dream to find unpublished photographs of the artist that have never been seen. In this case, we spoke to Nicola, a great photographer. She went to visit Auerbach in 2015 for a morning, making works in natural daylight from black and white 35-mm film. She took several iconic images of Auerbach at the age of 87, looking like he could be a man in his fifties.

This is testament to the power and strength of the man. Not just of the mind, but physically. Oil paint is heavy and hard to manipulate, particularly when scraping it off.

HL: Can you provide indicative price ranges for available works in the exhibition?

MT: Auerbach’s works are highly sought after. The show ranges from £250,000 for a 1980s or 1990s charcoal, to multiple millions for earlier heads. Recently, the artist’s Head of JYM (1984-85) sold at Sotheby’s for a record public price of £5.65 million (including premium). His market has grown organically and is therefore incredibly robust. The new catalogue raisonné now runs to 2022, providing greater clarity on extant work. These are beautiful, rare things and they will only become more sought after with time.

We find our clients for Auerbach are totally global, whether it’s from the US, East Asia, Europe, Middle East and Africa, South Africa, or South America. They are all over the world and he touches on something very broad, very human, which has a totally international appeal and will continue to do so.

Two works, which sum up the exhibition for me, are from totally different periods. Sixty years apart, they are both for sale: the early charcoal from 1960 of Julia, Auerbach’s wife, and the last work we are showing, Reclining Head of Julia, from 2020. To see his longest standing sitter, Julia, 60 years apart, has a powerful resonance. Together, they demonstrate a trajectory which is ultimately redemptive of a young man dealing with the horrors inflicted by the Second World War, losing his parents and being uprooted from his place of birth, Berlin, and moving to England. In this beautiful late work of his wife Julia, she is afflicted with all the pains of old age but there is a kind of peace to it.

THE RISE OF THE ARTIST MUSEUM

BY GRACE ENGLAND (6 MINUTE READ)

THE GLENN BROWN COLLECTION

Among the hundreds of events, private views and shows which launched during Frieze Week (as well as the fair itself), British artist Glenn Brown opened his own self-funded museum, The Brown Collection. Tucked away in a mews off Marylebone High Street, Brown says he hopes the collection will introduce his work to a larger audience and provide visitors with a haven to sit, read and relax. Announced a month ago, The Brown Collection will initially exhibit the artist’s own work, with plans over time to bring in pieces from other artists in Brown’s personal collection.

A mix of sculptures, paintings and drawings from Brown’s oeuvre, the collection is housed in Bentwick Mews, a property the artist purchased six years ago. Having originally planned to use the house for a studio office, Brown instead made the decision to restore and convert the building into an archive and exhibition space frustrated, he said, by the fact that “people couldn’t see my work in London.” Indeed, while Brown is widely collected and included in major public collections throughout the UK, including the Tate, British Museum and Arts Council, he has not had a major institutional show in Britain for some years, his last large-scale retrospective taking place at Tate Liverpool in 2009 (later touring to museums in Turin and Budapest).

Bemoaning the rotation of commercial shows as too slow (especially given the transnational nature of Brown’s market), Brown has opened this new venture close to The Wallace Collection, a museum housing many masterpieces which have inspired his own practice (a must-see is his version of Fragonard’s Blue Boy). While Brown’s work is sought after on both the public and private market, the Brown Collection’s impressive capacity is largely due to a tendency by the artist to retain as much of his own work as possible. The artist is also known to buy back some of his earlier, more historic pieces.

Glenn Brown is the latest example of a growing number of artists who have founded and self-funded museums of their own work. While many single-artist foundations have been established posthumously (with examples including The Frida Kahlo Museum in Mexico City, Musée Picasso in Málaga and Paris, and Musée Courbet in Ornans) a select few have been founded by the artists themselves in their lifetimes.

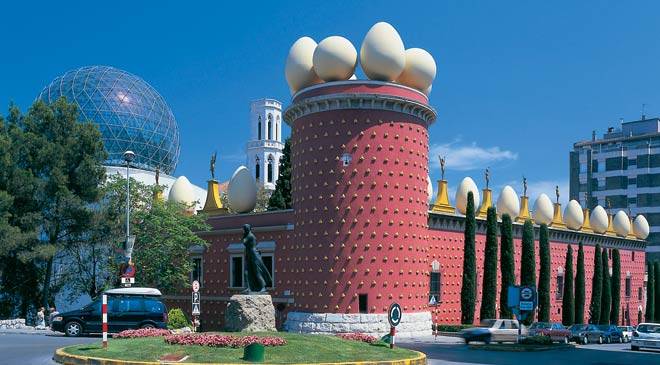

One of the most impressive (and bizarre) “artist-museums” is the Dali Theatre and Museum in Dali’s hometown of Figueres, Spain. Conceived in the 1960s by Dali and the Mayor of Figueres, Dali took over the ruins of the town’s municipal theatre in the 1970s, a building of sentimental value where Dali had held the first ever exhibition of his work. The Dali Theatre-Museum officially opened in 1974 and, as well as housing over 1,000 works by Dali, is considered a Surrealist masterpiece, with every aspect of the architecture and interior designed by Dali himself. These include some suitably wacky features, including the Mae West Room, an installation when viewed from a certain angle forms the ‘face’ of the famous actress. The artist’s burial crypt sits at the center of the museum.

Establishing a legacy, and having control over that legacy, seems to be the crux of the artist-museum. Yayoi Kusama, currently the world’s most expensive living female artist, opened her own museum in her home city of Tokyo in 2017. Operated as the principal project of her foundation, its aim (according to the museum director) is to offer “visitors a chance to learn about the courageous battles that Kusama has fought as an avant-garde artist, allowing them to experience and feel the sincerity of her ideas.” As an artist who faced a great deal of sexism and xenophobia early in her career, and who has battled mental health problems for most of her adult life, establishing her own controlled and curated space seems to have been the paramount motivation.

A fear of mortality is also a key factor when artists decide to transition from creative to curator. British artist Tracey Emin recently underwent an intense battle with bladder cancer and the disease came close to claiming her life. In September 2021, after undergoing extensive surgery, Emin announced that she would turn her Margate studio into a museum after her death. Partly inspired by a visit to Marfa, Texas, where she saw the Donald Judd Foundation building, Emin decided she wanted a place to house her extensive archive of works, photographs and essays, as well as her own collection of “other people’s art.”

In January 2022, Emin announced the establishment of a museum and art school. Launched in October 2022, TKE Studios provides 30 affordable artist studios, as well as an 18-month artist residency funded by the Tracey Emin Foundation. A former mortuary, which sits near the 30,000-square-foot converted bathhouse, the property will also serve as a small museum for Emin’s enormous archive of 30,000 photographs and some 2,500 works on paper.

The growing popularity of the artist-museum is perhaps the latest step for contemporary artists choosing to exercise greater autonomy over their image. At a time when the artist’s public persona is increasingly scrutinized, with cancel culture, social media and gallery hierarchies having the power to make or break an artist, the artist-museum allows artists to regain some control over how they might be perceived.

Indeed, foundations which have chosen to establish single-artist museums posthumously have often been met by the dilemmas of inheritance struggles, legal disputes and family conflict. The most prominent example is the Picasso Family which has endured numerous disputes for decades. Most recently, plans for a new Picasso Museum in Aix-en-Provenance were abandoned in September 2020 after three-year negotiations between the town council and Picasso’s stepdaughter Catherine Hutin-Blay collapsed.

By choosing to establish open collections in their lifetimes, prominent public-facing artists like Brown, Emin and Kusama can avoid some of the misrepresentations of legacy and the dispersal of personal collections which can often follow death. Reflecting on the creation of her new artist studios, residency and museum, Emin remarked: “When I was ill, I thought I was going to die. A part of me asked, what’s it all about? What am I here for? What am I doing? I knew I could do so much more, but I wasn’t sure what it was. And then the whole thing made perfect sense. If we can get one person here that becomes a really good, amazing artist, I’ve done my job.”

From the sentimental to the truly fantastical, no matter what form it takes, the artist-museum has emerged as a powerful phenomenon.

FRIEZE WEEK 2022 ROUND UP

BY CHARLIE WOOD (5 MINUTE READ)

AUCTIONS ANALYSIS

The Frieze Week London auctions opened to a backdrop of jitters surrounding uncertainty around UK government policy and the falling pound. Overall, however, the sales were a success for all the major houses, selling squarely within or above their presale estimates. Sotheby’s lead the total at £96 million ($107 million), the highest result for its October sales in seven years. Christie’s followed with £72.5 million ($82.2 million), which beat its 2021 Frieze total, and Phillips was at £18.7 million ($20.9 million).

All of them achieved strong sell-through rates ranging from 94-100%, but the sales were tightly managed with several withdrawals from each house ahead of time, helping to ensure strong final statistics.

There was much speculation regarding a potential increase of international buyers piling in due to the falling pound, and while there was significant international bidding, data released by the houses reflected broadly similar levels to last year. American and Asian bidding continues to be hugely important to the results of these sales and they remain firmly scheduled to conveniently capture both time zones, despite disrupting schedules for those also at Frieze.

Christie’s evening sale demonstrated significant Asian bidding: one paddle bid on over 10 lots and was a huge support to the sale. Likewise, Sotheby’s had strong levels of American bidding which drove the prices for several top lots, notably Gerhard Richter’s “first abstract painting” 192 Farben (1966) which sold for £18.3 million premium ($20.5 million) against an estimate of £13 – 18 million.

Young contemporary artists continue to show market strength. Phillips, always strongest in this area, ensured its sale was much more focussed towards this category with fewer Impressionist & Modern lots offered this season despite previously venturing into these collecting categories. Several artists making their auction debut, including Julian Pace and Rebecca Ness, significantly outperformed their estimates.

High prices were also achieved for Flora Yukhnovich and Caroline Walker, but there was notably calmer bidding for other artists in this category, including Jadé Fadojutimi, Christina Quarles and Shara Hughes. Not necessarily reflective of waning demand, estimates for many of these artists have now significantly increased, therefore, hammer prices are falling closer to their pre-sale expectations rather than vastly outreaching them as per previous sale cycles.

There were strong results for several blue-chip paintings throughout the week. David Hockney’s unusual landscape Early Morning Saint-Maxime (1968 – 69) vastly exceeded expectations at Christie’s, selling for £20.8 million premium ($23.7 million), double its high estimate. Richter’s cloud painting, Study for Clouds (Green-blue) (1971), also performed well at Christie’s with a result of £11.17 million premium ($12.7 million). Bidding was notably thinner, often with just two buyers battling it out, suggesting that demand at the very top level could be tightening. Two top-priced Banksy works fell significantly below expectations as price levels have, perhaps, reached an unsustainable level.

Top-priced works sold nonetheless; several key trade buyers made opportunistic purchases. The Nahmads acquired Christie’s Francis Bacon Painting 1990 (1990) below estimate; it hammered at £5,950,000 ($6.6 million) below a £7 million low estimate. At such a sensible price the piece was undeniably an attractive option for inventory.

Notable auction records for the week include a new record for a Tracey Emin painting set at Christie’s: Like a Cloud of Blood (2022) sold for £2.3 million premium ($2.6 million) against a £700,000 high estimate. New records were set at Phillips for Michaela Yearwood-Dan and Robert Nava. Sotheby’s set artist records for Louise Giovanelli, Charlene von Heyl, Kiki Kogelnik, Julien Nguyen, Caroline Walker and, most significantly, Frank Auerbach for his 1984 – 1985 Head of J.Y.M, achieving a new record of £5.6 million premium ($6.3 million).

5 EXHIBITIONS NOT TO MISS IN LONDON

Maximillian William – Somaya Critchlow, Afternoon’s Darkness

47 Mortimer Street, London, W1W 8HJ

Until 19th November 2022

Thomas Dane – Cecily Brown, Studio Pictures

3 Duke Street, London SW1Y 6BN

Until 17th December 2022

The Approach – Caitlin Keogh, Running Doggerel

1st Floor, 47 Approach Road, London, E2 9LY

Until 17th December 2022

Hayward Gallery – Strange Clay: Ceramics in Contemporary Art

Belvedere Road, London, SE1 8XX

Until 8th January 2023

Tate Modern – Cezanne

Bankside, London, SE1 9TG

Until 12th March 2023

TOP ART MARKET STORIES THIS MONTH

- Artists take to Instagram to criticize Gilbert & George’s claims that museums are now ‘woke’ and only focus on Black and women artists

- Frieze Opens to a Flood of Hungry Collectors, Calming Fears That Competition From Art Basel’s New Paris Fair Would Tank Attendance

- Paris+ par Art Basel’s VIP opening: galleries report good sales, the right people and a clear step up from Fiac

- Damien Hirst – The Currency: Is setting fire to millions of pounds worth of art a good idea?

- Opening Paul Allen’s Treasure Chest

LOOKING AHEAD

The highest value single owner sale to come to auction, the sale includes notable works by Botticelli, Canaletto, Cezanne, Lucian Freud, David Hockney, Gustav Klimt and Georges Seurat, spanning 500 years of art history.

All proceeds from the sale will be donated to charity.

FURTHER READING

- The Asking Price: Understanding Value 2

- Market Update: How the Art Market Joined the Digital Age

- Jan Prasens on Talking Galleries Panel Focus: Art Finance Debunked

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

The Scoop #10 – November 2nd, 2022

In the 10th edition of The Scoop, we cover the rise in the correlation between crypto and equities and fractionalization. We also examine the royalty debate in the NFT space and spotlight Yuga Labs.

CRYPTO MARKETS

CRYPTO COMMENTARY

Bitcoin, the bellwether for crypto, has been rangebound – confined to upper and lower limits – since July. We’ve seen the same pattern in the stock market. Correlation between the traditional equity markets and crypto prices has grown stronger over time, with both responding similarly to events like the Fed announcements.

Instead of being an alternative to traditional markets, crypto has succumbed to the same economic pressures. It appears retail investors are staying on the sidelines, wary of further declines and future uncertainty while institutional trading has dominated the market. Less trading has produced less movement. With another interest rate hike in the works and a strengthening dollar, we can expect there to be continued downward pressure on cryptocurrencies. However, there have been rumors of the Fed easing its hikes as early as next year, but it will rely upon positive movement in the inflation measures.

In other news, the SEC continues its dive into the crypto markets with investigations into former crypto lenders Celsius and Voyager, along with the bankrupt Three Arrows Capital hedge fund. They are also probing Yuga Labs, creator of the Bored Apes collection, to better understand the dynamics of their NFT business. For many investors, the SEC looking into these issues is a positive development, citing more comfort in transacting when there are rules and regulations in place to serve as guard rails for this growing market. The headlines may not be great, but progress is being made for the better.

WHAT’S THE BUZZ

We’ve heard of other collectibles having shared ownership, but the digital nature of NFTs has made fractionalization even simpler.

FRACTIONALIZATION

- Fractionalization is when one NFT is split into smaller pieces to allow for more than one owner.

- Tokens for ownership are created and sold on the secondary market.

- This increases liquidity for the owner while creating an opportunity for those with fewer resources to own a piece of the NFT.

- This process does have down sides including IP rights concerns, contract security and cost.

- As part of a wider probe, the SEC is looking to determine if fractionalized NFTs should be treated as securities.

- Fractional.art (which is becoming Tessera) is currently the main platform to offer fractionalization, with several smaller marketplaces in competition.

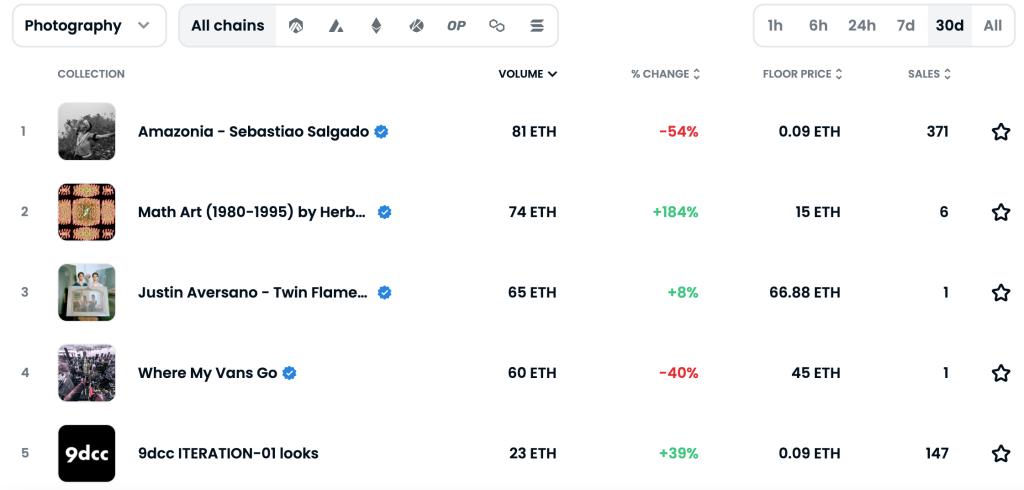

NFT BLUE-CHIP COLLECTIONS

Top 5 NFT Collectible Collections

Top 5 NFT Photography Collections

NFT COMMENTARY

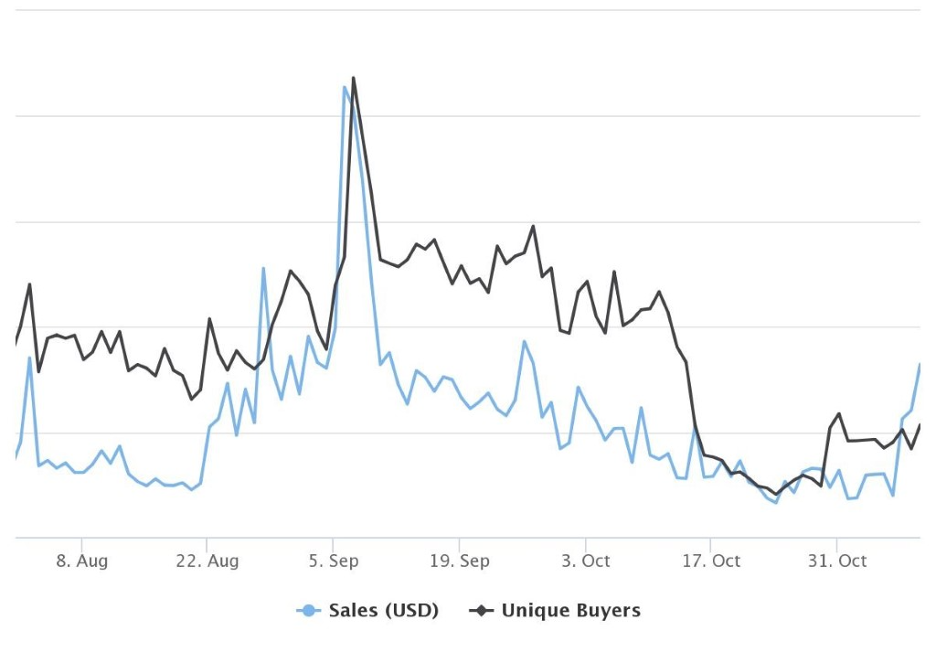

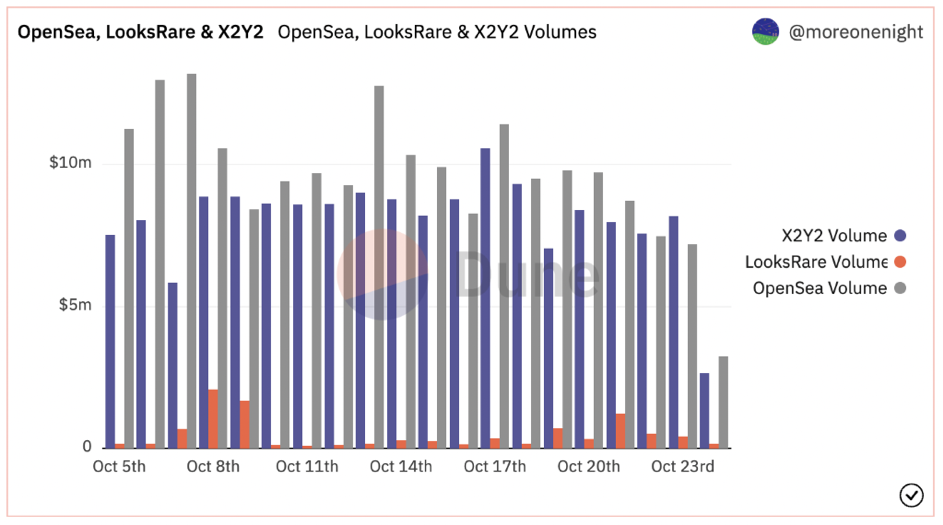

The top of the charts is business as usual with the big names still seeing the most volume; however, overall volumes are hovering around $10+ million a day. It’s important to mention that we can’t just look at OpenSea anymore. The rise of X2Y2 has been a long time coming and they are now in competition with OpenSea for being the largest marketplace.

One reason for X2Y2’s rise is that it doesn’t enforce creator royalties. The biggest debate in the NFT space right now is how royalties should be handled: Artists and creators argue they should be enforced while investors and traders are focusing primarily on their own margins. Since the royalties can’t always be enforced “on chain” but only in marketplaces, some artists have gone as far as blocking their work from being listed on the platform. In an already competitive market, this will change the dynamic for where creators sell their work and buyers purchase their NFTs.

Christie’s 3.0 had a successful debut with a 100% sell-through rate on its nine Diana Sinclair pieces. Prices ranged from about $5,000 to $10,000 with a premium piece selling for over $25,000. This was a very strong showing in an otherwise gloomy market. On the other hand, Sotheby’s Amazonia blind mint featuring Sebastião Salgado’s work didn’t get such a warm welcome. With a price point of $250 and 5,000 pieces available, only 2,280 were minted in the open mint window. It seems as though many collectors were hesitant to purchase a piece when they didn’t know what they were getting. While the same drop mechanics have worked in other instances in the NFT market, it appears we may need some re-tooling for the fine art crowd.

NFT ARTIST SPOTLIGHT

YUGA LABS

In departure from our usual practice, in this issue we’ll highlight a creator group as opposed to a single artist. Yuga Labs has so far outperformed the rest of the NFT space by quite a wide margin with its Bored Ape Yacht Club collection. Through a keen mix of technology, art and marketing, it developed a cult following in the NFT space. One of the first projects of its kind, it’s one of the few creators to successfully deliver on its plans. It incorporated in the state of Delaware in February 2021. The Bored Ape collection was launched on May 1, 2021, with a floor price of .08 ETH, around $240 at the time. By August, the floor price was over 44 ETH, $135,000 at the time marking one of the biggest jumps in the space.

Following that success, Yuga Labs launched Bored Ape Kennel Club and Mutant Ape Yacht Club to tie in with Bored Apes. All have proved a success so far, including the most recent sale of Otherside deeds which represent land in the metaverse it’s building. Since then, it’s also purchased the rights to Cryptopunks and Meebits, two separate but high performing collections that are now part of its ecosystem.

The collection was created in anonymity, and the creators were only recently revealed (or doxxed) by Buzzfeed as Greg Solano and Wylie Aronow, who are otherwise relatively unknown. In late March, Yuga announced a $450 million funding round with Andreesen Horowitz (A16Z) valuing the company at $4 billion. With the sway it holds in the NFT market right now, many are looking at it as a primary example of a successful NFT business.

NFT & CRYPTO NEWS

- Another NFT Martketplace makes royalties optional

- Bitcoin’s correlation with Stocks comes back as economic factors roil markets

- Crypto is more attractive with aggressive SEC

- Solana seeking on chain enforceable royalties

- NFTs can be considered property in Singapore

- What are generative art NFTs?

- Snowfro announces first collection since Chromie Squiggles

- Real estate fractionalized NFTs are here

- RTFKT’s “Phygital” luggage flies off the shelves

READ PAST ISSUES OF THE SCOOP

- The Scoop #9 – October 15th, 2022

- The Scoop #8 – September 20th, 2022

- The Scoop #7 – August 15th, 2022

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.