SUMMER 2018: AN ART ADVISOR’S ROUND UP OF ART BASEL MIAMI

Roxanne Cohen, Director of Art Advisory, The Fine Art Group, at Art Basel Miami Beach 2018. Leading galleries from North America, Latin America, Europe, Asia and Africa show significant work from the masters of Modern and contemporary art, as well as the new generation of emerging stars.

Another great year, touring the fair with clients as leading galleries from North America, Latin America, Europe, Asia, and Africa show significant work from the masters of Modern and Contemporary Art, as well the new generation of emerging stars. Paintings, sculptures, installations, photographs, films, and works of the highest quality were on display in the main exhibition hall. Ambitious large‐scale artworks, films, and performances became part of the city’s outdoor landscape.

Selected Highlights

SPRING JEWELRY AUCTIONS REVEAL CURRENT TRENDS

This year was particularly intriguing as we saw many collections from prominent individuals go up for sale, including the Dodo Hamilton Collection at Freeman’s, which included a 16.56 carat emerald-cut diamond, which sold for $802,000. Another lot of note is the Farnese blue diamond, which was given to Elizabeth Farnese (daughter of the Duke of Parma) as a wedding gift in 1715. This diamond was passed down through royal families all throughout Europe. Sotheby’s sold the diamond in their Geneva Magnificent Jewels auction for $6.7 million, which exceeded the pre-sale estimate of $3.6 million – $5.2 million. Christie’s New York had an auction on June 12th where many pieces from the Rockefeller collection were sold, including 2 bracelets by Jean Schlumberger that both more than tripled their estimates.

In addition to the blue diamonds outlined above, it is also a good time to sell:

- Art Deco Cartier – Christie’s sold an Art Deco diamond bracelet (lot 94) by Cartier for $118,750 (estimate: $60,000-80,000) in their Magnificent Jewels sale on June 12th.

- Quintessential Van Cleef & Arpels brooches – Christie’s sold a gold, diamond and ruby ‘Love Birds’ brooch by VCA (lot 76) for $47,500 (estimate: $12,000-$18,000) in their Magnificent Jewels sale on June 12th.

- High Quality White Diamonds – In the Sotheby’s and Christie’s Magnificent Jewels sales, we saw many D color, Flawless or Internally Flawless diamonds sell for within or above estimates. For example, Sotheby’s Geneva sold a 51.71 carat (lot 373) round brilliant-cut diamond that is D color and Flawless for CHF 9,260,000 (estimate: CHF 7,870,000-9,100,000). In the exact same sale, an oval diamond that weighs 50.39 carats (lot 350) that is D color and Flawless sold for CHF 8,131,000 (estimate: CHF 6,960,000-7,680,000).

In the same sale (lot 163), a ‘mystery-set’ (method of setting stones for which the house is known) sold for $162,500 (estimate: $70,000-100,000).

Doyle in New York, also sold a VCA gold, black enamel and sapphire ‘dog’ brooch (lot 286) for $16,250 (estimate: $2,000-3,000).

The Spring jewelry sales are showing that it is still a great time to sell your signed pieces and standout stones.

– Lauren Peck, National Tangible Asset Manager, GG

RELATED CONTENT

- Kate Waterhouse Joins The Fine Art Group as Director & Senior Jewelry Specialist

- White Glove Jewelry Sale at Sotheby’s for The Fine Art Group Client

- Watch TFG’s New York Luxury Week 2023 Webinar

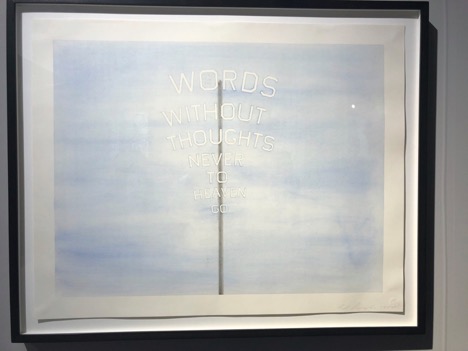

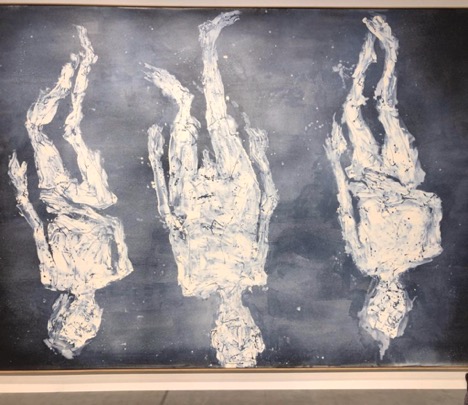

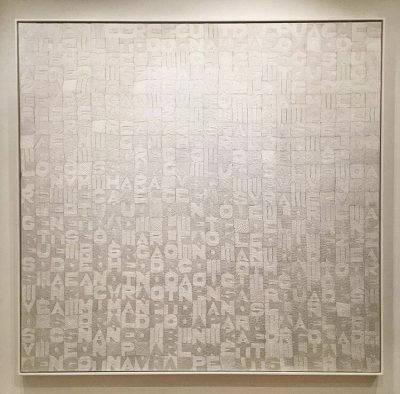

Highlights from this year’s Basel Miami fair include works with social commentary that addressed political issues such as Sam Durant’s large red painting “End White Supremacy” that was featured at Blum and Poe, Los Angeles, which greeted attendees upon arrival at the fair. Numerous artists used the opportunity to voice opinions about immigration, worker’s rights, women’s rights, and Black Lives Matter. Jack Shainman Gallery in New York represent numerous artist whose work address issues of color such as Carrie Mae Weems, Kerry James Marshall, Nina Chanel Abney, and Radcliffe Bailey. Kehinde Wiley’s Equestrian Portrait of Isabella of Bourbon, 2016, featured an oversized portrait of a contemporary African American woman seated royally on horseback.

Not all works were as politically motivated and controversial as the above-mentioned pieces. The overall consensus regarding what collectors were buying and why was that there was a conservative and thoughtful approach to purchases. Many collectors are more concerned with investment value for the art they purchase and look to advisors and evidence of proven tract records within the primary and secondary markets. Many galleries included new-to-Basel artists as a way of diversifying the traditional parade of named artists that usually litter the floors and walls of the enormous convention center.

British Galleries were selling well with the changes in currency exchange since Brexit. The British owned galleries we visited were anxious to assist clients with information and negotiated prices. European and Asian Galleries offered a variety of smaller pieces by well-known artists. A South African Gallery exhibited works with political overtones.

Some of the more popular artist of this year’s fair was Yayoi Kusama, with dotted paintings at several galleries, many with the asking price at $1M or below. Gagosian Gallery proudly displayed Jeff Koons enormous Blue Diamond sculpture, one of ten or so similar works with different colored stones, all being offered at $3M-$4M. George Condo’s market is rallying in 2016 and several galleries offered his paintings with prices ranging from $150,000 for small works to $1M for his oversized paintings. Jean Dubuffet was the sweetheart of many galleries that offered older works prior to 1950s to his latter more colorful works from 1970s being offered for $2M at Landau Gallery.

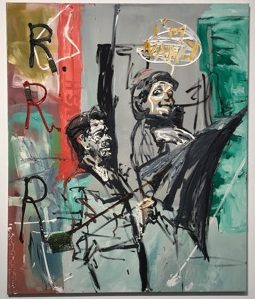

Some of the artworks that were limited or missing from Basel this year include Jean Michel Basquiat paintings that were very few and far between with an asking price of $3M-$4M for mid-size wall pieces. Not many of Warhols graced the walls of numerous galleries as in earlier years at this this fair. Smaller Richter’s were available, but the large masterful pieces were tied up at auction instead. Also missing from Basel Miami were Damien Hirst paintings, which appeared in large quantity at Art Miami this year instead. Also in minimal supply were digital, video artworks and new technology pieces.

This year’s takeaway from Basel Miami is that savvy collectors are using advisors and researching artist and markets before jumping into purchases above $250,000. Buyers were much more discerning when it came to what they wanted to purchase. Prices for blue-chip works are higher than ever, but galleries were willing to negotiate on many of the artworks. It doesn’t seem to be a good time to roll out new young unproven talent for dealers unless willing to price the pieces conservatively. Suffice to say, Art Basel Miami is a good barometer of the state of the world as seen in the works presented by artists and the works that were sold to collectors. Despite the rallying of the stock market, collectors were not as confident as the market has experienced in past years.

By Ruth Crnkovich, Senior Advisor, Pall Mall Art Advisors

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

With the price of gold, diamonds and jewelry continually changing, seeking professional advice relating to your specific requirement is extremely important. An item retailing for £100,000 one month could lose significant value six months later, so knowing what to insure it for correctly or, possibly even, when to think about selling it, are becoming increasingly critical issues.

At The Fine Art Group our team of jewelry specialists monitor prices and trends in the international market to make sure that you can be properly informed and looked after.

The jewelry market over the past few years has been unusually volatile for several reasons – some directly due to the general ‘woes of the world’ and some caused by some quite dramatic fluctuations in commodity, material and gem prices.

THE GOLD MARKET

In 2007, the price per ounce of gold was around the $750 mark – it peaked late in 2012 at $1,890 – and fell back to just over $1,000 in recent months although it’s edging up to the $1,200 mark today.

However, in pieces of gem set jewelry the gold value factor is not huge – the gem prices, manufacturing costs and retail profits are larger factors.

THE DIAMOND MARKET

Diamonds, despite what De Beers say in their advertisements, are not rare. Huge deposits of good quality stones are regularly being found in mid-Africa and now Botswana has pretty well become the diamond centre of the world, with De Beers moving their headquarters there from London.

Mining techniques are better and more efficient, so there are more than enough stones to go around. Slackening demand from the Middle and Far East for many of the slightly lower grade stones and sizes have seen noticeable drops in market prices. De Beers and their fellow core suppliers have had to do a lot of juggling and adjustment to try and keep things on an even keel.

However, if the stone is exceptional in all of the three main quality criteria i.e. size, colour and clarity, it will still be very expensive. The trade price of a one carat flawless D colour (the best) stone, is well over twice the price of a one carat H colour and VVS2 clarity (both acceptable commercial qualities) stone.

There have been some exceptional auction prices recently for coloured diamonds, specifically for pink and blue stones with prices approaching $1 million dollars per carat. There is a very rare red diamond coming up for sale in the Spring, which could break records despite being only just over one carat, i.e. 6.5 mm diameter.

There’s a slight, but increasing, threat to the stability of the diamond markets with the arrival of man-made diamonds. They have been around for a few years and are ‘genuine’ stones i.e. made from of carbon, but have up until now been a rather unattractive bright orange/yellow color and they were costing more to make than the price for a natural one.

However, techniques have improved and costs have dropped and they are now producing acceptably ‘white’ stones at commercially viable prices.

RUBIES, SAPPHIRES & EMERALDS

The biggest movement in the gem market has been the huge increase in auction prices of good rubies, sapphires and to a slightly lesser degree emeralds – with the big proviso that they are ‘natural and untreated’ stones and have a laboratory certificate to prove it. Nearly all the colored stone modern jewelry that you see in shops today will have stones treated with heat and highly technical processes to improve their color and clarity and therefore retail value. So it is important to ensure you have certificates and an up to date valuation.

Thailand, Vietnam, Ceylon and India are the centers for this stone enhancement. The market is awash with these stones and trade prices are very low, plus with modest manufacturing costs over there, there is plenty of scope for retailers to put a pretty punchy profit mark up on the pieces. So, it’s the good colored stones from the 1920’s and 1930’s, before this enhancement became so wide spread, that are the ones that hit the headlines. A good color and clarity natural ruby can be worth more than a diamond of comparable size, but a recognized laboratory certificate is a must.

There have been two other ‘spikes’ in the market over recent years, both driven by Middle and Far Eastern buying. First came amber, but it has to be a butter scotch brown/red color and as big as possible and unfacetted. Amber has always been associated with good fortune in the Buddhist world and has medicinal properties also. About a year ago, good amber was selling for more per ounce than gold, but there is recent auction evidence to suggest that the amber boom is over.

THE PEARL MARKET

The other spike has been in the pearl market, specifically the natural saltwater pearl market. Cultured pearls are natural beads ‘farmed’ in seawater by introducing man made beads in to the soft tissue of an oyster. The oyster’s reaction to these ‘irritations’ is to cover them in ‘nacre’, which is the lustrous shell like covering that we see on the pearl necklaces in most shops. The beads can be 4 or 5 mm in diameter so the thickness of the nacre coating can be pretty thin and lacking in lustre depth. In a natural seawater pearl the oyster takes in the occasional tiny grain of sand around which it builds up the layers of nacre, so in an 8 mm diameter natural pearl you may have 7 mm depth of nacre rather than 3 or 4 mm in a cultured pearl. If you put one of each of these pearls together the wonderful depth of lustre of the natural pearl is very apparent.

Again a laboratory certificate and an up to date valuation is a must. But the main problem for the pearl market is the arrival of freshwater pearls from China. These are farmed in rivers and lakes and not in oysters but in mussels. A mussel can produce more pearls, more often, but they can be of poor lustre and are prone to being misshapen. They are however very cheap and can be seen up to 15 mm in diameter.

Whilst auction prices for fairly modern ‘ordinary’ jewelry can very modest indeed – and a small fraction of its retail replacement price – the market for ‘big name’ pieces with good style and quality is as strong as ever. Cartier, early Tiffany, Boucheron, Bulgari, Buccellati, and Lalique all sell strongly. From the previous century there is a strong collectors’ market for work by Castellani and Giuliano and anything with an interesting historical or royal background will generally fare well.

So, with the price of gold, diamonds and jewelry continually changing, seeking professional advice and having your jewelry reviewed annually is extremely important.

At The Fine Art Group our team of jewelry specialists monitor prices and trends in the international market to make sure that you can be properly informed when choosing to sell your piece. We can also provide you with an accurate valuation for insurance purposes, reducing the prospect of any issues arising out of loss. Accurate valuations can also play a vital role in successful estate planning.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.