ART AS AN ASSET CLASS LEADERS

Observer’s 2023 The Business of Art Power List: Art as an Asset Class has listed Philip Hoffman, alongside Allan Schwartzman, as a leading authority on transforming art as an asset class. Patti Wong & Associate’s Daryl Wickstrom was also named by the Observer as one of the Most Influential People in the Art World Today.

BUILDING THE FINE ART GROUP

Hoffman has a history of making smart decisions for himself and for the collectors and investors he serves. At 27, Hoffman became the youngest C-level executive Christie’s had ever appointed and stayed with the auction giant for the next 12 years, becoming its deputy CEO of Europe before leaving it all behind to launch his own firm. His clients include high-net-worth families—30+ billionaires, as he has described them—plus private equity firms, hedge fund managers and real estate developers around the globe. “Smart people would build an art collection with an advisor who understands how to make money, and they can buy art that they love and make a lot of money at the same time,” Hoffman told Observer in 2019. Fast forward to today, and he’s still 100 percent focused on building The Fine Art Group into the number one partner for those looking to transact at the highest levels of the global art and collectibles markets. “Assembling the most experienced and talented team in the industry worldwide is a key priority,” he tells Observer. “We look forward to expanding our network and bringing a number of new, very experienced colleagues on board.”

Click here to read the full article in Observer.

Click here for the full article.

We are delighted to welcome Tad Smith, former CEO of Sotheby’s, to The Fine Art Group as Chairman of the Supervisory Board. Tad brings outstanding expertise and insight on a global scale, joining our growing network of the best talent in the field, which already includes Patti Wong and Allan Schwartzman.

His knowledge of the art industry, coupled with his considerable management experience, will be a tremendous benefit to our team as we continue to position The Fine Art Group as the best global partner for clients looking to transact at the highest levels of the market.

RELATED NEWS

- The Fine Art Group expands into Asia with investment in the new advisory

firm Patti Wong & Associates - Bringing together the complementary skills of The Fine Art Group and Schwartzman&

- The Fine Art Group Announces Australian Collaboration

TFG INTERN PROGRAM

The Summer 2023 interns at The Fine Art Group were tasked with selecting their dream auction items from recent and upcoming sales, unrestricted by financial constraints. Their intriguing selections provide insight into their passions and enriching experiences at The Fine Art Group.

Jocelyn Hawkins, Art Advisory Fellow – New York, NY

Sotheby’s Institute of Art, 2024; VCUarts, 2019

MA, Art Business ; BA, Art History

ALEX KATZ (AMERICAN, B. 1927)

Eleuthera (1999)

Screenprint in colors on Rives paper

Signed in pencil and numbered ‘PP 1/5’ (a printer’s proof, aside from the edition of 75), co-published by the artist and Brand X Projects, Inc., New York, printed by Brand X Editions, Inc., New York, the full sheet.

48 x 26 3/4 in.

Bonhams

Prints & Multiples Summer Splash

4-14 August 2023

Lot 7

ACHIEVED: $25,600 inc. premium

An exceptional Katz print recently came to sale at Bonhams. Eleuthera depicts two very Katz-esque female figures in swim costumes with bold-colored caps. Behind them, the ocean is rendered in a simple plane of turquoise blue but still captures a glimmer of sunlight dancing on its surface. Some rays even catch the profile of his subjects’ faces, adorning them in the same flash that makes the water so beautiful. In his classic style, Katz depicts a magical moment. While this print appears very flat, he has captured the space’s and figures’ three-dimensionality.

Eleuthera refers to a small island in the Bahamas, only two miles wide. In this tightly framed composition, Katz transports viewers to that compact yet blissful environment. What makes this work even more special to me is its edition. This specific print is number “PP 1/5,” meaning it is the first of five Printer’s Proofs. In a previous sale, Christie’s noted that ten Artist’s Proofs were made, making the Printer’s Proofs even rarer. While I believe other collectors would focus on the paintings of Alex Katz more than his works on paper, I believe that purchasing a screen print of this uniqueness is a great way to build a Katz collection beyond one medium.

The last sale of an edition of Eleuthera achieved a hammer price of $11,000 at Christie’s, whereas the sale of the first Printer’s Proof reached $20,000 at Bonhams. These sales were less than a year apart with the Christie’s sale having been held in October of 2022 and the Bonhams sale having taken place just this past week in August of 2023. 2023 has been a mixed year for Katz screenprints, with some achieving beyond their estimate and some failing to even reach it. It is interesting to compare the different types of Katz prints that intrigue buyers.

Jiayi (Joyce) Liao, Arts Management Intern – Philadelphia, PA

Yale University, Class of 2025

Double Major in History of Art & Economics

HUANG YONGYU (CHINESE, 1924-2023)

Lotus (1996)

Scroll, mounted and framed, ink and color on paper

Inscribed and signed, with three seals of the artist

Dated August 18, 1996

28 1/2 x 55 3/8 in.

Christie’s, Hong Kong

Summer Reverie: Chinese Paintings Online

15-29 August 2023

Lot 69

ESTIMATE: HKD 300,000 – 400,000

The artwork I chose was painted by Huang Yongyu, a self-taught contemporary Chinese artist known for his woodblock prints, ink-wash paintings, and stamp designs. Born in 1924 in Fenghuang, China, Huang never attended a regular school but studied literature and art independently. He often depicted wildlife, foliage, or human figures and sought to express childlike innocence. His works are in the collections of major institutions such as the Metropolitan Museum of Art in New York and the Asian Art Museum in San Francisco. Huang scheduled a centennial exhibition in 2024 but passed away on June 13, 2023.

I chose this painting because of its iconic subject, rare occasion, and reliable provenance. The lotus is one of Huang’s favorite subjects. This work represents his signature style of combining the painterly qualities of Abstract Expressionism with the Chinese tradition of “xieyi (painting ideas).” The composition draws viewers into a vast expanse of a harmonic fusion of ink, color, and water.

Despite its popular subject, this work has a unique context. According to the inscription, the piece – titled “bai nian hao he (may the blessed union last for one hundred years),” a common marriage blessing in Chinese – was painted as a gift to celebrate the 50th marriage anniversary of Chengxing and Madam Mu Zhen. ThelLotus is a symbol of marriage since “he (lotus)” is a homophone for “he (union).” The two lotus flowers positioned side by side in this painting probably represent the couple. The present owner of this work acquired it from the original recipients, which confirms its authenticity.

This will be the third time Christie’s presented “Summer Reverie: Chinese Paintings Online.” Huang’s works performed well in the previous two auctions, as exemplified by Lotus (1998) in 2022, which sold for HKD 1,386,000 (USD $176,598), 454% above its mid-estimate. Further, the artist’s recent death could make this sale a favorable time for acquisitions, as research shows that the value of works tends to drop in the year of the artist’s death and increase again afterward.

Comparable works in past auctions suggest the high potential value of this painting. Among 2,182 works by Huang Yongyu sold at auctions since 1988, 49 have similar subject matter, size, and medium as the one currently offered, with a record price of HKD 2,200,000 (USD 283,800) realized by Colorful Lotus (2002) at Christie’s Hong Kong in 2015. In 2023, two comparable works sold at China Guardian Auctions in Beijing outperformed expectations: Lotus (2004), sold in March, realized RMB 460,000 (USD 66,810), 360% over its mid-estimate; Lotus in Morning (2000), sold on June 14, a day after the artist’s death, realized RMB 862,500 (USD 120,666), over 50 times of its conservative estimate.

Kaylin Jury, Marketing Intern – Lititz, PA

Washington and Lee University, Class of 2024

Art History and Spanish Major | Cultural Heritage and Museum Studies Minor

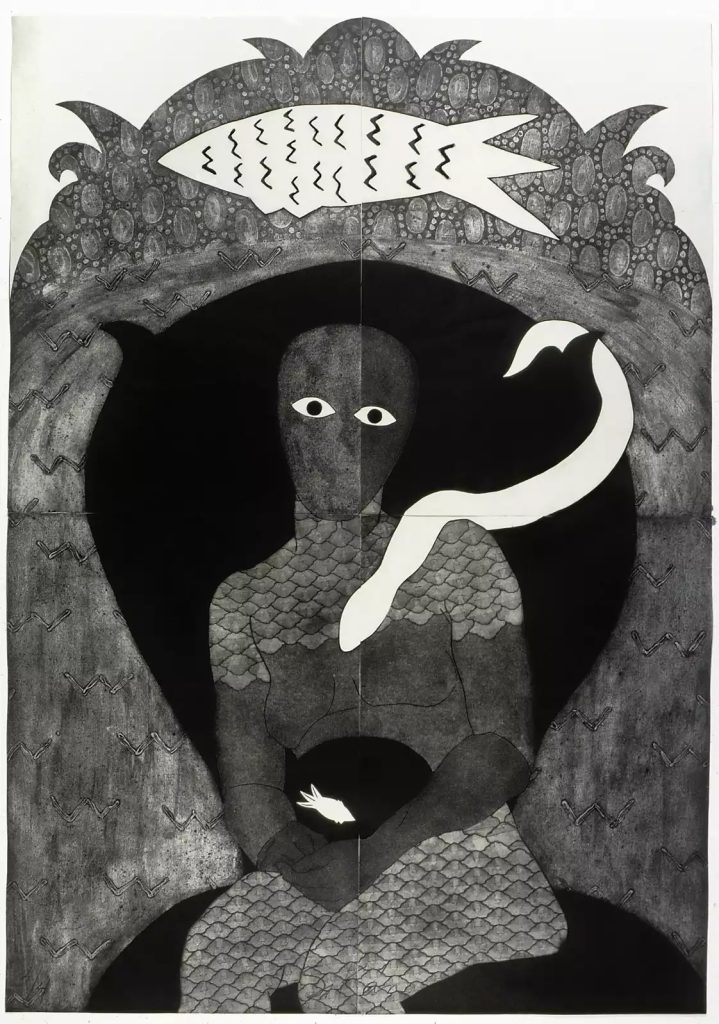

BELKIS AYÓN (Cuban, 1967-1999)

Sikán (1991)

Collograph

35 x 27 1/2 in.

Christie’s, New York

Latin American Art

28 September 2023

ESTIMATE: $40,000-$60,000

Belkis Ayón (Cuban, 1967-1999), a Cuban printmaker, is best known for her black-and-white depictions of Abakuá, an all-male, Afro-Cuban secret society. Ayón was enthralled with the group’s only female figure, Princess Sikán, who quickly became a central figure in the artist’s work. A 2019 Frieze article described these two women, artist and muse, as each other’s “alter ego[s].”

The deep textures, stark contrasts, and piercing, almond-shaped eyes seen in this depiction of Sikán are staples of Ayón’s style. The texture and depth Ayón achieves come from her use of collagraphy, a printmaking technique where ink is transferred using a collaged printing plate. One can see the joints between the individual prints in her 1991 Sikán, demonstrating the uniqueness of the artist’s technique. Combined with the work’s crowned design, these details make the piece a nontraditional and exceptional work from the Latin American sale.

As an influential female Cuban artist, Ayón has only recently begun to receive the attention I feel she deserves. Although high-achieving before she died in 1999, Ayon took flight in 2016 with the Fowler Museum’s exhibition of her first solo show. Since then, Sikán has been displayed in the Reina Sofia and El Museo del Barrio, demonstrating that it is a true museum-quality piece. Many other examples of Ayón’s work are in the permanent collections of the Museum of Contemporary Art, Los Angeles and, the Wilfredo Lam Center of Contemporary Art. I am excited to see this unique piece of Ayón’s work brought to public attention.

Similar pieces that sold above their high estimates in March 2023, like Untitled (Silkan with Goat) and ¿Arrepentida? (Repentant?), were placed in auctions focused on contemporary art. With Sikán coming to auction in a Latin American sale targeting collectors interested in Cuban art, I am interested to watch its performance.

Ran Peng, Art Marketing Intern – Pittsburgh, PA

Heinz College, Carnegie Mellon University, Class of 2024

Master of Arts Management

ROY LICHTENSTEIN (AMERICAN, 1923-1997)

Mirror #6 (1972)

Lithograph and screenprint in colors on Special Arjomari paper

40 3/8 by 29 3/4 in.

Sotheby’s, London

Contemporary Discoveries

17 August 2023

Lot 26

ESTIMATE: GBP 8,000 – 12,000

ACHIEVED: GBP 12,700

As someone deeply interested in conceptual and Post-War and Contemporary art, I picked the lithograph and screenprint Mirror #6 by Roy Lichtenstein, in which he explored abstraction and discussed the concept of the “mirror” with his symbolic style. I really like the vibrant blocks of color and the conceptual discussion between the mirror’s formality and functionality.

Mirror #6 presents an oval shape in shades of dark red, black, and yellow with jagged lines and dots, creating a gradual transition from dense to light areas. The colors and dot clusters reveal the glass mirror’s edges while presenting its reflective nature. The oval mirror is placed at the center of the print and presented frontally without any reflected object. In this way, Lichtenstein separates the form and concept of the mirror from its functionality. With blocks of vibrant colors and dense dot clusters, Lichtenstein represents the reflection of light on the uneven surface of the mirror. This style helps viewers explore the conceptual difference between the mirror’s reflection and the mirror itself.

Throughout art history, mirrors have been used to convey the hidden complexities and dualities of the surface-level or outward presentation of self. In classic mythology, for example, mirrors served as a form of moralistic commentary on vanity. Lichtenstein’s work, however, challenges these traditional metaphors by shifting the focus from the reflected objects to the mirror itself. In this way, the artist poses a conceptual question to the viewer regarding the aesthetic comparison of an iconized object and its formal/physical features.

Lichtenstein revised his investigation of abstract aesthetics in his later career. Nevertheless, I believe the Mirror series is a solid showcase of his conceptual exploration, which he later continued in his Reflection and Interior series.

Various examples of similar Lichtenstein works have come to market in the last two years. For example, I found that a different edition of the same print, Mirror #6, and a print in the same series, Mirror #7, sold in the $10,000-$15,000 range. Since both previous pieces came to market in New York, I will be interested to see if London collectors take a similar interest in Lichtenstein’s Mirrors.

RELATED CONTENT

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Fine Art Group offers hands-on internships for recent graduates and individuals with diverse backgrounds in the art world. This program provides first-hand experience in TFG’s appraisal, art advisory, agency, marketing, and business development divisions, in which the interns work directly with the corresponding advisors and teams.

Selected candidates must possess an exceptional work ethic, excellent time management skills, and a detail-oriented and professional demeanor, taking accountability for their tasks. Candidates should demonstrate an interest in art through work experience or studies and be motivated to excel in the gallery and auction market. Proficiency in Apple Mac OS, MS Office, Photoshop, and internal

INTERNSHIP POSITIONS

TFG internships last from 3-4 months and are offered as full-time positions.

Appraisal Management Intern

In-person only position – Philadelphia Metro Area

The Appraisal Management Intern will support the Appraisal and Advisory Departments by working with our team of experienced art appraisers. We seek a detail-oriented intern with a keen interest in and knowledge of art and antiques. The selected candidate should also have an outstanding work ethic, efficient time management, and be a team player.

Intern responsibilities include:

- Researching and cataloging antiques.

- Assisting with on-site client visits and appraisals.

- Formatting/editing documents and images for internal system tracking.

The intern will also collaborate with other departments to provide administrative and operational support.

Advisory Intern

Hybrid position allowed – New York City

The Advisory Intern will support the Advisory Department by working with our team of experienced art advisors. We seek a detail-oriented intern with a keen interest in and solid background in art history and antiques. The selected candidate should have an outstanding work ethic and time management skills.

This position is responsible for researching and cataloging antiques, updating client information in the CRM system, and maintaining 1stDibs accounts. The selected candidate is also responsible for creating client presentations, editing photos and documents, photographing items and artworks, and placing global exhibition consignments. They will also collaborate with other departments, including marketing and general operations, to provide administrative and operational support.

Art Marketing & Business Development Intern

Hybrid position allowed – East Coast

The Art Marketing Intern will support the Marketing Department and work closely with the Business Management and Operation departments. We seek a detail-oriented intern with an interdisciplinary background in art and marketing/management with a keen interest in art and antiques. The ideal candidate should have experience in design and marketing platforms such as Adobe Creative Suite, Mailchimp, or similar newsletter software, and WordPress. They should also have an outstanding work ethic, efficient time management, and be collaborative.

The Art Marketing Intern will analyze marketing data and produce reports, research digital and social media marketing keywords, and maintain websites and mailing lists. The Marketing Intern is also responsible for social media graphics, creative designs in Adobe Creative Suite, and some minor video editing. They will collaborate with the Advisory and Appraisal teams and general operations to provide administrative and operational support.

Read more about the open internships on our careers page. Please email your resume and cover letter to jobs@fineartgroup.com. Currently, we are not accepting phone calls about available positions.

Managing a growing collection can prove to be a daunting task for even the most seasoned collector. “How do I keep track of my purchases? How do I coordinate a museum loan or exhibition? When should I get an appraisal? How do I find a conservator that fits my needs?” As a Collections and Inventory Associate, I find the answers to these questions and much more. Working with The Fine Art Group’s global team of specialists, we create a bespoke plan for each collection and manage every object with the utmost care.

SERIOUS COLLECTORS NEED PROFESSIONAL COLLECTION & INVENTORY MANAGEMENT

WAYS THE FINE ART GROUP CAN SUPPORT IMPORTANT COLLECTIONS

- Inventory Management

Organizing and maintaining a comprehensive inventory of the client’s collection, including detailed records of each object, its provenance, condition reports, and relevant documentation. Our team will enter all documents into a collections database accessible to the client, their representatives, and The Fine Art Group.

- Appraisals & Valuations

Coordinating regular appraisals and valuations to provide clients with up-to-date information on the value of their collections.

- Logistical Oversight

Managing the logistics involved in handling and transporting artwork, including coordination of packing, shipping, and installation, ensuring proper care and adherence to international best practices.

- Disaster Planning

Implementing measures to protect the collection from potential risks such as natural disasters, fire, theft, or damage and developing emergency response plans, and coordinating with relevant experts for conservation and restoration in case of an incident.

- Museum Loan Advice

Providing guidance and assistance in navigating the process of lending artworks to museums and institutions, managing the logistics, insurance requirements, and legal considerations involved in loan agreements.

- Security Consulting

Advising on what protections a collection requires when on display, in storage, or during transportation and assisting in acquiring needed services.

- Philanthropic Strategy

Assisting clients in leveraging their collection for philanthropic purposes, offering guidance on charitable donations, art-related events, and collaborations with cultural institutions or nonprofit organizations.

- Exhibition Strategy

Working with our specialists to develop strategies and recommendations for exhibiting collections, including curatorial advice, display techniques, and exhibition planning to maximize the collection’s visibility and impact.

- Introductions to Vetted Industry Experts

Liaising clients with experts related to subjects such as tax planning, conservation, restoration, academic researchers, and scholars.

- Art Finance

Supporting through TFG’s Art Finance department for temporary finance for further collection development.

RELATED ARTICLES

- New Public Sculpture for Guangzhou, China

- The Secrets to Maintaining Large Collections

- The Fine Art Group’s Art-Secured Financing Solutions Continue to Meet Increasing Client Demand

OUR SERVICES

The Collections Management division at The Fine Art Group, represented by Luke Jacobs as the Collections & Inventory Services Associate for the Americas, aims to provide comprehensive and customized solutions to support clients in managing their collections effectively.

Patti Wong, Founder of Patti Wong & Associates, and her successful acquisition of Gustav Klimt’s Dame mit Fächer (Lady With a Fan) on behalf of an anonymous Hong Kong client for a record-breaking $108.4 million was the main topic of Artnet News’ article, “Who Bought the Mysterious Klimt at Sotheby’s? An Equally Enigmatic Hong Kong Power Broker, Some Believe.”

Philip Hoffman, Founder and CEO of The Fine Art Group, spoke with Katya Kazakina of The Art Detective about clients’ interests in the most recent May auctions for the article.

Click here to read the full article on Artnet News.

Newsfeed image credit: Gustav Klimt, Dame mit Fächer (Lady with a Fan) (1917-18).

Anita Heriot, The Fine Art Group’s President of the Americas, speaks with Bowdoin Magazine, a publication for Bowdoin alumni, about her experience in the ever-changing art world and her role at The Fine Art Group.

Click here to read the full article in Bowdoin Magazine.

Newsfeed image credit: Cover of Bowdoin Magazine’s Spring/Summer 2023 issue.

Patti Wong, founder of Patti Wong & Associates, is profiled by Penta Magazine, an imprint of Barron’s. She discusses her incredible over 30-year-long career, her impact on Asia’s rising art market, and the opening of her new Hong Kong-based advisory business Patti Wong & Associates.

Click here to read the full article on PENTA on Barron’s.

Full article

Philip Hoffman and Freya Stewart recognized by Spear’s Magazine

The Fine Art Group is honored to have Philip Hoffman and Freya Stewart recognized by Spear’s Magazine as top recommended professionals in their fields, Art Advisory and Art Finance. They have been ranked as experts in the art market and art finance industry for high-net-worth individuals in the UK.

VIEW EACH LIST AT SPEAR’S MAGAZINE

Spear’s 500 Best Art Advisors List

Spear’s 500 Best Art Finance Advisor List

THE FINE ART GROUP EXPANDS REACH TO AUSTRALIA AND NEW ZEALAND

The Fine Art Group is the largest art advisory company in the world. Its new alliance with Australian-based Roger McIlroy takes its reach into the Pacific region as McIlroy accepts position as Chairman, TFG, Australia and New Zealand.

TFG Founder and CEO, Philip Hoffman says, ‘Roger has achieved an international reputation for excellence in the art world and is one of the most trusted individuals in the field. His experience, knowledge and extensive global networks make him the ideal new TFG senior resource in the region and we are delighted to have him join the team’.

Roger’s successful 30-year association with Christie’s led to the establishment in Australia of his leading independent art advisory business. Equally recognized for his expertise in the fine art auction room, Roger will continue his prominent role as head auctioneer of Deutscher+Hackett, Australia’s top auction house.

ART CONTINUES GLOBAL GROWTH AS ALTERNATIVE ASSET

This exciting new collaboration between TFG and Roger McIlroy reflects the global growth of art as a recognized alternative asset. TFG is the first international art group to respond to this shift and to move into Australia and New Zealand, providing unrivalled service and access to all aspects of the international art market. This development follows TFG’s expansion into Asia through a joint venture with former Sotheby’s executives Patti Wong and Daryl Wickstrom, and their collaboration with preeminent New York art advisor Allan Schwartzman and his team at Schwartzman&.

In Australia and New Zealand, Roger McIlroy will work in association with TFG Vice President, Leticia Hoffman, a member of TFG since 2014. With over a decade of experience in the art world, Leticia has handled some of the world’s finest artworks, gemstones, and jewels. Notably, Leticia aided with the sale of the Cartier ‘Sky Blue Diamond’ for $18 million.

With their combined skills and expertise, Roger and Leticia will continue to deliver private and corporate clients informed advice for the management, building, care and development of their art and tangible asset collections. Roger’s and TFG’s international alliances provide unrivalled leverage, offering Australian clients premium opportunities to sell, buy and secure finance across diverse categories within the art market.

Roger and Leticia will be supported by a team of 80 specialists and advisors from around the world, covering virtually every type of collecting category and available to provide ready assistance.

GLOBAL ART SERVICES POWERHOUSE

For over two decades, TFG has maintained an unrivalled track record across the art world. TFG helps clients navigate all aspects of the art market, from providing assistance with collection strategies, acquisitions, appraisals and the selling of works of art, through to art financing. This new collaboration with Roger McIlroy adds to the definition of TFG as an art industry innovator now available to meet new market demands in the Pacific region.