“A true real asset art loan (meaning a loan secured solely by art, without extensive borrower financial assets/liquidity tests) is very attractive for owners of high value art (and jewelry) because it’s a very straightforward way of releasing capital in short order, at a time where access to fast liquidity is so valuable for many people.”

CEO Art Finance and Group General Counsel of The Fine Art Group, Freya Stewart, speaks to Patricia Lee at Withersworldwide and discusses bank loan liquidity opportunities and current art loan challenges.

Read the article in full here.

“Whether you need guidance through the art market or wish to develop your taste and artistic knowledge, it is worth seeing the advice and support of experts. Philip Hoffman is one of the most experiences of these experts.” In the entrepreneurs issue of Credit Suisse’s magazine, Scope, our Founder and CEO Philip Hoffman points out that “collectors are no longer thinking of their art as a separate, purely passion-driven entity – they want it to be financially sustainable, secure, and efficient – from buying to storing to selling. I think both collectors and private bankers now appreciate how valuable proper advice is in this area.”

Follow this link to the full article to read about shifts in collecting trends, the importance of independent art advice, and how to borrow against your art.

In the Deloitte Art & Finance Report 2019, Freya Stewart contributed an article on the current state of the asset-based art-secured lending market, and the challenges and opportunities the next five years will bring.

“Awareness and understanding of art-only asset-based financing among the top-end collecting community and, importantly, their financial advisors and family offices, has without doubt risen in recent years…. In particular, significant younger collectors, and collectors who are entrepreneurs in other markets, are coming to recognize the diverse utility of art-secured credit facilities…

… The growing demand for art-backed loans is a natural reflection and extension of the increasingly sophisticated nature of the world’s most active and prominent art buyers.”

Read Freya’s full article on pages 120 – 121 of the Art & Finance report here.

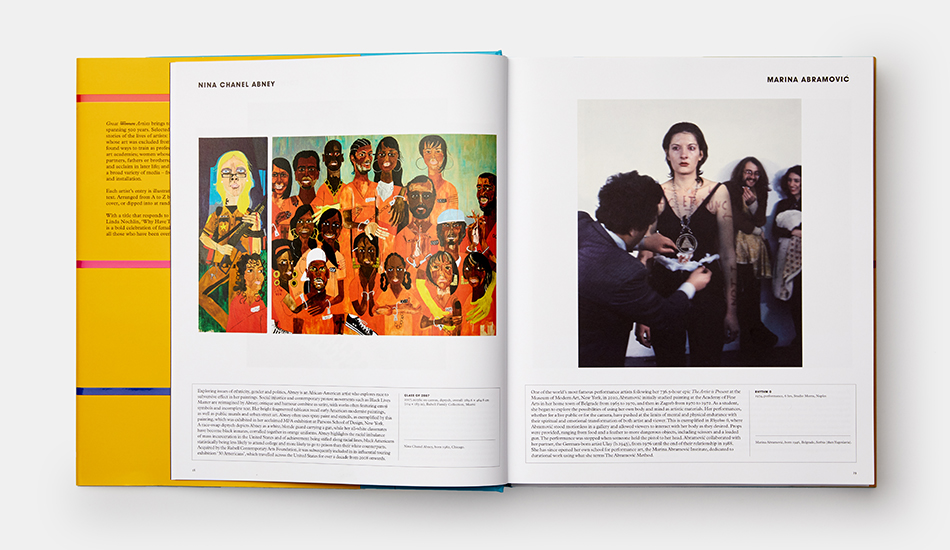

Henry Little, Associate Director of our art team, is a frequent contributor to Phaidon publications such as Vitamin T: Threads and Textiles in Contemporary Art and most recently, Great Women Artists. Past and present female artists are gaining greater recognition throughout the art world, a shift this comprehensive volume reflects. Featuring more than 400 artists from 50 countries, this fascinating presentation of 500 years of female creativity ‘reveals a parallel yet equally engaging history of art for an age that champions a greater diversity of voices’.

The publication Great Women Artists will be available from 25th September 2019, visit the Phaidon website for more information.

FURTHER READINGS

The Fine Art Group is proud to announce the opening of a new regional office in historic Charleston, S.C., allowing our experienced team of appraisers and advisors to maintain the highest levels of accessibility, transparency and trust for clients in the southeastern United States.

Since its founding in 1670, Charleston has remained a cultural crossroads and retained an extended dialogue with the fine and decorative arts market driving connoisseurship and collecting throughout the region.

TFAG looks forward to taking part in this important conversation by providing clients with the same access to exceptional art market intelligence they have grown to know and expect. Our services include appraisals, visual inventory, collection management, art advisory and continuing education. Details on these services are at our service page.

Shane David Hall, Appraiser & Advisor – Senior Decorative Arts Specialist, will lead the Charleston location. Shane earned Bachelor of Fine Arts degrees in Historic Preservation, Urban Planning and Art History from the College of Charleston, and a Master of Arts in American Fine and Decorative Arts from Sotheby’s Institute of Art, New York City.

With a lifelong enthusiasm for art, architecture and decorative arts, Shane began his career as curatorial assistant at This Historic Charleston Foundation and interned with the prestigious Winter Show. He acquired extensive art market experience at three international auction houses, becoming the Director of Selkirk Auctioneers & Appraisers in St. Louis, Mo. , one of America’s oldest auction firms. Shane is certified in the Uniform Standards of Professional Appraisal Practice and is an active member of the College of Charleston Alumni Association. Hall looks forward to assisting clients in North Carolina, South Carolina, Georgia, Alabama, Mississippi, Louisiana, Texas and beyond.

SHANE’S INSIDER GUIDE TO CHARLESTON

MUSEUMS

Gibbes Museum of Art

Founded in 1858, the Gibbes Museum is the foremost collection of American art that incorporates the story of Charleston and the South. The museum connects the city and regions artistic past to a vibrant contemporary art scene and continued scholarship.

Halsey Institute of Contemporary Art

Housed within the School of the Arts at the College of Charleston, the Halsey originates five to seven exhibitions annually dedicated to contemporary art and focusing on emerging and mid-career artists.

EVENTS

Charleston Antiques Show

The premier fine art and antiques show in the southeast highlighting over 30 dealers of fine arts and antiques showcasing 17th to mid-century modern, English, European and American period furnishings, decorative arts and fine art, architectural elements, garden furniture, vintage jewelry, silver and more.

Spoletto USA

For 17 days and nights each spring, Spoletto Festival USA fills Charleston’s historic theaters, churches and outdoor spaces with performances by renowned and emerging artists in opera; theater; dance; and chamber, symphonic, choral, and jazz music. Spoleto Festival USA is recognized as America’s premier preforming arts festival.

DINING

Breakfast

Miller’s All Day

Celebrating everybody’s favorite meal by shining a spotlight on small batch grains, perfectly turned eggs, delicious proteins, craft cocktails, and gentle surprises designed to delight even the most hardboiled diner.

Lunch

Gaulart & Maliclet

Providing fresh, affordable, healthy, global cuisine with French flair in a social environment that encourages community and the Arts.

Dinner

FIG

Our approach is simple. We have a passion for pure flavor, quality ingredients, and for creating an atmosphere that is convivial, approachable, and a haven for people who simply love food.

THE FINE ART GROUP AT LONDON ART BUSINESS CONFERENCE

On September 4th, Freya Stewart will be speaking at The Art Business Conference.

Now in its 6th edition, The Art Business Conference is an annual one-day conference, held in the heart of London. Through paneled discussions and speeches by leading experts in art, business, and technology, the conference provides an informed global perspective on key issues of the art market, and looks ahead to potential future developments.

Freya Stewart will be speaking on the subject of Demystifying Art Finance in conversation with Financial Times reporter Melanie Gerlis. Their session includes,

“Whether you own your own art collection, are an advisor seeking more insight for clients, or if you just want to know more about this rapidly developing market, this ‘need to know’ expert session will cover the ins and outs of art lending from loan costs and terms to financing for art business.”

Read more about The Art Business Conference here.

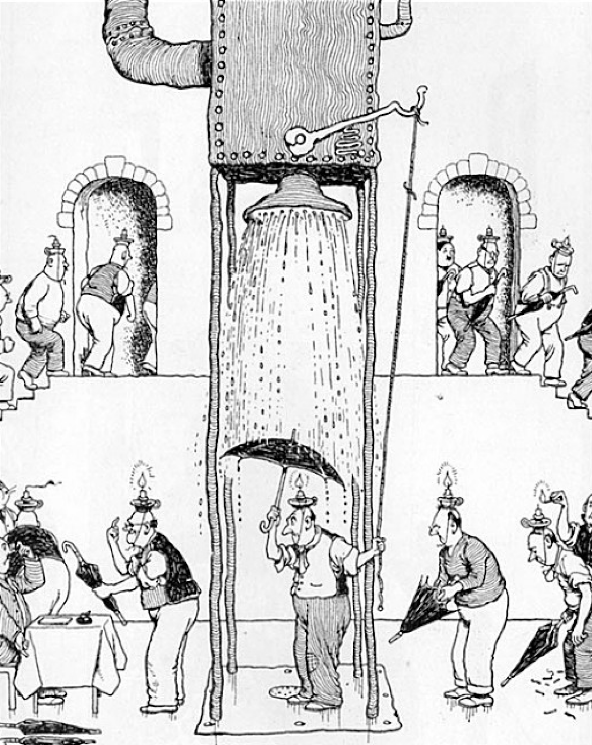

HOW PHILIP HOFFMAN BEGAN ART COLLECTING

In my early twenties my brother and I were captivated by the illustrator and satirist, William Heath Robinson. It was one of these absurd and charming drawings of an ad hoc contraption that became the first work I ever purchased. I think it was Robinson’s imagination that had me so intrigued. Today, the walls of my study are covered floor to ceiling with the original cartoons from the early 1900s.

A little later I began to collect antiquarian books. The obsession started when I was studying at York University; I used my student loan to buy an 18th century rare book on wine for £100 – thus complimenting my then and continuing interest in wine! A few years ago, when we renovated our home in London, I had a library specifically built to house my ever increasing antique and rare books collection. However, I will always value my first, and it has stood proudly in my library for over 40 years.

Since I started working in the art world, at least 30 years ago, my taste has slowly developed and changed and I’ve been heavily influenced by my wife, Nicky. It was Nicky who encouraged me to buy my first ‘real’ picture, a Bridget Riley at FIAC in Paris. I have always been interested in Modern British art, and I think Riley is one of the most revolutionary British painters of them all and I am looking forward to her upcoming retrospective this year.

THE FINE ART GROUP: LEADING ART FINANCE PROVIDER

With the acquisition of Falcon Fine Art’s art-secured loan book, The Fine Art Group further cements its position as a leading art finance provider. It marks the first significant consolidation of specialist art lenders in a maturing and growing art financing market.

“We are delighted with the acquisition of Falcon Fine Art. This inaugural art-financing business consolidation strengthens our long-term commitment to being the leading art finance provider to collectors and owners of high value art globally. This is an exciting time for our business as demand for our art financing product increases – we look forward to continuing to deliver the best art lending service to our clients.”

– Freya Stewart, CEO of The Fine Art Group’s Art Lending business

The Fine Art Group founded its art-secured lending practice three years ago to provide specialist art-secured financing to collectors and owners of high-quality art and jewelry, under the leadership of Freya Stewart. Having established a strong track record in the art lending space, with a commitment to provide financial solutions for a growing global client base, The Fine Art Group was the natural buyer for Falcon Fine Art.

Kamel Alzarka, the Chairman of Falcon Group, said: “This sale makes perfect sense, as we continue to focus on the growth and expansion of our core business, providing solutions for our large corporate clients.”

Meet Roxanne Cohen our New Director of Art Advisory

Born and raised in London, Roxanne Cohen comes from an art collecting family. After 30 years in the UK, she relocated to NYC, the center of the contemporary art world. With years of experience as an independent art consultant, Roxanne now brings her skills to The Fine Art Group. For 5+ years, she worked at Christie’s Auction House within the Post-War and Contemporary Art Department and Client Advisory. Her extensive knowledge of the primary and secondary art markets helped clients build unique collections of work by various artists, both emerging and blue chip.

Roxanne has a Masters in Art Business from Sotheby’s Institute which is affiliated with Manchester University, a BA (honors) in History of Art and Architecture from Manchester University (UK), and a Certificate in Collections Management from Sotheby’s Auction House.

BUY WITH YOUR EYES, THEN WITH YOUR MIND

By this I mean, buy what you feel passionate about and then validate the purchase with your due diligence.

Loving the work must be the most important factor. You should take time to develop your eye, research and learn what it is that you love. Visit Museums, Art Fairs, Auction Houses, Galleries and follow people in the art-world on Instagram. Read as much as possible on artists you’re looking at, check their resume for important gallery and museum shows. Did an important collector own the piece you’re looking at? Has it been exhibited before? Have you checked auction results to make sure that you are paying fair market value?

Make sure you see the work in person. Photographs and PDFs can be digitally enhanced. It is also crucial that you have the correct measurements. Make sure your measurements reflect the size with frame. The work does not necessarily need to match an interior but should fit well in the space. Buying art for your home means that you will live with it every day; you don’t want to regret an ill-informed decision.

Looking for a work by an established artist on a lower budget? These blue-chip artists may remain out-of-reach for the collectors with lower budgets but there are more accessible works out there. An artist’s early drawings, studies, print editions for example, represent a good starting point for anyone wishing to own a work by a blue-chip artist. When buying, consider looking for works that capture the most distinct elements of an artist’s practice.

Don’t just ‘buy into the hype’ especially with young emerging artists. If you do, make sure you will love the work in the long run, as the emerging market can be very volatile.

It’s also important to buy quality not quantity when investing in art. Invest in fewer pieces that are higher quality. Art is a purchase for life, so it’s better to collect slowly with a focus than try to rush.

An art advisor can be used along the entire spectrum of the collection process – from early days when a simple educated walk through a fair may be a great start, to pricing works before acquisitions, to developing a comprehensive collection management strategy. Having a trusted advisor to work with can be a major benefit as they know you, your taste and are committed to building your collection with your values in mind.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

2017 Agenda: Personal Use of Business Autos, Millennials at Work + More

What’s on the agenda for the Personal Lines Practice Group in 2017?

Suggestions ranged from personal use of business autos to hiring, handling and keeping millennials at this month’s teleconference, chaired by George Pester of Johnson Kendall Johnson.

THESE WERE AMONG THE TOPICS

- Training new producers

- Social media campaigns that keep the agency’s name in front of clients and prospects

- Social media’s role in client retention

- How your agency can increase visibility through volunteer days, networking groups and other efforts

- Improvements in the claims process

- Risk management techniques that lower risks

- Technology and risks, such as helping clients in geographic areas where alarm systems are required

- Segmenting clients and the use of service center

- How to hire, handle and keep millennials

- Time management

- Client retention strategies

- Motivating service teams to offer additional products to clients

- Community events that draw business to the agency

- Personal use of business vehicles and insurance pitfalls

- Encouraging referrals from commercial lines

- Structuring service teams

The next teleconference will be Dec. 14 with Colleen Boyle, senior vice president-national sales director of The Fine Art Group, as a guest speaker. Her topic will “Completing the Picture of Wealth: Managing Tangible Assets.”