The Asking Price: Understanding Value 2

Written by Henry Little, Director, Art Advisory; Charlie Wood, Associate Director, Art Advisory; Grace England, Researcher

INTRODUCTION

The Asking Price #2 – December 9th, 2022

The Fine Art Group is pleased to present The Asking Price, a new monthly newsletter focused on the global art market.

Drawing upon world leading expertise, The Asking Price offers regular insight into the complex world of art dealers, art fairs and auction houses.

For our second edition:

- Charlie Wood provides the key conclusions from the mammoth round of New York auctions in November, including the billion dollar sale of the Paul Allen Collection (5 minute read)

- Grace England explores the history of Miami’s vibrant contemporary art scene following Art Basel Miami’s successful 20th edition (7 minute read)

NOVEMBER AUCTIONS IN REVIEW

BY CHARLIE WOOD (5 MINUTE READ)

Due to the behemoth Paul Allen collection coming to market, the New York November Marquee sales occurred over two weeks this year. Total evening auction sales of Impressionist, Modern, Post-War and Contemporary art (with some Old Masters) reached $2.38 billion (hammer price) against the total pre-sale estimate of $2.07 – $2.59 billion. Exceeding expectation, this is the highest total on record and likely to catapult 2022’s total auction turnover into its highest ever result.

THE PAUL ALLEN COLLECTION

The first week began with the evening sale (Part I) of the Paul Allen Collection, which resulted in a hammer total of $1.3 billion ($1.6 billion with premium), surpassing the presale estimate of $1.06 – $1.23 billion, with all proceeds going to undisclosed charities. There has been much discussion about the lack of bidding wars or drama during the sale. However, much of this is due to the high estimates that accompanied the works, estimates that no doubt were required to win the sale from competitors. These prices took the wind out of the sale room activity but should not take away from the success of the auction and the tremendous results.

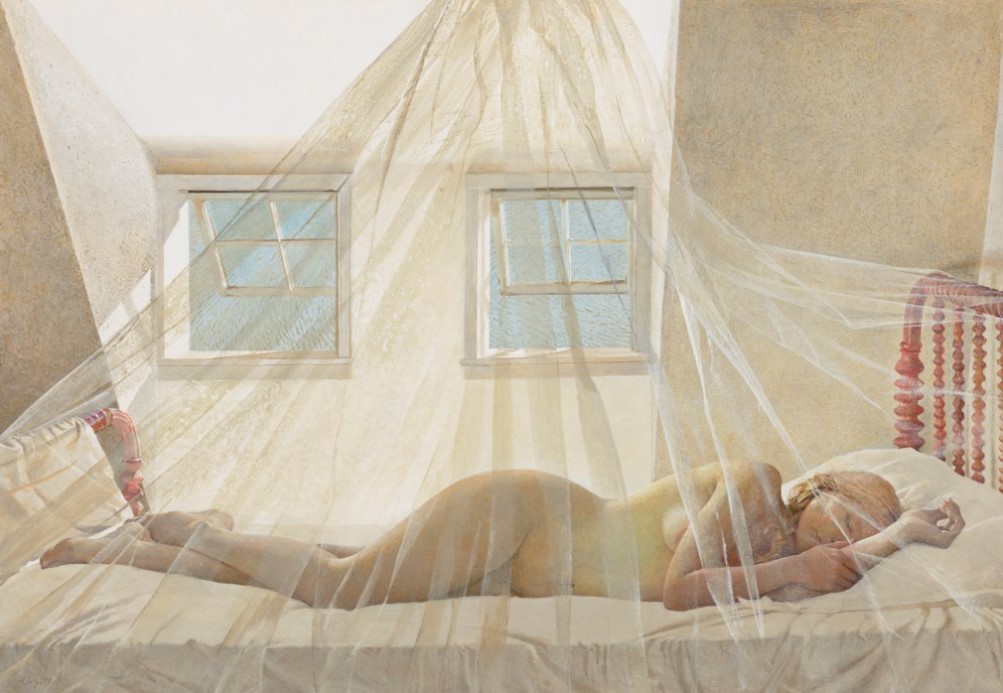

There was some spirited bidding on lots including Andrew Wyeth’s Day Dream (1980) which sold for a new record of $23.3 million (premium), more than seven times its high estimate, and Georgia O’Keeffe’s White Rose with Larkspur No. I (1927) which sold for $26.7 million (premium) above its $8 million high estimate. The whole sale set 20 new records for artists including Van Gogh, Klimt, Seurat, Jasper Johns and Lucien Freud.

All but one of the works sold (a Magritte was withdrawn as the sale began). Five lots sold for more than $100 million (premium), 15 others sold for over $20 million (premium) each. Of the 60 works offered, 39 were backed by third-party guarantees, but few of these works sold to their guarantors, a further demonstration of the wider demand for the material and pushing the results of the sale.

NEW YORK EVENING SALES

Despite Christie’s coming in with the highest total of the week due to Paul Allen, during the second week of sales Sotheby’s evening auctions appeared to have performed better than Christie’s overall. However, all the houses struggled, with several big withdrawals and reserve adjustments, meaning most sale totals were below expectations.

Sotheby’s began the second week with a single-owner sale of works from the collection of the late Whitney Museum president David Solinger. The 100% sold auction, remarkably with no guarantees, hammered at $116.4 million, towards the top end of the presale estimate of $86.7 – $118 million. Nearly half (11 out of 23) sold for hammer prices above their high estimates, with a new record for a de Kooning work on paper. Aside from this and Sotheby’s Now sale (also 100% sold), the remaining evening sales underperformed. Phillips’ sales total was $2.8 million below its anticipated total, Sotheby’s Modern and Contemporary sales together hammered $31 million below their pre-sale estimates. Christie’s 20th and 21st Century evening sales combined were $97.8 million below their expected hammer totals, their unsold $35 million de Kooning painting a large contributing factor.

Despite these totals, the average sell-through rate for these auctions was a very successful 94%. This is the result of tight sale management, lowering reserves and securing last minute third-party guarantees at conservative levels. Nevertheless, this confirms that most of these works did find buyers despite the market having spent $1.6 billion the week before. In addition, over $200 million was spent across all houses in the day sales, with an average sell-through rate of 84%. These sales, a high revenue stream area, with the houses not typically having to give away significant commercial terms compared to evening sale lots, are a good indicator of the stability of the market. As per past sale trends, the Post-War and Contemporary day sales continue to outperform the Impressionist and Modern category.

Despite this category remaining strongest, the market for some of the young artists in the newly coined ‘Ultra-Contemporary’ category, saw less frenzied demand than previous sale cycles, a development that had gently begun in the October London sales. Works by Maria Berrio, Lucy Bull and Salman Toor did all vastly exceed their estimates and saw lively bidding. By contrast, all but one of the offered Anna Weyant paintings sold for below her primary price levels of $600,000. Only one of the two Christina Quarles paintings hammered at the primary price level of about $1.2 million, the second painting hammering just above the low. Works by Amoako Boafo, Nicolas Party and Avery Singer also hammered below their low estimates. Yet the prices for many of these artists remain high for their age and career, more expensive than A+ works on paper (and even some paintings) by Impressionist and Modern Masters.

Moreover, these results should be viewed in the context of rising estimates and buyers becoming more selective as more works come to market. The differing results for the two Quarles pieces, for example, are to some extent reflective of the differing quality of the works. The successful outcome of the Sotheby’s Now sale that offers works from this category, hammering at $37.5 million against the low estimate of $32.4 million, also shows that this market segment still has considerable strength, even without the froth and unsustainable market heat.

The overall results reflect that the Paul Allen sale (and on a smaller scale, the Solinger sale) were a huge success, but the auctions that followed were markedly less so. This has led to some further suggestion that more challenging conditions may lie ahead for the art market. However, this viewpoint does not consider the wider picture, with $1.6 billion spent the week before, the buying power of collectors was perhaps waning by week two. This was a significant amount of material to ask the market to absorb. Moreover, the general totals and sell-through rates continue to display the resilience of the art market, against significant geopolitical disorder, rising inflation and fears of a recession that is currently affecting other markets to a greater degree.

These results also further demonstrate the importance of these single-owner collections in boosting overall volume and sales totals, as well as setting new records. More collections are anticipated to come to market in the coming years and these will continue to add vitality to a market that thrives off fresh material.

ART BASEL MIAMI BEACH: 20 YEARS

BY GRACE ENGLAND (7 MINUTE READ)

THE ‘MAGIC CITY’

This year marks 20 years since Art Basel came to the sunny shores of Miami, Florida, which has long been a haven for the wealthy to spend their winters and retire in a more forgiving climate. In the last two decades, however, the city’s cultural credentials have grown steadily. A 2018 study by UBS found Miami to be the second richest city in the U.S. and the third richest city globally when it comes to purchasing power. Today, the “Magic City” is home to dozens of art fairs, institutions, public art programs and private museums, including the Rubell, Margulies and de La Cruz collections. Each of these focuses primarily on American art and have vocally championed contemporary and emerging artists, opening their collections to the public in 1993, 1999 and 2009, respectively.

The correlation between the growth of private collections and the founding of public museums is strong, with the Museum of Contemporary Art in North Miami and the Institute of Contemporary Arts also opening in the mid-1990s. Above all, Art Basel is credited for the major expansion of the city’s art scene. Aside from a well-established collector base, the city’s location affords a dialogue with South American artists, galleries and collectors, as well as an appealingly warm climate in the traditionally off-season month of December.

THE BIRTH OF ART BASEL MIAMI

The arrival of Art Basel in Miami, and the subsequent expansion of its art scene, is largely attributed to two entities: the Miami-based collectors Norman and Irma Braman, and their long-term advisor and art world powerhouse, Jeffrey Deitch. Some of the earliest U.S. visitors to Art Basel in the 1980s, the Bramans introduced Deitch (who had first led them to Basel) to more Miami-based collectors who quickly turned into clients. This would connect Deitch to individuals who became pivotal in the creation of Art Basel Miami, namely Craig Robins (developer of the Miami Design District).

The reported “top buyer” at the time in Basel, Deitch developed close links with the fair’s chief, Lorenzo Rudolf, and director of communications, Sam Keller. When the fair looked to the U.S. for a new location, the Bramans proposed Miami Beach. The main selling points were the wealthy demographic with great buyer potential, the reasonable pre-holiday hotel rates before the Christmas festive season, and the excellent climate and glamorous lifestyle which would attract party-loving fairgoers.

With an initial delay due to 9/11, the fair officially opened in December 2002. From the start, the Miami Design District played a distinct role. With Craig Robins having begun to acquire property in the neighborhood during the 1990s, it has since become a community of designer shops, high-end restaurants, museums and fair spaces. Special exhibitions by the fair have taken place there almost every year since its opening, with the Institute of Contemporary Art and de La Cruz Collection both located within the Design District.

To this day, Deitch remains an integral partner in the fair’s activities. Since 2015 he has frequently collaborated with Gagosian on a satellite show during the fair’s run, with the latest show this year, 100 Years, featuring the likes of Theaster Gates, Damien Hirst and Rachel Whitehead, and taking place at the Buick Building in the Design District.

A FOCUS ON THE RUBELLS

Having begun collecting in New York in the mid-1960s after their marriage, Mera and Don Rubells’ collecting habits expanded after the death of Don Rubell’s brother, the infamous owner of Studio 54 nightclub, Steve Rubell. His significant inheritance allowed them to develop their collecting habits and invest in a number of hotels in South Florida. This began their historical relationship with Miami with the couple moving to the city from New York in 1998. Collecting emerging contemporary artists from the beginning (their initial budget for art buying in the mid-1960s was $25 a week), their collection now holds works by over 1,000 artists, including Jean-Michel Basquiat, Marlene Dumas, Oscar Murillo, Cindy Sherman and Kara Walker.

In 1993, they opened the Rubell Family Collection in the Wynwood neighborhood of Miami. An anomaly in the area at the time, they would kickstart a new trend for private collections and art-focused businesses and galleries opening in South Florida over the next decade. As of 2019, the collection is housed in the Allapattah neighborhood in the re-named Rubell Museum. Reportedly owning over 7,400 works, the Rubells also announced the opening of a second museum location in Washington, D.C., in October 2022. An important development, it demonstrates how far the Rubell influence has traveled outside of the West Coast to become a recognized institutional body.

OUTSIDE OF ART BASEL

As the longstanding mainstay of Miami’s contemporary art ecology, Art Basel is now surrounded by a plethora of other art and design fairs across Fort Lauderdale and Miami Beach during this pivotal week in December. Design Miami launched in 2005 under Craig Robins as a way to both incorporate design galleries into the fair week and further develop the Design District. Others have joined too, including NADA (New Art Dealers Alliance) in 2002, and Untitled in 2012, both focusing on emerging art. Not forgetting of course Art Miami, Miami’s longest running anchor fair which preceded Basel, having launched in 1989. Originally following Art Basel Miami in January, it now runs in parallel and comprises a wider empire, incorporating other fairs in Miami and New York such as CONTEXT, Aqua Art Miami, Art Wynwood, Palm Beach Modern + Contemporary, and Art New York.

Miami art week has become known for a more ebullient atmosphere, possibly the consequence of its more informal appeal compared to the original Art Basel. This took an early form in performance art and began under Jeffrey Deitch. Deitch Projects first launched its performance program in the house (and pool) of collector George Lindemann at the first Art Basel Miami in 2002. Deitch continued with this performance program (his last in 2014 included pop singer Miley Cyrus) until he switched to an exhibition collaboration with Gagosian in 2015. The performance strain of Miami art week has, however, continued to thrive. In 2022, South African artist William Kentridge, fresh from a concurrent career retrospective at the Royal Academy of Arts in London, performed a work at the Adrienne Arsht Center for the Performing Arts.

In 2021, with the arrival of NFTs and huge growth of the digital art scene, Miami was quick to participate in the market frenzy. Art Basel Miami partnered with blockchain Tezos to invite guests to mint their own NFT, NFT superstar Beeple was spotted making the rounds at the fair, and NFT platforms and NFT selling galleries such as SuperRare, Pace Verso and Nagel Draxler were granted booths. A momentous moment, with Art Basel Miami arguably the first mainstream fair to fully incorporate and promote NFTs, it took advantage of the recent emigration of many fintech companies to low-tax South Florida, as well as introducing Miami’s wealthy collectors to another sector of art collecting.

While the NFT world has suffered considerable setbacks in 2022 with the crash of the crypto market, inflation and general market distress, tech-enabled art platforms continue to expand in Miami, with a key example being Aorist, a climate-conscious NFT marketplace launched during 2021’s Miami art week with an immersive, aquatic-themed installation by Refik Anadol.

THE ULTIMATE SUNSHINE APPEAL

Miami art week has become a vital keystone event in the art market calendar. Art Basel, and the subsequent growth of Miami’s contemporary art scene, has resulted in a collector hub, fueled by the establishment of native commercial galleries such as David Castillo, Fredric Snitzer and Emerson Dorsh.

Attractive from the beginning for its location, climate and wealthy demographic, since inception Art Basel Miami has become the most celebrity laden of the annual fairs (competing only with Frieze LA). Leonardo DiCaprio, Sylvester Stallone and Barbara Streisand are all big-time collectors and regular visitors. It is certainly the most carnivalesque of the Basel fairs. The artwork on offer, extravagant events and overall atmosphere are far less formal than traditional art fairs – a combination, perhaps, of pre-Christmas anticipation, local wealth and sunshine. At a time of year when the art world fades into hibernation for the holiday season, and art market centres London and New York cool, literally and figuratively, Miami offers warmth and energy to close out the year.

EXHIBITIONS NOT TO MISS

LONDON

Barbican – Carolee Schneemann, Body Politics

Barbican Centre, Silk Street, London, EC2Y 8DS

Until 8th January 2023

Lisson Gallery – Richard Long, Drinking the Rivers of Dartmoor

27 Bell Street, London, NW1 5BY

Until 21st January 2023

Ben Hunter – Rodin, Moore, Whiteread, Keith-Roach

44 Duke Street St James’, London SW1Y 6DD

Until 27th January 2023

Gagosian – Lucian Freud, Francis Bacon, Frank Auerbach, Michael Andrews

20 Grosvenor Hill, London, W1K 3QD

Until 28th January 2023

Tate Britain – Lynette Yiadom-Boakye, Fly in League with the Night

Millbank, London, SW1P 4RG

Until 26th February 2023

NEW YORK

Mnuchin Gallery – Lynne Drexler, The First Decade

45 East 78 Street, New York, NY 10075

Until 17th December 2022

Gagosian – Anselm Kiefer, Exodus

555 West 24th Street, New York, NY 10011

Until 23rd December 2022

Green Naftali – Jacqueline Humphries

508 West 26th Street, New York, NY 10001

Until 14th January 2023

Mendes Wood DM – Antonio Obá

47 Walker Street, New York, NY 10013

Until 21st January 2023

Guggenheim – Alex Katz, Gathering

1071 Fifth Avenue, New York, NY 10128

Until 20th February 2023

TOP ART MARKET STORIES THIS MONTH

- Art Basel in Miami Beach sales report: Dealers Brace for Gloomier Times Ahead

- At Art Basel Miami Beach, a Tale of Two Markets: Lean at the Top, But Robust on the Lower End

- ‘Art Basel has to keep changing’: after 20 years, what is next for the fair juggernaut?

- Hong Kong’s autumn auctions for modern and contemporary art saw a 38% drop from last year—but why?

- A Hack Has Revealed What Many Long Suspected: The Owners of Auction Houses Are Also Some of Their Best Customers

- Paul Allen’s Masterpiece-Filled Collection Sells for $1.5 Billion at Christie’s, the Biggest Sale in Art-Market History

- Despite Shanghai fairs Art021 and West Bund shutting early due to Covid concerns, dealers report decent sales

LOOKING AHEAD

After a busy autumn season with no COVID-19 related disruptions the market will quieten until early February when Frieze Los Angeles opens for the first time at Santa Monica Airport with more than 120 exhibitors.

Meanwhile Art Basel Hong Kong, opening late March 2023, is will open for the first time without strict quarantine restrictions in place.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.