The Scoop: A Bi-Weekly NFT & Digital Art Newsletter 10

The Scoop #10 – November 2nd, 2022

In the 10th edition of The Scoop, we cover the rise in the correlation between crypto and equities and fractionalization. We also examine the royalty debate in the NFT space and spotlight Yuga Labs.

CRYPTO MARKETS

CRYPTO COMMENTARY

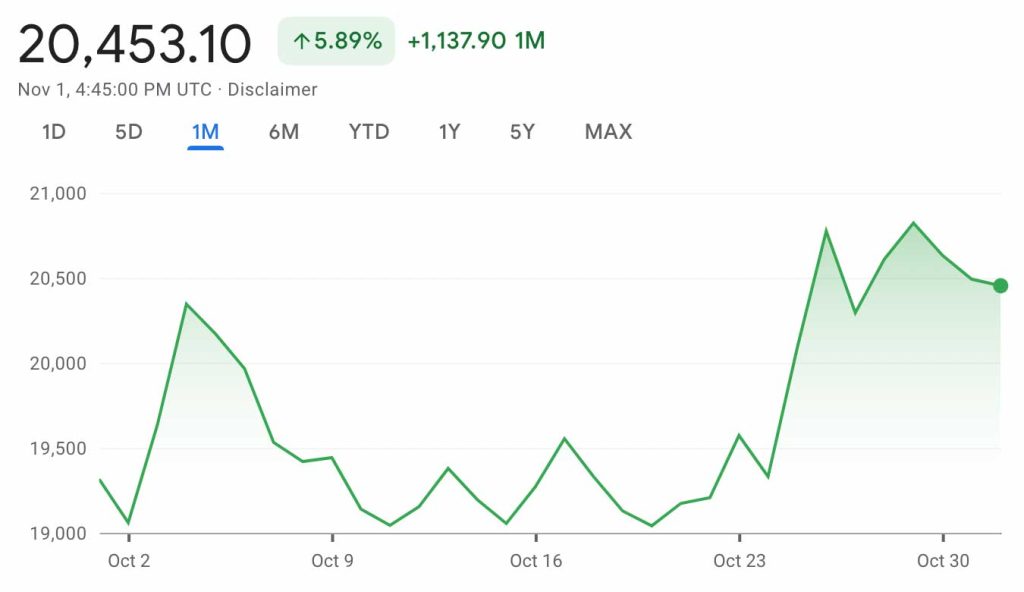

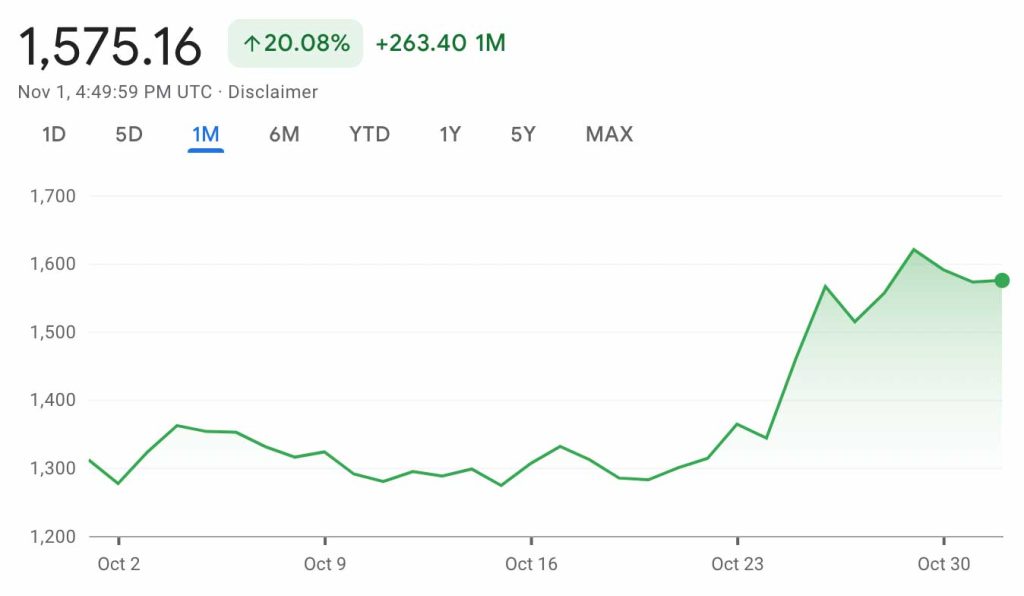

Bitcoin, the bellwether for crypto, has been rangebound – confined to upper and lower limits – since July. We’ve seen the same pattern in the stock market. Correlation between the traditional equity markets and crypto prices has grown stronger over time, with both responding similarly to events like the Fed announcements.

Instead of being an alternative to traditional markets, crypto has succumbed to the same economic pressures. It appears retail investors are staying on the sidelines, wary of further declines and future uncertainty while institutional trading has dominated the market. Less trading has produced less movement. With another interest rate hike in the works and a strengthening dollar, we can expect there to be continued downward pressure on cryptocurrencies. However, there have been rumors of the Fed easing its hikes as early as next year, but it will rely upon positive movement in the inflation measures.

In other news, the SEC continues its dive into the crypto markets with investigations into former crypto lenders Celsius and Voyager, along with the bankrupt Three Arrows Capital hedge fund. They are also probing Yuga Labs, creator of the Bored Apes collection, to better understand the dynamics of their NFT business. For many investors, the SEC looking into these issues is a positive development, citing more comfort in transacting when there are rules and regulations in place to serve as guard rails for this growing market. The headlines may not be great, but progress is being made for the better.

WHAT’S THE BUZZ

We’ve heard of other collectibles having shared ownership, but the digital nature of NFTs has made fractionalization even simpler.

FRACTIONALIZATION

- Fractionalization is when one NFT is split into smaller pieces to allow for more than one owner.

- Tokens for ownership are created and sold on the secondary market.

- This increases liquidity for the owner while creating an opportunity for those with fewer resources to own a piece of the NFT.

- This process does have down sides including IP rights concerns, contract security and cost.

- As part of a wider probe, the SEC is looking to determine if fractionalized NFTs should be treated as securities.

- Fractional.art (which is becoming Tessera) is currently the main platform to offer fractionalization, with several smaller marketplaces in competition.

NFT BLUE-CHIP COLLECTIONS

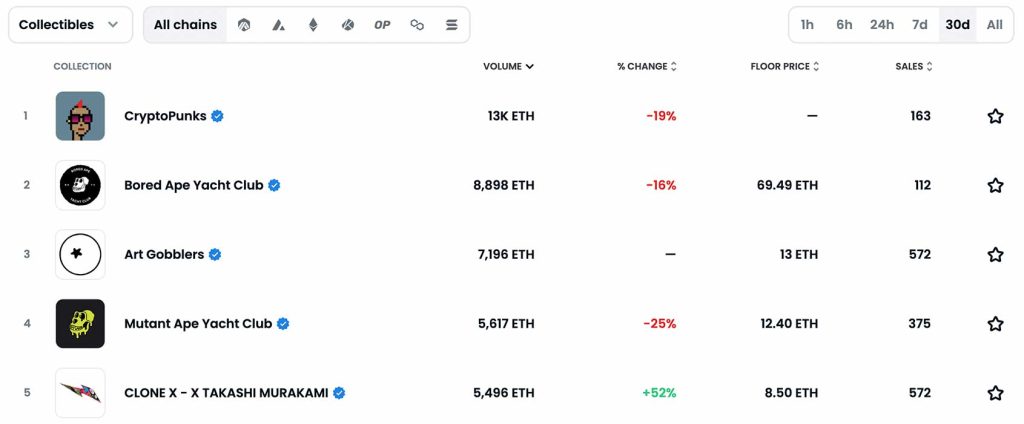

Top 5 NFT Collectible Collections

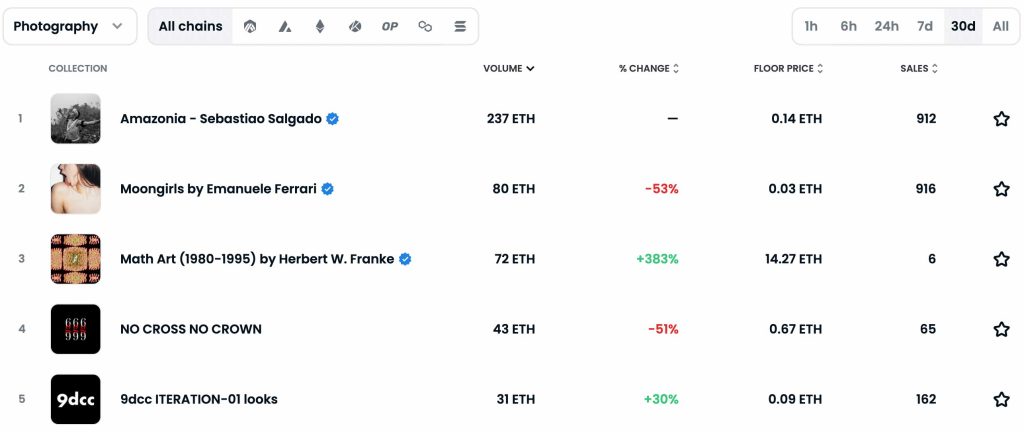

Top 5 NFT Photography Collections

NFT COMMENTARY

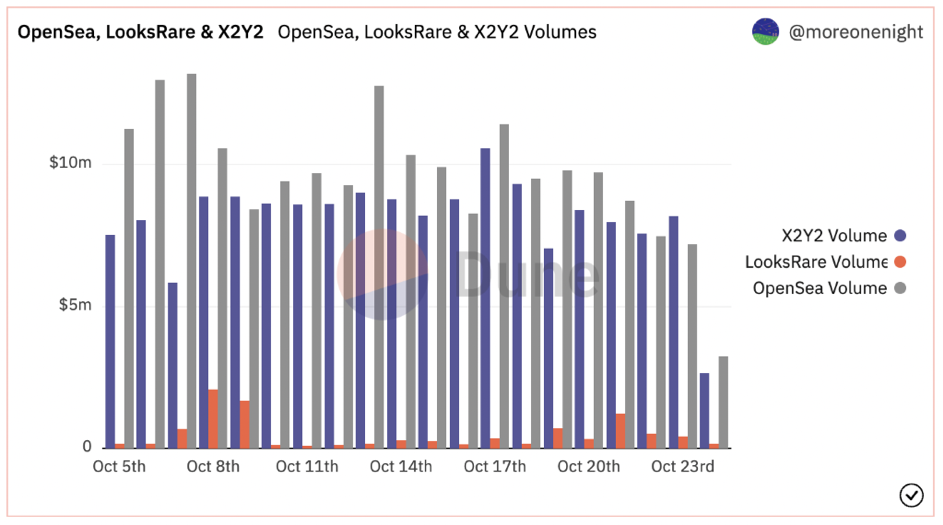

The top of the charts is business as usual with the big names still seeing the most volume; however, overall volumes are hovering around $10+ million a day. It’s important to mention that we can’t just look at OpenSea anymore. The rise of X2Y2 has been a long time coming and they are now in competition with OpenSea for being the largest marketplace.

One reason for X2Y2’s rise is that it doesn’t enforce creator royalties. The biggest debate in the NFT space right now is how royalties should be handled: Artists and creators argue they should be enforced while investors and traders are focusing primarily on their own margins. Since the royalties can’t always be enforced “on chain” but only in marketplaces, some artists have gone as far as blocking their work from being listed on the platform. In an already competitive market, this will change the dynamic for where creators sell their work and buyers purchase their NFTs.

Christie’s 3.0 had a successful debut with a 100% sell-through rate on its nine Diana Sinclair pieces. Prices ranged from about $5,000 to $10,000 with a premium piece selling for over $25,000. This was a very strong showing in an otherwise gloomy market. On the other hand, Sotheby’s Amazonia blind mint featuring Sebastião Salgado’s work didn’t get such a warm welcome. With a price point of $250 and 5,000 pieces available, only 2,280 were minted in the open mint window. It seems as though many collectors were hesitant to purchase a piece when they didn’t know what they were getting. While the same drop mechanics have worked in other instances in the NFT market, it appears we may need some re-tooling for the fine art crowd.

NFT ARTIST SPOTLIGHT

YUGA LABS

In departure from our usual practice, in this issue we’ll highlight a creator group as opposed to a single artist. Yuga Labs has so far outperformed the rest of the NFT space by quite a wide margin with its Bored Ape Yacht Club collection. Through a keen mix of technology, art and marketing, it developed a cult following in the NFT space. One of the first projects of its kind, it’s one of the few creators to successfully deliver on its plans. It incorporated in the state of Delaware in February 2021. The Bored Ape collection was launched on May 1, 2021, with a floor price of .08 ETH, around $240 at the time. By August, the floor price was over 44 ETH, $135,000 at the time marking one of the biggest jumps in the space.

Following that success, Yuga Labs launched Bored Ape Kennel Club and Mutant Ape Yacht Club to tie in with Bored Apes. All have proved a success so far, including the most recent sale of Otherside deeds which represent land in the metaverse it’s building. Since then, it’s also purchased the rights to Cryptopunks and Meebits, two separate but high performing collections that are now part of its ecosystem.

The collection was created in anonymity, and the creators were only recently revealed (or doxxed) by Buzzfeed as Greg Solano and Wylie Aronow, who are otherwise relatively unknown. In late March, Yuga announced a $450 million funding round with Andreesen Horowitz (A16Z) valuing the company at $4 billion. With the sway it holds in the NFT market right now, many are looking at it as a primary example of a successful NFT business.

NFT & CRYPTO NEWS

- Another NFT Martketplace makes royalties optional

- Bitcoin’s correlation with Stocks comes back as economic factors roil markets

- Crypto is more attractive with aggressive SEC

- Solana seeking on chain enforceable royalties

- NFTs can be considered property in Singapore

- What are generative art NFTs?

- Snowfro announces first collection since Chromie Squiggles

- Real estate fractionalized NFTs are here

- RTFKT’s “Phygital” luggage flies off the shelves

READ PAST ISSUES OF THE SCOOP

- The Scoop #9 – October 15th, 2022

- The Scoop #8 – September 20th, 2022

- The Scoop #7 – August 15th, 2022

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.