The Scoop #10 – November 2nd, 2022

In the 10th edition of The Scoop, we cover the rise in the correlation between crypto and equities and fractionalization. We also examine the royalty debate in the NFT space and spotlight Yuga Labs.

CRYPTO MARKETS

CRYPTO COMMENTARY

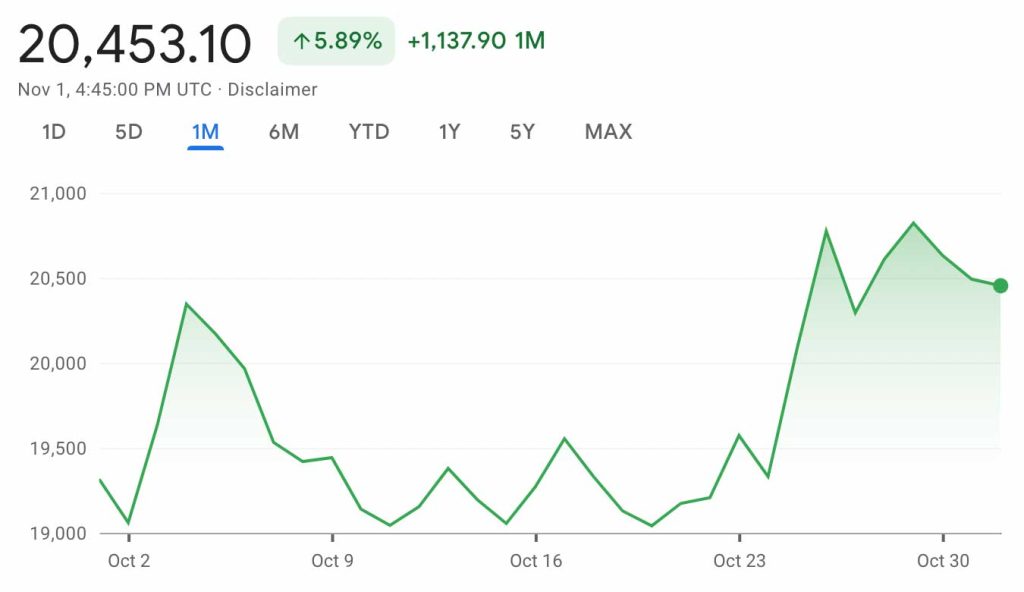

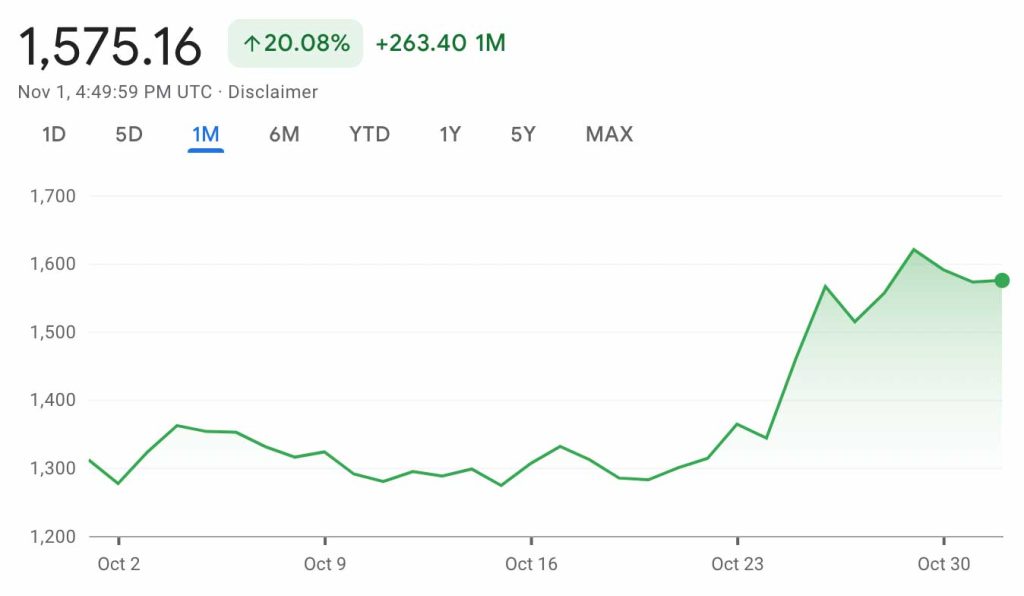

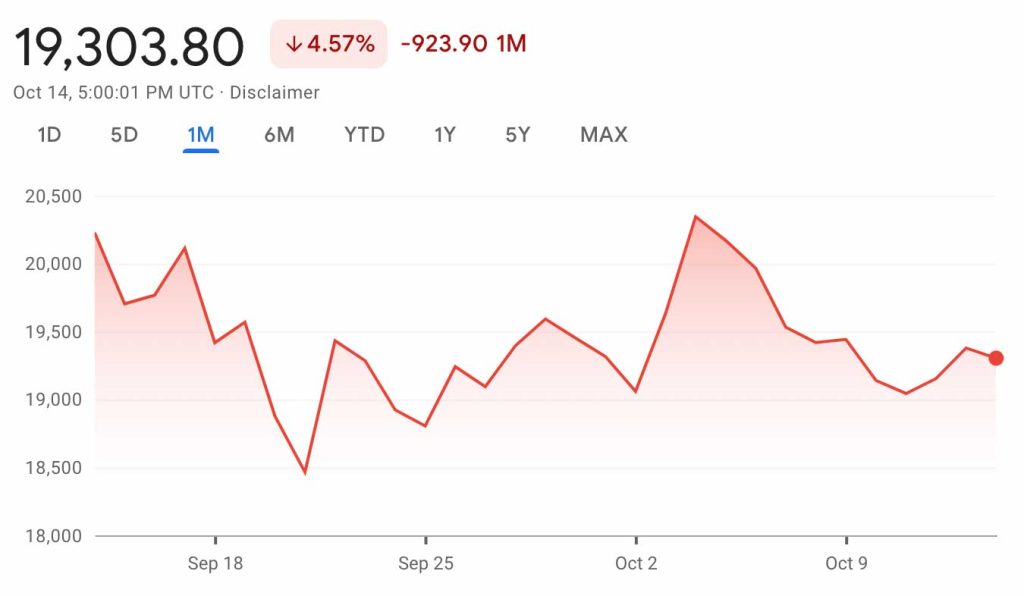

Bitcoin, the bellwether for crypto, has been rangebound – confined to upper and lower limits – since July. We’ve seen the same pattern in the stock market. Correlation between the traditional equity markets and crypto prices has grown stronger over time, with both responding similarly to events like the Fed announcements.

Instead of being an alternative to traditional markets, crypto has succumbed to the same economic pressures. It appears retail investors are staying on the sidelines, wary of further declines and future uncertainty while institutional trading has dominated the market. Less trading has produced less movement. With another interest rate hike in the works and a strengthening dollar, we can expect there to be continued downward pressure on cryptocurrencies. However, there have been rumors of the Fed easing its hikes as early as next year, but it will rely upon positive movement in the inflation measures.

In other news, the SEC continues its dive into the crypto markets with investigations into former crypto lenders Celsius and Voyager, along with the bankrupt Three Arrows Capital hedge fund. They are also probing Yuga Labs, creator of the Bored Apes collection, to better understand the dynamics of their NFT business. For many investors, the SEC looking into these issues is a positive development, citing more comfort in transacting when there are rules and regulations in place to serve as guard rails for this growing market. The headlines may not be great, but progress is being made for the better.

WHAT’S THE BUZZ

We’ve heard of other collectibles having shared ownership, but the digital nature of NFTs has made fractionalization even simpler.

FRACTIONALIZATION

- Fractionalization is when one NFT is split into smaller pieces to allow for more than one owner.

- Tokens for ownership are created and sold on the secondary market.

- This increases liquidity for the owner while creating an opportunity for those with fewer resources to own a piece of the NFT.

- This process does have down sides including IP rights concerns, contract security and cost.

- As part of a wider probe, the SEC is looking to determine if fractionalized NFTs should be treated as securities.

- Fractional.art (which is becoming Tessera) is currently the main platform to offer fractionalization, with several smaller marketplaces in competition.

NFT BLUE-CHIP COLLECTIONS

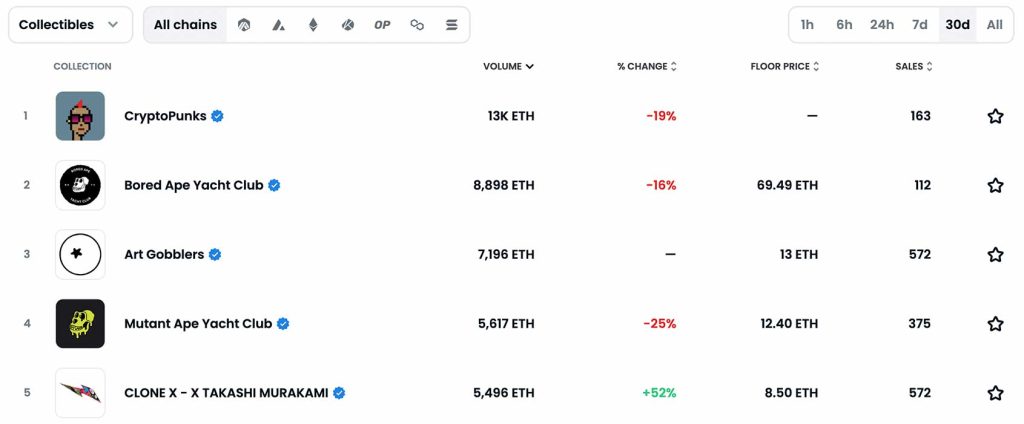

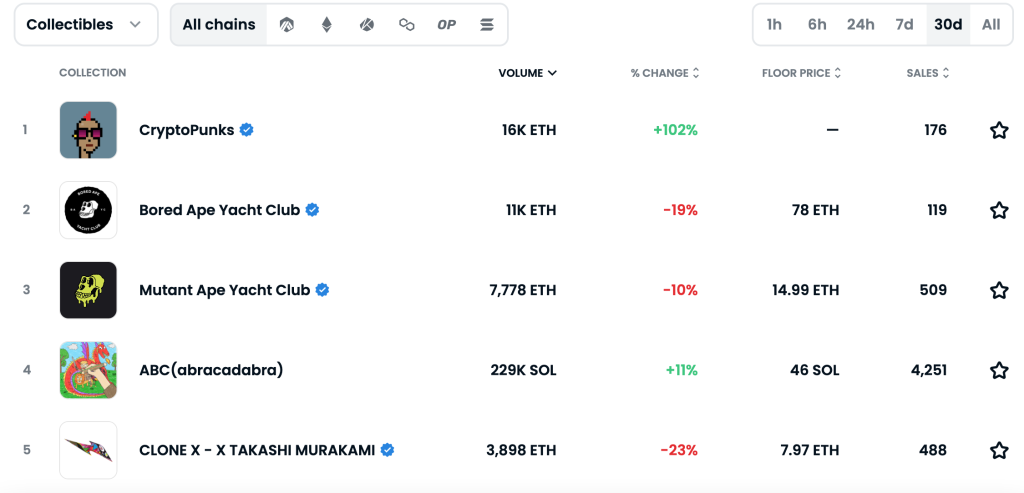

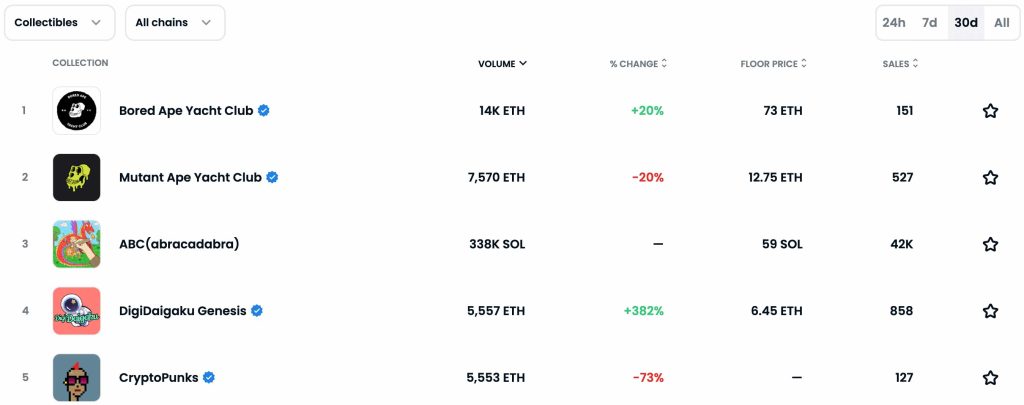

Top 5 NFT Collectible Collections

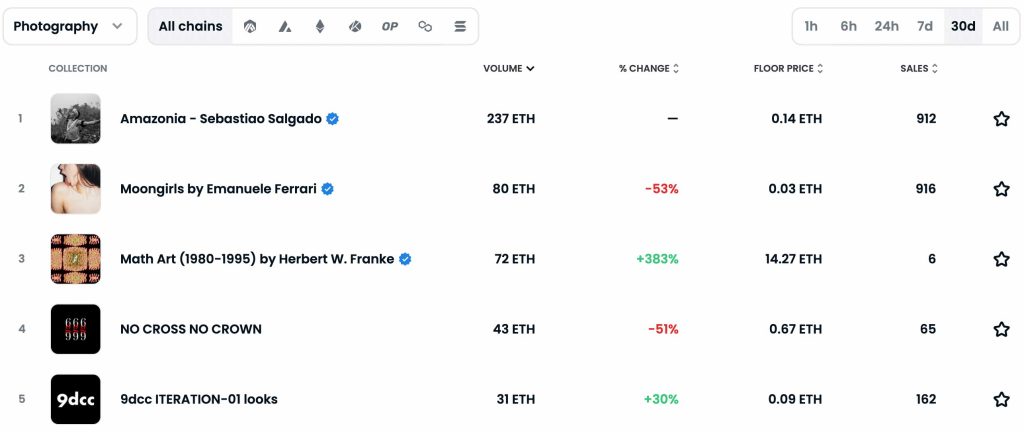

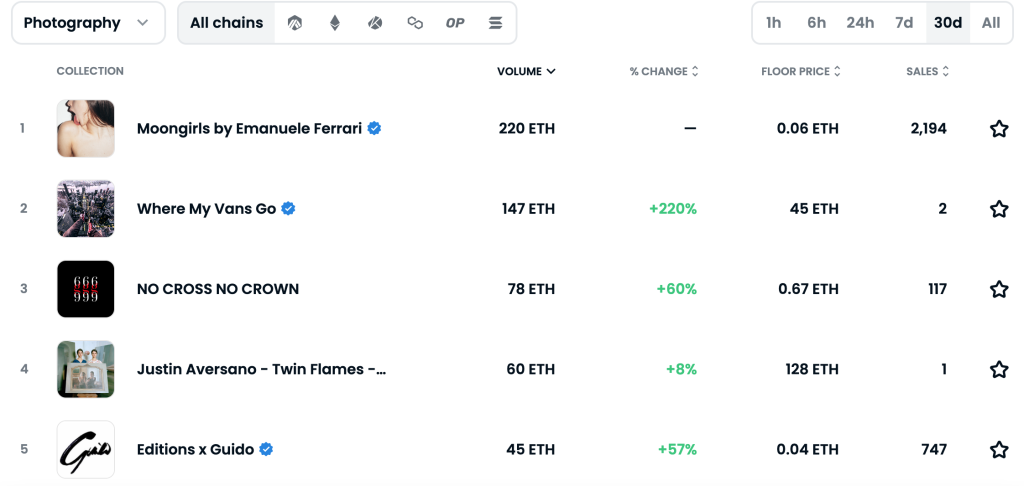

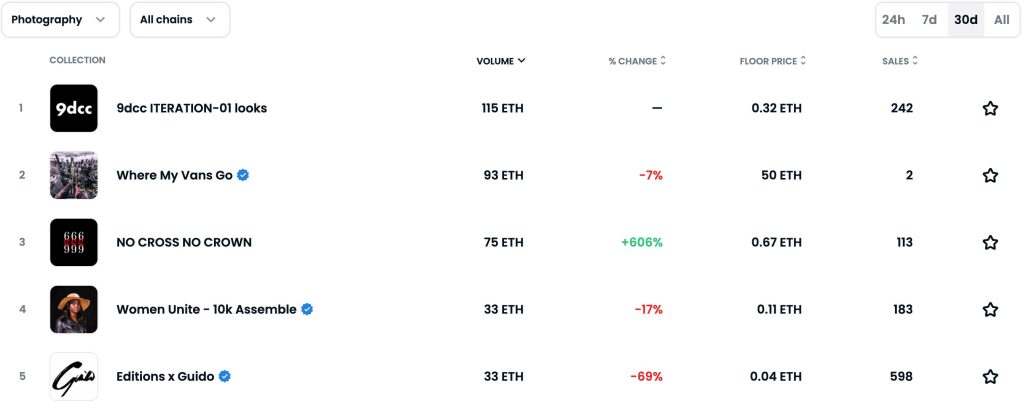

Top 5 NFT Photography Collections

NFT COMMENTARY

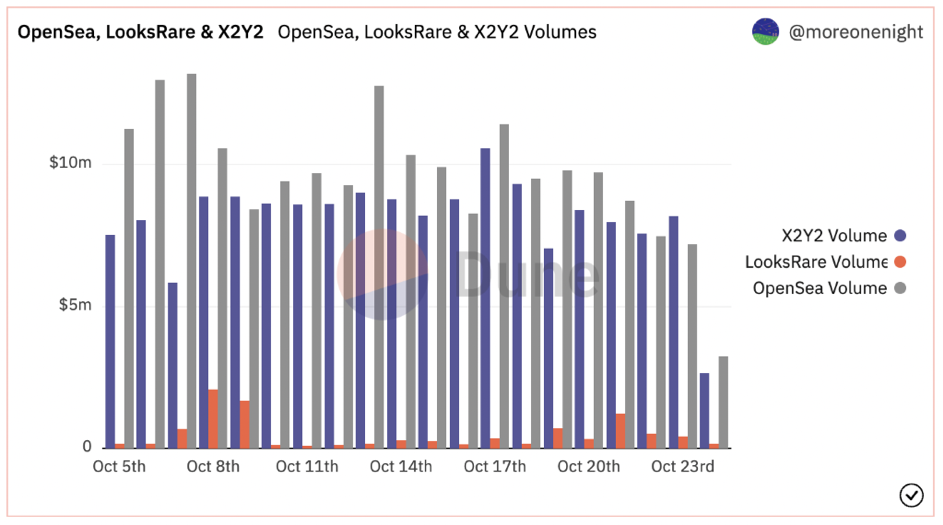

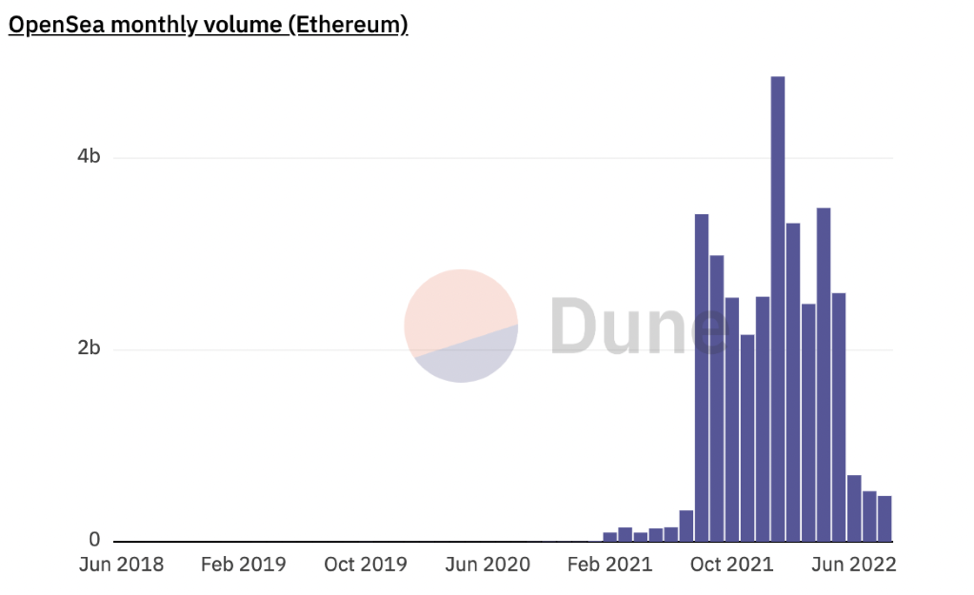

The top of the charts is business as usual with the big names still seeing the most volume; however, overall volumes are hovering around $10+ million a day. It’s important to mention that we can’t just look at OpenSea anymore. The rise of X2Y2 has been a long time coming and they are now in competition with OpenSea for being the largest marketplace.

One reason for X2Y2’s rise is that it doesn’t enforce creator royalties. The biggest debate in the NFT space right now is how royalties should be handled: Artists and creators argue they should be enforced while investors and traders are focusing primarily on their own margins. Since the royalties can’t always be enforced “on chain” but only in marketplaces, some artists have gone as far as blocking their work from being listed on the platform. In an already competitive market, this will change the dynamic for where creators sell their work and buyers purchase their NFTs.

Christie’s 3.0 had a successful debut with a 100% sell-through rate on its nine Diana Sinclair pieces. Prices ranged from about $5,000 to $10,000 with a premium piece selling for over $25,000. This was a very strong showing in an otherwise gloomy market. On the other hand, Sotheby’s Amazonia blind mint featuring Sebastião Salgado’s work didn’t get such a warm welcome. With a price point of $250 and 5,000 pieces available, only 2,280 were minted in the open mint window. It seems as though many collectors were hesitant to purchase a piece when they didn’t know what they were getting. While the same drop mechanics have worked in other instances in the NFT market, it appears we may need some re-tooling for the fine art crowd.

NFT ARTIST SPOTLIGHT

YUGA LABS

In departure from our usual practice, in this issue we’ll highlight a creator group as opposed to a single artist. Yuga Labs has so far outperformed the rest of the NFT space by quite a wide margin with its Bored Ape Yacht Club collection. Through a keen mix of technology, art and marketing, it developed a cult following in the NFT space. One of the first projects of its kind, it’s one of the few creators to successfully deliver on its plans. It incorporated in the state of Delaware in February 2021. The Bored Ape collection was launched on May 1, 2021, with a floor price of .08 ETH, around $240 at the time. By August, the floor price was over 44 ETH, $135,000 at the time marking one of the biggest jumps in the space.

Following that success, Yuga Labs launched Bored Ape Kennel Club and Mutant Ape Yacht Club to tie in with Bored Apes. All have proved a success so far, including the most recent sale of Otherside deeds which represent land in the metaverse it’s building. Since then, it’s also purchased the rights to Cryptopunks and Meebits, two separate but high performing collections that are now part of its ecosystem.

The collection was created in anonymity, and the creators were only recently revealed (or doxxed) by Buzzfeed as Greg Solano and Wylie Aronow, who are otherwise relatively unknown. In late March, Yuga announced a $450 million funding round with Andreesen Horowitz (A16Z) valuing the company at $4 billion. With the sway it holds in the NFT market right now, many are looking at it as a primary example of a successful NFT business.

NFT & CRYPTO NEWS

- Another NFT Martketplace makes royalties optional

- Bitcoin’s correlation with Stocks comes back as economic factors roil markets

- Crypto is more attractive with aggressive SEC

- Solana seeking on chain enforceable royalties

- NFTs can be considered property in Singapore

- What are generative art NFTs?

- Snowfro announces first collection since Chromie Squiggles

- Real estate fractionalized NFTs are here

- RTFKT’s “Phygital” luggage flies off the shelves

READ PAST ISSUES OF THE SCOOP

- The Scoop #9 – October 15th, 2022

- The Scoop #8 – September 20th, 2022

- The Scoop #7 – August 15th, 2022

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

Philip Hoffman, Founder and CEO of The Fine Art Group, spoke with Bloomberg about the rising demand for fine art by the wealthy in relation to recent decisions by private financial institutions in Australia and New Zealand to sell company art collections.

Click here to find out more and read the article in full.

LISTEN TO OUR LATEST 20-MINUTE WEBINAR

We invite you to listen to Tabitha Nicolas, Regional Appraisals Manager, speak with Rick Worm, Risk Mitigation Specialist with Hagerty Insurance, in a 20-minute virtual forum. They discuss what you can do to mitigate the financial risk of your passion assets when faced with disaster or damage.

DISASTER PLANNING & YOUR ALTERNATIVE INVESTMENTS

With the increased threat of natural disasters in recent years, mitigating the risk to a collection is at the forefront of many of our clients’ minds in high-risk locations. Wildfires, hurricanes, and tornados aside, collectors should also be prepared for unexpected events like a pipe burst or electrical fire. With proper planning, collectors can mitigate risk and be armed with a roster of resources to lean on in the event of a disaster.

RISKS & EXPOSURE

- CAT exposures: wildfire, earthquake, hurricane, snow, wind

- General hazards: extension cords, flammables, hanging items, workshops, shared spaces, old pipes and wiring

PROACTIVE STEPS TO REDUCE RISK & LOSS

- Documentation as proof: digital inventory management including documentation, visual inventory and condition assessment

- Current appraisals for full Retail Replacement Value (RRV)

- Planning, prioritization and logistics

CASE STUDY

In 2021, a TFG client had an electrical house fire on the first floor of their home. In addition to the fire and smoke damage, their home suffered significant water damage due to the firefighters’ efforts to control the fire. Although they had blanket and some scheduled insurance coverage, the family failed to have an updated appraisal for over ten years, and the scheduled assets were significantly underinsured. The family kept physical paper records on the collection, but they also were destroyed in the fire. Nothing had been backed up within a cloud-based system, and the burden of proof fell on the client. Without accurate retail replacement appraisals, they found themselves in a position where they lost valuable family heirlooms and an American art collection that had been curated for decades. In addition to the financial loss, they had to rebuild a home which put emotional stress on the family. This family came to The Fine Art Group after a disaster had already struck. However, steps could have been taken preemptively to mitigate the loss, including backing up information off-site, up-to-date appraisals, and proper inventory management.

TOP 3 TAKEAWAYS

YES, IT CAN HAPPEN TO YOU

And when it does, the burden of proof is on the owner!

HAVE A PLAN

Create an exit strategy and know your priorities. The Fine Art Group understands that every collection and collector is unique, each having distinct priorities and considerations for the needs of their art and tangible assets. Our team will work with you and/or your team to craft a bespoke collections plan that considers the highest risks.

The Fine Art Group offers complete evacuation planning services, which arm our clients with a roster of resources to lean on. Collectors must have a point person and have confidence that their collection will be in the right hands should a disaster occur.

KNOWLEDGE IS POWER

Current Replacement Values

The most significant issue collectors face after emergencies is inadequate insurance for their fine art and collectibles. The Fine Art Group has a team of over 50 specialists that can identify, catalog and value a collection to ensure accurate and up-to-date replacement value appraisals. Our team regularly provides complimentary schedule and appraisal reviews, updating clients on the adequacy of the appraised values of their assets. Depending on the type and value of the assets, a reappraisal is recommended every 3 to 5 years, or if the value has increased or decreased by 10-15%.

Know What You Own

After catastrophe, theft, or damage, the burden of proof is on the owner. They must be able to establish value and provide a complete inventory of what they own. This can be a challenging endeavor if the owner has not created an offensive strategy to mitigate disaster. Our experienced appraisal team has developed a Visual Inventory product designed to address this issue. Conducted by qualified appraisers, our visual inventory captures the entire range of assets that make up the contents and valuable collections in a home. This detailed visual record of the interior and exterior of the property significantly streamlines the insurance claim process in the event of a loss.

FURTHER READING

The Scoop #9 – October 15th, 2022

In our 9th edition of The Scoop, we discuss crypto’s response to global inflation, the Ethereum merge, and spotlight the NFT artist XCOPY.

CRYPTO MARKETS

CRYPTO COMMENTARY

Crypto is at a very unique point in its history. Bitcoin and Ethereum have developed their own trading cycles throughout the years, but only in a stable macroeconomic environment. The last global recession was from 2007-2009, before Bitcoin was invented, so this is the first time anyone is seeing this new financial ecosystem under external duress. Rising interest rates and high inflation have put the squeeze on markets around the globe. Some are fleeing Bitcoin to get away from risk, but there are others investing in Bitcoin as an inflation hedge. With the U.N. calling for the Fed to halt its rate increases for fear of tipping less developed countries over the edge, there is no track record for how cryptocurrencies will react to the scenario that is currently playing out.

Despite the unique circumstances facing the crypto markets, we are still seeing major brands enter the space. NASDAQ, the second largest stock exchange in the world, is launching a digital assets business aimed at institutional investors. The business unit is going head to head against Coinbase, Blackrock, Fidelity and Gemini by offering crypto custody services. As more companies begin to offer this service this will ultimately support wider adoption of these assets and increase the competition in this space.

Voyager, the insolvent crypto lender, placed its assets up for auction after declaring bankruptcy, and the winning bidder was rival platform FTX. An agreement for $1.4 billion was reached in bankruptcy court for the fair market price of Voyager’s crypto assets with only $51 million attributed to paying for the platform’s business and user base. FTX has been quick to snap up distressed assets in the crypto world after pulling in over $1 billion in revenue last year.

The SEC made its thoughts known on those promoting crypto currencies with its ruling on Kim Kardashian, which found that Kardashian violated the anti-touting provision of federal securities laws. Without admitting or denying the SEC’s findings, Kardashian agreed to settle for $1.26 million, including approximately $260,000 in disgorgement, which represents her promotional payment, plus a $1 million penalty. Kardashian also agreed to not promote any crypto asset securities for three years. With a strong precedent like this, we believe there will be more of these cases in the future.

WHAT’S THE BUZZ?

With the highly anticipated Merge on Ethereum successfully completed, what are the outcomes?

OUTCOMES

- “The Merge” refers to the original Ethereum Mainnet merging with a separate blockchain called the Beacon Chain.

- Ethereum transitioned from “proof of work” to “proof of stake.”

- This change reduced energy consumption by 99%.

- The number of Ethereum tokens being created moving forward also went down 90%.

- Those with large Eth holdings can now stake their balances to earn monetary rewards for confirming transactions on the network.

NFT BLUE-CHIP COLLECTIONS

Top 5 NFT Collectible Collections

Top 5 NFT Photography Collections

NFT COMMENTARY

The ongoing bear market continues as volumes are still muted. There is little sign of a break in sight with other macroeconomic issues playing out. The last data point from the Sotheby’s Max Stealth collection auction indicated that even the high-end market has been impacted.

However, it seems that the bear market is the best time to build. After Christie’s Ventures was announced in June, and we are starting to see the first outcomes for the new business with Christie’s launching Christie’s 3.0, its Web3 platform that will service all of its NFT needs. After The Merge, they chose Ethereum to build on. Going forward all Christie’s 3.0 NFT auctions will take place on the Ethereum blockchain network from start to finish. All transactions, including those after the sale, will be automatically recorded on the blockchain. A true differentiator, Christie’s 3.0 addresses the fundamental needs of the market by including compliance and tax tools, making it the first of its kind. Christie’s 3.0 is the result of a collaboration with three leading companies in the Web3 community – Manifold, Chainalysis and Spatial.

Sotheby’s next major event will be a NFT mint, with 5,000 pieces from Sebastião Salgado in a collection called Amazonia. This is the first time Sotheby’s is hosting the creation process for NFTs on its platform. For $250 buyers can mint a unique 1/1 from the collection; however, they will be randomly assigned and revealed three days after the mint closes. This is following the playbook of many other NFT collections where collectors feel the rush of not knowing what NFT they will ultimately end up with. How this is received from a fine art perspective is something we will be watching closely.

NFT ARTIST SPOTLIGHT

XCOPY

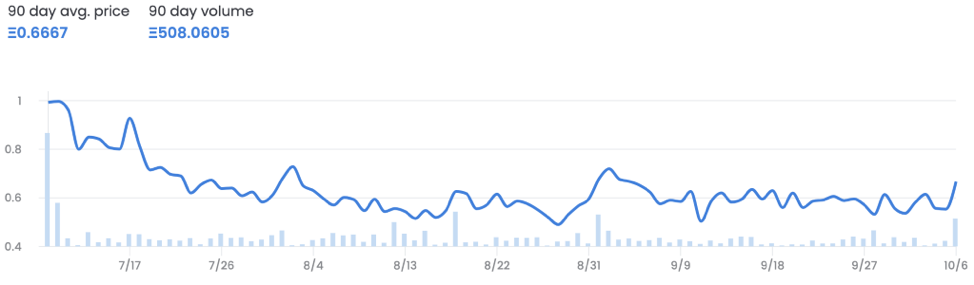

After a piece did well in the Sotheby’s Max Stealth auction, we want to look at a true unknown in the space – XCOPY. One of the first digital artists to start using NFT technology in 2018, we still don’t know the identity of XCOPY. The work this creator has been putting out looking at death, dystopia, and apathy has sold for incredible sums throughout the NFT bull run with A Coin for the Ferryman selling for over $6 million on SuperRare. With just short of 10,000 pieces created, many with epilepsy warnings, the work has proliferated throughout the art world and XCOPY has developed a cult following. While we don’t know what drives the creation of these pieces, and we may never know, this has quickly become a name to know in the NFT world. The Max Pain editions have seen a recent uptick in sales after the auction, as seen below. Vertical bars are volume.

NFT & CRYPTO NEWS

- Nasdaq to Wait for Regulation Before Launching Crypto Exchange

- Binance Blockchain Hit by $570 Million Hack

- Tyler Hobbs’ Fidenza NFT Project Gets $1M Pump Over 48 hours

- Fed to deliver another big rate hike

- Digital Art Platform, Verse To Host Live Minting At Frieze

- Ethereum Merge boosts network speed

- Court docs reveal details on Celsius Customers

- FTX’s $1.4B bid on Voyager Digital assets: A gambit or a way out for users?

- Amazon move could be game changer for Crypto

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

WATCH OUR LATEST EDITION OF THE EDUCATED EYE: HOW TO BUY & SELL SMART

In the upcoming fall auctions, there are three exceptional single owner sales that will be composed of a multitude of objects. These three sales are the Paul Allen sale at Christie’s, the Ann & Gordon Getty sale at Christie’s and the Hôtel Lambert sale at Sotheby’s. In order to navigate these three exceptional sales, we hosted a webinar titled The Educated Eye: How to Navigate a Multi-Category Collection at Auction, using the Hôtel Lambert sale as a case study to explore how to make the most of these opportunities.

Join us for a 30-minute in-depth discussion on how buyers can navigate multi-category single-owner sales to identify opportunities and hidden gems within the larger sale context. We will be using the upcoming Sotheby’s Hôtel Lambert auction as an example. Our experts will cover various categories of fine decorative arts and furniture.

SINGLE OWNER SALE HIGHLIGHTS

Hotel Lambert, Une Collection Princiere Volume I – V, 11th – 14th October, Paris & Online

The Ann and Gordon Getty Collection, 10th – 25th October, New York

Visionary – The Paul G. Allen Collection, 9th & 10th November, New York

Tips & Opportunities

EXPLORE NEW ASSET TYPES AND COLLECTING CATEGORIES

Both the Ann & Gordon Getty Collection and the Hôtel Lambert sales have a wide range of objects and an accompanying wide scope of prices. Objects at accessible price points create an opportunity to explore new asset classes and collecting categories. For example, if a collector has a particular interest in Chinoiserie, this is a great opportunity to delve deeper into a sub-category such as enamel ware or cloisonné.

LOOK FOR PIECES THAT ARE FRESH TO THE MARKET

There are a number of pieces in these sales that have been in the market within the last 10 – 15 years. However, as these are single owner sales, there is an opportunity to come across pieces that have not been to market for a generation. For example, this George II Green and Gilt Japanned at Parcel-Gilt Bureau Cabinet last appeared on the market in 1980.

FOCUS ON PROVENANCE

Provenance alone is enough to interest collectors when buying a new piece. Within these sales, there are many objects that have a very rich and deep provenance that should not be missed. This enamel oval dish displaying the Judgement of Moses passed through the Hubert de Givenchy Collection as well as the Yves Saint Laurent and Pierre Berge Collection before ending up at the Hôtel Lambert.

CHOOSE THE RARE, UNIQUE, AND UNUSUAL

Choosing rare and unusual pieces that are unlikely to come up again is a way to ensure you don’t miss out! This gorgeous snuff box has the most unusual leopard print pattern adorning the top and bottom surfaces. Despite the unorthodox patterning, the leopard print fits right into the maximalist fashion of the 1700s.

AVOID MULTIPLES AND MORE COMMONLY FOUND PIECES AS THEY TEND TO SELL ABOVE MARKET VALUE IN THESE TYPES OF SALES

FURTHER READING

- The Asking Price: Understanding Value 1

- The Asking Price: Understanding Value 2

- Don’t Go It Alone: Let Us Be Your Auction Sale Advocate

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Few people would question that the threat of climate change is one of the most controversial and impactful subjects of the moment. In a year that saw soaring temperatures and the UK’s hottest summer on record, it has become near impossible to ignore the environmental shifts on our planet. As governments and scientists struggle to implement the necessary measures and precautions, it was only a matter of time until the art world became not only involved, but directly impacted.

Industries such as air travel and fast fashion face steady criticism for their effect on world water and fuel shortages. The art world is not immune to similar implications. As in-person fairs and international travel once more become regular occurrences on our calendar, the environmentally astute remind us that the art world cannot exist in the same pre-covid routine.

Art Museums & Activists Taking a Stand

One of the biggest wake-up calls the art world received in recent months is the wave of climate activists targeting significant artworks at major museums. Over the last summer, activists in Italy, Germany and Britain have staged protests where they affix themselves to some of these countries’ most valuable artworks, including Botticelli’s Primavera at the Uffizi in Florence, the Vatican’s Laocoön and His Sons, and Van Gogh’s Peach Trees in Blossom at the Courthauld in London. With the aim to “protest the fossil fuel madness,” these groups, (most notably the Ultima Generazione in Italy and its counterpart, the Lezte Generation in Germany) protested to bring attention to the climate crisis. Interestingly, the Just Stop Oil and Ultimate Generazione groups are both funded by the Climate Emergency Fund, a Los Angeles-based organization set up by a group of millionaires three years ago. These include some of America’s richest offspring, with Rory Kennedy (daughter of Sen. Robert Kennedy) and Aileen Getty (granddaughter of Jean Paul Getty) listed among the founders.

While the protestors have been careful not to attach themselves to the actual artwork, the museums have understandably expressed concern about how far these protestors could go. For instance, the Courthauld had to send the frame for Van Gogh’s Peach Trees out for conservation, leading to three of the protesters being criminally charged in the case. While German and British museums have criticized the actions of the activists as potentially damaging to high-value art pieces, the American Institute of Conservation has spoken out in support, claiming that these groups are merely looking for a way to speak out where international governments are falling silent.

The Impacts of Climate Change Within Art Institutions

Whether they support the protests of climate activists within their spaces or not, art institutions are gradually bringing greater attention to the crisis within their own programs. The Royal Academy Summer Exhibition 2022 was curated around the theme of “Climate” with the chosen artists displaying a range of works which used direct, violent, and often apocalyptic imagery. The exhibition itself received mixed reviews and even some criticism; the Guardian’s Jonathan Jones labelled the show “climate kitsch.” However, it does signify how the museum sector is beginning to show direct awareness for the state of the planet. This most crucially includes adapting their spaces for the future; for example, Florence’s Uffizi Galleries recently revealed plans for a €50 million project, “Boboli 2030,” to protect the historic Boboli Gardens against the effects of climate change. The Storm King Art Center in New York announced a similar $45 million re-design and upgrade to increase biodiversity.

Many galleries also have begun banding together to preserve wildlife and endangered ecosystems. The sustainability New York collective Galleries Commit recently partnered with the artist-led non-profit group Art to Acres to preserve 200,000 acres of landscape near Machu Picchu in Peru. This area has one of the last 1% of cloud forests on the planet, and museums such as MoMA, the Guggenheim and the Hirshorn, as well as organizations and dealers like Artform and David Zwirner, have donated hundreds of thousands of dollars towards this large-scale conservation.

Following in the footsteps of charity Gallery Climate Coalition, many campaigns of this kind are expected to arise with more and more arts organizations taking steps to reduce their carbon footprints. In the last few weeks, calls have been made for the British Museum to cut ties with British Petroleum (BP). Shell and BP previously were two of the biggest investors in British public arts, but over the last five years many major institutions (such as the National Portrait Gallery, Tate, and Royal Opera House) have ended partnerships with the companies over their use of fossil fuels. This most recent call to cull this funding has most notably come from British Museum employees and other institutional staff. In May 2022 there was an unanimous vote at the PCS Cultural Group (a trade union that represents 4,000 UK cultural workers) to end fossil fuel sponsorship. The repercussions for ending such controversial support for museums, which has nevertheless proved vital in the last years of economic hardship, are yet to be seen.

Insuring Art in the Ever-changing Environment

So, what does all this mean for the art collector? Well, the most pressing environmental issue facing the collector today is primarily problems with insurance. As natural disasters — hurricanes, flash flooding, wildfires, etc. — become regular news headlines around the world, the insurance market teeters on a dangerous edge of unpredictability. The transport, storage, conservation, and display of high-value art pieces has become more important than ever with such climate uncertainty, as well as more economically treacherous. As reported by The Art Newspaper, great waves (both literal and metaphoric) began to hit the insurance market in 2017 when a series of hurricanes hit the Gulf Coast in the US, causing insurance industry losses of more than $300 billion. Florida, the state with the flattest land range, is especially at risk with the rise of sea levels. Annual flooding in the state is up an astounding 400% in the last 16 years, and as a result, in 2020 it announced $4 billion in state-wide spending on flood protection.

Insurance Analysts are using climate change data to assess potential dangers to calculate risk factor. It will become increasingly likely that high-risk locations (such as those prone to earthquakes) will see higher premiums for art storage and cause financial implications for collector residencies. Cities such as Miami and Venice, which are long-term hotbeds of the art world and yet some of the most prone to natural disaster, may face significant challenges when it comes to the expansion of galleries or fairs. California and Florida, in particular, while housing some of the country’s wealthiest art patrons, collectors and museums, face the most risk environmentally, with fine art insurance policies becoming immensely difficult to obtain or renew as new restrictions are continually implemented. According to New York-based insurance company Berkley Asset Protection, premiums for fine art insurance coverage are increasing as much as 12%, with the annual cost of California homeowners’ policies rising as high as 40%. While some clients negotiate to have policies exclude natural disasters altogether to reduce cost, insurers warn this is a dangerous gamble, and with the increasing likelihood of annual wildfires and flooding, unlikely to pay off. Indeed, some insurance companies are even imposing deductibles on collectors who reside in particular states or locations, an extra cost which can amount to as high as 10% of total collection value.

The UK is arguably less prone to extreme natural disasters in comparison to the US or some other European countries. Greece, for instance, is one of the world’s most seismically active countries. However, given the record-breaking temperatures the UK experienced this year which put the nation at a standstill, UK fine art insurance can be expected to put a heavier emphasis on the natural event risk factor in the future. With policy change towards global warming recurrently low on international governments’ agendas, the threat of climate change is still heavy on the art world’s head. Collectors should be sure to have a close conversation with their insurer about climate data analysis, and to assess the environmental situation of their work regularly. Art, much like our planet, is unique and irreplaceable and must be afforded the right protection.

Why You Should Rely on the Expertise of a Sales Agent

when Divesting Tangible Assets

Two weeks ago, a luxury realtor I had not met before rang. She was referred by a mutual colleague and she began by saying, “I was told you are the thought leader for fine art and collectibles … I hope you can help.” I was intrigued and wanted to learn more. The realtor had recently sold a multi-million-dollar home in a luxury market for a client who was experiencing a disruption in her life. The seller’s husband had faced a rapid decline in health, and the couple was forced to sell their dream home. They downsized to an affluent retirement community, moving from an exceptionally large, single-family residence to a much smaller condominium. During this process, the seller queried the realtor for a recommendation on who could monetize the fine art, antiques and other high value collectibles the couple did not plan to keep.

Having no knowledge of the auction market, the realtor completed a quick internet search and provided her client with the name of a local auction house. This is where the trouble began. The seller had agreed to an abbreviated timeline and was anxious to find professionals who could help. Without much consideration for the type of property the auctioneer typically offered or due diligence as to how the auctioneer’s sales preformed, the seller, feeling rushed, entered into a sales agreement at an abnormally high commission rate and began to indicate what she would like to sell. This included fine art that often trades in a global salesroom, fine English and American furniture purchased from dealers in London and New York, as well as more common but valuable décor the owner had procured from a notable interior designer.

Prior to any auction, it is typical for consignors to review cataloging and approve sales estimates. During this review, not only did the seller discover simple cataloging errors but also was horrified to learn of the auctioneer’s policy to begin every lot at a standard starting bid, no matter the value of the object – leaving the seller extremely exposed to loss. Withdrawing the objects from the auction was not possible, so the seller crossed her fingers, hoped for the best and reluctantly moved forward. As expected, a collection of objects that would total mid-six figures in any regional or national sales room realized a small sum, a third of their potential value. The seller, and rightfully so, was extremely unhappy with the auction house and realtor who made the recommendation. The realtor is concerned there could be forthcoming litigation for referring an unvetted organization to a discerning client and that the client would tell their social and business network about the sales debacle.

This all made me wonder, what should a seller know before engaging with an auction house and how can sellers as well as professionals protect themselves from falling victim to an opaque market?

CHOOSING THE BEST SALES VENUE: DO YOUR DUE DILIGENCE

I once heard a colleague exclaim, “Not every auction house is made equal.” That’s sage advice when considering a potential consignment of fine art, antiques or other high value collectibles. Determining the most appropriate market and venue is paramount to achieving the best results and maximizing return for any seller. I often hear collectors say, “I only buy what I like” or “I am not interested in art as investment.” But when push comes to shove, and a collector attempts to monetize an object, they are often shocked by the differential between purchase price and resale value but to also discover passion and investment intersect here. This is equally true when considering divesting a collectible asset by analyzing the who, what, when and where of sales strategy. In some instances, a specialized sale may be the most appropriate option and can provide a unique environment tailored to a particular collector or object. Specialized sales target specific collecting categories including various artistic movements, styles and regional objects, often capitalizing on the unique quality these items exhibit selling together. For instance, an auction house in California may not have the buyer to sell modern British pottery whereas Sotheby’s conducts a Mod Brit auction annually or the unusual timepiece consigned to a regional Atlanta sales room would perform better in a dedicated timepieces auction in New York, London or even Geneva. Similarly, it may be appropriate to place more general material within the context of a larger auction that offers various asset classes. What is most important is the research and analysis completed to determine what recipe would yield the best sales results. And remember – an auction house is never going to turn away a quality consignment or admit that they may not have the appropriate buyers to successfully offer an object. Their job is to obtain the best property possible, drawing interest to their firm in hopes of attracting improved opportunities in the future. Sellers must protect their interest by researching the most appropriate auction house, auction season and/or sales venue, which not only provides competitive advantage for the seller but also protects the asset from under-preforming.

A SALES AGENT CAN NEGOTIATE PREFERENTIAL TERMS

Many moons ago I attended the Florida State Bar Trust and Estate Conference in Palm Beach where a well-respected auctioneer presented. Before departing, the last thing he shouted into the microphone was, ”And remember, everything is negotiable.” No truer words have ever been spoken by a professional in the auction industry! Auction houses typically assess a myriad of fees including a standard commission which is often coupled with transportation fees, insurance fees, photography fees, marketing fees and other miscellaneous expenses such as a buy-in fee if the object goes unsold. While auction houses provide an integral service to collectors, their profit stream comes from both the buyers and the sellers. Depending on the value, quality, quantity, rarity or even provenance associated with the object being sold, auction partners may be more likely to negotiate their sales fee structure to secure the consignment. This is particularly true when the opportunity presents vetted property, but also when the consignment is in a competitive scenario meaning other qualified auction partners are pitching for the same project. The more coveted the consignment, the easier it is to negotiate preferential terms. Due to the significant value and volume of sales The Fine Art Group oversees annually in the auction market, our leverage with the auction houses exceeds what individuals typically can achieve on their own.

DON’T GO IT ALONE IN THE FINE ART MARKET

The fine art market is often considered an opaque industry with little transparency. When potentially selling a single object or an entire collection, it is imperative to bring in an INDEPENDENT representative to protect the seller in the auction sales process. In addition, a firm such as The Fine Art Group can provide insight and added benefits that a sole proprietor cannot. This often includes a diverse roster of experts and specialists who can share insight to not only the fine art market but also the furniture & decorative arts market, jewelry, timepieces, luxury couture, books & manuscripts, as well as many other more nuanced collecting categories. With this knowledge comes unique insight into the overall market and knowledge of recent public and private sales to which a collector may not be privy. This industry expertise can provide a collector with a unique perspective in determining what sales strategy would best benefit the desired outcome, including potentially holding an object until market conditions improve or even considering a charitable contribution when appreciation impacts capital gains taxation. Simply due to a sales agent’s leverage in the market, auction commissions and fees can be further discounted. Divestment of high-value collectibles often takes place during moments of disruption and can be stressful for consignors who are unfamiliar with the process. A sales agent can not only expertly negotiate commissions and fees but also organize logistics and oversee the entire sales process from lot placement to marketing strategy, contributing to the overall success of the sales process.

A SUCCESSFUL FORMULA FOR SELLING AT AUCTION

Selling at auction can achieve tremendous results. The key to success is the following formula: Choose the right venue, negotiate the correct deal and monitor the process from beginning to end. The Fine Art Group’s experienced staff is poised to provide any advice throughout the process.

FURTHER READING

- Don’t Go It Alone: Let Us Be Your Auction Sale Advocate

- Are You a Tangible Asset Fiduciary? Topic #1

- What to Hang on Your New Walls: The 5 Golden Rules

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Sales Agency Team combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

The Scoop #8 – September 20th, 2022

In our 8th edition of The Scoop, we discuss inflation’s impact on the crypto markets, NFT sales volumes, and spotlight the founder of Art Blocks.

CRYPTO MARKETS

CRYPTO COMMENTARY

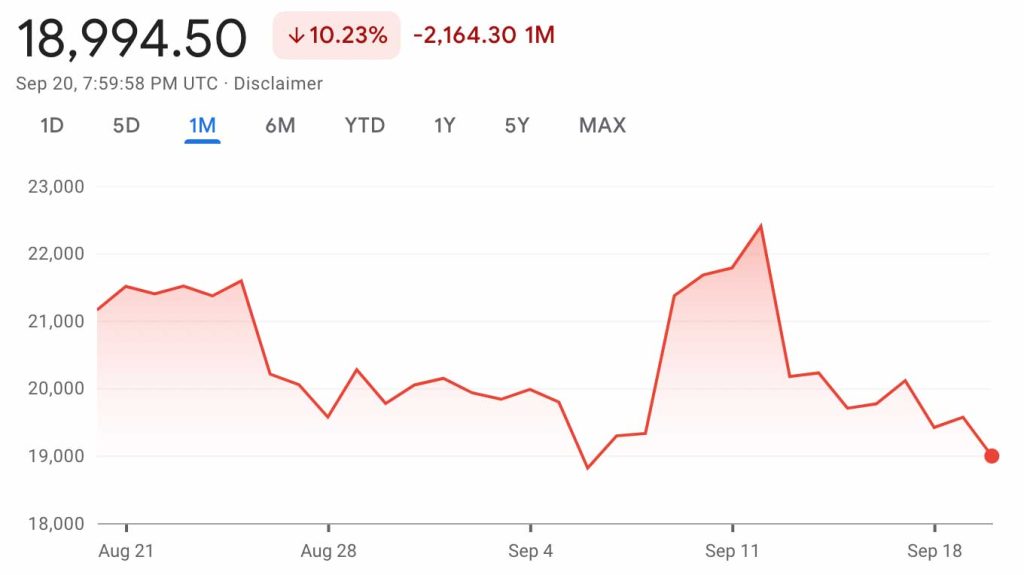

The bumpy road continues for markets across the board as the Fed has indicated that interest rates will remain elevated for the foreseeable future. Markets reacted negatively to Jerome Powell’s comments that the Fed would continue to raise rates as high as needed and keep them there “for some time” to tame inflation, which is running much higher than its 2% target. Traditional equities and cryptocurrencies alike saw increased volatility after the remarks, and more is expected as Fed President John Williams pushed back on the idea that there would be a rate cut next year.

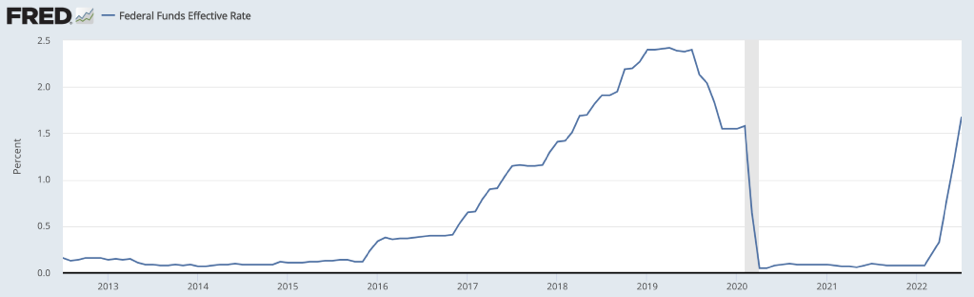

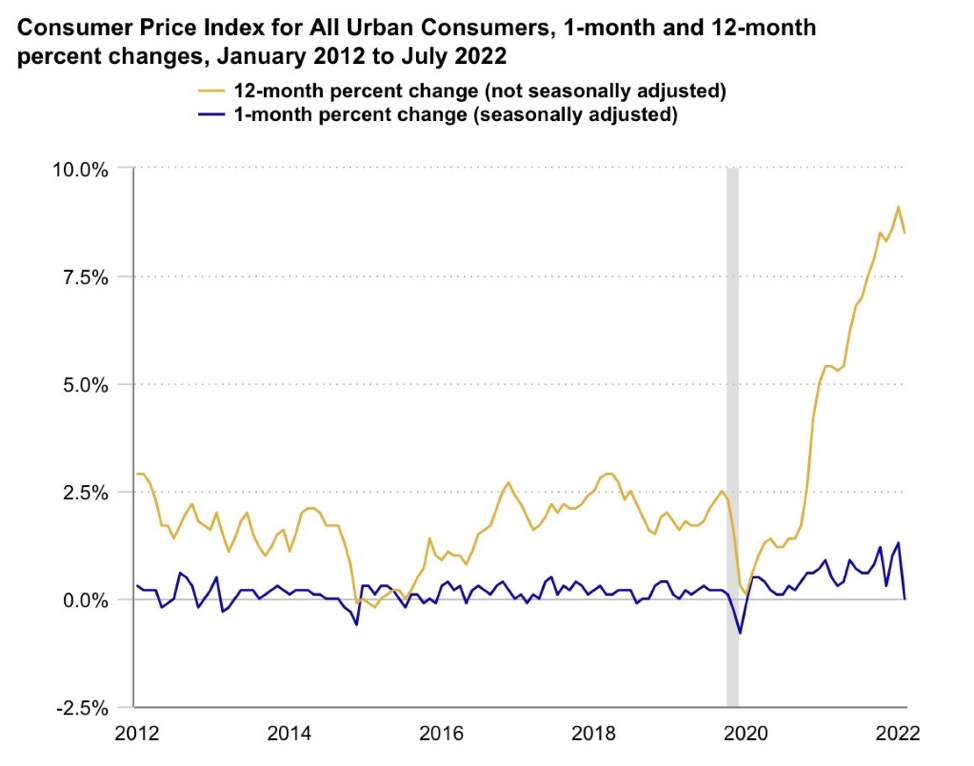

Looking at the Fed funds rate level over the last 10 years shows the healthy and natural rate hike cycle begun in 2016 to keep the right balance between growth and potential inflation. As COVID, a black swan event, hit the global economies in an unprecedented way in early 2020, the Fed slashed the interest rates back to near zero (shaded area on the graph). While the short term pain from the pandemic was blunted, this allowed for inflation to grow very quickly unchecked as the economy reopened. It’s worth noting that despite the spate of recent hikes, the Fed funds rate is now at the levels we saw just before the pandemic. Although inflation slowed down a bit in July to an 8.5% increase year-over-year in CPI, we are still at levels not seen in the last four decades.

The reactions of the market aren’t a surprise, and since many investors are still fleeing risk, the major indexes and tokens could continue their descent. We are still teetering on the edge of a recession, with the next six months being crucial for a “soft” landing.

WHAT’S THE BUZZ?

In the world of NFTs, what is the single most important piece of security? A seed phrase.

A SEED PHRASE

- Every seed phrase consists of 12-24 random words pulled from a list of 2,048.

- If access is lost to your wallet or it is deleted, you must have the seed phrase to restore your access.

- There is no one to call for help if a seed phrase is misplaced; all of the contents in the wallet are lost.

- The seed phrase must be kept secure at all costs!

- One of the largest phishing scams seen in this space is malicious actors pretending to be from Metamask or Coinbase and asking people to verify their seed phrase. Nobody from any of those companies will ever ask for it.

NFT BLUE-CHIP COLLECTIONS

Top 5 NFT Collectible Collections

Top 5 NFT Photography Collections

NFT COMMENTARY

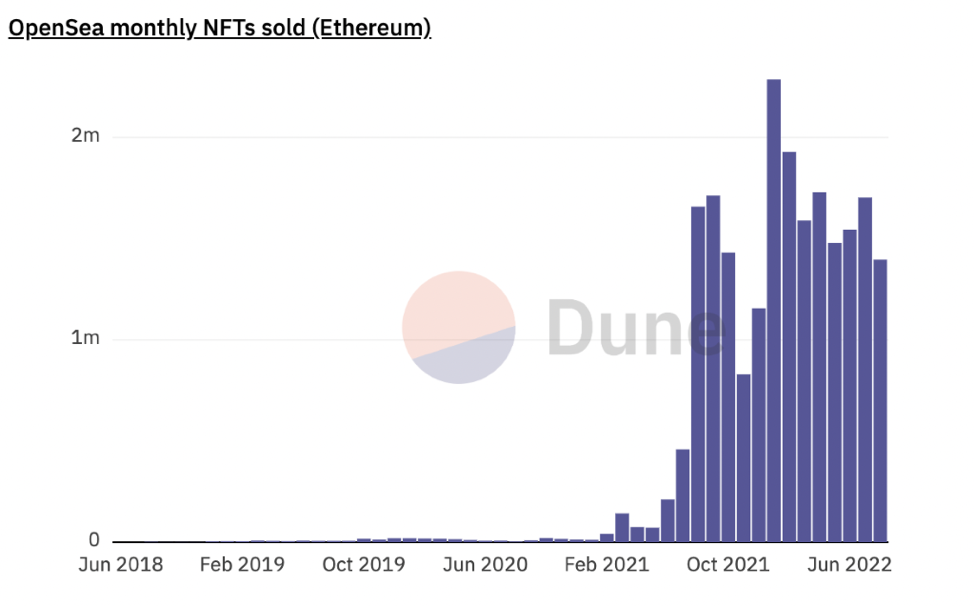

While the usual suspects are in the top NFT charts, there is nothing usual about the trends that we’ve been seeing in the NFT markets. We’re still seeing the consolidation behind Bored Apes, Cryptopunks, and the Art Blocks collections, which is expected for the blue chips. But the real story is in the number of NFTs being sold and overall cash volumes.

Looking at total number of NFTs sold, summer was business as usual. The count of NFTs being sold looks healthy and doesn’t hint at a market downturn. The data points to the number of sales being in its expected range.

When we look at the overall monthly volume on the Ethereum network (measured in USD) we’re seeing a summer slowdown with considerably less currency changing hands. We understand it’s a bear market for crypto and that’s a factor, but this leads us to believe it really is a bear market for NFTs as well. People are still buying NFTs but aren’t paying as much. The average price per NFT has dropped considerably.

The most recent test for the secondary NFT market came from the Sotheby’s MaxStealth Collection sale on Sept. 14. It was the first NFT single-owner live auction, and it opened the door for this concept moving forward. Pieces from XCOPY, Pak and Beeple were included in the 26-lot offering. The timing of the auction was a bit puzzling. With the unease in the global economy and crypto space, it seems that Sotheby’s bet the quality of NFTs on offer would offset the pressure from the larger macro-economic picture. We were able to derive a lot about the health of the high-end NFT market from this sale, especially how valuations are tracking in a bear market. With several pieces withdrawn or unsold it seemed that demand did not meet the Sotheby’s sales expectations – the sale achieved an aggregate sale price of $1.7m against a total pre-sale low auction estimate of $2.9 million. Lots above the $100,000 mark seemed to struggle with the exception of the XCOPY piece, while mid-value lots from Beeple, Hackatao/Coldie, and Alessio De Vecchi sold above their respective high estimates.

NFT ARTIST SPOTLIGHT

Erick “Snowfro” Calderon

The man, the myth, the legend behind Art Blocks has been a force in the NFT space since he sold his Cryptopunks to fund his new project. Since its inception, Art Blocks has become the epicenter of generative art in the NFT space. From Fidenzas to Ringers, some of the most pivotal collections have found a home under the Art Blocks umbrella.

Before Art Blocks, Erick dabbled in painting and other forms of colorful art yet never sought out gallery representation. However, when it comes to generative art, his Chromie Squiggles have become one of the grails in the NFT space since their launch. Working in 3D rendering software called Three.js, Erick adapted one of the sample scripts – a rigid squiggly line consisting of squares – and smoothed the lines out and added movement, rainbows and translucency. Most recently, the Chromie Squiggles popped up on tickets for VeeCon, a conference hosted by Gary Vaynerchuk who is also a Web3 entrepreneur. Rumor has it they’ll soon be on a football jersey somewhere in the EU, bringing further exposure to this new breed of art.

After making a splash in 2021, Art Blocks announced a partnership with Pace Verso in June 2022 bringing two of the most prominent players in Web3 and contemporary art together. This venture will open the doors to new exhibitions and collaborations between the traditional art world and the NFT space. Each has a lot to bring to the table, so we’re looking forward to seeing where this goes.

NFT & CRYPTO NEWS

- It’s Time to Separate NFTs from Digital Art

- Starbucks “Odyssey” is getting on the blockchain

- Bored Ape NFT Band to Make Music with Beyoncé-, Timberlake-Linked Productions

- Pace Verso and Art Blocks Detail First-Ever NFT by A.A. Murakami

- An A.I.-Generated Picture Won an Art Prize. Artists Aren’t Happy.

- LG Bringing NFT Art to your TV

- Olafur Eliasson launches a virtual reality work and NFT commissioned by MetaKovan- the man who paid $69.3m for ‘that’ Beeple

- Is it a Pyramid Scheme if they tell you it’s a Pyramid Scheme?

- The Merge is coming

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

We remember our Sovereign Queen, Elizabeth II,

with enormous gratitude, great pride and a profound sense of loss.

Henry Little Presents to TheMerode

TheMerode is hosting a special evening September 19th, where they’ll survey recent auction results and forthcoming sales to spotlight key trends in the art market, as well as discussing important developments in the gallery scene and reviewing the year’s art fairs.

Auctions, galleries and art fairs have been humming with business in 2022. Will that continue in the face of widespread economic uncertainty? And what will the coming year in the global art market bring? Will Paris take London’s crown in Europe? Will overheated market segments cool? And what can we expect in the major autumn auctions?

Hubert d’Ursel, Director Benelux, has the pleasure to introduce industry expert Henry Little, Director of Art Advisory, who will offer his predications for the months to come, giving guests of TheMerode a chance to be up to date and ahead of the curve for the new market season.