Written by Zhanna Ter-Zakaryan, Associate, Art Advisory; Luke Jacobs, Collections & Inventory Services Associate; Charles Curtis, Wine Specialist & Advisor; Greg Adams, Digital Assets Consultant

THE SCOOP: #14 – June 29th, 2023

Our experts delve into the allure of the collectible whiskey market and its appeal to the next generation of collectors. We then focus on highlighting rising LGBTQIA+ artists and exploring their contributions to the art world. Finally, we provide an update on the exciting NBA NFT collectibles market, where traditional sports card collectors are venturing into the digital asset marketplace.

Whether working with a first-time buyer or an experienced collector, we support our clients across all aspects of the acquisition process. If you are seeking assistance with your collections, please contact our Advisory team.

COLLECTIBLE WHISK(E)Y

BY CHARLES CURTIS

Distilled spirits are among the hottest categories of collectibles, and whisky (or whiskey) leads the pack. To clear up the matter of spelling, it is generally the case that Scottish producers will spell their spirit ‘whisky,’ and American and Irish distillers will usually spell it ‘whiskey.’ However, this is not universally the case. With the proliferation of high-end labels, collectors interested in exposure to this market are spoiled for choice. However, a bit of background is in order since not all whiskey is created equal.

WHAT MAKES A WHISKEY WORTH COLLECTING?

Whisky is commonly purchased for consumption. To be considered collectible, a whiskey must have a viable secondary market. This presents a difficulty for U.S.-based collectors since alcohol is tightly regulated in the United States, distilled spirits even more so than wine. Despite this inconvenience, the collectible market continues to boom. On May 11th, Sotheby’s New York presented ‘The Legacy Collection’, a single-owner sale of 142 lots that is expected to garner between $1.4 and $1.9 million. The results suggest that collectors will pay up for the bottles they need, while there will be room for new collectors to get in at a reasonable price point. While the 53-year-old Macallan distilled in 1948 and a 40-year-old distilled in 1939 made $40,000 per bottle with premium or more, other similar whiskies did not sell. Sotheby’s regularly auctions spirits, as does independent wine and spirits specialist Acker, whose recent ‘Distilled’ sale was on May 31st. Most U.S.-based collectors still try to assemble a collection by buying bottles on release. To succeed at this strategy, knowing which bottles are most sought-after is necessary.

The largest share of the collectible market goes to Scotch whisky. Although there are today 143 distilleries operating in Scotland, not all of these produce collectible spirits. The Scotch whisky with the most brand visibility is certainly Macallan. The world record for the most expensive bottle ever sold is for the 1926 Macallan, sold at auction by Sotheby’s London in October of 2019 for £1.5 million. Other collectible Scotch whisky brands include Port Ellen, Brora, Ardbeg, Bowmore, and Springbank. Quality is a factor, but in the world of whisky, scarcity drives prices even greater than in other categories. The 1926 Macallan was one of 40 bottles produced, while Port Ellen and Brora are examples of distilleries that have closed, known as ‘silent stills.’

October 24, 12:00 PM EDT

ESTIMATE: 350,000 – 450,000 GBP

LOT SOLD: 1,452,000 GBP

Courtesy of Sotheby’s.

According to the Scotch Whisky Association, exports totaled £6.2bn in 2022 and reached 180 countries worldwide. However, the combined impact of Brexit and global economic and political instability have disrupted the secondary market for rare whisky, occasioning a correction of nearly 20% across all types in the past twelve months, according to Whiskystats.com. This website was established by Johannes Moosbrugger in the Netherlands, whose index demonstrated an increase of +191.27% since inception (January 2013) after considering the recent market correction.

The Scots sell more whisky than the American and Japanese distillers combined, but these categories are also very collectible. Worldwide, Japanese whisky is also a dominant force. Brands like Karuizawa, Yamakazi, and Hanyu are the stuff of dreams for initiates of collectible whisky. The most expensive bottle of Japanese whisky is the Yamakazi 55-year-old, which sold for HK$ 6.2 million ($795,000) in August 2020.

SOLD FOR: HK$6.2 million (US$795,000).

Courtesy of Thespiritbusiness.com.

AMERICAN WHISKEY & YOUNG COLLECTORS

American whiskey also has its admirers. Perhaps the most sought-after brand is Pappy Van Winkle. Sotheby’s New York sold a bottle in December 2022 for $52,000, an astonishing 17 times more than its presale estimate. In March of 2022, the house conducted a sale exclusively dedicated to American whiskey, which sold for a combined $1.6 million. Sotheby’s noted that the category appeals to a youthful demographic, with more than 40% of the buyers under 40 years of age. Other brands of collectible American whiskey include Colonel E.H. Taylor, Michters, Eagle Rare, A.H. Hirsch, and Willett Family. Of particular note is the annually-released Buffalo Trace Antique Collection, which includes George T. Stagg, Sazerac 18 Rye, William Larue Weller, Eagle Rare 17, and Thomas H. Handy.

The database Whiskystats.com was established by Johannes Moosbrugger in the Netherlands. This index demonstrated an increase of +191.27% since inception (January 2013) after taking into account the market correction of -18.03% in the past twelve months.

CELEBRATING PRIDE: 5 YOUNG CONTEMPORARY LGBTQIA+ ARTISTS

BY ZHANNA TER-ZAKARYAN AND LUKE JACOBS

As our world and culture continue to evolve, artists in the LGBTQIA+ community are finding more acceptance than ever within the art world when it comes to expressing their identities and cultures. In celebration of Pride Month, below we spotlight five young LGBTQIA+ artists pushing the contemporary art world forward. By exploring their practices, this edition of The Scoop aims to highlight these artists’ professional achievements and their art historical contributions, both in the LGBTQIA+ community and the art world as a whole.

DORON LANGBERG

Radiant in color and quite often monumental in scale, Doron Langberg’s (b. 1985) paintings explore serenity, intimacy, and closeness. The portraits of his friends and lovers, their bodies often intertwined amongst themselves and with the surrounding landscapes, are conceived directly from life and are often painted en plein air. For the artist, the sense of a ‘living person’ and a lived experience in his paintings is essential. In a way, Langberg consistently blurs the line between abstraction and figuration, as his portraits are dissolved within their surroundings, evoking a sense of closeness and queer sensuality. As the artist puts it, “Queerness for me is not just a sexual experience, but a way of being in the world which affects every aspect of my life. Using intense colors and different paint textures and marks to create these everyday scenes, I want to connect with a viewer by speaking to our most basic commonalities – our bodies, our relationships, our interiority – rather than the social categories that may separate us.“

Courtesy of the artist and the Victoria Miro Gallery, London.

Courtesy of the artist.

Doron Langberg currently works and lives in Brooklyn and was born in Yokneam Moshava, Israel, in 1985. The artist received his MFA from the Yale University School of Art and his BFA from the University of Pennsylvania. His works are currently on view at Rubell Museum in Miami (through November 2023), and previous group exhibitions included the Institute of Contemporary Art in Boston, the Institute of Contemporary Art, Miami, and RISD Museum, Rhode Island, among others. Langberg held his first solo exhibition at Victoria Miro in London in 2021 and is represented by the gallery.

SALMAN TOOR

Langberg’s contemporary and friend Salman Toor (b. 1983) focuses on the representation of day-to-day moments of queer men within cosmopolitan and domestic settings. The artist’s subjects, often engaged in routine activities, are fictional in nature but are meant to be versions of himself, his friends, and loved ones. As Toor places them in these mundane environments, he deals with the complex, multi-layered idea of what it means to be queer in society while also playing on how relatable these depictions might seem to the viewer. The rich brushstrokes pay homage to the Dutch masters, and the vibrant color palettes evoke a sense of ambiguity, vulnerability, and even anxiety, as the environments depicted by Toor may or may not be welcoming.

Courtesy of the artist and Luhring Augustine.

Courtesy of the artist and Luhring Augustine.

Born in Lahore, Pakistan, in 1983, Toor lives and works in Brooklyn. He studied painting and drawing at Ohio Wesleyan University and received his MFA from Pratt Institute in New York. Toor’s solo exhibition, originally on view at the Baltimore Museum of Art in 2022, is currently at the Tampa Museum of Art in Florida (through June 2023). Other solo exhibitions include the Whitney Museum of American Art, New York (2020-1), and at Luhring Augustine Gallery, New York (2021), which also represents the artist. Toor’s works have appeared in various public collections, including the Frick Madison, New York, and the Hayward Gallery, London.

RF. ALVAREZ

The notion of home is ever-changing, and for RF. Alvarez (b. 1988), this includes the physical environments, people, memories, and experiences through which this concept of belonging is perceived. Alvarez’s paintings depict safe and intimate spaces the artist has created with his husband and loved ones — environments that allow one’s identity and sexuality to be celebrated and fluid. Often placed in nocturnal and enigmatic settings, the figures are captured in fleeting moments, be it an intimate embrace at a large dinner party or a glimpse of the artist’s husband waking in the morning. The concept of home and belonging not being tied to a physical place goes beyond these shared moments as the artist explores his experience as a queer man of Mexican and Texan heritage. As Alvarez puts it, “A lot of my work is about the fallacy of the cowboy figure and its paper-thin vulnerability.”

Courtesy of the artist and Alanna Miller Gallery.

Courtesy of the artist and Alanna Miller Gallery.

RF. Alvarez was born in San Antonio, Texas, and currently lives and works in Austin, Texas. He received his BA from Wesleyan University in Connecticut and has held exhibitions at Alanna Miller Gallery, New York, Taymour Grahne Projects, London, and Ruiz Healy Gallery, San Antonio. Alvarez is represented by Alanna Miller Gallery in New York.

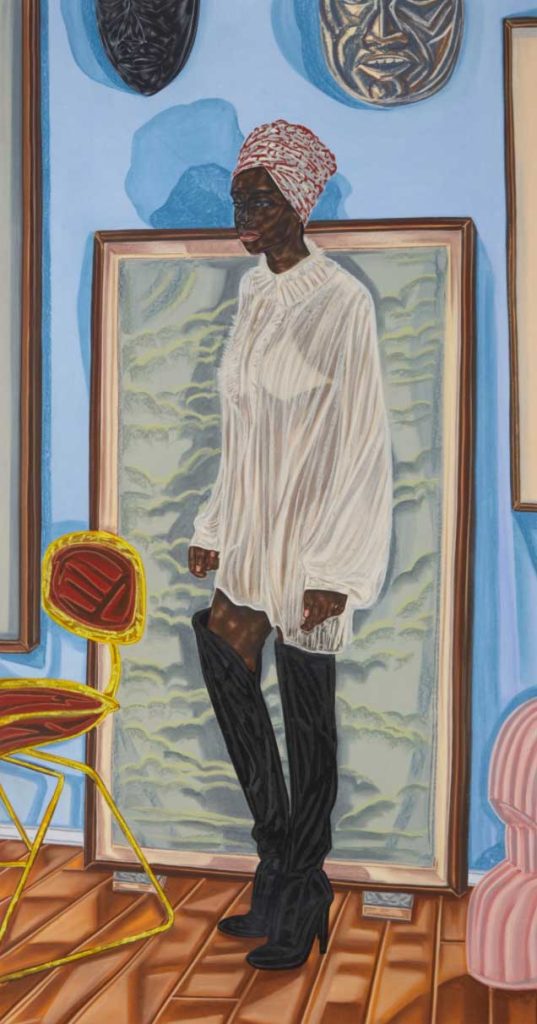

MICHAELA YEARWOOD-DAN

The work of Michaela Yearwood-Dan (b. 1994) aims to build spaces for the queer community, creating a sense of bliss and abundance. Community building and access are crucial components in her work: last year, she made a public mural installation for Queercircle, London, an LGBTQIA+-led charity, working at the intersection of arts, culture, and social action. Her lush paintings, works on paper, and ceramics build on her own personal narrative and reflect on the multitude of her influences, including Blackness, queerness, femininity, poetry, and Carnival culture in the context of her West-Indian heritage. Yearwood-Dan’s monumental paintings with abstract forms, heavy brushstrokes, and lyrical texts that blend with the thick paint go beyond clichés of representation, often giving an inviting feeling of home. The artist’s rich color palette has both personal and symbolic associations, as the bright hues echo the lesbian and bisexual pride flags, while her lyrical inscriptions on the thick brushes of paint create a sense of meditation, familiarity, and closeness with the viewer.

Courtesy the artist and Marianne Boesky Gallery, New York.

Courtesy the artist and Marianne Boesky Gallery, New York.

Yearwood-Dan attended the University of Brighton, where she received a BFA in painting in 2016. She recently closed a show at the Green Family Art Foundation in Dallas called Considering Female Abstractions, now on view at the Contemporary Arts Center in Cincinnati (through August 6th, 2023). Her work is in the permanent collections of the Hirshhorn Museum and Sculpture Garden, Washington, D.C., Institute of Contemporary Art Miami, and the Jorge M. Perez Collection, Miami, among others. She recently held a solo exhibition at Marianne Boesky Gallery in New York and is represented by the gallery.

KYLE DUNN

In his sensuous, intimate, and psychologically dense paintings, Kyle Dunn (b. 1990) reflects on queerness from an inward perspective as well as on its outward projection. Drawing inspiration from his own life and sources such as vintage gay photography, Greek antiquity, and film stills, the artist explores the dynamics of gay relationships not often represented in visual culture, along with gender roles and social expectations. Dunn’s figures include sculpted elements: made with plaster and foam, these relief paintings carry autobiographical and, at the same time, fictional accounts as they respond to social and even private expectations of masculinity. These sculptural elements, as well as Dunn’s intentional placement of his subjects often facing away from the viewer, create a sense of ambiguity: these intimate environments may evoke both peace and claustrophobia.

Courtesy of the artist and P·P·O·W, New York.

Courtesy of the artist and P·P·O·W, New York.

The sculptural elements of Dunn’s paintings reflect the artist’s study of Interdisciplinary Sculpture during his 2012 BFA at the Maryland Institute College of Art, Baltimore. He recently had a solo exhibition at P·P·O·W, New York, and is represented by the gallery. His work is in the collections of the Institute of Contemporary Art, Miami, the Sunpride Foundation, Hong Kong, and X Museum, Beijing.

NFT MARKET UPDATE

BY GREG ADAMS

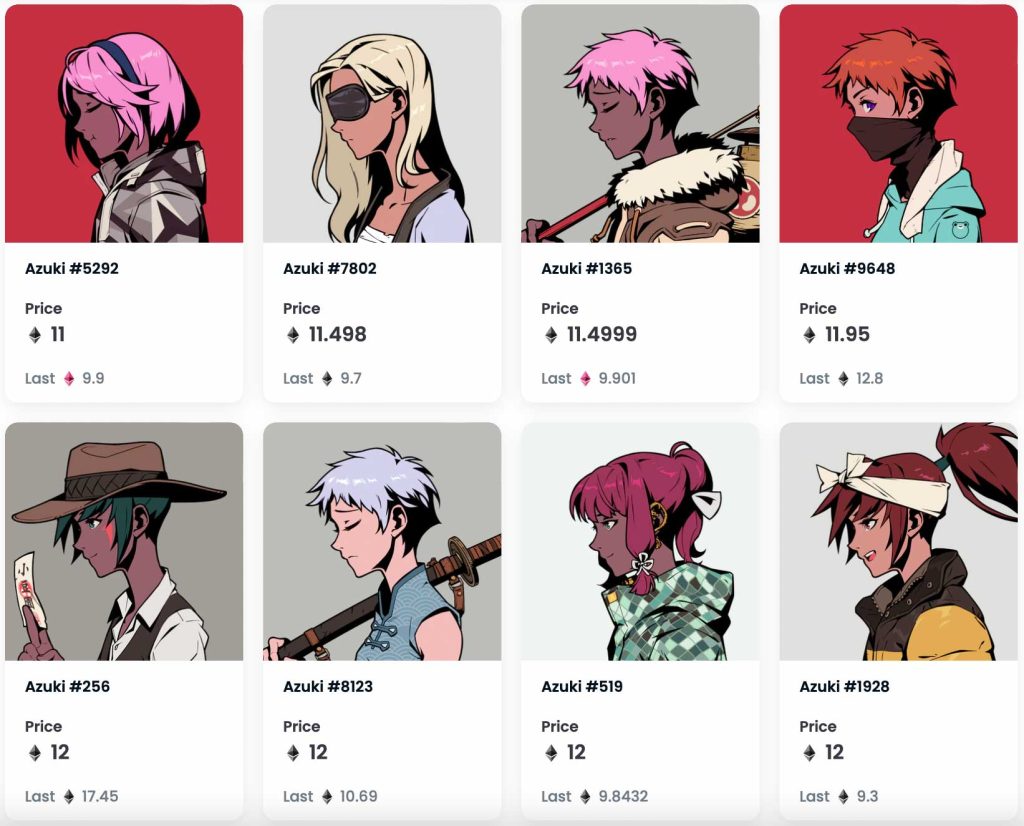

NBA COLLECTIBLES MEETS NFTS

The world of NBA collectibles has expanded into the digital realm with the emergence of Non-Fungible Tokens (NFTs). These unique digital assets have revolutionized the way fans engage with and collect basketball memorabilia. After the recent 2023 NBA playoffs, we want to take a look at the new wave of NBA collectors. NBA Top Shot is an NFT platform that allows users to collect, trade, and showcase digital NBA collectibles as NFTs. NBA Top Shot NFTs are unique digital assets representing a specific moment in time during an NBA game, such as a game-winning shot or a memorable dunk. Each NFT is licensed by the NBA and the NBA Player’s Association and verified on the FLOW blockchain, ensuring its authenticity and scarcity.

Dunk · Oct 11 2020

2020 NBA Finals (Series 1)

Legendary #23/79

9 Moments burned

Owned by @easyaces

TOP SALE:

$230,023.00

Courtesy of Nbatopshot.com.

The popularity of NBA Top Shot has multiplied since its launch in October 2020, with some NFTs selling for hundreds of thousands of dollars. The platform has attracted a wide range of collectors, including NBA fans, crypto enthusiasts, and investors. Many are former basketball card collectors and have transitioned to the new technology. NBA players have also shown interest in the platform, with some creating their own NFTs and partnering with NBA Top Shot to release exclusive collections.

NBA Top Shot has created a new type of collecting culture, where ownership and scarcity of digital assets have become highly valuable. The platform has also sparked discussions about the future of NFTs and their potential to disrupt traditional forms of art and collectibles. While the market for NBA Top Shot NFTs remains volatile, it has become a significant player in the growing NFT ecosystem.

NFT NYC 2023

The event this year was seemingly subdued as crypto winter kept a cold grip on the market. No Radio City Music Hall, no long lines, no huge sales, and far fewer community get togethers that seemed to be the highlight of 2022. It was a different mood for many that were in attendance, less celebratory but far more resilient.

Nonetheless, the culture was still very much alive. LTD.INC showcased a new way to use NFT technology as Wrangler teamed up with artist Jeremy Booth to create a custom “Western Art Dept” black denim jacket. The jacket had Jeremy’s art and an NFC (near field communication) chip that let anyone the artist met during the week scan his sleeve to receive a “proof of friendship” POAP with his art on it. The jacket was also paired with a token that verified ownership and authenticity. This particular practice may become more commonplace with luxury brands in the future as well for ease of tracking

Another highlight was a scavenger hunt around the city hosted by collector and influencer G Money and his Web3 company, 9dcc. Over three days, participants had to hit places around New York City to collect POAPs (Proof of attendance protocols) to complete the challenge. At the first stop, they were treated to baseball caps, which became ubiquitous with the event, and for those that finished, there was a chance at winning a Chromie Squiggle as a prize. Overall a unique way to provide a social and marketable event using the core NFT technology.

Christie’s hosted the Next Wave: New York Edit auction on their Christie’s 3.0 platform, ending with selling 16 lots. It was a mixed batch as far as meeting price expectations, with a total of 135.5311 Eth (~$253,000) spent on the sale.

While it was hard to compare to last year, this year’s conference was nothing to scoff at. Enthusiasts, collectors, and builders are pushing this technology further, and the applications continue growing.

*All images courtesy the artists and the respective galleries.

READ PAST ISSUES OF THE SCOOP

- Reintroducing The Scoop: The Next Generation Collector – March 9th, 2023

- The Scoop #12 – December 21st, 2022

- The Scoop #11 – November 22nd, 2022

OUR SERVICES

From our advisors’ strategic insight and clear guidance to our market-leading art finance and sales agency services, we help our clients build their collection, secure their investments and appraise their assets to realize their true value.

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

Written by Colleen Boyle, Managing Director of Business Development & Philanthropic Strategy; Zhanna Ter-Zakaryan, Associate, Art Advisory; Kate Waterhouse, Director & Senior Jewelry Specialist; Greg Adams, Digital Assets Consultant

THE SCOOP #13 – March 9th, 2023

INTRODUCTION

THE NEXT GENERATION COLLECTOR

BY COLLEEN BOYLE

Welcome to the latest edition of The Scoop! We are now refocusing its content to include not only NFT and crypto topics but also issues and concerns related to the next generation of collectors as they face the responsibility of inheriting wealth and a fast-moving market of new and alternative investments. A portion of this wealth is in the form of tangible assets that reflect the interests and legacies of their families. This asset class of personal property, which includes art, jewelry, wine, vintage cars, watches, rare books, coins, and other niche collectibles, is referred to as passion assets. Have Next Generation collectors been educated about their potential inheritance of passion assets? Are they prepared? Will they want to build on inherited collections, forge their own path, divest, or donate? Are they fueled by a desire for change and positive impact while simultaneously preserving a family legacy?

What type of collecting entices the next generation? How and where are they buying? Are they investing in NFTs or other new media types? What are the issues related to, and the impact of, these types of investments? What are the current trends within the art world that affect, or are affected by, the Next Gens? The Scoop will address all these topics, including the art market, social impact, sustainability, and how the next generation can balance these issues with sound investment strategies.

THE MYSTERIOUS STORY OF THE NEW: EVER-CHANGING TRENDS

BY ZHANNA TER-ZAKARYAN

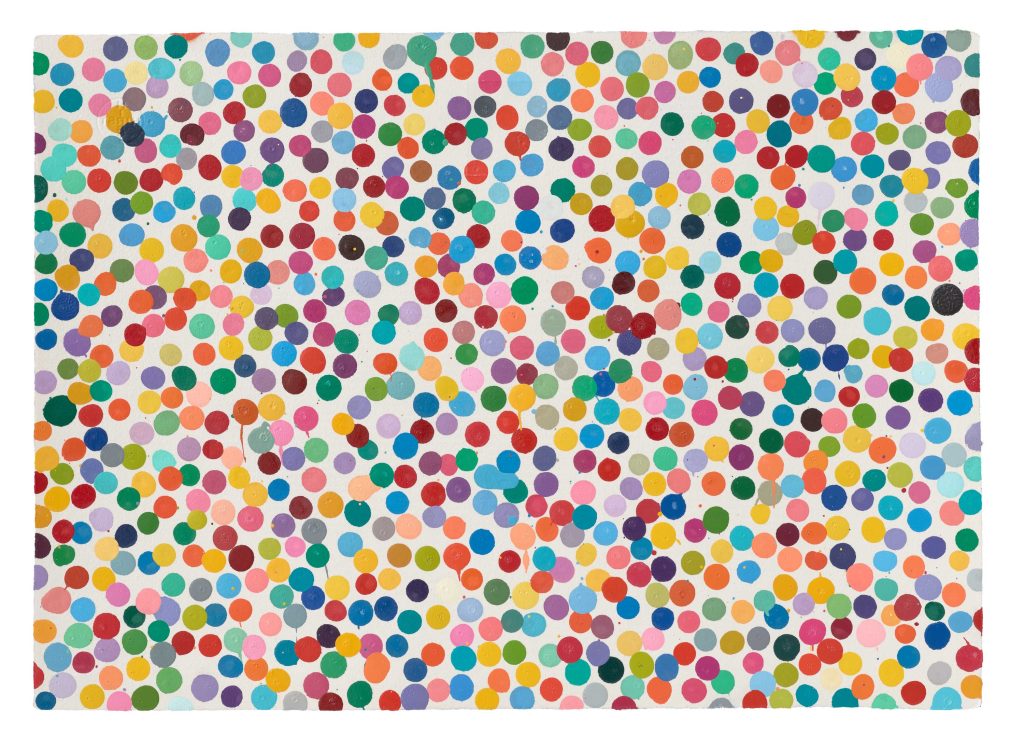

The art market has undoubtedly been feeling the influence of Next Gen collectors. According to Artnet News, the number of lots by young contemporary artists (those born after 1975) rose by approximately 250 percent between January 2013 and July 2022, while the total auction sales for young contemporary art skyrocketed by 700 percent in the same period. [1] Though these Next Gen collectors are not the only ones interested in emerging young contemporary art, they have nonetheless been pushing these numbers to new heights.

This group of collectors has been reshaping the art market, challenging previously accepted approaches to collecting art: from the rise of NFTs to an increased interest in art that is appealing on screen, the traditional format of the art market has been changing.

Recently, trends in the art market have fluctuated more than ever before. Paradigm shifts in the industry now occur faster, as art buyers, including Next Gen collectors, are swiftly moving onto the “next hot thing.” The past years are testimony to these fluctuations.

By 2021, the young contemporary art market prided itself on being the fastest-growing sector within the secondary market. During that time, artworks created a year prior generated ten times more revenue than a decade earlier. For the first time, Sotheby’s dedicated an independent evening sale to young contemporary art only. The Now Evening Auction focused on art executed in the last 20 years.

YOUNG CONTEMPORARY ART PRICES IN 2021

The following year experienced a slight slowdown in the previous craze over this latest type latest art, or “wet painting.” The young contemporary market did not completely flatline, and new auction records were still being established for emerging artists. However, a sense of general caution was nonetheless noticeable. Macroeconomic fluctuations aside, there were multiple possible reasons for this:

- Increased Demand but Not Enough Supply

- When young contemporary artists become hot, the demand for their work surpasses the possible supply. While this factor can build artists’ secondary market by pushing their numbers to new heights, it can subsequently cause their market to decline.

- Controlling the Urge to Flip

- Another reason is the notion of “flipping.” Selling a recently purchased artwork for a quick profit is not new but has been quite prominent in recent years. To avoid an immediate resale of a work by a trending artist, representing galleries started creating more stringent resale rules for collectors. As a result, works by young contemporary artists purchased recently on the primary market (meaning directly from the galleries or artist studios) became scarce on the secondary market.

These factors were doubtless not the only ones at play in the market’s slowdown last year. Against this cautious outlook, this year has already seen two major art fairs (Art SG in Singapore and Frieze Los Angeles) and experienced its first marquee evening sales in London.

FRIEZE LOS ANGELES 2023

Frieze Los Angeles brought together galleries, institutions, curators, and individual collectors in its new location at Santa Monica Airport. The fair has grown exponentially since last year, including a 30 percent increase in exhibitors.

LONDON EVENING AUCTIONS 2023

The young contemporary art segment of the London evening auctions suggested a slightly positive change compared to the caution of 2022. With the debuts of a few new names in the secondary market, multiple auction records were set during the sales.

As the art market continues to wax and wane, 2023 has yet to show whether the current fluctuations mean the market will soon settle in line with other segments of the art world. This year will also continue to shed light on how sustainable the meteoric increase in the interest in young contemporary works is and how the Next Generation collectors affect it.

[1] Artnet News Pro, “The Artnet Intelligence Report, Fall 2022 Edition”, October 27, 2022, esp. 51-2.

JEWELRY TRENDS: EVERYTHING OLD IS NEW AGAIN

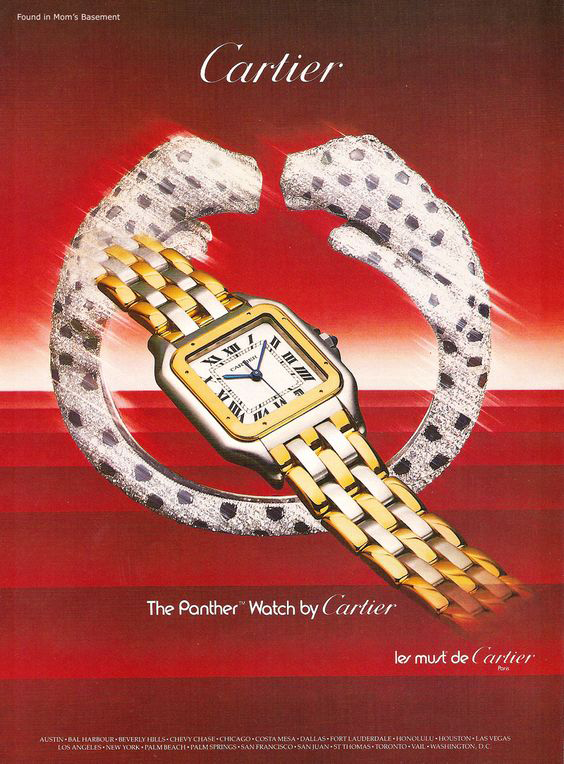

BY KATE WATERHOUSE

As a young girl, I remember how my mother chose and wore her jewelry every day and for dinners and events. Playing “coat check girl” at their cocktail parties offered me a front-row seat to the best jewelry designs from the late 1980s and early 1990s. I fell in love with the clean, bold aesthetic of the period, even if I was too young to truly understand what I was looking at and why it appealed to me so strongly.

Yellow gold and diamond parure

circa 1990

Sotheby’s

Magnificent Jewels Sale

May 17, 2007

Lot 63

ESTIMATE: 15,000-20,000 CHF

Since the first decade of the new millennium, we have seen consistent collector appreciation of signed jewelry by significant jewelry houses. With that has seemingly come a renewed appreciation for the designs made popular just a mere decade or two before 2000. Next Generation collectors may be inheriting these specific pieces at this time. They will have to decide whether retain them in the hope their value will continue to increase, sell them or expand their collection with more investment-worthy jewelry pieces.

An excellent example is Cartier’s beautiful “stalking panthers” collection, which debuted in 1988/1989 and has been offered regularly over the years at auction. Described by auction houses as a collection anchor and a traditional classic, David Bennet and Daniela Mascetti said, “Ecological issues such as flora and fauna extinction prompted many jewelers to look into nature for a source of inspiration in the late 1980s, early 1990s. The panther motif, which became Cartier’s living symbol with its aggressive sensuality and agility, perfectly suited the taste and spirit of the contemporary woman.”*

*For further details, please refer to David Bennet and Daniela Mascetti’s book “Understanding Jewellery,” Antique Collector’s Club, Revised edition 2003, page 453, for an example of the continued appreciation of nature in jewels and jewelry.

There are several reasons to consider adding pieces with a robust design in vintage jewels like those in the Cartier collection. First, buying vintage jewels is a beautiful way to honor the preservation of the environment. Mining, cutting, refining, and manufacturing new precious metals and gemstones have an environmental impact while giving legacy pieces a new spot in your collection limits your carbon footprint. Ideally, vintage jewelry will live on in that state forever without further environmental repercussions.

DIAMOND-SET ‘PANTHÉRE’ COLLAR NECKLACE

AND BRACELET SUITE

Bonhams

London Jewels Sale

December 1, 2022

Lot 225

SOLD: £103,620 INCLUDING PREMIUM

Additionally, the potential long-term financial viability of evergreen pieces in fashion offers a reasonable way to potentially “park” wealth by associating the value to a living, breathing piece in a market that continues to be cyclical.

Included in this article is our “Stalking Panthers” example of two similar suites (otherwise known as a “parure” to some collectors) that sold approximately 15 years apart. We can see how values have changed as the desire for this piece has increased interest with a renewed appreciation for the 1980s/1990s design aesthetics from Cartier, Tiffany, Bulgari, and Marina B. Certainly a market worth watching in 2023!

NFT ART MARKET UPDATE

BY GREG ADAMS

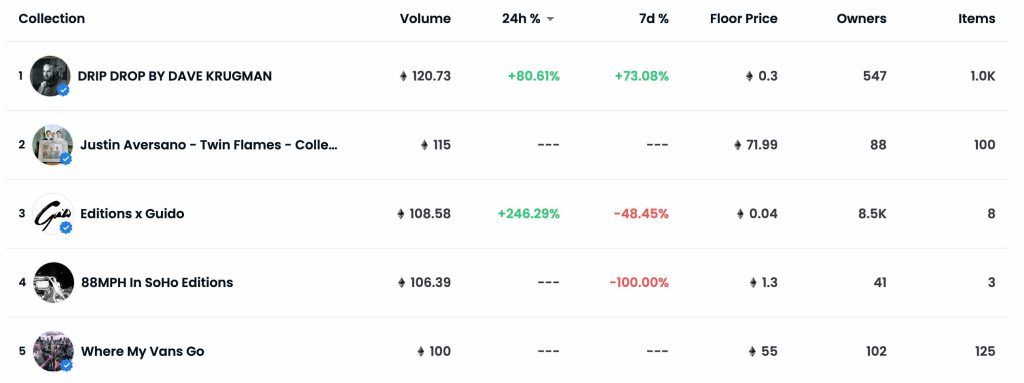

The NFT market has shown signs of life in 2023 after a bleak end to 2022, with open editions becoming the latest driver in a market that has seen a rise in trading volume and NFTs sold. Open editions are drops where collectors can mint as many tokens as they’d like, and most are a relatively low cost, $10-$100.

The art market has usually focused on limited editions, which have been seen as more exclusive and worthy of collecting. Still, they ultimately cap the artist’s earning potential for a piece. A paradigm shift, especially with digital work, may be happening towards an open edition business model that would not reduce return if an artwork is popular.

Outside of the Bored Ape Yacht Club’s Sewer Pass, Jack Butcher’s Checks has been the biggest mover in recent weeks. Over 16,000 NFTs were minted during the drop for around $8 each. Currently, they are selling at 1 ETH, around $1,600. After the initial drop was complete, more details were released about how the collection would be gamified with mechanics that allow a collector to burn (destroy) tokens to claim rare pieces in the future, driving total sales of the collection to $38 million.

In January 2023, a rare alien CryptoPunk sold for $1.2 million; it was headline news. Shortly after, Alex Ness dropped M0N3Y PR1NT3R G0 BRRRRRR as an open edition, selling over 20,000 copies at .069 Eth each (~$110), bringing in around $2.2 million. It’s the most significant, successful, single-image drop in the NFT space but didn’t get nearly as much press as the CryptoPunk. Both are positive signs for the NFT market and show there is no right or wrong way to market art in Web3.

There is some debate over open editions in the NFT community. Supporters say it’s a great way to onboard new collectors with a low-cost entry point while getting an up-and-coming artist more recognition. There are critics, however. The strategy’s recent success has led to a flurry of open editions on the market. Some avid collectors have raised concerns about oversupply and dilution of the market, similar to the young contemporary painting market mentioned earlier in The Scoop. For those reasons, many established artists have shied away from the tactic; they want to maintain their price point and prefer a more balanced approach. Only time will tell how well they age.

NFT ARTIST SPOTLIGHT

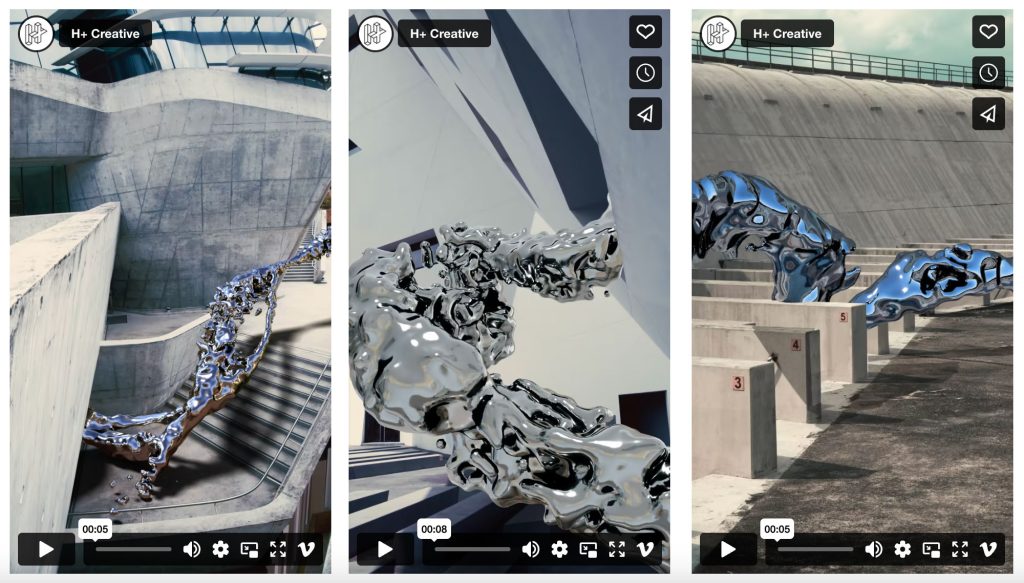

FVCKRENDER (Frederic Duquette)

Born in 1991, this Vancouver-based artist has been creating digital art for quite some time. After a 2016 bike accident left him with no sensation in his left side, he started exercising his brain by working with rendering software. Since then, he has blossomed into a leading digital artist collaborating with Lil Nas X, LeBron James, and luxury brand Dior.

CREATIVE: FVCKRENDER

CLIENT: Christian Dior / Hypebeast

ROLE: 3D Composition, Animation

PRODUCER: H+ Creative

FVCKRENDER is one of the highest-selling on-chain artists in the digital assets world and a strong supporter of new technology. He doesn’t hide his confidence in the future of NFTs, saying, “NFTs allow for the value we (digital artists) have created on culture to be returned to us financially. For that, I am eternally grateful. Another concept I enjoy is the ease at which one can track the provenance and ownership of NFTs. I love the transparency of the blockchain just as I love being transparent emotionally with each of my works.”

Not only has he had successful personal releases, but he has the attention of bidders at traditional auction houses with his most recent piece, SHIFT//, selling for $107,100. His next step is working with physical art, creating custom 3D-printed pieces to go hand in hand with his digital art. We’ve seen classic collections showing interest in pairing digital tokens with their physical counterparts. For a piece in 3rd party storage, it would be easy to sell the token without moving the original work. This pairing of an NFT with a physical artwork or collectible may become more common since the digital token is easy to track regarding provenance and ownership. The use cases for this technology continue to expand, and FVCKRENDER is leading the way.

READ PAST ISSUES OF THE SCOOP

- The Scoop #12 – December 21st, 2022

- The Scoop #11 – November 22nd, 2022

- The Scoop #10 – November 2nd, 2022

OUR SERVICES

From the strategic insight and clear guidance of our advisors to our market-leading art finance and sales agency services, we help our clients build their collection, secure their investments and appraise their assets to realize their true value.

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Scoop #12 – December 21st, 2022

In this edition of The Scoop, we touch on the continuing FTX postmortem and how the current NFT market is weathering crypto winter.

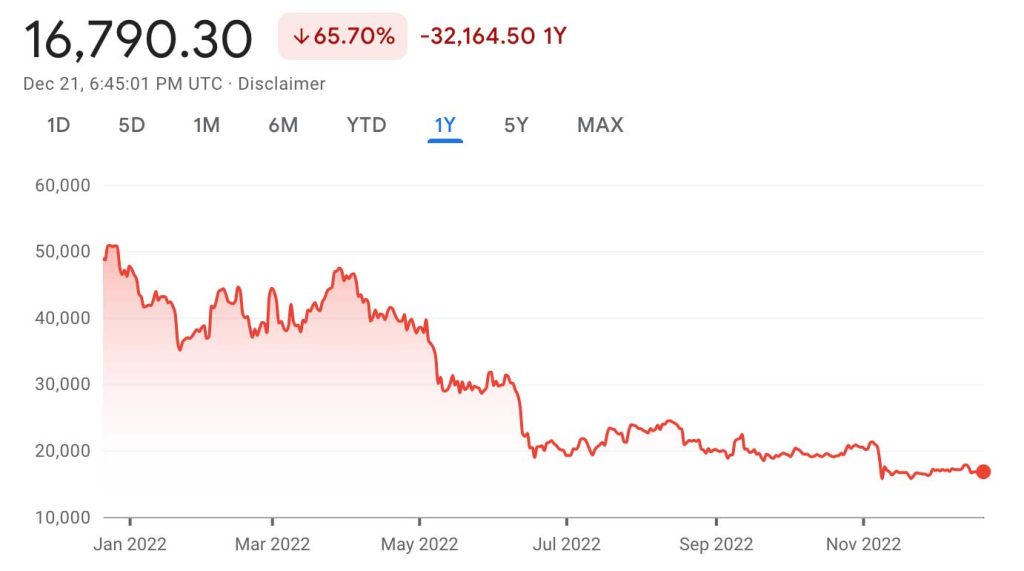

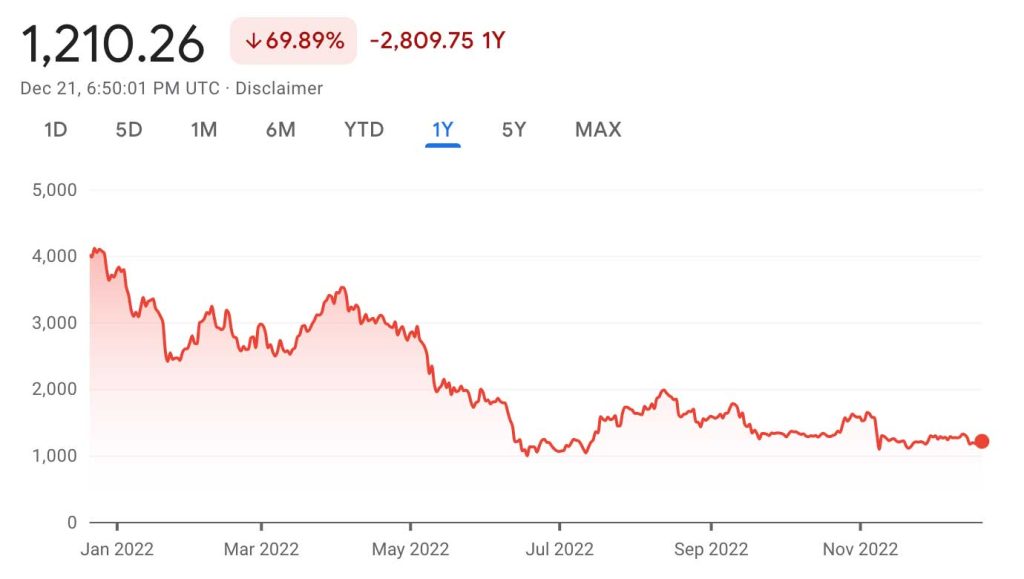

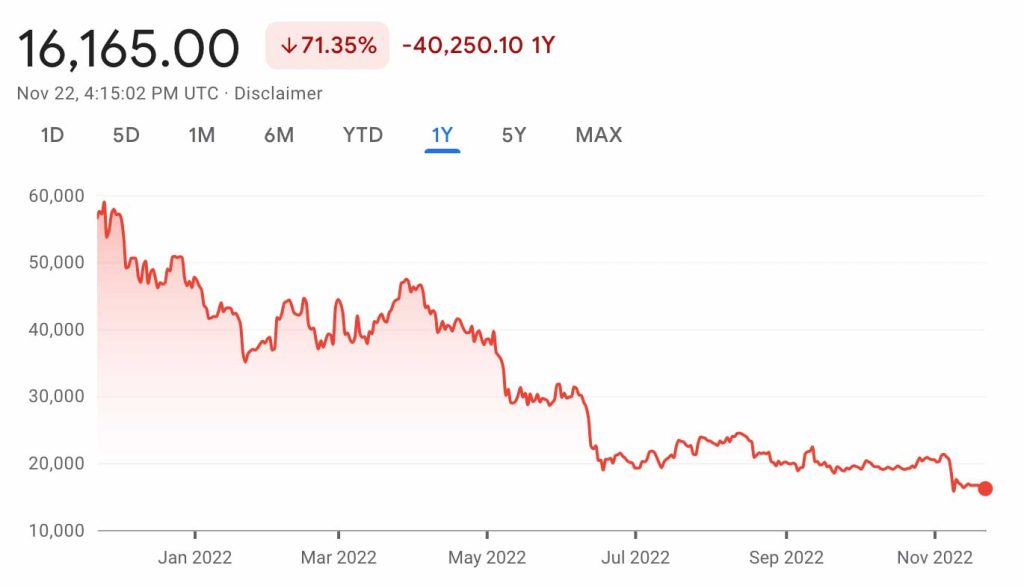

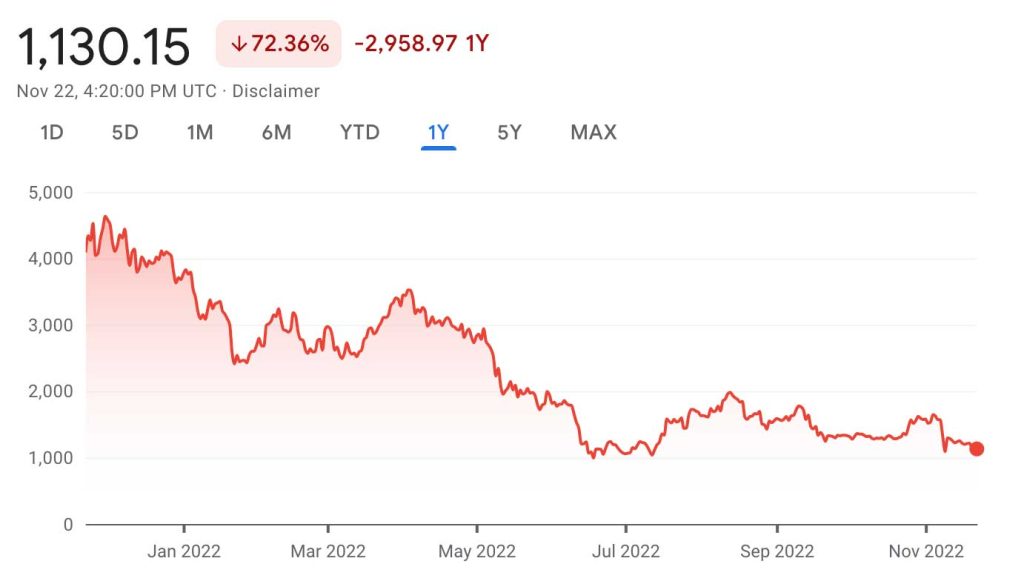

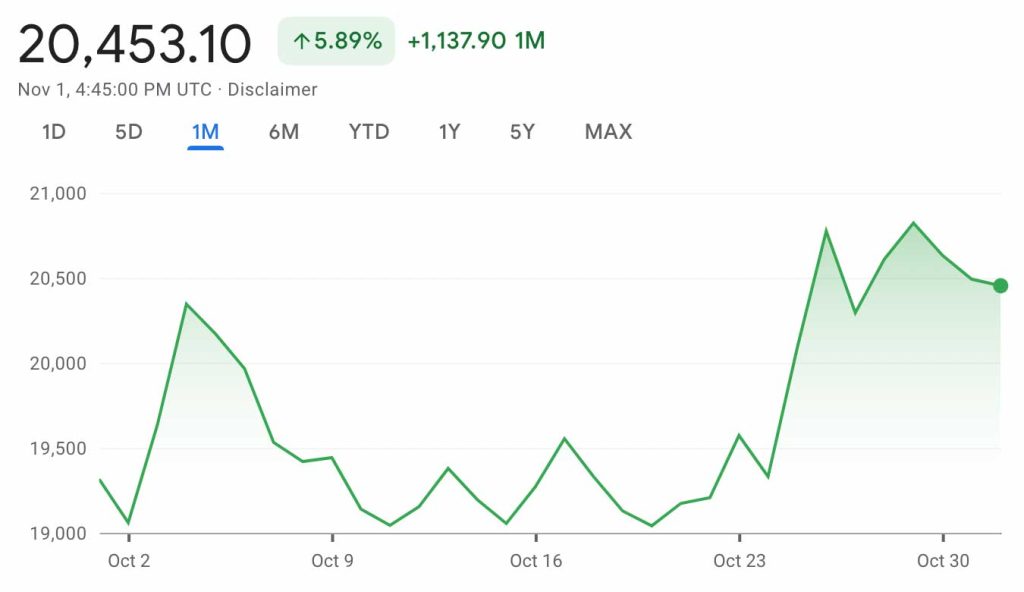

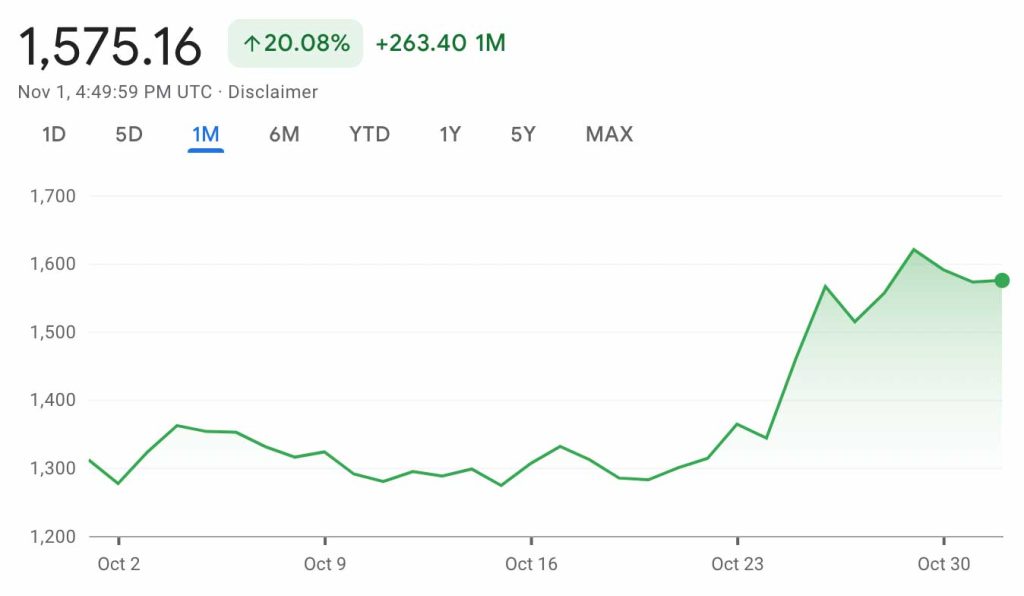

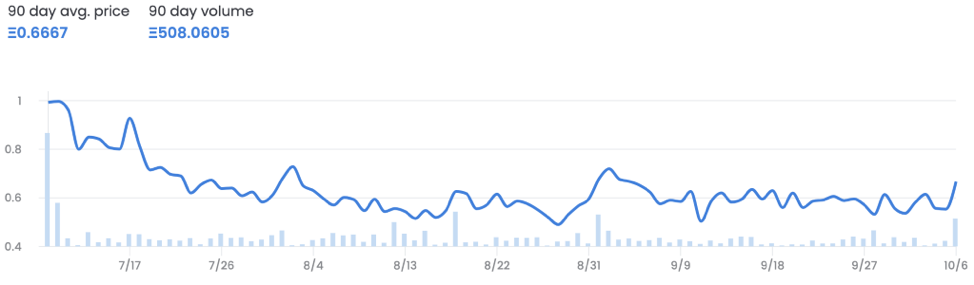

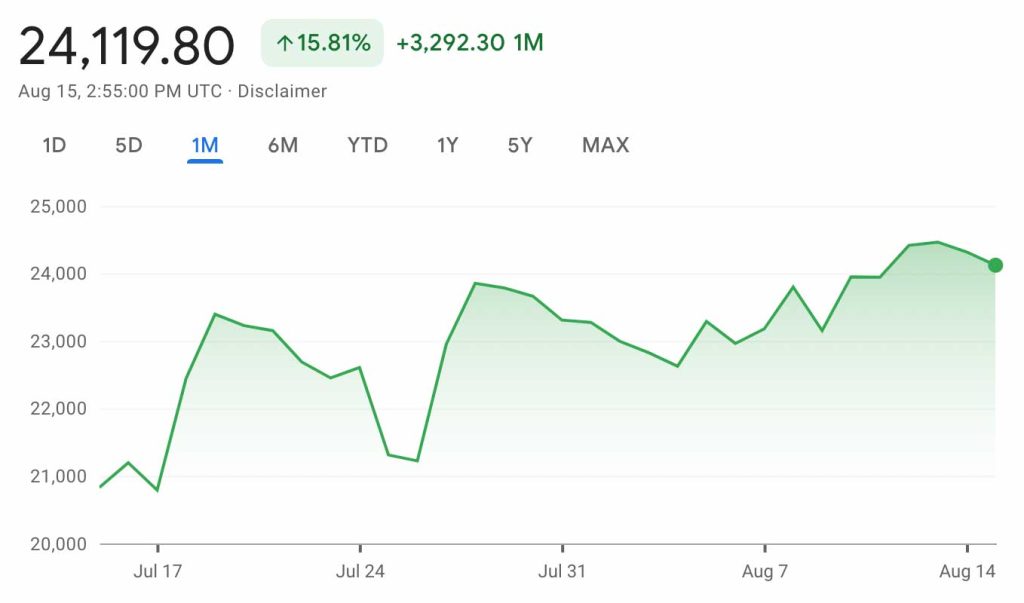

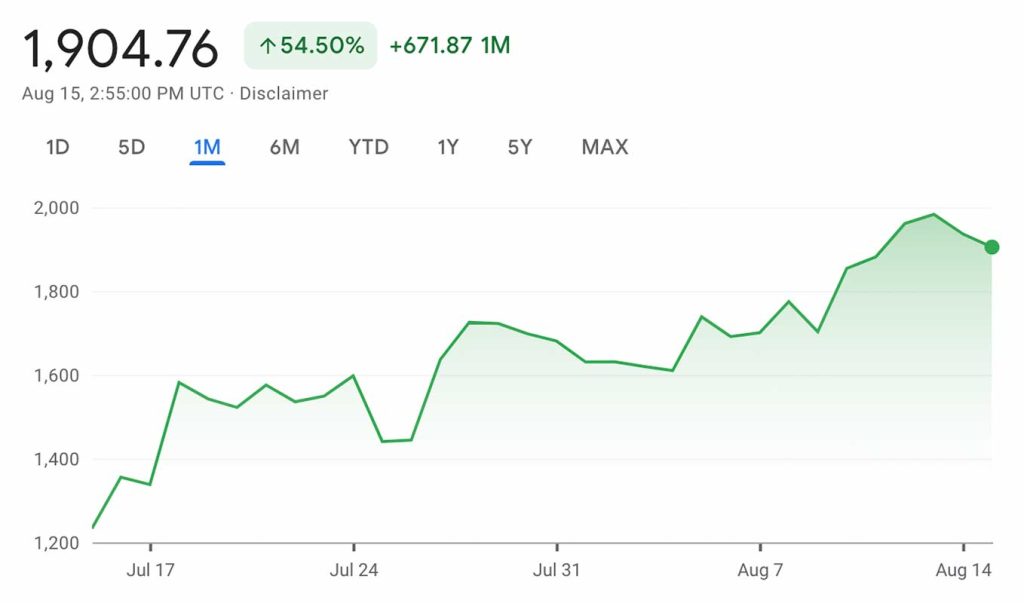

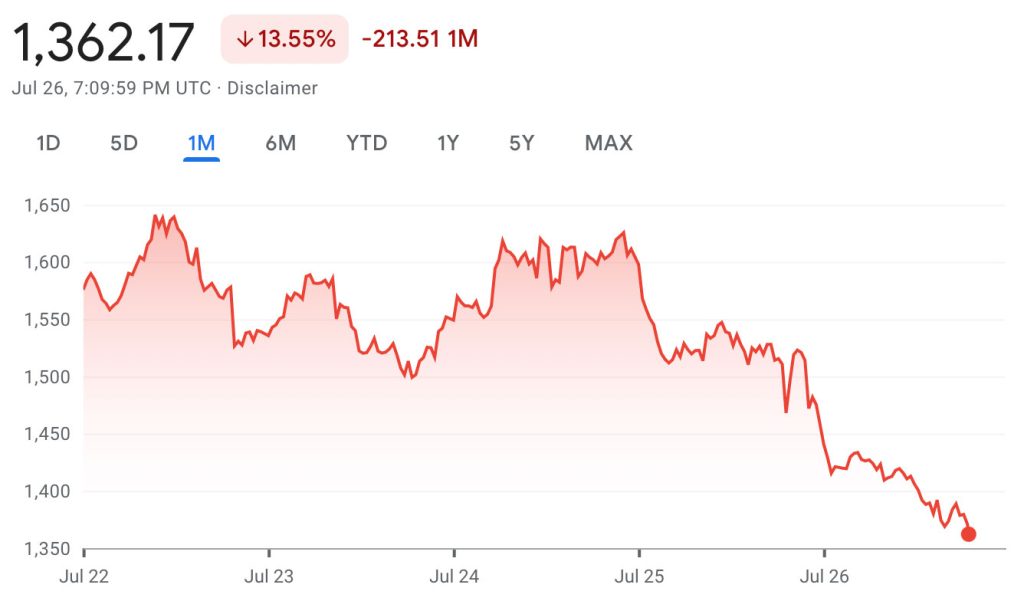

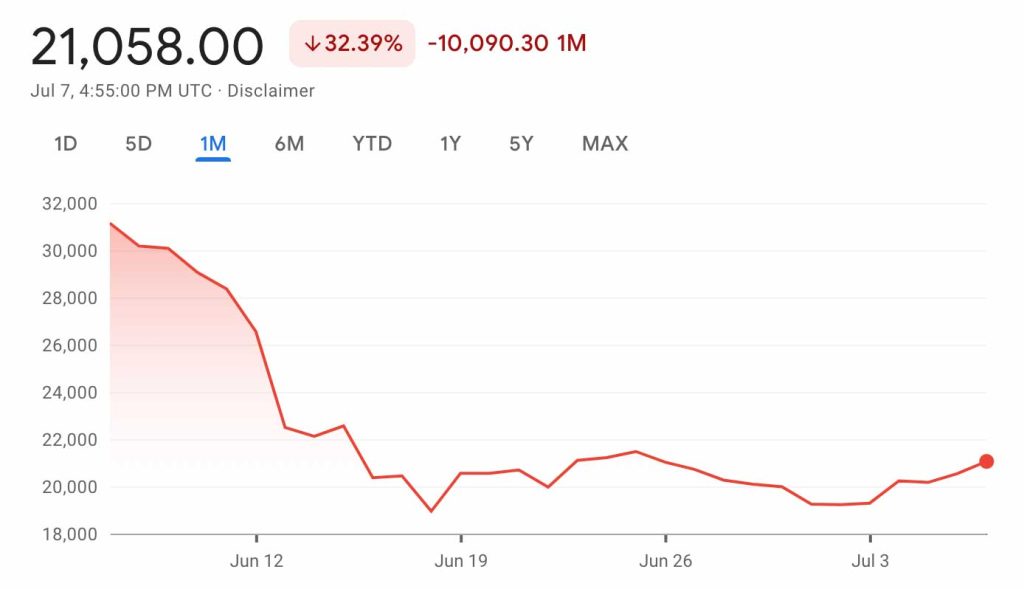

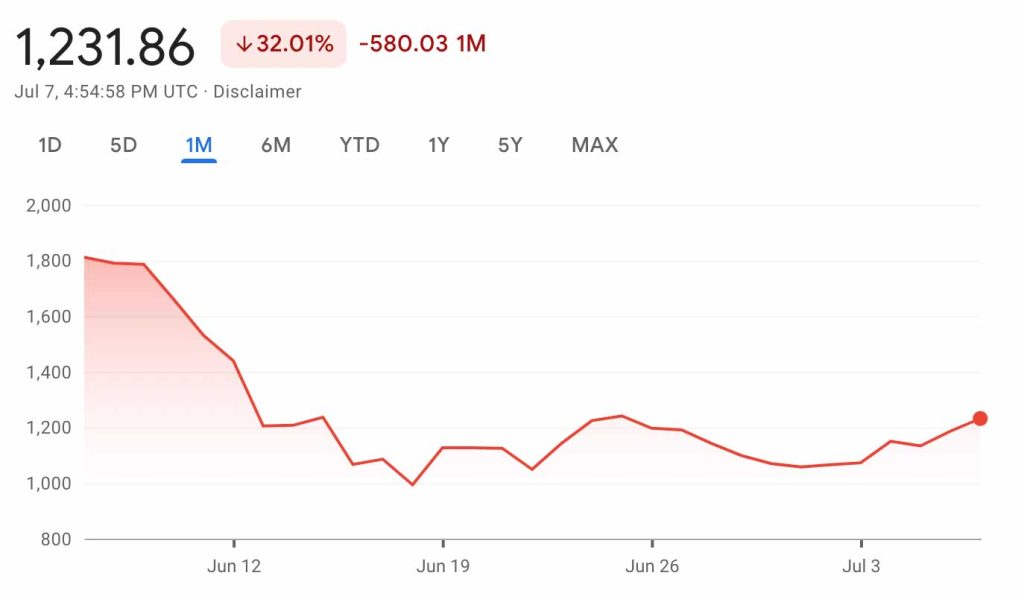

CRYPTO MARKET

Bitcoin to USD

Ethereum to USD

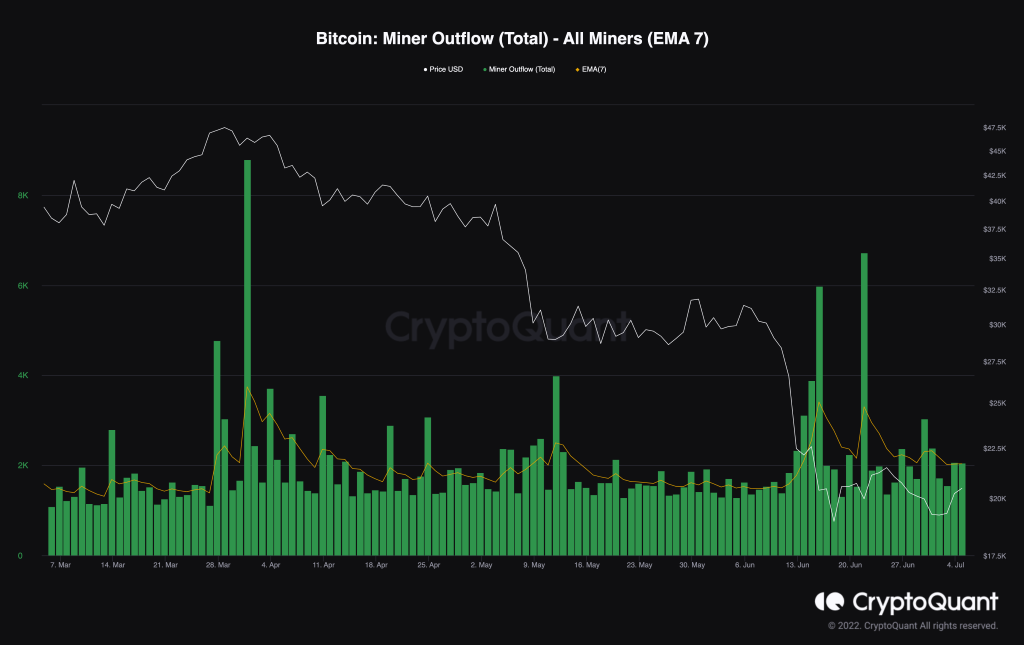

CRYPTO COMMENTARY

With the postmortem under way on the FTX meltdown, we’re seeing just how inept both Sam Bankman-Fried and Caroline Ellison really were. John Ray, the new CEO, had this to say about the previous management when testifying to Congress: “From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.” He described the $8 billion in missing customer funds as old-fashioned embezzlement, adding, “never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.” U.S. prosecutors have charged Sam Bankman-Fried with wire fraud and money laundering among other things, and he is currently awaiting extradition to the U.S. from the Bahamas. There are rumors that his second in command, Caroline Ellison, is cooperating with law enforcement to expose the depth and details of this fraudulent scheme.

It’s important to remember that FTX was a piece of infrastructure, like a stock exchange or bank, and not representative of the blockchains and cryptocurrencies that were sold on it. Bitcoin and Ethereum remain technologically sound and continue to run without issue. Just like we’ve seen in the past with traditional finance, bad actors can cause detrimental damage to any market they are part of, and this is a serious setback to the entire crypto space. There are some pundits who are using the FTX saga to cast doubt on blockchain, but that’s like being mad at the U.S. dollar when Bernie Madoff got exposed which doesn’t make sense. Bankman-Fried is likely headed to jail, but crypto isn’t going anywhere.

WHAT’S THE BUZZ

One thing that has become clear is that securing your crypto will be very important moving forward. Private keys are the only way to guarantee ownership.

PRIVATE KEYS

- A private key is a secure code that enables holders to make cryptocurrency transactions and prove ownership of their holdings.

- Bitcoin keys specifically feature a 256-bit string displayed as a combination of letters and numbers.

- The best way to self-custody crypto is to keep it in cold storage, disconnected from the network on a Ledger/Ballet device.

- If you lose or forget your private keys, there is no way to recreate or reset them.

- “Not your keys, not your crypto”

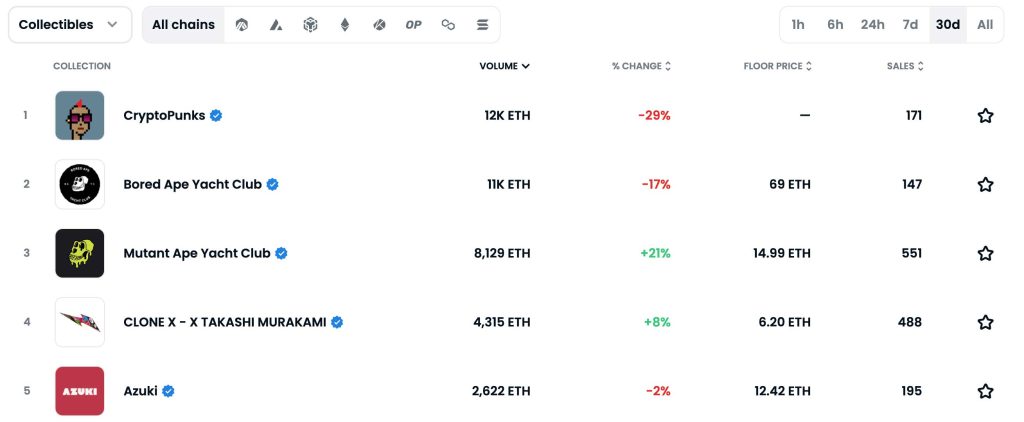

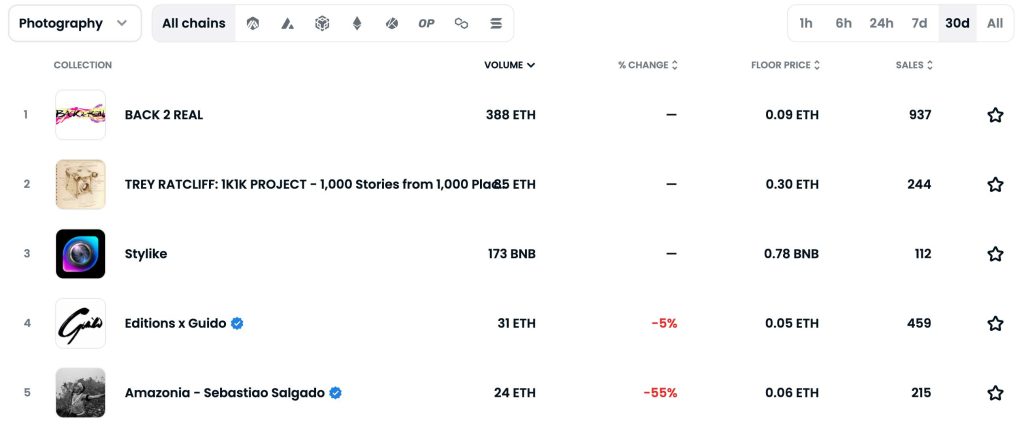

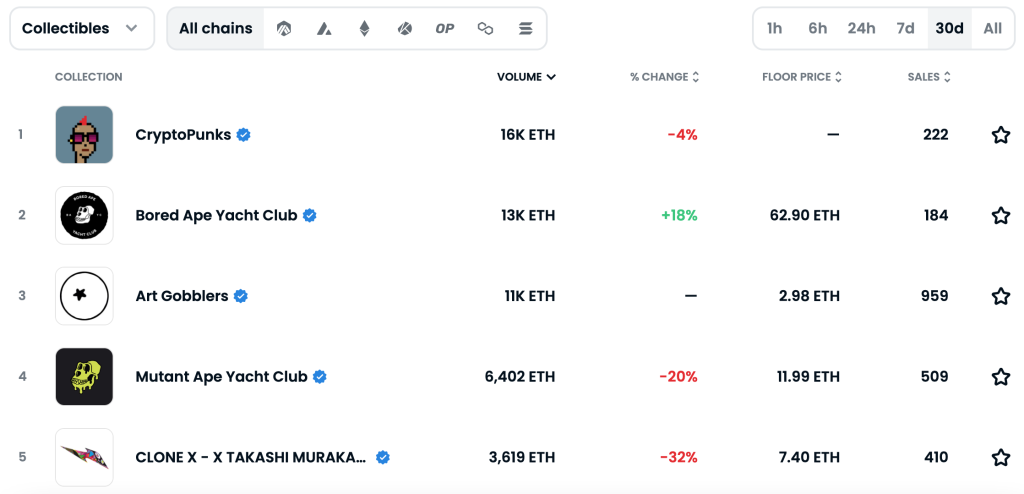

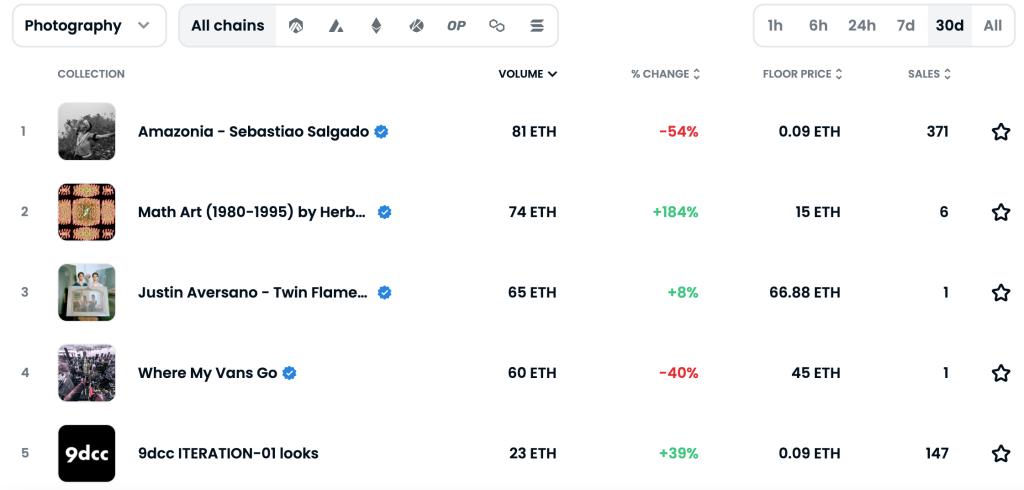

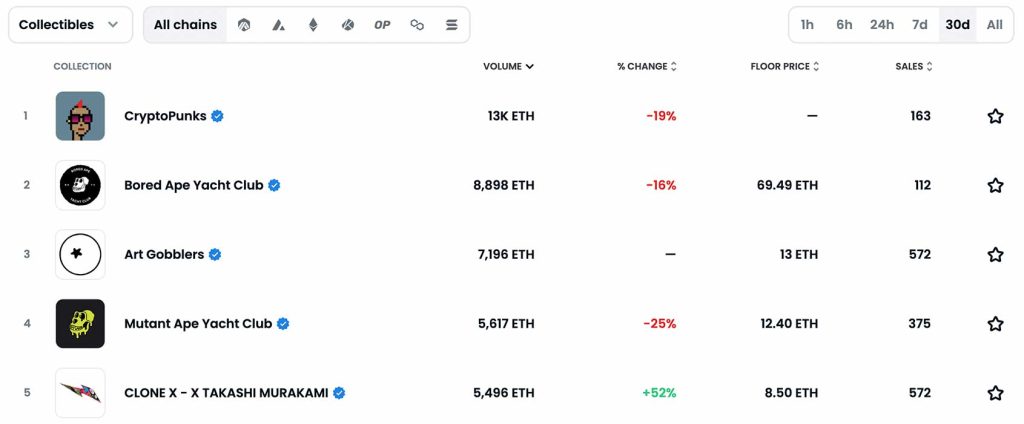

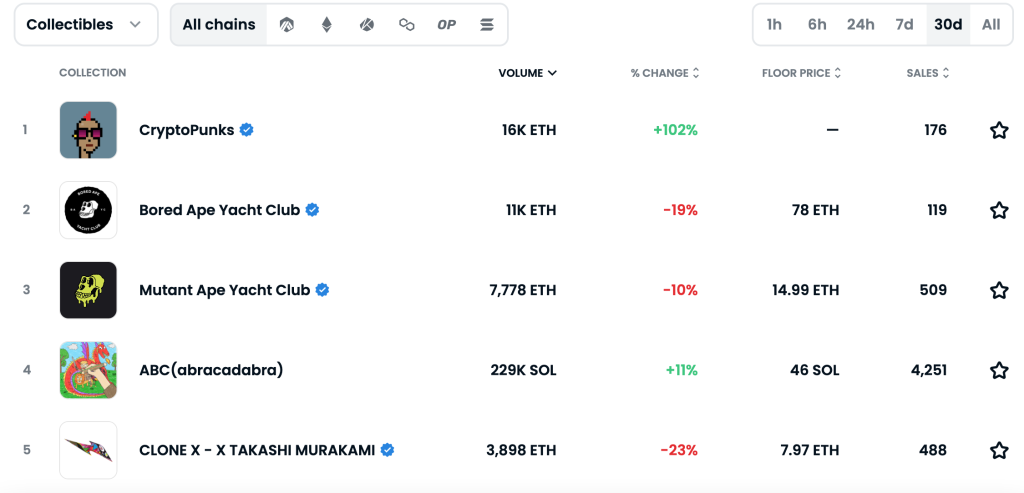

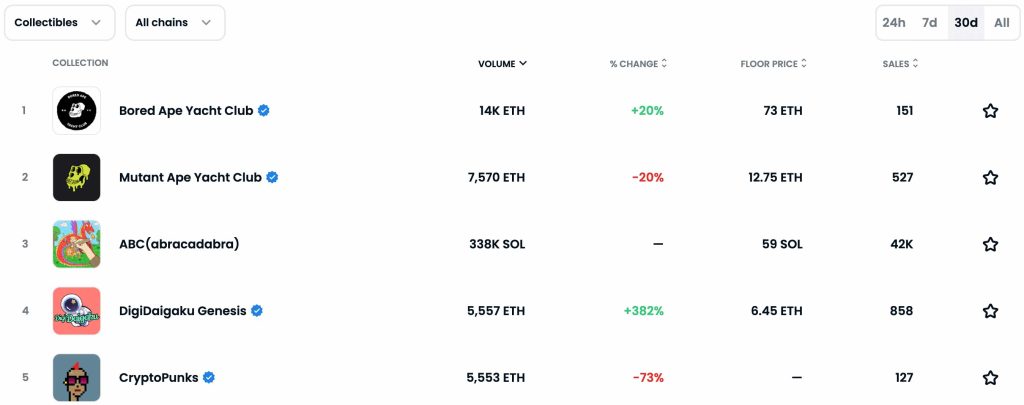

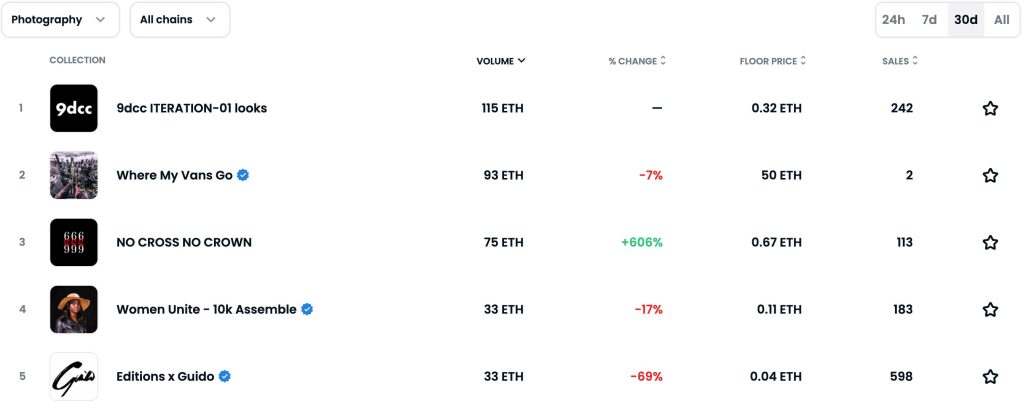

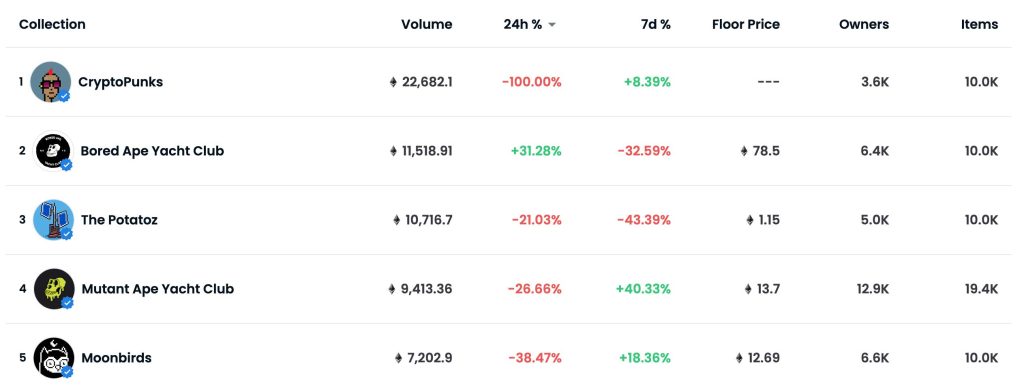

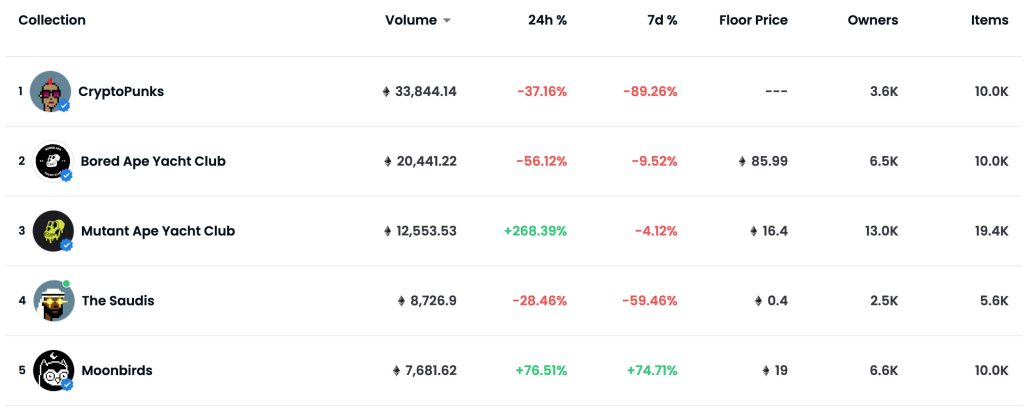

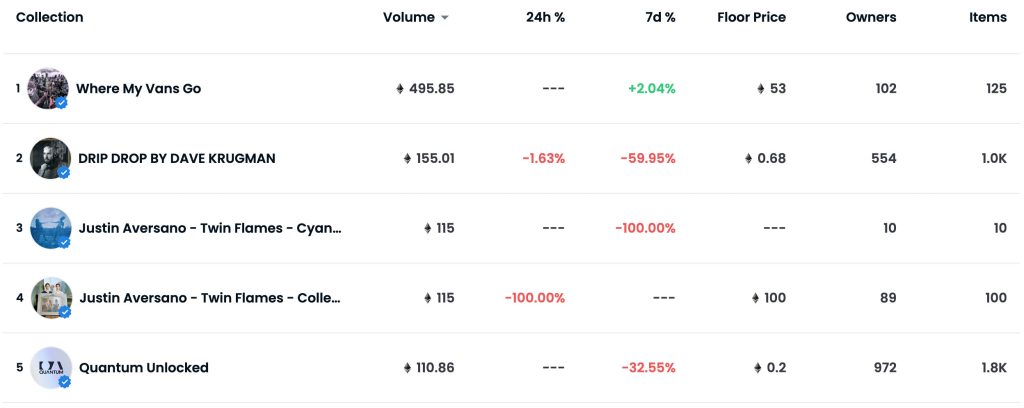

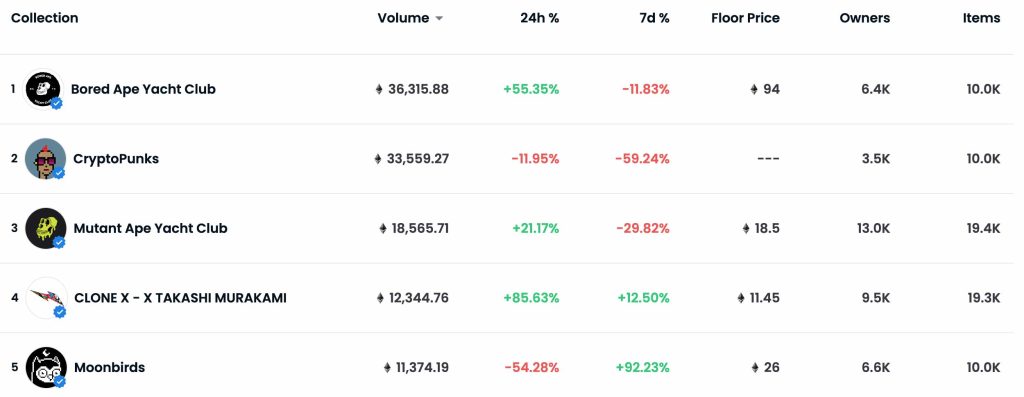

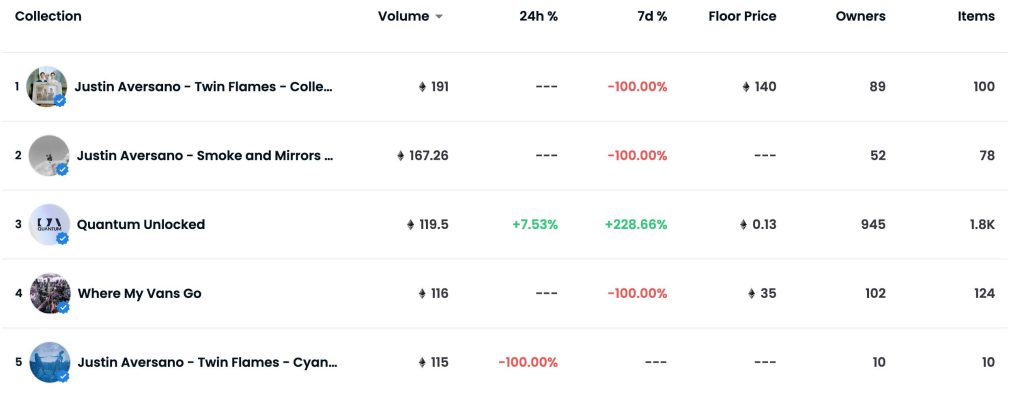

NFT BLUE-CHIP COLLECTIONS

Top 5 NFT Collectibles Collections

Top 5 NFT Photography Collections

NFT COMMENTARY

The NFT market is still crawling along as the bear market continues. We’re seeing the top collections maintain their floor prices which is an encouraging sign, but their underlying value is still fluctuating with the price of Ethereum. The one thing that has dramatically slowed down since the bull market is volume. Overall, we’re seeing fewer transactions and less money changing hands and that has been the status quo since early summer.

The most recent sale from Christie’s took place during Art Basel in Miami with a collection titled Next Wave: The Miami Edit. It was a well-rounded offering with pieces from different genres across a wide range of price points. The auction finished with a 93% sell through rate after selling 14 of 15 pieces; however, the majority did not meet their lower price expectations. It seems as though even high-profile shows are not immune to the cold of crypto winter.

In a more promising sign, Instagram has officially launched its NFT offering to select artists who have started minting and selling pieces directly on the social media platform. The first few pieces that have been offered have sold out in minutes with artists and creators being the main beneficiary of that income, unlocking a new way to monetize their work. With the numbers of users Instagram (and Meta) have, this is a large play for wider adoption. If this business model works we could see more people that haven’t had exposure to NFTs yet start to get involved. One of the main things driving the sales is affordability; the pieces that have been offered so far have been around $100 which is certainly less than most marketplaces. Onboarding new participants seems to be priority No. 1 at this point.

NFT ARTIST SPOTLIGHT

Gary Vaynerchuk

While Gary Vaynerchuk isn’t the best artist, just look at his VeeFriends collection and you’ll find that he is one of the loudest voices in the space supporting the technology behind NFTs. When he first launched VeeFriends, many were less than enthused about the art. However, Gary wasn’t in it for the art; he was in it for the utility.

Gary was one of the first to add real world value to digital assets by linking attendance to his annual business conference to the ownership of his NFT collection. The conference, which usually costs several thousand dollars to attend, was free for the first three years to anyone that held one of his NFTs. When it came time for the conference last year, Gary’s team airdropped a separate token that represented a ticket to all his holders. They then had the decision to either attend, or sell that token to someone who wanted to go.

To take it a step further, after releasing VeeFriends Series 2 he launched a card game to match the NFTs. Think trading cards, Pokemon for example, with each character having a different skill set. Again, he was building a real-life experience for those who held his digital assets. His larger ambition is to create a whole brand around the VeeFriends IP including merch, cartoons and a large trading card ecosystem which will bring everything back to the NFTs he originally created. The two things that are valuable in NFTs are history and utility, and he is a master of utility.

NFT & CRYPTO NEWS

- Sam Bankman-Fried extradited to US, seeking bail deal

- Donald Trump’s NFT Collection loses steam

- Driftershoots sells out in 10 seconds as Instagram’s first NFT

- Crypto’s regulatory fate will be decided in the year ahead

- Binance’s books are a black box

- Magic Eden launches protocol to enforce creator royalties

- Bitcoin miner Coin Scientific files for bankruptcy

- Crypto Winter… or Ice Age?

READ PAST ISSUES OF THE SCOOP

- The Scoop #11 – November 22nd, 2022

- The Scoop #10 – November 2nd, 2022

- The Scoop #9 – October 15th, 2022

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Scoop #11 – November 22nd, 2022

In this edition of The Scoop, we look at the FTX fallout, how other alternative assets are thriving, and feature a master of minimalism in our Artist Spotlight.

CRYPTO MARKET

Bitcoin to USD

Ethereum to USD

CRYPTO COMMENTARY

In a departure from the correlation we were mentioning in the last edition of The Scoop, the crypto market has taken a further step into crypto winter. Many thought the worst was over after Voyager, Celsius and 3AC collapsed, but it appears that they were just the prelude to something bigger. FTX, the second largest crypto marketplace, was using customer funds to take risky bets on the market, according to the Wall Street Journal. In a since deleted tweet, CEO of FTX Sam Bankman-Fried said “FTX is fine. Assets are fine.”

There was an announcement from the CEO of Binance, Changpeng Zhao, saying that it had signed a letter of intent to acquire FTX after it performs due diligence on the company’s holdings. Shortly after that, Binance said it was walking away from the deal because the financial hole in FTX’s balance sheet is too large. Short of Sam Bankman-Fried pulling a rabbit out of the hat, FTX customers may be stuck holding the bag.

The contagion isn’t over yet, with other platforms that had exposure to FTX experiencing liquidity issues. Gemini, one of the larger US exchanges, had to press pause on its Earn rewards program as it was unable to process withdrawals. In addition to other platforms one of the biggest losers is the Solana (SOL) token. Sam Bankman-Fried has been a large proponent for the network and without FTX’s investment in the token the value has dropped 40%. Solana offers faster transactions and lower gas fees than its larger competitor, Ethereum, but adoption was limited. Traders are trying to catch knives as the value keeps dropping, but what will be interesting is how the thriving NFT ecosystem on Solana reacts.

WHAT’S THE BUZZ

Blockchain networks will be utilized in many ways in the future, but they all rely on nodes to operate effectively.

NODES

- Nodes store and verify new blocks of data as transactions are executed on a blockchain.

- Each node chooses to accept or reject the newest block based on the validity of its signatures and transactions.

- If the block is accepted, then it continues to be shared with other nodes until a consensus is reached.

- Having multiple nodes continuously syncing with one another maintains the integrity of the network.

- Since nodes are distributed in a decentralized manner, there is no single owner of the data.

NFT BLUE-CHIP COLLECTIONS

Top 5 NFT Collectibles Collections

Top 5 NFT Photography Collections

NFT COMMENTARY

The reliance of NFTs on blockchains is something so many people have glazed over. From valuation dependency to functional capability there would be no NFTs without their crypto foundations. With the shakeup at FTX and the ripple going through the crypto markets, Solana has become a victim of questionable financial decisions. In September, Solana NFT sales rose by 77% compared to August, but now they’ve had 40% of their value sapped in a day. This volatility is unprecedented and shows the risk this market presents. What if the same happened to Ethereum?

The rapid fluctuation in value is what has thus far kept NFTs from being more mainstream. The Fine Art Group recently attended the Appraiser Association of America’s Of Value: 2022 National Conference and there were many interesting takeaways on the NFT market. A panel of specialists in the insurance, art and auction businesses gathered to discuss how their industries were approaching the new technology. Each are embracing it and building as they go. The insurance industry has been slow to insure these intangible items since valuation models are still being built. Ultimately, stability (and regulation) would make these tasks much more palatable. Sotheby’s is looking at it as an opportunity to grow; 78% of clients bidding on NFTs were new to Sotheby’s and the majority are under 40. With this fresh crowd, the art industry is starting to embrace the new medium.

ART AS AN ALTERNATIVE ASSET

Those looking for alternative assets that aren’t so tied to crypto valuation and macro-economic factors are looking elsewhere. We’re seeing NFT collectors starting to branch out by adding physical items to their galleries. These next generation collectors are buying everything from contemporary art to high end sneakers and trading cards. NFTs have been the perfect gateway to the art world for many newly affluent collectors.

The Fine Art Group experts are thought leaders in the area of art and investment. With multiple art funds under their belts and with the appraisal division being one of the largest globally, we thought it might be useful to get a bit of insight into the art market today. Both Roxanne Cohen and Elena Ratcheva, Directors in our Art Advisory division, were bidding in the evening sale for Paul Allen at Christie’s so it might be useful to hear their thoughts.

With over 1.5 billion dollars trading in two days, is the art market oblivious to the inflationary economy? Roxanne noted that prices for pieces in the $2 to $8 million range were in many cases double expectations. The price range is very much the sweet spot for investment, and it was clear that wealthy individuals understand this to be the case. There is no doubt that we were seeing investment in this range of value as a “safe” place for them to park their cash. A+ examples of paintings selling in the art market are also achieving above estimate.

The key takeaways from our specialist Elena Ratcheva are:

- “Always collect the very best example you can afford; it should pay dividends in the future.”

- “The very top end of the market is completely separate from the rest: blue-chip, high-quality works are seen as a clear hedge against inflation.”

The Fine Art Group Art Investment Advisors are available to speak in more detail. Their contact info is below.

Elena Ratcheva

Director, Art Advisory

Roxanne Cohen

Director, Art Advisory

NFT ARTIST SPOTLIGHT

GRANT RIVEN YUN

Growing up, he always told his father he wanted to be a photographer and spent his childhood drawing as much as he could. During his freshman year in college, he started using PowerPoint to create images using layers and gradients before transitioning to Adobe Illustrator sometime later, admitting “I felt completely lost when I first came to the digital side.” His artistic influences came from such unique places like Standard Station by Ed Ruscha and The Midnight Ride of Paul Revere by Grant Wood. Another interesting space in which he found inspiration was the early 90s video games. He attributes his clean lines and basic compositions to the combination of all the art that drew him in.

One thing he told himself before even entering Web3 was that he would be featured by an auction house. His success in the NFT space landed him a spot in the Sotheby’s Hong Kong Digital Art Fair with his piece Special Delivery selling for HK $693,000. He has worked across several platforms, with his Nifty Gateway Life in Japan editions on OpenSea being the lowest cost entry point to collect his work.

NFT & CRYPTO NEWS

- 4 Key Takeaways from the FTX Fiasco

- Yuga Labs Donating CryptoPunk to ICA Miami

- Christie’s 3.0 Presents: The Miami Edit

- Solana plummets amid FTX Crash

- Sotheby’s will auction off rare ring with NFT Authentication

- Nike launches .swoosh for larger Web3 ambitions

- Instagram to let creators sell NFTs through platform

- Reddit NFTs Surge

READ PAST ISSUES OF THE SCOOP

- The Scoop #10 – November 2nd, 2022

- The Scoop #9 – October 15th, 2022

- The Scoop #8 – September 20th, 2022

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Scoop #10 – November 2nd, 2022

In the 10th edition of The Scoop, we cover the rise in the correlation between crypto and equities and fractionalization. We also examine the royalty debate in the NFT space and spotlight Yuga Labs.

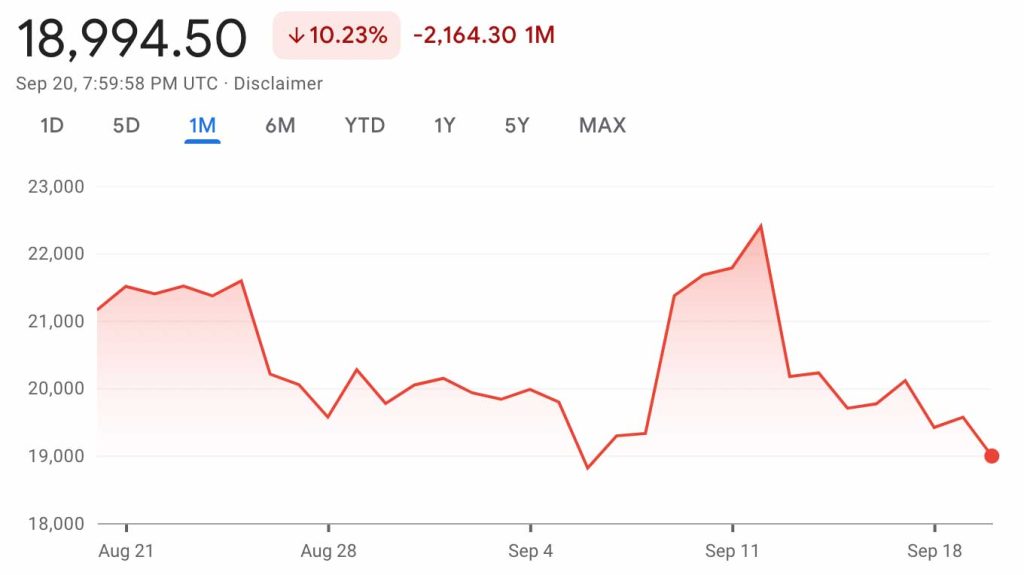

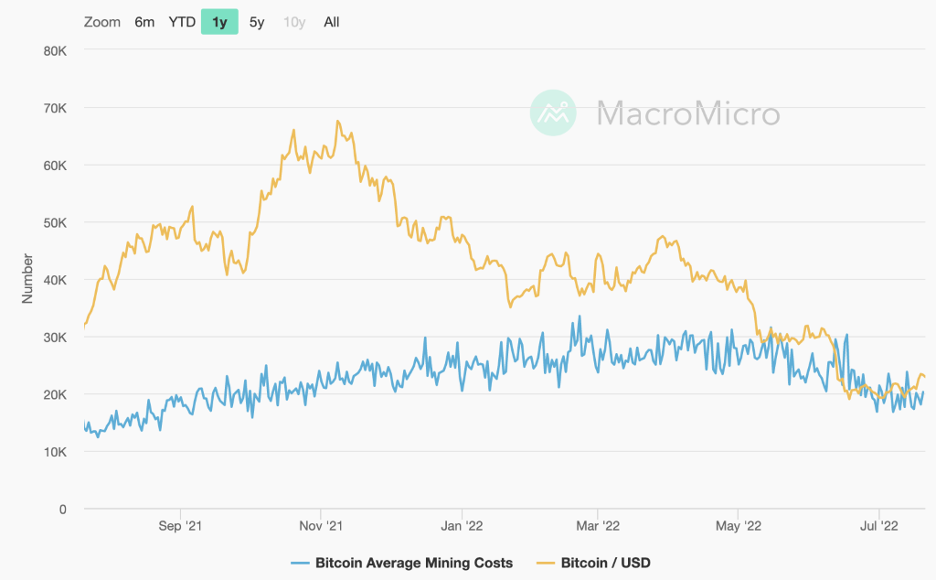

CRYPTO MARKETS

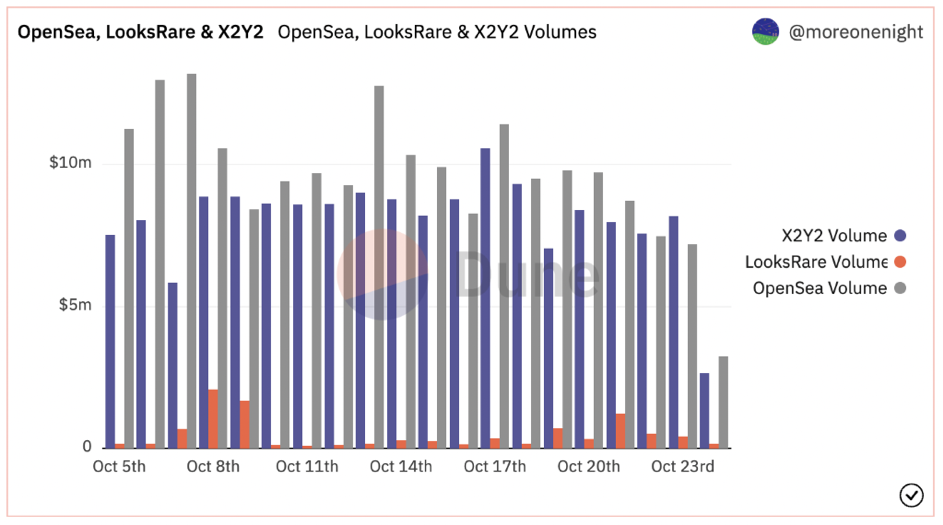

CRYPTO COMMENTARY

Bitcoin, the bellwether for crypto, has been rangebound – confined to upper and lower limits – since July. We’ve seen the same pattern in the stock market. Correlation between the traditional equity markets and crypto prices has grown stronger over time, with both responding similarly to events like the Fed announcements.

Instead of being an alternative to traditional markets, crypto has succumbed to the same economic pressures. It appears retail investors are staying on the sidelines, wary of further declines and future uncertainty while institutional trading has dominated the market. Less trading has produced less movement. With another interest rate hike in the works and a strengthening dollar, we can expect there to be continued downward pressure on cryptocurrencies. However, there have been rumors of the Fed easing its hikes as early as next year, but it will rely upon positive movement in the inflation measures.

In other news, the SEC continues its dive into the crypto markets with investigations into former crypto lenders Celsius and Voyager, along with the bankrupt Three Arrows Capital hedge fund. They are also probing Yuga Labs, creator of the Bored Apes collection, to better understand the dynamics of their NFT business. For many investors, the SEC looking into these issues is a positive development, citing more comfort in transacting when there are rules and regulations in place to serve as guard rails for this growing market. The headlines may not be great, but progress is being made for the better.

WHAT’S THE BUZZ

We’ve heard of other collectibles having shared ownership, but the digital nature of NFTs has made fractionalization even simpler.

FRACTIONALIZATION

- Fractionalization is when one NFT is split into smaller pieces to allow for more than one owner.

- Tokens for ownership are created and sold on the secondary market.

- This increases liquidity for the owner while creating an opportunity for those with fewer resources to own a piece of the NFT.

- This process does have down sides including IP rights concerns, contract security and cost.

- As part of a wider probe, the SEC is looking to determine if fractionalized NFTs should be treated as securities.

- Fractional.art (which is becoming Tessera) is currently the main platform to offer fractionalization, with several smaller marketplaces in competition.

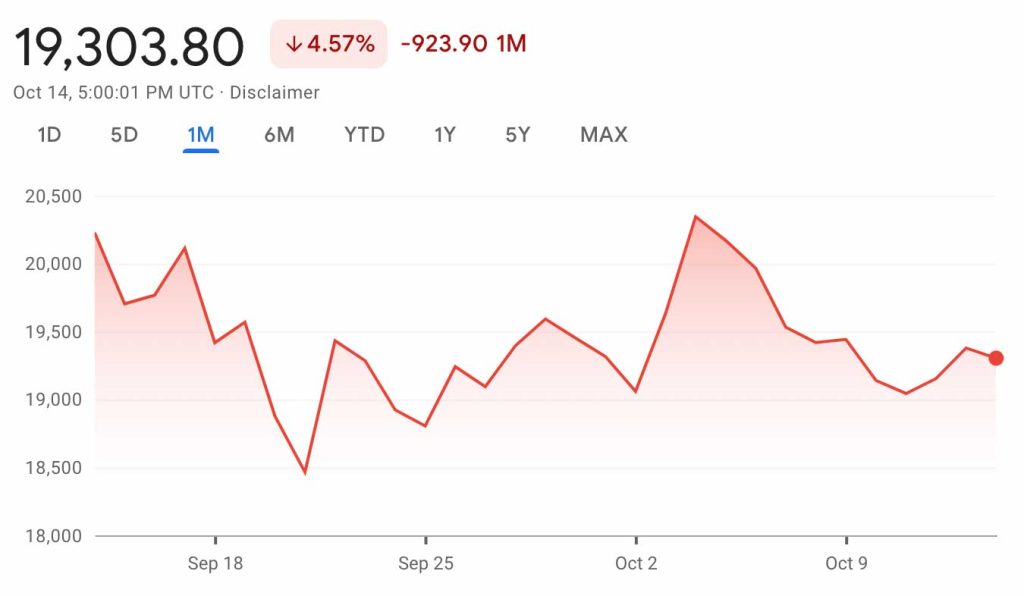

NFT BLUE-CHIP COLLECTIONS

Top 5 NFT Collectible Collections

Top 5 NFT Photography Collections

NFT COMMENTARY

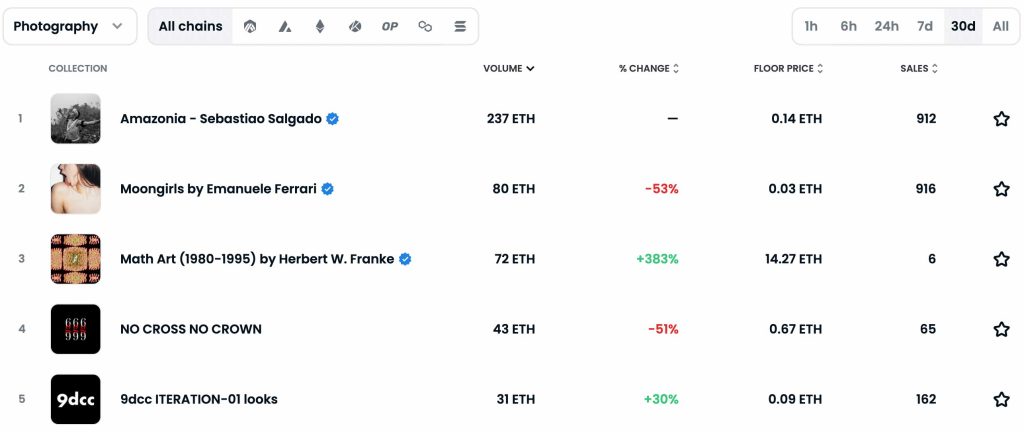

The top of the charts is business as usual with the big names still seeing the most volume; however, overall volumes are hovering around $10+ million a day. It’s important to mention that we can’t just look at OpenSea anymore. The rise of X2Y2 has been a long time coming and they are now in competition with OpenSea for being the largest marketplace.

One reason for X2Y2’s rise is that it doesn’t enforce creator royalties. The biggest debate in the NFT space right now is how royalties should be handled: Artists and creators argue they should be enforced while investors and traders are focusing primarily on their own margins. Since the royalties can’t always be enforced “on chain” but only in marketplaces, some artists have gone as far as blocking their work from being listed on the platform. In an already competitive market, this will change the dynamic for where creators sell their work and buyers purchase their NFTs.

Christie’s 3.0 had a successful debut with a 100% sell-through rate on its nine Diana Sinclair pieces. Prices ranged from about $5,000 to $10,000 with a premium piece selling for over $25,000. This was a very strong showing in an otherwise gloomy market. On the other hand, Sotheby’s Amazonia blind mint featuring Sebastião Salgado’s work didn’t get such a warm welcome. With a price point of $250 and 5,000 pieces available, only 2,280 were minted in the open mint window. It seems as though many collectors were hesitant to purchase a piece when they didn’t know what they were getting. While the same drop mechanics have worked in other instances in the NFT market, it appears we may need some re-tooling for the fine art crowd.

NFT ARTIST SPOTLIGHT

YUGA LABS

In departure from our usual practice, in this issue we’ll highlight a creator group as opposed to a single artist. Yuga Labs has so far outperformed the rest of the NFT space by quite a wide margin with its Bored Ape Yacht Club collection. Through a keen mix of technology, art and marketing, it developed a cult following in the NFT space. One of the first projects of its kind, it’s one of the few creators to successfully deliver on its plans. It incorporated in the state of Delaware in February 2021. The Bored Ape collection was launched on May 1, 2021, with a floor price of .08 ETH, around $240 at the time. By August, the floor price was over 44 ETH, $135,000 at the time marking one of the biggest jumps in the space.

Following that success, Yuga Labs launched Bored Ape Kennel Club and Mutant Ape Yacht Club to tie in with Bored Apes. All have proved a success so far, including the most recent sale of Otherside deeds which represent land in the metaverse it’s building. Since then, it’s also purchased the rights to Cryptopunks and Meebits, two separate but high performing collections that are now part of its ecosystem.

The collection was created in anonymity, and the creators were only recently revealed (or doxxed) by Buzzfeed as Greg Solano and Wylie Aronow, who are otherwise relatively unknown. In late March, Yuga announced a $450 million funding round with Andreesen Horowitz (A16Z) valuing the company at $4 billion. With the sway it holds in the NFT market right now, many are looking at it as a primary example of a successful NFT business.

NFT & CRYPTO NEWS

- Another NFT Martketplace makes royalties optional

- Bitcoin’s correlation with Stocks comes back as economic factors roil markets

- Crypto is more attractive with aggressive SEC

- Solana seeking on chain enforceable royalties

- NFTs can be considered property in Singapore

- What are generative art NFTs?

- Snowfro announces first collection since Chromie Squiggles

- Real estate fractionalized NFTs are here

- RTFKT’s “Phygital” luggage flies off the shelves

READ PAST ISSUES OF THE SCOOP

- The Scoop #9 – October 15th, 2022

- The Scoop #8 – September 20th, 2022

- The Scoop #7 – August 15th, 2022

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Scoop #9 – October 15th, 2022

In our 9th edition of The Scoop, we discuss crypto’s response to global inflation, the Ethereum merge, and spotlight the NFT artist XCOPY.

CRYPTO MARKETS

CRYPTO COMMENTARY

Crypto is at a very unique point in its history. Bitcoin and Ethereum have developed their own trading cycles throughout the years, but only in a stable macroeconomic environment. The last global recession was from 2007-2009, before Bitcoin was invented, so this is the first time anyone is seeing this new financial ecosystem under external duress. Rising interest rates and high inflation have put the squeeze on markets around the globe. Some are fleeing Bitcoin to get away from risk, but there are others investing in Bitcoin as an inflation hedge. With the U.N. calling for the Fed to halt its rate increases for fear of tipping less developed countries over the edge, there is no track record for how cryptocurrencies will react to the scenario that is currently playing out.

Despite the unique circumstances facing the crypto markets, we are still seeing major brands enter the space. NASDAQ, the second largest stock exchange in the world, is launching a digital assets business aimed at institutional investors. The business unit is going head to head against Coinbase, Blackrock, Fidelity and Gemini by offering crypto custody services. As more companies begin to offer this service this will ultimately support wider adoption of these assets and increase the competition in this space.

Voyager, the insolvent crypto lender, placed its assets up for auction after declaring bankruptcy, and the winning bidder was rival platform FTX. An agreement for $1.4 billion was reached in bankruptcy court for the fair market price of Voyager’s crypto assets with only $51 million attributed to paying for the platform’s business and user base. FTX has been quick to snap up distressed assets in the crypto world after pulling in over $1 billion in revenue last year.

The SEC made its thoughts known on those promoting crypto currencies with its ruling on Kim Kardashian, which found that Kardashian violated the anti-touting provision of federal securities laws. Without admitting or denying the SEC’s findings, Kardashian agreed to settle for $1.26 million, including approximately $260,000 in disgorgement, which represents her promotional payment, plus a $1 million penalty. Kardashian also agreed to not promote any crypto asset securities for three years. With a strong precedent like this, we believe there will be more of these cases in the future.

WHAT’S THE BUZZ?

With the highly anticipated Merge on Ethereum successfully completed, what are the outcomes?

OUTCOMES

- “The Merge” refers to the original Ethereum Mainnet merging with a separate blockchain called the Beacon Chain.

- Ethereum transitioned from “proof of work” to “proof of stake.”

- This change reduced energy consumption by 99%.

- The number of Ethereum tokens being created moving forward also went down 90%.

- Those with large Eth holdings can now stake their balances to earn monetary rewards for confirming transactions on the network.

NFT BLUE-CHIP COLLECTIONS

Top 5 NFT Collectible Collections

Top 5 NFT Photography Collections

NFT COMMENTARY

The ongoing bear market continues as volumes are still muted. There is little sign of a break in sight with other macroeconomic issues playing out. The last data point from the Sotheby’s Max Stealth collection auction indicated that even the high-end market has been impacted.

However, it seems that the bear market is the best time to build. After Christie’s Ventures was announced in June, and we are starting to see the first outcomes for the new business with Christie’s launching Christie’s 3.0, its Web3 platform that will service all of its NFT needs. After The Merge, they chose Ethereum to build on. Going forward all Christie’s 3.0 NFT auctions will take place on the Ethereum blockchain network from start to finish. All transactions, including those after the sale, will be automatically recorded on the blockchain. A true differentiator, Christie’s 3.0 addresses the fundamental needs of the market by including compliance and tax tools, making it the first of its kind. Christie’s 3.0 is the result of a collaboration with three leading companies in the Web3 community – Manifold, Chainalysis and Spatial.

Sotheby’s next major event will be a NFT mint, with 5,000 pieces from Sebastião Salgado in a collection called Amazonia. This is the first time Sotheby’s is hosting the creation process for NFTs on its platform. For $250 buyers can mint a unique 1/1 from the collection; however, they will be randomly assigned and revealed three days after the mint closes. This is following the playbook of many other NFT collections where collectors feel the rush of not knowing what NFT they will ultimately end up with. How this is received from a fine art perspective is something we will be watching closely.

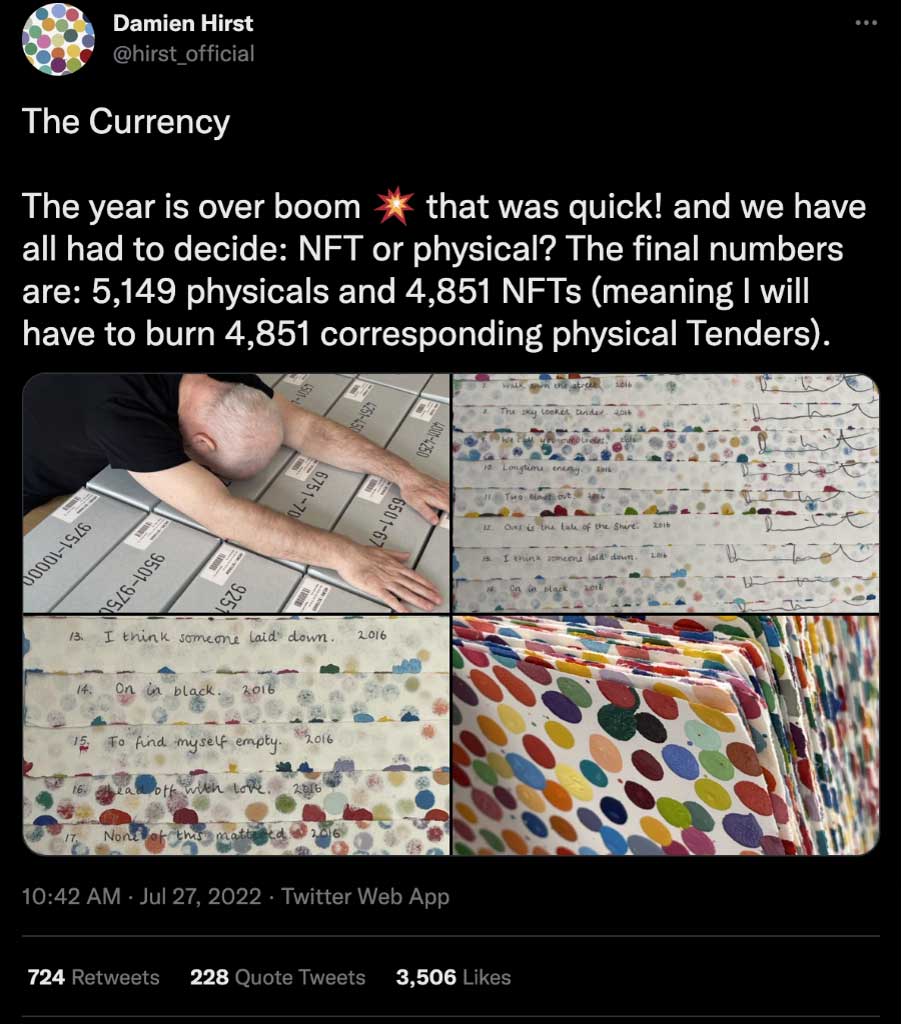

NFT ARTIST SPOTLIGHT

XCOPY

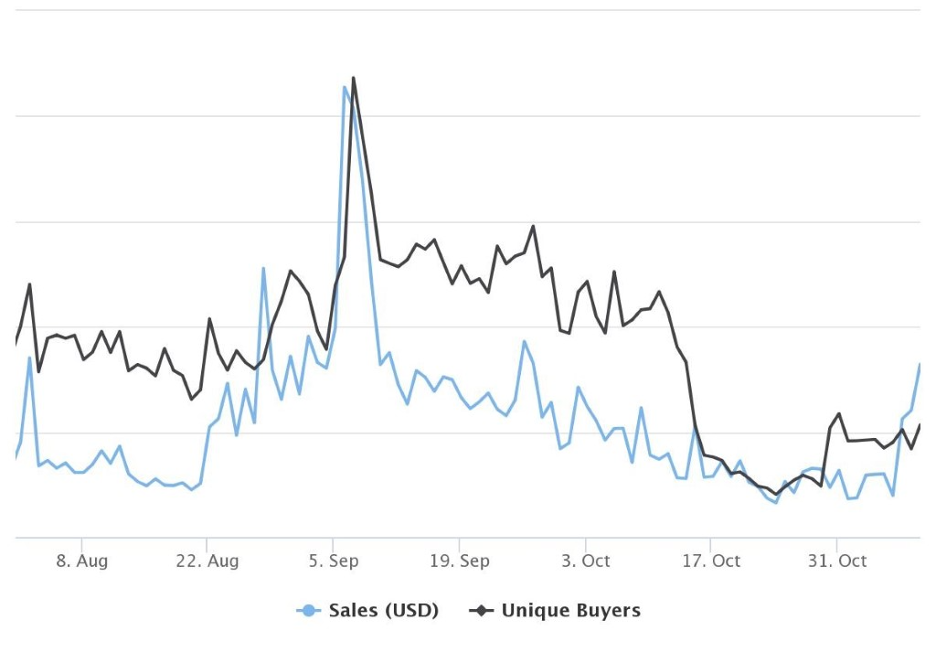

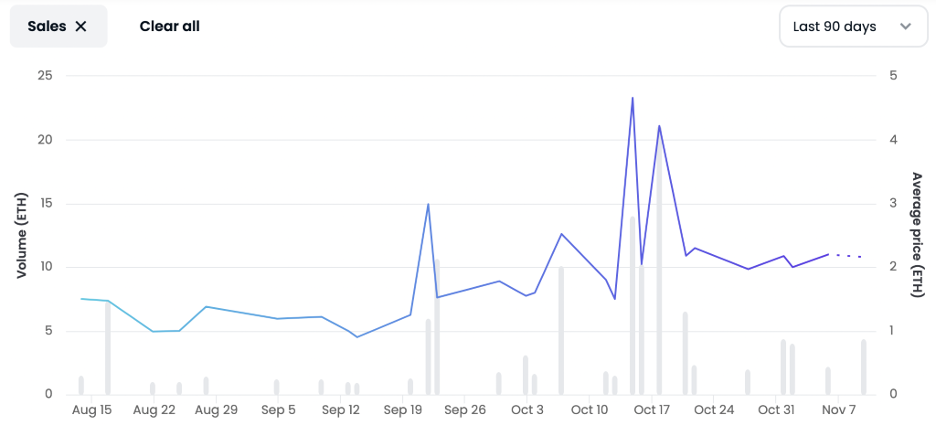

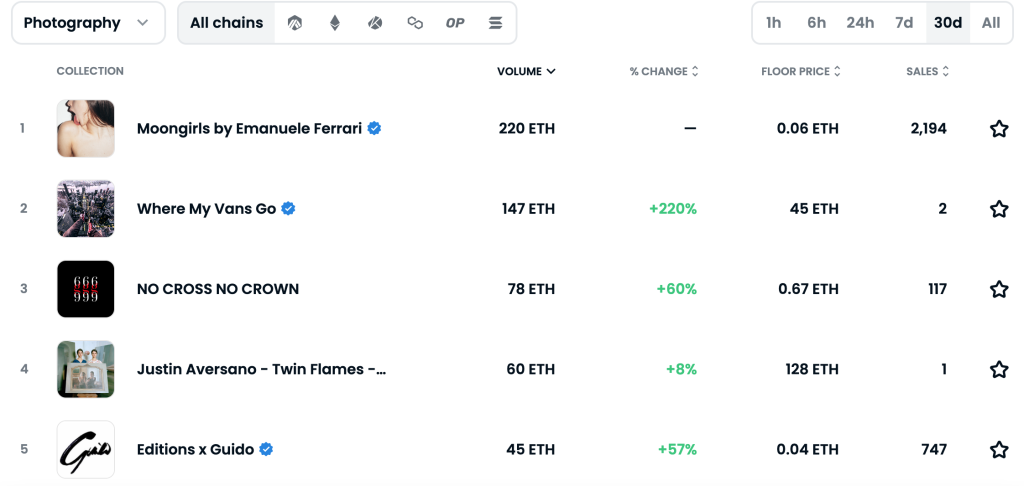

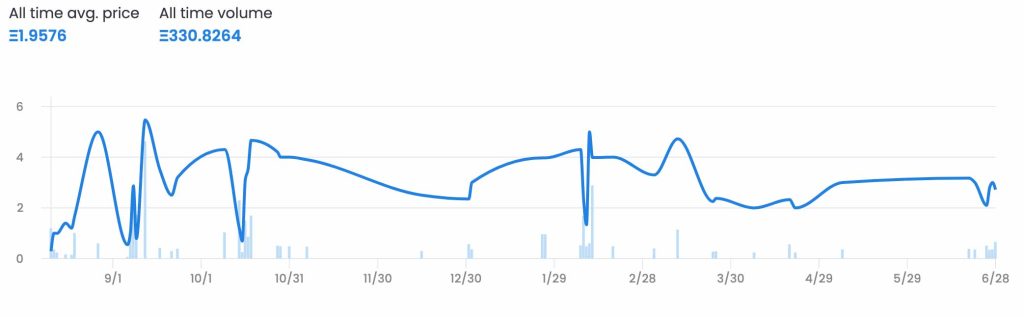

After a piece did well in the Sotheby’s Max Stealth auction, we want to look at a true unknown in the space – XCOPY. One of the first digital artists to start using NFT technology in 2018, we still don’t know the identity of XCOPY. The work this creator has been putting out looking at death, dystopia, and apathy has sold for incredible sums throughout the NFT bull run with A Coin for the Ferryman selling for over $6 million on SuperRare. With just short of 10,000 pieces created, many with epilepsy warnings, the work has proliferated throughout the art world and XCOPY has developed a cult following. While we don’t know what drives the creation of these pieces, and we may never know, this has quickly become a name to know in the NFT world. The Max Pain editions have seen a recent uptick in sales after the auction, as seen below. Vertical bars are volume.

NFT & CRYPTO NEWS

- Nasdaq to Wait for Regulation Before Launching Crypto Exchange

- Binance Blockchain Hit by $570 Million Hack

- Tyler Hobbs’ Fidenza NFT Project Gets $1M Pump Over 48 hours

- Fed to deliver another big rate hike

- Digital Art Platform, Verse To Host Live Minting At Frieze

- Ethereum Merge boosts network speed

- Court docs reveal details on Celsius Customers

- FTX’s $1.4B bid on Voyager Digital assets: A gambit or a way out for users?

- Amazon move could be game changer for Crypto

READ PAST ISSUES OF THE SCOOP

Disclaimer

Information in this report is compiled from a number of sources; The Fine Art Group does not make any representation or warranty, express or implied, as to its accuracy or completeness. The Fine Art Group shall not be liable for any errors or inaccuracies in this report or for any actions taken in reliance on information or opinion contained in this report. The Fine Art Group are under no obligation to update or keep current the information provided herein. Information in this report is provided solely for information and marketing purposes and is not to be construed as investment advice or a personal recommendation, nor as legal, tax, regulatory, accounting or any other specialist technical advice. Capital is at risk when buying or selling the types of assets discussed in the report, and any decision to do so is solely at the risk of the buyer or seller. Prior performance is not indicative of future results. Neither The Fine Art Group nor any of its directors, officers, employees, or agents accepts any liability for any loss or damage arising out of the use of all or any part of this document or reliance upon any information contained herein.

The report contains hyperlinks or references to third-party advertising and websites other than The Fine Art Group website. Any such hyperlinks or references are provided for your convenience only. We have no control over third-party advertising or websites and accept no legal responsibility for any content, material or information contained in them. The display of any hyperlink and reference to any third-party advertising or website does not mean that we endorse that third-party’s website, products, or services. Your use of a third-party site may be governed by the terms and conditions of that third-party site and is at your own risk.

The Scoop #8 – September 20th, 2022

In our 8th edition of The Scoop, we discuss inflation’s impact on the crypto markets, NFT sales volumes, and spotlight the founder of Art Blocks.

CRYPTO MARKETS

CRYPTO COMMENTARY

The bumpy road continues for markets across the board as the Fed has indicated that interest rates will remain elevated for the foreseeable future. Markets reacted negatively to Jerome Powell’s comments that the Fed would continue to raise rates as high as needed and keep them there “for some time” to tame inflation, which is running much higher than its 2% target. Traditional equities and cryptocurrencies alike saw increased volatility after the remarks, and more is expected as Fed President John Williams pushed back on the idea that there would be a rate cut next year.

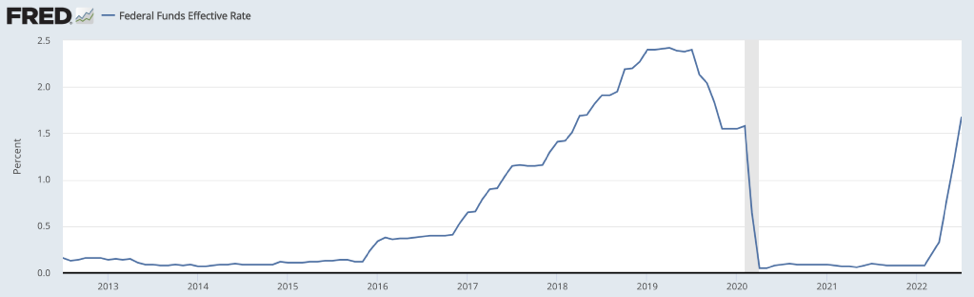

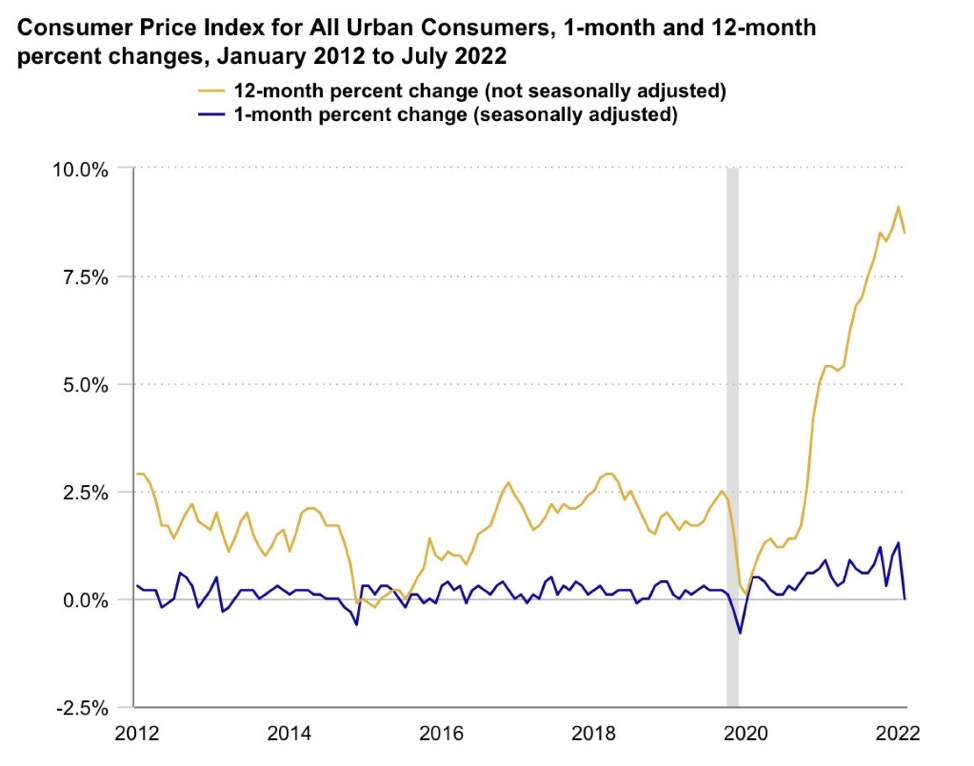

Looking at the Fed funds rate level over the last 10 years shows the healthy and natural rate hike cycle begun in 2016 to keep the right balance between growth and potential inflation. As COVID, a black swan event, hit the global economies in an unprecedented way in early 2020, the Fed slashed the interest rates back to near zero (shaded area on the graph). While the short term pain from the pandemic was blunted, this allowed for inflation to grow very quickly unchecked as the economy reopened. It’s worth noting that despite the spate of recent hikes, the Fed funds rate is now at the levels we saw just before the pandemic. Although inflation slowed down a bit in July to an 8.5% increase year-over-year in CPI, we are still at levels not seen in the last four decades.

The reactions of the market aren’t a surprise, and since many investors are still fleeing risk, the major indexes and tokens could continue their descent. We are still teetering on the edge of a recession, with the next six months being crucial for a “soft” landing.

WHAT’S THE BUZZ?

In the world of NFTs, what is the single most important piece of security? A seed phrase.

A SEED PHRASE

- Every seed phrase consists of 12-24 random words pulled from a list of 2,048.

- If access is lost to your wallet or it is deleted, you must have the seed phrase to restore your access.

- There is no one to call for help if a seed phrase is misplaced; all of the contents in the wallet are lost.

- The seed phrase must be kept secure at all costs!

- One of the largest phishing scams seen in this space is malicious actors pretending to be from Metamask or Coinbase and asking people to verify their seed phrase. Nobody from any of those companies will ever ask for it.

NFT BLUE-CHIP COLLECTIONS

Top 5 NFT Collectible Collections

Top 5 NFT Photography Collections

NFT COMMENTARY

While the usual suspects are in the top NFT charts, there is nothing usual about the trends that we’ve been seeing in the NFT markets. We’re still seeing the consolidation behind Bored Apes, Cryptopunks, and the Art Blocks collections, which is expected for the blue chips. But the real story is in the number of NFTs being sold and overall cash volumes.

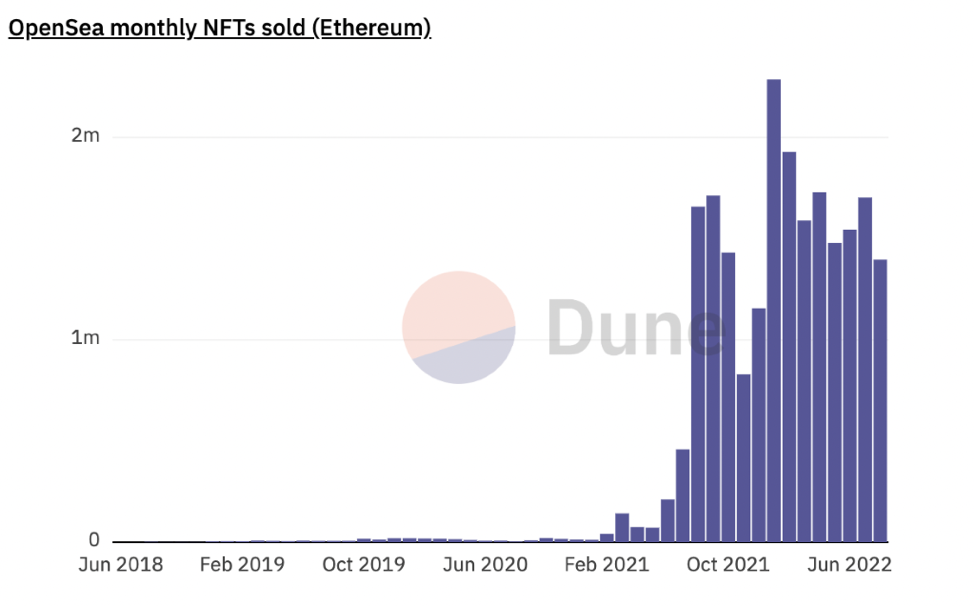

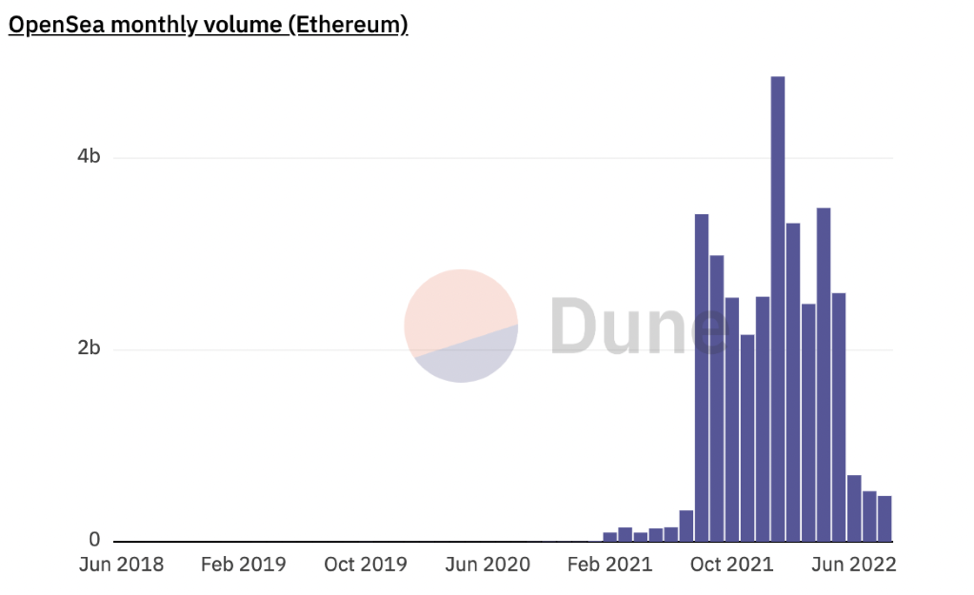

Looking at total number of NFTs sold, summer was business as usual. The count of NFTs being sold looks healthy and doesn’t hint at a market downturn. The data points to the number of sales being in its expected range.

When we look at the overall monthly volume on the Ethereum network (measured in USD) we’re seeing a summer slowdown with considerably less currency changing hands. We understand it’s a bear market for crypto and that’s a factor, but this leads us to believe it really is a bear market for NFTs as well. People are still buying NFTs but aren’t paying as much. The average price per NFT has dropped considerably.

The most recent test for the secondary NFT market came from the Sotheby’s MaxStealth Collection sale on Sept. 14. It was the first NFT single-owner live auction, and it opened the door for this concept moving forward. Pieces from XCOPY, Pak and Beeple were included in the 26-lot offering. The timing of the auction was a bit puzzling. With the unease in the global economy and crypto space, it seems that Sotheby’s bet the quality of NFTs on offer would offset the pressure from the larger macro-economic picture. We were able to derive a lot about the health of the high-end NFT market from this sale, especially how valuations are tracking in a bear market. With several pieces withdrawn or unsold it seemed that demand did not meet the Sotheby’s sales expectations – the sale achieved an aggregate sale price of $1.7m against a total pre-sale low auction estimate of $2.9 million. Lots above the $100,000 mark seemed to struggle with the exception of the XCOPY piece, while mid-value lots from Beeple, Hackatao/Coldie, and Alessio De Vecchi sold above their respective high estimates.

NFT ARTIST SPOTLIGHT

Erick “Snowfro” Calderon

The man, the myth, the legend behind Art Blocks has been a force in the NFT space since he sold his Cryptopunks to fund his new project. Since its inception, Art Blocks has become the epicenter of generative art in the NFT space. From Fidenzas to Ringers, some of the most pivotal collections have found a home under the Art Blocks umbrella.

Before Art Blocks, Erick dabbled in painting and other forms of colorful art yet never sought out gallery representation. However, when it comes to generative art, his Chromie Squiggles have become one of the grails in the NFT space since their launch. Working in 3D rendering software called Three.js, Erick adapted one of the sample scripts – a rigid squiggly line consisting of squares – and smoothed the lines out and added movement, rainbows and translucency. Most recently, the Chromie Squiggles popped up on tickets for VeeCon, a conference hosted by Gary Vaynerchuk who is also a Web3 entrepreneur. Rumor has it they’ll soon be on a football jersey somewhere in the EU, bringing further exposure to this new breed of art.

After making a splash in 2021, Art Blocks announced a partnership with Pace Verso in June 2022 bringing two of the most prominent players in Web3 and contemporary art together. This venture will open the doors to new exhibitions and collaborations between the traditional art world and the NFT space. Each has a lot to bring to the table, so we’re looking forward to seeing where this goes.

NFT & CRYPTO NEWS

- It’s Time to Separate NFTs from Digital Art

- Starbucks “Odyssey” is getting on the blockchain

- Bored Ape NFT Band to Make Music with Beyoncé-, Timberlake-Linked Productions

- Pace Verso and Art Blocks Detail First-Ever NFT by A.A. Murakami

- An A.I.-Generated Picture Won an Art Prize. Artists Aren’t Happy.

- LG Bringing NFT Art to your TV

- Olafur Eliasson launches a virtual reality work and NFT commissioned by MetaKovan- the man who paid $69.3m for ‘that’ Beeple

- Is it a Pyramid Scheme if they tell you it’s a Pyramid Scheme?

- The Merge is coming

READ PAST ISSUES OF THE SCOOP

Disclaimer